Sure, you probably don't want to sell your services or products and receive a gold coin or a piece of jewelry in the mail as payment. However, that transaction wouldn't force you to pay fees to an intermediary. The benefits of online, digital transactions include immediacy, standardized and objective trading values, and a minimal currency physicality (you don't have to bring your favorite steer to the transaction).

As transactional methods have evolved, we've gained convenience but given up the free exchange of currency (and privacy if you want to get into a Bitcoin conversation).

Yes, PayPal is speedy and usable in most countries, but accepting an international payment could cost you anywhere from 3% to 8% of the transaction, sometimes more. The same goes for credit cards. The common 2.9% + .$30 fee is high enough as it is, and that's not including international payments and the complex fees when using different cards, swipers, and online payment services.

How Do You Get Rid of Those High International Transaction Fees?

The tried-and-true method for sending or receiving a payment across borders is the wire transfer. But a wire transfer is somewhat complicated, pricey, and it takes a while for international transfers.

PayPal solves many of these problems, but the fees are out of control for those international payments through PayPal. I recently looked into how my international clients pay me for services. Over the years, PayPal has been grabbing around 6%-8% of my income.

Wise, formerly TransferWise is the solution. It's not perfect, and it has a bit of a learning curve, but once you feel comfortable in the dashboard, Wise is just as easy to use as PayPal–and the fees are cut significantly.

Wise (formerly TransferWise) Uses and Benefits

- The fees for Wise are significantly lower than payment options like PayPal and Stripe.

- The platform creates a borderless account for you for accepting over 30 currencies.

- You can create banking details in other countries. For instance, a US-based business can have a EUR checking account and receive payments into that account.

- All transfers stick to the real exchange rate, as opposed to other services that add on fees or use outdated market exchange rates.

- Ecommerce companies can rapidly pay out suppliers all over the world and get paid from customers in different currencies.

- The currencies you send out or receive are automatically converted to your own currency.

- It's a great payment system for nomads or freelancers, seeing as how you don't have to worry about high fees, and you get paid in any currency.

- There's an option to leave currency in your international bank accounts. This comes in handy if you spend time in other countries or need to eventually pay contractors with that same currency. There's no need to convert the money!

- Wise integrates seamlessly with major invoicing software, and developers have access to the API to integrate with their own systems.

- Batch payments are possible to easily send out money to your workers around the globe.

- Personal payments work well on Wise as well. It's a more affordable way to transfer money to relatives in other countries or students studying abroad. PayPal and wire transfers are often far more expensive than Wise.

- Your recipient or payer doesn't need to open a Wise account to receive or send money. This is a major advantage, seeing as how most competitors require the person on the other end of the transaction to have an account, adding a significant roadblock for international business.

Business Offerings from Wise (Formerly TransferWise)

Wise isn't for everyone. If you're running an online store or freelance business in the United States, and all of your customers and clients are in the United States, you can get paid through ACH transfers, PayPal Business Payments ($0.50 transaction fee when used with certain invoicing software,) or good old checks. You also don't have to pay an international credit card or PayPal fee when working domestically.

Therefore, Wise is for online stores, contractors, freelancers, and any organization or individual tired of high fees and low transparency when it comes to international payments and currency exchange rates.

What business products and services does Wise offer?

- A multi-currency account for sending, accepting, and holding over 50 currencies.

- An option to receive free transfers with your very own local bank account details in USD, GBP, EUR, AUD, NZD, and PLN.

- A streamlined system for paying invoices to contractors abroad.

- An option to invoice your own international clients with close to no fees.

- Monthly statements to keep track of your transactions come tax time.

- An ecommerce payment platform to pay global suppliers and accept Amazon and Stripe payouts for free.

- Payment automation with help from the Wise API.

- Tools to send payments directly to individuals like family and friends without any fees or misrepresented market rates.

- An international debit card for local use in many countries.

👉 Don't forget to check out our Wise review.

How to Use Wise – Setting Up an Account

The Wise payment process will seem foreign to some people. However, it's a simple process that requires a quick, free account sign up and a few verification elements.

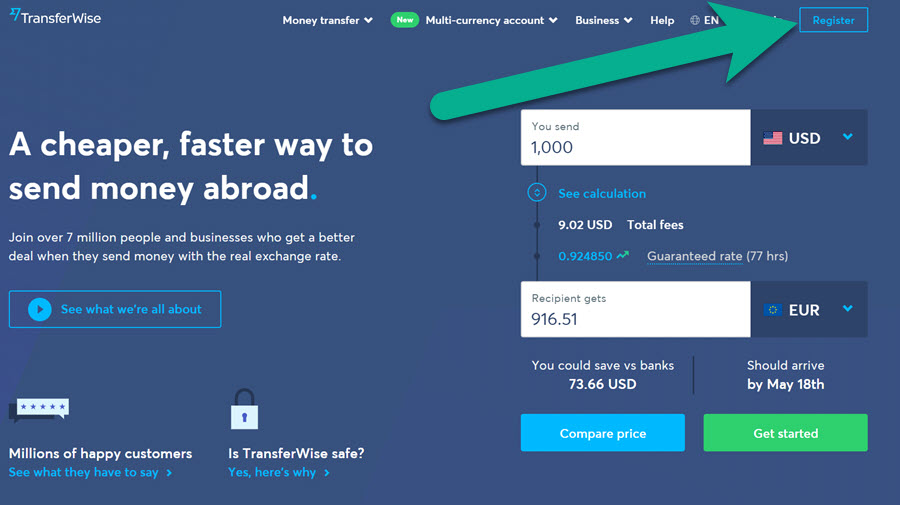

To begin, go to the Wise website.

Click on the Register button.

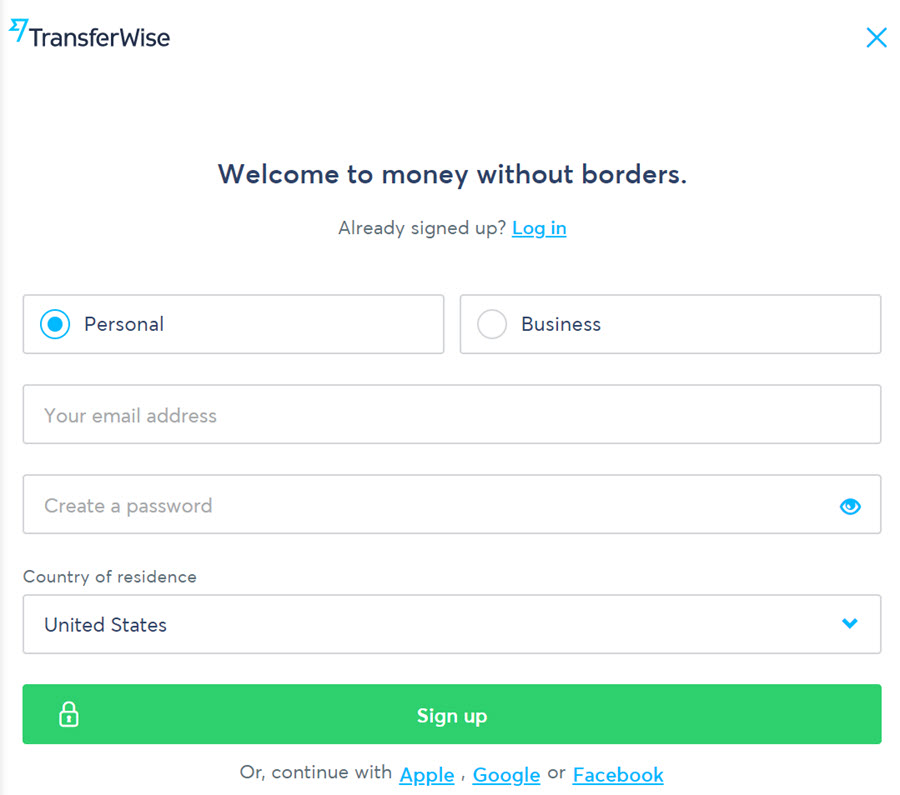

Make a personal or business account. You have the option to add both and switch between the two when inside the dashboard. Business and personal accounts work almost exactly the same, it's simply a way to separate your finances.

Type in your email address and create a password. Choose your country of business or residence, then click on the Sign Up button.

Wise then brings you to the dashboard with information about how to verify your identity and account.

You'll most likely receive an email for this as well.

Verifying Your Identity

Similar to all financial institutions, Wise, wants to have an identification card on file so it knows who's using the service. It depends on where you send your money transfer from, but these are the general rules.

Wise, formerly TransferWise, asks for one of the following documents for identification:

- A photo driver's license (not valid for New Zealand residents who send NZD).

- A photo passport (Internal Ukrainian and Russian passports are not allowed, so those residents need to use driver's licenses or international passports).

- A national identification card (Nigerian IDs must be the most recent version).

How to Use Wise to Accept International Ecommerce and Invoice Payments

Let's say you're one of the following:

- An ecommerce store owner who sends out invoices for international payments.

- A freelancer or contract worker who has international clients.

- An online store owner who accepts international credit cards and online payments through Stripe and Amazon Payments.

- A seller of online subscriptions or recurring products/services with international customers.

Regardless of which of those categories you fall into, Wise works pretty much the same for everyone.

- You open a Wise account.

- You activate whatever receiving accounts are needed.

- You give your account details to the payer.

- Then Wise converts and gives the money to you, with real currency conversion rates and extremely low fees.

Accepting International Payments

You have two options for getting paid:

- Having your customer/client send money to a Balance account.

- Having your customer/client send money to a Recipient account.

What's the difference?

A Balance is an online banking account that you hold in a certain currency. You might open a EUR or GBP or USD balance to receive local transfers. Balances make the most sense if you plan on using those currencies for other business or personal expenses, such as paying contractors or buying sandwiches on your regular business trips from the US to Great Britain. If you don't have any need to spend money in other currencies, there's not much of a reason to hold balances in those currencies. For instance, I accept payments for my business in GBP and EUR. But I don't need a balance for either since all of my spending is done in USD.

A Recipient account is the default account that money goes to when someone pays you in a specific currency. You can mark a Balance account as the primary Recipient for a specific currency. This routes the money to the right accounts and cuts out any unnecessary transfers or conversions. For instance, you may have multiple EUR accounts but only want money going to one. In addition, Wise automatically converts money if it's needed for sending to Recipient accounts. An example would be for my own freelance business. All of my money will eventually go to my USD Chase account. So, I made that my primary Recipient account. I invoice in USD, then if someone pays me in Euros or GBP (or any currency) it gets converted and placed into my Chase account as USD. There's often no need to get a payment into a Balance account when you don't use that currency yourself.

Working With Wise Balances

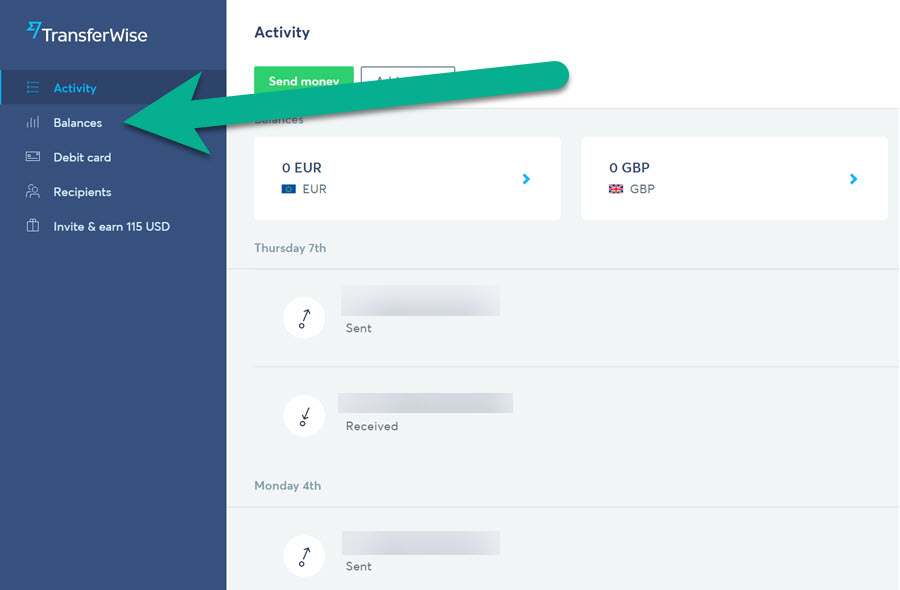

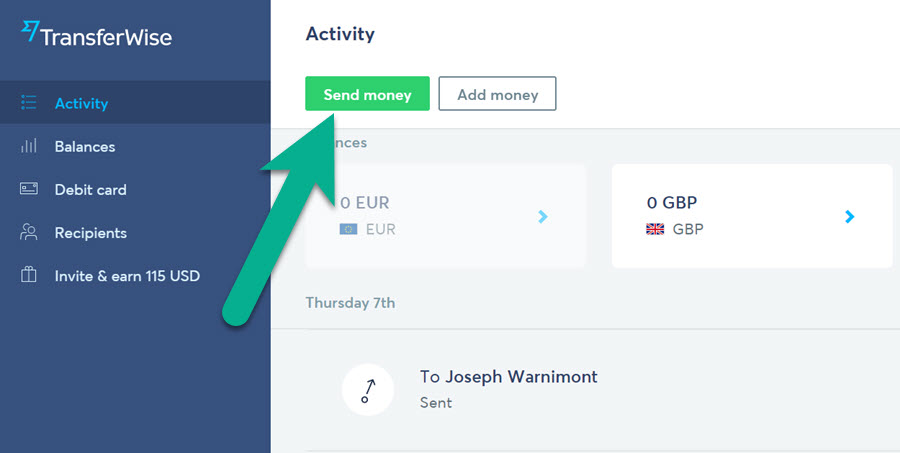

In your Wise dashboard, click on the Balances tab. There's also a Wise app that has the same menu items.

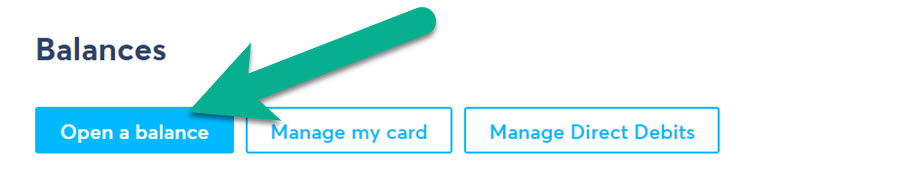

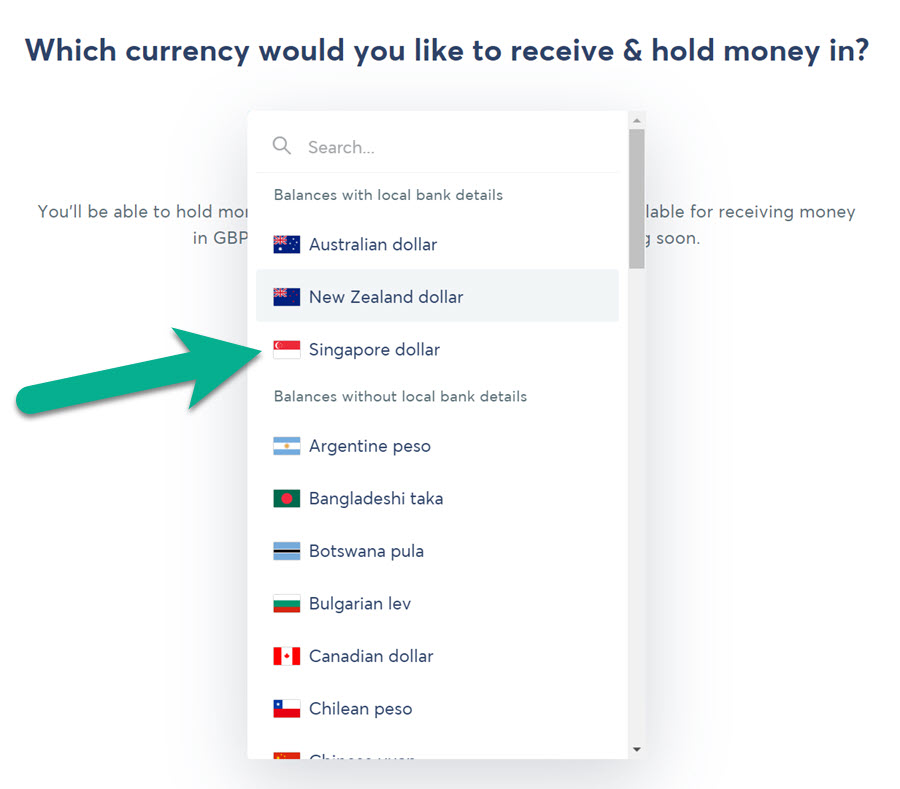

Click on the Open A Balance button to proceed.

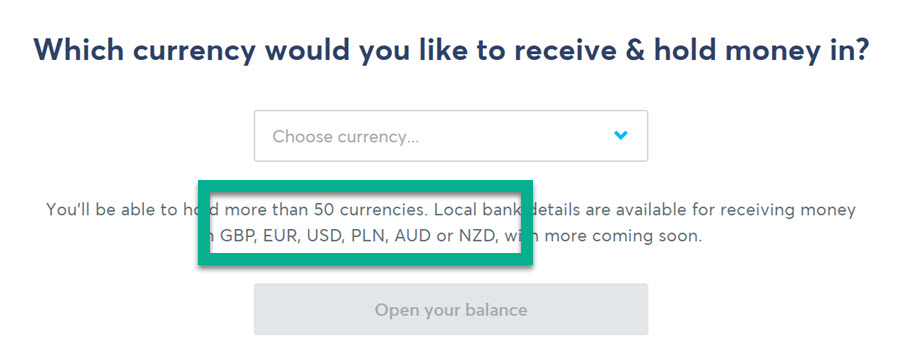

This sends you to a new page for choosing a currency for that balance account. As you can see, Wise, formerly TransferWise, supports balances for over 50 currencies. However, the local bank details for receiving money are only available in GBP (Great Britain) EUR (European Union) PLN (Poland) USD (US Dollars) AUD (Australia) and NZD (New Zealand).

Scroll through the Search field to find the currency you need. This would be a currency that you are getting paid in and would also like to use for your own spending.

For instance, let's say I get paid in New Zealand dollars or Singapore dollars and also send payments to contractors in those currencies. Since I'll be using the currency and not converting it to my own USD account, it makes sense to have a Balance.

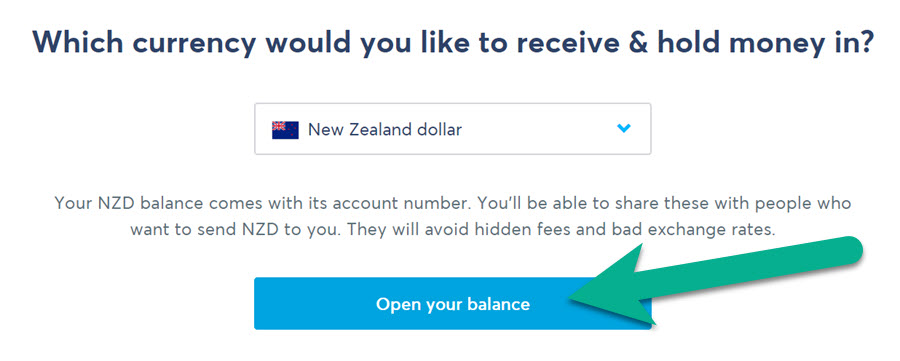

Choose the Balance currency you need.

With a currency selected, click on the Open Your Balance button.

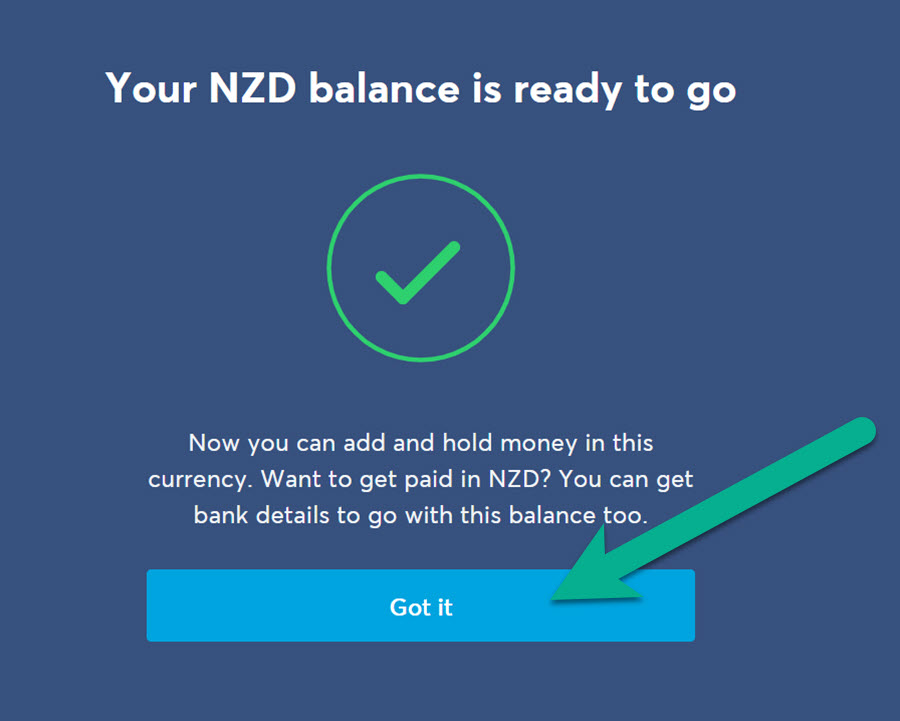

The following page explains that your balance is created and that you must generate bank details if you plan on accepting payments from other people in this currency.

Click the Got It button to move on.

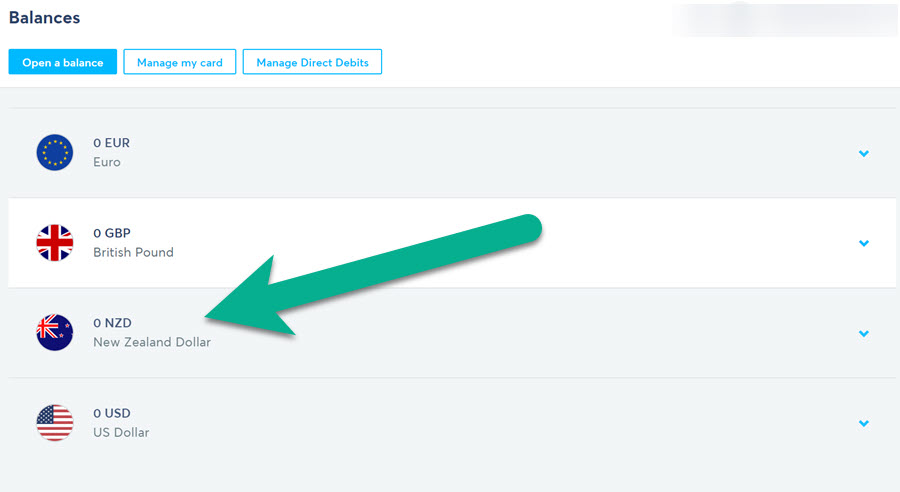

Back at the Balances page, Wise shows the entire list of balances you hold. I have one for EUR, GBP, NZD, and USD. I don't really use any of these (since all of my money ends up going to a local Chase USD account,) but plenty of businesses will need to hold balances for future payments to contractors or merchants in these currencies.

To actually accept payments in these currencies, click on each balance.

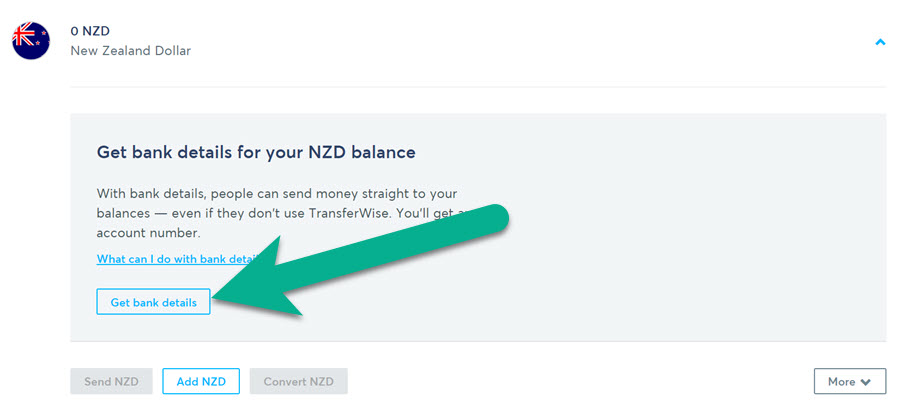

Choose the Get Bank Details button.

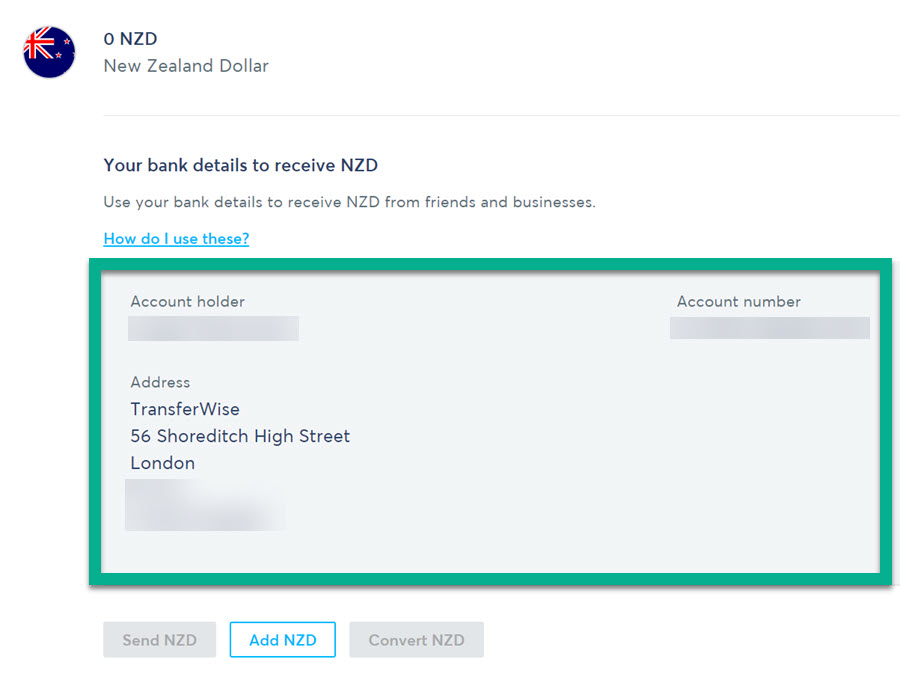

Wise generates a bank account (it's categorized as a checking account) with details like the following:

- Account holder.

- Account number.

- Bank address.

Each currency has varying account details. For example, EUR accounts use IBAN and SWIFT bank codes, while USD accounts have ACH routing numbers.

How do these banking details help you in getting paid?

You have two options for getting paid:

- Ask your contractor/payer to make a Wise account. They can then look up the email associated with your account and send the payment directly to you.

- Give those bank details to the payer. They can then punch them in for a transfer amount from their own local bank account.

After the payment is made, you'll begin receiving emails and dashboard notifications telling you where the money is and how long it'll take to reach your account.

Working with Wise Recipient Accounts

As covered in the previous sections, a Recipient account is the default account that currencies end up in.

You might have multiple EUR accounts. If that's the case, just make sure you set one as your primary recipient. This way, all EUR payments go to that account.

Recipient accounts also work for eliminating the need for multiple transfers and conversions.

An example would be an ecommerce store or service provider who only plans to route all payments into their local currency. My contracting business has international clients who pay in multiple currencies. However, I never pay bills or my own workers in anything besides USD. Therefore, I'd rather just have a primary USD Recipient account. Then, I invoice clients in USD, they can pay in whatever currency they want, and Wise converts it for me and drops it into my USD account.

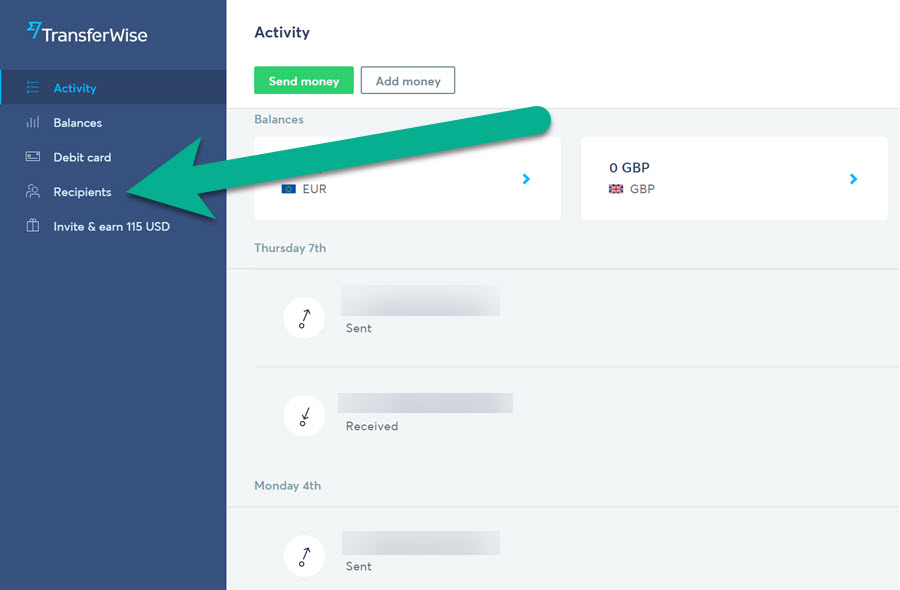

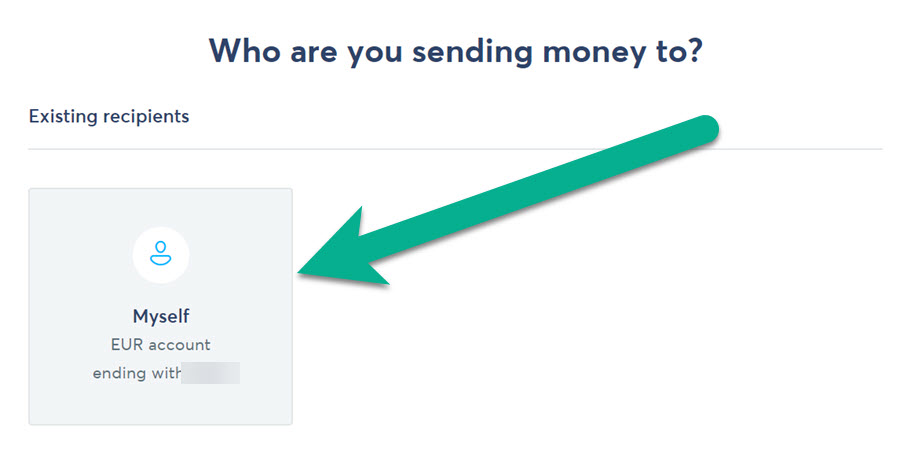

To link a Recipient account, click on the Recipients tab in the Wise dashboard.

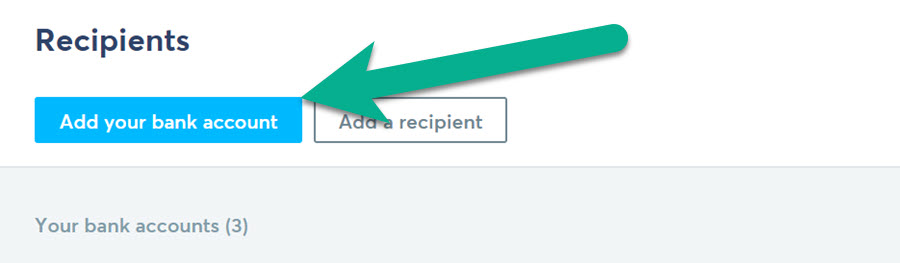

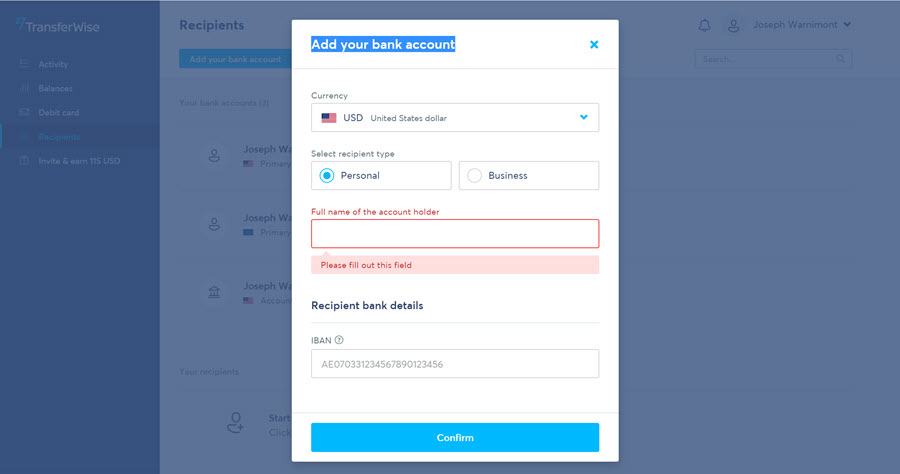

Choose the Add Your Bank Account button or the Add a Recipient button. They both pretty much do the same thing.

You're not creating a new account here. This is for linking an existing bank account.

You could add details from one of your Wise Balance accounts or even type in the details from your local bank account (that's what I do for my business, since I want everything going there).

Choose the bank account's currency. Mark if it's a personal or business account, then fill in everything like your full name and whatever bank details are necessary for that currency (IBAN, routing number, SWIFT code, IFSC code, etc.).

Double-check to ensure the numbers and spellings are all exactly right. Otherwise, delays will occur with your transfers and conversions.

Click on the Confirm button to link the bank account.

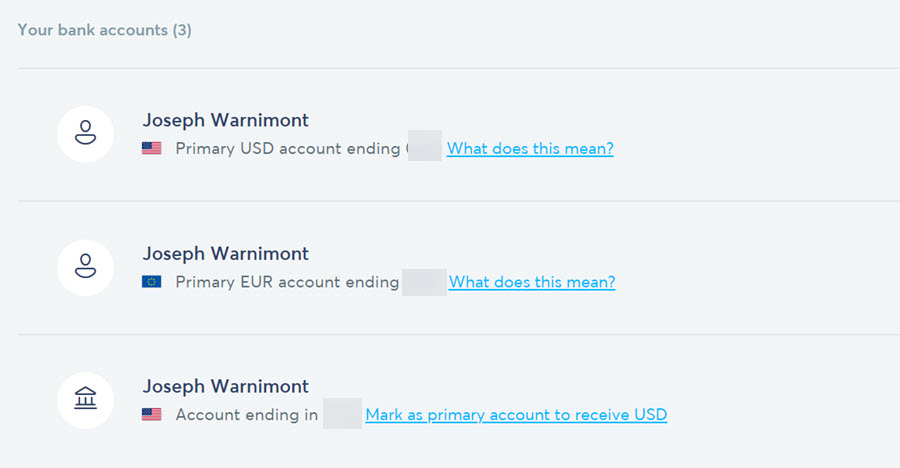

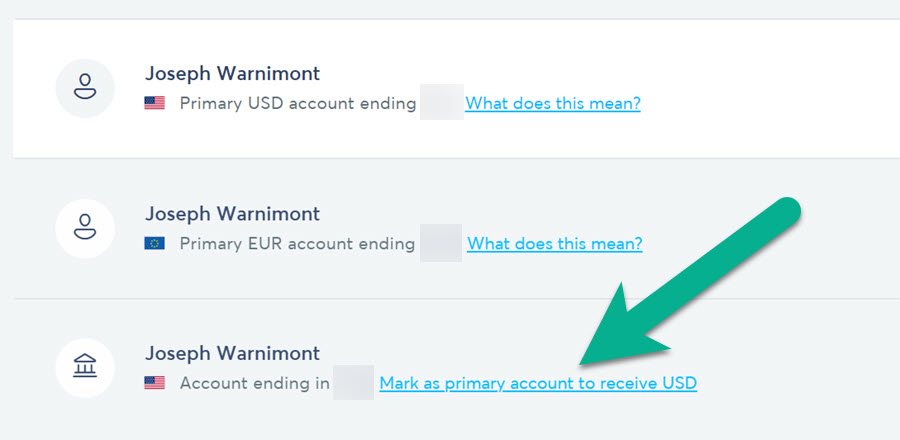

Now, all of your recipient bank accounts are shown in a list. I have one primary recipient if I get paid in EUR. I also have one for USD, which is my local bank and not any of my Wise balances.

To reassign your primary recipient accounts, click the link next to the desired account that says “Mark As Primary Account to Recieve That Currency.”

Each Primary account is labeled after that.

How Long Does it Take to Get Your Money?

Transfer time depends on the following elements:

- If your account is all set up and you've gone through security checks.

- What time the transfer is sent.

- The payment methods you use.

- The countries being sent from and sent to.

I've found that transfers usually take about three to six business days to end up in my USD account. But again, it all depends on the above factors.

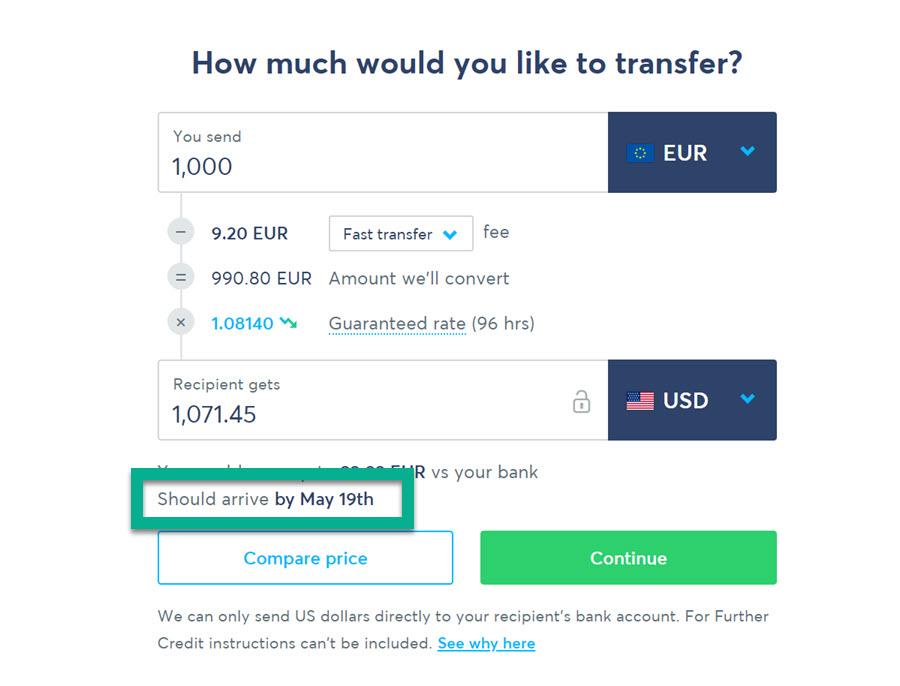

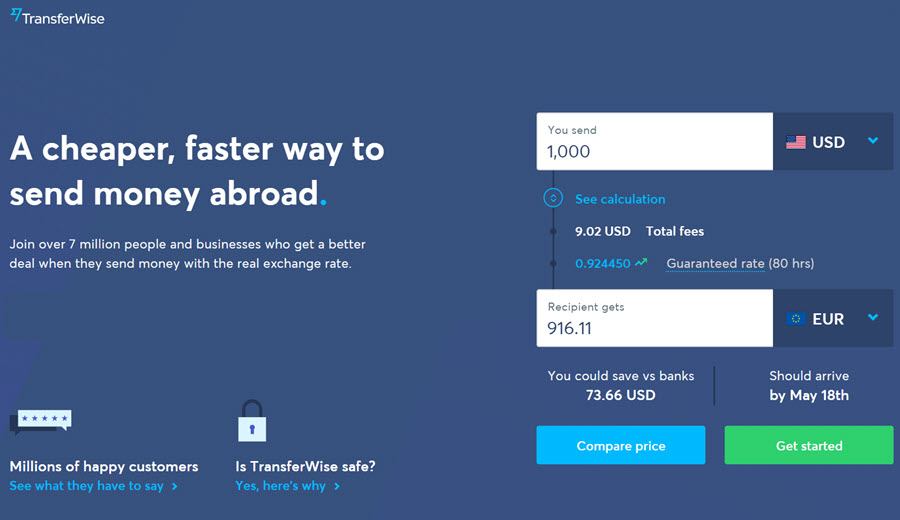

Use our Wise fee calculator to evaluate the timing of your transactions.

It reveals the estimated date of arrival. Emails are also sent to you about approximate deposit timing when someone sends you money.

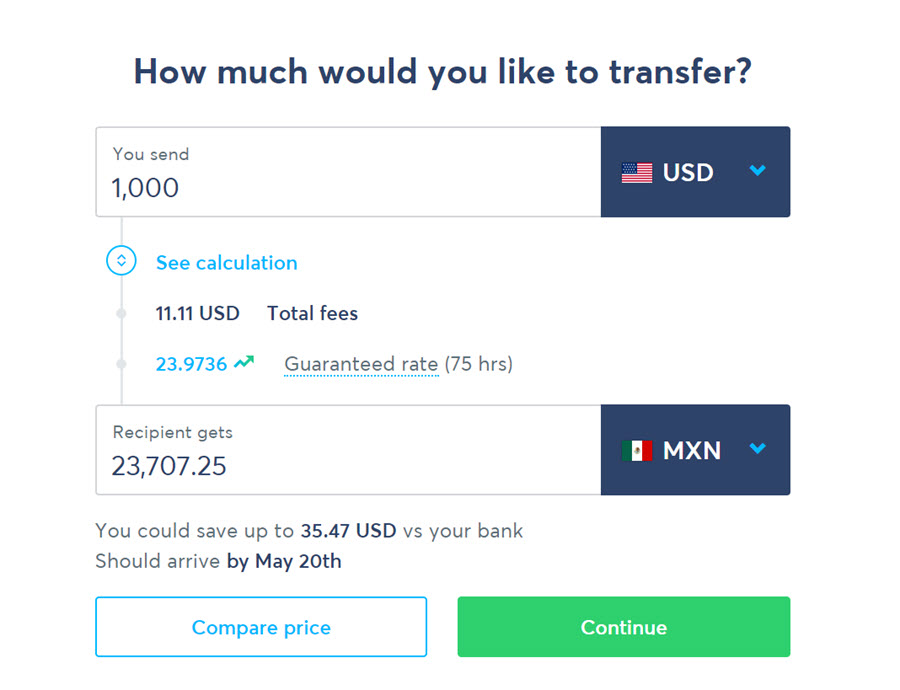

Type in how much you'd like to transfer, along with the beginning and end currencies. Let's say I have a supplier in Mexico and need to pay them $1,000 USD. They'll want the money in MXN, so I'll make sure that happens.

Everything is very transparent, showing total Wise fees (as you can see, it's significantly cheaper than PayPal and bank transfers,) the guaranteed conversion rate, and the arrival date.

Click the Continue button.

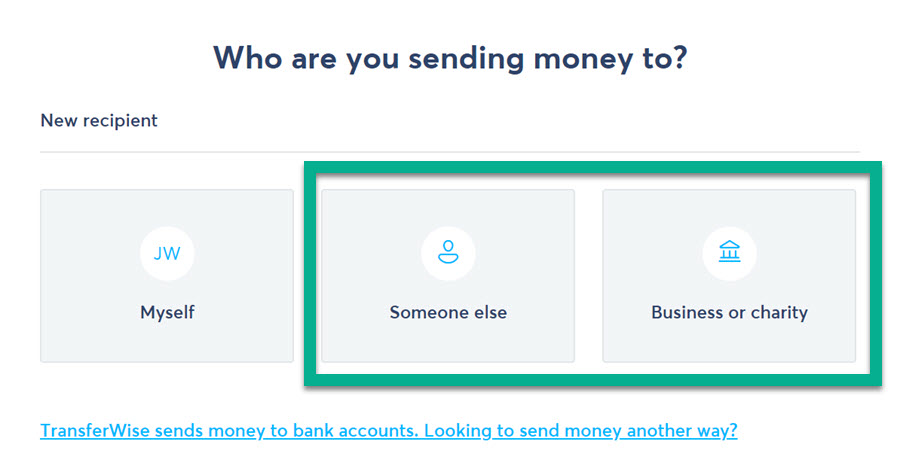

Choose who you're sending money to.

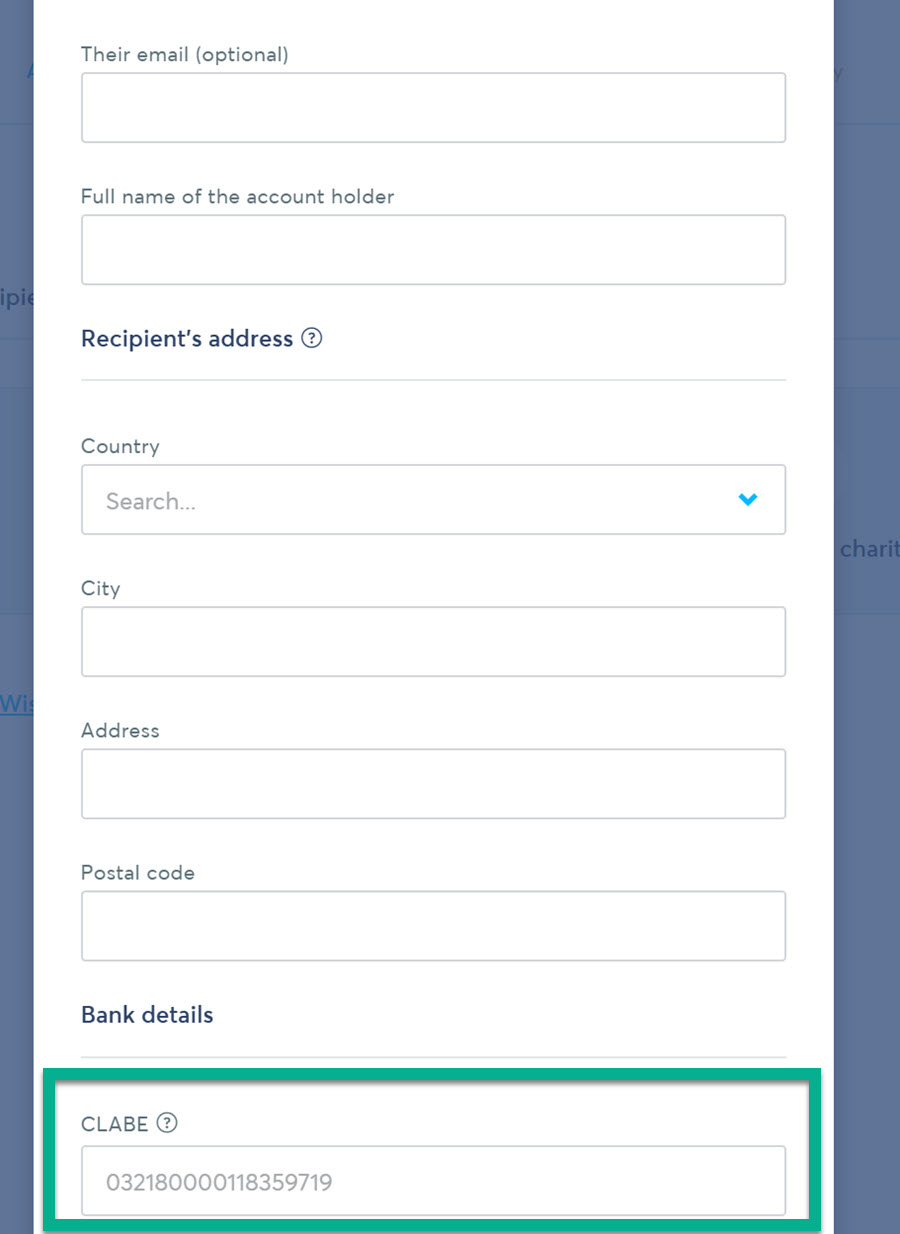

Type in information like their email, address, and the recipient's bank account number. You'll need to ask them for all of this.

How to Use Wise: It's a No-brainer for Saving on Fees and Making/Receiving Quick International Money Transfers

Wise, formerly TransferWiseis a pleasant surprise for online stores, freelancers, contractors, travelers, ex-pats, international students, nomads, and suppliers who pay and get paid from companies and individuals outside of their own countries.

It's easy to use this money transfer service once you understand the interface (we recommend searching Google and reading the many blog posts from Wise,) PayPal and bank fees are eliminated to almost nothing, and you can hold different currencies in your accounts.

If you have any questions about how to use Wise, or any other currency transfer companies, let us know in the comments below.

How can you pay a UK credit card from the wise account?

Hey Lisa,

Yes definitely!

Hi, I have customer has transferred to Thai Bank Account and the last email said the transfer has been cancelled, and i have received an email again said I have to register an email address. I asked my customer and he said I have to complete the transfer. Can any one explain please.

Thank you.

I too have long been annoyed by PayPal’s excessive fees, both for receiving money, and the hidden clip on currency conversion.

A reasonable TOTAL fee would be something like 1.7% (as opposed to the 6% they currently take).

So Wise is very attractive. But they need to provide the payer with a way to pay by credit card (rather than just a bank transfer).

I wonder when this feature will arrive?

I received an email saying the transfer was cancelled. My husband previously transferred it and I received an email stating I will receive the money on Monday 18th July. I would like to know the reason why it was cancelled.

Hey Blfern, you should contact their support team and see what happened.

Hi, I want to get paid from my international clients into transferwise account.

the question is when i send them “payment invoice” using the method described above. the payer must have a transferwise account. or the payer can pay using their credit card or paypal ?

Hey Khubaib,

You can add you Wise IBAN number, and they can pay you via wire transfer, so they don’t necessarily need to have a Wise account.

Just opened a Wise account….

I’m an expat from the USA living in Thailand…How to transfer US Dollars converted to thai baht to my Thai Bangkok Bank account into Thai baht?

Hey Glenn,

Please contact Wise for customer support. I’m pretty sure they can help you with this.

I have a USA client who needs to pay me a pre-defined amount in Euro. How can I set-up Wise so I can sent a link with the invoice and then they pay in USD (including all costs to them), but on it’s way transferred into the exact amount of Euro to go into my bankaccount? Does the client need a “wise” account? They probably don’t want that and want to pay directly from their USA bank account. Is that possible? what Wise account do I need myself so I can sent them payment links and they transfer the exact invoiced euro amount into my bank?

Hello, You can open an account for every currency, in this case EUR and then just make the conversion and transfer the amount in the USD account. The client doesn’t need to have Wise account.

One of my costomer asking me to receive Direct Debit through SEPA transfer method. They asked me to send CID code Account.

My Question is, How Can I get the CID Code?

Thank you

Hello, you should contact Wise regarding this, as we don’t have this information.

Do you HAVE to open a Wise Business account to pay international contractors, or is using a Wise Personal account fine as long as you’re keeping the appropriate bookkeeping? Does Wise care if you’re using a Personal account for Business?

Hello Robert, in some you will need a business account., You can find more info here.

While opening a transferwise account as a Us citizen, do you need to deposit an initial $20 before going on to verifying your identity. Can you also help me list out all the steps you took to create an account as a Us citizen. I need this for a friend of mine. Thanks.

Hello,

I Appreciate your nice topic.

I have a problem here in my country. I don’t have any normal bank account like Visa or Master cards. I just can open transferwise. But here’s my question,

I’m starting my online clothing store (dropshipping).

Can I use transferwise For receiving payments?I don’t like giving them my account number or something like that! I want my customers to pay normally with the typical gateway. I just want my money to go to my transferwise account.

And the second question is:

Can I buy my stuff from AliExpress?

You will need a payment gateway to start accepting payments without giving out your account number. You can find a list with some of the best payment gateways here.

As for the second question, the answer is yes 🙂 The Wise card is just like any other card, you can use it for online payments without any problems.

Hej,

tack för en mycket bra guide. Trots dess grundlighet måste jag fråga hur det blir i följande fall. Jag har svenskt bankkonto, men befinner mig ofta i EUR-zonen, och önskar äga en del kapital i EUR, både för valutans skull i sig, och således skydda mig mot kurssvängningar, och för att kunna betala med Transferwisekortet utomlands. Min svenska bank har i normalfallet ett utlandsöverföringspåslag på 1,65 %. Om jag nu helt enkelt vill ha in pengarna på Transferwise på billigast vis, hur gör jag? Går det att överföra i SEK, och på kontot växla till EUR, eller är det bättre att föra över till EUR, och hur blir avgifterna lägst i båda fallen? Skall det vara på balans- eller mottagarkonto?

Tack på förhand,

Bert van Quantz