In today’s mobile and internet-steered society, hard cash is out, and digital payments are in – and in the wake of the global pandemic, there are increasing concerns over cash's hygiene. So, this trend is only predicted to continue.

Even bank cards are becoming more confusing and risky, as hackers and scammers make debit and credit card companies their fraud and theft subject.

Whereas, with digital payment services, it's never been easier to send and receive money from the convenience of your smartphone.

Millennials have long since been advocates of digital payments. However, the market is overcrowded with endless P2P payment apps, so picking the right one for you can seem like a thankless task.

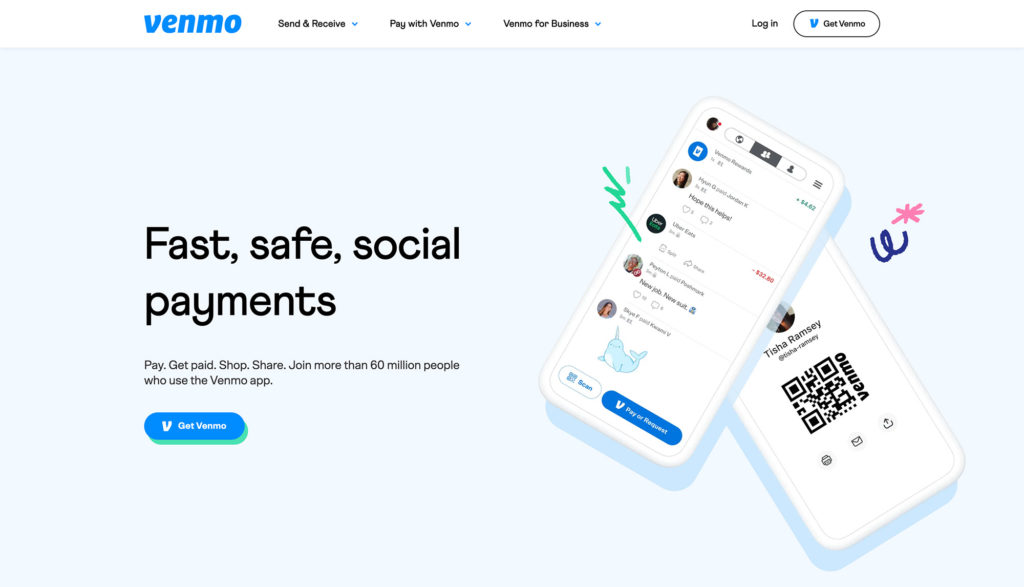

One such leading P2P mobile app is Venmo – an app designed for making quick digital payments with just a few taps. In light of that, we're putting Venmo under the microscope to answer the question: What is Venmo and how does it work?

Ready? Let’s get right into it.

What is Venmo and How Does it Work?

Launched back in 2009 as a startup, Venmo is a peer-to-peer payment platform owned by the well-respect financial institution, which is PayPal.

Venmo allows users to send and receive money. With this handy smartphone app, you can request, send, and receive money to and from anyone who's a Venmo user with a Venmo account. However, at the time of writing, Venmo's only accessible to US residents.

To date, Venmo is a widely accepted payment system by approximately two million brick-and-mortar and online merchants. Wow! That number screams Venmo’s popularity in the United States.

But, that's not all; Venmo is also great for sending and requesting money from friends and family.

Have you ever been out for dinner or a movie and been left with the awkward chore of reimbursing family or friends? Or with asking your friends to pay back their portion of the bar tab?

If so, you'll be pleased to hear that Venmo offers an easy solution.

It makes splitting any payment a breeze – rent, dinner bills, cab fares, event tickets, and so on. It's the answer to the complicated maths and awkward social situation that comes with any money-sharing scenario.

Bye-Bye awkwardness.

What’s more, Venmo has a unique feature that sets the app apart from the rest – A social media network. You can connect and interact with friends and keep up to date with them via a news feed.

It also shows the transaction history between you and your buddies. However, this is an optional feature. If you prefer not to broadcast your transactions, you have the option of turning off posting.

It's easy to find other Venmo users via their username, phone number, or even a FAC and begin sending or requesting money.

With so many fabulous features, it's no wonder Venmo's dominating the US P2P payment market. We all agree that giving money is never fun. But Venmo lets users jazz up their transaction by using emojis to match the situation or describe the transfer reason.

So, next time you pay for your glass of wine, issue a Venmo payment with a wine glass emoji. Now, that’s a playful gesture.

How Does Venmo Work?

Venmo's business model is such that it's a virtual fiscal intermediary.

Sounds complicated, right?

Let’s break it down.

Venmo is best described as the middleman between the sender’s and the recipient’s bank accounts. It's Venmo that ensures a successful transaction takes place between the two parties.

Venmo users can instantly begin exchanging funds with one another. But to get started, you'll have to follow a few steps:

- First off, sign up for a Venmo account – You can do this either through Venmo's website or by installing the Venmo app on your smartphone.

- You can now link your Venmo account to your debit card, credit card, or bank accounts.

- Now, choose a funding source from your linked cards, accounts, or your Venmo balance.

- Now you're ready to pay or request money from others with your Venmo account.

- If you're sending money, add a recipient, a balance, a note, and emoji (optional), and you're good to go!

- When you receive a payment via Venmo, you can either save it in your Venmo account for future purchases or transfer the entire amount to your bank account. The choice is yours.

…Yes, it’s that simple!

At this point, it's worth noting, Venmo is a mobile-only app, but it also supports payments via Siri voice command or iMessage.

To view your Venmo transactions, head to the app, or sign in via Venmo’s website. However, you cannot request, make, or receive payments on the desktop website.

Is Venmo Safe?

P2P payment apps like Venmo are usually safe to use when either the money's sender or recipient is someone you know.

That said, all internet apps are vulnerable to security breaches and, therefore, must boast the highest safeguarding standards.

Venmo uses data encryption technology to protect users against unauthorized transactions. If you happen to lose your phone, you can log out of the app from Venmo's desktop site to reduce the risk of fraudulent transactions.

It also stores the user’s information on servers housed in secure locations. You also get an option to set up a PIN code to access your mobile application.

But there's a catch…

While it's true, Venmo offers 100% protection for unauthorized transactions; it comes with a few limitations.

Unauthorized transactions are branded as the ones ‘that you did not authorize, and that did not benefit you.’ Other scenarios also qualify for 100% Venmo protection, including:

- If there's a discrepancy over the amount you sent/ the company has debited.

- If you receive a payment and the amount deposited into your account is an incorrect one.

- If a transaction isn't correctly visible on your statement

- If the company fails to do the math

To qualify for 100% protection, you must report the unauthorized transaction within 60 days from the day of its appearance in your account.

Venmo, therefore suggests you check your statements regularly and report any unauthorized transactions promptly.

We advise you to follow some precautionary measures to combat any security breaches, for instance:

- Don't store large sums of money in your Venmo account.

- Transfer funds immediately to your linked bank accounts.

- Use Venmo to exchange funds only with people you know and trust.

- Venmo's default new account setting is “public,” which enables the app to publish your transactions on its public feed. To cloak transaction histories, it's recommended that you opt-out of Venmo’s social network. You can do so by changing your privacy settings to “private.”

How Much Does Venmo Cost?

Venmo's standard services are offered absolutely free of cost, making it free to use for the majority of users. It's free to send money to family and friends using a checking account or debit card.

However, for processing credit card transactions, there's a 3% processing fee involved.

Venmo vs. Other P2P Payment Networks

Now that we've covered the basics of what Venmo has to offer and how they operate let's see how Venmo fares against its competitors…

Venmo vs. PayPal

If you've read this review from the beginning, you'll know by now that PayPal owns Venmo.

So, you might be wondering why we even put PayPal on the list?

Even though PayPal operates Venmo, there are distinct differences between the two.

Yes, PayPal is similar when it comes to transferring money. The funds are taken from your bank account, debit, or credit card linked to your PayPal account.

Or you can pay via your PayPal balance, just like Venmo. However, PayPal can be used around the world. It also offers protection for buyers who do business with merchants and independent sellers.

Fees – PayPal charges a transaction fee of 2.9% and a fixed fee of $0.30 for US credit and debit card transactions. If you're sending money outside the country, the cost may be even higher. Like Venmo, PayPal also charges $0.25 for instant transfers on eligible accounts.

Network reach – Venmo can only be used in the United States, whereas PayPal has a global network and can be used internationally.

Payment types – PayPal and Venmo's payment options are the same — bank account, debit card, credit card, or from the respective app’s account balance.

Speed – PayPal and Venmo also have the same transfer speeds. Regular ACH transfers from your Venmo or PayPal balance can take anywhere between one to three days. There’s also the 30-minute instant transfer for some eligible accounts.

Safety – The major difference between PayPal and Venmo is the Buyer and Seller Protection that PayPal offers. PayPal empowers users to file disputes if something goes wrong when buying or selling products from independent sellers.

For more information about PayPal, check out our review.

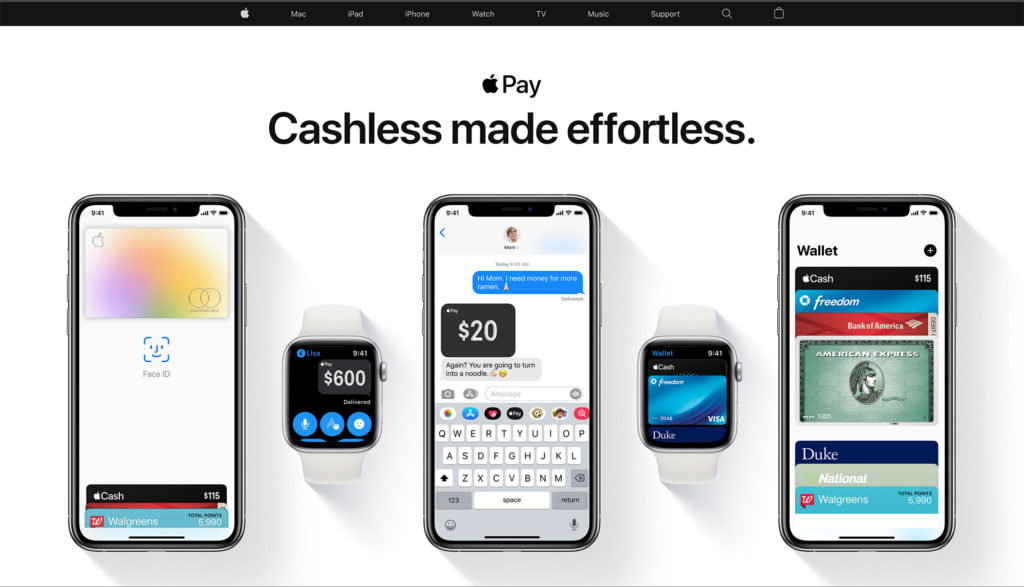

Venmo vs. Apple Pay

Apple Pay allows Apple users to send and receive money via an app. It's only compatible with the latest Apple Watch, Mac, iPhone, and iPad (iOS 11.2 or later).

So, if you and your friends are Team Android, you may still need Venmo.

Like Venmo, Apple Pay is also accepted by a vast number of retailers. And similarly, Apple Pay users can make payments from their mobile devices by linking their credit and debit cards.

Any payments made are verified with a passcode, Face ID, Touch ID, or a double-click on the side of your Apple Watch to ensure security.

Fees – Apple Pay doesn't charge you for debit card usage. However, there's a 3 percent fee if the funds come from your credit card.

Network Reach – Originally launched in the United States, Apple Pay has expanded its reach and is now available in the United Kingdom, Australia, Saudi Arabia, Russia, Brazil, Canada, the United Arab Emirates, Taiwan, Hong Kong, China, Montenegro, Serbia, New Zealand, Ukraine, Kazakhstan, Singapore, Georgia, Belarus, Japan, Macau, and all countries in the European Economic Area (EEA). That’s Apple for you.

Payment Types – Apple Pay supports many international payment methods—such as Mastercard (including Maestro), Visa (including Electron and V Pay), American Express, and Discover. That's as well as country-specific domestic payment schemes—for example, Australia's EFTPOS or China's UnionPay. However, you can only send money via messaging in the U.S.

Speed – As with Venmo, the money you receive in Apple Pay goes onto your in-app balance, which can then be transferred to your bank account. However, this can take up to three days.

Safety – Apple Pay has better security features than Venmo. Most notably, two-factor authentication, a tokenized method for transactions, data security, and data privacy.

Venmo vs. Google Pay

Google Pay is one of the leading (and cheapest) P2P apps on the list. It combines all of the features of Google Wallet and Android Pay in one unified place.

Sending money to friends and family using this app is effortless. You just need to find the person via their name, email address, or phone number to get going.

Fees – Google Pay doesn't charge any fees for debit cards or bank transactions.

Network reach – As of 2020, Google Pay is currently available across 30 countries.

Payment types – Only debit cards or bank accounts can be used with Google Pay. Credit cards, PayPal accounts, and prepaid cards can't be used alongside Google Pay.

Speed – Google Pay sends and receives money within minutes, which is similar to Venmo’s instant transfer feature. However, it could take up to 24 hours, depending on your bank. Transfers made via bank accounts can take up to three business days.

Safety – Google Pay has a 24/7 fraud monitoring feature that gives you 100% coverage for verified, unauthorized transactions on your account. Any unauthorized purchases on your account need to be reported within 120 days.

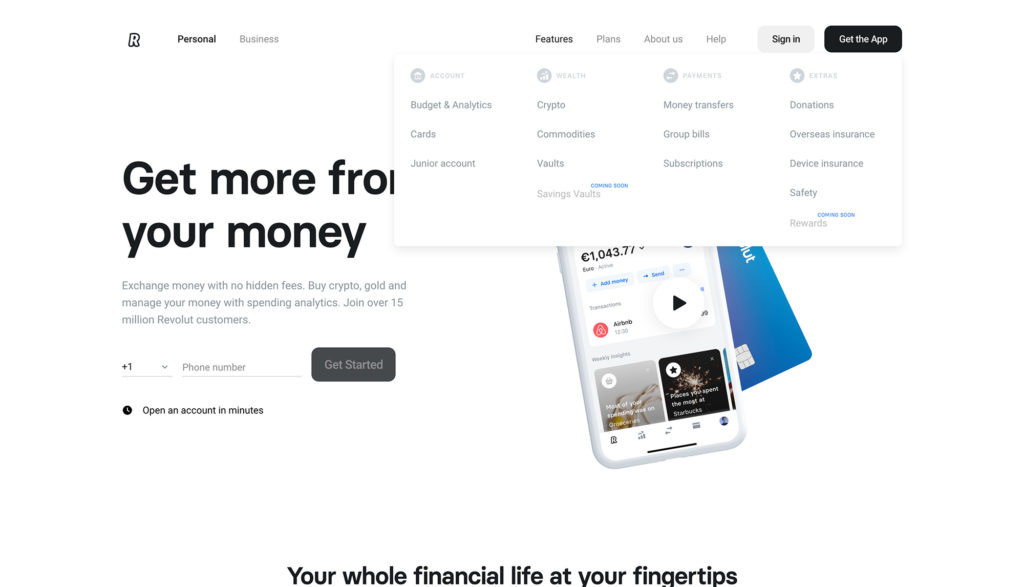

Venmo vs. Revolut

With over 10 million users in Europe alone, Revolut is an innovative digital banking and currency exchange business that facilitates global spending and transfers at the best exchange rates.

They offer a wide range of money transfer features along with other services for personal and business customers.

Revolut is available on both Apple and Google Play app stores.

Fees – Opening an account and the same currency money transfers are free. For international transactions, regular wire transfer rates are applied. There's also a charge involved to use SWIFT.

Network Reach – Revolut is currently available in Switzerland, Australia, all the EEA countries, and in the United States.

Payment types – You can use bank accounts, debit and credit cards, and Apple pay.

Speed – Depending on the currency and transfer type, it takes anywhere between 1-5 days to receive the funds.

Safety – Revolut‘s anti-fraud system uses machine learning algorithms to detect suspicious transactions. In the case of a card loss, you can freeze or unfreeze your card in seconds.

FAQs

To round up this review, we're going to answer some frequently asked questions about Venmo:

Do you need a bank account for Venmo?

You need to link your bank account to transfer money. However, a recipient doesn't necessarily need a bank account as you can store your funds as your Venmo balance.

How do you pay someone on Venmo?

You can link your bank account, credit card, or debit card to your account and then search for the recipient using their email address or phone number. If they don't have a Venmo account, they need to create one to receive the money. You can also cancel the payment if the receiver doesn’t accept the money.

Is there a monthly fee for Venmo?

The app can mostly be used for free. However, there are two main Venmo charges:

- A 3% transaction fee for credit card payments – Fortunately, this fee doesn’t apply for authorized merchant purchases.

- A minimum of 25 cents to a maximum of 1% per transaction for instant transfers – These transfers are delivered within half an hour.

That's it where Venmo fees are concerned!

How does Venmo verify my identity?

To verify your identity, Venmo asks for your basic information like your legal name, date of birth, address, and SSN/ITIN. They may ask for some additional information if required, like:

- U.S. passport

- Driver license

- U.S. government-issued ID

- DHS card

- Tribal ID card

Are You Ready to Start Using Venmo?

After having read this review we hope we've managed to answer the question: What is Venmo and how does it work?

In short, Venmo is loaded with heaps of benefits, especially for people who are well-versed in handling all kinds of transactions using their smartphones.

Overall, the app is easy to use and offers speedy payments in almost all types of scenarios.

Venmo is the perfect P2P platform if you're looking for a solution for paying friends and family. Most notably, for settling a bill or paying for a drink or coffee while you're on the go. It's not only intuitive, but it's also very social.

However, if you're more privacy-minded, you can simply adjust your transactions' visibility to fit your comfort level.

Alternatively, you could opt to use any of the top Venmo.com alternatives listed above. Which will you decide? Either way, let us know in the comments box below!

Is this application available in Brazil?

Hey Jaque, I thinks not available at the moment.

When the venmo account is frozen it is not easy to unfreeze it, they need to work more on that.