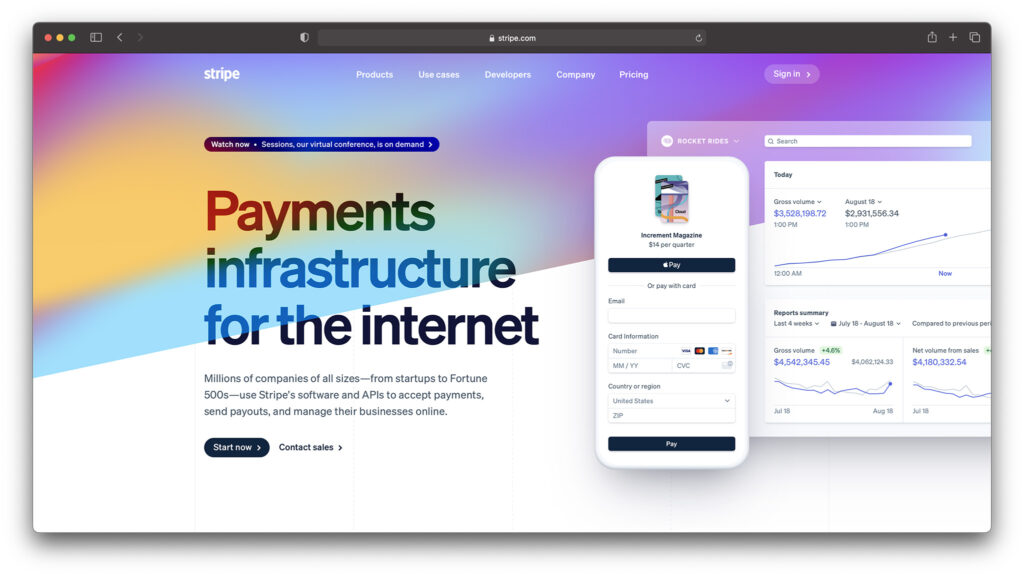

The Stripe payment processor has some romance behind it. Not only does it have big-name clients like Lyft, Target, and Warby Parker, but the impressive team of co-founders certainly brings a bit of glamour into the equation. In this Stripe review, we'll uncover if Stripe is all it's cracked up to be.

There's plenty of hype behind the Stripe company, and as a third-party payment processor, it offers some of the best development tools, security measures, and international business modules for online commerce.

The whole point of Stripe is to make it easy for anyone to do business online. If you're running a subscription-based model, Stripe has you covered. If you'd like to customize your shopping cart for something unique, Stripe is there to help you out.

In addition, Stripe has a flat rate for its pricing, so you don't have to think too much about how much your company pays.

Table of Contents:

- A Quick Glance at Stripe

- Where is Stripe Available?

- Stripe Review: The Primary Products and Services

- Stripe Review: The Rates and Extra Fees

- The Difference Between Regular Stripe and Stripe Elements

- Stripe Review: Customer Support

- Who Should Consider Stripe as a Payment Processor?

What is Stripe?

Stripe, like most payment processors, isn't perfect. However, the pros definitely outweigh the cons, so we put together a quick list of why or why you might not consider Stripe for your own online business.

Stripe is quickly emerging as one of the most valuable payment processing solutions for businesses of all sizes. Though it took some time for Stripe to catch up with PayPal, it’s now valued at around $35 billion, and has millions of customers.

Stripe Pros

- The subscription features are easy and powerful.

- Stripe supports marketplaces.

- International merchants should have no problem with Stripe.

- The reports are easy to understand and comprehensive.

- The flat-rate pricing is transparent and not confusing like so many competitors.

- The development tools stand out for advanced customization.

- Advanced features for reporting to help you track your sales

- Excellent range of marketplace tools

- Exceptional solutions for subscription payments

- Growing range of technology enhancements

Stripe Cons

- High-risk industries and countries are not supported by Stripe.

- You don't get a direct phone support line.

- Stripe puts its own infrastructure over everything. A seemingly random account suspension might happen if you violate the terms.

- Lots of the tools cater to larger companies. This is good for scaling up, but sometimes I get the feeling Stripe cares most about the behemoths.

- May require some technical skill for implementation

Stripe Review: Where is it Available?

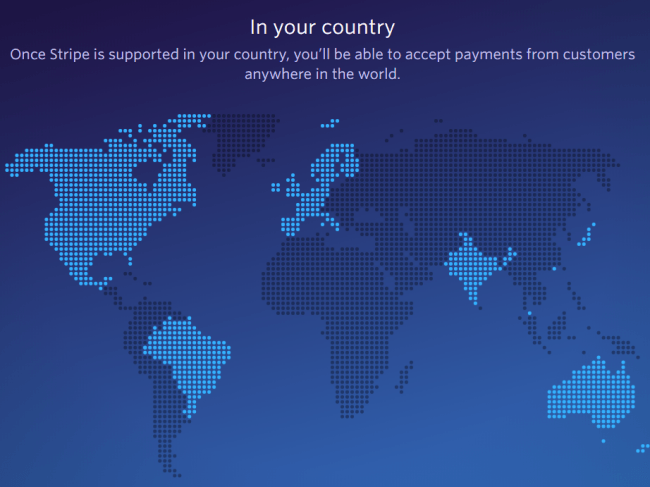

Stripe is offered in over 26 countries at the time of this article. Most of these countries are in Europe and the Americas, so you're going to have to look elsewhere if you live in Russia, most of Asia, all of Africa, and much of the Middle East and Eastern Europe.

I would argue that the locational limitations are one of the biggest downsides to Stripe, but from a business perspective, it's clear the Stripe is trying to avoid the highest risk locations in the world.

Having said that, Stripe recently released a private beta version for India. So, it's clear that the payment processor is trying to expand into potentially more risky markets and figuring out ways to offer its services to merchants all over the world.

As for the countries where Stripe is available, here's the list:

Both Brazil and Mexico are on this list, but you need to request an invite before being approved. If you run your business in the following countries you shouldn't have a problem signing up for an account immediately:

- Australia

- Austria

- Belgium

- Canada

- Denmark

- Finland

- France

- Germany

- Hong Kong

- Ireland

- Japan

- Luxembourg

- Netherlands

- New Zealand

- Norway

- Singapore

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

- Italy

- India (beta)

- Portugal

Stripe has been growing over the years, so you do have the opportunity to sign up for email notifications and specify your country. Then, Stripe sends you an email as soon as it launches in that country. The only problem is that a Stripe launch may never happen in your area.

So, you need to look elsewhere at the time being if Stripe isn't available for you.

If you're in a non-supported country, yet you'd still like the advantages of Stripe, a program called Stripe Atlas is offered to set up your online business as an incorporated company in Delaware.

This program costs you a one-time fee of $500, plus the $100 yearly renewal of your Delaware registered agent. Finally, a $25 per month fee is implemented to maintain an American bank account.

An American business is desirable for a few reasons, and the security and ease-of-use behind Stripe might make this venture worthwhile for some businesses in high-risk countries. However, it's only available to online businesses. A retail store can't get access to Stripe Atlas.

Unique, European Payment Methods

As you may have already assumed, Stripe does an excellent job of catering to US and European stores. Another way this is completed is by offering support for popular European payment methods for both European and US merchants. Some of these include Sofort, EPS, P24, Bancontact, and Giropay.

The Primary Products and Services

The Stripe brand tries to make the packages and services as simple as possible. When you land on the website you might wonder how it could be so basic.

Stripe does this by breaking the products and services into two categories: Payment Processing and Developer Tools.

However, once you start to sift through the features in each of these categories, it becomes clear that far more is offered than just two products.

Stripe has one of the biggest selections of accepted payment types around. From debit cards to credit cards, you should have no problem with this payment processing company. There are over 135 currencies that you can accept money in, and on top of some rather interesting international payment solutions, you also get a host of popular payment options for your stripe account too, such as Google Pay, Apple Pay, Alipay and Visa Checkout.

If you want to avoid exchange rate fees, you can simply set “presentment” currencies when setting your Stripe payment strategy up. With this strategy, Stripe accumulates different balances for the currencies you’re paid in, which you can send to different bank accounts.

The Payment Processing Category

As we mentioned, the payment processing tools are offered in 25 countries around the world. That said, it still works well for international business in these locations, since Stripe accepts over 135 types of currencies.

So, you may not be able to run a business with Stripe in Vietnam, but an American or German business is able to collect Vietnamese Dong as payment.

Payment processing is immediately provided to those companies that run business in the accepted countries. It's similar to PayPal, where you would integrate the third party processing tool into your online store. This instant access to payment processing is good and bad.

The good part is that you get approved almost immediately. The bad is that your account eventually gets evaluated as you do business. Therefore, you might see your account shut down if Stripe doesn't like something.

A regular merchant account, on the other hand, does the vetting prior to you setting up an account. So, a merchant account would make more sense if you're worried about getting shut down later.

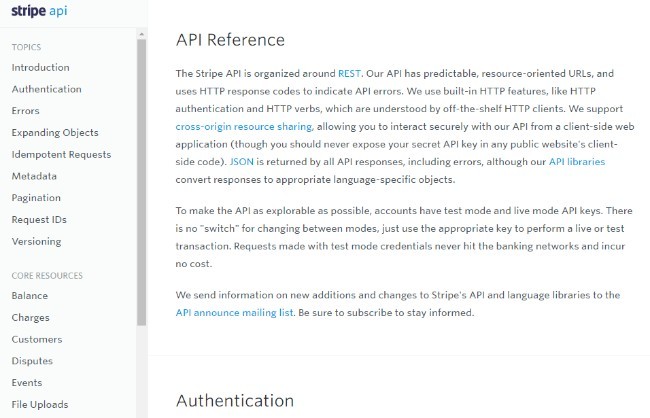

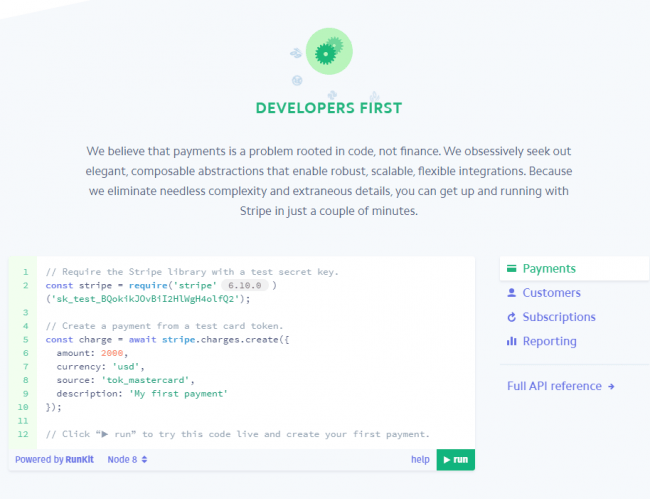

Stripe Developer Tools

This part of Stripe is what makes the payment processor stand out from other competition. It's one of the reasons so many large companies partner with Stripe since you can customize the processing system and scale it up as your company grows.

For example, you can get started with Stripe without writing a line of code. This speeds up the whole process by allowing you access to over 500 of Stripe's ecosystem partners.

Stripe provides access to the API (application programming interface) so that developers can sink their teeth into the program and integrate Stripe into unique websites. Then, the developer can use programming languages to adjust how the processor works and looks.

With the Stripe documentation and open API, it's a desirable environment for full control.

So, some online merchants might only need the payment processing support, but many others are interested in the development tools. Regardless, each category includes a wide range of other products and services, as outlined here:

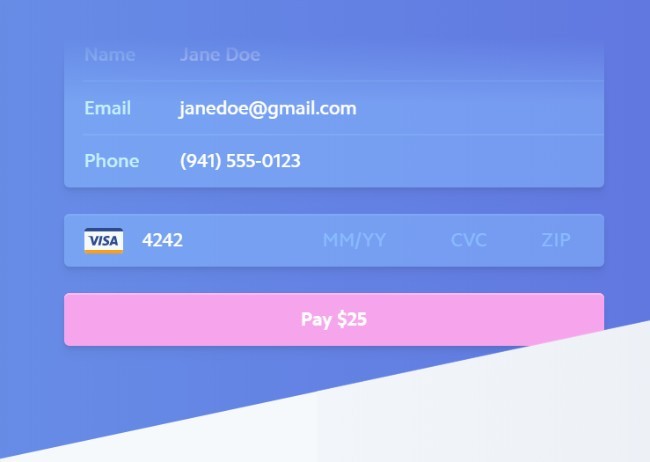

- The Stripe Checkout Module – We'll talk about Stripe Elements (further below,) but it's basically a quick way to customize your checkout however you want (using pre-built components).Combine that with the standard Stripe checkout tools and you have a system that allows you to design and launch your checkout quickly. In short, PCI compliance is done for you, and you can make your check out fit your website, all without complicated design tools.

- Subscription tools – PayPal charges for its subscription service, but Stripe does not. This means that running a subscription site allows you to offer multiple tiers, plans, and subscriber types.

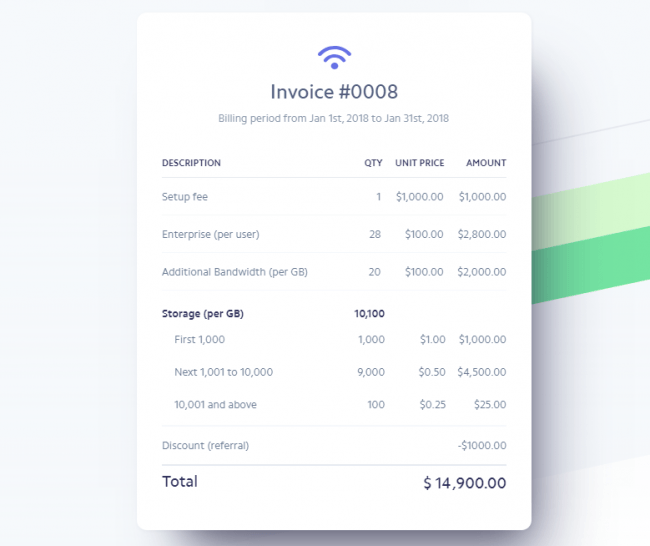

- Stripe Billing – This Stripe module offers a streamlined set of tools for creating and managing your subscriptions. It also lets you test your pricing, send out customized invoices, and create recurring business relationships.

- Stripe Relay – The Relay product combines mobile app commerce with your online store. So, if you'd like to have a standalone app you can upload your products from your website and collect payments just like you would through your regular store.

- Stripe Radar 2.0 – Most online payment processors have some sort of fraud detection, but Stripe takes it to a new level. Since fraud is so common in online business, Stripe stands out quite a bit. Currently in its second version, Radar utilizes machine learning to identify fraud and the users that commit fraud. It also provides a dashboard for setting rules and seeing which of these rules are broken when people make purchases on your site. Stripe Radar can reduce fraud instances by up to 25%.

- Stripe Connect – The Connect product works with online marketplaces, where the merchant receives support for over 100 currencies along with the conversion tools needed along the way. You can verify a wide range of international sellers and configure automated payment schedules for the merchants selling in your marketplace.

- Offering coupons and free trials – Some of the best marketing tools you'll need are already in the Stripe payment processor. In short, you can quickly create free trial periods and offer seasonal coupons for new customers who might prefer a deal when getting started with your company.

- Team management – Many companies want to give payment processing and data access to other users in the organization. With Stripe, you have team management tools for setting user permissions so that other people can view this information without going through a single account. Permissions are easy to manage, and you can even incorporate hardware tokens and two-factor authentication for added security.

- Options for building your own platform – Stripe supports the building of completely unique platforms, where the checkout process is going to be far more unique than your standard shopping cart and information collection page. For instance, Lyft has a platform where the payment is stored, but it's all tracked based on mileage.

- Support for marketplaces – Marketplaces are part of the platform building portion of Stripe, but it's a little more streamlined, with options for working with your merchants, giving out instant payments, and setting up commission structures.

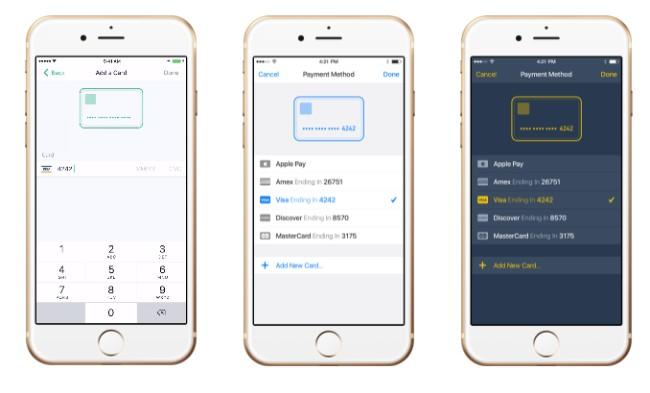

- Wallet payments – Average consumers are beginning to use mobile wallets to make payments. Therefore, Stripe supports options like Microsoft Pay, Google Pay, Apple Pay, Alipay, and WeChat Pay.

- Mobile commerce – Stripe Relay is similar to this, but the mobile commerce section promotes the use of Android and iOS apps so that you can collect the payments in those app forms. You even get a feature for saving customer data in the app, allowing customers to make quick payments in the future. All of your stats, payments, and business details are on the mobile interface. Both Android and iOS versions are available.

Additional Features OF Stripe

Notably, if you just want to sell online with your own shopping cart, you don’t have to go through all of Stripe’s payment related tools to do so. You can simply access the basic Stripe Checkout page.

Stripe integrates with a host of eCommerce website building tools, so you can take debit and credit card payments easily with 3DCart, Shopify, BigCommerce, Weebly, and Wix. There’s also the option to integrate with various CRM tools, shopping tools, invoicing platforms, and referral marketing services, so you can further grow your brand.

- Stripe Payouts: This is an automation toolset in Stripe that allows you to send mass payments to service providers, freelancers, and sellers easily. It can be helpful for companies that have specific compliance requirements to consider with global markets and third parties.

- Atlas: Atlas supports international businesses on Stripe who want to incorporate in the United States and set up a bank account in the UK. The solution supports tax and legal guidance, with Stripe saying that it’s had more than a thousand start-ups apply across over 120 countries. It’s also added more than 100 partners to the network since it launched originally.

- Stripe Radar for Teams: Radar for Teams helps merchants by giving them access to tools in the small business dashboard for setting specific rules for credit card payments and transactions. You can test what kind of impact the rules you set had on previous credit card processing data and reduce the amount of work your company needs to do. There are also various other fraud prevention tools built into Stripe too, such as CVV and AVS checking.

- Issuing: Another addition to the feature set available for Stripe is the option to generate both virtual and physical cards. This means that a company could create a card that would work just like an American express card for their employee expenses. Companies that create mobile wallets for use with online payment gateway technology can also use Stripe as a back-end processor to create cards that link to the mobile wallet balance of the user.

- Terminal: Terminal is a new set of tools intended to support Point of Sale payments. The solution comes with ready-to-use integrated hardware. However, there’s no POS app included with the terminal. Instead, you’re getting the developer tools required to create your app to integrate with Stripe. The SDKs currently available with Terminal include Java-based POS systems, and iOS tools for mobile. Android support is in beta mode now.

- Hardware: The native hardware and card reader solutions available from Stripe are reasonably priced, with competitive costs for in-person transactions. This is a game changer because there are various app developers who will have created POS and mPOS apps powered by Stripe. You pay the ecommerce rate for transactions.

- Corporate cards: For anyone interested, Stripe offers a corporate credit card. Customers who spend $5,000 on the card can also access $50,000 in free payment processing, and additional benefits when you’re purchasing with Stripe partners

- Sigma: A typical technology-driven payment processor might allow you to generate custom reports using a selection of prebuilt criteria options. However, Sigma allows you to create totally unique reports using SQL. If you can use this language, then Sigma can give you the data you need. This is a lot better than what you get from companies like Square, which are fantastic for reporting. Advanced business intelligence is a fantastic extra from Stripe,a nd it’s charged based on your business’s sales.

- Stripe Capital: Like Square and PayPal, now offers customers the option to use it as more than just a credit card processor. Business owners can get short-term loans and merchant cash advances through the dashboard with Stripe. You’ll need to be deemed “eligible” by the Stripe team to access this feature.

Ultimately, Stripe is more than just an excellent solution for processing payments and handling business expenses. Business owners can use this solution with their Shopify ort WordPress websites to set custom permissions for team members, while supporting merchants in more than 34 countries worldwide. It is worth noting that the features of Stripe may be a bit much for some companies, though.

If you’re dealing with invoicing and the occasional MasterCard transaction, you probably don’t need things like advanced reporting. If you don’t have a developer on your team, you may also struggle to get the most out of Stripe as a payment platform. It does require a little technology knowledge.

Stripe Review: The Rates and Extra Fees

As we talked about before, Stripe has a flat rate for all transactions. This makes it transparent and easy to understand.

With Stripe, that one flat rate is 2.9% +$0.30.

One word of warning is that Stripe doesn't refund any of these transaction fees. So, if you make a refund to a customer, that transaction fee is lost to Stripe. This means that you may have to eat this cost or charge a slight fee to your customers if they wish to return a product.

An advantage of going with Stripe is the ACH support. The transaction fee is 0.8% per transaction, with a maximum of $5.

For a while, Stripe would assist merchants in processing Bitcoin payments. Those transactions had the same fees as ACH. However, as of April 23, 2018, Stripe halted all support for Bitcoin processing.

Non-profit discounts are available with Stripe, and there’s a plan for people who deal in micropayments too, although there’s not much information out there. Stripe doesn’t refund processing fees, even in the case of refunds and returns. You’ll need to keep this in mind when writing your company’s return policy.

Stripe also charges a chargeback fee at the industry standard of $15. However, if the chargeback is decided in your favor, you will get a refund on that fee.

Billing Fees

Stripe has two tiers for its billing tools: Starter and Scale.

You can use the starter plan for free for up to the first $1 million in recurring transactions. Beyond that, you’ll need to pay 0.4% on each transaction, on top of processing fees. The scale plan charges around 0.7% per transaction too. The trade-off with Scale is that you get an extra discount on wire transfers and ACH credit, as well as access to the Stripe Sigma service.

Connect: The Stripe marketplace comes with a variety of additional fees depending on whether you want to use the Express or Custom accounts. This includes a $2 monthly fee, and a 0.25% mark-up on account balances, as well as expedited debits with as 1% transaction fee.

Radar: If you’re in need of specific fraud tools, you can get an additional suite for $0.04 – which is waived for accounts that pay the standard transaction fee. Most small businesses probably won’t need this, but it will appeal to companies who have a lot of staff members. There’s a more customizable version of the technology available for $0.06 too.

Sigma: The advanced business intelligence and reporting tool from Stripe uses a sliding scale for pricing, based on your overall transactional volume. This is excellent for a lot of business leaders. If you get under 500 charges a month, you’ll only pay $0.02 per charge, up to a cost of $10. This also comes with an $10 infrastructure fee. If you go over the threshold, you pay a monthly infrastructure fee starting at $25 per month.

Terminal: If you’re keen to integrate your Stripe payments experience into the POS technology you’re using in your business; you’ll be able to process payments at a fee of 2.7% plus $0.05 per transaction. You don’t need to pay anything extra to access developer functionality. There are two integrated card readers available at $59 and $299.

Receiving payments

Merchants have a lot of great value to get from Stripe if they’re working on an international basis. You can display multiple currencies instead of just one, and your Stripe system will convert them automatically. There’s only a 1% conversion on transaction fees too.

How quickly do you receive your payments?

As long as you're not considered a high-risk company, Stripe pays most US merchants within two days. As for companies outside of the US, a seven-day payout system is still in effect.

What about chargebacks?

It's standard in this industry to charge $15 for all chargebacks. Stripe is no different. Stripe does have an evaluation process in place for all chargebacks. What's nice is that Stripe actually refunds the $15 fee if a chargeback dispute results in your favor. However, most merchants state that this is a very rare thing to happen.

Which companies are the Stripe pricing and fees best for?

Stripe pricing is reasonable and easy to understand. That said, it's not the least expensive for many online stores. For instance, some interchange-plus plans out there make it cheaper for certain companies. There are also plenty of payment processors that offer discounts to certain brands, especially non-profits.

The main advantage of Stripe is the lack of monthly and hidden fees. This is especially advantageous for low volume merchants.

Stripe has also recently added support for micropayments, where you pay a higher percentage transaction fee and the flat per-transaction fee is dropped. This comes in handy for artists, musicians, and anyone else selling digital goods, since it would be tough to eat a transactional fee of $0.30 for an item you're selling for $0.99.

Contracts and Early Terminations

You're not locked into any contracts with Stripe, making it useful for if you want to terminate your account early. In fact, Stripe doesn't really have any hidden fees, making it one of the more transparent options out there.

A Warning on Chargebacks

It's important to read the terms of service from Stripe since it pretty much states that Stripe can freeze your account for any reason it deems worthy. So, if you are looking for more stability, Stripe might not be for you.

If your industry is considered high-risk, Stripe might not be for you. If you have lots of chargebacks, Stripe might not be for you. In fact, Stripe states that it doesn't work with merchants with chargeback rates of more than 1%.

That's a difficult number to stay under for online merchants.

The Difference Between Regular Stripe and Stripe Elements

Stripe Elements actually integrates with the regular Stripe payment processor. The core functionality of Stripe is to collect payments through your online store, while the Stripe Elements tool is a collection of pre-built modules for making a customized checkout area.

The Stripe Elements checkout pages are built by the Stripe team for full optimization, localization, and real-time validation.

In short, it's an easy way to get away from hosted checkout pages from third-parties or e-commerce platforms. You know the pre-built checkout modules are optimized to boost sales, and you still get the solid pricing and reliable interface of the regular Stripe system.

Not only that, but you can adjust your checkout area to fit your brand perfectly. Elements works with far less code than usual, and it gives you the best building blocks for making your own checkout experience.

Stripe Elements is also PCI-compliant.

Stripe Review: Customer Support

The best part of Stripe customer support resides in its documentation and online resources. To start, the Stripe blog covers updates on the processor and how you can implement some of the new features.

The development page has a full API reference module, with information on all popular coding languages.

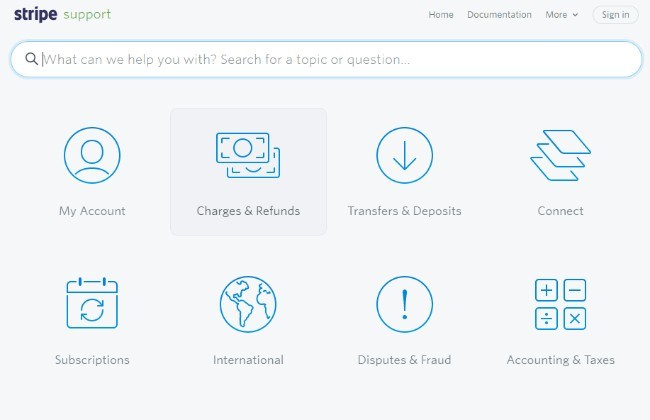

The Stripe Support area provides a knowledge base for seeking out certain topics and locating articles for things like subscriptions, disputes, fraud, accounting, refunds, and more.

A documentation area is also there for more advanced research.

As for direct contact information, Stripe offers 24×7 phone and chat support. This is pretty huge for online merchants, since this type of constant support isn't all that common for payment processors. In addition, Stripe used to not have phone support, so it's moving forward to help out its customers.

Furthermore, you can contact the Stripe support team through email. Some of the languages supported through email include English, French, German, Italian, Japanese, and Spanish.

Opinions about how Stripe support treats customers is widely disputed. Some merchants have great words to say, while others think the complete opposite.

It typically depends on your own unique experience, as the same kind of debate on customer support can be found with just about every other payment processor in the industry. Not only that, but Stripe is a large, popular brand, which essentially means that you're bound to stumble upon lots of excellent and poor reviews.

Who Should Consider Stripe as a Payment Processor?

With the addition of micropayment support, artists and people selling digital goods have a home at Stripe. The average online e-commerce store owner should do just fine with Stripe, considering the pricing is standard and you don't have to worry about hidden fees or multiple payment plans.

Not having to pay a monthly fee is also great for low volume sellers.

Most of the western world has access to Stripe Payments, but you might get rejected or shut down from Stripe if your business is considered too risky or Stripe doesn't support companies in your particular region. The same goes for online stores with higher than a 1% chargeback rate.

Other than that, Stripe is perfect for developers and companies that want full customization over checkout modules. The API is available for complete integration control, and the Stripe Elements builder is sure to help you even more with your creative process.

If you have any questions about this Stripe review, drop a line in the comments below. We would love to hear from customers who have used Stripe in the past since it always seems to be a good conversation when talking about payment processors.

Feature image by Adewale Bobby

This payment system began to massively block all accounts of Ukrainians and others, freeze the wallet with balances, and then the process of stealing money begins.

Also, they want to start cooperation with Russia, which is perhaps why they began massively blocking all users of Ukraine. They stole $70,000 from me personally. Reason: Someone paid for goods worth $100 with a stolen card, after that they discuss returning the money to the client, block the account, notify that all the money will be seized and block the ability to communicate with them, all that remains is court… But if you are a resident of the UA it is quite difficult.

I do not recommend anyone to use this service!

Thanks for sharing your review Labzin!

Nice Reviews ! Thanks for sharing informative blog.

You’re welcome Tom!