It seems like everyone has a PayPal account, but most people think of it for transferring money to friends, storing funds, or sending invoices. But PayPal For Business is also a useful ecommerce tool for integrating with online stores, accepting payments, and even getting paid on the go. In this PayPal review, we're going to look at what PayPal offers for business credit card processing. Sure, you could use the system as a freelancer and collect payments for your services, but this is an entirely different type of transaction. Our goal here is to uncover everything about PayPal as a merchant account, payment processor, and multi-channel sales option.

Throughout our in-depth PayPal review, we outline how well the payment processor integrates with other systems, what you can expect to pay in fees, and what types of selling options are available, like processing payments from online marketplaces.

The best part about PayPal is its security, particularly when selling through marketplaces like eBay, Amazon, and Etsy. In fact, its early support for secure eBay transactions is one of the main reasons the PayPal user count has consistently increased since PayPal's inception. They offer verified buyer and seller protection to prevent scams, and ensure that neither side feels uncomfortable transacting with strangers online.

PayPal also excels in its global accessibility. Whereas many payment gateways restrict use to merchants in certain countries, PayPal has a long history of supporting over 200 markets and 100+ currencies. You can also accept and convert international payments with ease, making PayPal an ideal solution for international business.

Keep reading our detailed PayPal review to understand exactly how much you're going to spend, and what types of online businesses should use PayPal.

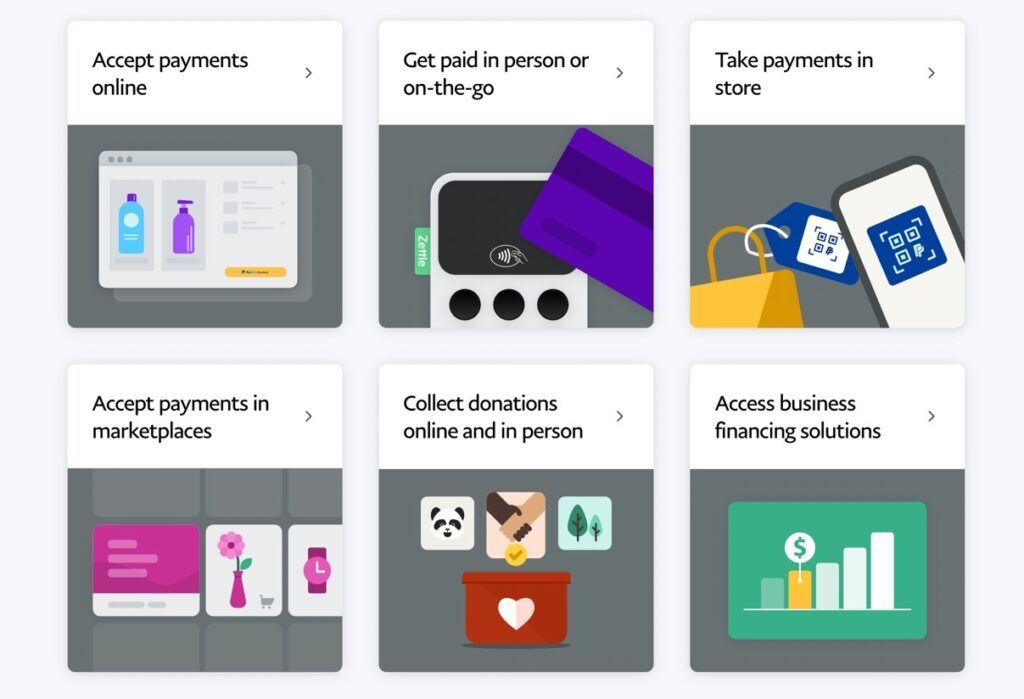

Top PayPal Features and Tools

PayPal offers several tools and plans for online businesses to accept payments in their stores. Here's what's available:

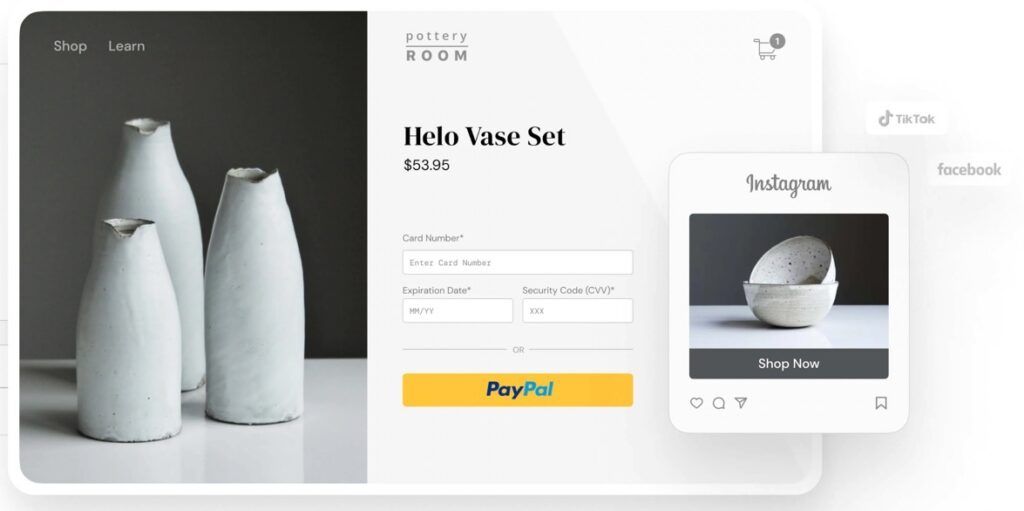

- PayPal Website Payments – A simple module to accept debit and credit cards through an online store, even if customers don't have PayPal. This is the main checkout tool from PayPal, and it integrates with popular ecommerce platforms like Bigcommerce, WooCommerce, and Wix.

- PayPal Business Point of Sale – Also called “PayPal Zettle,” this offers a complete point of sale system for accepting physical purchases, tracking sales, and syncing offline and online purchases.

- Marketplace Payments – Tell eBay, Etsy, and other marketplace customers they can trust you as a merchant with PayPal's checkout. The Marketplace Payments module offers instant integrations, added protection, and rapid processing.

- PayPal.me – A mobile app for collecting business and personal payments on the go.

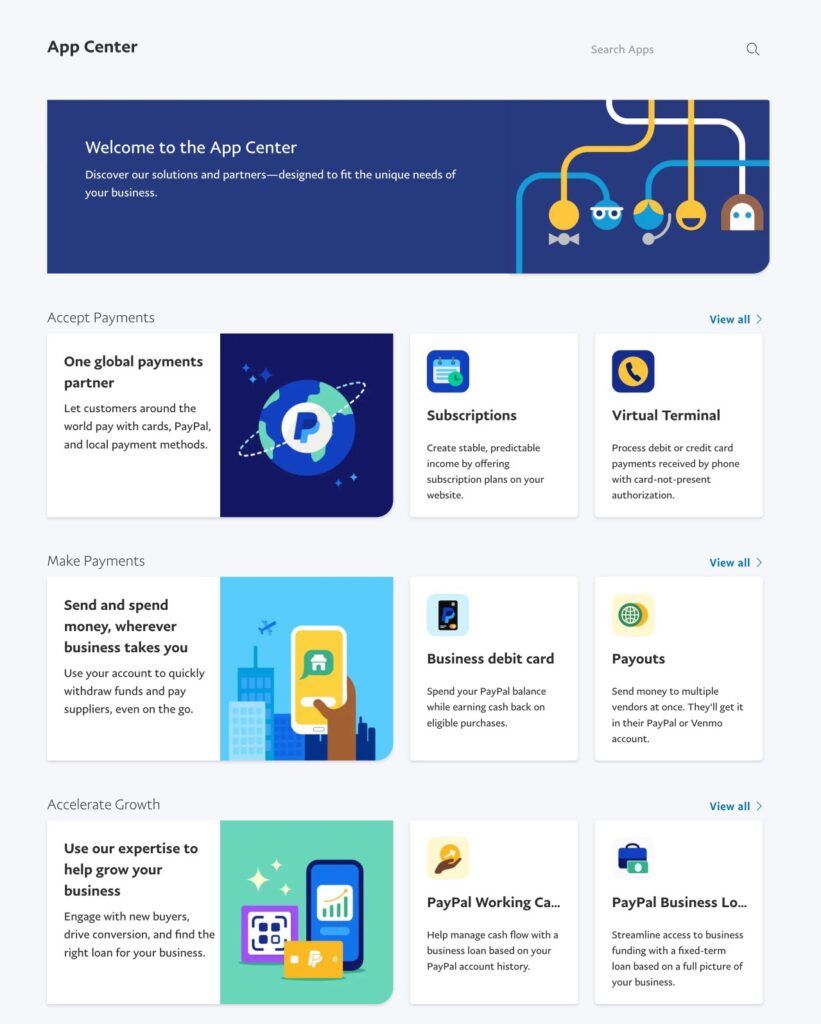

- PayPal App Center – A collection of various add-ons to extend the functionality of your payment processing. Options include subscriptions, virtual terminals, digital goods, business debit cards, QR codes, virtual card numbers, business loans, and dispute management.

- PayPal Credit – A “Bill Me Later” tool for merchants to offer customers.

- PayPal Fundraising – An online payments module to attract and collect donations with international support and lower transaction fees.

- PayPal Business Loan – A fast way to get cash for your business.

- PayPal Invoicing – Freelancers and contractors can send out quick invoices for the services they perform.

PayPal Ease of Use

Is PayPal easy to use?

The PayPal website is historically difficult to navigate, with far too many links and constantly changing pages for new services and fees. However, the basic payment processing tool has remained intuitive, glitch-free, and easy to implement on any ecommerce store.

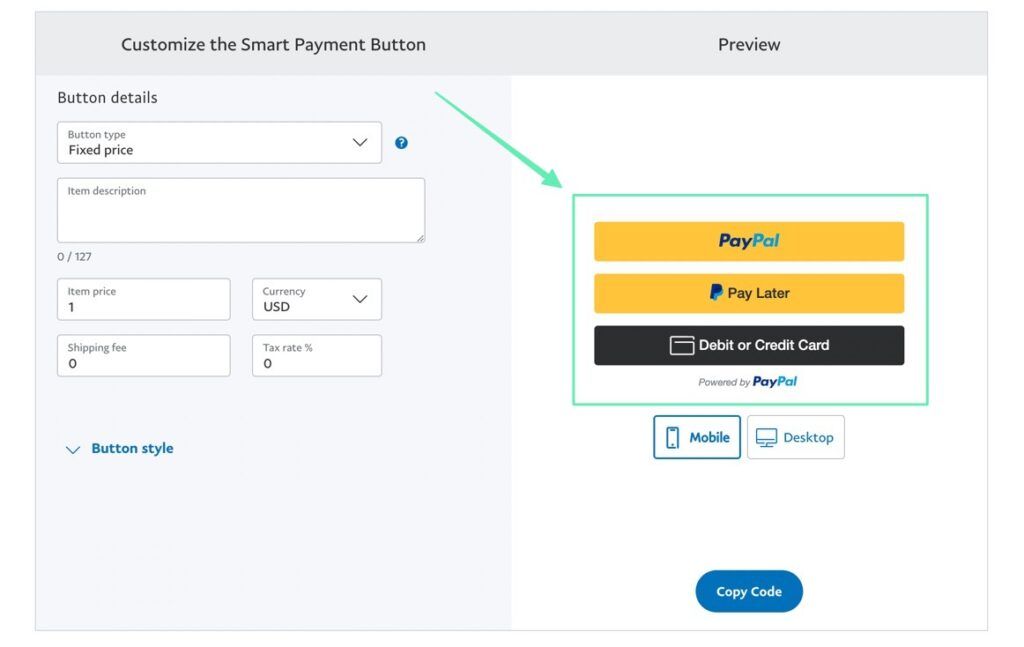

You can grab a simple PayPal button (by using the PayPal Checkout app) and start selling products from any website. Even if you don't have a shopping cart, the PayPal button offers the flexibility to place it anywhere on your website, essentially converting any type of site into an online store.

And PayPal's Website Payments feature expands upon that simplicity with a complete online store experience, sending customers through a shopping cart, checkout, and payment processing area.

We also found that the PayPal mobile app is just as smooth as Square, and they give you a free swiper to plug into your phone's headphone jack. PayPal provides an excellent mobile payments solution, and it integrates with your online store, POS, or whatever type of configuration you have.

Other highlights of the interface include PayPal's sales reporting, always sleek invoicing interface, and a beautiful new app store that replaced its previously endless list of products into a more digestible app store.

Just be careful on the PayPal website; our PayPal review uncovered a maze of information that's often contradictory, linking to old pages, or simply confusing because of their wide range of offerings.

PayPal Pros and Cons

PayPal stands out as one of the best-known solutions for managing transactions in today's digital world. However, just because a solution is popular doesn't mean that it's going to be the right option for every business.

PayPal makes it easier for customers to make secure purchases online without having to rely on their bank account.. It's also possible to tie a debit card or credit card to PayPal in case you run out of money in your account. This makes PayPal one of the more reliable choices for a virtual money transfer. However, it lacks in some areas.

PayPal customers are constantly complaining about the company's lack of customer support, and issues with high-risk industries, among other things. Some of the most common pros and cons worth noting from our PayPal review include:

Pros 👍

- Trusted by consumers around the world

- One of the most popular ways to make a payment online

- Industry standard processing fees

- Quick Buy buttons and full checkout modules

- A large app center to extend your online store and payment processing

- Support for selling subscriptions and recurring payments

- Support for international sellers and multiple currencies

- Great developer tools for integrations and growth

- Extensive integrations with countless ecommerce platforms

- Ideal for low-volume merchants who don't take too many payments

- Suitable for an all-in-one payment system

- Options to activate buyer and seller protection

- Ties into accounting and financial tools

- Suitable for use via mobile devices

- Available hardware and card readers

- Options for borrowing money and capital

Cons 👎

- Inconsistent support for customers

- Confusing website that makes their simple products tricky to understand

- A lengthy list of fees, making it tough to figure out how much you're charged for each transaction

- Extremely high fees for international transfers when compared to competitors

- Convoluted dispute and resolution process

- It's often harder to provide refunds to customers when they pay through PayPal

- Can, in rare cases, suddenly shut down your account

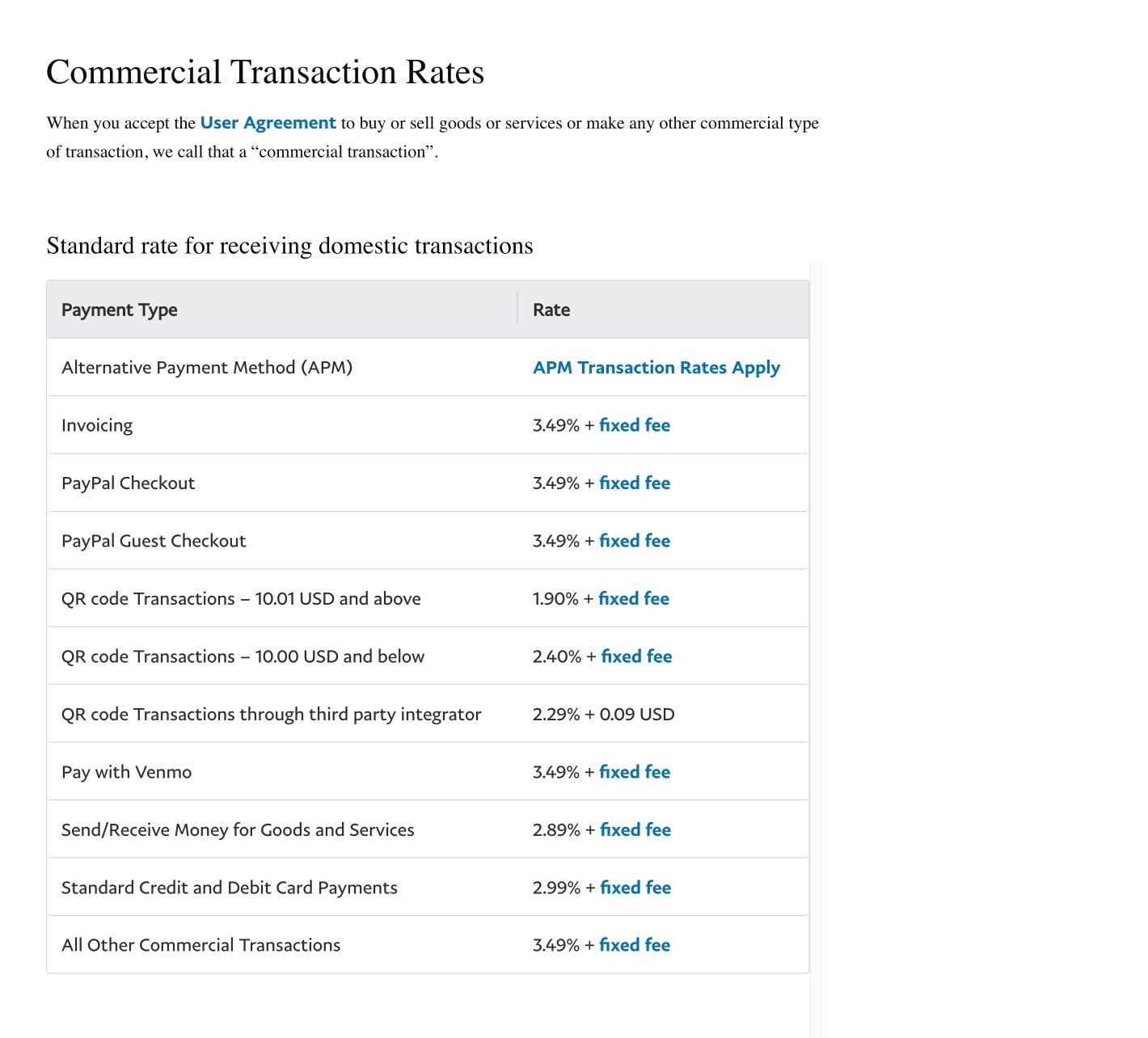

PayPal Pricing

As mentioned in the pros and cons, PayPal tends to follow industry standards for its basic processing fees. In the past, that fee was 2.9% + a fixed fee ($0.30 fixed fee in the US), but PayPal has slowly increased transaction fees to reach 3.49% + a fixed fee; that fixed fee depends on the country in which you conduct business.

When straying away from the standard merchant fees, PayPal pricing gets complicated. PayPal has an extensive list of merchant fees based on the type of transaction, location, medium, and currency.

We won't cover them all, but here are the merchant fee essentials:

- PayPal Checkout transactions: 3.49% + fixed fee ($0.49 fixed in the US)

- Send/Receive Money for Goods/Services: 2.89% + fixed fee

- Standard Debit and Credit Card Fees: 2.99% + fixed fee

- Invoicing: 3.49% + fixed fee

- International transactions: The standard domestic fee (3.49% + fixed fee) plus 1.50%.

- Donation transactions: 2.89% + fixed fee (add 1.50% for international)

- PayPal Here transactions: 2.7% to 3.5% + fixed fee

- Chargebacks: 0.40% to 0.60% per transaction

PayPal Fee Calculator

Consider using our PayPal fee calculator to understand how much you’re likely to pay when processing ecommerce transactions:

Keep in mind that this pricing varies drastically from past merchant fees you may have experienced with PayPal. Our PayPal review showed that these ecommerce products are deprecated or still in use but not marketed much by PayPal:

- Payflow Pro

- Payments Advanced

- Payments Pro

- Virtual Terminal

So, you might have access to a product like Payment Advanced, and PayPal still supports it, but they're drifting away from all of those options in favor of the all-encompassing PayPal Website Payments product.

If you're still using something like Payflow Pro, Payments Advanced, or Payments Pro, they all have monthly fees ranging from $5 to $30.

Customer Support

The usual problem that people have with PayPal is that thousands of customers have talked about horror stories of funds tied up in the PayPal risk department. It seems like the company has eased up on this throttle, but there's still the looming possibility that thousands of dollars could randomly get frozen inside your PayPal account.

That said, the PayPal customer support team is pretty solid, but most of your time is going to be spent on the community forum or knowledge base. PayPal clearly wants you to figure out most of the problems on your own, so they direct you through a considerable amount of documentation that could very well resolve your issues.

A PayPal blog gets published consistently, so you can find articles about updates and tips. Connecting with PayPal on social media is possible, but we recommend going through phone or email. The response times are sub-par, and the customer support staff clearly outsourced, but having direct access through phone and email is definitely better than nothing.

One huge benefit of working through PayPal is that you can usually complete a quick Google search to fix your problem. It has so many users that people are talking about it online quite a bit.

Extending PayPal with the PayPal App Center

Aside from taking online payments, PayPal can also help with a wide range of other transactional experiences. You can access your own PayPal card reader and use PayPal for currency conversion. What's nice is that most of these extras have been converted into apps for you to install whenever you need them from the PayPal App Center.

Here are just some of the extra products and services to explore.

- PayPal Payouts: If you're hiring freelancers, employees, or contractors, and you want to pay them via PayPal, you can. The PayPal Payouts app sends multiple payments at once, rather than making one payment at a time. Sending various payments also means that you save some cash on standard rates.

- PayPal Business Debit Card: Sign up for a business debit card to get cash back on all spending and to deposit business revenue into the account.

- Subscriptions: Offer trial periods for certain products and create flexible subscription plans for products from your online store, all processed by the PayPal checkout system.

- PayPal.Me: Share a simple link to quickly get paid for your products or services. No need for an online store.

- PayPal Zettle: PayPal's modern POS system with an advanced app that syncs with your store, and hardware such as card readers, receipt printers, and cash drawers.

- Virtual Terminal: A method of accepting payments from any device as long as you have internet access. It uses “card-not-present” authorization and accepts all major debit and credit cards.

- Donations: Accept onetime donations or customize the app for recurring contributions.

- Sell On Social: Post products on social media sites and stay protected with PayPal checkout tools.

- QR Codes: Show a QR code to customers for them to scan and pay you with PayPal on their own devices.

- Gift Cards: Generate digital gift cards, then sell them from your online store.

- Store Cash: Run an automated discount generator to recapture leads and reward customers without having to create the discounts yourself.

- PayPal Shipping: Discounted shipping labels, streamlined pickups, and package shipping in one dashboard.

- Happy Returns by PayPal: Offer in-person returns to thousands of “Return Bar locations around the US.

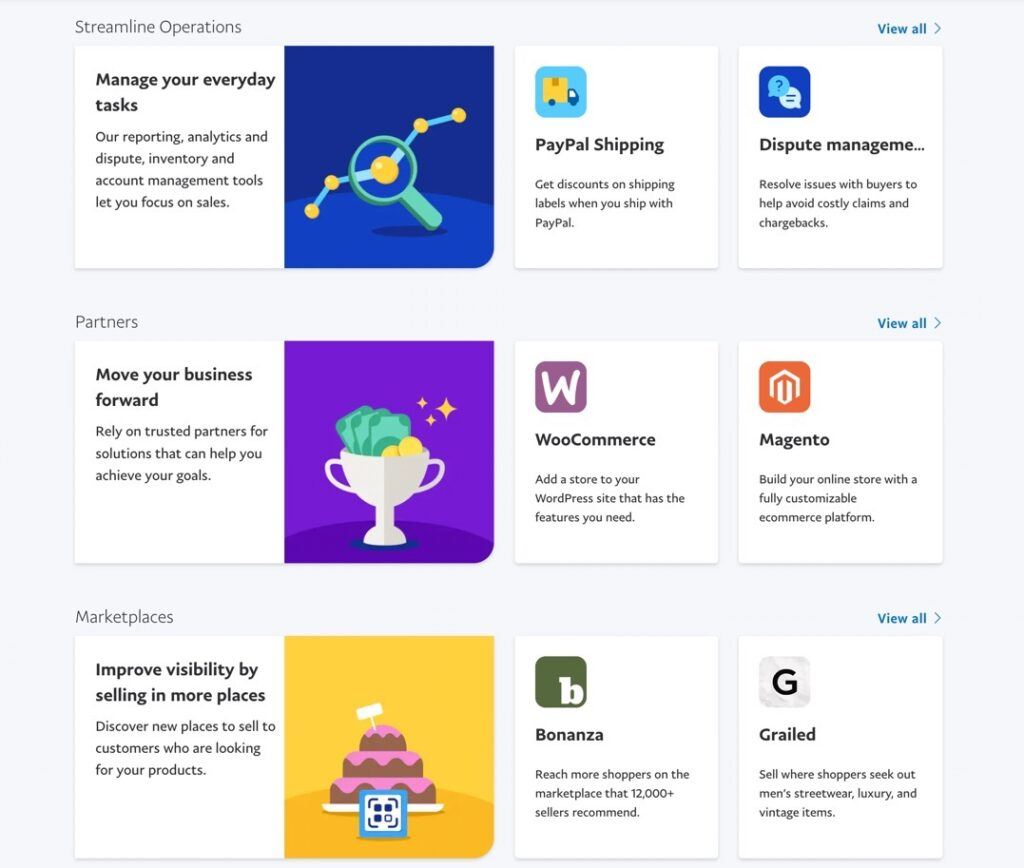

Integrating with Ecommerce Marketplaces

We know PayPal for its direct integration with eBay, but it also features a collection of apps for linking to other marketplaces, some of which include:

- Walmart

- Wish

- Swappa

- Grailed

- Bonanza

Technically, shoppers have the option of using their PayPal balances to pay for products on Amazon, but there's no PayPal integration or direct shopping cart tool, since Amazon has its own distinct checkout.

You'll also notice that many popular marketplaces already have PayPal as a default payment method when you create an account, so even though you won't see an Etsy or eBay app on PayPal, it's available to offer your customers in both of those marketplaces.

PayPal Developer Tools – The Basics

During our PayPal review, we also found the company's developer tools rather appealing. PayPal has been supporting developers in the digital landscape for a while now. However, the company doesn't stand out as the most reliable option on the market. PayPal doesn't match companies like Stripe and Braintree in these areas.

However, it's still an excellent choice to build a more customized payment solution for your business.

Features for developers include:

- PayPal Checkout Tools: This allows you to use a developer to implement your PayPal checkout experience into your website. The tools include a variety of integration options focused on apps, mobile, and desktop web browsers.

- PayPal Subscriptions: If you're hoping to run a subscription-based business with PayPal, consider the Subscriptions solution for developers. These tools make it easier to create billing agreements and plans that automate the subscription process.

- PayPal Invoicing: While you can use the web interface from PayPal to create invoices, you can also try the API for developers to design and create invoices you send directly to your customers.

- 3rd-Party Integrations: PayPal offers solutions to merge with and create external shopping cart systems and plugins.

- Multiparty Marketplace: This is an option for marketplace store owners who want to include a payment solution for the marketplace as well as an onboarding guide for users.

- Payouts: Develop a custom solution to generate mass payments to non-employee workers like contractors and freelancers.

- Disputes: Create a custom, automated dispute resolution center.

- Reporting: Build advanced insights catered to your company, with transaction-level analytics and more.

- Identity: Construct a way for customers to access your online store by only logging in with their PayPal credentials.

Those are the standard developer tools, and here are the APIs and SDKs available for your developer:

- Payment Data Transfer

- Instant Payment Notification

- Webhooks

- Braintree SDKs

- Donate SDK

- JavaScript SDK

- Braintree GraphQL API

- NVP/SOAP APIs

- REST APIs

It's also worth mentioning that all developers get access to an API executor, PayPal sandbox, and demo portal for testing.

PayPal Funding and Capital Solutions

As we mentioned above, one of the things that makes PayPal so impressive is the fact that the company can offer more than just an immersive online payment experience. With PayPal, you also have access to business funding.

The first thing you need to know about PayPal for payments, is that the money from your transactions will be available almost instantly within your PayPal account, you can then spend the amount that you earn anywhere online that accepts PayPal, or transfer the funds directly to your bank account.

PayPal also offers its own debit card for business users, which is available through MasterCard. This gives business owners an easy way to access cash from the PayPal account without having to wait for your funds to transfer. This card can also be a good option if you need to keep your personal and business accounts separate for tax purposes.

As for actually gaining capital to fund your business, PayPal offers two options:

The PayPal Working Capital option offers:

- One fixed fee that you can often choose

- Automatic repayments pulled from your sales

- A calculator and consultation to determine the size of your loan

- No credit check required

The PayPal Business Loan offering provides:

- A tailored loan solution with your own dashboard, necessary documents, and a personal loan agent

- Options to choose your loan terms and amount based on your eligibility

- A streamlined application that analyses business health

- Predictable payments that pull on a weekly basis from your bank account

- One fixed fee

- Loan approval within minutes

Top PayPal Alternatives

PayPal isn't for all businesses. Our PayPal review showed that some users think the fees are too high, or the online store tools are too confusing. Regardless of your reasoning, it makes sense to explore PayPal alternatives. We also find it prudent to consider pairing PayPal with another payment gateway, since you can then provide multiple payment methods to customers.

Here are some notable PayPal alternatives to consider:

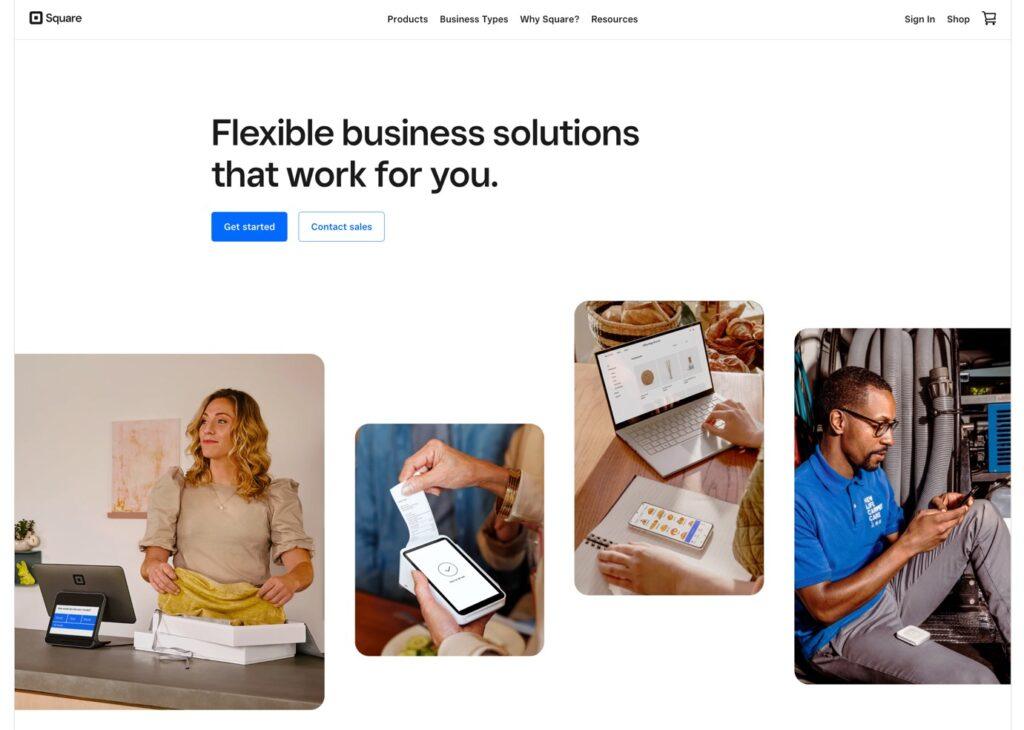

Square

Square is one of the more impressive and attractive options in the market for today’s merchants. One thing that makes Square so impressive is that it’s perfect for both online and offline selling. Often, it’s difficult to find a company that can provide both solutions so well.

Square is a leading tool for in-person and retail transactions, thanks to a range of hardware options that you can tie into your plan. You can accept cash, checks, gift cards, and cards. Also, if you don’t have an internet connection, you can still take payments.

To build an online store, Square offers a free shop builder (since it purchased and integrated Weebly), where you add products, activate the Square checkout system, and market your brand, all from one simple dashboard.

Square comes with all the functionality you need to monitor your business on the back end. You can assign a tracking number to pieces of inventory and keep track of all your payments from things like Visa or MasterCard. You can even create a website that’s connected to your POS, so you get a totally synchronized experience.

Square for Retail ensures that you can sell faster with tracking, adjustable components, point of sale performance, vendor management, and customer profiles. There’s also the option to create reports that you can share with the rest of your team and shareholders. For instance, you might make a goods sold report, or track employees with timecards.

After reading out PayPal review, checkout our comprehensive Square review here.

/furt

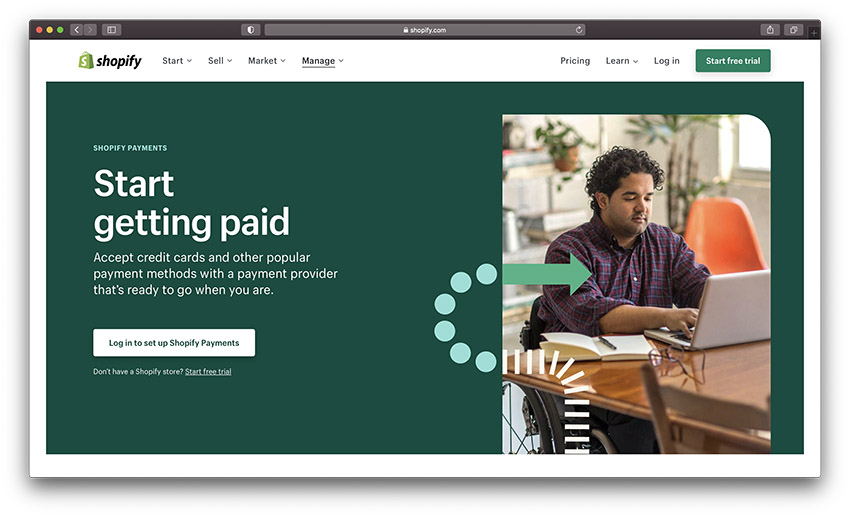

Shopify Payments

Shopify Payments is an interesting alternative to other leading solutions like Square, PayPal, and Authorize.net. Just like many other market leaders available today, Shopify Payment helps you to take many card payments.

One of the interesting things about Shopify Payments is that you can reduce your processing and transaction fees on Shopify by using this built-in system. Shopify Payments also ensures that you can track every aspect of your business in the same environment.

You don’t need to jump between different apps to get results. Shopify makes it quick and easy to accept payments online and offline. There’s also support for things like Facebook shops, buyable pins, Amazon, Facebook Messenger, and more.

Shopify Payments only works within the Shopify ecosystem, so we highly recommend it for Shopify store owners; it eliminates extra transaction fees, provides a seemless setup, and you don't need to go through a credit check.

Read our full Shopify Payments review here.

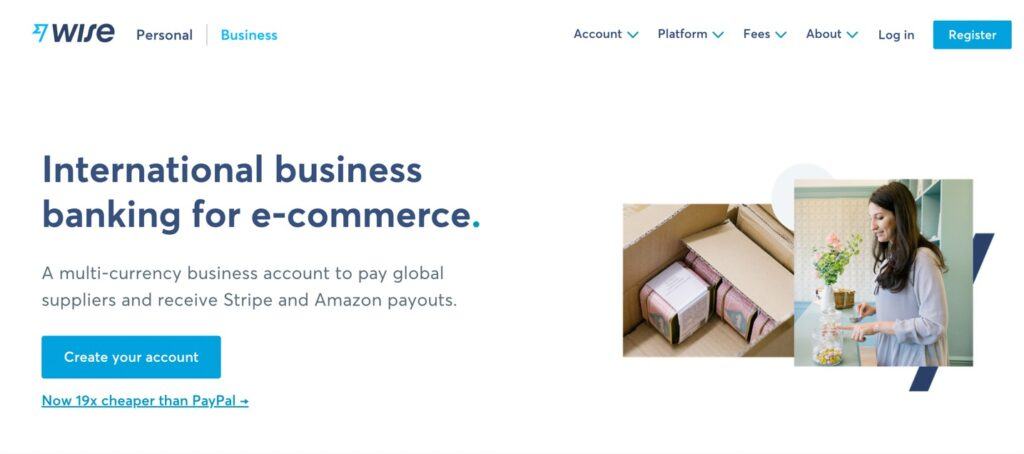

Wise (Formerly TransferWise)

Wise advertises itself as one of the cheapest and most effective ways to send money around the world. You can send and receive money with a borderless account and put that money in a Wise business debit card. This makes it easier to keep your personal and business payments separate when growing your brand.

Like PayPal, Wise ensures that you can send and receive money easily. Run batch and payroll payments, get paid as a freelance expert, and even explore the payouts solution, too. The Wise system even comes with the option to create your own solutions via the payouts API.

Another big benefit of this solution compared to options like PayPal, is the company claims to have one of the fairest exchange rates around. You can get rid of problems like hidden fees, complete around 90% of all transfers from the UK to Europe, and more.

If you conduct a higher amount of international sales, then you might be able to save a lot of time and money. It’s definitely worth checking this solution out if you need something that’s simple and straightforward for international sellers. Keep in mind, however, that Wise is more for transferring payments, not processing ecommerce transactions. You can absolutely accept an international payment and send out a product, but Wise doesn't have any checkout module, just a simple link for you to get paid.

Read our full Wise review here.

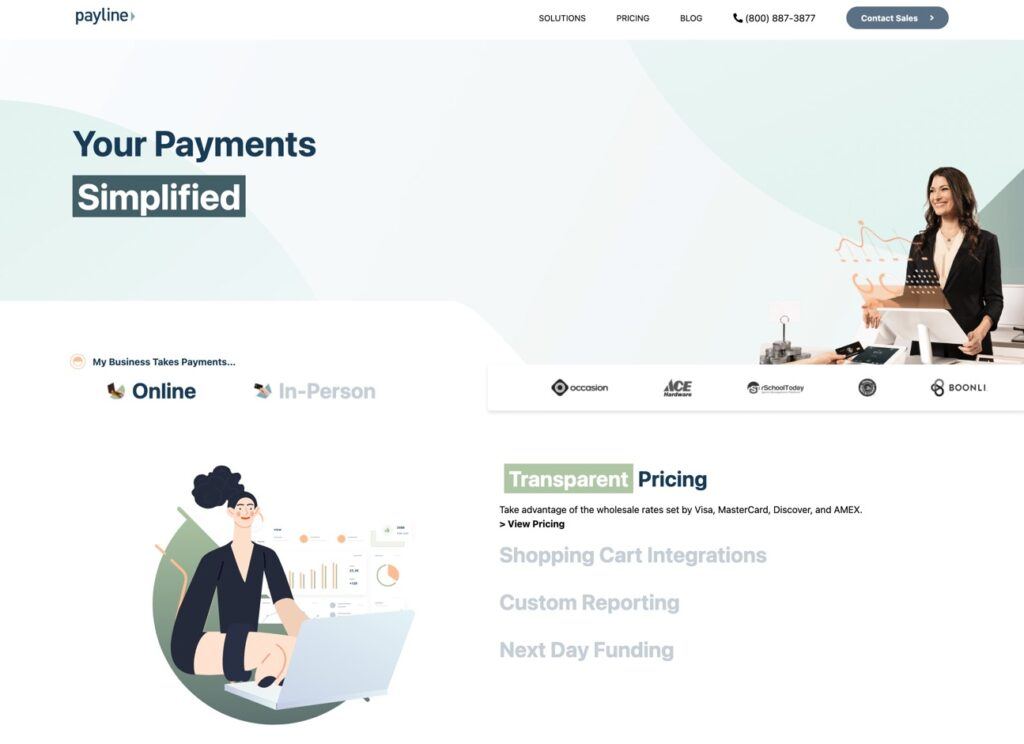

Payline

Payline promises an open and fresh approach to getting the payments that you deserve online.

Payline is one of the more impressive alternatives to PayPal on the market today. The reason this company stands out so much is that there are no gateway or transaction fees to worry about. No annual fees or monthly fees to consider, and the deposit times are exceptionally fast.

Payline has transparent pricing for all online and offline transactions, and it's all powered by a simple calculator that uses interchange, monthly, and transactional pricing, with no additional costs after that. There are also features like chargeback protection and fraud prevention, so you can protect yourself from payment headaches.

Other than that, Payline offers readers and terminals, API and developer documentation, invoicing tools, a beautiful dashboard, and top notch customer support through a robust online knowledgebase and dedicated support reps.

On the other hand, it’s worth noting that Payline does provide support for more risky accounts, as well as specialist options for healthcare.

When you're done with the PayPal review, read our comprehensive Payline Data review here.

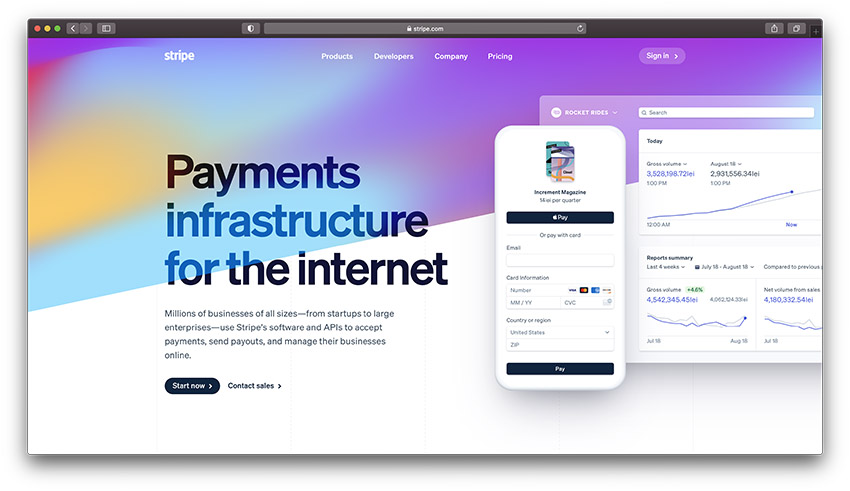

Stripe

If you’re running an eCommerce business and you want plenty of room to grow, then Stripe could be the perfect alternative to PayPal. This developer-first company takes a different approach to managing your payments. The simple and effective API means you can get your Stripe solution up and running in little time.

Stripe is available in over 47 countries for ecommerce payment processing and in-person POS systems. It also offers products for invoicing, billing, corporate cards, payment links, taxes, terminals, and much more. Stripe has continued to maintain its industry standard pricing at 2.9% + $0.30 per ecommerce transaction, which is significantly lower than PayPal.

The self-hosted checkout experience provided by Stripe also means that you don’t have to send your customers to an external site like PayPal. This saves companies from monthly fees and other concerns. Another convenience of this platform is that it’s fantastic for bank account deposits.

If a customer purchases a product from the business using Stripe, the network will automatically send funds into an outside bank account, so there aren’t as many manual transfers to think about. This reduces the risk of things like account holds and fraud suspicion.

Read the comprehensive Stripe review here.

Don't forget to check out our top 10 PayPal alternatives for more info.

Who Should Use PayPal?

Can you run a large ecommerce site with PayPal as its sole payment processor? Technically, yes. But we recommend it for companies just getting started, since it's super easy to install, and it integrates with options like Shopify (read our full Shopify review), WordPress, and BigCommerce (read our full BigCommerce review).

As you move onto more advanced payment processors like Stripe, it's not a bad idea to still include a PayPal button, considering many people still love using PayPal. The main reason you wouldn't use PayPal as your traditional merchant account is because most other solutions save you money as sales grow. For example, surpassing $5 to 10,000 in sales will cost you far more with PayPal than it would with other payment gateways.

If you have any experience running PayPal on your website, or if you have questions about our PayPal review, leave us a comment below.

The worst thing I did in my life is that I opened a PayPal account. My account was hacked and I can’t access it until this moment. My money was embezzled due to poor PayPal customer service. They don’t care about complaints and they don’t handle complaints quickly. Reasons why you should not deal with PayPal

1- It is not secure because you can change the password a million times a day and the PayPal system does not alert you that your account has unusual activity, which means that hackers can hack your account.

2- When your account is hacked, it is not possible to communicate with PayPal, because the only way to communicate in one case is to enter your account and then you can talk to them, how can you do that when the hacker changed the password and you do not own it

3- Each PayPal office in all countries is different from the other in the speed of solutions, as they are not a unified system

4- The first international language, which is English, is not included in non-English speaking countries. For example, you are in Belgium and you want to communicate with PayPal in Brussels. They will speak only two languages, which are French and Dutch.

5- They cannot recover your account when it is hacked and they delay you for very long periods without radical solutions

6- In the case of accessing their websites, each country differs from the other in the way of communication. For example, in some countries, when you cannot enter, there is the possibility of entering as a guest and communicating with them to explain your problem. In Belgium, this item is not available. When you click on the Contact Us link, you will be directed to the error page. This means that the actions of their sites differ from one country to another, and this proves that No centralization or unified system for them

7- About communicating with them, it will take more than 10 days to respond to your e-mails and there are no immediate solutions. This means if your account has one million euros and you are the owner of a company and you have daily financial obligations, you will not be able to dispose of your money in your PayPal account because you cannot enter your account and they do not have quick solutions for you, and their messages begin with the word apology only without immediate solutions, and you die every day a hundred times from the nervous pressure facing you and your money is seized and you do not have any information.

And vice versa, if the message is condemnation and denunciation of what they are doing to you, they do not publish it and punish you by the long waiting period to respond to your e-mail.

This is what happened to me until now. I advise you to stay away from PayPal for these reasons. You will feel and believe my story when your account is hacked and disasters begin.

Amazing experience with a rep named Rebecca in the call center. May have been in the Arizona location? I had a problem with my payments being on hold and she explained everything so thoroughly and went above and beyond. PayPal holds payments for a ridiculous 21 days but she helped me find a way to get the money sooner. I did have to email my buyers but once they did everything I instantly got my money. She also gave me resources to help my small business!

Thanks for sharing Tabitha!

The PayPal customer service is catastrophic. We pay more than EUR 10,000 in (overpriced) fees to PayPal. When there is a problem, there is only the chat. People in the chat are extremely rude and won’t help to solve the problem. I truely hope that PayPal will be replaced by better competitors.

Worst thing I’ve done in my life I signed up for Paypal,When your account is stolen, you cannot contact PayPal,You cannot send emails to them. You can not contact them without logging into your account. Paypal is like a black box, you can only solve your account problems when you enter this box ,How do you get into this black box when your account is stolen.Whoever takes over your account takes over your money.You can change the password of your account a thousand times a day, and the Paypal does not send a security warning,This means that a hacker can hack your account

Après quelques années d’utilisation de Paypal , j’ai mis un terme à mon compte après une mésaventure avec Aliexpress. J’ai reçu le mauvais produit commandé et j’ai demandé en conséquence un remboursement à Aliexpress qui a mis un temps fou à répondre à mes demandes. Et cela après de multiples “chats” avec l’entreprise. J’ai donc décidé de faire appel à Paypal qui a pris le parti du marchand au détriment du consommateur. Retourner le mauvais produit par la poste exigeait que je débourse en frais postaux le prix du produit livré. J’ai décidé de fermer mon compte Aliexpress, de recourir à une carte VISA rechargeable et de limiter mes recours à Paypal qu’au strict minimum. La confiance est rompue.

Sorry to hear about that Jean.

Connaissez la vérité :

La réalité pour les marchants c’est que paypal indique des frais à 2% sur Shopify, pratique en réalité des frais réels qui correspondent à 4% (sur de montants de 40 à 80€) ! De plus ils gardent l’argent plus d’une 20e de jours afin d’avoir le temps de spéculer avec.

C’est une solution américaine, basé en Irlande pour la partie Europe, afin de ne pas payer de taxe en France.

A tout ceux qui aiment utiliser paypal, sachez la réalité des difficultés pour les commerçants qui l’utilisent. A bon entendeur…

Loved Paypal for years serving eBay store & discount shipping services, staying safe from paying strangers.

However, an eBay sale last month to a newly registered buyer turned ugly. Catfish was using their Dad’s IDs, changed the PICKUP ONLY deal to SHIPPING a delicate machine 800miles, ignoring warnings of damage. Glass bulb inside broke, instead of easy paid fix offer, REFUSED delivery + RETURN to seller (us) and ALL money back, even special high dollar shipping box 62″ long, 200# rated.

PAYPAL held those payments hostage

PAYPAL ignored details of the dispute

PAYPAL then REFUNDED ALL of their payments without my OK

My rating for Paypal was 4-stars, now 1-star after all the additional hoops they ran me through in addition to the life changing ones this chronic liar self-centered buyer did.

I cannot get in touch with paypal. They are retaining money paid from my customers even though the products has been delivered. I have tried to reach them, but no response!

I think PayPal may be in the business of making profit by selling prepaid debit cards, and then making nearly impossible to use online for shopping. After registering the card, they asked me online to update the information on the card. I changed the address because I’m using the card for a holiday purchase. After attempting to purchase my holiday gift, the transaction was not accepted. I had to call PayPal (painful – but whatever). The call center asked for my information, including the address the card was registered – I figured that meant originally registered. Nope. Then the account got locked. Now I can afford to lose $200 to this scam, but I wonder about the family trying to make ends meet. Shameful. I Highly recommend AGAINST using this company. I’d stick with the standard card companies.

J’utilise Paypal depuis quelques année…

J’utilise Paypal depuis quelques année maintenant, et là… grosse déception. Ils m’ont bloqué mon compte depuis maintenant 2 semaines avec bien sur de l’argent de bloqué dessus. Aucun recours. Ils demandent une confirmation d’identité mais refuse systématiquement la photo de carte d’identité. Service d’aide complétement inutile car appart vous dire qu’il faut remettre une photo d’identité ne serve à rien. Situation gravissime, c’est littéralement de la prise d’otage d’argent. Fuyez sincèrement car aucun recours

Sorry to hear about this Emille, you can find some of the best alternatives to PayPal here.

Most people hate paypal .

It appears that both these payment methods have a serious problem. You can not tell them which settlement currency you want. They default to the country currency not the bank account currency. If you are in Canada and have an account in USD in your Canadian Bank. If you make a payout from your USD PayPal account to your USD Canadian Bank account. PayPal will convert the money to Canadian before sending it out.

Once the Canadian funds are received then your bank will convert it back to USD for deposit. You end up paying a conversion fees to PayPal plus a conversion fee to your bank. This amounts to 4% loss of your money !!

In normal banking one can send USD to a recipient without having to convert the money to the recipients country currency.

exactly! I want to complain about my USD – USD transactions being converted against my will, even after I set USD to default, it converts to Euro and back! (I am residing in Europe). Horrible customer service from PayPal, they are impossible to contact by webpage, phone or email, and there is no way to fix this issue. This is illegal by law, as there should be a way to complaint about their services. Avoid PayPal for all costs, the company is a scam.

I have used PayPal for years. This is the year 2020 I’ve had the most problems. I bought a dress from Boohoo for $40.56 through Paypal. The dress did not fit and for my taste garbage. How about Boohoo wants to pay me half of a refund instead of my full refund and PayPal decided in their favor. I am extremely upset!!!!

I’m sorry to hear about this Felicia.

PayPal is very unreliable company You cannot get a hold of them in person. It is a garbage outfit that cannot produce the product that you order.

PayPal is an evil company

As a realtor, I paid $600 to a web in China for Ads postage. They give me a link to pose my profile. Nothing else. I don’t know this web before and front agent promised me a big dream. 3 months is gone, nothing came to me. So I asked the remaining $450 back. Today PayPal noticed me service delivered, then denied my case. So my $600 is gone, for nothing, nothing, nothing.

I really don’t know how PayPal made this decision. I did not get any penny from the web and the web agent delete me from his social media. Compared to credit card company, PayPal is junk and scammers’s pal. Sincerely. Hue

Hello Hua, sorry to hear about that. I hope you managed to solve the problem in the meantime.

Bogdan, Hua Yang’s experience is quite common. It is very similar to the other experiences flooding your comment section, and it is similar to my own. The only difference is I have lost thousands of dollars. The company has denied my claim, siting different reasons each time I prove that their previous reason was wrong, and has now completely lied about the facts. I highly suggest that you take a good look at the online reviews of PayPal, which tell the story of an untrustworthy company that lies to its customers about their protection policy. Then, I hope you will write a review of the stories you’re seeing here and elsewhere. It may just make a lot of difference.

Thanks for your suggestion Dave!

I bought a cell phone through Swappa and payed for it through Paypal. Part of my payment came off of my credit card attached to Paypal and the rest came from my Paypal balance. After receiving the phone that was advertised as BRAND NEW, it was discovered that the phone was not new, but was a very poorly done, refurbished phone and the battery swelled and pushed the screen off of the phone after 2 months of use. I tried to deal with the seller directly and they refused to help. Seller instructed me to take the phone for repair and gave me the names of local repair facilities to take it to. Next, I messaged Swappa and they didn’t even reply so I began a dispute process. My credit card company refunded the portion that was charged through them after I sent over documented proof that the phone was NOT NEW AS ADVERTISED. It was plain and clear evidence from a third party (cell phone repair facility that the seller told me to take the phone to for repair). I sent the same documentation to Paypal and Paypal refused to help me, stating that I had extended use of the phone over the 2 months since buying it and implied that my “extended-use of the phone” is the problem. Beware of buying through Paypal!

Sorry to hear about that Caroline.

paypal sucks! They put a limitation on my account with no reason and refused to close my account. This kind of company should not exist.

Why you should not use PayPal (UK)

We have been using PayPal for years without any issues.

Last week for the first time PayPal notified us of a suspicious transaction on our account that they were investigating. We looked at our recent transactions and there were two fraudulent transactions. We advised them of both fraudulent transactions. So far so good.

They advised us that they would refund one of the transactions, but the second (the transaction they had originally notified us of) was legitimate.

They closed the case in the resolution centre and there was no way (online) to get any further assistance. We contacted them by phone, they agreed to reopen the case, and we explained that both transactions were at similar times and for similar goods. Goods that we had no history of purchasing. They had no explanation for why one of the transactions had been refunded but not the other.

We contacted the seller and they advised they couldn’t help and we had to speak to PayPal.

PayPal re-investigated and advised (once again) that the transaction was legitimate.

We have had fraudulent transactions on our debit and credit cards on a number of occasions over the last 20 years, in every case the money was refunded without any issues.

We investigated what our rights are “PayPal v’s Debit Card v’s Credit card”. In the UK you have statutory protection for credit card purchases over £100 (Section 75) and a number of debit cards also include protection. But PayPal includes no statutory protection, if a transaction is via PayPal you lose the protection provided by your Debit / Credit cards.

We are still trying to convince PayPal that this transaction is fraudulent but we hold out little hope.

We are in the process of closing down our PayPal accounts and will now use alternative methods for paying for goods.

PayPal is very convenient, seems secure, but if you have a fraud issue you are completely at the mercy of whether PayPal agree it’s a fraudulent transaction. This fraudster has happily got away with £90.

bjr

j’ai fais un achat le 14 décembre avec paiement PayPal pour noël

le paiement (dit différé) est bloqué pour je ne sais qu’elle raison jusqu’au 24 décembre,entretemps j’ai acheté sur Ebay et tous les paiements sont passés,j’aurai aimé qu’on m’explique.c’est un minimum pour une banque

Par mail j’ai envoyé trois messages j’ai reçu en retour à chaque fois….. le règlement paypal ,EN FAIT C’EST INFORMATISE par téléphone très difficile de les joindre la semaine dernière jusqu’à 1/2 heure d’attente en vain,c’est une BANQUE DEMATERIALISEE ET DESHUMANISEE.

Ce matin j’arrive à les joindre mais comme le prénom du compte est au nom de ma femme ils ne veulent pas me communique la moindre information alors que j’ai ma carte bancaire enregistré à mon nom et tous les accès,adresse mail etc… de plus c’est un cadeau pour ma femme…..,pas prêt de faire de Paypal notre compte principal

Paypal’s dispute system is unworkable. I purchased the advertised motorcycle helmet. I received a tin can push bike helmet from China. I filed a complaint. Paypal instructed me to return the item. They gave me an address written in Chinese characters, without translation. Australia Post would not accept the address. There was not way of contacting Paypal to get a proper address in English without providing a tracking code. Paypal cancelled my dispute because I did not provide a tracking code. There is no avenue for review. The vendor makes fraudulent claims worldwide, knows that the system is flawed, knows how to avoid the process, and Paypal support this fraudulent activity by complacency.

a fuir

a fuir, ce sont des voleurs irresponsables.

vous leur faite confiance pendant 10 ans pour votre commerce et du jour au lendemain ils ferment le compte pour des raison de reglement. pas moyen de savoir pourquoi, toujours la meme reponse de robot.

des sociétes comme cela ne devraient pas exister, il faut tout faire pour les éliminier. en tout cas n’utilisez JAMAIS paypal

Sorry to hear about that Sylvain.

Tout à fait d’accord avec vous sylvain, paypal n’est plus le service populaire détenu par ebay, changer de maître a aussi changé d’attitude et de règles, à éviter absolument

It is very interesting that most PayPal reviews have been archived or deleted. It looks like they are working hard at keeping the negative comments off the web.

I’m finding PayPal not worth the effort. The constant ghosting of their emails (spam). The barrage of emails to update tax info. And a new pet peeve of mine, giving out the cell phone so that you receive a constant barrage of text messages for security reasons and sometimes marketing. Just much easier to set up a merchant account and pay the 3.5%. PayPal fees will be approaching the same as any merchant account because that is what they are.

My personal experience with PayPal is pretty bad.

I’ve always used it supposing that PayPal would have teken care of potential troubles with fake shippings and similar problems, but the first once I had a problem after several years of use, PayPal did absolutely nothing to solve the matter and just made me loose a lot of time and the money paid.

Other aspect, the once I had to buy in different currency, the exchange rate applied by PayPal have been around a 4% extra.

At the end of all, I can say that’s safer to use a pre paid credit card instead of PayPal. the provider of the credit card is not applying extra costs for foreign currencies and, expecially, in case of fraud the bank is covering with an insurance, PayPal doesnt.

Back in August, I used my PayPal business account to send money to a friend. Because it was a personal transaction, I very carefully specified that the money come from my Wells Fargo card instead of the balance of my PayPal account. But PayPal wiped out my balance anyway, only taking the remainder from my personal card instead of the full amount. I spent HOURS in chat and on the phone complaining and trying to get a resolution. They couldn’t put the money back but assured me it was a technical glitch that had been fixed. They said it would not happen again. Yesterday, I sent more money to the same friend. Same result. My PayPal account is what I use to pay business expenses. To have it used for a personal transaction not only screws up my records, it takes away the money I need for my business. They want me to jump through all the same hoops they put me through last time. Not happening. Fool me once…etc.

Sorry to hear about that Beth, I hope this will get fixed soon!

Paaswad bhul gae he pilic rest my paswad

PayPal is a scam. Make sure you read the ENTIRE site before signing up including FAQ and and small print. I got a cash card and tried to load at Walgreen’s cvs 711 and dollar tree all locations declined my cash load. I deposit the money to the back for a bank transfer which ALWAYS took only 1-3 business days now claim it takes 5DAYS no where does it state its BUSINESS DAYS unless you look at the fine print. Also I sent the transfer on the 25th and now its stating it won’t Arrive until the 1st, which now makes it 6 days. When you pull up paypal.Com it states get your money in 1-3 days but once you start the transfer then states 5 days. Custimer service reps are rude and manager was no help just kept talking over me and acting like I should know paypal inside and out. He stated it went to a 6th day because they go by ach clearing and because the transfer was made AFTER the banks working hours I tacked on another day again website doesnt state that unless you read fine print, false advertisement and abusing their customers paypal users beware!!!!

A few days ago i checked my PayPal statement only to find that an item i had purchased over the internet and thought i had paid through Pay Pal had been paid there but a duplicate payment had been made from the bank account that was listed on my PayPal profile.

I called PayPal customer service to work out the issue. “all representatives are busy” leave your name and a representative will call you back between 48 and 108 minutes from now.

When a Customer Service Representative did call back i could understand something less that the full content of her language and regardless of my having proof of the duplicate payments, she told me that such would never happen. No matter what i said she insisted that i must be wrong.

Ultimately i asked her to close my account and rebate the balance by check via US Mail

This is how one treats a customer in America? I’m so often reminded of the signs you see all over mercantile establishments in India – quote from Ghandi. the customer is in an imposition to your day, he is the reason for your being there. And you wonder why we’re losing out edge.

I would like some sort of help.

I signed up for PayPal Business and every time I try to collect a payment from a customer, it doesn’t accept their card.

A couple of customers even signed up for PayPal accounts when they should have been able to pay as a guest, but that still hasn’t helped.

Much too much of a hassle and an embarrassment.

Have you tried contacting their support team?

In no way possible. You can try and try and try, but no results

Stay away from PayPal, they held all our money and i couldn’t bring my wife who is at a risk pregnacy and had contracrions to the hospital to check.

I’ve sent book statment, bankstatment, id so many times and already spend over USD500 on international roaming calls trying to solve this situation.

They keep send emails saying it’s not a valid proof of address it’s been a night mare for us.

Et oui idem

Et oui idem, vélo électrique acheté sur gearbest France, envoyé de France, reçu sans la clé de mise en route, ni de frein avant, retour pour remboursement.

Renvoi a Hong-Kong, pas de transporteur capable d’envoyer un colis de 32 kms et 145 cm de long, gearbest me donne une adresse en Espagne, je renvoi 82€ d’envoi plus 693 € de vélo sauf que PayPal a clos ma demande car je devait r’envoyer exclusivement à Hong Kong.

A éviter absolument, ce sont des voleurs…

MERCI PAYPAL

I wouldn’t recommend to anyone. I’ve used PayPal without trouble for years and I’ve faced two problems. At first, when I created the account it wouldn’t receive nor send any money and when I asked them about it, their answer had absolutely nothing to do with my problem. I let it go and a few months later, the account was working just fine and I’ve used it for years to receive money for my freelance work and make simple purchases online. I had a credit card and a bank account linked and then suddenly they’re asking for proof of identity and proof of address and not accepting anything I sent nor letting me withdraw or transfer my money. I was using an Israeli account but had moved to the US later on and kept using my account but they wouldn’t accept a proof of an american address nor an Israeli P.O.Box. Then the moment they found out I have a Palestinian address, they permanently limited my account with over $900 in it. I’ve contacted them throughout this whole problem at each step to get help but their customer service was crappy as always and they kept answering with the same email over and over which had nothing to do with the questions I actually ask in my emails. I now have an account with $900 that I can’t withdraw for 180 days and then I have no idea how they will let me withdraw it but this whole experience was horrible and I don’t recommend at all. I’ll be moving to payoneer or something else as soon as I figure out how to get my money.

I find it absolutely ridiculous that an online platform needs a proof of address or specific locations for online purchases. They could have let me keep using their services despite my location as I am only using their services for online purchases. I just don’t get it.

Sorry to hear that Nancy.

Here are the Top 10 PayPal alternatives. Let me know if you need any additional help.

–

Bogdan Rancea

I also have used Paypal for years and absolutely HATE using them! I bought a cell phone through Swappa and payed for it through Paypal. Part of my payment came off of my credit card attached to Paypal and the rest came from my Paypal balance. After receiving the phone that was advertised as BRAND NEW, it was discovered that the phone was not new, but was a very poorly done, refurbished phone and the battery swelled and pushed the screen off of the phone after 2 months of use. I tried to deal with the seller directly and they refused to help. Seller instructed me to take the phone for repair and gave me the names of local repair facilities to take it to. Next, I messaged Swappa and they didn’t even reply so I began a dispute process. My credit card company refunded the portion that was charged through them after I sent over documented proof that the phone was NOT NEW AS ADVERTISED. It was plain and clear evidence from a third party (cell phone repair facility that the seller told me to take the phone to for repair). I sent the same documentation to Paypal and Paypal refused to help me, stating that I had extended use of the phone over the 2 months since buying it and implied that my “extended-use of the phone” is the problem. Beware of buying through Paypal!

You probably won’t have any issues with PayPal is your account currency matches the country of issue. However, if you card is in dollars while the local currency of your country is different, the system will automatically assign local currency to your account. As a result, you lose on double currency conversion. I think a business specializing in financial matters should know these things.

In addition, if you contact customer service about it, they will change the currency of your account, but will NOT refund you the losses that happened due to their buggy system. The worst customer service I’ve ever seen.

Thanks for the feedback Victoria.

I have been a customer of theirs for 15 years and while they have no problem accepting payments from me and taking their fees, I have never once had a payment received that they didn’t put a hold on from 2 weeks up to 1.5 months. I cannot wait for ebay to transition away from them and hope to be one of the first to go. Their customer service is horrendous as well as their treatment of their customers. If you can avoid dealing with them at any cost, do so and save yourself many headaches!

Hello James,

Unfortunately, eBay won’t stop using PayPal mainly because the have acquired the company back in 2002.