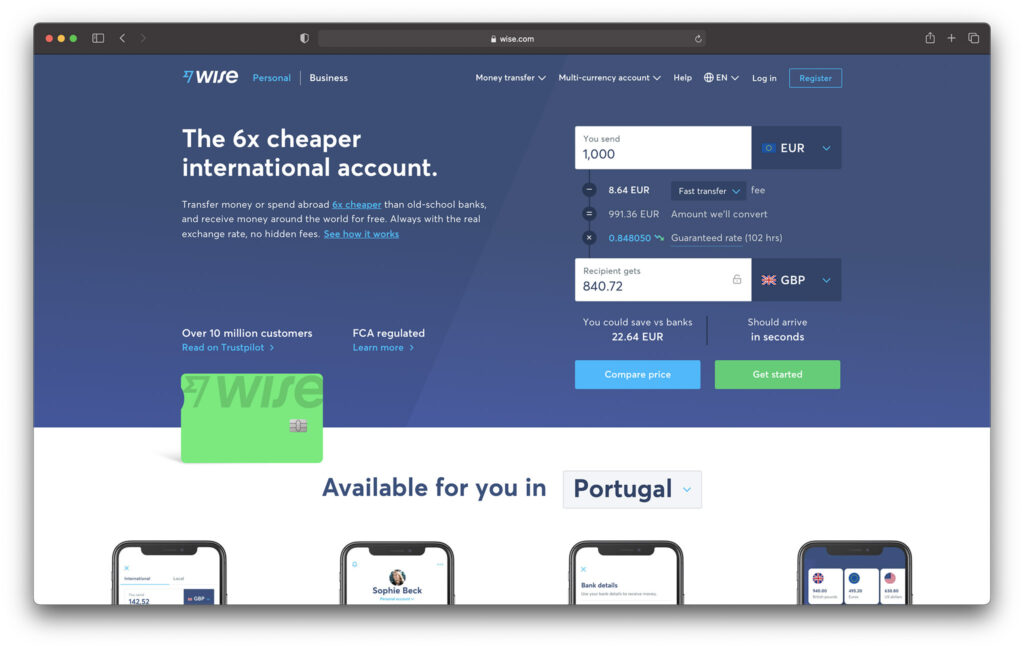

In this Wise vs Revolut review, we’re looking at two of the most popular solutions for sending and receiving money abroad.

Our first provider, Wise, specializes in making it as cheap as possible to send money in other currencies. Revolut, on the other hand, is a mobile banking solution with even more to offer. But, which one's right for your purposes? Keep reading to find out…

What is Wise?

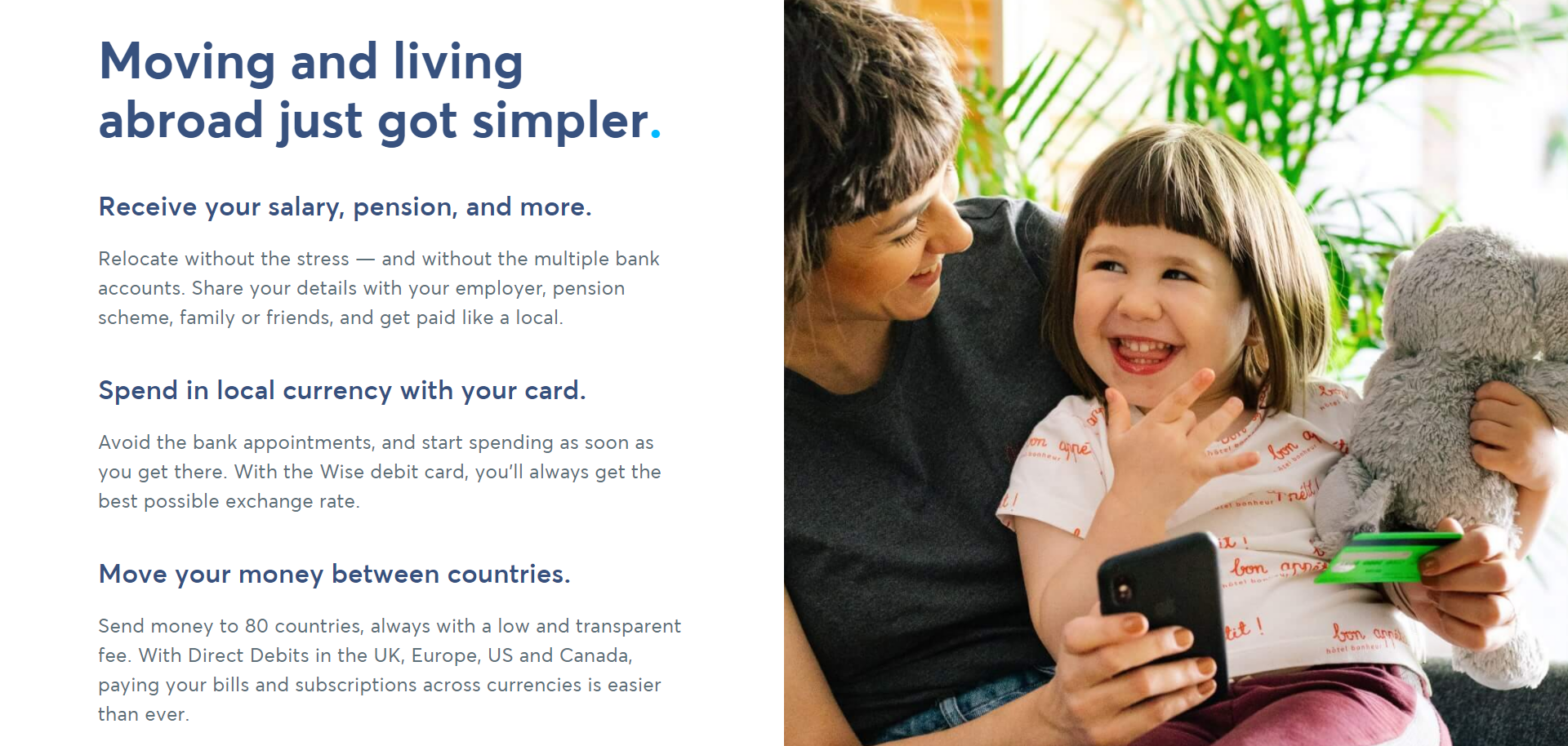

Although Wise offers its own accounts and financial management services, Wise’s central value proposition provides a fast and easy way to send money abroad.

If you haven’t heard of Wise, you might recognize its old name: Transferwise. Any foreign national living in another country has likely heard how this service could help them send money back home or convert foreign savings.

The name switch occurred in March 2021, making it a relatively recent development. But despite its rebranding, not much has changed. The company remains one of the most trusted services for sending money abroad affordably.

Transferwise was launched back in 2011 by a couple of entrepreneurs that wanted to transfer money across borders.

Back then, there wasn’t an easy way to do it. Every path for transferring money abroad relied on a net of banking institutions that would each add a charge along the way. Needless to say, this got expensive! So wise innovated this process by using mid-market exchange rates for currency transfer.

How?

Wise empowers you to make bank transfers to a Transferwise borderless account. Once the money's in that account, Wise transfers the currency using the mid-market rate. After the currency exchange, Wise then makes a local bank transfer to the person you want to send the funds to.

Consequently, no bank can add any hidden transfer fees along the way, which often can amount to as much as 5% of a transfer.

Wise, instead, charges a small percentage as a transaction fee, and you’ll know what you’re spending upfront. In some instances, you may find Wise is 8x cheaper for making foreign transfers.

👉 Read our Wise review.

What is Revolut?

Revolut‘s a mobile banking app that claims to handle ‘all things money.’ It's one of the major contenders in digital and mobile banking today. In fact, Revolut is the United Kingdom’s fastest-growing financial app.

Founded in Britain back in 2015, initially, they focused on money transfer and exchange. It's focused on the European market, but most of its services are also available in the US.

So it's safe to say Revolut is well on its way to becoming a truly global financial app.

Fast forward to 2021, Revolut now boasts over five million personal customers and 500k business customers in over 35 countries.

Gone are the days where Revolut only offered money transfer and exchange services. Instead, the overall financial health of its customers is now their primary concern.

Revolut grants plenty of control over your finances with its intuitive app and financial management features.

But, as you’ll come to see, this sets Revolut apart from Wise. It doesn't matter whether you want to manage your finances, help your children budget, or benefit from a flexible, mobile bank account – Revolut has it all.

👉 Read our Revolut review.

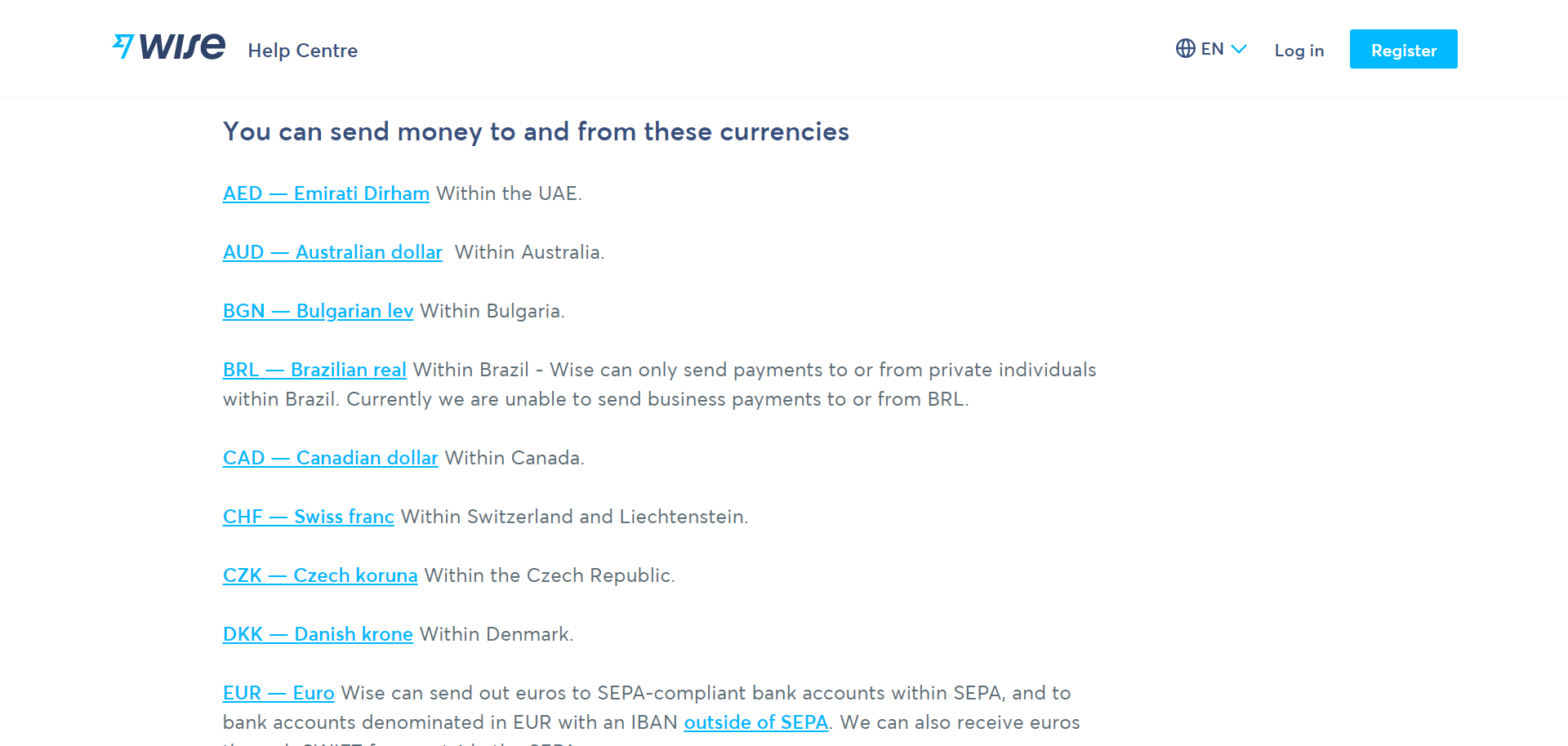

Wise vs Revolut: Currencies

If your goal is to send or receive money from abroad, you’ll want to ensure Wise, or Revolut can handle the currencies you use the most with ease.

Wise’s Currencies

With Wise, you can send and receive money from the following 24 currencies:

- AED

- AUD

- BGN

- BRL

- CAD

- CHF

- CZK

- DKK

- EUR

- GBP

- HKD

- HUF

- IDR

- INR

- JPY

- MYR

- NOK

- NZD

- PLN

- RON

- TRY

- SEK

- SGD

- USD

Didn’t see the foreign currency you're looking for? Additional to the currencies above, there are a further 29 currencies that you can send money in. However, you can't receive these currencies into your account.

For more info, you can view the complete list of available currencies here.

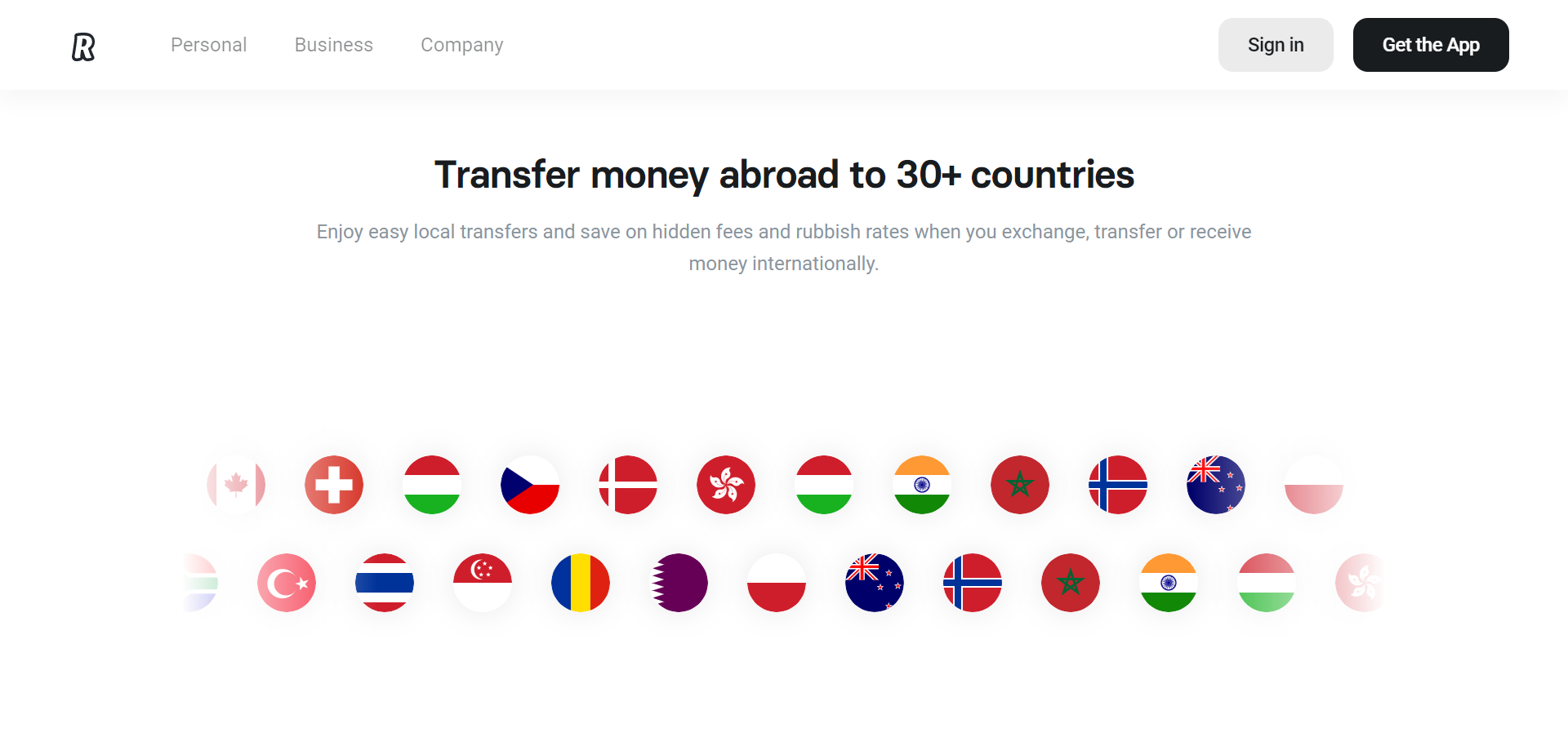

Revolut’s Currencies

Revolut’s currencies are organized a little differently – Revolut's current accounts support 28 currencies.

These are:

- AED

- AUD

- BGN

- CAD

- CHF

- CZK

- GBP

- HKD

- HRK

- ILS

- ISK

- JPY

- MAD

- MXN

- NOK

- NZD

- PLN

- QAR

- RON

- RSD

- RUB

- SAR

- SEK

- SGD

- THB

- TRY

- USD

- ZAR

Then, there are 35 currencies you can exchange money into inside the Revolut app. On top of the currencies we’ve already mentioned above, these include:

- DKK

- EUR

- HUF

- IDR

- INR

- MYR

- PHP

You can also top up your Revolut account is also possible with these 15 currencies:

- AUD

- CAD

- CHF

- CZK

- DKK

- EUR

- GBP

- HKD

- JPY

- NOK

- PLN

- RON

- SEK

- USD

- ZAR

Wise vs Revolut: Features and Services

As we've already hinted at, the range of features offered by Wise and Revolut is where their services differ the most.

So let’s take a look:

Wise’s Services

Wise keeps things simple and focuses on doing what it does best: International money transfers. As this implies, its key features revolve around sending and receiving money.

Its features are best separated into personal and business.

Personal Users

Personal users can make one-off payments at the real exchange rate with Wise’s small, transparent fees. You can send large or small amounts in the currencies discussed above.

Wise also enables you to track your money while it's in transit, so you can keep the recipient updated with its progress.

Personal account holders can also set up recurring payments like direct debits for bills, rent, etc. You can also hold multiple currencies, making it easy to manage international funds wherever you are.

Business Users

Business users enjoy a few extra features. For example, they can use Wise to pay invoices locally or abroad and set up mass payments for up to 1,000 international recipients at once.

Then, just upload a spreadsheet with the necessary invoice and currency info, and Wise will do the rest.

You can sign team members up to your Wise account so they can take expenses directly from your business account. You can also manage cash flow better by:

- Filtering transactions by team member

- Downloading statements

- Setting spending limits

The business account also comes with API access, so your development team can dig into the code and set up automated workflows.

That’s it!

There are no bells and whistles, just simple multi-currency accounts that make it easier and cheaper to send money abroad.

Revolut’s Services

Revolut has a lot more to offer if you’re looking for a feature-rich alternative to traditional banking. First of all, let’s talk about the features that closest match Wise’s.

Send and Receive Money

Revolut makes it simple to send and request money for free with just the tap of a button. This makes bill-splitting with friends and family a breeze. You can also send reminders if you haven’t been paid for something yet. Like any banking service, you can, of course, also send money to specified bank accounts.

Revolut also grants free transfers so that you can send money abroad in over 30 currencies. The process is instant between Europe, The US, Singapore, Japan, Australia, and more.

International and local business transfers are also possible with Revolut’s business accounts.

And like Wise, you can add team members, review their payments and transfers, set spending limits, and create approval rules and workflows.

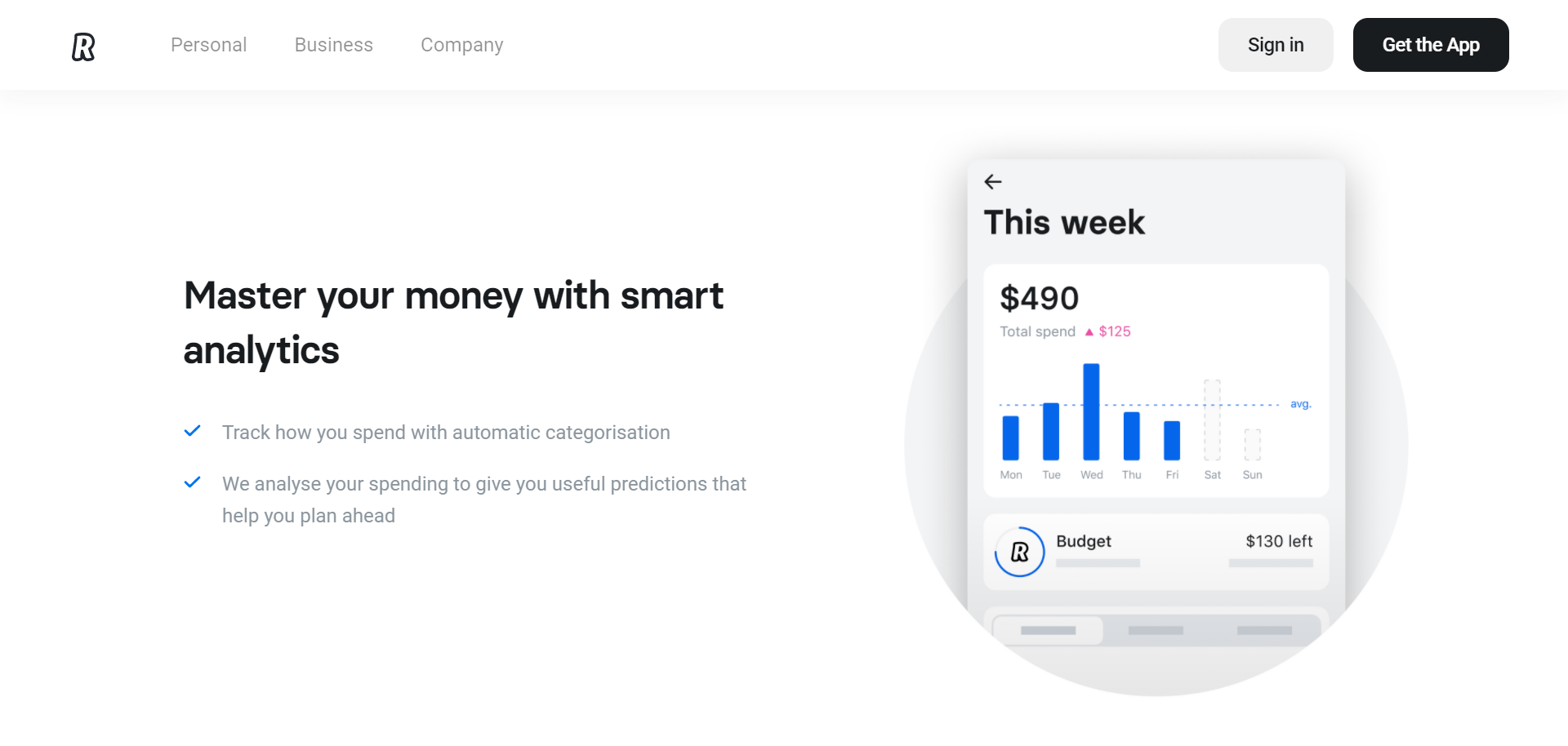

Budgeting and Analytics

Where Revolut goes much further than Wise is with its actual app for managing money. Account-holders can set monthly budgets across specific categories, like restaurants and groceries.

This takes seconds, and you’ll be notified if you're close to overspending.

Revolut automatically categorizes your transactions so you can quickly analyze where you're spending the most money and where you might be able to save.

You can even create custom categories and retrospectively add past transactions to these groups.

You can also establish saving goals for each month. Revolut will even calculate a daily spending limit to help you hit your target. Revolut's great for budgeting, not just for you but also for your family.

All accounts come with access to at least one Revolut Junior account for children between 12 to 17, so you can help them learn how to spend and save responsibly.

The junior plans come with all the budgeting and financial tracking features mentioned above and even a physical card for them to use. In addition, you’ll receive instant spending alerts when your kids make a payment and can set custom controls for their spending, including hard spending limits.

Junior cards also can’t be used with age-restricted merchants.

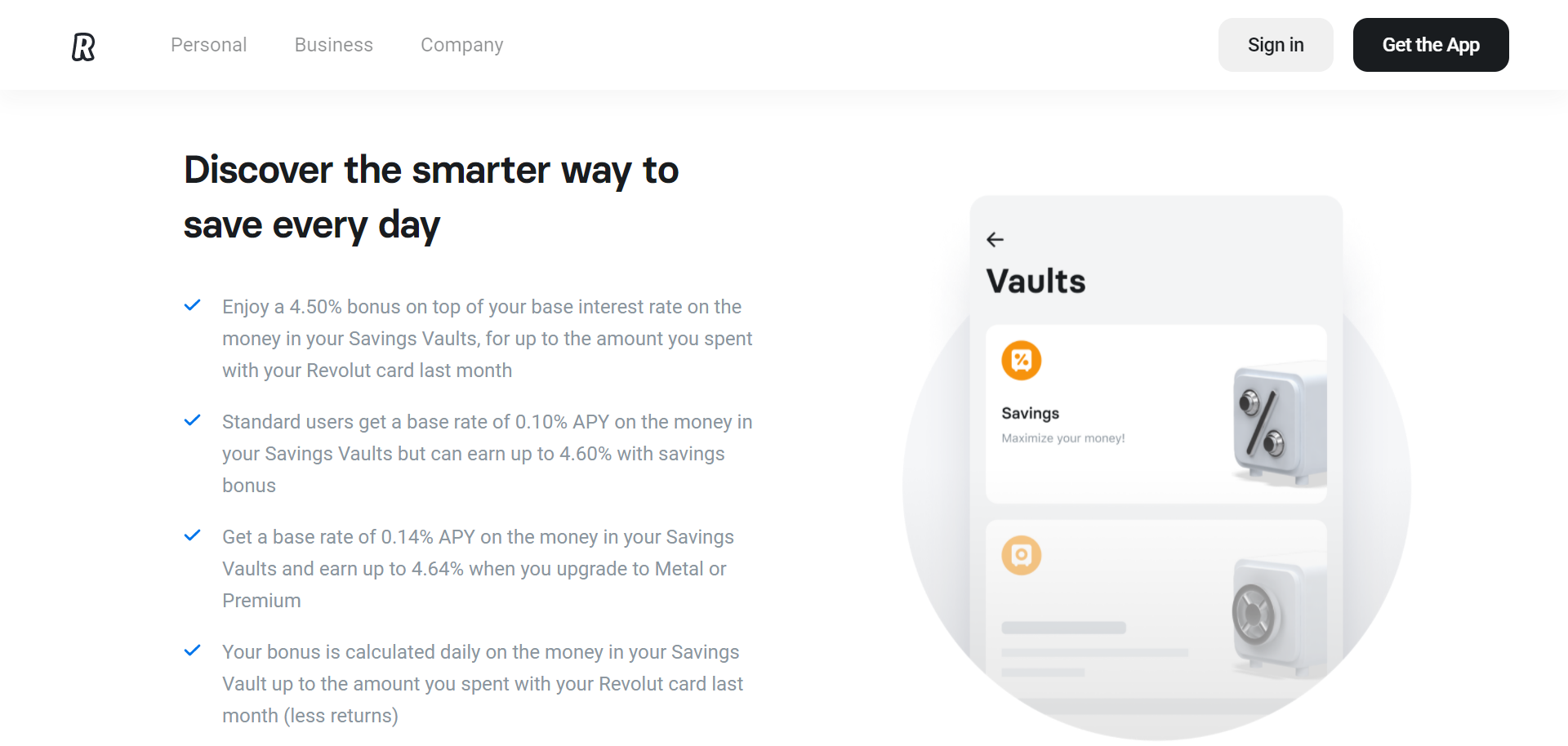

Saving Vaults

Unlike Wise, Revolut allows you to earn interest on your savings. Each pricing plan comes with tailored interest rates. All you have to do is stick your savings into a ‘vault,' and you'll earn up to 0.14% annual percentage yield.

You could also earn a bonus of 4.5% on top of your base interest (up to the amount you spend with your Revolut card). In addition, there are no withdrawal limits on saving accounts. You can withdraw instantly and at any time.

You can easily create saving vaults for specific saving goals in different currencies.

This keeps your funds separate from your main account to help you get a clear overview of what money is available for you to spend without touching your savings.

And to help you fill your vaults, Revolut enables you to round up spare change from card payments to deposit it into your savings. You can even create group vaults to save for shared goals, like holidays or your dream home.

Of course, vaults also come with some of the standard account features—for instance, the ability to set goals and deadlines for your savings.

Business Features

Finally, Revolut business users get access to a few additional features that help them manage their money.

For example, you can easily track subscriptions and see where you’re regularly spending.

In addition, you can review all subscriptions and regular spendings in one view for online services like business software and online ads.

You can pause or cancel redundant subscriptions directly through the app and set limits on your recurring payments. This will notify you if a provider tries to charge you more than your limit.

You’ll also be notified if you don’t have enough money in your account to cover scheduled payments.

The business account also helps you track expenses. You can track spending with company cards and keep all categorized transactions digitally as receipts.

Account-holders can tailor their team member’s access and spending limits for each card and sync these expenses and other transactions with Xero. Alternatively, you can export a spreadsheet to use with your favorite accounting tool.

Wise vs Revolut: Plans and Pricing

When it comes to accounts and pricing, Wise and Revolut take two drastically different approaches.

That’s because Revolut offers far more in terms of banking and financial management features. In contrast, Wise makes it cheap and easy to open an account and benefit from a card that holds multiple currencies.

Let’s take a look:

Wise’s Plans and Pricing

Although accounts and plans aren't as intrinsic to Wise’s setup as Revolut, Wise offers a multi-currency account.

This allows you to store your money in different currencies and simplifies transfers via your account. Both personal and business accounts are available.

The Wise card is available in over 200 countries and unlocks several benefits.

But as for the actual pricing, Wise’s personal accounts are free. You’re only charged for the account if you hold more than 15,000 euros in your balance. If you exceed this limit, a 0.40% annual charge applies.

If you want a Wise debit card, you can order one for $9 or a replacement card for $5. With that card, all ATM withdrawals over $100 per month cost 2%. You’re also charged $1.50 per withdrawal after your second ATM withdrawal that month.

Receiving money into your account is free for all major currencies. However, wire transfers in USD come with a $7.50 fee.

But, you can send money for free via direct debit in GBP, EUR, AUD, and USD. For any other currency or payment method, a charge applies. This varies by currency and can be calculated on Wise's website.

If you want to use Wise for Business, you can set up a business account for a one-time $31 fee. This unlocks all the bank details you need to do business internationally. For instance, you’ll receive an IBAN, routing number, sort code, and more.

You’ll also be able to receive overseas payments into your account without high recipient or currency conversion fees. In addition, you'll be able to easily send and receive money at a scale in over 70 countries.

Revolut’s Plans and Pricing

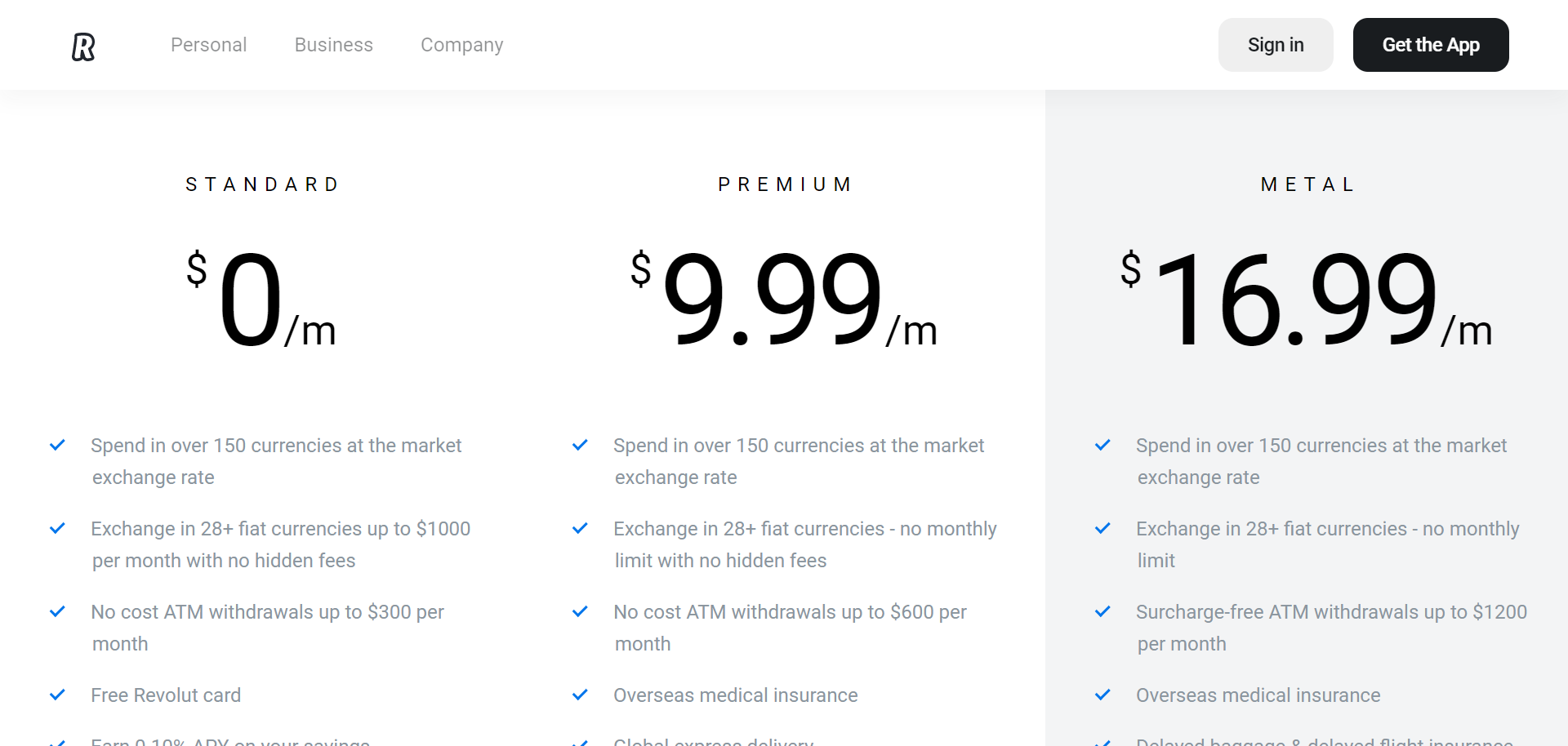

In contrast to Wise, Revolut has several plans (both free and with monthly fees) available for personal and business use:

Personal Plans

Let’s start with Revolut’s free standard plan.

There's no monthly cost associated with this account. You can spend money in over 150 currencies at the market exchange rate. You’re can also exchange over 29 currencies up to $1000 per month, with no hidden fees. Plus, you don’t have to pay for ATM withdrawals up to $300 per month!

In addition, you’ll receive a free Revolut card where you can earn up to 0.10% APY on your savings. On the standard plan, you also benefit from a Revolut junior account for one kid.

The standard plan comes with all of Revolut's core features for budgeting and saving money abroad. For instance, you'll receive instant payment notifications; you can round up card payments to work towards saving goals and more.

Creating the account only takes minutes, and once you're up and running, you can start managing your finances straight away.

Next, there's the Premium account. This will set you back $9.99 a month. Here, your monthly ATM limit increases to $600 per month, and you’ll benefit from extra features like:

- Overseas medical insurance

- Global express delivery for your card

- Priority customer support

- A premium card with exclusive designs

- Disposable virtual cards for better online security

- Revolut junior accounts for up to two kids

On the Premium plan, you'll earn 0.14% APY on savings, and you'll enjoy one fee-free international transfer per month!

Lastly, the Metal Plan costs $16.99 per month. It further lifts the ATM withdrawal limit to $1,200 per month. In addition, you’ll receive a premium Revolut metal card.

Other benefits include delayed baggage and delayed flight insurance. You'll also receive free lounge passes for you and up to three friends if your flight's delayed by over an hour.

Additionally, you get up to five Revolut Junior accounts and three fee-free SWIFT transfers each month.

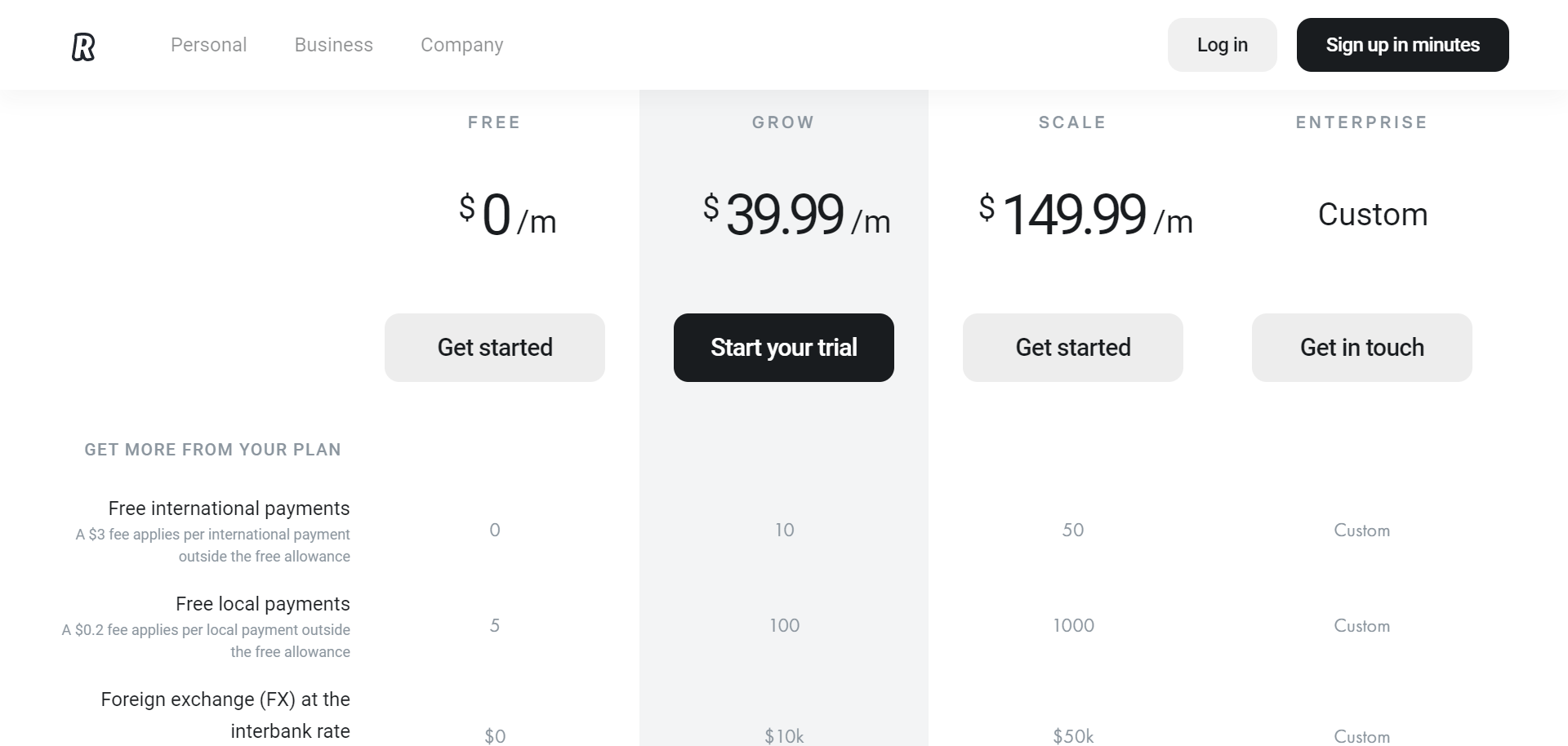

Business Plans

Revolut also offers four different business plans, which give you more control over your team members. You'll also benefit from free local and international payments and features to help manage your expenses – to name a few!

Once again, we'll start with the Free Plan. This package is limited – it doesn’t come with any free international payments, and you can only make five free local payments. (Otherwise, a £0.20 fee applies per local payment.) You also don’t have an allowance for foreign exchange at the interbank rate – each exchange is subject to a 0.4% markup.

You can register ten team members on the free plan, but you can’t manage their account permissions or expenses. You can make free payments to other Revolut accounts, hold over 28 currencies, carry GBP and USD in your account, and create virtual company cards.

You can also manage subscriptions and recurring payments in your account and connect your everyday apps and accounting software.

Many more features and benefits are unlocked with the Grow Plan for $39.99 per month. For example, you’ll now get ten free international payments, a foreign exchange allowance of $10k, and 100 free local payments. You’ll also receive priority 24/7 support via live chat.

The Grow plan empowers you to manage your team’s expenses and account permissions. You can register 30 members and protect yourself from administrative errors by setting up approval workflows. In addition, you can set up bulk payments.

Revolut is constantly growing, and in the future, this account will also unlock local accounts in more currencies and payroll features. So, watch this space!

The Scale plan costs $149.99 per month.

This further increases your allowances – more specifically, you can make 50 free international payments, 1,000 free local payments, and you'll benefit from a foreign exchange allowance of $50k. You can also register 100 team members.

If none of these plans suit your business size, you can opt into a custom business account with bespoke pricing for a program that meets your unique needs.

Please note: Registering additional team members (on any plan) will cost you $5 per month.

Wise vs Revolut: Customer Service

Money is a sensitive matter, and if anything goes wrong with a transfer or your account, you'll need to rely on a good customer service team for help.

So let’s take a look at how Wise and Revolut can help out if you run into an issue:

Wise’s Customer Service

Wise offers an online help center. Here you'll find the answers to frequently asked questions and guides on sending money, editing and canceling transfers, managing your account, the Wise card, and much more.

If you want to contact Wise’s customer support team, you'll need to log into your account. You can contact support reps via:

- Phone

- Facebook Messenger

Their support center operates Monday-Friday, 8 AM to 8 PM UTC.

Revolut’s Customer Service

Revolut also offers extensive self-help documentation on its website. Here you can review info on all its available features and find answers to common questions.

If you want to receive personalized support, you can get in touch via in-app live chat.

The speed at which you'll hear back hinges on your chosen plan. Phone support is, unfortunately, not available.

Wise vs Revolut: Pros and Cons

Nothing beats a quick and straightforward pros and cons comparison to highlight where these services really shine.

So let’s take a look:

Wise’s Pros:

- You'll get access to low-cost, transparent fees and exchange rates with real-time online calculations. You can quickly review how much a transfer would cost you and how much you’ll save, and then decide whether to go ahead with the transaction.

- Wise is 19x cheaper than PayPal for money transfers and often up to 8x cheaper than conventional banks. As a result, it's one of the most affordable options for money transfer currently on the market.

- Wise comes with an open API to enable you to create custom integrations.

- It’s intuitive and easy to use.

- Wise is suited to individuals and sole traders who want to send smaller amounts of money each month.

Wise’s Cons:

- Wise doesn’t offer a great range of native integrations. For example, it only integrates with accounting software Xero, QuickBooks, and FreeAgent.

- You don’t get access to a great many additional services. Its prime function is to send money abroad and receive money quickly. This means it falls flat on many of the features Revolut offers, like budgeting tools, bill splitting, setting financial goals, etc.

- For many countries, Wise isn’t the fastest way to transfer money. (although it also isn’t slower than any bank.)

Revolut’s Pros:

- You can create junior accounts with your primary plan. This works wonders for helping your children establish healthy financial habits.

- Revolut provides free withdrawals abroad up the withdrawal limit on your account. After that, all foreign withdrawals are charged 2%.

- Revolut boasts a decent Trustpilot score: 4.3 out of 5-stars (at the time of writing)

- You can apply for a credit card, with flexible credit up to twice your monthly salary (up to €6,000)

- You can earn interest on your savings.

- Revolut comes with both a web and mobile app for banking, which gives you plenty of flexibility.

- International transfers don’t incur extra charges.

- Revolut comes with a range of helpful budgeting features to help you get more from your money.

Revolut’s Cons:

- You’re charged a shipping fee to receive your card unless you've subscribed to a Premium or Metal account.

- While Revolut has an EU banking license, issued in 2018, they don’t offer the same financial security as services with an FSCS deposit guarantee. For that same reason, they can't deal in cash or cheques.

- There's no phone support available with any of Revolut’s plans.

- While you can send international payments for free, there's a monthly limit on how much you can send. This makes Revolut less flexible than Wise if you want to send larger sums.

Wise vs Revolut: When Might Their Services Be Right for You?

Now we've taken an in-depth look at both Wise and Revolut. There's no denying that both have their ups and downsides and are, ultimately, credible and helpful banking solutions.

Which (if either) of these two financial services is suitable for you depends on your situation.

But, in this section, we’ll shed some light on when it's better to use Wise or Revolut:

When to Use Wise

While Wise offers you a card that holds multiple currencies and an easily manageable online account, it doesn’t provide any of the advanced banking features that Revolut does.

Accordingly, it’s best to use Wise for what it was designed for – sending and receiving money abroad.

A Wise account is free, and even requesting a card won’t set you back much.

In short, Wise is an invaluable service if you anticipate frequently sending payments abroad, and might be right for you if:

- You've moved abroad and getting paid there but want to convert your income back into your original currency.

- You want to send money to friends, family, and service providers abroad

- You want to make the most of your savings in another currency when spending lots of money in another country, like buying property, paying rent, etc.

- You want to do the majority of banking using a different app and only use Wise for its money transfer services.

- You have a good grip on your finances and don’t need lots of budgeting features.

- You only occasionally send money abroad, including large sums over $1,000

When to Use Revolut

Revolut is a solution for all of your financial needs and provides in-depth banking features. Its tools might help you and your family create better financial habits.

With the many budgets, bill-splitting, and saving features, you can easily manage your money. On top of this, Revolut provides an excellent account for travel purposes.

You can withdraw cash for free abroad, make cheaper international payments than most traditional banks allow, and, depending on your chosen plan, benefit from extra travel features.

Choose Revolut if:

- You need a mobile banking account to budget your money, grow your savings, and control your spending habits.

- You’re a business and want to arrange bulk payments and manage team members.

- You travel frequently and need a card and account that entitles you to extra travel perks. For instance, overseas medical insurance and airport lounge passes.

- You're looking for a family-friendly account that can help you support your children’s financial futures as well.

- You live abroad or have loved ones abroad and want to send money there up to ten times cheaper than regular banks.

Wise vs Revolut: Our Final Verdict

So, there you have it, our Wise vs Revolut review! While both Wise and Revolut might have started as money transfer services, they've since found their own niches.

For simply sending money abroad, Wise remains the most popular choice. It still offers the best rates online, especially if you want to send large sums whenever it suits you without a spending limit.

In contrast, Revolut is excellent as a general travel account for its ability to hold multiple currencies. Its accounts also come with various features to make it easier to budget and save and track your spendings.

In short, Revolut is a feature-rich mobile banking service. It even allows you to earn some interest in your savings.

We hope this Wise vs Revolut review has helped you figure out which of these services might be right for you. Or are you considering a different platform like Sepa? Either way, let us know in the comments below if you’ve had any experiences sending money with either solution. We'd love to hear from you!

Hi I was wondering which bank is better for receiving montly payments of around 6000USD. Could you advise which bank is more favorable if you are living in the UK?

Thanks for the in-depth comparison. I am using wise, but recently cancelled a transaction before completion. My bank charged twice and 16 days later I’ve only gotten one returned amount of money.

Otherwise, I have enjoyed Wise…no pun intended.

👍