With increasing digitization, it's no wonder traditional banks no longer play such an essential role in our lives, and in their place, mobile-only banks are popping up all over the show.

Not only do these platforms conveniently enable us to bank from the comfort of our homes, but (usually) they also offer a range of money-savvy features. With so many perks to be had, it’s no wonder these banks have enjoyed such an influx in popularity!

Revolut and N26 are two such digital banks. Both have made big names for themselves in the world of online banking, so in this article, we're comparing the two to see which is best.

There's lots to talk about, so let’s dive in!

What is N26?

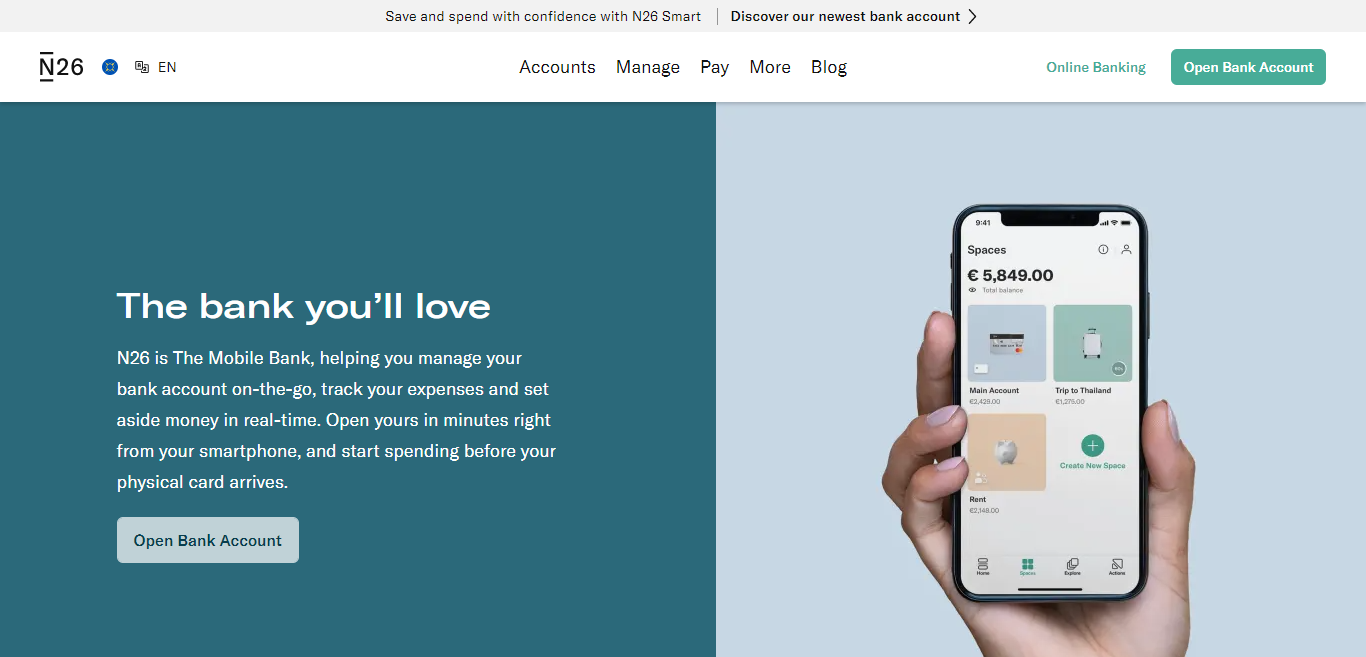

N26 believes banks should be as mobile and flexible as their clients. In light of that ethos, they offer a fully digital banking experience designed to be as transparent and straightforward as possible.

Founded in 2013, N26 now has a team of over 1,500 people across 80 nationalities and boasts five offices worldwide and over 5 million customers!

As we proceed, bear in mind that N26 is especially popular in Europe. While their services are available in the United States, they're much more limited in comparison. As such, the following review is more relevant to European users. It’s also worth noting that at the time of writing, N26 has shut down its services in the UK.

What is Revolut?

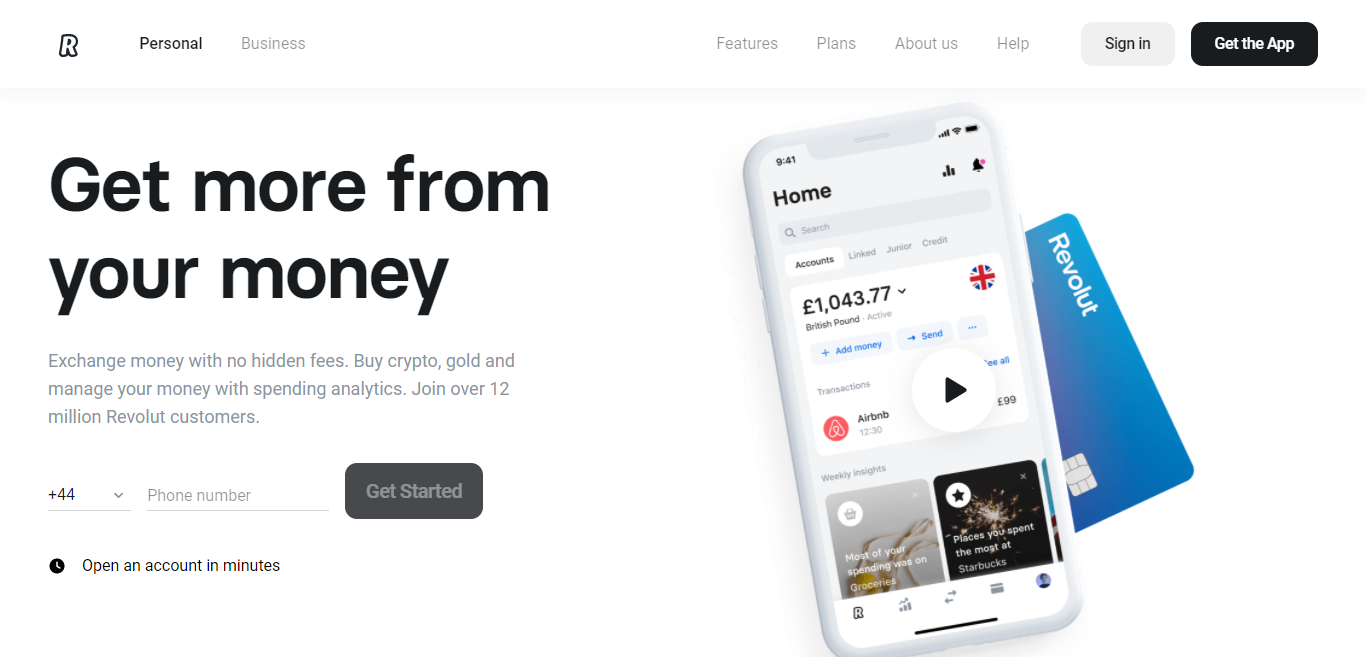

Revolut (read our full Revolut review) provides one app ‘for all things money,' to help you with everyday spending and financial planning. At the start of 2021, they had over 12 million personal customers and another 500k business customers.

Whereas N26 started in Germany, Revolut was born in the UK in 2015. At the time, they focused on offering money transfer and foreign exchange services. Now, they've branched out to provide customers with the features they need to enjoy better financial health and more control over their money.

Revolut too focuses on the European market and has found much popularity there. That said, they have also expanded their services to include the US.

Unlike N26, most of their features are also available for US citizens. So if that's where you're based, we can save you some time and say from the get-go that Revolut has more to offer you!

N26 vs Revolut: Their Pros and Cons

For a quick and simple comparison, let’s review the most advantageous aspects of these services and where their flaws can be found.

N26’s Pros 👍

- Free card shipments

- There is a free card and a bank account available.

- ‘Spaces' allow you to organize your spending better, which makes budgeting your money easier.

- You can set up an authorized overdraft within a couple of minutes.

- There's a desktop version available (which comes with a dark mode!)

- N26 has a full banking license

N26’s Cons 👎

- N26 provides limited services in the US and is no longer available in the UK, where all accounts were closed.

- Withdrawals abroad are charged with a 1.70% transaction fee.

- You don't earn any interest on your savings.

- After your free cash withdrawals for the month, N26 charges you €2 for each ATM withdrawal.

- N26 doesn't offer credit cards

Revolut’s Pros 👍

- Revolut provides a comprehensive service all around the world, including well-represented US features.

- Revolut comes with junior accounts included, so if you have a family with young children, you can tap into Revolut’s junior features to teach them to save money.

- There is a free card and account available.

- You can make free withdrawals abroad, depending on your account withdrawal limit. After the limit is hit, each foreign withdrawal is charged at 2%.

- You can set budgets within the app to better plan and oversee your money.

- You can earn interest on your savings.

- You can make free international transfers.

- Revolut now offers a web app for banking.

Revolut’s Cons 👎

- You have to pay shipping fees to receive your card unless you opt for the Premium or Metal account.

- Although Revolut was granted an EU banking license in 2018, they cannot offer financial security services such as the FSCS deposit guarantee. They also can’t handle cash or cheques.

- Revolut doesn't provide phone assistance.

N26 vs Revolut: Their Core Features Compared

When we talk about mobile banking, you would expect a few core features from such a service. Of course, N26 and Revolut both allow you to transfer and receive money, keep your cash secure, withdraw funds, and issue cards that can be used in physical stores. You can top up your card and use it to pay contactless in-store.

On top of the basics, this section of the review looks at the other features these banks have to offer…

N26’s Features

Before we delve into the nitty-gritty, we want to highlight that N26 has recently introduced a web-app. Here you can access the same features as their mobile app but on a bigger screen. Handy, right?

Managing and Tracking Your Money

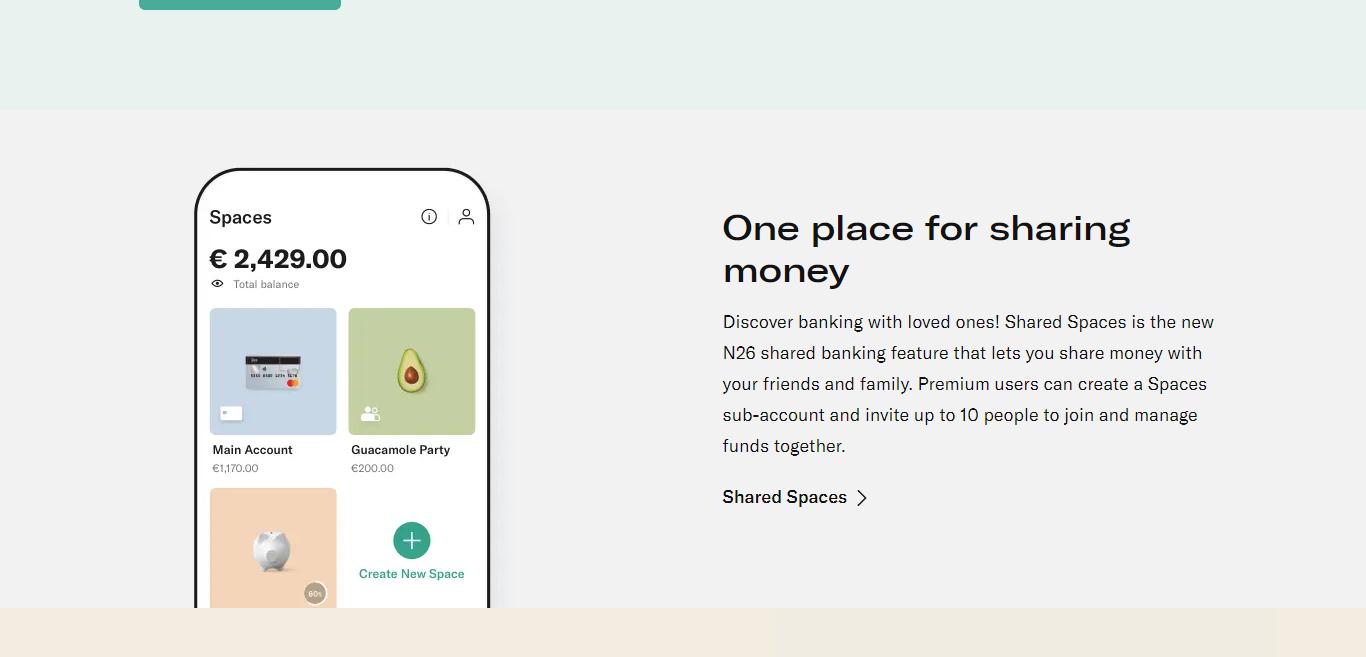

N26 lets you manage your money more efficiently by launching sub-accounts (which N26 calls ‘Spaces'). These work wonders as savings accounts. Here, you can set, display, and track your savings targets from inside your N26 current account. Within a few taps, you can get an overview of all your transactions and see how close you are to your saving goals.

You can even create rules to quickly set up recurring bank transfers between your central and sub-accounts. Once a rule's set up, your account takes care of it independently.

On top of that, N26 permits you to create ‘Shared Spaces,' where you can share money more quickly and save with your friends and family towards the same financial goals.

Budgeting

N26 sends instant push notifications to your smartphone, so you're kept fully up to date on the state of your finances. You’ll receive notifications after all transactions, mobile payments, ATM withdrawals, direct debits, and transfers.

You can also set a daily spending limit and lock/unlock your card from the convenience of N26's app.

You'll also find it easier to stay on top of expenses with N26's statistics. From one easy-to-read dashboard, your spending is automatically broken down into categories so you can see exactly where your money's going. You can even create your own spending categories using tags to personalize these stats further.

Extras

N26 offers travel insurance and additional perks, including free ATM withdrawals abroad, your choice of color for your card, and exclusive partner discounts.

With several of N26's accounts (the You, Business, or Metal bank accounts), you’re covered for travel health insurance, including emergency medical insurance and compensation for flight or baggage delays. You’re even covered for trip cancellation or curtailment!

You can also get mobility coverage for vehicle rentals and mobile phone insurance. Allianz provides all N26 insurance.

Revolut’s Core Features

Revolut offers an impressive list of features. So much so that it would take a long time to go into all of them in detail. Instead, we’ll look at the feature categories and touch on some of the most popular functions in each.

Please note, like N26, Revolut now also offers a web app that you can use from your desktop (since December 2020).

Account Features

Revolut’s account features aim to make it easy to manage and view your money. In that spirit, Revolut offers:

- Linked bank accounts. You can oversee all your money from one place by linking external bank accounts to Revolut. This empowers you to track all your spending from one centralized hub. It's also easy to send money between accounts using the preauthorized link account.

- Budgets and analytics. You can set spending budgets and use the analytics tool to help you manage your money smarter. Your spendings are categorized in real-time, so you know where you’re spending the most. Revolut also provides useful predictions to help you plan your financial future.

- Junior accounts. You can set up bank accounts for your kids to help them build healthy money habits. This comes with a card and a child-friendly app that you, the parent, can control. Junior cards can’t be used with most age-restricted merchants, and you can always freeze or unfreeze your kid’s card to limit their spending.

- Pockets. These help you organize your spending. You can sort your direct debits, subscriptions, and scheduled payments into different ‘pockets.’ Bills are paid automatically from these pockets when they're due. You can also set money aside to cover these recurring transfers, so your principal bank account balance is free for you to use without overspending.

Wealth Features

Revolut offers several features to help grow your wealth via financial investments.

To help reach your saving goals, you can also put money aside in vaults. From there, you can withdraw money instantly while enjoying a 0.65% daily interest ratio for your GBP funds. You can create separate personal vaults for different currencies (euros (EUR), USD, GBP, etc.) and keep commodities. You can even open group vaults to save with friends and family.

Payment Features

Revolut enables you to send and request money with just a tap and no hidden fees. In fact, you can make free transfers to other Revolut users in over 30 countries – and add a gif to your payments to make them laugh. Win-win! Sending money to local bank accounts is also free, and international money transfers come at cheap exchange rates.

If you set up direct deposits with Revolut, you can also get your paycheck up to two days earlier.

You can even split bills and costs with friends. Say, for example, you’re taking a trip with others, you can set up a group bill to share considerable expenses in one place.

Extras

These are some of the additional features Revolut offers:

- Rewards. Save money with personalized discounts and cashback. These are selected based on your spending habits. Cashback is sent right to your account when you use the Revolut card.

- Donations. Donate with a tap to causes you care about.

The following perks are already available in Europe but are soon coming to US account holders:

- Overseas insurance. You can opt into Revolut’s pay-per-day travel medical insurances. It only charges you for the days you're actually abroad, using geolocation technology. Medical and dental coverage starts from as little as £1 a day.

- Device insurance. Get mobile phone insurance from £1 a week with global coverage against accidental damage.

N26 vs Revolut: Their Cards and Costs Compared

With any bank, you can choose from different cards that often come with their own perks. This is true for N26 and Revolut as well. So, let’s take a look at what accounts they offer…

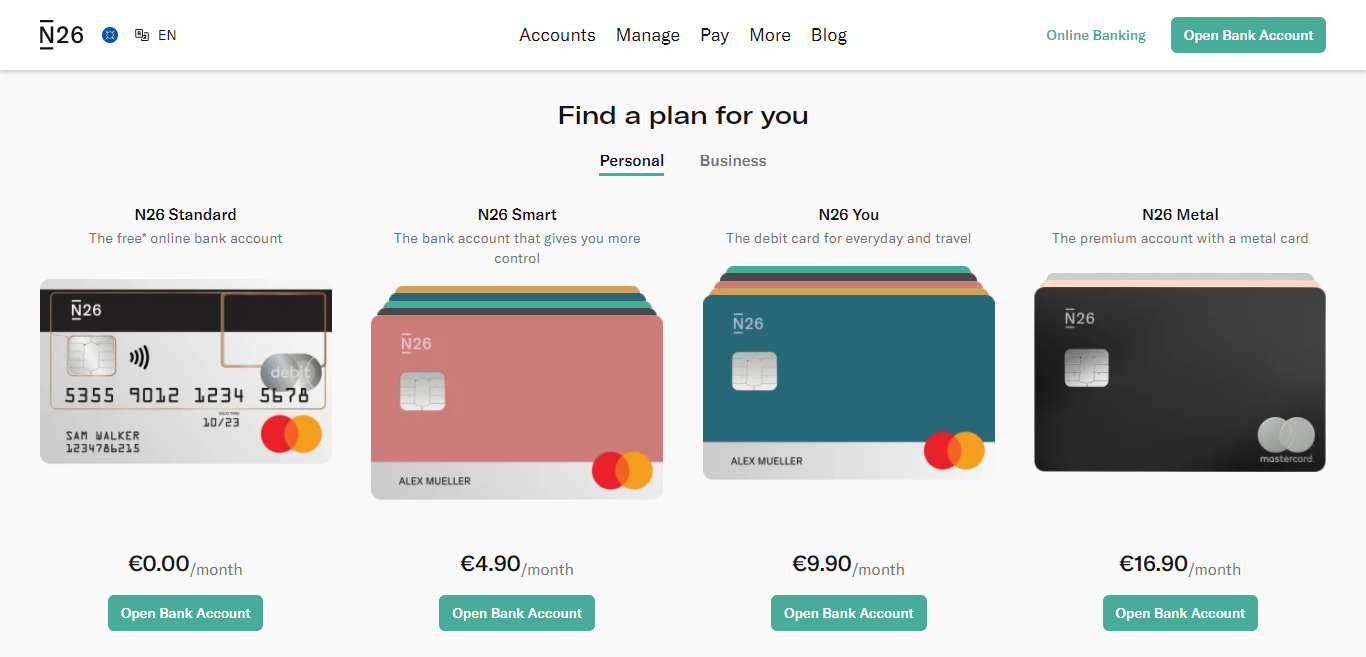

N26 Charges

N26 Standard

The Standard N26 program is a free account. This comes with all the basic spending, saving, and tracking features. The MasterCard that comes with it is also free and accepted worldwide. You can set daily spending limits, lock or unlock your card, and reset your pin wherever you are, using the N26 app.

24/7 chatbot support is also available on all plans.

N26 Smart

With this premium N26 account, you can choose your card's color (ocean, sand, rhubarb, aqua, or slate). You also get five free ATM withdrawals every month and zero foreign transaction fees when you spend abroad. You can even enable mobile payments like Apple Pay to start spending before your physical card arrives in the post!

The Smart account also unlocks access to 10 ‘Spaces' to better manage your money. Plus, you can request an extra card for more flexibility and use round-ups to save on every purchase. You'll also benefit from premium partner offers, which are selected based on your spending habits.

The N26 Smart account is available at €4.90 a month. From this plan onwards, you’ll also be able to access phone support via a direct hotline.

N26 You

At €9.90 a month, this debit card is best for managing your daily and travel-related finances. On top of all the features mentioned above, you also get unlimited free withdrawals in any foreign currency, medical travel insurance, trip insurance, flight insurance, and luggage coverage. You also get mobility insurance and winter sports insurance.

N26 Metal

And finally, N26’s most premium card is the Metal card, for €16.90 a month. Here you'll get everything in the previous account, plus an 18-gram metal card and your free withdrawal limit is raised from five to eight (within the Eurozone). Your insurances include Car rental insurance away from home and phone insurance (against damages and theft).

Your perks also include unique experiences curated for you, on top of the premium partner offers. Not to mention, your customer support improves to a dedicated N26 metal line for priority support.

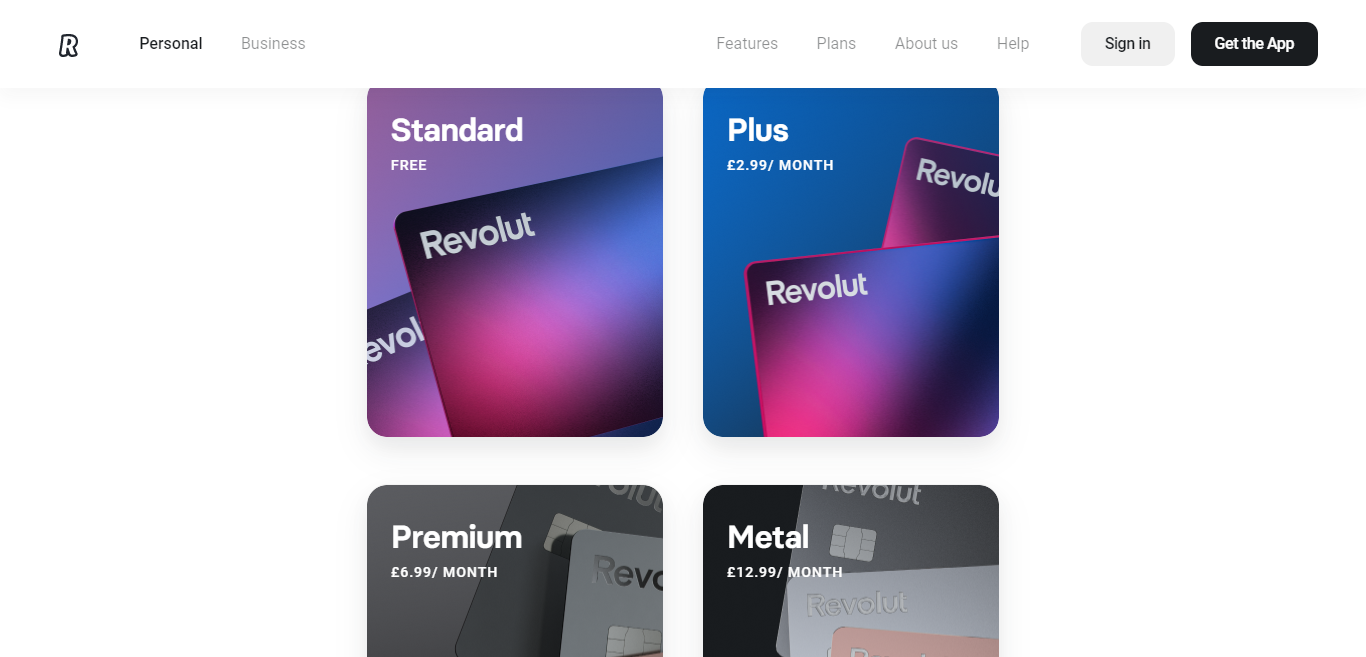

Revolut Charges

For easy comparison, Revolut has very similar plans to N26. This is especially true of the Metal card.

Standard

Like N26, Revolut’s standard card is also free. You can spend in over 150 currencies at the interbank exchange rate. There's no cost for ATM withdrawals up to €200 per month. However, you will be charged for the delivery of your Revolut card (card delivery is around €5).

You also gain instant access to a Revolut Junior account for one kid. However, you don’t accumulate daily interest on your savings.

Plus

This Revolut account is available for €2.99 a month. Here, you can earn 0.3% daily interest on your savings and enjoy a customizable design on your card. You also gain access to priority 24/7 customer support, global express delivery, and overseas medical insurance. On the Plus plan, you also get junior accounts for up to two kids.

Additionally, Revolut provides purchase protection up to €1000 a year, including ticket and returns protection.

Premium

The Premium card is available for €7.99 a month and elevates your no-fee ATM withdrawals to €400 a month. You can also choose from a range of exclusive card designs and make unlimited cross border international payments, plus one SWIFT transfer.

The Premium account also comes with unlimited disposable virtual cards for safer online shopping. You'll also benefit from discounted device insurance (20% off regular coverage). Plus, your daily savings interest is increased to 0.65%.

For travelers, the Premium account also comes with:

- Overseas medical insurance

- Delayed baggage and flight insurance

- Free lounge access with SmartDelay if your flight is delayed by more than one hour.

From this plan onwards, your card is shipped to you with free express shipping. You’ll also gain access to unlimited no-fee currency exchange Monday to Friday.

Metal

With the Metal card, you’re charged €13.99 a month. In exchange, you gain surcharge-free ATM withdrawals for up to €800 per month. You’ll also receive the exclusive Revolut metal card and cashback on card payments. Outside of Europe, cashback is 1%. The metal card also comes with five junior accounts.

N26 vs Revolut: Customer Support

Money is a significant talking point. Sometimes you need to get in touch with your bank to clarify issues of concern or ask questions. This is where high-quality customer service comes into its own. So, let's see how N26 and Revolut compare in this department…

N26

N26 can be contacted 24/7 via live chat on their website or in-app. If you opt for a Premium account, you'll also unlock phone support. Or, with the Metal card, you'll amp things up a notch with access to priority support via a dedicated hotline. Of course, N26’s website also provides an online help center where you can peruse through plenty of self-help materials.

Revolut

Revolut also offers 24/7 customer service. However, they only provide live chat and email support – they don't have a phone line. Their website also features an online help center where you’ll find guides and answers to frequently asked questions.

N26 vs Revolut: Our Final Verdict

If you’re tired of old-school banking, N26 and Revolut are two mobile banks that will take you into the new age of financial management. In terms of in-app features, they compete well. You’ll find a wide variety of nifty features, from budgeting tools to easy card-freezes. Both platforms will keep you posted on what you're spending and where, help you meet your savings goals, and provide greater visibility over your money.

When choosing which service is better for you, it comes down to your personal needs. N26 and Revolut’s fees are slightly different, and depending on how you choose to use their service, you might end up paying more with one over the other.

For example, Revolut offers slightly better fees when it comes to international transfers and withdrawals. Perhaps this makes it a better travel card for you.

Also, your options might be limited by location, as N26 doesn’t offer its banking service in the UK and only introduced limited features in the US. That said, N26 is a fully licensed bank and can provide a few more protections and services.

So, there you have it – the choice is yours! What’s your experience with mobile banking? Have you tried either one of these or other challenger banks like Monzo, Transferwise, or Moneybeam? Please share your experiences in the comments below, and let us know what you think.

Revolut is cheaper in use for free Instant Payments and top ups. N26 is trailing with charging for that kind of banking. So for daily use Revolut is better.

I would like to know how N26 and Revolut cards work in Argentina, and if they charge different commissions due to inflation in Argentina.

Hello Juan,

As far as I know, the platforms are not available in Argetina at the moment.

For people on the continent at least it’s gotta be N26. The FSCS deposit guarantee could’ve got more attention in the conclusion but that should be the deciding factor for Europeans

👍👍👍

It won’t be long before Revolut is in Germany. Currently, there is already the 100,000€ protection. N26 has lost a lot of features in the last few years. I have more hope in Revolut.