If you’re looking for the best online banks, France has plenty of great options to choose from. Whether you’re temporarily working in Europe and need to manage your money, or you’re setting up a new French business, the right online bank can be a fantastic resource.

Mobile and online banks give you more freedom to manage your money from anywhere, track transactions, and even make payments.

Today, we’re reviewing some of the most reliable online and mobile banking services available to consumers and businesses in France. Let’s dive in.

In this article

What is an Online Bank?

An online bank is a digital-first banking service that allows you to conduct financial transactions and manage your money through the internet.

With “online banking” you can complete a range of financial tasks, from issuing payments, to setting up standing orders, without having to visit a physical bank branch. You might even be able to monitor transactions from your mobile.

While the features offered by online banking vendors can vary, most of the top online banks in Europe will provide comprehensive access to your checking and savings accounts.

You’ll be able to do many of the things you’d usually do at traditional banks, like applying for a new French bank account, or transferring and depositing money.

You can also check bank statements, request a new debit card, or credit card, manage overdrafts, and apply for cashback services.

With a mobile or online bank, you may even be able to check the interest rate on different card services, or convert foreign currency into euros.

The main thing you can’t do with an online account, is make ATM withdrawals. You’ll still need to visit a physical cash point to withdraw money from your account.

What are the Best Online Banks in France in 2023?

- Revolut

- Wise

- Nickel

- N26

- Tomorrow

The best mobile or online bank in France for your needs will depend on a range of factors, including what kind of account services you want to access, and whether you already have a French bank account.

You may also need to think about interest rates, ease of use, and bank fees.

Some companies offer different services for expats, or those with banks in other European countries. There are even “international bank” options which can help you to manage your transactions in various countries throughout Europe.

We’ve examined some of the most popular French online banks to bring you this list of the most reliable options available today.

1. Revolut

One of the most popular European online banking companies, Revolut is ideal for business owners and consumers alike.

This comprehensive mobile banking service was founded in 2015, and supports business users in more than 200 countries and regions.

With Revolut, you can access easy payment processing options, complete with currency conversion options for international payments.

There’s also the option to earn up to 4.75% interest on your account, with “Savings Vaults”. Plus, Revolut has a fantastic reward scheme, so you can save as you spend. The open banking platform can connect multiple accounts in one space.

Plus, it allows you to track subscriptions and payments, block transactions, and even make investments in real-time. You can trade thousands of global shares, buy gold and silver, and even purchase crypto for your digital wallet.

When you open an account, you’ll receive a debit card for withdrawals, though your monthly withdrawal limit will depend on your plan.

Pricing

Users can sign up for a Standard account with Revolut for free, which includes built-in budgeting, saving solutions and transaction management.

Premium plans start at £2.99 per month with extra saving and cashback features. There are also “Premium” plans for £6.99 per month, “Metal” plans for £12.99 per month, and “Ultra” plans for $45 per month.

More expensive plans unlock more features, like personalized cards, better interest rates on savings, and great deals on medical and travel insurance.

Pros:

- Support for international payments and transactions

- Intuitive mobile app and online platform

- Fantastic reward scheme and benefits

- Savings vaults with great interest rates

- Investment options built-in

Cons:

- Advanced plans can be expensive

- There are limits on withdrawals

Further reading 📚

2. Wise

Wise (previously Transferwise) is probably the most well-known online banking solution for international money transfers. It’s ideal for residents and non-residents of European countries alike, combining digital banking with a convenient mobile app and low transaction fees.

Wise supports more than 40 currencies across 160 countries, and is used by millions of people worldwide.

The app includes tools for money transfers, money management, and budgeting. Plus, there’s a handy calculator on the website which helps you to determine how much you’ll spend when using your Wise bank card or making an international payment.

Wise offers ultra-low rates for sending money to international companies. Plus, you can earn interest on various payments.

There’s even a comprehensive “Business account” option, with specialist tools to help you pay employees and suppliers.

As an added bonus, Wise comes with exceptional security features built in, making it one of the best banks for those in search of peace of mind.

Pricing

Registering for a Wise account is free, although you will have limitations on how much cash you can withdraw without paying a fee. After withdrawing £200 in one month, you’ll be charged 1.75% at every ATM.

There are also fees for sending money in different currencies, starting at 0.43%.

Specialist features, like business banking options, may also incur an additional fee, so it’s worth reaching out to Wise if you’re unsure.

Pros:

- Excellent customer support team

- Cheap international money transfers

- Fantastic security features included

- Compatible with all kinds of payment systems

- Useful business banking features

Cons:

- Limits on cash withdrawal

- Fees on some transactions

Further reading 📚

3. Nickel

Intended to offer users a simple way to leverage international banking services, Nickel is a convenient tool for French business owners and consumers.

You can create an account in as little as five minutes, and access a standard or premium MasterCard debit card straight away.

There are no income requirements to setup an account, no hidden fees, and no overdraft fees. Plus, you can make withdrawals for free at dedicated “Nickel” points around the world.

Nickel allows users to manage their entire banking strategy from their website or mobile app on Android or iOS.

Nickel also has premium and business cards available, with reduced fees for transactions worldwide. Plus, retailers can even use Nickel to create their own point of sale solution.

The rates are extremely affordable, though they do vary depending on your plan.

Pricing

A basic Nickel account costs 20 euros per year, with access to 1 account, 1 master card, and full card payment solutions.

You can also purchase specialist cards for an extra fee each month on top of the 20 euro annual fee. The “My Nickel card” costs 10 euros for 4 years, for a personalized card.

Nickel Premium costs 30 euros per year, and includes better rates on foreign withdrawals, exclusive insurance, and free card payments abroad. Nickel Metal costs 80 euros per year, and comes with commission-free withdrawals.

Pros:

- Excellent and easy to use mobile app

- Nickel ATMs located worldwide

- Multiple card options to choose from

- Excellent customer service and support

- All the features of a traditional bank account

Cons:

- Some cards are quite expensive

- Annual fee on all plans

4. N26

Voted the best bank in the world in 2023, N26 is a fantastic online and mobile bank, trusted by millions of customers.

Although it’s based in Germany, it serves users across the globe. Not only is Nickel one of the most secure online banking services around, but it’s also highly versatile.

There are tons of business and personal accounts to choose from, and you can even access personal reports on your spending and transactions.

This makes it easier to create personal or business budgets based on real data. You can set up push notifications for your phone, set goals for your spending strategy, and even create “sub accounts” for saving.

N26 works with Apple Pay and Google Pay for contactless payments, and it’s available in various languages, including English, French, German, Spanish, and Italian.

There are even integrations available for Wise. What’s more, the customer support team is quick and responsive.

Pricing

You can create a current account and start investing in digital banking with N26 for free. Alternatively, there are a range of personal and business account options with different features.

Personal accounts range from €4.90 to €16.90 per month, with more free ATM withdrawals and advanced features.

Premium business accounts also range from €4.90 to €16.90 per month, with extra features like two-factor authentication and cashback options.

Pros:

- Wide range of personal and business accounts

- Exceptional security and privacy features

- Lots of payment options

- Cashback options on some cards

- Excellent customer support

Cons:

- Limited free cash withdrawals

- Some features are exclusive to paid accounts

Further reading 📚

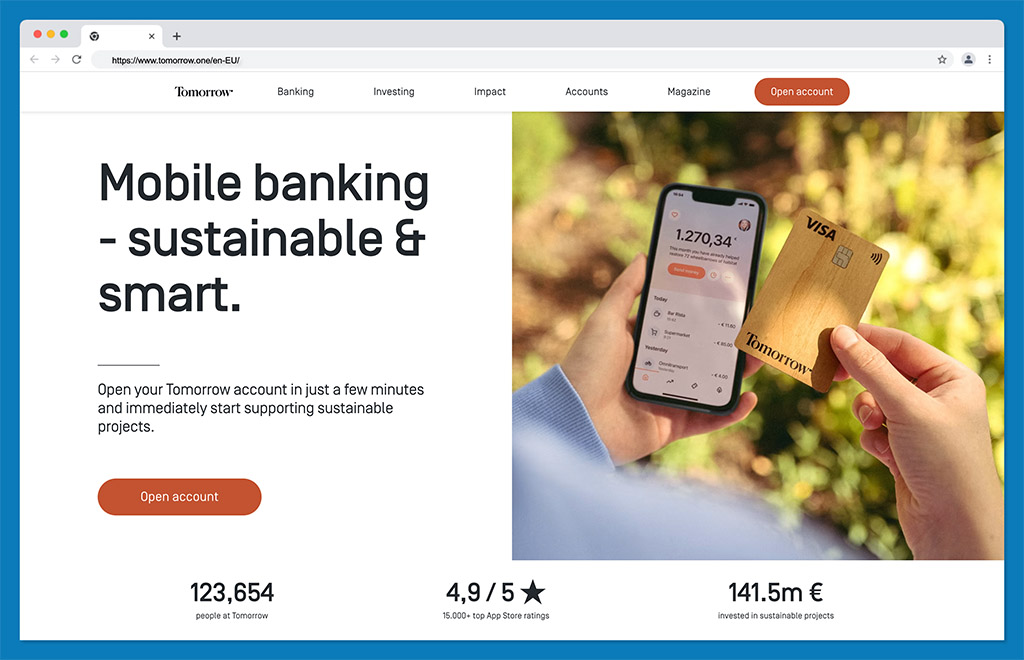

5. Tomorrow

With an English-speaking support team, an exceptional approach to security, and an easy-to-use mobile app, Tomorrow is a great choice for digital banking.

What sets this company apart from other international banking providers is its approach to sustainability.

The company focuses on green operations, and even offers wooden debit cards. Aside from its eco-friendly focus, Tomorrow only benefits from some unique app features.

There’s an “Insights” section on the app for an overview of your finances. Plus, you can create “sub accounts” with pockets to organize your money for different purposes.

Tomorrow makes mobile payments safe and easy, with support for Google and Apple pay. You can also pay companies and withdraw money around the world free of charge.

Tomorrow also offers support for round-up payments (so you can invest in the environment), shared accounts, and spending limits, so you can control your budget.

Pricing

Prices for Tomorrow accounts start at €3 per month for the “Now account”, with a free Visa debit card and 2€ withdrawal fees. More advanced accounts like the €7 per month “Change” account offer up to 5 free withdrawals per month, while the €15 per month Zero card offers unlimited free withdrawals.

Pros:

- Eco-friendly and sustainable business processes

- Free withdrawals on some account tiers

- Exceptional budgeting and investing tools

- Useful transaction insights

- Sub accounts for organizing your money

Cons:

- No free account option

- Some limitations on support

Choosing the Best Online Bank in France

When it comes to choosing the best online bank in France, there are plenty of great options to choose from.

While you can always consider applying for an account with one of the high-street banks in Paris or other French cities, some providers will place limitations on your account depending on your visa and other factors.

Alternatively, an international online bank gives you more freedom.

Many offer access to English-speaking customer service teams, as well as a host of tools to help you manage your budget and track transactions.

Remember, it’s worth carefully assessing any fees you’ll need to pay, and examining the application process before you dive in.

Comments 0 Responses