Looking to send money internationally? Don’t want to pay the high markups that come with bank transfers or PayPal? Then we encourage you to continue reading our Wise review, a detailed analysis of an international sending and receiving platform with low fees and an easy interface.

Wise doesn't just cut your fees in half, it also charges a small fraction of the fees you would incur by sending or receiving money overseas with PayPal or your bank. Many times, you'll find that the fees are close to zero.

Keep reading to see our in-depth Wise review, filled with pros, cons, and breakdowns of each product and feature.

Btw, here's a video version of our Wise, review created by my colleague Joe. 🙂

What is Wise?

What is Wise, and how is it going to solve any of your payment problems?

Wise (formerly TransferWise), is a UK-based company that believes that money should have no borders. The company is the creation of Kristo Käärmann and Taavet Hinrikus.

Taavet was working for Skype in Estonia and was paid in EUR despite being based in London. Kristo, on the other hand, worked in London, and was paying for a mortgage back home in his native Estonia.

Their plan was simple. Every month they looked up to find the mid-market rate. Kristo then sent pounds into Taavet's UK account and Taavet sent Euros to Kristo's account.

Both received the money that they were promised, and there were no nasty hidden fees involved.

From this, Wise, was born and it has set up accounts all across the world. Now, you simply pay into Wise's bank account in the country of your choosing and they will pay your recipient with the correct exchange rate.

Since it's inception in 2011, Wise, has accumulated over 6 million customers and is backed by investors involved in companies such as Virgin and PayPal.

Wise's Pricing

The biggest advantage of Wise, is how transparent they are with pricing.

In regards to costs, these will all be different based on how much you are sending, what country you are sending it to, and what the currency is. However, a quick test of multiple scenarios shows how the fees are insanely low across the board.

Just check out our fees calculator you can instantly see how your money is converted. If you want to see the fees in detail, visit their pricing page. This calculator is provided because every transfer is different. We also like this page for you to get a more clear-cut view of what the general fees look like.

Let's take a look at the general fees, then we'll go into some hypothetical transfers to show how low the pricing is for Wise.

First off, here are the general fees to expect when working with Wise:

- Creating and managing an account – Free.

- Holding currencies in your accounts – Free.

- Creating multi-currency bank account details (like IBAN and routing numbers) – Free.

- Receiving direct money transfers in EUR, USD, GBP, PLN, AUD, and NZD (by this we mean a transfer from EUR to EUR or USD to USD) – Free.

- Fees for converting any currencies – 0.35% to 3% – during my testing it was almost always closer to the 0.35% fee.

- Adding a direct debit to your account – 0.2%.

Hypothetical transfers and their fees:

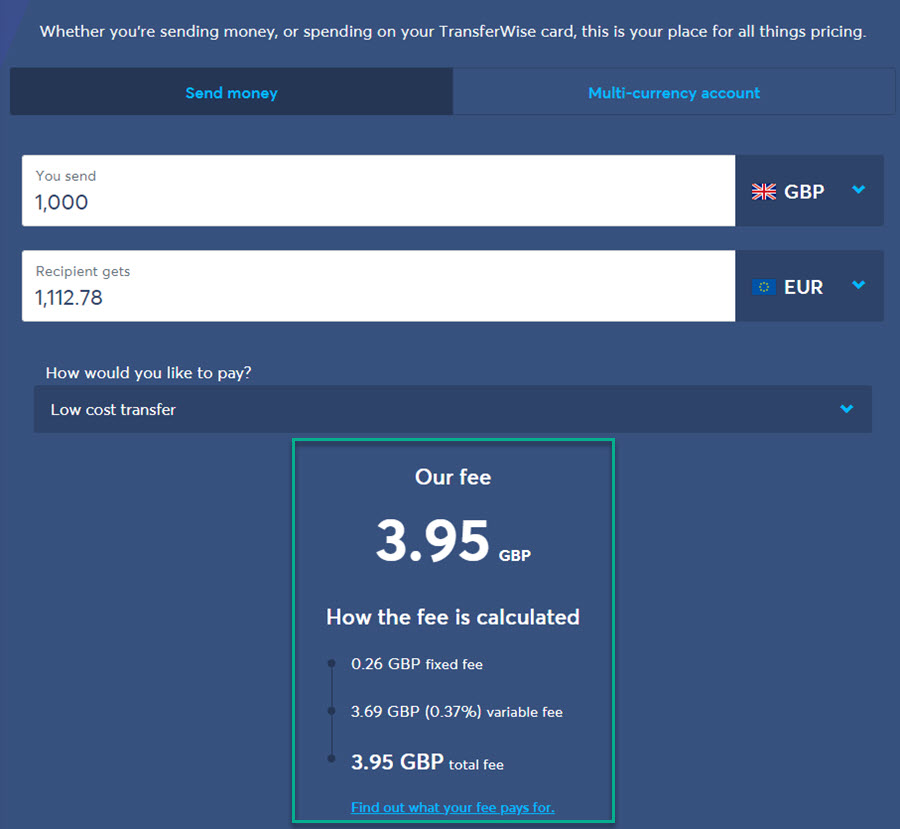

Let's say I want to send money to a contractor or supplier. I'm sending 1,000 of my own GBP. They will then receive the money in EUR.

- The low-cost transfer method has a .26 GBP fixed fee.

- There's a 3.69 GBP (0.37%) variable fee.

The grand total is 3.95 GBP to send 1,000 GBP and convert it to EUR.

If you've ever sent an international bank transfer, or done the same thing through PayPal, you know that the fee would be around 40 to 100 GBP. That's incredible how much cheaper it is to use Wise.

Note: A faster transfer is available for a slightly higher fee.

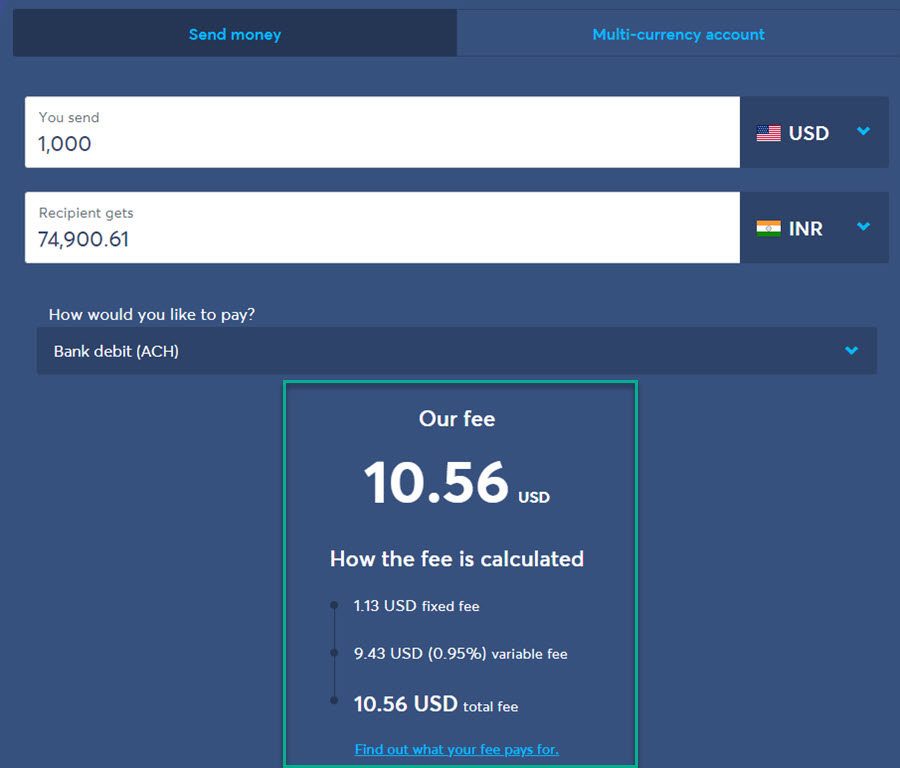

Next up, let's pretend I need to send out 1,000 USD to a contractor in India. That means I'll send it from my bank account and Wise converts and sends it to an INR account.

Because the transferring currencies have changed, payment options have also changed. Instead of the low-cost and high-speed transfers, we can choose to go with an ACH transfer, wire transfer, debit card, or credit card.

But don't worry, even though your contractor can't create an INR account in Wise, the service still converts it for a low fee and puts it in their local bank account.

The cheapest option is to send via ACH, with the following fees:

- A fixed fee of 1.13 USD.

- A 0.95% variable fee that comes to 9.43 USD.

The total fee is $10.56 USD. Again, a bank or PayPal transfer would typically range from $40 to $100.

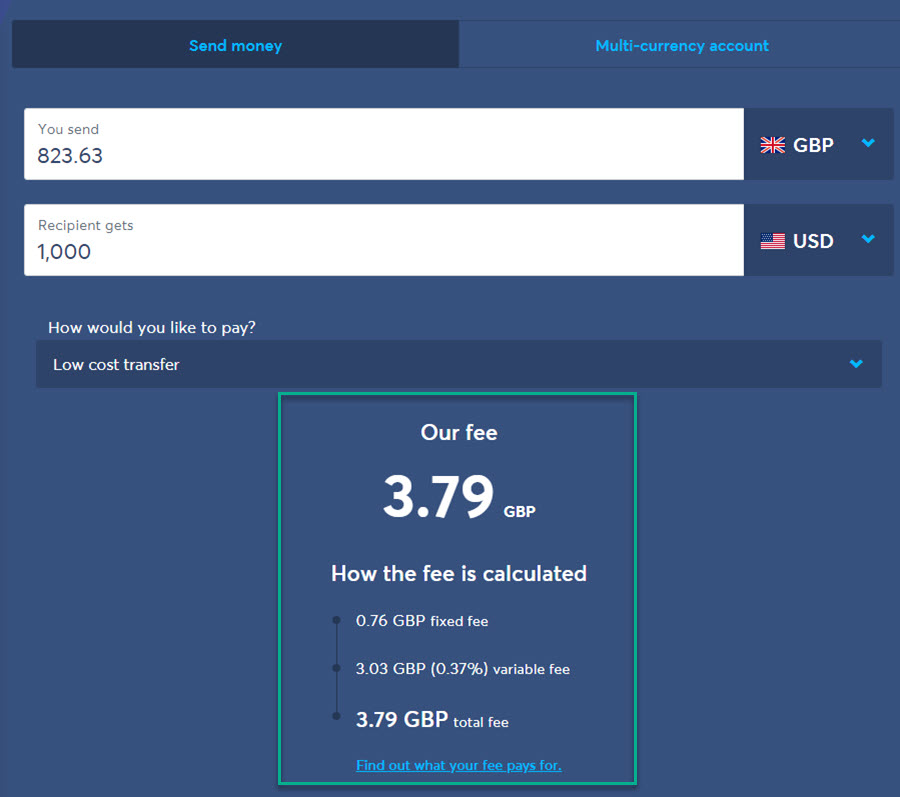

Finally, you can use these calculators to see how the fees look when accepting money from clients or customers overseas.

The only difference is that the “You Send” text on the calculator is the person paying you. Other than that, the calculator works exactly the same.

I work in the United States, but I have clients in parts of Europe and the UK. If I invoiced one a client in the UK for 1,000 USD, all they would have to do is type in 1,000 USD in the “Recipient Gets” field. That calculates that they must send 823.63 GBP.

For my business, I get exactly what I invoiced. The payer absorbs the following fees:

- 0.76 GBP fixed fee.

- A variable fee of 3.03 GBP (0.37%).

That's it. The total fee is 3.79 GBP.

All of these calculations make me wonder why I always used PayPal and bank transfers to collect international payments in the past.

Every time I type something into the calculator it shows fees far below 1% when using Wise. International payments through PayPal are often around 6 to 10%. In short, you're paying lots of money just to get paid or to pay someone. It makes no sense.

Wise, on the other hand, turns the process into an easy one and ensures that most of your money ends up in your hands.

Pricing for the Debit Card

The final area where you may see some fees is with the Wise debit card. Our Wise review showed that there aren't actually that many fees involved with the card.

To clarify, you don't need to get the Wise debit card if you don't plan on using it.

It's a nice luxury for business people or travelers who find themselves spending in multiple currencies while going from country to country.

We'll cover the debit card limits in the following sections, but here are the fees to expect:

- Signing up and receiving the debit card – Free.

- Spending with the currencies you have in your account – Free.

- Converting a currency with the use of your card – 0.35% to 3% (this is actually no different than converting with the Wise dashboard, so you're not losing money).

- Spending in rare currencies – They charge a “Mastercard rate.” This could mean anything. I'd try to avoid this.

- ATM withdrawals up to $250 per month – Free.

- ATM withdrawals over $250 per month – 2%.

All in all, the debit card is similar to any debit card you'd get from your local bank. The main things to avoid include using it for ATM withdrawals and spending in rare currencies. Other than that, the transfer rates are the same and most of the things you do with it are free.

Wise's Features

Wise features are broken into a handful of categories depending on how you plan to use the service. At it's most basic, Wise is a money transfer service, most commonly used for international transfers to keep rates low and stick to the real exchange rate.

Most of the features we uncovered in our Wise review utilize the same process, where someone sends you money or you send someone else money. Then, Wise converts the money, or keeps it in the same currency, depositing it into the account of your choice. That's pretty much all Wise does. For some reason, it's easy to make the process of sending and collecting money abroad seem complicated in your own head, but the Wise interface makes it simple.

As for the product and service features offered, here are the main categories:

- Simple money transfers from one bank account to another.

- Large money transfers.

- International money transfers, providing quick and low-rate exchanges.

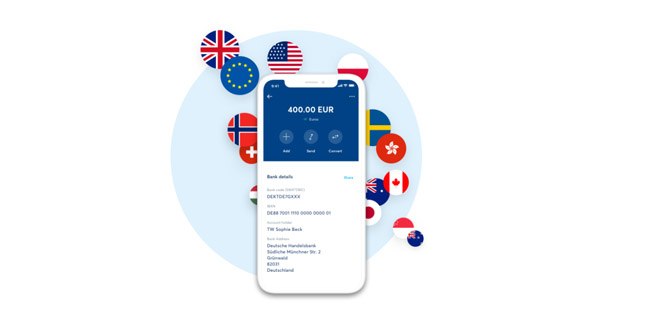

- A multi-currency account for accepting, spending, and holding money in several currencies.

- A debit card that links to the multi-currency bank account. This helps when you need to spend money abroad in a physical setting.

- Tools for paying invoices to multiple people around the globe.

- Integrations with some of the more popular invoicing software.

- API access to automate much of your payments and payment collection processes.

- A transparent transfer calculator to see how much you're being charged in fees (usually close to zero,) what the current exchange rate is, and how long it's going to take for money to end up in the final account.

- Monthly statements to keep track of how much you've been spending and receiving in your accounts.

- Options to complete transfers even if your customer or contractor doesn't have a Wise account.

Wise Business for business

For your ecommerce business, you have the opportunity to set up a Wise Business, account which allows you to get paid with extremely low fees from anywhere in the world. Additionally, you can hold and then convert your money into over 40 currencies. This allows you to send money anywhere in the world completely stress-free.

So how does that work?

Essentially, you receive the local bank account details which then allow you to receive payments in major global currencies such as Euros, US dollars, and UK pounds.

You then pass these bank details onto your recipient which helps you to avoid the high markups that you get with international payments, most notably from PayPal, Stripe, and wire transfers. The same can be done for accepting payments from other companies and individuals.

What's great is that anyone can use Wise Business, and personal spending and collecting payments. Create business and personal accounts to ensure that your finances remain separated. There are a few small differences about personal and business accounts (like how you can't get a business debit card in some countries, but you can usually get a personal debit card,) but overall, they function the same way. The distinction is primarily made to keep your expenses separate.

Wise Business accounts are helpful for some of the following people and organizations:

- Online stores that collect payments from customers or clients in other countries.

- Online stores that hire contractors or work with suppliers in other countries.

- Freelancers with clients abroad.

- Students or family members who need to get money from back home.

- Enterprises that send out large batches of money to contractors and other workers on an automated basis.

Running your own business is already expensive. Why is it that you have to pay so much money to pay your workers or get paid yourself? That's what Wise is trying to fix. I've heard many people argue that PayPal and bank fees are “just a cost of doing business.” That's a way of thinking that makes it really easy to make less money.

With a business account, there's no need to pay anywhere from 2% to 10% for international transfers through PayPal. Credit card fees also get out of control when making payments overseas. What's worse is that many of these payment processing companies try to blame conversion rates. The only problem is that they often use outdated transfer rates and sneak in hidden fees. They claim it's part of the transfer fee, but really, they're taking the money for themselves.

Receiving money through a Wise Business, account means you're paying little to no fees, depending on the type of payment, when the payment is made, and where the payment is coming and going. Overall, you don't have to worry much about those factors since the fees typically remain far under 2%. In my personal experience, all payments I've received have had a less than .50% fee attached. That's amazing compared to the fees you see from PayPal.

Wise Review: Exchange Rate Locking

When transferring money, Wise, automatically locks the exchange rate for a specified amount of time.

For the vast majority of countries, this is 24 hours. For others, it's locked for 42 hours. For BRL (Brazilian Reals) the exchange rate is locked for 72 hours. This ensures that massive fluctuations in the exchange rate won't affect you at the last minute.

We recommend checking out the Wise Calculator to get a feel for what types of fees and exchange rates to expect from the service. Each transfer is broken down into fees so that you know exactly how much is being charged for exchange rates and the fee taken by Wise, (which is usually close to nothing).

Why Does Exchange Rate Locking Matter?

Unfortunately in this digital age, we've given up lots of control and transparency in our lives in exchange for convenience and “free stuff.” Examples of this include online payment processors. Ticketmaster and StubHub charge high fees to purchase online. Why? Because it's quick. People don't have to leave their homes.

However, paying a fee that equates to a full extra ticket to a sporting event or Broadway show makes no sense when you could just drive or walk to the box office and get the tickets with no fees.

Overall, many of these processing companies have no competition, and users don't want to drive to pick up tickets. The payment companies have full control over what they charge.

The same can be said for PayPal and other international payment gateways. Several years ago it was impossible to send or receive money overseas without it being really expensive or requiring a trip to go pick up the funds. PayPal fixed that, and there aren't many competitors. So, PayPal charges high fees, especially for international payments.

There's also the exchange rate dilemma. It's common for processors to add on other fees and simply claim it's part of the exchange rate. People are too busy with their lives to check in on the truthfulness of this, they don't have time to argue, or there's no other option.

Therefore, it's extremely important to lock in the real-time exchange rate so that you aren't charged for a worse rate that happened two weeks or months ago. Whether it's used as extra fees for the payment processor, or the rate is outdated, you're the one losing money when you don't know the real exchange rate.

Multiple Transfer Types

Various offerings from Wise get marketed separately. I'm assuming this is because they need to rank on the search engines for different keywords and offer some sort of targeted content when interested parties land on their website.

However, quick transfers, business accounts, personal accounts, ecommerce transfers, and freelancer accounts, are all pretty much the same thing.

You generate an account, then send or accept international payments for clients, customers, and friends. That's all.

So, I'm trying to make it so that some of the marketing content from Wise doesn't confuse you.

Your payments as an ecommerce business don't vary when compared to payments between family members in different countries.

Having said that, the fees, and the way in which your money is transferred, does depend on the type of transfer you choose, the type of currency that's being sent, and when it's sent.

For instance, if I wanted to send 1,000 USD and have it converted automatically into INR for a contractor, these are the payment methods and their fees as of this article:

- Bank debit (ACH) – $3.49 fee.

- Wire Transfer – $5.34 fee.

- Debit card – $12.35 fee.

- Credit card – $36.61 fee.

Wise, is transparent whenever you initiate a transfer. You'll see the fees and possible payment methods before clicking the Send button.

Sometimes, you won't see all of these types of payment methods, depending on which currencies are being exchanged.

A 1,000 GBP to EUR transfer gives you the following options:

- Low-cost transfer – 3.95 GBP fee.

- Fast and easy transfer – 6.92 GBP fee.

- Advanced transfer – 3.95 GBP fee.

Overall, the offerings change based on your type of transfer. The good news is that Wise always tells you the options prior to sending, and most of the time they're far cheaper than PayPal or other gateways. The only option that looks too expensive is the credit card fee when transferring USD–and it's not the best idea to use credit cards for international payments anyway.

The Wise Debit Card

Linked to the borderless business account that we mentioned earlier, you can also apply for a Wise debit Mastercard.

The debit card is currently only available in some countries. You can see a list of the countries here.

Also, some of those countries only allow you to apply for the debit card if you're using a personal account. For example, I have a US account, so I could only get a debit card under by personal Wise account, not the business one. Apparently support for that is coming in the future.

How can the card be used?

For a start, the debit card is contactless and allows you to spend money anywhere in the world at the promised exchange rate. It's always free to pay with any of the currencies you hold within your account. If you wanted to convert to a different currency, Wise offers fantastic low conversion fees as well as zero transaction fees.

You can also make withdrawals at any ATM, but the maximum amount you can take out is very low. Once you surpasses the limit for that currency, you'll be charged a 2% fee. In general, we recommend knowing the debit card limit for your currency (outlined below) and avoiding ATMs as much as you can. You can use the debit card to complete most of your transactions and skip the cash.

Who should consider the Wise debit card?

We like it for ecommerce businesses that have people who travel to other countries. You could also use it for purchasing from suppliers in other currencies.

You could very well utilize it like a regular debit card in your home country, but it's more useful when traveling, like as a person studying abroad in Europe or a business person who travels to other countries and doesn't want to worry about international fees.

We recommend checking out the debit card fees and limits for your own country, as they change based on your location and use of the card.

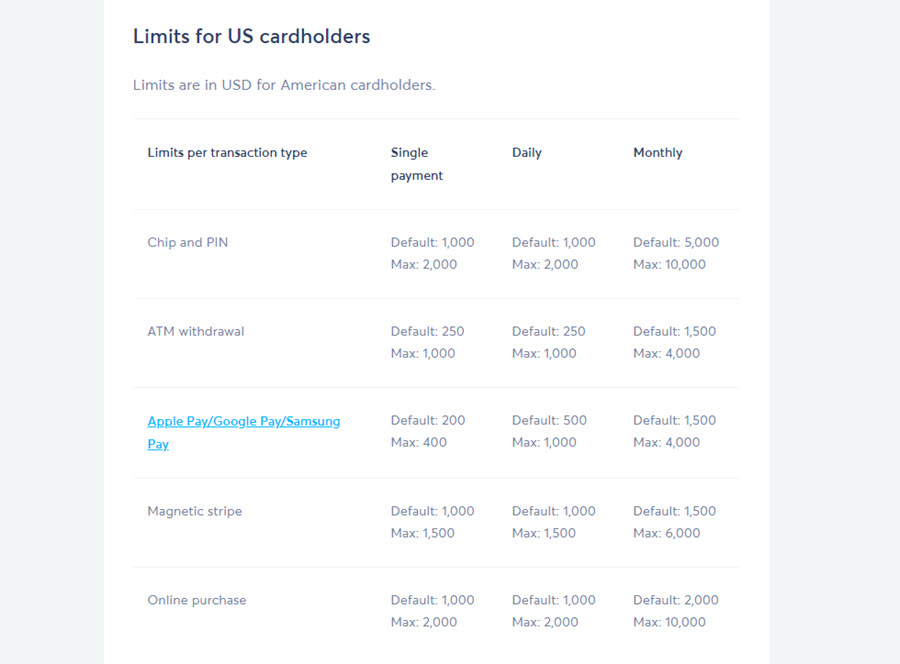

A few examples and highlights include the following:

- ATM withdrawals are free until you hit a low limit. Here are some monthly limits: 200 GBP (United Kingdom,) 350 SGD (Singapore,) 350 AUD (Australia,) and 250 USD (USA). That's not much, but it may serve those who are in a pinch while abroad.

- Maximum daily limits for using the card's chip and PIN to pay in person: 2,000 USD, 17,500 AUD, NZD (New Zealand,) and SGD, and 10,000 EUR and GBP.

- Maximum monthly limits for using the chip and PIN to pay in person: 10,000 USD, 52,500 AUD, NZD, and SGD, and 30,000 EUR and GBP.

There are other limits when going contactless, using the magnetic stripe, and going with an online purchase. Overall, all of those methods tend to remain similar to the limits for the chip and PIN usage.

Besides the extremely low ATM withdrawal limits, the debit card is useful for spending online and making in-person payments in many currencies.

Our only warning from this Wise, review is to either never use the Wise debit card at an ATM or at least know the limits so you don't end up going over.

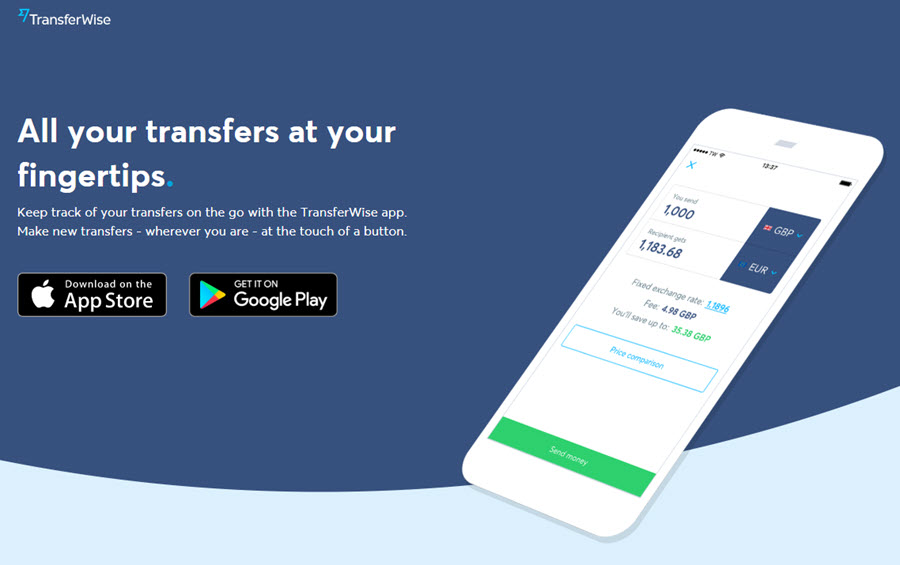

The Wise Mobile App

Wise also offers a mobile app so you can make transfers while on the go. To speed up the process of payments, you can also look at previous payments and repeat them with the touch of a button. This is perfect if you have recurring monthly payments to make. They have recently added Apple Pay to transfer funds.

The app is easy to use for business and personal exchanges. I can see all of my past transfers and payments, send out money to all of my contacts, and convert money between the accounts I hold in Wise.

Another reason we like the app so much is that it sends you notifications about your payments. Is your contractor asking about when their payment is going to land in their account? All you have to do is go to the app to check the status.

Are you confused about why it's taking so long to receive a payment from a client or customer? Check the app. It's similar to checking on the status of a package from UPS or FedEx. Wise tells you exactly where the money is, whether it's being converted on their end or if it's being sent to the bank account.

They also tell you an estimated date in which the money should arrive, all in the mobile app. During our Wise review, we realized that the mobile app provides a quick button for freezing and unfreezing your debit card.

Everyone who travels has stories about items getting lost or stolen. The last thing you want is another person trying to use your debit card while you're abroad. Once you can't find the card, go to the app and block it from being used.

Wise Security

To learn more about all aspects of Wise security, go to this page.

It's worth noting at this point that Wise is not a bank.

However, it is authorized and securely regulated by the Financial Conduct Authority (FCA) in the UK just as any other bank would be.

Under regulations enforced by the FCA, Wise has to hold all the funds from their customers separately to the money that they use to run their company.

Therefore you can be confident that in the very unlikely event that Wise folds (which isn't likely with over 6 million customers and growing) your funds are secure and will be paid back from the separate account.

A few other Wise security measures include:

- DDoS protection from Cloudflare.

- Regular updates and patches to the software.

- Tightly secured servers with audit logs to see who accesses the servers.

- Hardened servers with restrictive firewalls.

- Wise is SOC 1 type 2 and SOC 2 type 2 certified and GDPR compliant.

- Several user-based security offerings are available, such as phishing tracking, two-step login authentication, and recommendations for making strong passwords and storing those passwords.

Customer Support

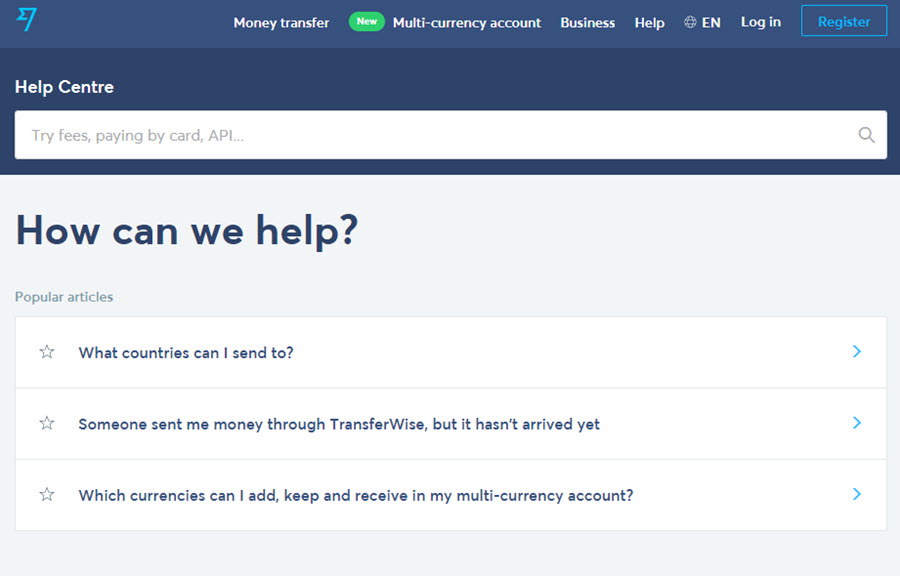

The FAQs online are well-organized with sections for transfers to and from any currency Wise works with. You can also get information about the mid-market rate, which not all providers explain. If you need to ask a question, you can start a live chat with a customer service representative.

The Wise Help Center provides a field for typing in a keyword and locating a knowledgebase article to walk you through the solutions. As for direct support modules, the easiest is the online chat, which I've used with excellent response rates.

You can also contact the customer support team through email, phone, and social media. The only limitation I've encountered is that you usually won't get a response outside of regular business hours.

Other than that, Wise customer support is helpful and friendly.

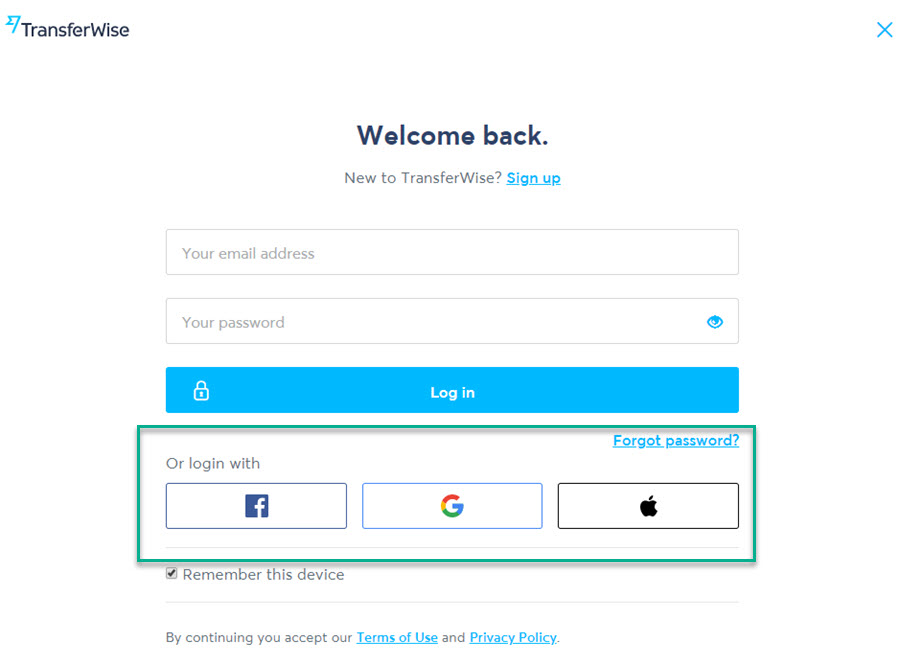

Signing Up With Wise

Start by going to Wise. To make the initial signing up process smooth Wise will give you the option to do so via your Google, Apple, or Facebook account.

Before you begin sending and receiving money, there is a strict process to verify your identity in order to comply with anti-money laundering regulations. You will need to provide any of the following two documents:

- Identification Document – Passport, National ID card, Photo Driver's Licence.

- Proof of address – A utility bill (phone, electricity, gas), credit card statement, tax bill, vehicle registration.

It's worth noting that a mobile phone bill is not acceptable. The requirements also vary based on your location. For example, a local Russian passport doesn't qualify as a valid form of ID. Your best bet is to walk through the signup process to see what is required for your own situation.

TranferWise Review: The Pros

- Wise Fees – Compared to the fees you would pay if transferring via a bank account or PayPal, Wise blows it out of the water. From the example above, a transfer of £1,500 to Euros had a fee of just 0.402% compared to fees of up to 10% with the alternatives.

- Transparency – There are transparent fees with Wise, and the company is built on this ethos. Their handy widget spells this out for you as well. The only additional fees are for debit and credit cards and all this information is listed on their help section.

- Speed – The speed of the transfer is a big plus point of Wise. Speeds range from 24 hours to a full week, but that's no different than a regular wire transfer or when sending through PayPal.

- Rate locking – Wise realizes that it isn't your job to keep up with market exchange rate predictions and this can be very time-consuming. From the minute your payment is locked in they will lock it for a period of time to avoid huge fluctuations.

- Wise Security – Wise adheres to regulations by the FCA so all your funds are held in a separate borderless account. Our Wise review unveiled that your money is safe if anything were to happen to Wise.

- Business Account – The ability to send, receive, and spend money in over 40+ currencies is a fantastic advantage for international businesses. You can set up local business accounts in minutes without even having an address in these countries.

- With Wise, you have control to get the best exchange rates – When you send money internationally, you can choose the point at which Wise calculates your exchange rate; either on the day you activate the transfer or when the transfer becomes effective. This increases the likelihood of getting a better deal.

- User Friendliness – Wise's interface is straightforward and easy to use.

- Various payment methods are available – For your convenience, Wise accepts a variety of payment methods.

- Wise doesn't demand a minimum transfer amount – Feel free to send $1 if that's what you want.

- Wise's registration process is clear and easy to understand – Have you ever tried to find all of the terms and conditions and fees on the PayPal website? It's a mess. With Wise, everything is spelled out right on the homepage.

- There's a high daily transfer limit – You can send up to $49,999 each day using Wise (or $199,999).

- Batch payment tool (for business accounts) – This Wise tool allows you to make numerous transactions with just one file upload. All you have to do is fund the transfers, and you're good to go!

- High levels of client satisfaction – Google “Wise review” to find that most customers like it quite a bit.

- Track your transfers every step of the way via your Wise account – This can be done through the mobile app or through your desktop browser.

Wise Review: The Cons

- High Volumes – For large transfers, Wise's fees would definitely be beaten by bigger corporations such as Moneycorp.

- Sign up – Having to show two documents can be a laborious process and it is quite slow. The fact that a mobile phone bill can't be used has been listed as a complaint among users.

- US Mastercard – A Mastercard is still not available for North American companies. However, it is in its beta stage and will be available eventually. Having said that, you can get the debit card under a personal account in the US.

- Bank account transfers only – There's no option for either a cash or cheque pickup. Instead, with Wise you can only send money to a recipient’s bank account.

- Requires a Social Security number – You’ll need to provide a SSN to send money via Wise (which not everyone is comfortable with).

- Cannot pay recipients via check – As Wise uses a percentage system to calculate transfer fees, the more you transfer, the more money you pay them. Over time, you may find the fixed-rate pricing model is more cost-effective for you- especially if you're frequently sending large sums of money.

- Limited reach – If you're a business with clients and customers scattered across the globe, Wise might limit your reach. Over 60 countries and 100s of currencies are supported, but there are limitations in some areas.

- There's a chance Wise will deactivate your account – When you hit a specific transfer threshold, Wise will ask for additional documents and ID. If you're unable or unwilling to meet these demands, there's a chance they'll pause your account.

How Does Wise Compare?

Here's how Wise fairs against a few of its competitors:

PayPal vs Wise

In short, it's cheaper to transfer funds with Wise rather than PayPal (read our full PayPal review). Namely because unlike PayPal, Wise doesn't make money on exchange rates. Plus, the percentage charge on the overall transfer is minimal. Let's take invoicing on PayPal as an example. If I invoiced a client from the UK or Europe (and I'm in the US,) Paypal would take at least 6% of that transaction. Wise is usually closer to .05%.

Despite all that, PayPal is far more popular. As such, clients and customers may feel more comfortable using this company–especially when it comes to handling larger sums of hard-earned cash.

2Checkout vs. Wise

2Checkout beats Wise when it comes to the number of countries they operate in. Wise only supports a little over 60 countries whereas 2Checkout (read our full 2Checkout review) works in over 200 countries.

However, like PayPal, 2Checkout also charges high transfer fees. For example, if you want to transfer money within the US, you'll have to pay 2.9% of the total sum of money plus an additional $0.30.

You should also note, the price of making an international payment goes up significantly (which is where Wise comes into its own). Not only do 2Checkout users have to pay a 1% cross border fee, but they also have to shell out for currency conversion. This can be as much as an additional 2-5%!

Conclusion

Wise is a fantastic platform for sending money internationally. It's created by two people who experienced the same issues themselves and have built a tool from their own frustrations.

A streamlined onboarding process, low fees and great transparency ensure it's only going to go from strength to strength. Backed by huge investors and with FCA security, you know that your funds will be safe.

Although primarily a company for European, US, Singapore, and Australian users, Wise has been expanding its market to various other parts of the world. What's great is that most major currencies are supported in some way.

If you have any questions about our Wise review, let us know in the comments below.

I just made a reply to Carl Barta…and realised…that there are custom thingies too…

Like …if you do not know a person so well…or the the way of the land and its inhabitants…

Money thingies can be an issue too!

You need to keep your withs of course…not to get over excited…but also know the rules and laws and ways of other countries….

Wise and other things like this make it look like an easy thing…but I can also imagine…it has a lot of side thingies…

I just hope my transfer goes well 🙂 and in an Brazilian way :).

Fingers and toes crossed of course 😀

👍👍👍

One serious problem I have with Wise is that in order to get the advantage of the truly low fees you have to use ACH you have to give them your bank account log in credentials, at least in the U.S.. Only a borderline insane person would do that, since it is a violation of the terms of use for electronic banking with U.S. banks and effectively voids any liability of the bank for any future electronic fraud and losses on your account.

Hello Carl, the process is automatic and extremely secure: https://wise.com/help/articles/2932710/paying-by-bank-debit-ach-in-the-us

actually I totally agree…there is no guarantee with all hackings and money steeling people now a days! This site is a try-based on trust (and the word trust ment like all the meanings it can have and is used here on this planet) thingy and…I hope (after my first try today) it works as fine as it is said.

On other sites with reviews there are a lot of complaints too. Like the service when having problems with transfers and blocking an account … it would be wise to be transparant in that issue too. Now I really find it not cool to say ‘borderline insane person’ …its really not a nice thing to say…people with borderline are functional people as well…only with a bit more bagage. But never the less I quite understand this statement and I guess it does not only apply for only the U.S., but for every bank in every part of the world…

So…I do hope this will work out just fine…if not…I’ll let you lot know :).

Thanks so much for this review! I used TransferWise when in need over a year ago and I’m not considering to use it much more heavily. If you’re a freelancer planning to pay and receive invoices with Wise, is it mandatory that you have a Business account or can you keep your default (personal) one? Thanks!

Hello PM, in most cases the personal account will suffice.

Hi, thanks so much for the really helpful & detailed review! I’m wondering if the Transferwise Borderless Business account can be linked to payment merchants such as Worldpay, Stripe etc so that once you take a payment on a website through the merchant, the merchant deposits the money into your Transferwise account, as it would with a traditional bank account which would then convert the currency and charge you for doing so. Thanks again 🙂