Here we look briefly at Chicago-based Braintree Payments, highlighting some of the features a merchant might consider when picking a payment processor.

Today, Braintree is one of the biggest payment solutions in the landscape, offering an excellent selection of tools for business owners to explore. The company has offices all around the globe and appeals to small business owners and enterprise leaders alike. However, despite it’s size, Braintree continues to prioritize ecommerce companies.

Braintree currently offers two ways for merchants to use its services. The primary and most affordable option is to use a Braintree merchant account, which includes payment gateway access. You get a full merchant account that’s professionally overwritten and extremely stable. You don’t get the same stability with most PSPs like Stripe and Square. Plus, billing is per month, with no account fees, and no early termination fee.

Flat rate pricing from Braintree for its merchant account is fantastic, and there’s interchange plus pricing too. Alternatively, you can simply sign up for the payment gateway and use an API to integrate it into your existing merchant account. This might seem like a more affordable option, but it’s not always the best bet. The gateway fee is pretty high, and transaction fees add to the cost.

Braintree does make for a solid choice for many merchants, however, particularly in international ecommerce, the gateway can accept around 144 local currencies.

Braintree Payments Overview

Braintree has some heavy-weight support behind it. PayPal bought Braintree Payments in 2013 for $800 billion saying their products and development platforms were “complementary.” Obviously PayPal was also interested in Venmo (full Venmo review here), a PayPal competitor. Braintree purchased Venmo in 2007. Venmo lets people send each other money using an email address or mobile phone number and do so for free.

Braintree was founded in 2007, attracting $69 in venture capital funding, thus showing its potential early on. The platform is popular with tech startups including Airbnb, Fab, LivingSocial, Uber, Twilio, and GitHub. Of $12 billion in payments processed by Braintree in 2013, $4 billion were made using mobile devices, showing its wide adoption for mobile payments.

Braintree Payments Pros and Cons

Ultimately, if you’re running a business model in the United States and you need to manage payments online and offline, Braintree is a good parent company to consider. The processing fee and flat-rate pricing is easy to plan for, and the UI is great. Plus, you get an extensive range of integrations to choose from. However, this might not be the choice for you if you just need a gateway only solution.

Pros 👍

- Lots of great features

- Customize your UI

- Developer access on the backend

- Full range of payment types

- Multi Currency options

- Predictable flat-rate pricing

- Easy functionality

Cons 👎

- Not the best option for gateway only

- High risk industries not supported

- Long account set-up times

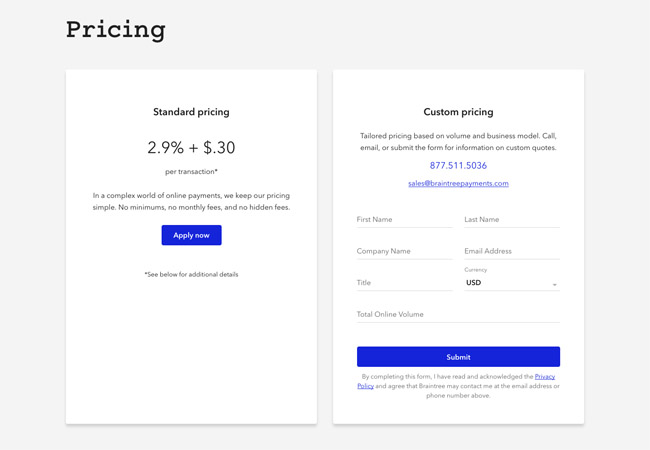

Braintree Payments Pricing

While some analysts have said that Braintree’s prices are high, they are the same as Stripe. The prices shown below do not include any surprises; there are no additional fees like setup or monthly maintenance fees.

- 2.9% + $0.30 per transaction

- $15 for each chargeback

You can accept all kinds of customer payments from American Express to PayPal and move money quickly into your bank account. If you’re running an eCommerce website, Braintree offers the benefits of no annual fee or monthly account fee.

You won’t have any monthly minimum to stick to, and there aren’t extra fees for customer support. There’s no PCI compliance fee, early termination fee, gateway fee, or statement fees.

The only potential extra expenses you’ll need to think about come when your customers make a purchase internationally. Transactions outside of USD incur a 1% fee, and an additional 1% fee applies to transactions made on cards issued outside of the US.

Braintree’s rate of around 2.9% plus $0.30 is competitive, when you consider the fact that there aren’t any extra fees to worry about. Remember that if you’ve integrated with PayPal, you will have those rates to think about too. It’s also worth noting that volume discounts are available for companies that take a lot of payments too, and there’s a discounted rate for nonprofits.

For businesses processing $80,000 per month, you can switch to a custom pricing plan. The interchange or flat-rate pricing plans give you more freedom, but the interchange plus is likely to be the more affordable choice. Flat-rate pricing can be more predictable, but you’ll usually end up paying more for certain transactions.

There’s also support for ACH Direct Debit processing from Braintree at a consistent price of around 0.75% per transaction. Maximum per-transaction fees are also capped at $5. Braintree’s payment gateway is something you can get on its own if you’re willing to pay the fees.

The gateway works with most of the merchant accounts you can create in the US, and there are a few fees to consider:

- $49 for gateway fees per month

- $0.10 per transaction (on top of processing rates from your provider)

- $10 per month for each additional account

Although these prices can be competitive, the expense often means that the payment gateway only product isn’t as affordable. Most merchant service providers will only charge around $25 per month for gateway fees, and around $0.05 per transaction for sales processed. This means that Braintree’s prices are quite steep. You do get some exclusive features with Braintree though, like an extensive API library.

Braintree Payments Main Features

Braintree focuses exclusively on selling digital and mobile products online. If you use mobile processing or you work in eCommerce, then Braintree has you covered. The features available from Braintree for business owners fall into two distinct categories: merchant accounts, and payment gateway services.

If you choose the merchant account, you get a full-service solution with a unique ID number, excellent account stability, and a fantastic set of features. There’s no minimum processing requirements either, so it’s great for smaller companies.

If you pick the payment gateway services, then you get everything you could need from Braintree beyond payment processing. You can use the Braintree gateway with your merchant account from another provider. However, per-transaction and gateway fees are almost two times higher than the average here.

Braintree’s services include the following:

- Braintree direct: Built for companies that need to sell directly on their site or mobile app. You can accept various payment options including debit and credit cards, PayPal, Google Pay, Apple Pay, and wallets. There’s also fraud protection, reporting, integration options, and recurring billing features.

- Braintree extend: Merchants can share payment data with their partners, including other merchants, platforms, and service providers. Companies can use extend to share data with security services, vault providers, loyalty partners, and reward partners. You can also develop in-context solutions with purchasing options in partner content.

- Braintree marketplace: Here you can manage various aspects of your business. You can split your payments between yourself and your providers, however, it’s difficult to determine how much this service costs.

- Braintree Auth: Designed for third-party providers instead of merchants, you can use this product if you use a third-party service for data analytics, recurring billing, invoicing, and so on. Auth is a good way to share merchant data securely.

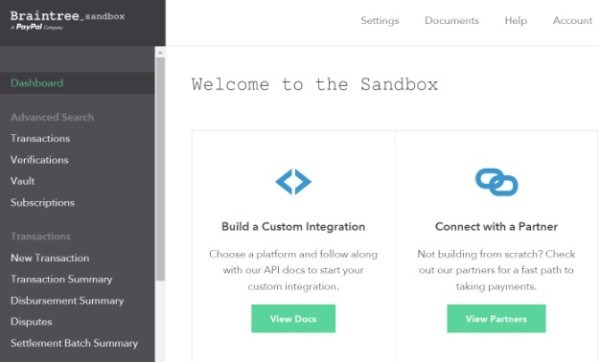

Test Drive Braintree

Anyone can create an account in the sandbox to see what the interface looks like. There’s nothing to give away but an email address. Since it’s a sandbox, it does not do any real payment processing. Here is the main dashboard:

Products and Services

Braintree provides its customers with a merchant account if they want one. So there is no need to pay a bank for that. In addition, Braintree offers these products and services and more:

- Credit card vault–stores customer payment data in encrypted format. The ability to download stored credit card information would more easily let the merchant switch to another payment processor if they wanted to. Ecommerce engines connected to that let customers update their payment data.

- Recurrent billing–storing customer information in the vault makes processing subscriptions, donations, SaaS fees, or any other kind of recurring payments easier.

- Mobile–works with mobile apps from the ecommerce partners mentioned below. Plus their SDKs lets merchants program their own payment buttons and apps for iOS and Android.

- International–available to merchants in the US, Australia, Europe, Hong Kong, Malaysia, Singapore, and New Zealand. The system supports 130 currencies.

- Payment gateway–obviously they provide a payment gateway, since that is why you are reading this.

- In-store payments: Primarily, Braintree is mostly intended for eCommerce functionality. However, you can also process in-person payments with PayPal. Braintree integrates with any mPOS apps and providers you might be using. Additionally, you can take verified payments at a checkout in the US, Australia, and the UK. However, you will need to pay PayPal company fees.

- Sandbox: Another way to take advantage of Braintree, aside from to access credit card payments and transactions from a debit card, is to experiment with its features as a developer. There’s a sandbox functionality that allows you to examine how Braintree works.

- Payouts: You can access marketplace business payouts through Hyperwallet to support mass payouts from your Braintree account to all the merchants selling on your platform.

- Data security: You always need to ensure that your payment solution can protect you from any scam or damages. Every big credit card processing solution, from authorize.net, to braintreepayments.com has security for all users, and Braintree also has PCI DSS compliance.

- Reporting: With reporting features you can track how many transactions you’re processing on business days. You could check whether your sales go down due to events like Covid, and look into customer reviews. You could even check whether you’re making more sales with euro prices, or dollars, so you know where your customers are.

Extra Features from Braintree Payments

Braintree’s list of available features continues to grow, with everything from support to protect you against fraudulent transactions, to reports to help you measure credit card transactions. There’s the option to create a custom UI experience for yourself and your workers. You also get Global selling support to help you accept payments in over 130 currencies.

If you’re selling internationally, you can offer different settlement and “present” companies, which means that you can display the currency that’s local to your customer, but still take the payments that are right for you. For your monthly fee, you also get in-depth fraud protection tools to help ensure that you’re not going to have to risk your positive reviews or hire a dedicated risk team.

Braintree also offers a good level of data portability, with a vault system that allows you to access customer stored payment information while maintaining PC compliance. To give you access to more functionality, you’ll also have the option to upgrade your shopping cart and other features with integrations to third-party tools.

PCI Compliance

For those who open a merchant account with Braintree Reviews, the company hands the merchant over to SecurityMetrics. They help Braintree customers obtain and retain PCI Compliance by providing the required annual survey.

Braintree also says that Braintree encryption lets customers create transactions “without the PCI compliance burden that comes with handling unencrypted data”. A merchant using a credit card must meet PCI compliance. But other forms of payment do not necessarily need that. PCI-compliant credit cards and POS, even with EMV chips, are not the best solution for security since those systems do not support end-to-end encryption.

Payment Methods

Braintree supports all of the payment methods mentioned below. Cash is not one of them, since it is not a brick-and-mortar POS system:

- PayPal

- Credit cards

- Venmo

- Apple Pay

- Android Pay

- Bitcoin, via the Coinbase exchange

Other Tools from Braintree Payments

- Fraud Tool–helps protect against chargebacks. They are not automatically added to the customer’s account, since there are several to choose from: basic, advanced, or integration with the Kount cloud service (for a fee).

- Webhooks–pushes notification to the merchant in the case of certain events in the payment gateway instead of requiring that the merchant check for those. These include subscription changes, disbursements from the merchant’s account, disputed transactions, and sub-merchant account status changes. It works like a function callback in event-driven programming by sending a POST to a URL on your site. So the merchant can broadcast that data to any other application.

Developer Tools

There are three options:

- Merchants can add Braintree to their ecommerce site using their SDKS listed below.

- Use the Braintree Payments extension for Magento. That requires some PHP coding.

- Pick an eCommerce engine with Braintree already integrated. Those are listed under Partners below.

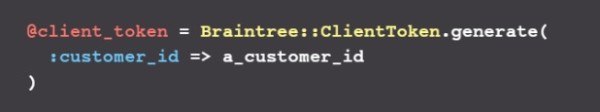

Braintree says developers can initiate a transaction with as few as “10 lines of code.” Here are 3 lines in Ruby.

Below we list the supported platforms. Client mean for inclusion in a mobile apps or web pages. Server is to integrate with the backend processing in your ecommerce engine.

| client: | iOS | HTML/JavaScript | Android |

| server: | Ruby | Python | PHP |

| Node.js | Java | .NET |

Companies without their own programmers can talk to any of these Braintree partners to help with the Braintree integration:

- Shopify

- BigCommerce

- WooCommerce

- CoreCommerce

- Easy Digital Downloads

- FreshBooks

- ShopSite

- Fleapay

- Wufoo

Braintree Payments Customer Support

Braintree support provides a knowledge base, whose value often depends on how easy it is to look up information. So that you actually find what you are looking for, they pay for the Google Custom Search Engine for their site.

Support agents are available from 8 AM CST to 7 PM, except Friday, when it is 8 AM to 5 PM. There is an emergency request form so that if the merchant opens a ticket after hours they can respond to a prompt to page an agent.

If the merchant suspects the payment platform is down, they can take a quick glance at the system status page to see if there is a general outage in their area.

Braintree Payments Security

This one is worth mentioning since not even PayPal includes that: two-factor authentication. That requires a cellphone-generated token to login, so if a hackers steals a password they cannot login, since they probably would not have the cellphone as well.

Hi, guys. I am new to the e-commerce. After I read all the comments, it seems that braintree is pretty terrible. So, what else company can deal with payment.

Hello Leslie, one of the best solutions would be Square, you can read our review here.

A EVITER.

Je ne vais pas rentrer en détail dans les interminables échanges avec ce qui ressemble à une version dégradé d’un service client, mais le résultat est la:

quelques transactions ont été acceptées au début et les autres restent bloquées chez eux et je peux faire une croix dessus.

siege au Luxembourg donc pour les attaquer en justice, ça coute assez cher.

Absolutely shocked by the poor service from Braintree. Each communication with their support, accounting and risk team is a treasure hunt, where information is revealed piece by piece. Yet the entertainment doesn’t last long, when you also realize that all the information which is given, is actually wrong, because the different departments dont speak to one another. While THEY seem to be doing a real good business with fraudulent transactions & chargebacks, they put small businesses at risk by freezing their accounts with absolutely no prior notification, telling you they will release funds, and an hour later telling you the contrary. Simply Outrageous.

Stay away down braintree. Their customer support is ridiculous. I faced a chargeback on my website while using Braintree and they firstly held all my funds and blocked all transactions, without any notice in a week!! The guys only focus on their big clients such as uber and Airbnb and just ignore the rest.

Stay way!!

This is the worst company ever. I own an online store and have been selling for 8+ years online. I decided to start going through Braintree with receiving payments recently. Well, I drive 2 hrs to pick up supplies for my business, get there and PayPal card declined. I had $7K in my PayPal account. Come to find out, after calling and being transferred to 7 different departments, there was a fraud on my account with 3 orders within the same day. Braintree asked me to refund these orders and don’t ship, then they will lift the limitations off my account. I went through this whole deal for 3 days without access to money then Braintree tell me to update some Braintree fraud tools to prevent this again, then my account will be back. Well I called Braintree again and got someone to walk me through the process of the fraud tools. After he said he will get them to review it within 24 hours. Day 4. I call Braintree again to see why my account is still limited. They told me give it 24 hours since I submitted all the documents they need. Day 5 (Saturday) I call to see what’s going on. I’m on hold for 35 mins. And she says, “I’m sorry but we usually have a specialist here at Braintree lift the limitations on the weekends, but unfortunately no one is here this weekend to do it.” So now here i am, a business owner that trusted Braintree and PayPal to handle my payments, now I had to turn away all walk in customers this week with debit cards and I couldn’t ship none of my online orders this week because I ship through PayPal and my account is locked. No access to my money but they let my customers continue to pay for items from me. Note: I have a family to take care of and I use this account for many things. I had to be ashamed asking people to borrow money for food for my kid because braintree decided to lock my account because they allowed a fraud transaction to come through. So I’m just here and I have to wait until Monday to even get more information about MY MONEY that I work hard for. Braintree is the worst company ever. Don’t ever trust them.!!!!

What is your recommendation for payment gateway?

These guys seem to be collecting data i sent my passport image they wanted the full image so they could see the mtr etc, sent letters with proof of address and then linked paypal to it and my UK bank account as well. They wanted business bank statements and sooo much more, i really was so frustrated with these guys and i know 10 other people who applied and got refused or just gave up like me. I would strongly recommend you stay away from these guys! Feels like some kind of scam to get my personal data now they have my passport images and proof of address and more 🙁 either t is a scam or only for the 1% super big business only… COMPLETE WASTE OF MY TIME!

Any downside to choosing this as the payment gateway for a woocommerce site?

Hi Alison, nope, nothing else comes up off the top of my head!