Expense management for your business can be complicated and expensive if you're forced to issue cards from traditional banks.

For example, the exchange rate might not be in your favor, and each card might come with account costs that can quickly add up.

This is where an alternative payment solution like Wallester Business might come in handy. They're a virtual and physical VISA card issuer that aims to save you time and money.

Wallester Business lets you quickly issue cards to your employees and track all their payments and expenses. With convenient cash management features and a fully white-labeled service, you can design your own card program.

Unfortunately, while the platform makes many things cheaper and more convenient, accounts are only available in EURO. Furthermore, Wallester Business doesn’t come with any native integrations, which makes incorporating your existing finance tools like Xero or Intuit Quickbooks a little more complex. It's also worth noting that only European Economic Area corporations can use this software.

That said, I think Wallester Business is best for small to medium-sized businesses looking to move away from shared credit cards to more streamlined expense management.

With the basics covered in this Wallester Business review, I’ll take a closer look at what this platform offers, its pros and cons, and pricing so that you can see how I arrived at this verdict.

There's lots to cover, so let's get into it!

What is Wallester Business?

Founded in 2018, Wallester Business is a fintech solution for startups and established corporations. It’s an official VISA partner and, as such, focuses on issuing VISA products, including debit cards, credit cards, prepaid cards, and more, for business.

Wallester acts as a sort of buffer account for your business, allowing you to centralize your employee spending/expenses. After Wallester’s quick and free setup, you must top up your account by bank transfer to cover all your predicted business expenses.

Once there’s money in the account, you can issue virtual and physical VISA cards to your employees, enabling them to spend from the expense account according to their needs and spending limits. (For those not in the know, a virtual card is an electronic card number that can be used like a physical card to pay vendors).

This can be done with Wallester’s mobile cash management app for iOS and Android.

Best of all, Wallester can allow for complete white-labeling of the platform. So not only can you brand your cards, but you can also white label the mobile app, so employees can always stay engaged with your brand.

The app provides the infrastructure you need to manage your finances with features like automatic spending categorization, issuing and freezing cards, pin reminders, pin changes, automated expense reports, smart receipt attachments, invoice storage, and more.

Another way to use Wallester’s payment cards is to pay gig economy workers. You simply give them access to a virtual card that’s pre-loaded with their salary. Then, they can transfer the money to their own account or start spending with the virtual card.

Wallester’s Other Key Features and Services

Corporate Cards

Wallester Business issues white-labeled corporate cards that can be fully branded. You can order as many physical cards as you’d like or generate virtual cards within seconds according to the limit your free or paid plan imposes. Your employees can then use these cards to transact business payments and pay for expenses like travel, corporate entertainment, software costs, etc.

Once the card is used, the user and the account holder (employer) immediately get a payment notification, and the expense is tracked. They can also take a picture of receipts or invoices using Wallester’s app to add to their records.

Wallester Business’s cards partner with VISA, so they’ll be accepted anywhere in the world where the VISA payment system is in use. In addition, the virtual cards work with e-wallets like Apple Pay, Google Pay, and Samsung Pay, and the physical cards can also handle contactless payments.

Expense Management

You can flexibly adjust the user settings on each card to manage spending and expenses. You can view card funds from a unified system and adapt your corporate budget anytime. You can also grant access rights to a virtual card to individuals or whole groups. For example, you could give an entire team access to a virtual expense card for their spending.

You can set daily or monthly spending limits. For example, set a single transaction limit or limit transactions to specific categories, like restaurants. Or you can determine whether a card user is allowed to make cash withdrawals. You can also require payment requests to approve each payment before it is made.

Finally, you can also ensure employees receive automated reminders to upload invoices to the app, so no information is missing from expense reports, which leads us nicely to my next point…

Reports

Wallester Business’s mobile app provides insights into your company’s spending. You can access expense reports based on parameters like general budget statistics or data on specific cards. You can also filter corporate expenses according to spending type and payment status.

You can also create account statements for selected time periods and export this data as Excel, PDF, or CSV files.

Wallester Business’s API allows you to smoothly integrate the platform with third-party financial accounting platforms. This makes consolidating the expenses you’ve tracked, other bills and overheads, your income, and your budget more manageable. Unfortunately, this does require someone on your team to develop your own integrations via the API, as no native integrations with third-party accounting tools are available.

Currency Conversion

While capital in a Wallester Business account is currently only held in Euro, you can make purchases in any currency you need. Moreover, according to Wallester’s website, The conversion rate is often 4x cheaper than that of traditional banks.

Unfortunately, as previously mentioned, there’s no way to hold multiple currencies in your account, which means Wallester Business is a little less convenient for international businesses.

Pros and Cons

Wallester Business Pros

- You can get up to 4x better exchange rates with Wallester cards.

- Wallester’s business cards are accepted worldwide (provided they support the international VISA payment system).

- It’s cheaper to issue cards to employees through Wallester Business than through regular banks (The average credit card can have upwards of $30 annual fees. Wallester doesn’t charge you extra subscription fees for each individual card, as long as the number stays within the range of your free or paid plan).

- You can order an unlimited number of physical cards with no ongoing fees for each card.

- Wallester Business’s white-labeling functionality allows your company to create a more personalized experience.

- Fast and free setup, with a basic free plan available that unlocks access to 300 virtual cards

Wallester Business Cons

- Wallester Business only operates with businesses registered in the European Economic Area or the UK.

- The account currency is only EUR.

- Integration with accounting solutions is possible with an API, but there are no conveniently established one-click integrations.

- The hike in price from the free plan to the first paid plan is quite steep.

- There is no dedicated community-driven help center on the website that explores its features in depth.

Pricing

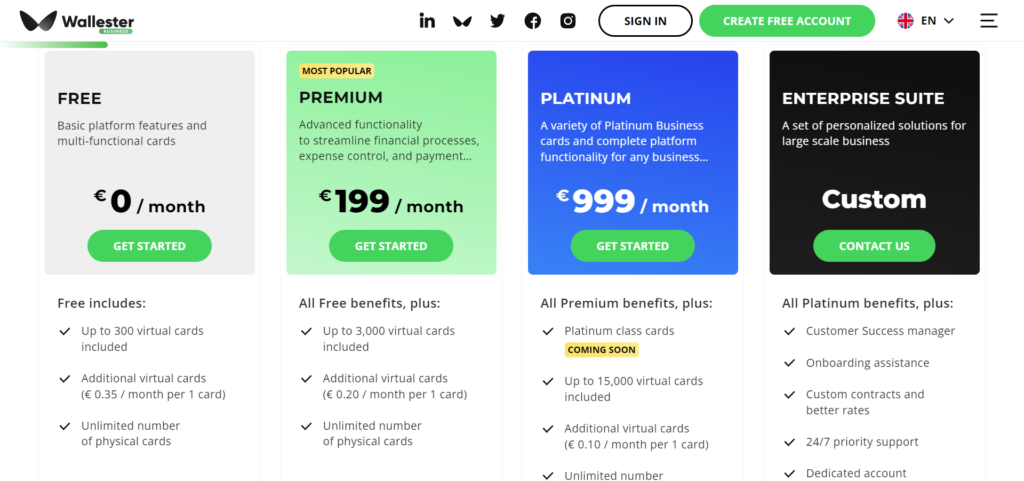

Wallester offers four pricing plans, including a free program and an Enterprise suite. At this point, it’s worth noting that physical card delivery costs 5 EUR per card all across Europe and on every package ( you can order as many as you want). Once you have your card, it doesn’t incur further annual fees!

Now that I’ve laid the groundwork for Wallester’s pricing, I’ll explore each plan:

The Free Plan

The free plan comes with up to 300 virtual cards. However, you can purchase additional cards for EUR 0.35 per card per month. You also get access to the cash management app and create as many sub-accounts as needed. Sub-accounts are accounts for your team, individual employees, freelancers, etc. However, you can’t make payments between accounts.

On top of that, the free plan has all the basic financial management features other programs enjoy, such as the ability to create individual spending limits, transaction exports (export transactions as PDF or spreadsheets), automated expense reports, accounting integrations through API, automatic spending categorization (categorizes payments into easily identifiable purposes like restaurants, entertainment, bills, etc.), and much more.

All plans (including the free plan) also have access to real-time live chat and email support.

The Premium Plan

The Premium plan costs EUR 199 per month. As well as everything you get in the free program, it unlocks advanced functionality such as free payments between accounts and the ability to send push and email reminders to your employees concerning missing documents (for example, so that no one forgets to photograph a receipt or upload an invoice).

This plan also includes up to 3,000 virtual cards, with additional cards costing EUR 0.20 per card per month.

The Platinum Plan

The Platinum plan comes with up to 15,000 virtual cards, and you can purchase additional cards for EUR 0.10 per card per month. In the future, the physical cards ordered on this plan will be eco-friendly platinum class cards with premium VISA offers and perks.

In terms of features, besides all the above, the Platinum plan unlocks detailed analytics and a dedicated account manager for support.

The Enterprise Plan

Becoming an Enterprise offers an individual approach to the construction of one’s own plan. It comes with a customer success manager who will discuss your business needs and growth from the get-go, onboarding assistance, custom contracts, and better rates. In addition, you’ll have 24/7 priority support and open access to the developer APIs.

How to Open a Wallester Business Account

Wallester Business’ setup is quick and free. However, you must provide two supporting documents to start issuing your first cards. One is a certificate containing information about your board members, and the other is a certificate of information about the business owner.

You also need to provide basic information about your organization, such as its registration number, VAT number, and any info on shareholders with more than 25% ownership of the capital.

Account registration can be completed in a few minutes and encompasses a four-step form. You’ll also be asked to sign a program participation agreement.

Wallester Business Review: My Final Verdict

That brings us to the end of my Wallester Business review!

In summary, I think Wallester Business may be a convenient solution for businesses trying to streamline their expense management. It’s handy for corporations requiring their teams and employees to make payments or those offering benefits like paid travel or fuel costs.

However, Wallester Business is only available for European customers, doesn’t facilitate multi-currency accounts, and doesn’t natively integrate with other tech solutions. In addition, while Wallester Business presents an affordable, fast, and convenient way to issue virtual and physical cards, the platform falls slightly shorter on its financial management features. As a result, companies with more advanced accounting and international payment needs may prefer the platinum paid plan of Wallester Business or more global alternatives like Revolut, which allows you to transfer and hold over 30 currencies.

That’s all from me, folks; let me know what you think of Wallester Business in the comments below!

Comments 0 Responses