In today’s Wave Accounting software review, we’re going to be exploring all of the key features and capabilities of a top solution for business accounting. It’s no secret that keeping track of business finances can be a complex process. In the average company, there are endless invoices, quotes, and ingoing and outgoing payments to assess.

Our Verdict

The functionality of the Wave accounting platform for payment processing, invoicing, credit card payments and more is fantastic. However, there are some limitations. Compared to options like Quickbooks, Freshbooks, Xero, and many other accounting tools, Wave’s solution isn’t very scalable. There are no receipt scanning features, and ACH payments can be a little expensive.

You won’t be able to access time-tracking tools with Wave payroll, which could make it harder to examine exactly how much you should pay your contractors. Additionally, the basic accounting capabilities have some limitations depending on the state or location you’re in.

What’s more, email support and live chat for entrepreneurs isn’t available for every tool. You’ll need to access certain features, like payroll if you want to leverage extra help.

Despite some drawbacks, Wave accounting is an excellent cloud-based tool. You can keep track of your financial statements wherever you are, with an intuitive and mobile-friendly dashboard. It’s easy to track accounts receivable and payable. Plus, you can create recurring invoices in seconds.

The Wave invoicing and accounting tools also support access for multiple users, so a startup company can set up different accounts with specific permissions to support their team.

At the same time, if you want to optimize your company and improve your chances of success, you’ll need to be able to create regular reports highlighting the financial health of the organization. A solution like Wave accounting can help with all of this.

One of the things that makes Wave’s accounting tools so unique, is they’re designed for anyone. You don’t need to be the owner of a huge enterprise to see the benefits, nor do you need excessive technical knowledge. Wave ensures even the smallest business leaders can get the most out of their cash flow, with convenient tools and services.

Read on for our full Wave accounting review.

What is Wave Accounting Software?

Wave, one of the leading vendors in the SaaS industry, produces state-of-the-art accounting software, targeted specifically at small businesses, micro companies, and freelancers. The finance management platform is approachable, easy-to-use, and relatively feature-rich too.

Even if you don’t have any accounting or bookkeeping experience, you can easily navigate the comprehensive platform to create invoices, cash flow reports, and more. What’s more, the in-built dashboards ensure you can keep a close eye on your financial situation at any time.

Wave’s accounting software is specially designed to appeal to smaller companies and service-based businesses. It supports everything from banking to payroll. Plus, there’s the option to access the support of advisors if you need extra guidance.

However, Wave’s solution isn’t without its limitations. The solution does lack some scalability which could make it less appealing for organizations as they begin to grow. You can’t necessarily integrate with all of the inventory management and CRM tools you might be using. Additionally, customer support is limited on some plans.

Wave Accounting Software Pros and Cons

Wave’s accounting software is a somewhat niche solution for financial management. By focusing on smaller companies, the organization has ensured an often over-looked component of the business landscape can access the right support. However, the small business technology may not be ideal for larger companies, enterprises, or organizations with complex cash flow strategies.

Pros 👍

- Free packages for beginners and micro business owners

- Unlimited invoicing capabilities with customizable templates

- Convenient mobile apps for android and iOS

- Built-in banking, payroll, and payment capabilities

- Unlimited users for each plan

- Easy-to-use backend environment to suit anyone

- Security for ensured peace of mind

Cons 👎

- Limited scalability for larger companies

- Extra support will incur an additional charge

- Limited auditing trail options

The Core Features

Wave’s accounting platform includes access to most of the core features small business owners, freelancers, and contractors will need to maintain good financial health. You can create custom invoices with unique payment terms, track bank statements, and create reports.

The solution benefits from exceptional ease of use, and allows companies to add as many users as they like, so there’s no limit on the number of staff members you can collaborate with.

Let’s take a closer look at each core feature:

Wave Accounting Invoicing

At the heart of the Wave Accounting platform is a set of exceptional invoicing features. The built-in invoicing software allows you to create professional-looking invoices with your own pricing, form fields, branding, and any other extra elements you like. The invoice templates are great, and the free accounting software allows you to make changes however you like.

You can set up recurring billing for repeat customers, so you can essentially run parts of your business on autopilot. Plus, the solution will send overdue reminders on your behalf. All of your payment information and invoices will automatically sync with the accounting software too.

Business leaders can access all of the information they need about their customers in one place, and it’s easy to track payments and communications with each client. You can invoice on the go with a free iOS and Android app, and receive instant notifications when an invoice is viewed, due or paid.

Plus, invoices can include a handy “Pay Now” button, which allows them to make payments using Apple Pay, secure bank connections, or credit card. Payments are processed within as little as one business day, and you can accept payments over the phone or in-person too.

Wave Payments

The “Payment” features in the Ave Accounting platform ensure you can quickly collect money through bank deposits, credit cards, and Apple Pay, within 1-2 business days. Transaction fees can be as low as just 1% per payment, which means you get more money in your bank account.

One of the biggest benefits of Wave is it makes it easier for customers to pay for products and services on their terms. You can email your customers with a pay now button for instant payments, and everything is tracked from start to finish, so you don’t miss out on any transaction data. Credit card processing is secure and straightforward, though transaction fees can vary.

Bank payments cost 1% per transaction, while credit cards cost 2.9% plus $0.60 via Mastercard or Visa. AMEX transactions are a little more expensive, with a fee of 3.4% plus $0.60.

All payments are supported by bank-grade security, and virtually all credit card options are accepted, so your customers will have plenty of options.

Wave Accounting Features

Of course, Wave also comes with plenty of features for standard accounting and financial management. The company will help you to prepare for tax season in no time. After you create your account, you’ll be able to access it anywhere. Plus, your data will be consistently backed up for peace of mind. As an added bonus, you can connect as many credit cards and bank accounts as you like.

Once you’ve connected your payment options, your transactions will appear in your bookkeeping section automatically, so you don’t have to monitor receipts manually. The easy-to-use dashboard also provides at-a-glance views of your financial health, so you can make better decisions for your future.

The accounting reports are easy to use, with options for profit and loss income statements, balance sheets, and cash flow. You can also create monthly and yearly comparisons.

Business owners using Wave don’t have to worry about security, as all connections are encrypted from start to finish. Wave’s servers are also housed using electronic and physical protection, and the company is PCI Level-1 certified.

As an added bonus, you’ll be able to leverage double-entry accounting capabilities. This means you can easily access the help of your accountant when using Wave. The user-friendly ecosystem ensures both you and your accountant can track everything in the same place.

Wave Accounting: Banking

Wave also has a unique solution for banking built into its software. The “Wave Money” free account will allow you to manage your money in an environment that’s automatically linked to your bookkeeping software. There are no monthly fees, account minimums, long-term commitments, or transfer fees to worry about. Plus, eligible customers can receive free, instant payouts.

Wave Money includes access to a Visa debit business card, as well as a virtual card you can access via a mobile app. These tools make tax season easier, as they allow you to keep business and personal transactions separate. There are on-the-go income tracking and check deposit options via the mobile app. Plus, you shouldn’t have to worry about ATM withdrawal costs either.

The Wave banking platform supports Google Pay, Apple Pay, and Samsung Pay, as well as free pre-authorized debits. You can also connect third-party payment processors. Plus, the solution comes with FDIC insurance for up to $250,000, for peace of mind.

Wave Accounting Payroll

Even small businesses have employees to pay from time to time. Fortunately, Wave makes managing employee payments simple and straightforward. You can pay independent contractors and employees alike, generating 1099 and W2 forms for tax requirements.

The Payroll software, like the rest of the tools on Wave, is connected directly to the rest of the Wave account ecosystem, to reduce the time you spend on bookkeeping. Wave’s payroll service can also automatically pay and file state and federal taxes in a range of different states.

There’s support for self-service pay stubs and tax forms, with user accounts for each of your employees. This means you can spend less time handling payments for your team members yourself. Users can also deposit payments quickly and easily into bank accounts with absolute security.

There’s even the option to leverage annual audits, so you can keep track of your payroll taxes, payments, and other factors. However, there is a fee on payroll, which we’ll come back to in a moment.

Wave Accounting Advisors

Although Wave Accounting software does make it easier to manage your financial needs alone, there’s a good chance you’ll eventually need some extra help as your business starts to grow. That’s why the company also delivers personalized support from expert advisors.

You can leverage bookkeeping support, from professionals who can perform transaction categorization, account reconciliation and more on your behalf. Plus, you get monthly review calls built-in. There’s also a service for accountant and payroll coaching.

The coaching services allow you to access extra support when learning how to manage your own books, without the help of additional accountants.

Pricing

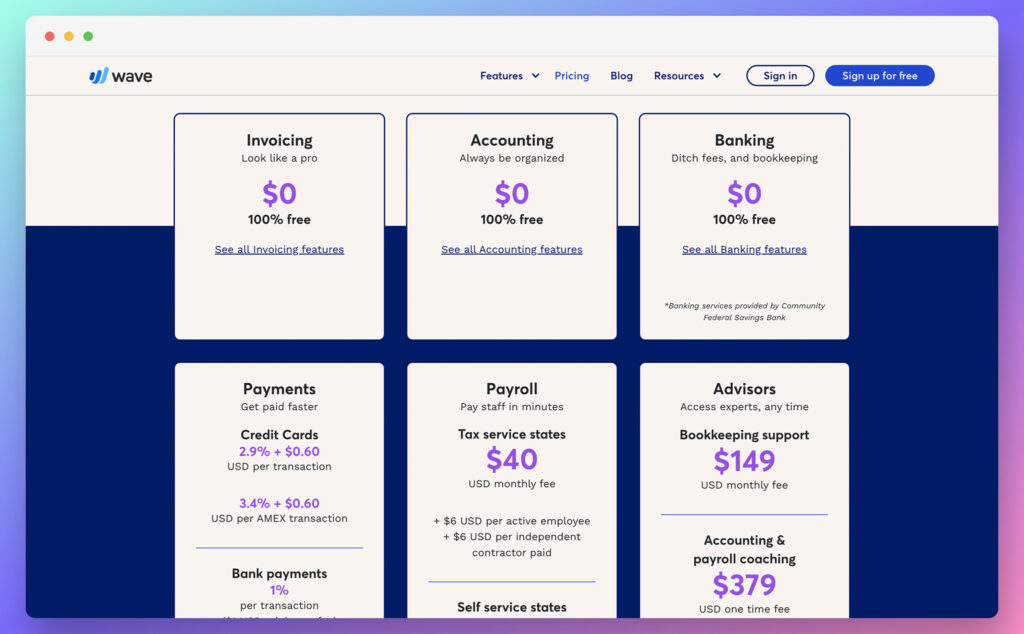

Part of what makes Wave Accounting software so appealing to small business owners and freelancers is that it’s almost entirely free to use. All of the invoicing, accounting, and banking features are totally free to use. Without paying anything at all, you’ll get features like:

- Unlimited income and expense tracking

- Custom sales taxes

- Exportable accounting reports and finance statements

- Unlimited credit card and bank connections

- Dashboard monitoring for invoices and balances

- Unlimited invoicing (with customizations)

- Automatic payment reminders

- Estimate to invoice workflows

- Online, credit card, and bank payments

- Invoicing and accounting synchronization

- Access to the Wave bank account

- Online and in-person debit cards

- Deposit checks and track income with the bank app

However, not all of the features are available entirely for free. You will have fees to pay on transactions if you’re going to be managing payments through Wave. As mentioned above, these fees start at 1% for bank payments, 2.9% plus $0.60 for credit cards, and 3.4% plus $0.60 for AMEX.

Payroll software also comes with a cost. Tax service states will pay a $40 per month fee, plus an extra $6 for every active employee and independent contractor you pay. Self-service states pay the same price per active employee and contractor, but only $20 per month.

If you want to access Wave advisors, the pricing is a little higher. Bookkeeping support starts at $149 per month, while the accounting and payroll coaching services cost $379 (one-time fee).

Customer Support

The customer service you’ll receive from Wave will depend on the services and solutions you access. If you’re only using the free accounting and invoicing products from Wave, all support is self-service only. This means you’ll have to solve your own issues using the available help center, or the Wave Accounting chatbot, Mave.

If you’re using payroll, payments, or advisors, as well as the banking product, Wave Money, you’ll have access to a few more support options. You can still use the self-service help center, or you’ll be able to speak to an agent through live chat or email.

Additionally, you can pay for additional support with the Wave accounting specialists. Pricing for an accounting coach will start at $229 for an hour of live coaching, with unlimited email and live chat support. This could be particularly useful for companies approaching tax season.

Wave Accounting Review: Conclusion

The Wave invoicing and accounting tools support access for multiple users, so a startup company can set up different accounts with specific permissions to support their team.

If you’re looking for a free service to help manage your chart of accounts, Wave could be one of the best business accounting software options out there. Just keep in mind the free version of any tool is unlikely to provide full functionality for a larger company.

If you’re looking for alternatives with more integrations, PayPal support, and advanced scalability, you can try Quickbooks Online, Xero, or Freshbooks.

Hey Joe,

Thanks for this helpful article! I do have a question before signing up with Wave accounting.

Can you use for your Etsy shop accounting without linking to your bank account, credit card, and PayPal? Even if I have to enter things manually for sales, and expenses. I am ok with that.

Thank you,

Liz Graham