The days of traditional walk-in banks can no longer be taken for granted. Why? Because of the advent of digital banking apps that offer competitive, convenient, and easy-to-use services. You can complete transactions at home, at work, or while you're on the go. Many come with a range of attractive features that make it hard for traditional banks to compete against.

That said, we’re taking our microscope to two such digital banks: Wise and N26.

There’s lots to look at, so let’s make a start.

What is Wise?

Established in 2011, this London-based online banking platform provides various personal and business accounts and international money transfers.

With Wise, you can accept money from international bank accounts while tracking your own transactions.

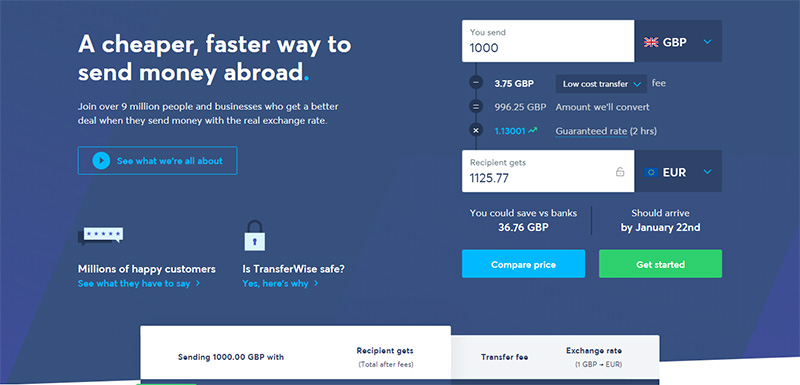

Wise (formerly TransferWise) describes its services as “the cheap, fast way to send money abroad,” stating they are on average eight times cheaper than “leading UK household banks.”

Impressively, Wise facilitates 750 foreign currency routes used by 9+ million people, sending around $6 billion every month!

💡 For more info read our comprehensive Wise review and our guide on how to use Wise.

What is N26?

Founded in 2013 and based in Berlin, Germany, N26 has more than five million customers across 25 countries and over 1,500 employees. N26 prides itself on its banking transparency and enables customers to start spending as soon as they open an account.

N26 is primarily aimed at European citizens, although US residents can access some of N26's services.

💡 For more info read our comprehensive N26 review.

Wise vs N26: Their Pros and Cons

The simplest way to compare the two platforms is a quick pro-cons list.

Below we highlight the most beneficial aspects of these services as well as their gaps:

Wise Pros 👍

- Wise is FCA regulated

- It's free to register

- It's cheap to send money overseas

- Wise has offices around the world that support multiple languages

- You can use your Wise card with Apple Pay

- You can spend in local currency with your card

- You can receive your salary and pension when living overseas

Wise Cons 👎

- There's only one type of Personal Account

- There's only one type of Business Account

N26 Pros 👍

- It takes only minutes to arrange an authorized overdraft

- N26 has a full banking license

- N26 offers free bank accounts

- N26 provides a free card and free card shipments

- There's a desktop version available

- Free cash withdrawals are available

N26 Cons 👎

- N26 doesn't offer credit cards

- You don't accumulate any interest on your savings

- There's a 1.70% translation fee on overseas withdrawals

- Limited service is available in the US

- It's not available in the UK

Wise vs N26: Their Core Features Compared

The most apparent difference between these two services is that N26 is a comprehensive mobile bank. In contrast, Wise heavily focuses on sending and receiving money overseas; it’s their main USP. Wise does, however, enable users to open personal and business multi-currency accounts, and that’s what we’re focussing on in this review.

Wise’s Core Functionality

Before we dive into Wise‘s multi-currency account features, we’ll do a quick nod to its money transfer services:

You can transfer money from one currency to another, with money reaching the recipient in just a matter of days. The Wise website has a currency converter calculator that shows the fees you'll be charged. So, rest assured, you can see exactly how much you'll pay before you press “send.”

Once you’ve sent your money, you can track its journey right the way through to its end destination point.

Now, let’s move onto Wise’s core banking features, which are split into two categories: Personal Banking and Business Banking:

Personal Banking with a Multi-Currency Account

With such an account, you can:

- Manage your money in 50+ currencies

- Send cash at live currency exchange rates

- Spend money you’ve had transferred to you with a Wise debit card

This Wise account is free to set up and available to US customers, offering cheaper rates than “old school banks.” There are no monthly fees or minimum balances to worry about. However, there's a fee for holding large sums of money, and we’ll talk about that lower down, along with Wise's other account fees.

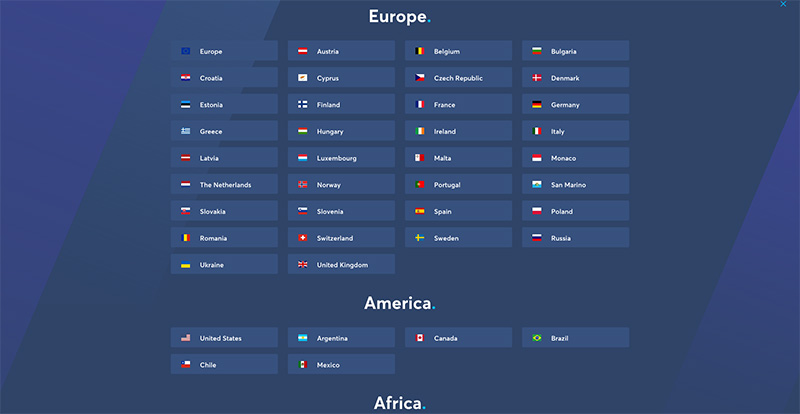

You can order and use a Transferwise card in the following countries:

- In Europe: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the United Kingdom.

- In Asia: Singapore

- In Oceania: Australia and New Zealand.

- North America: Available throughout the US (except Nevada and Hawaii).

Spending Money

Wise’s debit card allows you to spend money overseas in local currencies in over 200 countries. This includes spending with Google Pay and Apple Pay. Wise’s technology automatically converts your money to the local currency at low-cost fees. That said, there are ATM withdrawal charges if you prefer to pay in cash; again, we'll cover those further down.

Receiving and Adding Money

You can choose which currency your account automatically converts money into when you receive or add funds. There are eight to choose from: US dollar, UK pound, Euro, New Zealand dollar, Australian dollar, Singapore dollar, Hungarian forint, and Turkish lira.

Convert and Hold Currencies

Within seconds, you can hold and convert money across 55 currencies for free using real-time exchange rates.

Wise vs N26: Business Banking with a Multi-Currency Account

Now, let's take a peek at the Wise Business Account features:

This free account allows you to receive and send money across multiple currencies using real-time exchange rates. Wise calls it “business without borders.” Like Wise's Personal Account, there are fees involved, but we'll cover those lower down.

This account is aimed at three kinds of businesses:

- Freelancers and sole traders

- Small to medium-sized businesses

- Large or enterprise-level organizations

Here are its core features:

Pay Invoices and Overseas Clients

Make multiple and/or batch payments in one go. This feature is useful if you have recurring invoices to pay or payroll. Wise technology guarantees the use of real-time exchange rates using its batch payment tools: Bolt, Wolt, Hubstaff, and TimeDoctor.

Receive Money

A Wise business account provides you with your own local bank details. You just have to pay a small one-time setup fee. You don’t need a local address. This enables you to get paid or withdraw money from platforms you do business on, such as Amazon. Once the money's in your account, you can either:

- Leave it there for future invoice settlements

- Move it to your bank

- Transfer it to another business current account

Automate with API

Using Wise's API, business account holders can program:

- Automated payments

- Manage their finances

- Automate invoice payments and other financial transactions like standing orders, payroll, and recurring money transfers

…to name a few!

Customers get a unique API token identifier that your app or website can use to access other companies' API. This comes in handy if you or your developer need to code a custom integration.

Integrate Your Accounting

You can take advantage of being able to automatically sync your business activities with Xero (across 40+ currencies). By integrating with Xero, you no longer have to manually export and upload statements.

N26’s Core Features

Like Wise, N26 offers personal and business accounts. Each of these is divided into subcategories. Some types of accounts are free, while others have fees. We go into the costs further down in this review.

Here, we'll focus on N26’s bank cards, contactless payments, and bank account features for its Personal and Business Accounts.

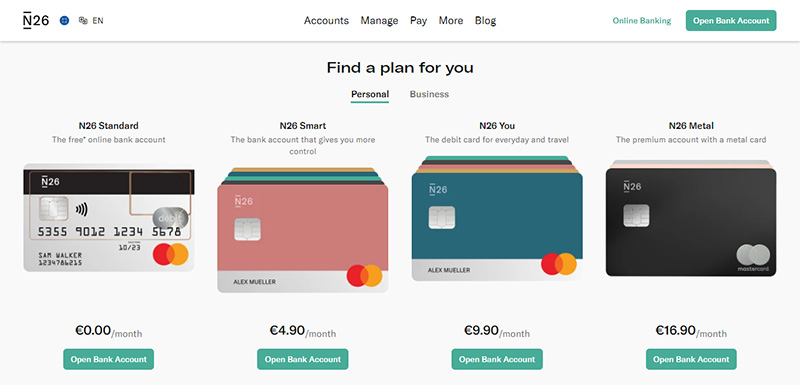

Let’s start with the N26 Personal Account. There are four to choose from Standard, Smart, You, and Metal. The features vary depending on which account you go for.

Standard: This account is free. You get a free transparent Mastercard debit card that’s accepted worldwide, with which you can make contactless payments. You can also make mobile payments using Apple Pay and Google Pay.

You can also:

- Set daily spending limits

- Lock or unlock your card using the N26 app (available for Android and iOS devices)

- Make free payments worldwide

- Make up to three free ATM withdrawals a month within the Eurozone

- Make mobile payments

Smart: With this account, you get all the basic banking functions outlined above, plus an optional extra Mastercard debit card. You also get five free ATM withdrawals per month within the Eurozone, and you can choose your card's color (ocean, sand, rhubarb, aqua, or slate).

You: With this account, you get the same features as above, plus unlimited free withdrawals in any currency on top of the five free ATM withdrawals per month within the Eurozone.

Metal: Here's N26’s most expensive account. It provides all the above features and eight free monthly ATM withdrawals within the Eurozone. You also get an 18-gram metal card.

Other features are worthy of note, which we go into more detail below:

Money Management

You can manage and track your money with what N26 calls “Spaces.” These are sub-accounts you can use as savings accounts. You can set and track savings targets and automatically transfer regular payments into designated spaces.

You can also create N26 “Shared Spaces,” which enable you to share money faster and save with friends and family towards the same financial targets.

You get 2 “Spaces” with the Standard account and 10 with each of the others.

All account holders apart from those on the basic Business plan also enjoy access to a feature called Round-Up. Here, each card transaction is rounded up to the nearest Euro, and you automatically save the difference in a “Space.”

Statistics

N26 automatically categorizes your spending into classifications. This enables them to generate monthly reports on how you manage and spend your money. Each of the four accounts grants access to this feature.

Payments

We’ve already mentioned you can make mobile payments with Apple Pay and Google Pay. However, N26 integrates with Wise to enable you to transfer money in different currencies (there are 38 currencies supported).

All N26 customers can also receive and send money using MoneyBeam, and receive incoming payments with SEPA Instant Credit Transfer.

N26 Business Accounts

Now let’s take the microscope to the N26 Business Account. Again, there are four to choose from: Business, Business Smart, Business You, and Business Metal. Again, there are fees, but we'll talk about those in the next section.

Business: This is the most basic business account, and it’s free. You receive a debit Mastercard, contactless payments, mobile payments with Apple Pay and Google Pay, 100% mobile banking via the N26 app, 0.1% cashback on card purchases, free worldwide payments, and up to three free ATM withdrawals per month within the Eurozone.

Business Smart: This account has the same features as above, but you get to choose your Mastercard debit card (these are the same as the personal account). You also receive a free optional extra card and up to five free monthly ATM withdrawals within the Eurozone.

Business You: The added extra features in this account on top of what you see above are unlimited free worldwide withdrawals in any currency.

Business Metal: This account is the most expensive, for which you receive an 18-gram metal card, 0.5% cashback on card purchases, and up to eight free ATM withdrawals per month within the Eurozone.

Like N26's Personal Accounts, their Business Accounts also have a few extra features worth noting:

Money Management

You can track all your transactions, including invoice payments. You can also download them into PDF or CSV reports to simplify things when it’s time for your tax returns.

Also, N26 offers business customers the same “Spaces” features previously discussed.

Statistics

Like Personal Account holders, all business customers have access to N26 statistical reports on account transactions, spending insights, and so on.

Payments

N26 Business Account customers also have the same payment features as Personal Account holders.

Other N26 Features

Lastly, there are other features that N26 customers enjoy that we don't have time to cover in any detail. Still, they may be relevant to anyone who wants to get real value for money from their N26 account. Here’s a summary of what these are:

- Travel insurance

- Exclusive partner discounts

- Travel health insurance including emergency medical insurance, trip cancellation or curtailment, and flight and baggage delays

- Mobility coverage for vehicle rentals

- Mobile phone insurance

The above applies to Business You, Business Metal, You, and Metal account customers.

Wise vs N26: Their Cards and Costs Compared

No one wants to be surprised by any hidden bank charges. That’s why we’re looking in some detail into the fees associated with Wise and N26's accounts:

Wise Charges

First, let’s look at the Wise Personal Account. If you hold such an account with a balance of more than €15,000, Wise charges an annual fee of 0.40%.

If you want a Wise debit card, it will cost you $9 to order. A replacement card is free, as are the first two ATM withdrawals up to $250. After that, they cost $1.50 per withdrawal. Monthly charges for ATM withdrawals of $250+ are 1.75%.

It is free to receive money in USD, EUR, GBP, NZD, AUD, RON, HUF, and SGDF. The same applies if you receive USD via an automatic clearing house (ACH). However, you're charged $7.50 for wire transfers.

A Wise Business Account is free to set up and hold 50+ currency balances. It's also free to receive money in Euros, British pound, Australian dollar, New Zealand dollar, Hungarian forint, Romanian leu, and Singapore dollar.

When it comes to sending money, that's when the fees kick in. For this, there's a fixed fee of $1.40. There's also a one-time fee of $31 to obtain bank details to receive currencies.

As with most banking accounts, transaction fees are involved when adding money to your business account and converting currencies. From December 2020, if you receive USD wires to your US account, it costs $7.50.

If your business account balances more than €70,000, you'll be charged an annual 0.4% fee. As with the Wise Personal Account, there's an online calculator so you can see precisely what currency conversion fees you’ll be charged before pressing “send.”

N26 Charges

First off, let’s take a look at charges for N26's Personal Accounts:

- Standard: This is free for balances up to €50,000. After that, a fee of 0.5% may apply.

- Smart: This account costs €4.90/mo

- You: This account costs €6.90/mo

- Metal: This account costs €9.90/mo

The monthly charges for the Business Account are precisely the same as the Personal Account.

Like Transferwise, N26 is keen to reassure its customers that there are no hidden fees. Both types of account incur no charges for:

- Services

- Overdrafts

- Foreign transactions

- Maintenance

And there's no minimum balance needed.

Wise vs N26: Customer Support

When it comes to finances, there’s nothing more frustrating than not accessing support and help quickly. So, let’s see how Wise and N26 stand up to scrutiny in this area.

Wise Support

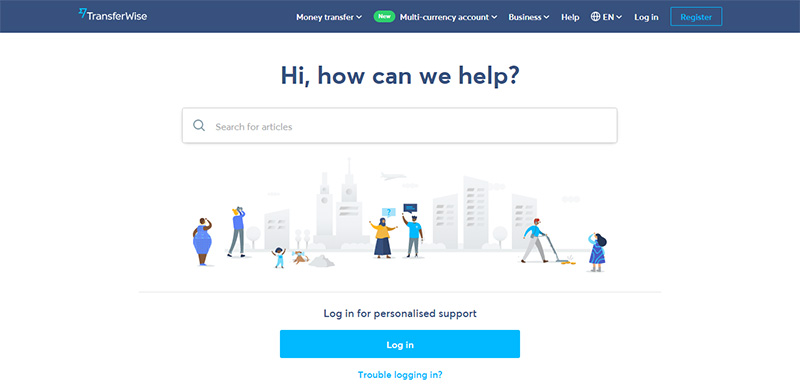

At first glance, Wise’s customer support offer is less generous than N26's. There's a Help Center on its website where you can type in your questions to populate helpful articles and guides. There's also a Q and A section that covers the following topics:

- Receiving and sending money

- Account setup

- Debit cards

- About Wise

If you still need extra help, you need a Wise account, which you need to be logged into.

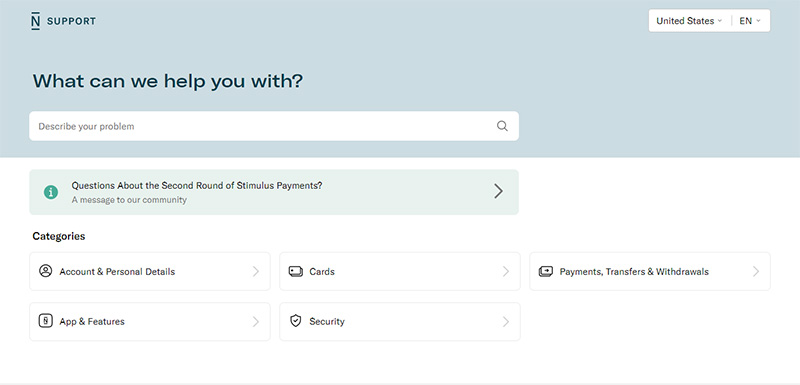

N26 Support

Both Personal and Business Account customers have access to the same type of support: Chatbot and in-app live chat support. All customers apart from those on the free accounts also get phone support seven days a week. That said, only N26 Metal and N26 Business Metal customers receive a dedicated Metal phone line seven days a week.

Wise vs N26: Our Final Verdict

Traditional banking with its borderless accounts are no longer the only type of financial management tool on offer. Both Wise and N26 are attractive mobile banking options for personal and business banking. Both mobile banks offer helpful in-app features, such as money management/tracking, sending money overseas, and provide a worldwide recognized bank card.

One of their main differences is that N26‘s fees are covered in its monthly subscription charges (free accounts aside), whereas Wise charges per transaction. So, before making any final decisions, be sure to factor that into your budget. Also, generally speaking, with N26's longer list of features, this solution provides more room for you to grow than Transferwise.

However, your choice may be determined by your location. For example, N26 has shut down its UK operation and offers limited service to US customers. So, if you live in either country, you may be better off with Wise.

Are you ready to start mobile banking with Wise or N26? Or are you considering one of their competitors like Revolut or Monzo? Either way, tell us all about it in the comments box below!

Gracias por tu estudio pormenorizado. Soy una chica española Estoy en ello porque me voy de Erasmus a Edimburgo en septiembre y tengo q decidirme ya por algún neobanco y había decidido N26. Si opto por N26 no podré operar en Reino Unido o es que los habitantes de Reino Unido no pueden obtener la cuentaN26 ? Que me aconsejas?

Hey Rosa, you can opt for Wise or Revolut if N26 doesn’t work for you.