Finding a reasonable payment gateway to use for your business is often like playing a game of golf: After much consideration, and lining up your shot, it seems clear that you've found the right route to the hole. However, a tree seems to always act as a barrier, then a friend comes up afterward and tells you that a different option may have worked better.

Have you ever found yourself in that situation? The payment gateway industry is a fickle one, so you may end up getting hit by unexpected charges, while a friend recommends a more suitable option after you've already gone through the work of setting up a payment gateway.

Our job here is to ensure that this doesn't happen at all.

We're continually looking at payment gateways and ecommerce platforms so that you make the right decision the first time.

So, we wanted to outline an interesting solution for a payment gateway for those who are looking for both mobile, in-store, and online payment collecting.

Introducing Payline Data.

| 👍 Pros: | 👎 Cons: |

| Interchange Plus pricing model keeps pricing simple and accessible

Mobile, POS and eCommerce payment processing available Month-to-month contract available with no cancellation fees Receive your funds into your business bank account within 2 business days Phone and email customer support with experts from the team Chargeback prevention and fraud protection with Verifi Highly accessible and user-friendly gateway interface Placement for high-risk merchant accounts available Support for mobile, in-person and offline payments Specialist payment options for healthcare companies |

Customer support only available Monday to Friday

Equipment must be purchased separately Minimum monthly charge of $25 for all packages

|

What is Payline Data?

Payline Data is an honest, transparent, and fresh approach to payment processing for companies in search of new and flexible solutions. Created by the “Pineapple Payments” brand, Payline Data delivers unique and industry-leading tech products to organisations sick of stressful transactions.

On the website for Payline, you'll find everything you need to know about the company, without any pushy sales or marketing. For instance, you'll discover that Payline Data has a wide range of options for online and offline transactions, ideal for those in need of an omnichannel approach to running their business. The omnichannel offering supports businesses of all sizes and industries, from Fortune 500 brands to tiny startups.

Headquartered in Chicago, Payline Data focuses on developing an opportunity to access everything from intuitive insights and reports on the backend to unique booking modules, pricing and support teams, and more.

Payline Data Review: Overview

Although the company is relatively new, it's founded on top of a lot of essential values. For instance, you can rest assured that the team will do everything it can to solve the problems typically faced in the payment processing world, including inflexibility, complexity, and inaccessibility. The transparent pricing of the product combined with superior technology means that you have the freedom to invest in commerce; however, you choose.

👉 Since its launch in 2009, Payline Data has remained teetering on the cutting edge of payment processing technology, with things like:

- Month-to-month flexible billing

- No early termination fees or long-term contracts

- Interchange-plus pricing for all merchants

- Standardized and straightforward pricing packages

- Free terminal equipment included with specific plans

- Excellent customer support and service

What Makes Payline Data Special?

There are plenty of things to love about Payline Data, including the ability to access a wide range of different features for your transactions. However, what makes this company special is its reputation in the marketplace. Ask around among merchants, and you'll find a truly impressive range of practices for honest and transparent sales. The standardized pricing packages mean that you can stop worrying about negotiating over rates and start building a business.

With this vendor, you can choose a plan that's right for you, and start selling in no time. Another exciting thing? Payline Data gives something back to its community and the planet. The company is connected with a wide range of CSR initiatives thanks to the Payline Giving program. This means that it supports 12 causes each year, one for each month. The fact that Payline gives a portion of its profits to charity each month means that you know you're dealing with a business that cares.

Alongside their charitable giving strategies, Payline offers paid volunteering days for its workers and provides discounted pricing for merchant accounts with registered charities. You can also sign up for recurring referral payments with PayLine if you're a charitable or non-profit organization, using the Commercial Co-Venture plan.

Payline Data: How it Works

Payline Data is what merchants refer to as a “front-end” payment processing. That means that it will connect your company to credit card networks and authorize transactions on the front-end for your merchant account. There's also back-end processing available through WorldPay, which happens to be one of the largest and most reputable back-end payment processes around.

When you sign up with Payline Data, you authorize the company to process debit cards, ACH, credit card, and e-Check transactions and deliver whatever funds you earn into your bank account. Depending on the sales channels you use and the nature of your business, there's a range of ways to make sure that you're able to accept whatever transaction strategies suit you. Payline Data also offers solutions for in-store, mobile, and online payments.

One unique feature? Payline also supports transactions specifically for High-Risk companies. We'll come back to that in a minute.

Payline Data Review: Pricing

The last thing any merchant wants is a payment processor that soaks up all of their hard-earned profits. One of the best things about Payline Data is the pricing structure that they use. Not only are costs from Payline affordable, but they're also 100% transparent – with no hidden fees.

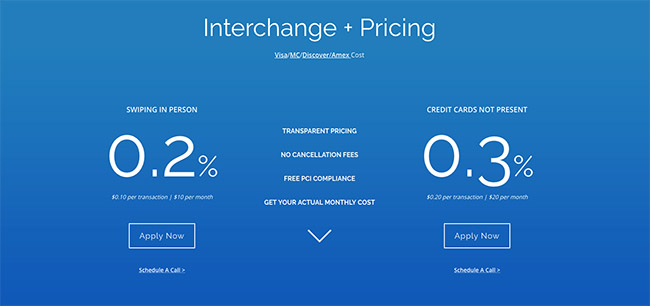

There are two primary pricing plans available, each with a range of interchange-plus pricing on credit card payments and small monthly fees to consider.

Payline Data “Start” Pricing

The first option for pricing is the “Start” package, intended for offline brick-and-mortar merchants. There's a per-transaction fee with this plan, with an interchange price, plus 0.2% and 10 cents. Remember, the interchange price is determined by the credit card network that you're using, such as Visa or Mastercard. You'll need to look into this to get a full price.

If you're using the Payline virtual terminal, then you'll be paying the interchange price, plus 0.3% and another 20 cents for any transaction. There's also a baseline monthly feel of $10 and another $25 monthly minimum on your purchases. In this plan, you'll be able to process mobile payments, get free PCI compliance, and buy your credit card terminal separately too. There's also a chargeback fee required of $25.

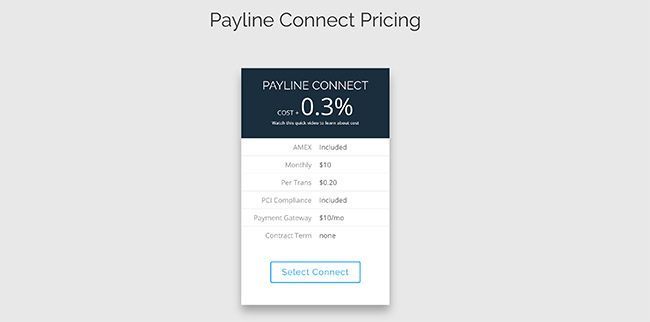

Payline Data “Connect” Pricing

The “Connect” pricing plan is designed specifically for merchants in the eCommerce environment. All virtual and online terminal payments are charged at the interchange price, plus 0.3% and 20 cents. You'll also have to pay a $20 monthly fee and manage a $25 monthly minimum on your transaction fees. Once again, there's a $25 fee for chargebacks.

The Connect plan comes with a Payline Gateway for no additional charge, along with free PCI compliance.

No matter which of the two plans you choose, you'll be able to cancel them at any time with no additional fees for cancellation. It's hard to find that kind of flexibility among most payment processors. Additionally, it's worth noting that Payline offers lower-cost pricing plans for specific businesses.

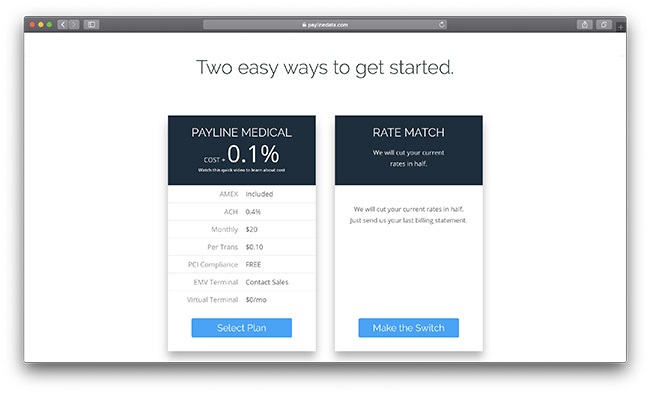

Payline “Medical” Pricing

One of the most recent additions to the Payline pricing plan structure is the introduction of a new “Medical” plan. This option is designed specifically for healthcare providers and charges each transaction with your interchange price, plus 0.30%, and 10 cents per transaction.

For ACH payments, you can expect to pay 4% on your transactions, but there are no monthly fees, and you get a dedicated account manager to help you out too. What's more, users can link up to the virtual terminal from Payline Data for an extra $10 per month.

Payline Data: Additional Fees and Options

On the Payline Data website, you'll find a calculator to help you calculate your estimated monthly cost for your transactions. That's a super useful feature, and it comes with insights into all of the major credit card providers too. With the calculator, you can see that if you process 1,000 in-person transactions per month for an average of $25 per purchase, you'll pay about $36.50 in transaction fees.

In addition to standard payment options, Payline Data comes with several optional add-ons to explore too. For instance, you can include a mobile POS solution for $7.50 per month under the plan with Payline Start. You'll also be able to add a variety of fraud tools into your package, which includes things like Payer Authentication and iSpy Fraud.

Subscription Billing

For subscription billing, Payline Data offers add-ons like QuickBooks syncing, invoicing, and account updating tools. You'll also note that all of the primary plans coming from Payline feature PCI compliance with no added costs. This is excellent for companies that want to keep their transactions as secure as possible and avoid any penalty fees for PCI non-compliance.

Overall, even if you choose to include the optional extras in your Payline pricing packages, you can expect to receive a fantastic deal from this company. Although the interchange+ rates aren't the lowest on the market, they come with free equipment and software that deliver higher value in the long-term.

Payline Data Review: Features and Capabilities

One of the most obvious reasons to choose Payline Data as your payment processor is that it will give you a range of fantastic solutions for managing your payments. After all, while low costs are great, it's the features that will sway you when you're investing in tools for your business.

Here's a deep-dive into some of the capabilities to expect.

Payline Data Review: Merchant Accounts

Regardless of the kind of company you're operating, you're going to need a merchant account to accept payments via WorldPay.

Fortunately, Payline Data provides a dedicated merchant account for each user, complete with a unique ID number, and a stable performance history that's sure to put your mind at ease. You don't have to share your account with other businesses, and you'll receive funds in your business bank account within 2 days or less.

Something that makes Payline Data stand out is their willingness to support high-risk merchant accounts. This means that you can still get a merchant account with Payline if you're selling riskier products like e-cigarettes, adult products, or firearms.

High-risk Accounts

Payline's high-risk accounts process offerings with a simple application process, and the option to choose from 20 different banking partners.

👉 Benefits of the high-risk merchant accounts from Payline Data include:

- Quick and easy application and approval processes

- Industry expertise with 20+ banking partnerships

- High-risk support team to help you process payments

With a high-risk merchant account from Payline, you can also diversify your business by providing customers with the option to make ACH payments. This is often a more secure and seamless solution than using a credit card, and it means that your customers can enjoy more payment options.

Since high-risk accounts can also come with the threat of higher chargebacks, the Payline company also strives to keep your chargebacks under control with a robust prevention platform that monitors your account in real-time. This helps you to win more revenue and reduce your losses over time.

Overall, Payline Data stands out by offering merchant support to companies that other organizations simply wouldn't touch due to their higher risk levels.

Payline Data Review: Payment Gateways

If you're a merchant in the ecommerce world, then you're going to need a payment gateway so you can take payments online. With Payline Data, that's no problem at all.

The immersive in-house payment gateway solutions from Payline are incredible and feature-rich, packed full of ways to take your earning potential to the next level. If you're looking for something flexible – then Payline has you covered from that angle too, with 175 different ecommerce platforms and carts to choose from. You can use Payline to accept debit, credit, and electronic payments, as well as processing invoices and establishing recurring payments.

Honestly, the options are endless.

One thing we were particularly impressed with is the fact that the Payline Gateway also allows users to manage multiple merchant accounts at once. That means you can run different businesses from the same environment. Plus, if you want to upgrade your customer management strategy, there's the option to save customer information, process vast numbers of transactions at once, and track your inventory.

According to Payline customers, processing up to 5,000 transactions only takes an average of 90 minutes – which is pretty speedy.

👉 Payline offers:

The mobile and online payment gateways are particularly impressive because they can integrate with more than 175 different online cart options. That means that you should be able to use whatever cart you like alongside Payline.

What's more, if you're looking to embed the Payline payment processing features into your existing technology stack, you can hand the open API over to your developer to do just that. The gateway and mobile APIs are excellent for companies that need full control over how they accept and manage payments within their software and mobile apps.

Payline Connect is the option that gives ecommerce and mobile app providers a payment gateway combined with built-in fraud protection and security. This solution is designed for online businesses that operate their own website and have integrations with sites like QuickBooks for financial management and account. It's also worth looking into Payline Connect if your existing processing configurations are causing headaches with chargebacks and PCI compliance.

Payline Data Review: ACH Payments

If you're interested in offering ACH payments as an option to your customers, then Payline has you covered there too. An ACH payment is generally a transaction processed through electronic networks in batches. The batches used with ACH payments can sometimes deliver smaller fees than credit card processing.

👉 With the Payline ACH network, you can:

- Transmit payments electronically to reduce costs and increase revenue.

- Access fees of less than $0.60 per transaction through batches

- Deliver better payment reassurance with alerts on when you've been paid

- Create a more convenient payment strategy with settlement processing multiple times per day.

- Reduce the common frustrations involved with accepting recurring payments.

- Convert your customers faster by offering them a wider range of additional payment options.

Thanks to immersive encryption technology and a fantastic selection of built-in security features, Payline Data can ensure ongoing peace of mind for their customers. The ACH strategy is safe and secure, providing far greater protection than old-school checks and other transaction strategies.

Payline Data Review: Recurring Payments

Recurring payments are growing to be a common requirement for many businesses in the modern landscape, particularly as software as a service and subscriptions become more popular.

👉 Whether you're making or accepting payments through Payline‘s ACH network, you can:

- Manage transactions on autopilot with invoicing, and payments delivered automatically

- Keep customers happy with authorized and approved billing schedules

- Build a solid foundation for consistent payment processing using traditional, expanded, or modifiable ecommerce processing.

Any business that bills customers consistently will benefit from the range of recurring payment options available from Payline Data. After all, when you're relying on monthly payments from your customers, you can't afford to deal with things like interruptions in your processing strategies. The subscription services from Payline Data are so easy to set up, that anyone can automate their entire recurring payment strategy in no time.

What's more, because the recurring payment environment is so hassle-free and straightforward, it means that companies can build a fantastic level of trust with their target audience, while making their processing strategy easier and more streamlined.

Why waste time on complicated invoicing when you need to focus on growing your business?

Payline Data Review: Terminals

Sometimes, finding the right payment processing solution isn't just about choosing the option with the best software. You'll also need to consider your hardware needs too.

Fortunately, Payline Data has you covered in that regard, with the option to buy a range of credit card terminals as “added extras” on your packages. There are a few specific terminals recommended by Payline, including:

Clover Go: The portable card reader from Payline that accepts everything from chip card to contactless payments, and magstripe. You can also take Android, Apple, and Samsung pay. The reader syncs with your smart device via Bluetooth and costs a one-time fee of $125 plus an additional $11 per month.

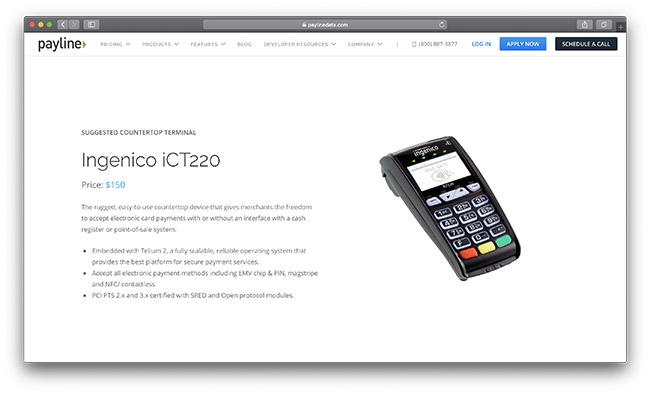

Ingenico Ict220

A slightly more advanced countertop device, the Ingenico is less intended for people on the go, and more for fixed brick-and-mortar locations. It can accept contactless, chip, and magstripe payments too. There's also a range of high-level security features built-in, and the option to print paper receipts.

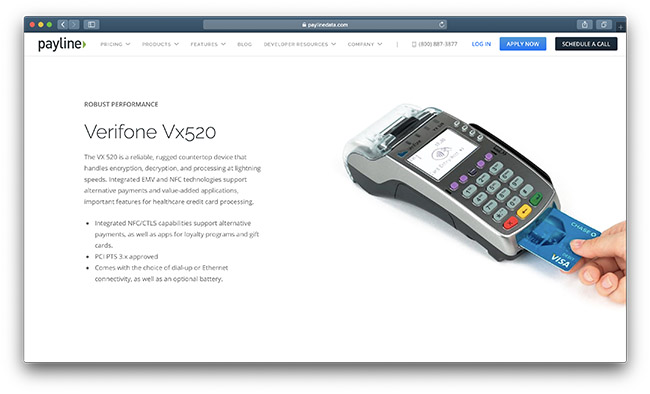

Verifone Vx520

The VX 520 is an excellent high-quality countertop device that handles things like decryption, encryption, and processing at lightning speeds. NFC and EMV technologies are integrated to support a host of alternative payments. What's more, there are unique features built-in specifically for healthcare companies.

As well as a range of hardware terminals, Payline Data also offers an advanced "virtual terminal."

What does this mean?

Well, basically, with the virtual terminal you can accept any payments from an internet-connected computer, even in a card-not-present situation. The software can process a host of transactions when coupled with any USB-connected reader. The virtual terminal is included free-of-charge with the Start pricing plan. Alternatively, you can get it for $10 per month with the Medical package.

Payline Data Review: Business Loans

Need help finding capital to get your business off the ground?

Payline Data can help with that too. If you're struggling to find financing for your company, Payline will allow you to set up a partnership with a broker. All you need to do is fill out a form, and you'll be linked directly to over 75 vetted lending partners.

Your options are listed on your Payline account, and you can access funds within 24 hours from some providers. Loan options include merchant cash advances, lines of credit, term loans, and even equipment financing. What's more, there's access to the extensive "Lendio" business loan marketplace via Payline, so you can find all the extra financing tools you need to keep your business running strong.

You'll be able to browse through intelligently-chosen options for your business funding and select a loan that best suits your business. The loan feature means that Payline customers can save a lot of time and resources on tracking down the funding they need to get their company started. Payline even leverages proprietary algorithms to boost your chances of finding a loan that's right for your company.

Payline Data Review: Security and Fraud Prevention

Alongside a wide variety of payment processing options, Payline Data also delights customers with an impressive selection of security features. Who doesn't need peace of mind these days, after all?

There are a host of additional security measures built-into your transactional journey, to keep your liability to a minimum. For instance, all customers are required to provide a CVV at checkout, and card-not-present customers are asked to verify their address.

The various features included with Payline Data security are intended to help businesses of all sizes stand up to the threat of fraud and reduce their risk of losing money or sensitive information. There's even an automated account updater so you can reduce the risk of falling victim to issues caused by problems with out-of-date transaction information.

👉 Some of the fraud prevention and security options offered by Payline include:

- Level 3 data: Options to pass on enhanced transaction data for reduced interchange costs

- Customer vault: Initiate transactions remotely without having to access cardholder data directly

- PCI compliance: PCI compliance is included as standard with all of the payment processing options available from Payline Data.

High-level Fraud Protection

For high-level fraud protection, Payline Data also offers access to third-party security programs like Ethoca and Verify. For instance, Payline is an authorized reseller of the Verifi product, which delivers award-winning cardholder dispute resolution networks to today's merchants. The CDRN solution means that you can protect your business by preventing chargebacks. Additionally, Verifi helps yo maintain transaction volume and revenue generation.

With Verifi, you can avoid acting on supplemental or old, out-of-date data when making transactions. You'll also be able to pinpoint potentially false alerts that increase your processing costs and minimize the loss of profits caused by time-consuming refunding processes.

As an additional method for protecting payments in the healthcare environment, Payline also ensures that it keeps its software as compliant as possible with the latest healthcare industry standards. The "Medical" package from Payline comes with simple cost-plus pricing like anything else on the Payline portfolio. However, it also comes with access to regulatory and HIPAA compliance, to ensure that you're not falling into problems with your customers or the payment regulators in the market.

Payline Data Review: Integrations

One of the things that makes Payline Data so impressive as a payment processing solution is the fact that it comes with so much flexibility built-in. As mentioned above, there are open APIs available and developer documentation for companies that want to embed their transaction tools into their existing payment processing strategies. That means that you have the freedom to design an environment that works perfectly for you.

Additionally, if you opt for the ecommerce solution from Payline, then you'll be able to integrate that with a range of financial management and accounting tools like QuickBooks. Access to a host of integrations means that it's much easier for companies of all shapes and sizes to handle things like financials, accounting, and payroll from within their Payline environment.

Although there's plenty of features built into the Payline experience, to begin with, having access to third-party shopping cart solutions and other essential integrations makes life a lot easier for business leaders who don’t want to be constantly transferring data from one environment to another.

Simplicity and ease of access when it comes to managing big data is one of the main reasons that today's companies are paying more attention to integrations and plugins when choosing the solution that's best suited to them.

Payline Data Review: Customer Service

Payline Data provides plenty of great features to delight merchants in search of a payment processing tool. For instance, the low-cost pricing and transparent costs mean that you can better manage the expenses involved with running your thriving business. What's more, the fact that you can take payments in so many different ways means that merchants can give customers the freedom to buy, however suits them.

For non-profit accounts, there are even extra benefits and discounted rates, so you can do something great for the world, without paying a fortune in monthly fees.

Of course, all of these benefits aren't worth much if Payline Data isn't there for you when you need some extra help using their service.

The good news is that the customer service from Payline is excellent. There's phone-based support during standard business hours from Monday to Friday. On the other hand, if you need additional help, you can use an email address to contact the Payline team, or you can serve yourself with the range of guides and tutorials in the Payline knowledge base.

Payline Data might not provide 24/7 customer support, but most companies just can't accomplish this these days. Additionally, if you do find a payment provider that offers around-the-clock support through instant chat, you're more likely to be dealing with a bot than a human expert. That means that you don't get the quality of support you need to make a real difference to your business.

Payline Data puts quality over quantity with its support offerings, ensuring that there's always a reputable person on the line when you need support during business hours. Plus, if you can't get hold of anyone, it's fair to say that the company's website is packed full of useful information to help you out. For developers, there's even a handy API reference available that should be invaluable to your abilities to integrate Payline into your existing websites and tools.

Payline Data Review: Final Verdict

If you noticed a severe lack of complaints or niggles during this Payline Data review, there's a good reason for that. It's challenging to find anything to whine about with Payline Data's platform. There's no early termination fees, no complicated pricing, and no overwhelming interface to deal with. The month-to-month billing and fantastic range of payment options to choose from make Payline Data stand out from the crowd as one of the best options for any company – no matter how small or large.

On top of that, a reputable sales and service team means that you can always get the additional support you need- no matter what's going on with your business. While Payline is one of the best solutions out there, that doesn't mean that it will be the right fit for everyone. There's no such thing as the “perfect” payment processor, after all.

For instance, Payline might not be ideal for you if you desperately need a company that can offer 24/7 support. Additionally, most of the time, the hardware that you need to process your transactions will have to be bought separately. There's also the fact that there's a minimum monthly charge for each package, which means that your overhead could be greater than you think, and there's more pressure on your team.

However, none of those down-sides should necessarily sway you from trying Payline, as they're such small issues that they barely qualify as problems. For the most part, Payline Data is a genuinely outstanding option for payment processing.

Comments 0 Responses