Are you thinking of using Square to support your revenue streams?

The chances are you've already been checking out countless Square reviews to get a feel for what this solution can do. After all, Square has been around for more than a decade now, giving it plenty of time to capture the attention of merchants around the world.

If you're tired of other square reviews not answering all your questions, you're in the right place.

In this Square review, we're going to give you your all-access guide to everything from the Square POS system and how it works, to square recurring payments, fees, customer service and so much more.

Let's get started, shall we?

Who Are Square?

Before we get to the meat of our square review, let's take a look at the background of this company.

The Square Payment system and point-of-sale solution come from a company that originally launched in 2009.

Now celebrating their tenth birthday, the company was one of the first to introduce the concept of mobile payments to the world. In 2009, swipe-based mobile payment processing systems belonged to the realm of science fiction.

Square showed merchants all around the world that there was an easier way to process transactions whenever, and wherever they were.

Today, Square's suite of offerings has grown at an astronomical level. It's currently the most feature-rich and advanced mobile processing solutions on the market. Capabilities include:

- Square POS system (Point of Sale)

- Analytics and reporting

- eCommerce

- Payroll

- Square recurring payments

- Invoices

- Inventory management

- Customer management

- Virtual terminals

- Multiple apps

While the mobile payment processing service might not be the go-to solution for all business types, it has a lot to offer, particularly if you're on the hunt for predictable pricing and reliability.

Square Pros:

- Predictable flat-rate pricing

- Excellent support for low-volume merchants

- No monthly fees

- Impressive feature sets

- Affordable chip card readers

- Free tools for selling online

- All-in-one payment

Square Cons:

- Not ideal for big companies with huge transactions

- Some account stability issues

- Not suitable for high-risk industries

- High fees for large businesses

Square POS System

When it comes to sorting through Square reviews, the easiest place to start is with the Square Point of sale system, or “POS.”

The Square Payment brand offers a POS solution for free, and the features that come with it are nothing like anything else you'll find on the market. Although they might not have the depth and intricacy that you'd see from expensive point of sale offerings, the Square POS systems are ideal for small businesses and people just getting started.

Even better?

👉 Square offers specifically tailored solutions to appeal to specific merchants in restaurants and retail. With Square POS, you can:

- Process cash and checks

- Set up gift cards

- Swipe cards without an internet connection

- Create printed and digital receipts

- Set up recurring payments

- Send invoices

- Use Square online payment reports to track progress

- Handle your Square payment fees

- Manage refunds

- Access tax information

- Handle tips and discounts

The sheer rate at which the Square payment system has been growing means that there has been a lot of changes to what you can accomplish in the last few years.

For instance, recently, the Square POS system has upgraded to work alongside advanced iPad devices and similar tools.

It costs about $60 a month to get started with these systems, and if you choose to invest in the advanced POS systems, you'll pay slightly higher fees per transaction – we'll come back to that in a bit.

For now, all you need to know is that Square online payments make building an effective Point of Sale system simple.

Let's take a look at what it feels like to set up your POS.

What to Expect from the Square POS System?

The Square payment system has many benefits to offer.

For a free mobile POS app, you get a lot from the initial tool, which means that Square competes easily with some of the bigger and more expensive options on the market. For instance, you can accept all major credit cards from virtually anywhere in the world.

You can take both chip cards and NFC payments for either contactless or traditional chip and pin transactions. Best of all, you can access your earnings as soon as the next business day (or at most, two business days after the payments were made).

Another major benefit of Square? You can also enjoy full PCI compliance. More than ever before, the need to handle peoples sensitive data with the utmost care and attention is of paramount importance. Therefore, having a payment system that's PCI compliant is worth its weight in gold.

👉 Some of the best features of the Square POS system include:

- Card on file: Keep your customer card information safely within the Square system – ideal for repeat customers who are sick of swiping their cards. Card on file works with Square invoices and other apps too. However, you need to pay extra for it.

- Offline payments mode: Don't worry about suddenly losing your internet connection and forcing your business to stop in its tracks. The Square bundle can operate in offline mode too, without any issues – even at festivals.

- Virtual Terminal: Enter credit card information directly from an internet connected device using a web browser. This feature is free and only requires you to pay processing costs for each transaction.

- Set up invoices with ease: Use built-in tools and templates to ask for Square payments via a professional-looking invoice. Square offers designs to support everything from purchase orders to ongoing contracts.

- Square Card: This Mastercard debit ensures that you can easily access your Square funds when you need to make payments on behalf of the business. This is excellent for keeping your business and personal expenses separate.

- Installment payments: Square supports recurring billing via invoices, but it recently added support for installment payments too. With this new feature, you can provide your customers with the option to access products on finance. You still get paid up front, but the Square Capital company will assume the risk of essentially “lending” to your customers, allowing them to pay what they owe over time.

Are There Any Downsides to Square?

Of course, Square isn't necessarily perfect.

There are a few drawbacks to consider.

Namely, if you work in a higher risk industry (for example credit counseling, credit repair, credit protection, identity theft protection, direct marketing, subscription offers, infomercial sales, etc.), then Square isn't the payment processor for you.

While there are some Square reviews out there that suggest that Square payment processing might be a scam, the truth is that it's a fully legitimate business – it just has a few issues.

Square.com does brilliantly when it comes to being transparent about what they can offer. However, they could provide more information about things like account holds and freezing – as this is one of the biggest issues that today's merchants face.

💡 Square still has a handful of issues with things like:

- Account stability and holds on funding: Before we delve into this, it's worth saying in some cases, the inconvenience caused here can be a blessing in disguise! Square has a pretty strict fraud prevention scheme which results in freezing funds if they think your account's in jeopardy. This often puts small businesses in a tricky position where they can’t access the cash that they need to stay afloat.

- Lack of communication: Square doesn't adequately explain the complications that sometimes arise with third-party payment processing. If your account's frozen, you can usually get it back up and running by proving who you are. However, if you don't satisfy their requirements, they'll indefinitely terminate your account- not cool!

- Lack of advanced features: Some entrepreneurs want to see more complex features that rival other point of sale systems — namely, advanced reporting and store credit. However, when you consider there isn't a monthly fee involved, the lack of more sophisticated tools is to be expected.

Despite a few downsides, Square payment is still one of the best mobile payment processing systems that you can consider on the market today.

Let's take a look at the most common areas of modern Square reviews in closer detail.

Square Online Payments Ease of Use & Set up

One of the most important things you'll need to consider when investing in any payments system is how easy it is to use. If you struggle to set your POS up every day, then you and your employees aren't going to get the most of it.

Getting started with Square payment is a straightforward process.

All you need to do to get started is register your details on the Square payments website.

Here, you'll need to enter a handful of details, such as your company name, email address, and what your business does.

You'll also need to provide your banking details so that you can get paid for your transactions, and send the recurring fees required for your transactions to Square.

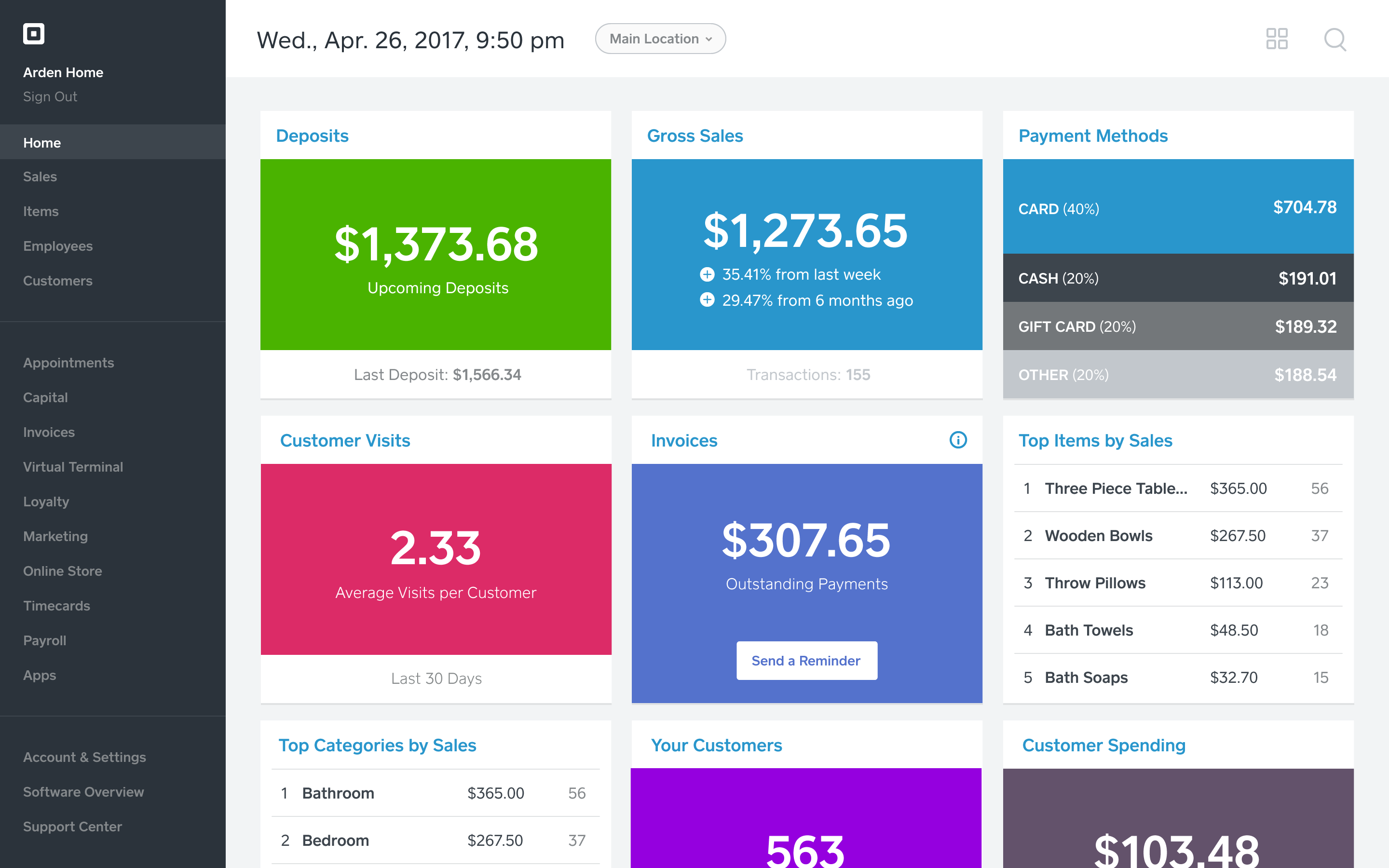

To simplify your payment management, Square also provides a payments dashboard, which serves as the hub for all your transactions. Here, you can add locations that your company trades from, list employees, and more. You'll also be able to list inventory too.

Square is a very attractive and clean-looking tool.

Need to adjust the details on a product for sale?

No problem.

When you click on a product, a pop-up window gives you the option to specify the quantity, size, discounts, and tax requirements for each item. There's also a “Split” button that allows you to split a bill between multiple customers instantly. Handy right?

When you're ready for your customer to hand over their cash, they can either enter their chip or swipe their card depending on your choice of Square's hardware systems (we'll come back to that below).

If you're just using an app on a tablet, then you can turn your device towards your customer easily so that they can enter a tip and sign their name.

The Square POS system provides plenty of guidance for your first sale, so don't worry about getting lost.

The Square Point of Sale Apps

One of the things that make Square payment so impressive is that it offers multiple ways to manage transactions. Square started with one “Square payments app,” which you could access on your point of sale terminal. Now, of course, as you'll see with most Square reviews, there are no less than four separate point of sale options.

According to the Square reviews that we've seen, the reason for creating multiple POS apps was that Square wanted to tailor to the unique needs of different kinds of merchants. After all, you might need various features depending on whether you're selling in a brick-and-mortar store, a dentist office, or a restaurant.

The available Square POS apps include:

- The Square POS system (general)

- The Square Retail app

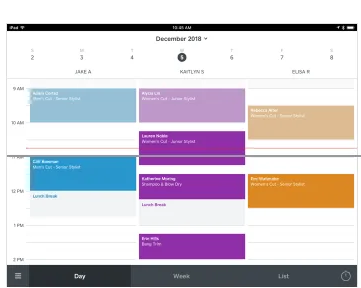

- The Square Appointments app

- The Square for Restaurants app

Let's look at each in closer detail.

The Square POS System (General)

The Square POS system app for general payments is the one that we already mentioned above so that we won't go into too much detail about it again here. Essentially, it's a free point-of-sale solution that allows you to manage everything from tips and discounts to transaction records, features include:

- Receipt printing

- Gift receipts

- Ticket printing

- Suspend tickets

- Item inventory tracking

- Tips

- Discounts

- Full/ Partial refunds

- Email/SMS receipts

- Offline mode

- Customizable invoices

If you don't need any specific support from your Square online payment system for a unique business, then the original POS app is fine for you. The system costs you approximately 2.75% per transaction in fees, and that's it.

The Square Appointments App

Here's where things start to get a bit more specialized.

According to other Square reviews, Square Appointments was an evolution of a basic scheduling add-on app that Square introduced to their service way back when. However, as the Squareup solution became increasingly popular, the company decided to go the extra mile and make Appointments an app in its own right.

With the Appointments app, you can link your transactions to your schedule, manage bookings, payments, and more. Originally, the app was only available for iOS, but it's now on Android too!

So, what makes Squareup Appointments so special?

Well, aside from flexible pricing and a 30-day free trial for teams, this app comes with state-of-the-art 24/7 support, and countless tools to manage your Square appointments. Features include:

- Inventory management

- Self-service for clients who want to reschedule appointments

- Tips and discounts

- Pre-payment options

- Widget integrates with existing sites

- Free online booking site

- Integrations with Google Calendar

- Invoices and reminders

- Customer notes

- Save cards on file

- Accept every payment

Once again, the Square payment app for Appointments is 100% free to download and access. You only need to pay a small fee on your transactions to use it, starting at 2.75%, just like the general Square payment app.

Notably, if you want to use the Square Appointments app with a team of people, then you'll need to pay $50 per month, and 10 centres for every tap, dip or swipe. However, the fee per transaction goes down to 2.5%.

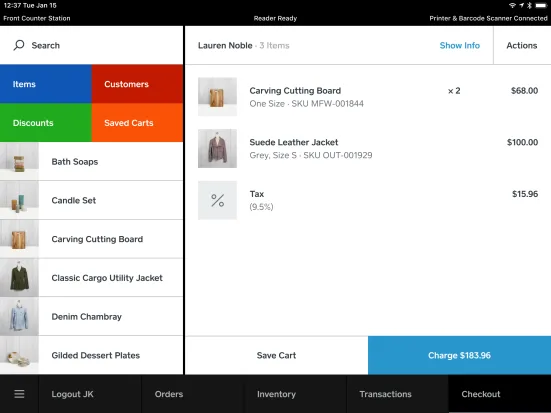

The Square for Retail App

Square‘s retail version of their payment processing app is an excellent opportunity to get more functionality for your store-based POS. Designed for companies with a lot of products to manage, the retail square payments service works on your iPad, and can be integrated into the “Square Stand.”

Square has gone above and beyond with its Retail selling solution. The system comes with three advanced reporting options to improve inventory management, as well as a host of additional features to upgrade your Square bundle.

Features include:

- Cost of Goods Sold reports

- Itemized exchanges

- Barcode scanning and printing

- Profitability and category reports

- Purchase order management

- Vendor management

- Transfer inventory between locations

- Employee management

- Discounts and tips

- Accept and receive catalog within the app

There are a simple search and checkout function to make transactions simpler for you and your customers too. Plus, you can set your POS up to receive digital orders, so that you can get an item ready for pick-up. The Square payment solution gives you a chance to set up simple customer profiles and create unique labels and categories for different aspects of your inventory.

For those who need to print their own barcode labels, generating codes in bulk takes just a couple of seconds from the Retail dashboard.

Like all of the Square pay apps, you'll be able to accept payments from virtually any major card, as well as Apple and Google Pay. Additionally, your account comes with the Square Secure suite of tools. Prices start at $60 per month per point of sale. You'll also pay 2.5% and 10cents for every transaction.

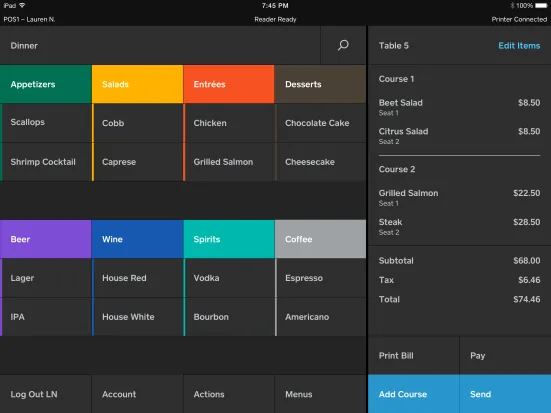

Square Payment App for Restaurants

Finally, just after the Square payments app for retail arrived on the scene, Square introduced its state-of-the-art solution specifically for Restaurants.

This specialized POS solution only arrived in May 2018, so it's one of the newer options in the Square marketplace. However, this fantastic tool has already emerged as one of the most popular tools for running a modern restaurant.

The user interface for the Square Restaurant app is entirely different to anything else you'll get in the Square bundle of products.

However, that isn't necessarily a bad thing. The hands-on interface means you can run your company as quickly and accurately as you need to, with plenty of guidance from the Square team. Features include:

- Personalized floor plan and interface

- Multi-menu support

- Coursing tools

- Voids and comps

- Split and move tickets

- Tip management and automatic gratuity

- Employee management

- 24/7 tech support

- Restaurant reports

The great thing about the Square restaurant app is that it's designed to suit you.

There are no one-size-fits-all options here.

Instead, you get to adjust everything from how menus appear on your POS, to how you manage your chefs and employees. You can also switch between light or dark backgrounds to suit the design of your restaurant.

For those who need a little extra help getting started, Square payment also provides the opportunity to work with a state-of-the-art onboarding consultant. This is a great way to learn how to set up your POS and make the most of it within a couple of hours. The onboarding does cost ($600). However it might be worth it for some companies.

Without onboarding fees, you can expect a monthly $60 fee for each location you set your POS up in. There's also the option to add new registers to the mix for a slightly reduced price of $40. For transactions, fees start at 10 cents and 2.6% more swipe or tap.

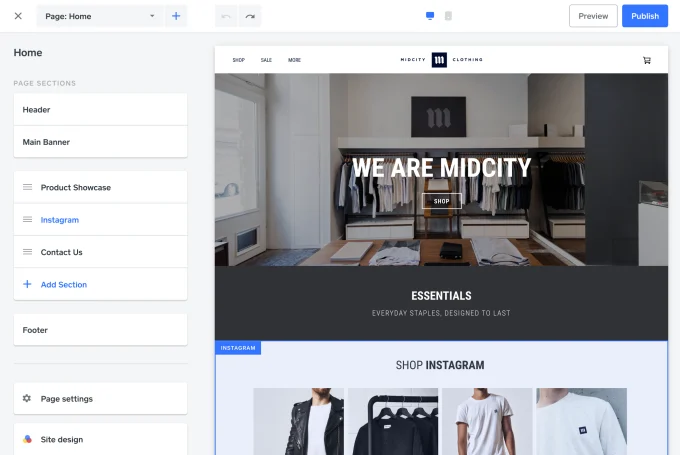

Square Online Payments and Digital Ordering

As the Squareup solution has evolved over the years, the company has realized that it needs to offer more than just offline and in-person POS options.

These days, Square wants to become every merchant's one-stop solution for whenever they need to manage transactions. This means creating an eCommerce and online shopping strategy to go alongside the POS and in-person payments.

👉 Some of the features you can expect when you invest in Square online payments include:

- Digital website hosting: Bring your own domain or purchase a brand-new one through the Square site instead. If you start from scratch, you can design the ultimate website using a selection of easy-to-use templates. There are even integrations with Instagram. All the Square POS system features are built into your site.

- New payment gateway: Integrate Square directly into your site to process your payments. You can even use it alongside other tools. Square works with WooCommerce, Magneto, Weebly, and countless other CRM providers.

- Sync retail orders: Let online shoppers purchase items online then collect them from your store in-person. This is an excellent option for both stores and restaurants. The inventory will sync across all of your platforms, to help with tracking too.

- Customize your dashboard: When it comes to making the most out of Square online payments, the panel is one of the most exciting tools you'll discover. There are various apps to explore, and you can customize everything to get the most personalized experience for your business. The hub is easy to use and intuitive, and there even apps you can access straight from your smartphone.

- Ecommerce marketing support: Square's online store recently upgraded to provide a variety of helpful eCommerce tools and applications. For instance, you can sell and accept square gift cards, send abandoned cart emails, integrate targeted Facebook ads, and even get support with SEO. Users can also access discounted shipping features, Sales coupons, and advanced analytics.

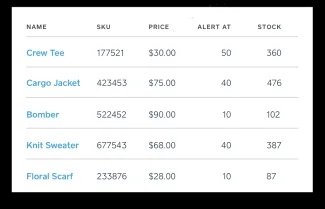

All of those incredible features of the Square online payment service are excellent on their own. However, it's worth mentioning the incredible functionality of the Inventory management tool separately. No matter what kind of business you're running, inventory management can be one of the toughest things to keep track of. Fortunately, Square payments can help with that.

Although Square's inventory management system might not be as advanced as some of the other market leaders, it's one of the most comprehensive options available for its price point. Additionally, if you choose to upgrade from the free solution to the Square Retail app, then you get something that's truly on par with all the other providers in the marketplace.

👉 For the basic inventory suite, you can expect capabilities like:

- Inventory count

- Item categories and varieties

- Item modifications and add-ons

- Bulk inventory export, import, and management

- Multiple tax rates

- Adjust stock levels

- Online and in-store sync

- Inventory reporting

One other thing we'd like to mention in this Square review is that if you already love a particular inventory management tool, then Square does support integrations. If you need something specifically robust, then you can check out the list of options on the Square marketplace. We'll come back to the available integrations later.

Other Payment Processing Features with Square

Already, it feels like we've covered a lot of information about Square payments

However – we're not done yet.

We've barely scratched the surface of what the Square bundle can accomplish.

Although Square might have started as a basic mobile payment processing application and tool, it's come a long way over the years. Some of the other noteworthy features you might want to check out include:

- Advanced customer database: These days, you don't just need to focus on collecting as many new customers as possible, you also need to keep existing clients happy too. The Square payment customer database tracks client behaviour, including sales and visits, and helps you to learn more about your target audience. You can even segment customers based on the frequency of their visit, or what they buy.

- High-level reporting: Square provides some of the most impeccable reporting features on the market today – particularly for pay-as-you-go vendors. You can create reports for your transactions according to specific periods and focus on certain item categories too. Most of the reports available can be exported into CSV, and they're included for free. If you choose the retail or restaurant app, then you'll get special advanced reports.

- Multi-store management: What if you have multiple store locations that you need to keep track of at the same time? That's not a problem with Square payments. You can manage every store you own from the same account with ease. You can even adjust inventories and pricing or tell your employees which location they're working at today.

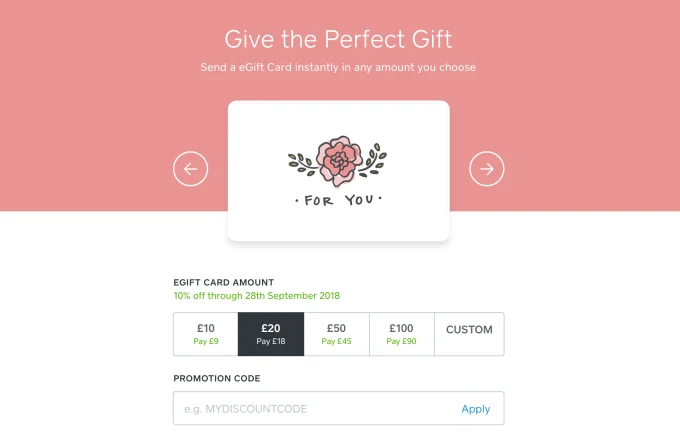

- Gift card management: With Square's amazing gift card feature, merchants can choose between custom designs, templates, pre-designed cards, and so much more. There are no costly redemption fees to worry about, and you can issue your cards online with ease too. Analytics and reporting will ensure that you can track how often people are using their gift cards. What's more, the system keeps track of any remaining balances on cards that haven't been fully redeemed.

- Customer feedback: Social proof is one of the most valuable things a company can access today. Fortunately, thanks to the Customer engagement tools available as part of your Square bundle, you can prompt customers to leave feedback about their experiences. You can implement feedback requests into all aspects of your business, which makes it easy to manage and identify problems easily. Companies can also access important customer details like purchase history and average spending too.

- Email marketing: As part of the eCommerce offering from Square, which comes with a handy collection of customer engagement tools, you can access simple email marketing. It costs a monthly fee to automate your emails, but this way, you can send regular campaigns and newsletters using the in-built Square services. You can also run social media campaigns, track information on your customer database, and speak to customers when they abandon their carts.

- Loyalty programs: Another excellent opportunity to improve your connections with your target audience, Square spends a lot of time and effort, keeping its Loyalty program ahead of the curve. There's a fully customizable rewards program which businesses can use to design specific VIP solutions for their customers. You can even adjust the copy and images that are used to sell your rewards to potential advocates. Square Payments can accept both card and card transactions as interactions that count towards awards too.

- Event rentals: Have you ever hosted an offline event? Then you'll know how exhausting it can be to find a way of managing payments. Square has emerged as a very popular choice for event ticket sales and on-site vending for your events. You can use Square for everything from rented hardware (cash boxes, receipt printers, etc.) to software.

Square is also brimming with features that can help with your administration and business management needs. Whether you're handling things like employee management, or setting up an event for your company, there's something from Square payment that will make your life easier.

For instance, maybe you need help track employee payroll and time management? That's a common concern for a lot of business owners.

The right square bundle can help with employee timecards and unique user permission roles. You can also set up Payroll and get the timecard feature for free.

For businesses that need a little extra boost, there's even a Square solution for that!

The Square Capital service provides business loans that you can access within as little as 24 hours. The repayments are made by Square deducting a tiny portion of the funds you process. For a lot of companies, this will be a bunch simpler than having to set aside cash for repayments.

Square Payments Security

Finding the right payment provider is tough.

There are so many questions you need to ask yourself, from how simple is their software, to how secure is the service?

Square recently upgraded their security solution with the “Square Secure” feature set – a bundle which they claim has saved sellers over $330 million in dispute issues.

The Square payment team even helps with fighting back against fraud. According to them, fraudulent purchases lead to payment disputes, which often cause merchants to lose money. With machine learning, Square can look at a variety of payments across a diverse ecosystem and recognize potential trends in fraud.

The intelligent software in your Square POS system can monitor payments to make sure you're not falling victim to suspicious transactions. If the team notices anything unusual, they'll contact you to address it. Square can even take over disputes on your behalf, speaking to customers, and providing legal data when necessary.

So, what about privacy and compliance?

Well, Square can help with that too.

The company knows that today's customers want to be sure that they're always safe from potential hackers and criminals. That's why all of their software is PCI compliant.

What's more, the Square hardware (terminals, etc) is engineered with safety at its core. Payments are encrypted to protect against hackers, and Square has in-house teams available to monitor and manage server activity.

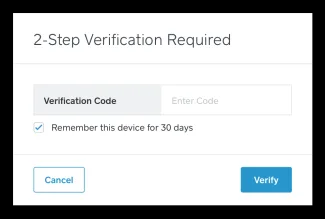

The Square group even provides state-of-the-art account protection tools across multiple layers to ensure that hackers are kept out of their systems. If anything goes wrong, you've still got features like 2-step verification, multi-access control, and constant security feedback to protect you.

Square POS Hardware

When it comes to mobile payments, Square is one of the best-known brands in the world.

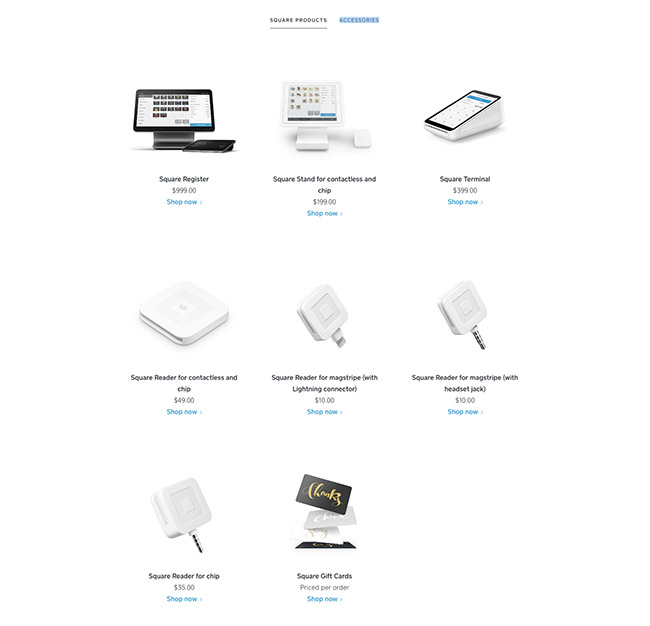

The company isn't just popular for its software though. Square payment systems also come with the option to include state-of-the-art hardware too.

Options range from receipt printers and tablet stands to card readers, cash drawers, and Square bundle kits.

If you do invest in hardware from Square – you don't need to stress too much about finding the appropriate device to use with it. The Square brand is pretty flexible about BYOD. Plus, you can always buy iPads and other systems directly from Square if you need to.

Since most start-ups have a hard time making their budget work at first, Square has implemented financing for hardware worth more than $49. This means you can buy your cash drawers and pay for them gradually over time.

Financing will depend on your credit situation – of course. Plus, you'll need to double-check if it's available in your State. However, it's not a bad deal if you're interested.

Now, let's take a look at some of the options for Square hardware in closer detail.

Square Register

Let's face it, beyond the standard POS; a register is probably the most common piece of hardware a retailer would need.

The registers from Square are very high-quality, featuring 13-inch touchscreens, and a 7-inch customer display. There are integrations with NFC and EMV payments, as well as magstripe. However, you need to pay extra things like cash drawers and receipt printers separately.

The Square Register comes with features like:

- Sync to other POS systems

- Send free invoices

- Get private customer feedback

- Add and edit items

- Track sales

By itself, it's available for $999. However, the deal where you get a USB cash drawer and receipt printer is pretty good too – at $1499.

For bigger companies, Square also offers custom pricing packages for the register. However, that's really only necessary if you generally take more than $250k a year in credit card sales. Otherwise, you'll be paying $49 per month, with a 2.5% fee + 10 cents for every payment.

Square Terminal

The Square Register is excellent – but it's pretty high-tech.

If you're just taking basic payments for a small business, you might not need something that sophisticated. That's where the Square Terminal comes in.

Designed with a small smartphone-sized screen, the Square Terminal runs the POS system you know and love and comes with integrated card readers for your contactless transactions, chip card, magstripe, and so on. There's also a handy receipt printer built-in.

One of the most impressive features of the Square Terminal is how powerful that little battery is. You really can use it all day, without losing charge.

It's an excellent piece of tech, complete with phone-reading software so your customers can use Apple or Google pay. Plus, if you're a brand-new merchant, you can grab your terminal for as little as $99. That's because Square offers a $300 processing credit for newbies.

Unfortunately, if you've been taking payments with Square for a while, the price goes up to $399, or $37 per month for 12 months. However – that's not too bad when you think about it. In terms of fees, you're looking at around 2.6% and 10 cents for every transaction.

Square Payment Options: Additional Hardware

The Square terminal and register are probably the most popular hardware systems on offer.

However, they aren't your only choices.

For people who want something super basic, there's the Square stand for contactless payments and chip transactions. Designed for an iPad, the system just gives you a basic POS system, along with a touchscreen that makes it easy to add items to a cart. Features include:

- Square card reader and dock included

- Swiveling stand so you can ask your customer to sign or enter their pin

- Chip and pin or contactless

The Square Stand is probably one of the cheapest mobile payment options available too. To purchase it outright, you'll shell out around $199, or $18 per month for 12 months. There's also a fee of 2.75% for every payment processed, with no monthly fees or long-term commitments.

If you don't need a full iPad touch-screen service, then you can go even more straightforward with a basic Square reader. These nifty little devices are about the size of your palm – so they're easy to take with you wherever you go.

Secure and easy to use, the Square reader accepts everything from Apple Pay, to chip cards. You can connect to the POS wireless, and accept payments in a matter of seconds. Additionally, there's the option to add a back-up magstripe reader and a doc for $29.00.

Available for a relatively reasonable price of $49.00, the reader also processes payments in offline mode if you can't find an internet connection. You'll still pay the 2.75% per swipe if you need to go online, and there are no extra fees to worry about. Features include:

- No battery to keep charge, just slip it into your pocket and go

- Take payments online or offline

- Send receipts digitally or print them for your customers

- Add a dock square reader for $29.00

- Plug in a back-up magstripe reader

- One price for dip and tap (2.75%)

- Accept all forms of payment – including Google and Apple Pay

Square Fees and Rates

Okay, so now we come to the complicated part – paying for your Square POS system.

Square‘s pricing strategy used to be a lot easier to understand back in the day when they only had one or two products to worry about. Now that you've got a bunch of different offerings to consider, there are some tricky parts.

The good news is that larger companies can achieve the occasional discount, and if you're a small business with fewer payments to manage, you shouldn't have to deal with anything other than the basic processing fees that we mentioned for each of the POS bundles above.

When it comes to accessing your money, you can usually get your cash within 1-2 business days, or you can request an instant deposit for emergencies, but Square will charge you 1% for the extra processing power.

For those who need some extra cash to keep their business running smoothly, the Square Card is pretty useful. Like PayPal's access card, your Square Card gives you access to all the funds you could want via your plastic, so you can just swipe and go.

For a reminder of the kind of processing fees you'll need to pay depending on your chosen POS and reading hardware, here's a quick run-down:

- Square POS system with mobile card reader – 2.75% per transaction

- Square register – 2.5% plus 10 cents per transaction

- Square Terminal -2.6% plus 10 cents per transaction

- Square for Retail POS – 2.5% with 10 cents per transaction

- Square for Restaurants POS – 2.6% with 10 cents per transaction

- Square Appointments – 2.75% for individual users per transaction

- Square Appointments – 2.5% plus 10 cents per transaction for teams

- On-file transactions – 3.5% plus 15 cents per transaction

- E-commerce transactions – 2.9% plus 30 cents per transaction

While Square payment fees can be a bit complicated at first, one point worth noting is that there are no additional fees to worry about beyond your per-transaction processing costs. That means that you get no chargeback fees whatsoever. There's even a chargeback protection program in place.

If you manage to keep running your business as usual without any problems, then there are monthly service fees that you might need to consider, for instance:

- Square Appointments: Free for individuals, $90 per month for up to 10 staff, or $50 per month for up to 5 team.

- Square for Restaurants: $60 per location with the option to add extra registers at $40 per month.

- Square for Retail: $60 per location with the option to add extra registers for $20 per month.

- Employee management (timestamps etc.): $5 per employee per month

- Square Payroll: $29 per month, plus $5 per month for contractors or employees paid.

- Loyalty cards: $25 per month for up to 50 visits, 35% per month for up to 100 visits, and $50 per month for up to 200 visits.

- Email marketing: $15 per month and up.

- Gift cards: $2 per card and less as you order more.

While the fees for Square might seem significant at first, they're very competitive. It's hard to find a similar processing rate and range of features anywhere else on the market. While there are a handful of mobile payment processing services out there, you don't get anything nearly as robust as what you can expect from the Square POS system.

The prices associated with Square really aren't an issue. The area where you're likely to have the most trouble is with the processing limits – which can be incredibly challenging to understand, and rather unpredictable.

Square Processing Limits

Most of the smaller merchants getting started with a Square payment system won't have to worry about processing payments at all – but it's good to be prepared.

Square gives its merchant a starting limit of around $50,000. However, some complaints suggest that you might need to keep transactions below $3,000 if you want to avoid issues.

However, there are also reviews from happy customers who take in more than $100,000, so it really depends on who you ask. This is one of the biggest issues that you have when you're using Square – the freeze-outs that they implement are incredibly difficult to understand.

If you're just running your business really well one month and earn a lot of cash, you could suddenly trigger attention from the Square risk department.

Honestly, it's not much fun to think that everything is ticking along smoothly, then suddenly discover that you can't use your payment system in the middle of a busy day.

Square Integrations and Add-Ons

As it becomes increasingly complicated to provide customers with excellent service, the best payment processor will always be one that plays well with other tools and devices.

Fortunately, the Square online payment network has a long list of integrations and add-ons available as part of its comprehensive app marketplace. There are solutions for everything from accounting tools and invoicing, to POS systems, recurring billing, and more.

One particularly impressive area?

Square offers specific integrations depending on which industry you serve. This means that you can get support for things like healthcare management, complete with HIPAA regulation.

For those of you who happen to have a handy developer on-staff, Square has its own APIs so that you can create custom integrations with the Payments system, POS, eCommerce tools, Inventory management, reporting, or even employee management.

The developer tools aren't quite as comprehensive as those you'd get from some other POS options on the market- but they're an excellent step up for companies who are getting started in the mobile payment space.

Square Competition

Wondering what kind of similar solutions you can get elsewhere on the market?

While Square payments might have been one of the first companies on the market to introduce mobile processing technology to the world – a lot has changed since the company began. Countless similar services have launched over the years, offering competing services and tools.

For instance, one of the world's best-known payment processors, PayPal, launched their own POS service in 2012, with a chip reader for $14.99.

Although the hardware you get from PayPal might not be as elegant as some of the options you'd get from Square, they're enough for a small business. Additionally, there's a standard rate of 2.7% swipe and dip for every payment. That one-size-fits-all rate might be easier to understand for some merchants.

The QuickBooks company, Intuit also has a mobile payments solution available too. If you're already using QuickBooks to track your invoices, then you'll probably find that it's a lot easier to use the Intuit payment processor too.

There's an app you can download for iOS and Android – which is 100% free to use, and the company sends you a card reader too. You might find that it's easier to splash out for the $49 Intuit all-in-one reader, however, as this accepts more forms of payment.

Square Reviews: Customer Service and Support

No matter how much of an eCommerce and payment processing superstar you are, there's always a chance that you're going to need some help.

That means that you're going to need a POS company that offers excellent support.

Square offers a handful of ways for users to get in touch for guidance, including @SQSupport on social media, emails, and even phone support between 6 am and 6 pm Pacific time.

Square is quick to brag about its amazing support team, which are on-hand to answer any questions you might have. What's more, there's the Squareup knowledgebase available for people who don't mind searching through articles to track down the source of their problem.

The knowledgebase is truly one of the most in-depth we've ever seen. There's a vast selection of articles to browse through, which means that you should be able to find virtually any answer to any question you may have. In our opinion, it really doesn't get much better than this knowledgebase.

The place where Square suffers is in supporting customers that have been locked out of their account. Apparently, you can't deal with this issue over the phone and are forced to wait around for feedback via email instead.

On the plus side, if you can't find support from Square, and you're struggling with the DIY system, then you can try the Square Seller Community instead. This is a forum full of people ready to answer your various questions.

Honestly, with such a large customer base to handle, and so many products to support, it's little wonder that Square has a few hiccups with support. However, that doesn't give the company a free pass.

Although there are plenty of reviews out there that say that Square offers fantastic guidance to those in needs, there's a serious gap when it comes to finding a resolution to your lock-out problems. If your account is incorrectly terminated and you want to know why, you're going to have to chase the company for several weeks or even months. This is one of the biggest complaints that we see from the Square community.

The Biggest Issues with Square Payments

Square genuinely does have a lot to offer as a payment processor.

However, it's not perfect.

Far from it.

Square has an A+ rating with the BBB, but they have had quite a few complaints. Around 2,000 in total. While this seems like a lot, it's not as much as you might think when you consider that Square has millions of merchants out there using their services.

Still, if you dig down into the complaints, you'll find that there are a few trends that keep showing up. Notably, there are some complaints from customers that have been scammed by merchants using Square systems. There's also a handful of complaints from people using Square credit.

If you find the reviews that relate to Square online payments and POSs systems, these are some of the most common trends:

- Terminations, Freezing, and Funding Holds: The bulk of the complaints against Square, as we've mentioned above, are related to the sudden cancellations of accounts that may have done nothing wrong. While Square does its best to protect against fraud, it's machine-learning system can sometimes detect suspicious behavior where there isn't any. This means that you could suddenly end up with a frozen account basically without warning. According to some complaints, you can usually get your account reinstated if you have the right documentation on hand. However, the trouble with this is that you need to get hold of the Square team first – which is an exhausting process. Additionally, your funds will be held for an entire 6 months, to account for any potential chargebacks before cash is released to you. This is a huge amount of time to go without payments you rely on to keep your business lights on.

- Some features lacking: Although Square payments have a lot to offer in terms of capabilities and features, there are some complaints that there may not be enough options for functionality with some merchants. Usually, these reviews come from people who want to see things like store credit and advanced reporting as part of the Square bundle. There's a good chance that these features might come through in the future. However, for now, more prominent companies may need to pay more if they want more advanced options.

- Fees: No matter which point of sale or online payment service you choose; you'll always find companies complaining that they wish the costs were a little lower. Processing and monthly fees for Square aren't nearly as bad as they seem. However, it's fair to say that most companies would be a lot happier if they were processing more than $250,000 a year and accessing the additional Square volume discounts.

The Biggest Benefits with Square Payments

There's plenty of angry and negative chatter out there when it comes to Square payments. However, the same could be said of a lot of payment processing services. It's worth noting that there are plenty of good points about Square too.

For instance, many of the square reviews we read through came from happy merchants who said the following things about the system:

- Excellent design and features: For a mobile payment processing system that doesn't come with any monthly fees, Square is very advanced. It's a great POS solution for a lot of businesses, and there's plenty of fantastic press out there saying that the payment services are abundant, immersive, and easy to use. It's challenging to beat the wide range of functionality options that you get from Square and still pay such a small price. Additionally, the list of available integrations and features are changing all the time. Unlike some other vendors, Square doesn't rest on its laurels; it's constantly upgrading to suit the new marketplace.

- Affordability: While we mentioned above that there are reviews that feature people complaining about the fees remember that there's always going to be someone who wants to pay less than the ticket price for their software and hardware. Ultimately, Square might not be the cheapest option in the world, but it's probably the lowest price you can get for such a feature-rich bundle. Additionally, you're getting all the benefits of things like PCI compliance and the option to take payments just about any way that you can think of.

- Ease of Use: Square is built for simplicity from the ground up. Setting up your account and getting started is a breeze, with virtually no training time required. Even slightly more complex systems like the POS for restaurants is accessible – you can change and customize your experience depending on your needs. If you need a system that will allow you to open an account and start processing payments in minutes, then it's hard to go wrong with Square. Thanks to their available credit options, there's even help for smaller companies who need a boost to get them started.

We'd also say that the wide range of hardware options available from Square a benefit too. There are so many different ways to set up your payment systems depending on your personal preferences and needs. It's always nice to have a bit of flexibility when you're establishing a new payment strategy.

Is Square Payment Right for You?

We've covered a lot of details in this Square payment review.

That's because there's a lot to go through.

Square might have started as a simple mobile payment processing system, but it's evolved over the years to offer so much more than anyone expected. Sure, you can take credit card payments on a simple terminal still – but you can also process contactless and online transactions too.

The functionality and diversity of Square have made its name synonymous with sales for merchants across the globe, and the company just keeps getting bigger.

It's fair to say that Square has had a few growing pains over the years. It has its issues with locking accounts for no reason because of a problematic AI algorithm, and fees have been challenging to understand in the past.

However, that doesn't mean you shouldn't consider a Square bundle for your organization. All you need to do is make sure that you're not running any high-risk business that could get you into trouble with the Square risk team.

For the majority of people who are just starting out with a new way to process payments, Square will be an excellent choice with plenty of versatility to offer.

Not only does it provide support for hospitality and retail companies, but it's starting to expand with APIs and integrations that make it more accessible for various other industries too – including healthcare.

What's more, with the employee management features you get, it can be a lot easier to manage things like payroll and time management.

Like any point of sale system, Square might not be the perfect option for everyone setting up a brick-and-mortar location.

However, through our comprehensive review, we've seen the growing pains, recognized the issues, and we still think that it's an incredible choice for the vast majority of companies.

If you're looking for something easy to use, versatile, and designed to suit the growth and evolution of your business, definitely take a look at Square. You can build your payment processing suite in a way that’s designed to suit you.

Thank you Rosie, grate review.

You’re welcome Ivan!