If you're scouring the web for a thorough N26 review, you're in the right place. Here, we're breaking down everything you need to know about this financial platform.

There's lots to explore, so let's dive into the nitty-gritty of this review…

What is N26?

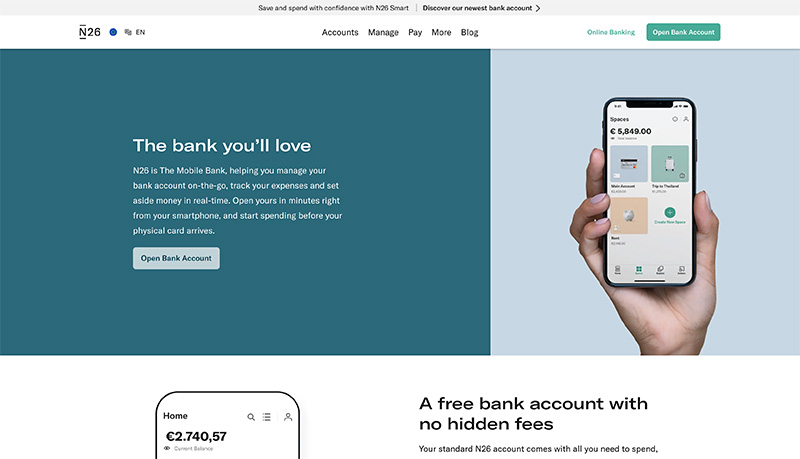

In short, N26 is a pioneer of modern banking. This entirely web-based, fully-licensed European bank provides everything you need to spend, save, and manage your money from the convenience of a smartphone app.

N26 users enjoy all the typical banking features, regulations, customer service, and security offered by regular banks. However, instead of going to an in-person branch or having to sign in to your online banking account via a desktop, you can access these benefits via N26's lightweight mobile app.

This is N26's story:

Founded in 2013 by Valentin Stalf and Maximilian Tayenthal, N26 was born to make banking more manageable and transparent. In 2015 N26 launched their first-ever products, including their free account and N26 Mastercards in Germany and Austria.

In 2016, N26 secured its European banking license from the European Central Bank. The following year, N26 introduced their metal card (more on this in a sec!).

Fast forward to 2020, and N26 surpassed over five million customers across 25 countries and boasted a team of more than 1,500 workers. To date, N26 has offices based in Berlin, New York, Barcelona, Vienna, and São Paulo.

As you can see, N26's growth is nothing short of impressive, and for a good reason…

How Does N26 Work?

N26 users are issued a MasterCard that can be topped up and used to transfer money and withdraw cash at ATMs around the world. N26 is available for those residing in:

- Germany

- The United States

- Ireland

- Austria

- Spain

- France

- Italy

- Belgium

- The Netherlands

- Finland

- Luxembourg

- Portugal

- Slovenia

- Greece

- Estonia

- Slovakia

- Poland

- Denmark

- Sweden

- Liechtenstein

- Iceland

- Norway

N26 has partnered with tons of reputable financial companies, including TransferWise (for low foreign exchange rates), Auxmoney (for credit), and Allianz and Clark (for insurance).

These strategic partnerships ensure access to all the services you would expect from a traditional bank account, including:

- Access to an international debit card (with free euro withdrawals from ATMs).

- Check your account balance via that N26 app.

- You can send bank transfers using 19 different currencies via the N26 app (for free!)

- You can exchange currencies at mid-market rates.

- Your N26 card facilitates contactless payments at in-person stores.

- You can save your payment details within the N26 app; this enables you to make payments without your card to hand.

- You can link your regular bank account to your N26 account so that you can charge your standard bank (instead of N26) whenever you want.

The Pros and Cons of N26

Let's start with the perks:

The Pros 👍

- It's great if you're operating within the global economy (mostly Europe, USA)

- You get access to an intuitive and convenient mobile app. From here, you can handle all your banking needs.

- It's free to create an account.

- You can activate an overdraft within minutes from your phone, with no penalty fees and full transparency as to the conditions of your overdraft.

- N26's fees are pretty low

- You benefit from 0% withdrawal fees. You can make up to three free ATM withdraws per month anywhere worldwide (with the free account). With N26's premium accounts, you can make more withdrawals for free! Once you've hit that threshold, you're charged €2 per withdrawal, which is incredibly competitive when you consider that most German banks charge between €5-7 to use another bank's ATM.

- N26's foreign currency exchange fees are very competitive, as you're not charged currency conversion fees. You just pay the real exchange rate.

- The only time you're charged a fee is when you withdraw money in another currency.

- You can get your N26 account up and running within 10 minutes.

The Cons 👎

Now for the drawbacks:

- N26 unexpectantly pulled out of the UK

- At the time of writing, N26 doesn't offer credit cards. If that's something you're after, you'll have to look for an alternative service

- N26 doesn't offer 24/7 telephone support

- N26 is limited to European and US users

- Some users complain about re-verification issues.

- Roughly 6% of negative TrustPilot reviews concern users getting locked out of their accounts and having their funds frozen. This, of course, can be incredibly distressing.

- Approximately 9% of negative TrustPilot reviews concern N26's customer service, more specifically, slow card dispatch and insufficient help in the event of a blocked account.

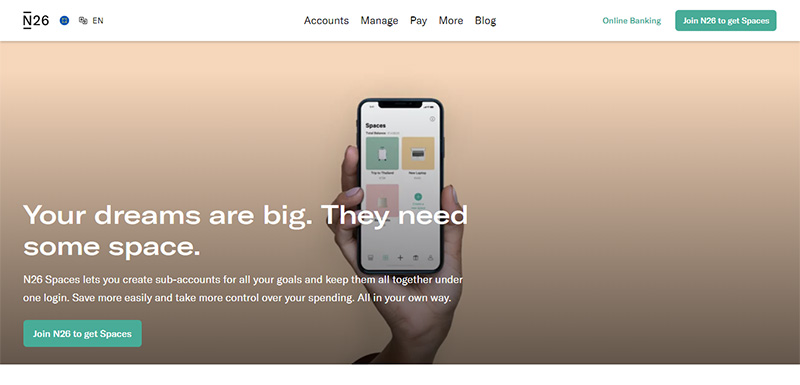

N26 Spaces

One of N26‘s neater features is its ‘Spaces' functionality. This enables you to create sub-accounts to help you achieve your financial goals. Whether you want to organize your money better or save up for something pricey, setting up a ‘Space' is an excellent way of achieving that.

You can even create rules that transfer recurring amounts from your main N26 account to one of your ‘Spaces' – a bit like a direct debit. You just need to create a rule once, and N26 handles the rest. Needless to say, this is a super-easy way of saving money and managing your finances.

You can also create ‘shared spaces.' This is a relatively new feature that enables you to share money with friends, family, coworkers, etc. With any of N26's paid-for accounts, you can invite up to ten other N26 users to a shared space. Whether you're sharing the cost of living with your significant other or saving up for a trip with your pals, a shared space could come in handy.

Budgeting with N26

You'll benefit from instant push-notifications on your smartphone. N26's app triggers these.

This ensures you know where your money's going at all times, as you'll receive a notification after every card and mobile payment, ATM withdrawal, direct debit, and bank transfer.

To help you budget, you can also:

- Set daily spending limits

- Lock or unlock your card

- Reset your PIN

You can handle any of these tasks at any time, from anywhere, via the N26 app. This functionality is terrific for giving you a greater sense of control over your spending habits.

On top of that, N26 also compiles stats on your spending. These are displayed so that you can get a feel for where your money's going with just a glance of your smartphone. Knowledge is power. It really helps to see where the majority of your money's going, so if necessary, you can reevaluate your spending patterns.

An N26 Review: N26 Perks

With N26, you'll enjoy exciting offers from their partner brands. To access these perks, head to your N26 app. Then tap the ‘Explore' tab, followed by ‘Discounts.' From there, you can explore the deals and offers available to you. You should also be able to see the instructions you need to follow to redeem the offer.

Here are just a few of N26's partners that you can expect to receive offers from:

- YOOX

- GetYourGuide

- Hotels.com

- TIDAL

- Soneva

- HelloFresh

- Booking.com

- Headspace

- Lime

- Babbel

- Skillyoga

- Blinkist

- adidas

- Fiverr

- Udemy

- 8fit

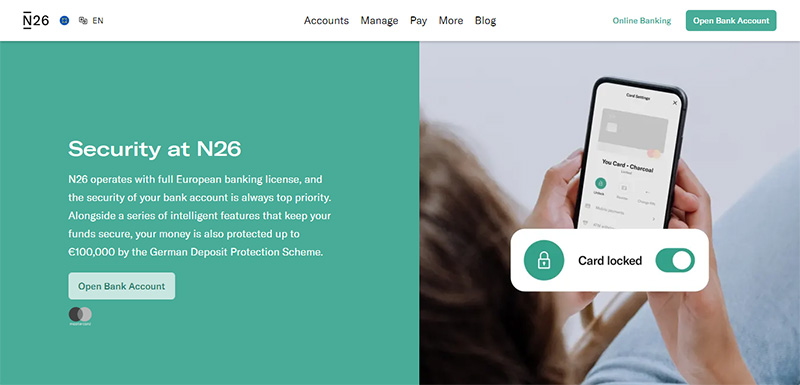

How Safe is N26?

N26 is very safe to use. Period.

It's a regulated German bank, and as such, it's afforded the typical safeguards associated with official banking institutions. On top of that, N26 utilizes several measures to ensure your account's safety and security. For instance, N26 provides you with full control over resetting your pin, locking your card, and you can disable foreign and online payments within seconds. Just head to the N26 app to handle these tasks.

Mastercard SecureCode also provides users an additional layer of fraud prevention. Plus, you benefit from fingerprint login rather than having to type in your password. This is universally recognized as a more secure way of accessing your apps.

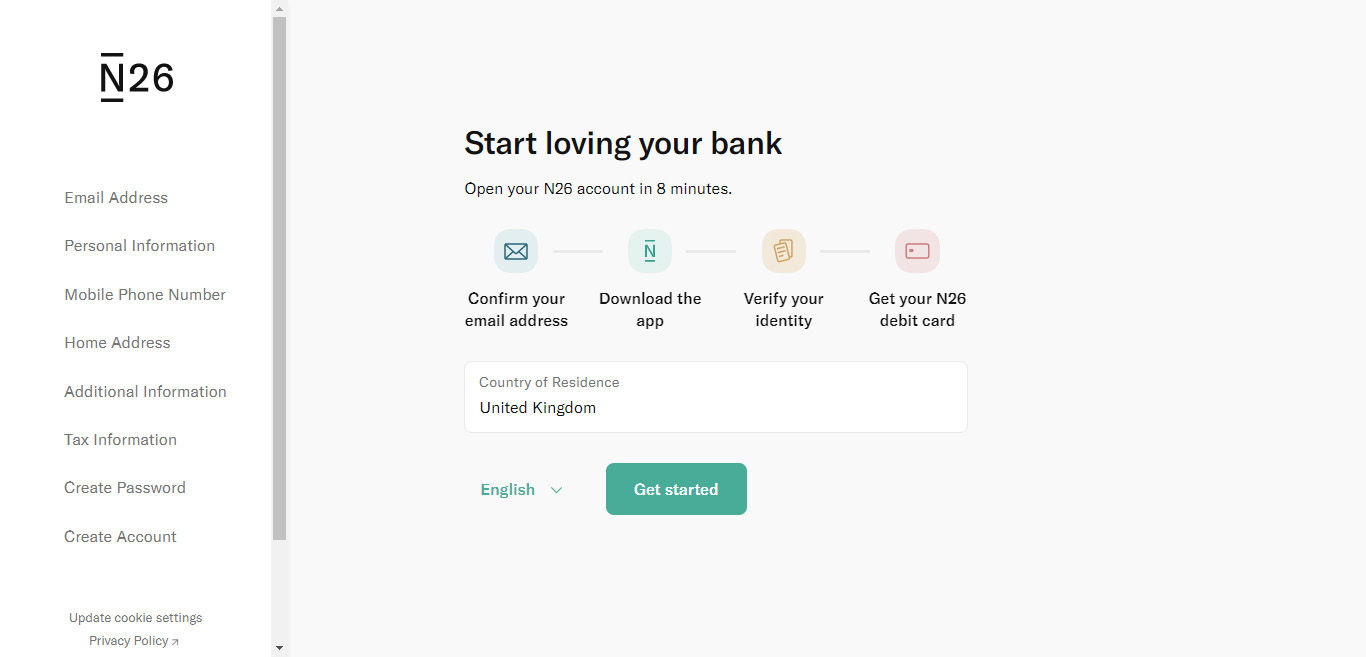

The Sign-Up Process

Signing up to N26 is easy – you can create an account within minutes!

Just:

- Provide and confirm your email address, personal details, and address.

- Pick your desired payment plan (more on this in a sec)

- Then, you'll have to prove your identity.

- Next, you're prompted to connect your smartphone to your N26 account and download the N26 app.

- Fill in the necessary details when prompted.

- Agree to the terms and conditions

- Order your card (this will take a few days to come through)

Please note that to successfully open an N26 account, you must:

- Reside in one of the countries listed above

- Be at least 18 years of age.

- Own a smartphone that's compatible with the N26 app

- Be able to provide a form of ID (the documentation required differs depending on your country of residence, so you'll need to double-check this on N26's website).

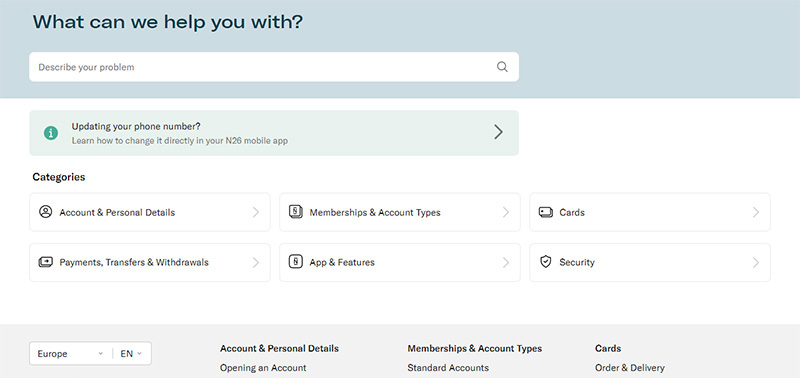

Their Customer Support

If you want to contact N26‘s customer service team, you can instigate a live chat with a customer support agent via N26's mobile or WebApp. You should be able to see your place in the queue, which is great for managing expectations. For quicker service, keep your Mastercard to hand. N26's live chat is staffed every day from 7 am to 11 pm (yes, this includes Sundays and bank holidays!)

Alternatively, if you prefer the self-help route, you can head over to N26's online Support Center. Here you'll find plenty of articles.

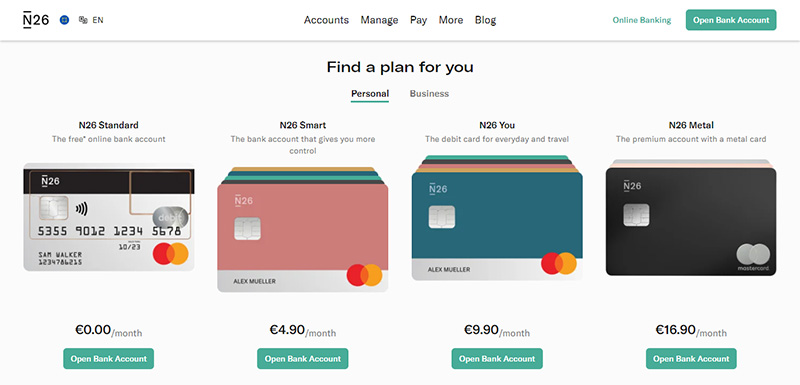

N26 Review: How Much Does N26 Cost?

Thanks to N26 being wholly online and its shrewd partnerships, N26's operating costs are minimal. This, in turn, enables them to offer more affordable rates to their customers. Although N26 operates outside of Europe, we're focusing on its European packages because this is where they excel:

N26 Standard

This is N26's free online bank account, which entitles you to a:

- Transparent Mastercard debit card

- You can use contactless payments at in-person stores.

- You can link your N26 account with Apple Pay and Google Pay.

- You can handle all your banking online, including sending and receiving transfers, setting up direct debits and standing orders, and sending instant transfers.

- You can make unlimited payments in any currency, for free.

- You can make three free ATM withdrawals per month (within the Eurozone)

- You'll get a better insight into your spending habits with N26's monthly overview. This breaks down your spending into easy-to-review categories so you can see exactly where your money is going.

- You can create up to two sub-account ‘Spaces' to better organize and save your money.

- There's a chatbot that can answer basic questions 24/7. Alternatively, you can contact N26's team via live chat inside the app.

- The German Deposit Protection Scheme protects your money (up to €100,000)

- 3D Secure (3DS) technology ensures your online payments remain secure

- You benefit from two-factor authentication (this provides an additional layer of security for keeping your money safe)

N26 Smart

For €4.90 a month, this bank account gives you more control. This could be ideal if you're looking for a debit card to handle your everyday banking needs.

You'll get everything in the N26 Standard package, plus:

- You can choose from five colors when ordering your Mastercard debit card.

- For a one-off fee, you can request an extra card.

- You can make up to five free ATM withdrawals a month (within the Eurozone)

- You can create up to ten ‘Spaces' sub-accounts to help you budget and save your money better.

- You can create shared ‘Spaces' with up to ten N26 users.

- You have the option of rounding up each card transaction to the nearest euro. The difference is automatically saved in a ‘Space' – this is a super-easy way of saving your money.

- You get access to offers and discounts with the world-class brands N26 has partnered with

- You get access to a phone number so that you can access telephone support seven days a week.

N26 You

If you're looking for an account to handle your everyday banking needs and travel, for €9.90 a month, the N26 You account could be the perfect option.

You get everything in the previous two accounts, plus:

- Unlimited free ATM withdrawals in any currency (worldwide)

- Access to medical travel insurance which coverage up to €1,000,000 for you, your partner, and family (this includes dental emergencies)

- Access to trip insurance for up to €10,000 in the event of trip cancelation or curtailment.

- Access to flight insurance. You get coverage for up to €500 if a flight's delayed for over four hours.

- Access to luggage coverage. This entitles you to up to €500 compensation for baggage delays over 12 hours. And if your belongings go missing, €2,000.

- Access to mobility insurance for car sharing, e-scooter, and e-bikes hires, for up to €20,000.

- Access to winter sports insurance, which you can claim upon in the unfortunate case of an accident during a trip to the mountains

N26 Metal

This is N26's most extensive account, and therefore it's most expensive with a monthly fee of €16.90 a month. You get everything in the previous payment plans, plus:

- You'll get an 18-gram metal Mastercard debit card (you can choose up to three metallic shades)

- You'll get up to eight free ATM withdrawals per month (within the Eurozone)

- You get access to car rental insurance (up to €20,000) when you hire a car abroad (or further away from home).

- You get phone insurance against damage and theft for up to €1,000

- You'll benefit from a selection of benefits and bespoke rewards.

- You get access to a dedicated N26 Metalline seven days a week.

N26 Review: Who's N26 Best for?

In short, N26 presents a decent solution for handling your basic banking needs. It's a fabulous online solution if you're looking for an online alternative to a traditional bank.

It takes mobile banking to the next level! Whether you're after free cash withdrawals from ATMs worldwide or international money transfers at affordable exchange rates, this online bank is handy for international travelers and standard personal users alike.

As previously discussed, if you breach one of N26's banking regulations, you could have your account locked, and your funds were frozen. This isn't uncommon with services like this. If this concerns you, we suggest limiting the funds you place in your N26 account, just to be on the safe side.

So, do you think N26 is the right banking app for you? Or do you think you'll go for one of the competing banking services like Revolut? Either way, let us know all about it in the comments box below. We look forward to hearing from you soon!

Achtung bei N26 wird man zwar mit offenen Armen Wilkommen geheißen, aber wenn man später jemanden vom Support braucht bekommt man keine Antworten mehr. Mein Konto wurde mir mittem im Urlaub gesperrt nachdem mich N26 zur Re-Identifizierung aufgefordert hat. Dieser Forderung bin ich auch gleich nachgekommen, das hat aber scheinbar nicht gereicht. Mit N26 steht man schnell mitten in Italien ohne Geld da – kann ich in Zukunft verzichten

Hello Simon, this happens with Revolut and other platforms, but it is a security measure.