PayStubCreator is a web-based pay stub generator designed by a professional U.S. accounting firm. It helps users quickly create accurate, legally compliant pay stubs and W-2 forms online — no subscriptions, no software installs, and no hidden fees. Whether you're an employer, freelancer, or independent contractor, PayStubCreator makes it easy to generate digital payroll documents in minutes.

In this review, I’ll break down PayStubCreator’s features, pricing, pros and cons, and key benefits to help you decide whether it’s the right tool for your payroll and income documentation needs.

Unlike many generic or fake stub creators found online, PayStubCreator prioritizes compliance and accuracy. It’s designed to meet IRS and state-level requirements, and it automatically calculates earnings, taxes, and deductions using up-to-date tax logic. This makes it a safer and more reliable option for businesses and individuals who need real documentation for taxes, loans, or employment purposes.

From straightforward pricing to fast downloads and a simple user interface, PayStubCreator offers an accessible and secure way to generate critical income paperwork. Below, you’ll find an in-depth look at everything you need to know before using the platform.

Key Takeaways 🔍

- Built by certified U.S. accountants to ensure IRS compliance

- Offers fast, accurate pay stub and W-2 form creation

- Pricing is $8.99 per stub and $14.95 per W-2 form

- No subscriptions, logins, or downloads required

- Not ideal for bulk orders (no volume discounts)

- No free trial available

Is PayStubCreator Legit?

Yes — PayStubCreator is a legitimate and professional-grade solution, built to solve a serious problem: the widespread use of fake or error-prone pay stub generators online. Here's a closer look at why it stands out in the market.

Developed by Real Accountants

Many free or low-cost pay stub tools on the internet are thrown together by developers with no financial background. This leads to common issues like miscalculations, outdated tax formulas, and even spelling errors that can flag your documents as fraudulent.

In contrast, PayStubCreator was developed by a professional American accounting firm with experience in payroll, tax, and compliance. This gives it a clear advantage in accuracy, reliability, and legal compliance. The backend is built to reflect the most recent tax laws, deduction categories, and wage codes used in the United States.

Complies with State and Federal Guidelines

One of the biggest risks of using generic or fake pay stub tools is generating documents that don’t meet your state’s labor laws or federal requirements. This can lead to penalties or legal issues, especially if you're using the stubs as proof of income for a loan, lease, or tax filing.

PayStubCreator handles these issues by:

- Auto-calculating taxes and deductions based on U.S. law

- Supporting federal and state-level requirements

- Using proper payroll terminology and abbreviations

- Offering clear documentation that can be verified

It’s also built to avoid the red flags that many banks and lenders look for when verifying income documents, such as unrealistic formatting, inconsistent math, or missing tax fields.

Secure, Instant, and No Recurring Fees

Security is another strength. Everything is web-based and encrypted, so you don’t need to download anything to your device. You input your data, the system calculates everything in real-time, and you instantly receive a downloadable PDF via email.

Key benefits of this process include:

- No subscriptions or accounts needed

- One-time payments: $8.99 for a pay stub, $14.95 for a W-2

- Immediate email delivery

- No recurring charges or upsells

Here’s a quick breakdown:

| Document Type | Price | Delivery | Format |

|---|---|---|---|

| Pay Stub | $8.99 | Instant Email | |

| W-2 Form | $14.95 | Instant Email |

This makes PayStubCreator a solid option for people who only need occasional access to accurate, printable payroll documents without paying for expensive payroll software.

What is PayStubCreator?

PayStubCreator is a web-based pay stub and W-2 form generator developed by professional accountants to ensure error-free calculations and quick delivery. The solution aims to help its users both create and track their pay stubs online as well as seamlessly generate W-2 forms in minutes. It also eliminates the theft margin as it is a lot more secure than receiving pay stubs by mail.

It's also important to note that this service does not require subscriptions or software downloads. It functions completely on the web. PayStubCreator also does not include additional hidden fees.

PayStubCreator Pricing

PayStubCreator offers an enterprise pricing package, which costs $8.99 per stub. And $14.95 per W-2 form.

Pros and Cons

Let's have a look at some of the pros and cons of this solution.

Pros

- The solution is completely automated from calculations to emailing.

- It is very easy to use without prior knowledge of such services.

- Allows you to create pay stubs and income proof documents in line with the legal rules and regulations of your state and the nation.

Cons

- This service does not offer a free trial.

- Pricing is per stub or form and they don't offer bulk discounts. This means that the more stubs or forms you have to create the more expensive the service gets.

Ease of Use

Using PayStubCreator is pretty stress-free and straightforward. All you need to do is include the required information about the employer, employee, salary, and pay window. Then PayStubCreator will automatically carry out the necessary calculations right away and in a matter of seconds, you'll have your pay stub all set for download and print.

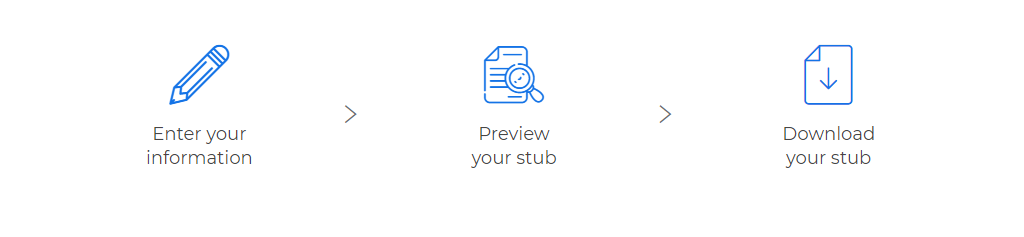

The solution works in three simple steps:

- Input necessary information

- Preview created stub

- Download generated stub

This goes for the W-2 form as well. All you need to do is fill in your information, submit it, download it, and then print.

PayStubCreator Features

Let’s have a look at the major features of this solution:

Easy and Quick W-2 Form Creation

Every business owner knows the complexities of generating W-2 forms. You must send in state and federal taxes from your staffs' incomes throughout the whole year. And during tax season you need to fit all of this data into 4 W-2 forms – 3 for your employee with 2 of the 3 attached to their folders and 1 (which makes up the 4) sent to the internal revenue service (IRS).

That's a lot of work. But with the PayStubCreator solution, you just need a couple of minutes to generate a W-2 form, have it sent to you by email, download it, and then print it immediately. The only thing you have to do is input the correct values including the employee and company data as well as the wage details, And PayStubCreator will carry out the calculations for you.

So, this feature saves you the time and struggle of manually calculating the wages of your employees or your wages. Rather it simply gives you access to generated forms instantly through email.

This feature also comes with support to help you through the process.

PayStub Generator

The paystub generator feature of the PayStubCreator solution permits employers, business owners, freelancers, and independent contractors to generate and track paychecks or pay stubs securely online.

This feature can be utilized for various purposes and scenarios. Users of the service can use it when paying remote or in-house employees, providing proof of income for rental loans, calculating and filing tax returns, or even when claiming disability benefits.

This feature is entirely automatic for deductions and calculations and only requires your input of data. You can use this for filing state and federal taxes, retirement contributions, wage fees, and insurance deductions. You can even create pay stubs that are compliant with statutory, labor, IRS, and legal requirements and regulations.

That said, let's see a summary of the primary features:

- Pay Stub Acronyms

- Digital Paychecks

- Instant Download and Print

- W-2 Form Tax Filing

- Accurate Calculations

- Deduction Codes

- Automated Emailing

- Pay Stub Generation

- Verification

- Proof of Income Document

Who is PayStubCreator Best For?

If you're trying to decide if PayStubCreator is the right pick for you, this section of the PayStubCreator review will help.

People Searching for A Safe and Contemporary Way to Generate Pay Stubs

PayStubCreator offers business owners, individuals, and companies a safe and convenient way to create pay stubs on the web. For example businesses, individuals and companies can use PayStubCreator to remunerate employees via direct deposits.

So rather than going to a physical bank to deposit checks for cash or mailing paper checks, users of the service can generate electronic paychecks and send forms straight to employees' accounts. This eliminates the possibility of stolen, lost, or misplaced checks or cash.

People Searching for A Seamless Way of Generating Tax Forms and Proof of Income Documents

This is an easy option to use when you have to create and submit proof of income documents, which is usually required by real estate agents, landlords, lenders, and banks. This occurs when you are applying for cash loans or intend to rent a house, apartment, or condo. PayStubCreator allows you to create online pay stubs for such purposes.

Reporting and calculating paid and owed taxes as well as receiving tax refunds is made easier by the solution as the PayStubCreator provides the taxes paid by users and the earnings received.

Employees, Employers, or Businesses Who Need to Generate Authentic Pay Stubs

PayStubCreator allows users to generate authentic pay stubs. With this service, you can instantly verify that all the details and information displayed in your pay stubs are accurate and true. It also allows you to use the deduction codes and appropriate abbreviations in the pay stubs.

The service also makes it easy to automatically calculate insurance, retirement gross earnings, withheld taxes, wage fees, and 401(k) deductions.

So if you need a way to ensure that your pay stubs are free of spelling and calculation errors and that you maintain accurate records and data by state and federal regulations and requirements then PayStubsCreator is a great option.

PayStubCreator Review: Conclusion

PayStubCreator has a great service for people who want to create authentic pay stubs automatedly that align with the government's rules and regulations. However, it does get a bit pricey due to its charge per stub and nil wholesale package. So if you have to create a lot of stubs you can expect this to eat way into your budget.

The Verdict: PayStubsCreator is an excellent choice for people searching for an automated and web-based way to generate pay stubs, tax files, and proof of income documents seamlessly.

Comments 0 Responses