Which payment gateway should you use for your e-commerce store? A lot of people struggle with this question. After all, payment gateways and online payments in general can be intimidating, especially if it's your first time around the block.

With dozens of online payment options to choose from, it can be a complicated decision. But this is where this guide comes into play. Here, we tell you what to look for in a quality online payment gateway and present five of the top solutions in the market.

In a hurry? Here's our summary of the top payment gateways out there:

Table of contents:

👉 What is a payment gateway?

👉 How does a payment gateway work?

👉 How to pick a payment gateway

👉 Best payment gateways compared

👉 Summary and final recommendation

Let's start with the basics:

What is a payment gateway?

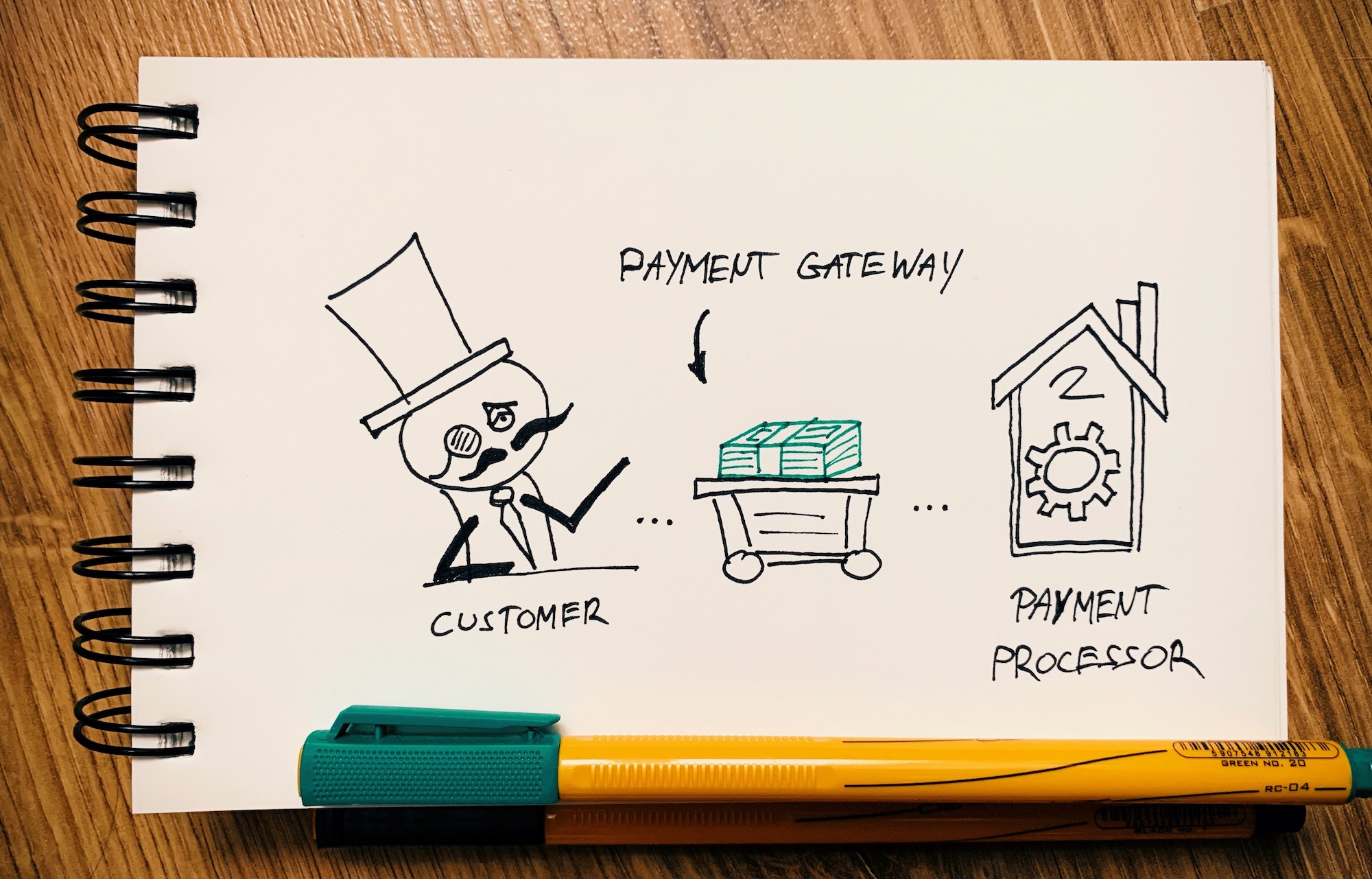

A payment gateway is the middleman between your online store and the payment processor that receives the payment from your customer.

In other words, once a customer enters their payment details on your site, the payment gateway takes care of sending that data securely to the payment processor.

You can think of it like this:

A payment gateway takes care of authorizing the payment and making sure that the data entered is enough to finalize the payment. The gateway protects the details of the credit card by encrypting all sensitive information it holds. This process ensures that personal private details are passed securely between the customer and the merchant.

A payment gateway is part of the “magic” that occurs in the background when a transaction takes place on the web. By sending information securely between the website and the payment processor, and then returning transaction details back to the website, it is a primary component that enables e-commerce stores to function.

If you have an (e-commerce) website and you are interested in accepting credit card payments online, you will need a payment gateway. It is effectively the bridge between your product sales and the customer.

How does a payment gateway work?

The good news is that, as an e-commerce store owner, you don't have to understand how the payment gateway actually works underneath. In practice, all you need to do is pick a gateway and then integrate it with your online store via what's usually a user-friendly setup wizard. After that, it just works and allows you to collect payments from customers.

But just to give you an idea, here's a general look at the steps that take place:

- A customer places an order on your website. They enter the cart, proceed to checkout and fill in their payment details.

- The payment gateway takes the payment information, encrypts it and sends it through a secure channel to the payment processor.

- The customer gets redirected to the payment processor.

- The payment processor takes the customer through the steps to finalize the payment.

- The payment processor verifies if the payment was successful and displays an adequate message to the customer.

- The customer can return to the online store.

What this means in practice is that the payment gateway is only responsible for allowing the customer to communicate with the payment processor. The gateway is just what the name suggests – a “gateway” that takes the customer's personal information through a secure channel to the payment processor.

How to pick a payment gateway

Here's what to look for in a payment gateway:

Five popular payment gateways to consider

Here are the most popular payment gateways in the market, their pros and cons, and the cost involved in working with them:

Note. The payment gateways featured below all check out on the points discussed above, that's why there's only five of them here.

1. Payline

Payline has been in the payment gateway business for a while now. They offer clear fees and a beneficial interchange-plus pricing model.

If you're going to be accepting mainly credit cards, this might be the best solution for you. In this model, you're charged based on each card's associated transaction fees plus the operator's fee.

That being said, you will need a separate merchant account to work with Payline, which does make the setup process more complex and perhaps not as friendly if you're just getting started with a new e-commerce store.

Payline is more of a hands-on payment gateway, meaning that it's up to you to set things up like recurring payments or other non-standard payment schemes. In other words, implementing a specific solution might be more complicated and therefore more fit for established businesses.

Pricing:

- due to the interchange-plus pricing model, you're charged the cost of the specific credit card you're processing + 0.3% of the transaction amount (you can negotiate the fee amount to 0.2% if you have a high enough volume)

- there's also a separate $10 per month fee to keep your account enabled

👉 Read our full Payline review.

2. Stripe

Stripe has been one of the most popular payment gateways in the market for a good couple of years. Clear fee structure, good integration with all major e-commerce systems and easy to use interface have been huge factors in helping Stripe gather a happy customer base.

Stripe is probably the most developer-centered payment gateway out there as well. This might sound intimidating to some, but what it actually means is that you can fine-tune Stripe to serve your business exactly the way you want it.

Stripe lets you handle one-off payments, bill customers on a recurring basis, set up a marketplace, or even handle in-person payments.

Stripe also guarantees transaction security and stores all credit card numbers and transaction details in a secure way (using good AES-256 encryption keys).

Moreover:

- Stripe has PCI DSS Level 1 certification

- Issues SSAE18/SOC 1 type 1 and 2 reports

- Has Money Transmitter Licenses across the US, AFSL in Australia, E-Money License in Europe, and registered MSB in Canada

- Is PSD2 and Strong Customer Authentication (SCA) compliant in the EU

- Works with 135+ currencies

- Currently available in 30+ countries

- Works with a huge number of third-party tools and platforms – read: will work with your e-commerce provider for sure

On top of all that, there's 24×7 support via email, chat and over the phone.

- 2.9% + 30¢ per credit card transaction amount within the US

- +1% when accepting international cards

👉 Read our full Stripe review.

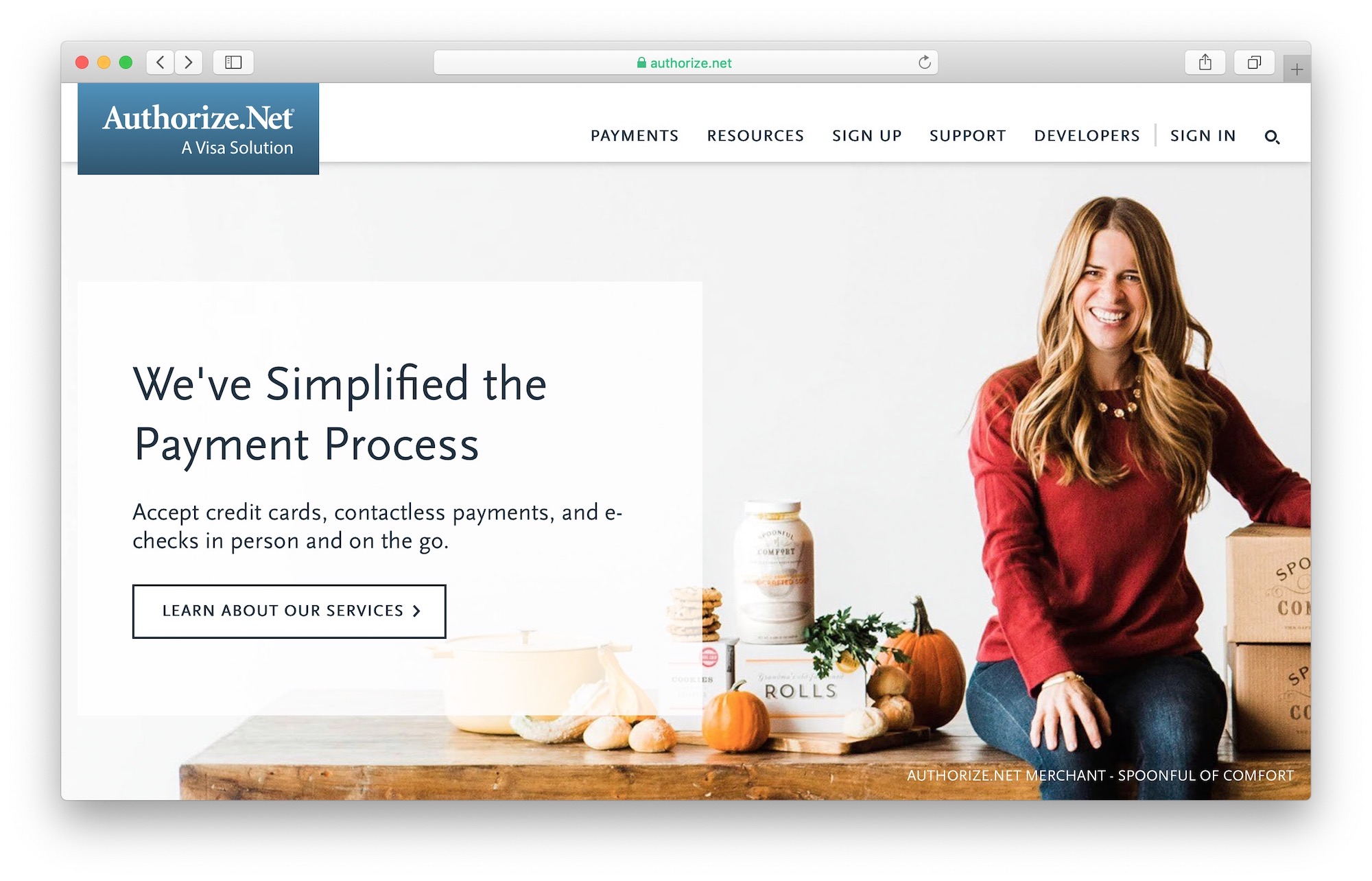

3. Authorize.Net

Authorize.Net is one of the most recognizable and oldest payment gateways operating on the web. They've been around since 1996 and have been making it possible for businesses of any kind to accept payments on the web and in person.

Authorize.Net allows you to accept credit cards, contactless payments, and e-checks.

There's also advanced fraud detection, which can save your business from unauthorized payments or other forms of payment-related troubles.

It's also worth pointing out that Authorize.Net stores your customers' data in a secure way and allows you to tokenize all the sensitive info.

Based on what your business needs, you can use Authorize.Net to issue invoices, set up recurring payments, and use a simplified checkout process.

Pricing:

- All-in-One Option: for businesses that don't have a merchant account; $25 per month and 2.9% + 30¢ per transaction

- Payment Gateway Only: for businesses that already have a merchant account; $25 per month and 10¢ per transaction

- Enterprise Solutions for businesses that process more than $500K per year

👉 Read our full Authorize.Net review.

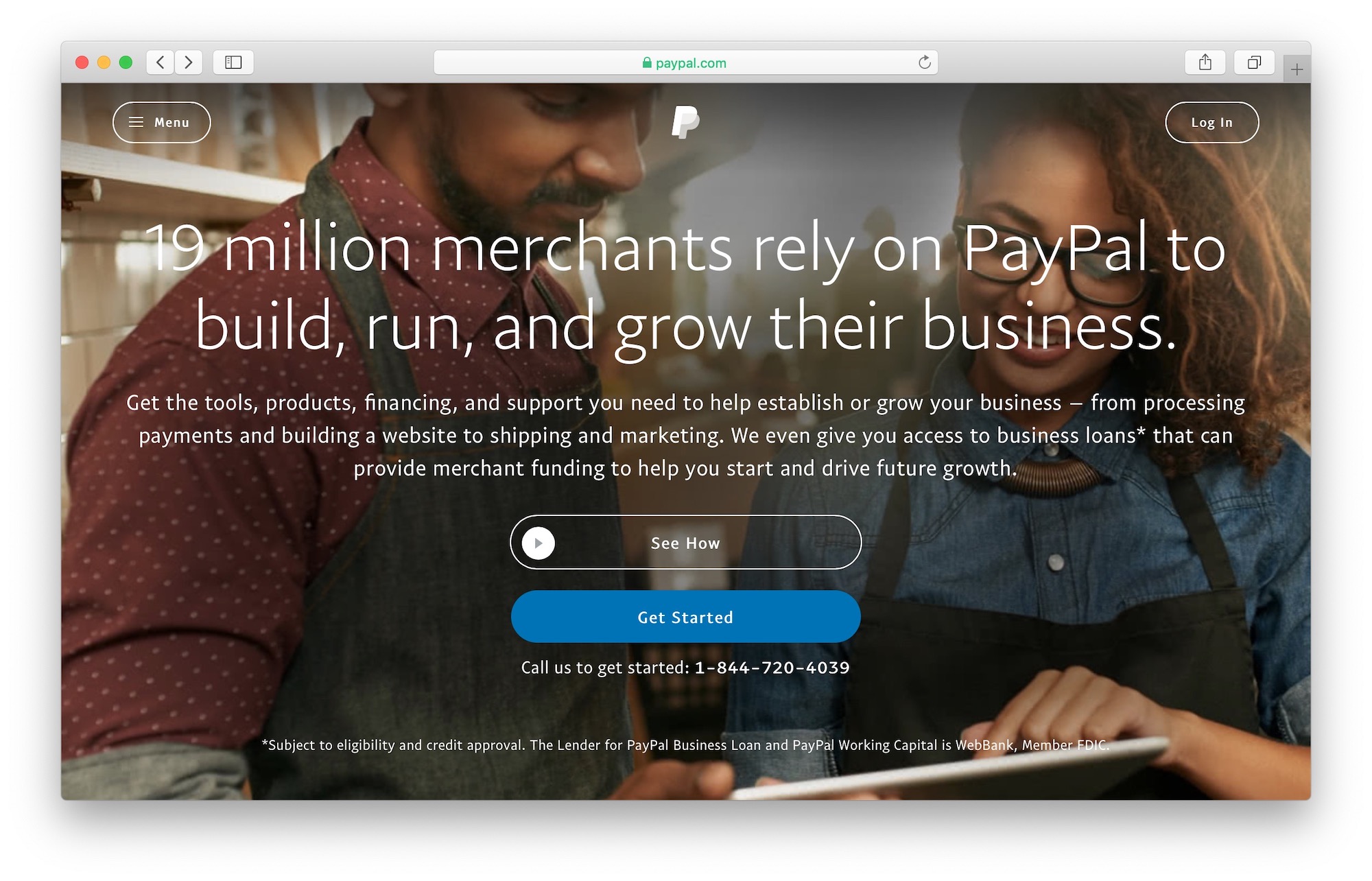

4. PayPal

PayPal is the most recognized and well-known payment processor / payment solution / payment gateway of them all.

PayPal is indeed much more than just a gateway that business owners can integrate with their e-commerce stores. In fact, many casual users have PayPal accounts of their own and use the service to handle casual payments on the web or even to split a bill with their friends.

All this makes PayPal the must-have payment gateway for your e-commerce store, purely because it's the one solution that guarantees you'll be able to sell your products to everyone.

From a business owner's perspective, there are different flavors of the PayPal offering that you should look into:

- PayPal Payments Standard

- PayPal Express Checkout

- PayPal Payments Pro

The differences between the three may be fine, but they can be significant based on the types of products you're selling.

PayPal Payments Standard and PayPal Express Checkout work very similarly. The only difference is that with Standard, the customer creates an order on your site → customizes it → and then gets redirected to PayPal to make the payment.

With PayPal Express, the customer will be redirected to PayPal to authorize the charge but won't complete the checkout process there. Instead, they will be able to come back to your site, customize the order, and then get charged in the background without leaving your site.

With PayPal Payments Pro, you get to customize the entire checkout process, and the customer remains on your site the entire time. Currently, PayPal Payments Pro is available only in a handful of countries.

Some more important details about PayPal as a payment gateway:

- you don't need a merchant account to use PayPal

- you get advanced fraud protection

- you can issue invoices

- you can withdraw money quickly to a bank account in your local currency

Pricing:

- PayPal Payments Standard: 2.9% + 30¢ per transaction; there are volume discounts if you process a lot of payments

- PayPal Express Checkout: 2.9% + 30¢ per transaction

- PayPal Payments Pro: 2.9% + 30¢ per transaction; plus $30 per month

👉 Read our full PayPal review.

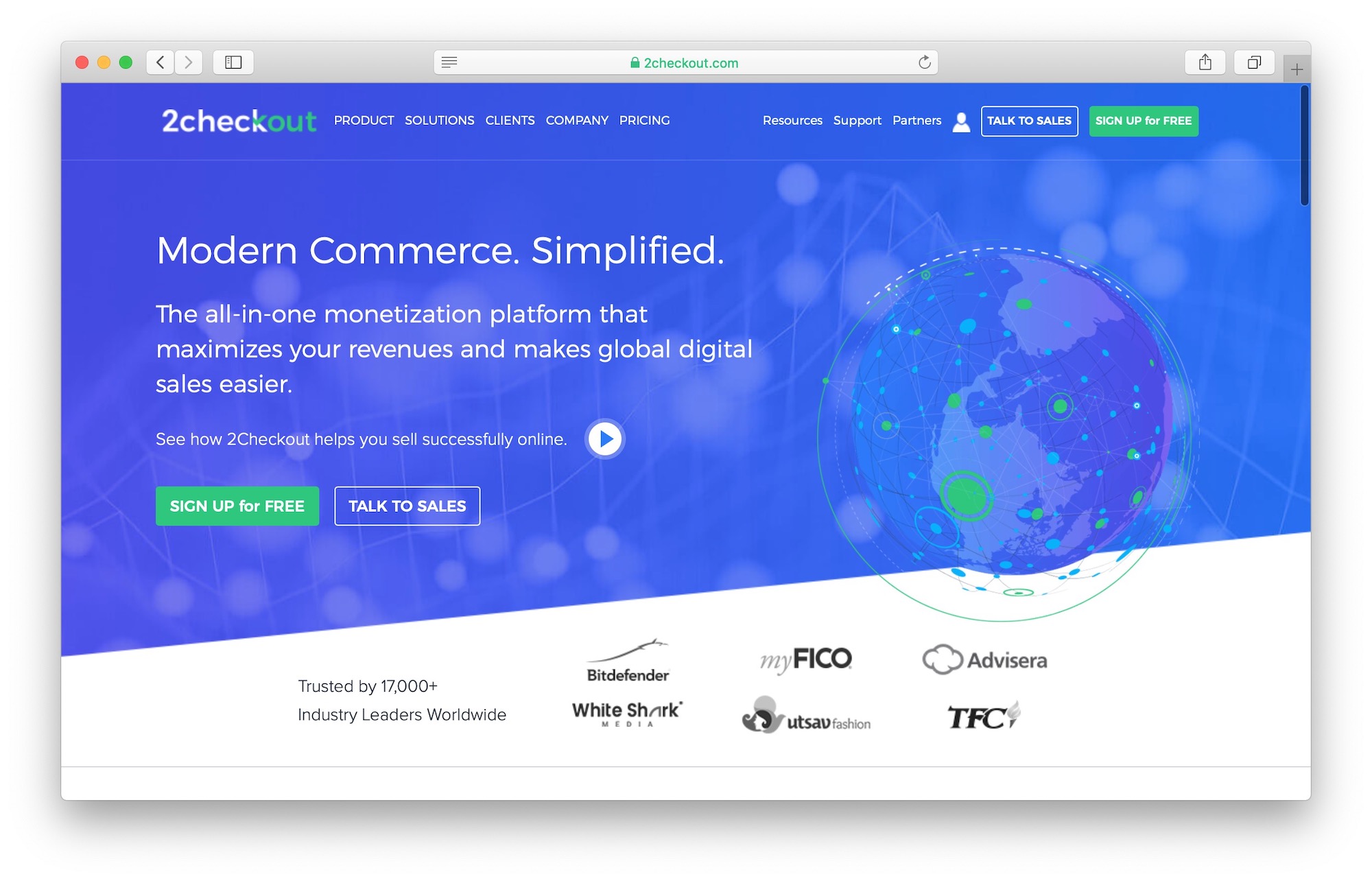

5. 2Checkout

2Checkout has been around since 2006 and now offers services in over 180 countries.

They provide you with a complete solution to process payments online, giving you access to an advanced platform where you can manage your business' finances and e-commerce efforts.

One of the unique things about 2Checkout is that apart from being able to integrate their payment gateway with all popular e-commerce platforms, you also get access to a hosted shopping cart that's been built with all of the best practices in mind and optimized for maximum conversion. This gives you the option to work with 2Checkout alone, without the need for an external e-commerces solution. This can be an attractive option for businesses that don't yet have an e-commerce setup.

Other important details about 2Checkout's offering:

- works in 29 languages and 100 currencies

- localized checkout for supported countries

- integrates with more than 120 e-commerce tools

- allows you to accept all major credit cards and PayPal payments

- the “2Comply” add-on provides advanced tax and VAT handling and compliance

Pricing:

- “2Sell”: easy and simple way to sell globally; 3.5% + 30¢ per transaction

- “2Subscribe”: for subscription businesses; 4.5% + 40¢ per transaction

- “2Monetize”: all-in-one solution to sell digital goods globally; 6% + 50¢ per transaction

This pricing may look like overall more expensive than the other solutions on the list but, particularly with the latter two plans, you get a number of extra features that go above just acting as a simple payment gateway.

👉 Read our full 2Checkout review.

Summary

This has been your first lesson on what a payment gateway is and the top five gateways available in the market.

At the end of the day, each of them will allow you to collect payments from your customers equally effectively. The real difference is in the side features offered and the overall experience of using the gateway and integrating it with your e-commerce store.

Here's a summary table to help you make a decision:

| Payment gateway | Price from | Editor's rating |

|---|---|---|

| Payline | credit card's own fees + 0.3% per transaction + $10 per month | ⭐⭐⭐ |

| Stripe | 2.9% + 30¢ per transaction | ⭐⭐⭐ |

| Authorize.Net | 2.9% + 30¢ per transaction + $25 per month | ⭐⭐ |

| PayPal | 2.9% + 30¢ per transaction | ⭐⭐ |

| 2Checkout | 3.5% + 30¢ per transaction | ⭐⭐ |

Setting these payment gateways aside, there's one more thing you might want to look into before you consider your e-commerce setup complete, and particularly if you're going to be working with multiple currencies. 💱

Basically, the problem with accepting multiple currencies is that you often lose out on various conversion fees when you try to withdraw the funds or process them in general. For this reason, I encourage you to complement your payment gateway(s) with Wise for Business.

Wise is a really innovative financial service. Basically, it provides you with local bank details for the UK, the Euro zone, Australia, and the US (without needing to have a local address). This means that you can request payments like a local no matter where you are. Then, you can withdraw money with low fees, thus minimizing your currency conversion costs.

Wise also works the other way around, meaning that it's your best way to pay invoices and send other payments – to your global suppliers, for example.

👉 Read our Wise review here.

This sums up the topic of payment gateways and how to choose the perfect one. If anything is not clear and you need help deciding, feel free to reach out to us via the comments below.

I loved the article but now I have the following question. What is the difference between a Payment Gateway, Aggregator and Payment Service Provider? Thanks in advance!

Hello Humberto,

We don’t have an article about this yet, but it’s on the shortlist.

Paypal is definitely still the most popular option, and especially for people who work on the internet. It is the form of payment par excellence, congratulations on the article!

Thanks!

im looking to set up a merchant account and i only process recurring ach transactions from customer accounts

$ volume small at first with one account maybe 93 transactions and $ 8500 per $100k per year

i have another account witch would be larger like 1700- 6800 transactions per month

with volume of about $3 million

looking for online portal that i can enter client info and have the system sweep ach transactions from clients

weekly, bi monthly or monthly

Thoughts?

Why does the title of the blog contain Adyen, but it is not mentioned once in the article?

Hello,

Thanks for the heads up! We’ve updated the post recently.

–

Bogdan – Editor at ecommerce-platforms.com

Thank you for clarifying

payment gateway, processor and merchant account. It appears the terminologies has changed but the concept is still the same. I incidentally worked on the first payment platform in West Africa with my company designated as MPP(Master Card Member Service Provider–The gateway interfacing transaction between customers account,issuer(MasterCard, VISA etc) and customer Bank accepting/processing transaction on behalf of their customers with account with the bank. What we do then is have the banking institution select two of their staff members each provided with separate unique key which is entered into an hardware security module (HSM), generating a unique Bank Identification Number(BIN). Once this step is completed we have the Bank information whenever their customer transaction comes in for processing. When a customer swipe their card at a terminal anywhere, We pick up the transaction, identifying the Bank using the BIN, routes the transactions to the Bank with a response for authorization and then the money gets payed at via the point of sale where merchant get credited and customer get debited

Things have changed over time and I want to get a feedback since I am in the process of signing up for a providers that can process online payment for service industry and we get payed for facilitating customer to service provider transaction:

What are the options for such start up with

(Payment Gateway(PG), Payment Processor(PP) and Merchant account(MA)) (PPM) taking into consideration the we need to have their API integrated into our website and I am looking at:

1 The most secure payment

2 NO set up cost and payment to PPM based on volume of transaction

3 Options to have PPM delivered via on platform for ease of processing and payment/ An alternate will be a PP + PG from one solution and MA as another solution if this will drive down cost

4 Ease of ending service if you are comfortable without any charge

5 Ease of integrating with our platform

Hi,

I am from Romania and I’m faced with a bit of a difficult situation. I created a shopify store and applied to almost all of the payment gateways listed on shopify but got rejected by all for the same reason, they don’t like dropshipping. It’s a clothing store, so nothing dangerous or shady.

Any solutions, or some kind of a workaround? Thank you

Hi Caesar,

Yes, payment processors can seem frustratingly cautious at times.

You may want to search for ‘high-risk merchant accounts’ — these are providers that specialise in payment processing for businesses that more mainstream providers are unwilling to work with.

You will end up paying more, but it’s a way to at least start trading. In the future, once you’ve built up a trading history, you’ll be seen as lower-risk and the more traditional providers may be willing to work with you.

Is there a gateway system that will not “pre-authorize” a card before we tell the system how much we want to charge on the card? For example, if a customer puts in a order for 2, $50 items ($100 total order) but we can only ship 1 of the 2 items right away ($50 worth) I don’t want them to be “pre-authorized” initially for $100 when then send their order through. I just want them to see the $50 charge once we ship the 1st item, then $50 later on when the 2nd item ships. Does anyone know a gateway system that allows this? We seem to be having a lot of trouble finding one.

Hi CARRIE, speak to SecureTrading. They’re an independent Payment Gateway not linked to a bank and can support the functionality you mention.

What needs to be done in order to work with bank directly? Is there some sort of certificate? I know that we have good data encryption (AES256 + Blowfish) at our website, but I can’t find a solution, which would allow me to just accept credit cards and work with the bank without any additional points in between

You will need to contact the bank you want to work with and they will provide some code. It’s best to find a developer in your country, he’ll know what to do.

Cheers,

–

Bogdan – Editor at ecommerce-platforms.com

you are so nice sir, this is so nice advise.

Helllooo friends,

Love my Merchant e Solutions Gateway provider.

However if you are a non-profit organization built on DONATION make sure you find a website that fully support DONATIONS pages because you will receive little or no help from Merchants E Solutions.

They provide a copy and paste HTML generated Donation form that provides no Cascading entries. The Form really sucks. You will have to pay thousands of dollars to a Developer to get ir going.

J.W.

We are facing difficulties on getting a payment gateway support on our website. Everyone rejected to support us for 3 reasons: (1) we deal with branded and authentic women accessories, (2) our business registered in the middle east and (3) we are an auction website. We heard about making our own payment gateway. Does anyone knows about this topic? how much will it cost? any complications?

Hi Collins,

My difficulty with these payment gateways is that the kind of description they assign to transactions done on merchant site. Example, you check into a hotel, and they do a pre-authorization to secure funds… but the narration on the customers account says google pay… And customers are denying such transactions because they have not done any activities at google pay… Kindly me unravel such scenarios. Thanks

Great article Matt Collins

You have given us such great information on the payment gateway. Please keep on posting some great articles.

Thanks for the excellent post.

Question for the Forum, our company is considering implementing Authorize.net or Stripe for a new eCommerce product we are launching and are trying to understand the fee structure. If we go with either Authorize.net or Stipe, do we still need merchant processing services from our bank?

We currently use Intuit/Quickbooks to process credit cards for our current merchant services where we accept credit cards. For our new consumer eCommerce product, do we need to pay both Authorize.net or Stripe AND Quickbooks, or does Athorize.net/Stripe handle all aspects of processing the transaction? Thank you

The combination we use (Stripe + PayPal, either Express or Standard) covers probably 95% of our customers.

Most people tend to just setup PayPal because thats what comes with most of the big e-commerce systems already pre-setup and plus it’s super easy to configure.

But I found that setting up Stripe as well to process credit cards on-site gave a great conversion increase. Plus it works in a similar way to PayPal on the backend, meaning you still don’t need to setup a merchant account with your bank and the money can just get transferred back to your bank account.

How can you use Stripe without SSL?

Hi Martin,

Stripe requires SSL on your website to work.

Best,

Bogdan – Editor at ecommerce-platforms.com

Paypal all the way, I’ve heard plenty of good things about Stripe – they customer service is excellent – at least when I was trying to contact them as a potential client.

I have been using Authorize.net for 8 years and their rates are the lowest I’ve found anywhere. Yes, you have to pay some monthly fees, but overall, if you sell a lot of volume, the per transaction fees are so much lower than anything else I have looked at.

Thanks for you valuable notes. I’m from iran and our business is about exportation of persian rugs, as we want to establish our online market we want a payment gateway provider but many of these providers don’t provide any service to iranian businesses. please help me to find a suitable provider that we can work with.

kind regards

Hi there, maybe this answer from Quora will help. Cheers!

Dear Catalin,

Thanks for great resources as always. I have been looking into this a long time but couldn’t find any relevant info. We are trying to find the best off-the-shelf ecommerce solution for us but we don’t have a US bank account and turns out to take advantage of shopify payment gateway to cut on the transaction fees, you need to have a US account. Otherwise, we need to pay 2% on every transaction in addition to the general credit card rates. Any suggestion would be highly relevant.

Best regards,

You can find a list here with the international payment gateways available. Keep in mind that these gateways all come with their own transaction fees. All transaction fees will be lifted regardless of your plan only if you are eligible to apply for Shopify Payments. Cheers!

On Shopify it doesn’t help to have just an US bank account, you need to have a SSN, too, to get approved to use Shopify Payments – if you signed up on 2016.

Go to ALTAR – stripe, they have solution for non US citizen, that need usa bank account with mercant , they are in silicon walley … i have that , and might tell they are the best .

so where is the actual comparison? vital info people actually need, like… COSTS?

Hi Foo, I suggest checking the comparison chart as well.

As much as people seem to hate Paypal, I think you’d have to be a fool to not at least offer it as an option on an ecommerce site. It’s just too trusted and well known not to. In fact I would even bet that offering it as an option is correlated with a higher conversion rate.