Payment processing is probably the most intimidating element of the whole “selling online” puzzle when you're just getting started. And that's perfectly understandable.

After all, this is the part of the job – as you're launching a new online store – where you start dealing with your customers' financial info, such as credit card numbers, sensitive personal data, and etc. And as an eCommerce store owner, it's your full responsibility to make sure that your customers' data is kept safe above all else.

Luckily, payment processing isn't that difficult to figure out once you start looking into it. For the most part, the difficult heavy lifting is handled by other companies so that you can focus on the core of your business. But we'll get to that…

✨ In this guide, we go step by step through the basics of payment processing and also explain the difference between a payment processor, a payment gateway, and a merchant account.

In a hurry? Here's a summary of the key differences between payment processors, payment gateways, and merchant accounts:

- Payment gateway – connects your eCommerce store to the payment processor; sends a transaction request to the payment processor

- Payment processor – processes the request from the gateway and executes it – takes the money from the customer and deposits it in your merchant account or an account managed by a third-party

- Merchant account – this is where the funds get deposited after a successful transaction; merchant accounts are optional, you don't need to have one as an eCommerce business

Table of contents:

👉 When does payment processing come into play?

👉 How all three work together

👉 What's a payment gateway?

👉 What's a payment processor?

👉 What's a merchant account?

👉 Summary

When does payment processing come into play?

The core items you'll need to get as an eCommerce professional include the following:

- 📛 A domain name (such as

xyzbusiness.com) - 🏗️ A quality eCommerce website platform (like Shopify or BigCommerce)

- 💻 Quality (not just the cheapest) web hosting (hosting is included with platforms like Shopify, but not with systems like WordPress/WooCommerce)

- 💳 A way to accept payments from customers – aka. payment processing

That last part is what we're going to discuss today.

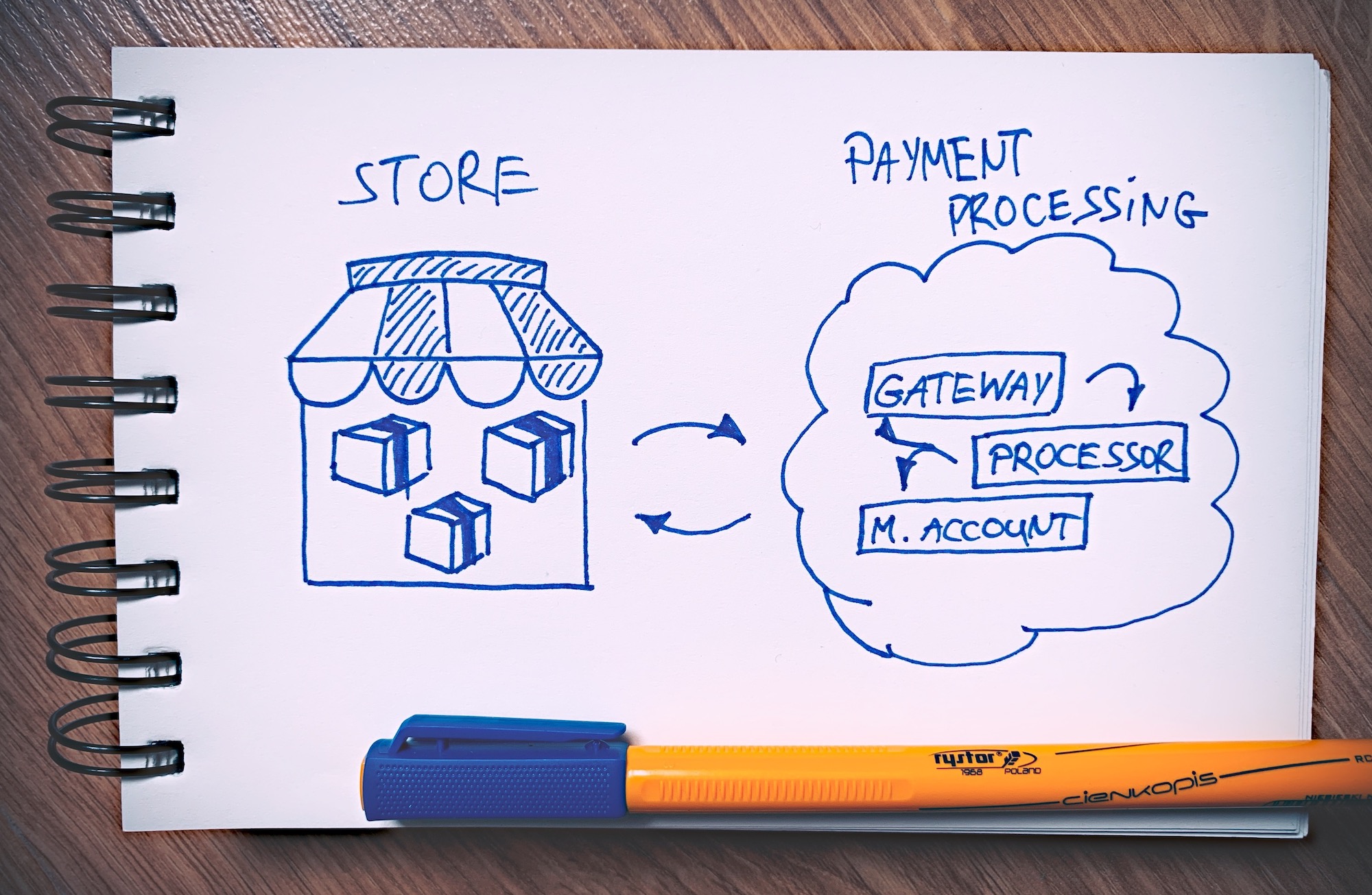

The first surprising thing about payment processing is that it works kind of independently of your eCommerce store. It's basically a whole separate thing/system that only gets activated when your customer is ready to pay.

Think of it this way:

In this model, the payment processing layer operates separately and only comes into play when needed.

When running a standard eCommerce store, you have your main store platform/system (like Shopify or WooCommerce) to take care of making your store website run – showcasing your products, letting customers browse them and place orders. Then, the actual processing of the payments usually takes place off site. Your store only connects to the payment processing mechanism and sends all the essential details to get it executed.

This is done this way for a couple of reasons. Firstly, it's a much more secure model. In it, it's the payment processing platform that needs to worry about the security issues and making sure that the transactions are kept safe. If it wasn't for this external payment processing, it would have to be you doing all this work.

The second reason is that various payment processing mechanisms, rules and regulations tend to change every once in a while, and it would be hard (if not impossible) to keep up with them if you did this yourself. Again, you have the payment processing platform doing this job.

Lastly, it's also a more trustworthy setup from the customer's point of view. For example, I'm sure you're going to be much more confident entering your credit card information via PayPal than on some random online store that you don't yet trust.

Now, with all things considered, the biggest advantage of this off-site setup with payment processing is that you – the store owner – simply don't have to worry about any of this credit-card stuff and can just leave it to the pros.

You can focus on doing business and actually generating sales, while someone else makes sure that all payments are processed correctly.

With that said, there are three main elements of a payment processing system. Yes, you've guessed it; they are:

- payment gateway

- payment processor

- merchant account

So what exactly is the difference between a payment gateway, payment processor and merchant account?

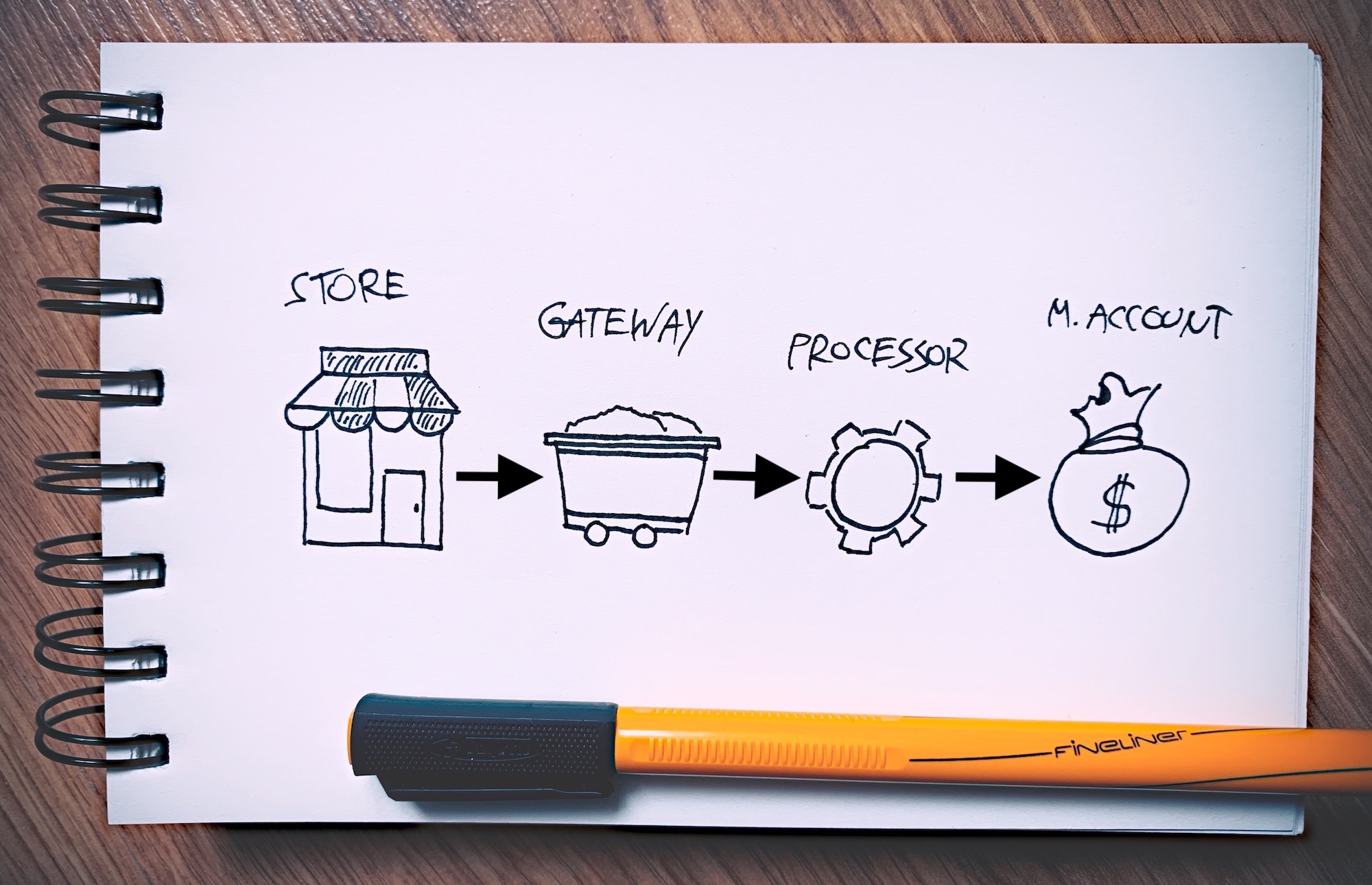

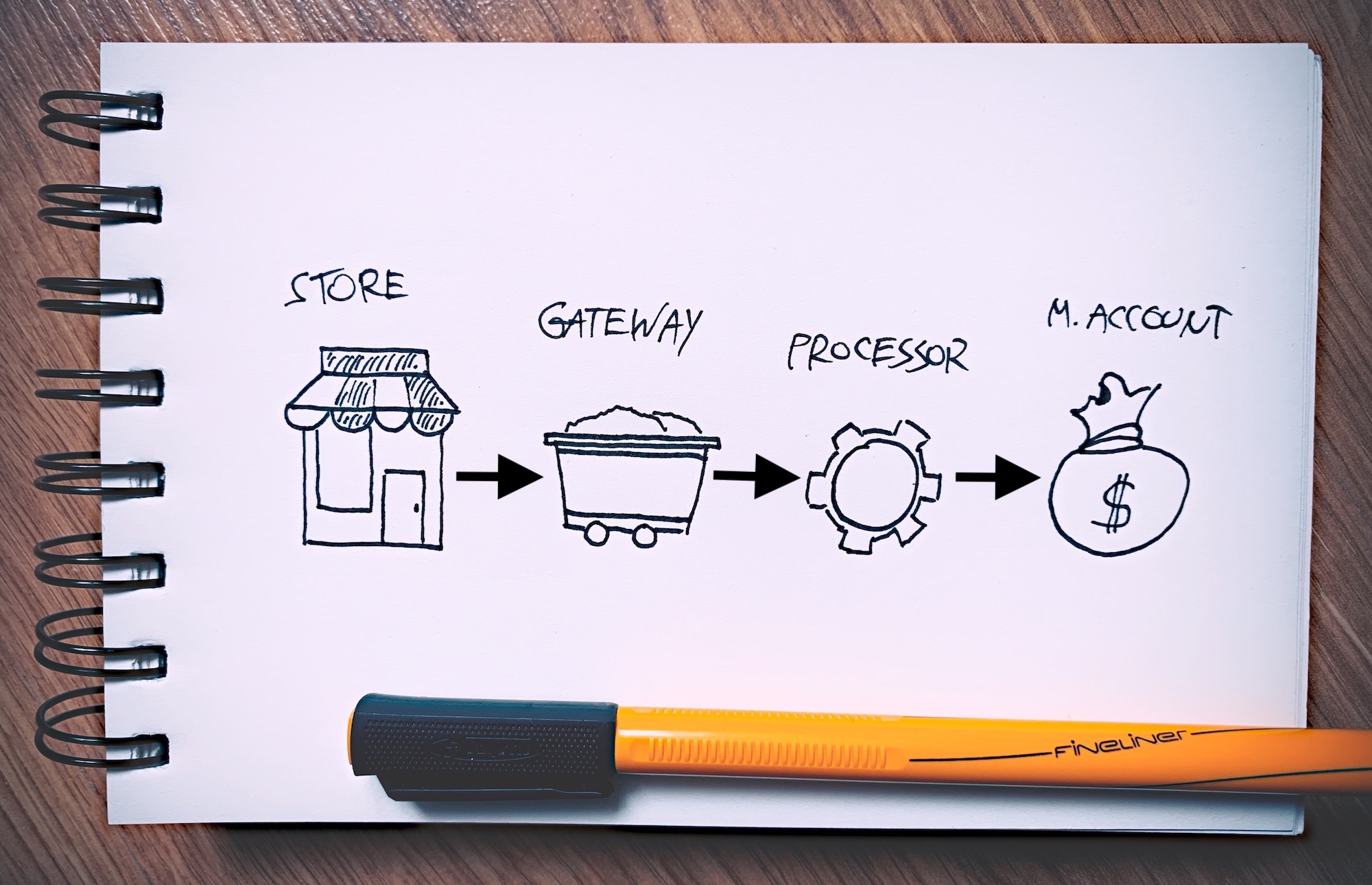

All three elements work together to transfer money from the customer to the merchant (you), but it helps to understand what each of them does throughout the process:

How all three work together

Here's how the magic happens when a customer places an order in your eCommerce store and then proceeds to pay for it:

Once the customer has picked a product and is ready to pay, each of the three elements handles its own unique task:

- The payment gateway takes care of sending the transaction request to the proper payment processor or credit card company issuer.

- The payment processor, as you would expect, processes the payment – making sure that it's submitted correctly, that the customer has funds at their disposal, and that all the payment details have been submitted correctly.

- The merchant account is where the funds get deposited when the processing ends successfully.

It essentially all goes from payment gateway → payment processor → merchant account.

While I'm at it, it's also good to keep in mind that in some setups, all three elements are hidden under one umbrella company. In other words, the store owner doesn't usually have to deal with three separate entities individually, but can instead work with a single company that acts as all three.

Now in a bit more detail:

🚪 What's a payment gateway?

A payment gateway is a middleman between your online store and the payment processor that receives the payment from your customer.

When a customer enters their payment details on your site (this can be their credit card number or any other method of payment), the payment gateway sends that data securely to the payment processor.

Here are some of the main benefits of using a payment gateway:

The cost of using payment gateways

Unfortunately, the cost is the most complicated aspect of using a payment gateway. Basically, there's no single price tag. Instead, you usually have to deal with a number of smaller fees connected to different parts of how the payment gateway functions.

Most commonly, there are three components of the final price tag:

- Set-up cost – varies from $0 – $250. If you haven't picked your eCommerce platform yet then look for ones that already have an integrated payment gateway, such as Shopify.

- Monthly cost – $10 – $50.

- Transaction fees – those are two-fold. Usually, it's $0.00 – $0.25 + 1% – 5% per each transaction. Just to make it clear, you have to pay both the fixed fee and the percentage of the transaction.

Most gateways offer discounts based on the volume of sales you're getting.

👉 We discuss the topic of payment gateways more in-depth in another post where we also list the top 5 payment gateways in the market. Check it out. Here's the shortlist in case you're curious:

Again, you can learn more about them and the prices of each in our in-depth resource.

⚙️ What's a payment processor?

Payment processors are the financial institutions that work in the background to provide all the payment processing services used by an online merchant. These companies usually have partnerships with other companies that directly deal with consumers or merchants.

The payment processor connects to both the merchant account and the payment gateway, quickly passing information back and forth, keeping it secure and almost instantaneous to the end user.

In simple terms, the payment processor takes the info about the transaction from the payment gateway, validates it, executes it, and then deposits the funds into the merchant account. It also notifies the payment gateway if the transaction was successful.

As we've touched on previously, choosing your payment processor isn't a decision that is solely down to the person who'll be in charge of the finance. A payment processor is vital for ensuring you have a good conversion rate, so it's a decision you don't want to take lightly.

A quick list of the top payment processors

There's an abundance of payment processors to choose from, but we've narrowed it down to just the very best:

1. Payline

Payline is particularly renowned for its honest sales practices and overall transparency. Well, it might not be the cheapest payment processor in the market, but you can bet that what it promises is what it ultimately delivers. Payline’s interchange pricing structure is, admittedly, way more transparent compared to the standard cost schedules offered by other solutions.

In essence, Payline gives you the benefit of knowing the payment fees and rates your business will incur ahead of time. Consequently, you’ll be able to plan your sales processes accordingly to minimize your transaction charges over the long haul.

That said, Payline is a holistic processor that goes beyond online payments to facilitate in-store payments, as well as mobile payments. Payline Connect is the ecommerce payment application, and it integrates with more than 175 shopping cart platforms. This allows it to securely process electronic and card payments on a wide range of online stores.

It’s also worth noting that Payline offers subscription billing capabilities for free. So, of course, you can leverage when it comes to recurrent charges for memberships, services, or products.

2. PayPal

Since its inception in 1998, PayPal has become the biggest player in the payment processing game. The company now operates in more than 200 countries/regions and supports ~25 different currencies.

PayPal can be directly integrated with your website, and because of its familiarity with customers all around the world, it's highly trusted. The flexibility of PayPal is truly great. You can process payments not only via your eCommerce store but also inside an app and even in your physical store.

- Read our full review of PayPal

- Discover the top 10 PayPal alternatives here

3. Stripe

Stripe describes itself as “developer-centric” and it's a very fitting term as Stripe's biggest advantage is how customizable it is. Stripe's API allows you, or your developer, to experiment and create an experience that fits your business perfectly.

Stripe is available in 20+ countries and lets you accept more than 135 different currencies! This means that you can charge your customers in their local currency while still receiving funds in yours.

Of course, Stripe lets you process both debit and credit card payments.

4. Square

Square is a fantastic option for a store looking to sell online as well as offline.

Square offers a range of devices you can set up in your physical store, from simple clip-on magstripe readers that you put on your phone, to contactless mats, terminals, stands, and even full registers.

Square is also incredibly intuitive and easy to understand for beginners. Its point of sale system (which is free) is the real added benefit. Advanced features such as digital receipts with integrated feedback forms, card splitting costs, as well as inventory management for tracking stock are all free.

👉 If you want to learn more about what payment processors are, here's our in-depth definition.

Their software compares payment options from more than 70 payment providers to find the solution with the most favorable terms and features for you. In fact, they promise an average fee reduction of 40%.

With AI technology, Swipesum detects when a business is overcharged for its credit card processing by looking at its processor relationships, contract negotiations, and pricing structure. Then, using a reading software that can verify interchange fees and pricing, they look at ways to optimize your payments.

You can book a free consultation with SwipeSum to take you through the best payment processing solutions for your company, pricing negotiation, and hands-on implementation.

Their consultants can also provide insights into your merchant account. By analyzing your merchant statements, Swipesum can provide cost-comparison proposals that give you an insight into whether you’re getting the best deal for your account. The price for this service is $25 per analysis.

For more in-depth consultations or larger enterprises, they have consultancy services starting at $50 an hour. Not only does Swipesum advise on the best payment options for this price, but they also offer educational services so that you know how to look for the best deals in the future.

But wait, there's more!

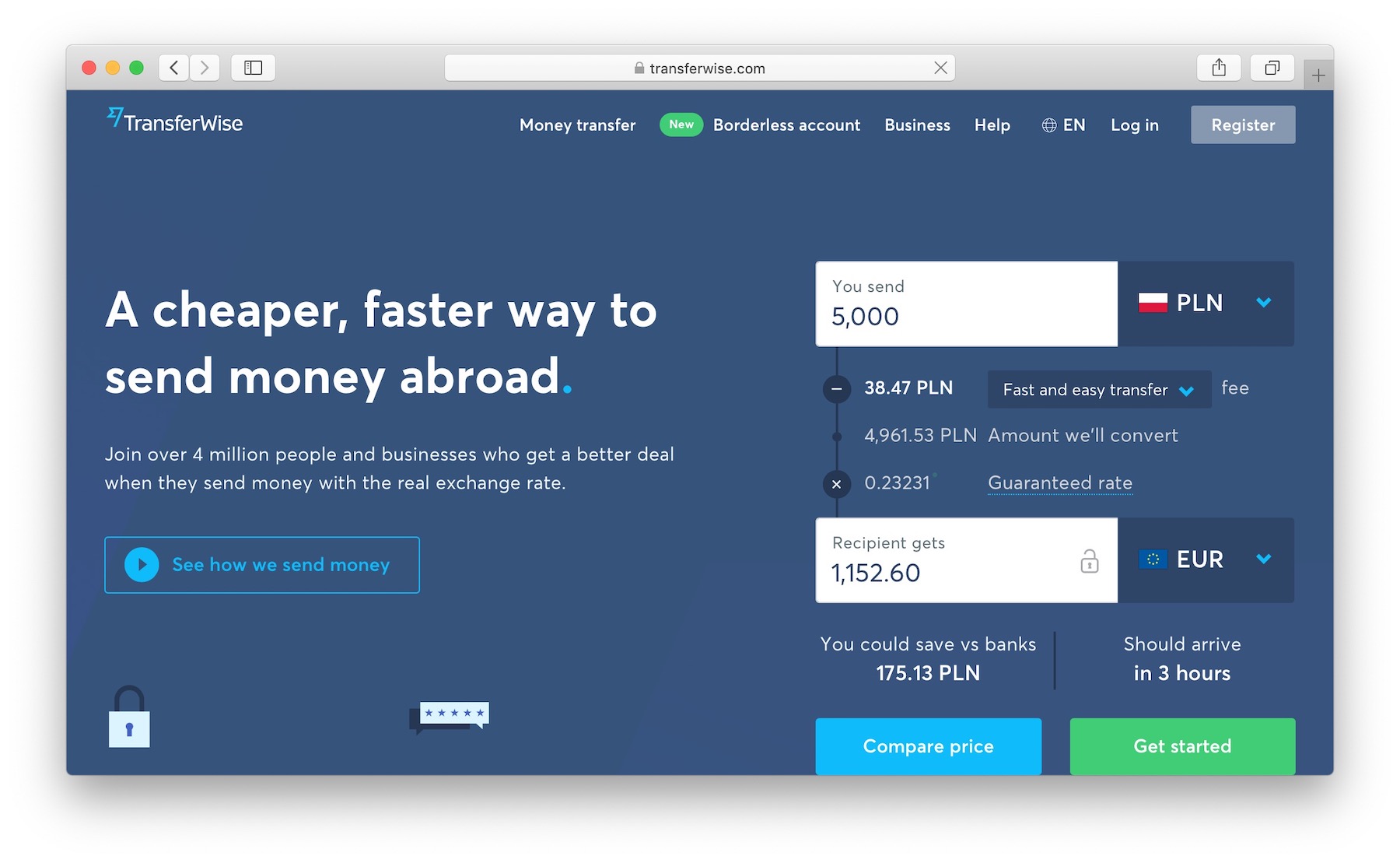

Even though it's not a payment processor per se, we also recommend getting on board with TransferWise if you're going to be dealing with any payment processor and especially if you want to accept payments in multiple currencies.

In such a scenario (accepting multiple currencies), you're usually going to lose a sizable amount of money to different conversion fees when you try to withdraw funds. This is where TransferWise comes into play.

TransferWise provides you with local bank details for the UK, the Eurozone, Australia, and the US. And you don't need a local address (which is usually a serious challenge if you want to obtain those accounts on your own).

This setup means that you can request payments like a local no matter where you are. Then, you can withdraw money with low fees, thus minimizing your currency conversion costs.

- Read our TransferWise review.

💰 What's a merchant account?

A merchant account is a special type of bank account. This account allows your business to accept payments by credit and debit cards that come from a payment processor.

It's worth noting that merchant accounts are often called MIDs (or merchant IDs).

When a transaction clears at the payment processor level, the funds then can be deposited into the merchant account. From there, they can be moved to the main bank account of your business.

The difficulty with merchant accounts is that it's not always easy to get approved for one with your bank. There's a lot of paperwork involved, and the requirements change massively from region to region.

There are a variety of firms, financial institutions, and banks that offer merchant accounts. However, which ones are going to be available to you depends chiefly on your location and country. Research your local market before deciding on a merchant account if you really need one – as I said, in many cases, you don't – you can have your payment processor handle all the work.

Yes, many payment processing and payment gateway companies provide merchant accounts as well. The only downside here is that there will be additional fees involved when you try to withdraw your funds from the processor to your normal business account. Speaking of which:

Merchant account alternatives

As I said, you don't need to have a merchant account in order to operate your online store effectively. In fact, you can collect payments from your customers and then get them deposited to your normal business bank account without a merchant account in between. To do that, you have to sign up with a payment processor that offers this kind of services.

The most popular options in the market are:

As you can see, these are the “usual suspects” all over again. These companies do offer the whole package – everything from a payment gateway, to payment processor, to full payment processing system. By picking either of them, you basically get all of your store's payment processing needs taken care of.

👉 If you want to learn more about what merchant accounts are, here's our in-depth definition.

Merchant accounts, payment processors and payment gateways summarized

Earlier on, I showed you a simplified model of how payment gateways, payment processors and merchant accounts work together. This one:

But now that we've explained the difference between each element in detail, we can flesh out their roles a bit more. I'm going to walk you through a standard transaction in a hypothetical eCommerce store:

Any questions on payment processing?

Understanding the basic details of how payment processing works is essential if you want to run an effective eCommerce store.

The exact differences between payment processors, payment gateways and merchant accounts are not that clear at first. However, the visuals and the outlines above should give you a decent idea as to how the whole process works.

If you're still confused or would like to express your opinion on the matter, let us know in the comments section below.

Great article! Such a clear and straightforward explanation of what is usually made to look so complicated. Thank you 🙂

Thanks Sandra! 👍👍👍

Hi, thanks for so valuable information. I´m residing in Guyana (south-america). I´m planning to open an e-commerce store. Banks here don´t offer the payment procesor possibility so I need an alternative. Paypal is also off because of the money laundering restrictions. Would you have a special recommendation for me? Thanks.

Hey Osmany, isn’t there a local payment processor available?

Great article! Well written, and very clear. About the payment processor, in traditional e-commerce model , why is the article not talking about Visa or MasterCard? Are they not example of payment processors that are used in e-commerce transaction? Also, there are models when the merchant uses e-commerce but doesn’t have a website. Payment is made via SMS or URL. In future iterations of the article would be good to elaborate more about this model ….thanks

Thanks fo the suggestions Samy!

I have a software platform in which multiple service providers will get subscribed. My company have a merchant account and paypal account by linking that. In the software plattform when a user pays the amount will be credited to our merchant account through paypal. We need to transfer the amount credited in merchant account to service provider’s business account. Please guide me whether it is possible or all service providers have to take paypal account?

I read previously an article said that the payment processor is the card companies like visa, master card etc or thats the way i got it.I got confused by the three parts of the payment processo tha mensioned above and there fuctions. What these companies(visa, master, amex etc) called and what they actuly do?

Thanks for the helpful article. I am confused about where credit card data gets stored. The payment processor takes it from my website to start the transaction, but am I also storing it on my site? And how does this work in the case of a subscription-based product, where we want to charge the same credit card periodically if the customer has opted in to that arrangement? Are we submitting the credit card info we’ve stored? I guess I thought a payment gateway would take the credit card data out of our hands entirely so we don’t have to be responsible for keeping it safe, but now I’m not sure that’s the case.

Am I right that for online transactions both a payment gateway and payment processor is needed, while physical Point-of-sale transactions with card only require payment processors? Second question: gateways and processors can be a single company/service provider? Or is the payment processor always a separate provider?

Hey there, I was wondering if they (payment processors) can actually see the details inside the transaction? (like what kinds of products we sell, categories, etc.?

Hey Eric, they won’t have access to the data.

Hi, great article!! Whats the difference between “direct processing services” and gateway services”. We use all three – we have a gateway, a processor and a merchant account. We are working toward going to “Level III credit card processing” Which requires sending more data and different types of data to the payment processor {I think}

PCI compliance is very important ot us because we take credit card numbers for orders over rphone. Can we use “direct proxessing services” with telephone credit card orders ( where a customer provides the credit card number over the phone ).

Thank you again for such a great easy to read article, Barbara Lewis

Hi,

Thanks for explanation. I got 70 % of it. However, it is always easier to follow new stuff if you also could include examples in the different categories. Then I would have got 90-100 %. Because if I want to get a overview of the different players and where they are in the cycle, it would be easier 🙂

Thanks!

Hello Andrea,

Thank you for your suggestion!

–

Bogdan – Editor at ecommerce-platforms.com

Thanks for the easiest way of explanation, however i am still little confused about Payment gateway , payment processor. Like its said that payment gateway carries the information and passes it on to the card network (Scheme) then where does the payment processor comes into picture. Please explain.

Hello Janet,

There are two stages to payment processing: the authorization (done by the processor) and the settlement, transmitting data between your bank and the customer’s bank (done by the gateway).

–

Bogdan – Editor at Ecommerce-Platforms.

Best explanation I have seen so far. Kudos!

its better explanation than others on google 🙂

What I can’t understand is why there seems to be no company except PayPal that offers everything. I set out looking for an alternative to PP and found Stripe, signed up, etc… then discovered I can’t use it unless I have a developer. I don’t. I just want to add some pay options for clients but I can’t believe I can’t find sources for “all in one, do-everything-just-like-PP” solutions so I don’t have to piece together, price-out, 90 billion different options. Maybe my computer is being blocked of all such results — b/c it must exist. There have to be loads of small-time freelance/sole proprietor types who do NOT SELL PRODUCTS but rather services like writing or editing or consulting or something who would want this. Sign up. Embed some code into your website. Done. A list of alllllll companies and their fees. Done. Easy. Nope, doesn’t seem to exist.

Hi, I am wondering which ones do you recommend for a software cloud based app. Thank you!

It’s certainly a confusing area with a lot of terminology that isn’t always used consistently. One thing perhaps worth adding is that smaller merchants wanting to keep things simple and avoid monthly fixed fees have tended to be best off using an all-in-one payment services provider such as Stripe or PayPal Pro which doesn’t need a separate merchant account. Larger merchants, however, tend to be able to save money by getting their own merchant account.

Good call, thanks for clarifying Matt!