Skrill has an interesting history. I've had some merchants ask me whether or not it's a scam. Let's be clear–I can be certain it's a legitimate payment processor. However, it does have some problems with transparency–especially in the United States.

And you're going to find that the fees are often less than desirable. However, this is often because Skrill does take on risk by supporting merchants that aren't supported by PayPal and other more popular processors. So, in this Skrill review, we'll learn about this interesting company and whether or not you should consider it at all.

Skrill Review: Who is it For?

Skrill used to primarily be used for storing and transferring online gambling winnings. The company was initially called Moneybookers, and although gambling is still supported on Skrill, it's evolved to include several other products and services.

For instance, a mobile wallet is provided by Skrill, and you also have the option to sign-up for ecommerce merchant services, also known as payment processing.

The main advantage of considering Skrill is how easy it is to send, accept, and store payments to a wide range of countries. Skrill seems to be driven by international transactions, and that's why sometimes a business in a more “risky” country may have no choice but to go with Skrill.

So, the advantages are that Skrill takes on more risk than other payment processors such as PayPal. It's known for excellent security measures to make up the risk being taken on.

Another thing to consider is that Skrill has been known to allow payments for more risky industries. This includes gambling, adult services, and firearms. It's not a guarantee, but several user reviews note that you'll have a much easier time partnering with Skrill than PayPal if selling something like that.

But, this type of risk comes with a price. The services and products are pretty much the same compared to the competition, so you're not getting anything extra. Yet, the pricing and fees aren't competitive, and I tend to assume this has something to do with the risk being taken on by Skrill.

So, if you're running a business in a country or industry that isn't supported by PayPal (read our full PayPal review), Skrill starts to look more appealing. But it doesn't make much sense for companies in the US or most regular European countries.

Skrill Review: Fees and Other Expenses

You'll quickly find that the fees and expenses are yet another reason US companies should typically avoid Skrill. To start, the website doesn't show any information about merchant fees or rates. None at all.

You have to contact the sales team, which to me shows that Skrill isn't being transparent for a reason.

In addition to that, Skrill has a currency conversion fee of 3.99%.

This means that if I accept a payment in another currency outside my country, and would like to have it converted to my own currency, I then get charged 3.99%.

When running a business in some countries you'll have to simply eat this cost. Skrill provides a debit card that can be used to store your funds, but it's only available for those in the European Economic Area. So, once again, US merchants don't have that small bonus.

But now that we've covered how US businesses shouldn't consider Skrill, let's look at the rates and fees for European businesses–since those are the only rates I was able to find.

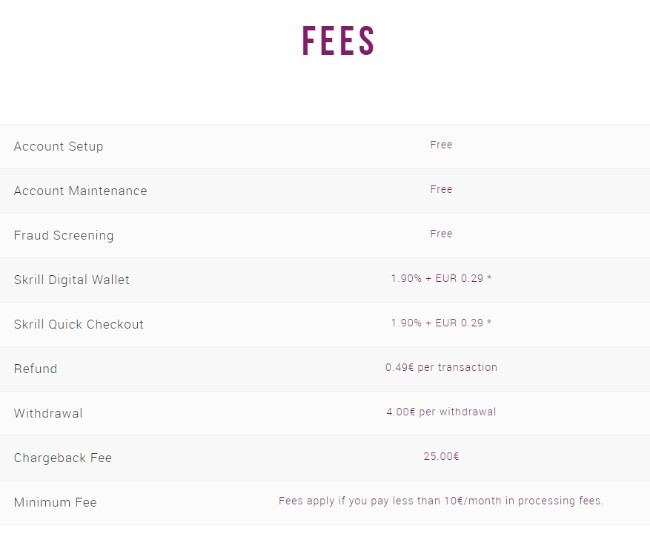

- Chargeback fees are €25.

- Transactions with the digital wallet are 1.9% + €0.29.

- Quick checkouts on an ecommerce store are also 1.9% + €0.29.

The conversion rates obviously matter, but as of right now you're not saving money compared to PayPal in the US dollar.

The good news is that Skrill doesn't charge any money for fraud protection, account maintenance, and account configuration.

There don't seem to be any monthly fees associated with a Skrill account, but the website does have some vague statements about how each merchant is different (so the fees could change). But, in general, you should only have to pay the transaction-based fees as you go along with your business.

But…

And this is a big but. Skrill doesn't disclose on its website that some type of fee is charged if your online store generates less than €10 per month in transactional fees.

Based on some of the competition, this fee could be extremely high. Therefore, it's disappointing to see yet another example of Skrill not being transparent with merchants.

A Few More Fees

If you've ever used PayPal to send money to your bank, you know that it's free, regardless of being a consumer or merchant. In fact, many processors stick to this model. They charge for processing but let you send money to your bank without a charge.

Skrill, on the other hand, has a fee of €4 for when you'd like to move money from your Skrill wallet to a bank. This is a little ridiculous, unless, once again, you're not able to use PayPal because of your country, currency, or industry.

Finally, merchant refunds have a fee attached to them as well. Compared to other processors, this is another example of how Skrill's fees are a little out of control. Most of the time a processor sends back the money and transaction fee so you're not stuck eating all of those costs.

However, Skrill tags on a €0.49 fee for every refund that comes back to you. So, you better hope that your customers aren't returning many products.

Skrill Review: Products and Services

As we've mentioned a few times in this article, Skrill's basic functionality is rather similar to that of PayPal. It works as an online wallet and a merchant payment processor. So, a regular person could send or receive money from a friend, or you have the option to accept or receive payments for your business.

However, there's a fee to send money to a friend. As of right now, that fee is 1.9% of the money sent, and it caps out at $20.

Many gamblers and consumers of more risky products and services have become used to these fees, but regular consumers would scoff at anything more than the 0% fee to send a payment to a friend with PayPal.

However, we're not all that concerned with the consumer fees, since this is a blog about the best ecommerce platforms and payment processors.

Unfortunately, Skrill strikes again with its lack of information online, at least in terms of its merchant services.

But here's what we could dig up for you:

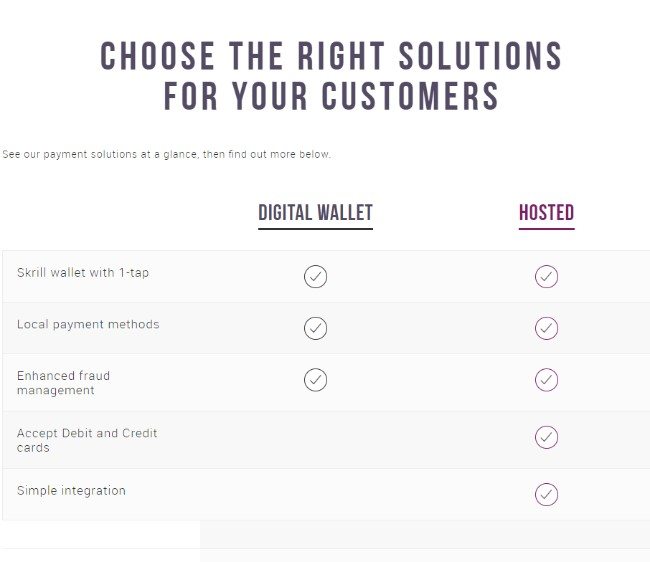

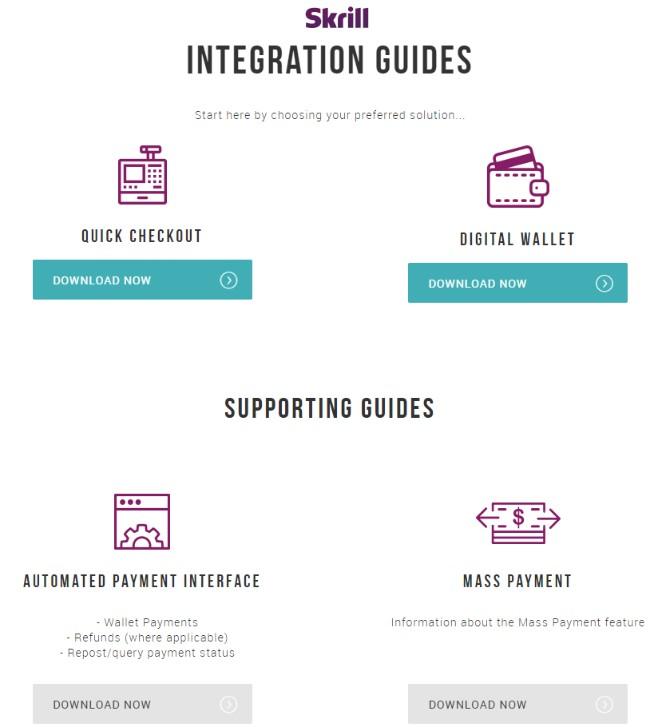

Two types of merchant services are offered–what they call hosted payments and wallet payments.

The wallet payments are like the “lite version” of hosted. The service essentially says that merchants can accept payments from any customers with the wallet, as long as that customer is using the Skrill wallet as well.

The hosted payments, on the other hand, are either embedded on your ecommerce site or processed through a Skrill checkout page. It's not that hard to embed Skrill on your site, so I would assume that you would opt for this instead of having customers redirected to an external page.

What else can you expect from Skrill?

- Support for some interesting payment methods – 20 local payment methods are supported, along with 80 direct bank connections.

- A one-click checkout option – Similar to what you'd find while shopping on Amazon, Skrill wallet users are able to click on one button and complete a purchase on your store. This feature isn't that unique, but it's included.

- Support for recurring payments – Once again, it's nice to see this feature included with Skrill, but it doesn't stand out compared to any of the competition. However, the combination of recurring payments and the one-click checkout make lots of sense for those gambling sites.

- Sending out payments to lots of people – This allows you to choose a large group of people and send payments to all of them at once. It might come in handy if you're working with several manufacturers or suppliers.

- Small transactions for apps – If you're managing a gaming website you might also have an app for that game. I guess this could also work for an ecommerce store with its own app. Basically, Skrill lets customers send you micropayments inside of a smartphone app.

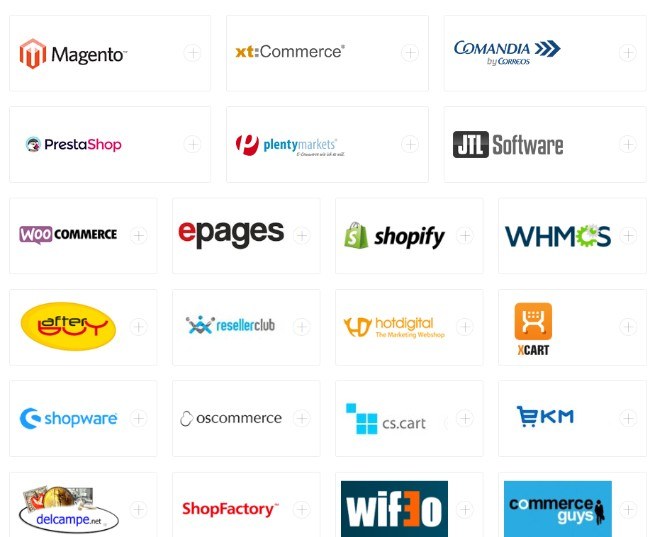

- Integrations with many ecommerce platforms – Many competitors have this as well, but you should know that Skrill has apps and support for platforms like Shopify, Magento, WooCommerce, and many more.

Skrill Review: How's the Customer Support?

The quality of customer support for a payment processor is usually determined by the resources on its website and what past customers have said. However, I tend to not put as much weight on user reviews since I find reviews are seldom written when people are in good moods.

That said, the reviews are fairly mixed, so I'll talk mainly about the online resources.

A help center is provided, but the articles aren't that detailed or plentiful. There's an email address for you to contact, which is most likely your best route. US merchants have no phone support, yet European merchants do.

A Final Word

With limited information about the features and fees online, it's no wonder Skrill does have its fair share of disgruntled customers. It's clear that US merchants should avoid Skrill, but Europeans might find it more useful with the dedicated customer support and debit card offering. I still think the only reason you would go with Skrill is if you're gambling, gaming, or maybe making some risky investments. The same might be said for companies in “risky” countries for PayPal to get into.

Other than that, there's no reason to put up with the high fees.

If you have any questions about this Skrill review, let us know in the comments.

Hi,

Does skrill accept sale of CBD products/ tinctures, lotions, etc

I do not have a legal entity, since I am a Swiss citizen and in our country it is not necessary to have a legal entity for an online store with a turnover of up to 100,000 francs per year.

Can I connect Skrill to my online store located on the Shopify service?

is skrill avilable in kenya??

Hello Chippy,

Unfortunately no.

Bought some bitcoins but Cannot withdraw. Not happy should be banned. Be careful if you buy crypto currency from them you can never withdraw only swap with other.

I tried to make a withdrawal from my skrill account but skrill company made changes to it which caused me a huge loss and when i made a complaint, their response was that they had the right to make changes according to their general terms and conditions “section 12.1 : We do not guarantee the availability of any particular withdrawal method and may make changes to or discontinue a particular withdrawal method at any time without following the procedure set out in section 17 as long as there is at least one withdrawal method available to you.”

and they got away with it.

Sorry to hear about that Mohamed. I hope you’ll solve this issue soon.

It is very ridiculous and unbelievable decision from SKRILL team to close my account permanently.

I have uploaded all required documents again and again for your reference and address verification.

But, suddenly my account was closed permanently.

By such actions from Skrill team with its users. Skrill will definitely loose the credibility among its users.

— Rajesh

Sorry to hear about that Rajesh.

Unfortunately you can’t assign 0 stars

Worst service ever.

Account opened on second of October.

I’ve been forced to make a deposit in order to activate the account.

Immediately after the account has been restricted.

I’ve sent all the verification necessary documents but nothing.

Basically they’ve taken my money just to lock my account making impossible to move my funds.

The Customer Service is absolutely useless.

After 5 Days i got requested to send (Again) the verification necessary documents. I did it (again) and I’m still waiting to be able to gain access to my account to take back my money and get the hell out of that ridiculous service.

Stay Away

Sorry to hear about that, you can find some alternatives here.

Hi yesterday, I asked my mom for a csgo game item and she said she bought it, I was seeing on Steam (which is the gaming platform) that I could upload by Skrill, so I created an account with my name, and I was able to create the account, then I loaded the MasterCard account for about 15 € and the Skrill platform accepts and has the money in the account. The problem is, I can’t put that money in the game now because the account is asking for my identity, but I don’t want to put my data, what to do? I sent an email about 10 hours ago and got no response.

Hello, my advice is to make sure you read the terms and conditions before signing up to any service.

Their customer support did not respond for email. I emailed the and ask to reset my password but they dont reply. No one help me. I can’t deposit to my account until now

Sorry to hear that Dolores, I hope you’ll get a reply from them soon.

Is skrill also available to Namibians?

Hello Thomas,

Unfortunately no 🙁

–

Bogdan – Editor at ecommerce-platforms.com