Some commons problems often arise when ecommerce professionals look for payment processing, like too many fees, high fraud or processing errors.

These hurdles make it a pain in the butt when researching for the best payment processing, but Alternative Payments has a new business model that attempts to get rid of these situations.

Alternative Payments has been around since 1999, but it rebranded in 2013 to target ecommerce businesses that want to expand into new and established markets.

Get This: Alternative Payments Removes the Need for Credit Cards

Alternative Payments realized that, in some countries, a credit card is not the primary payment method anymore. In fact, many customers in EU, Asia and South America prefer to skip credit cards for online payments.

Instead, they opt for local payment methods, making Alternative Payments one of the only platforms that offers this functionality.

What are the benefits of the Alternative Payments local processing?

- Customers can choose their own local payment methods, allowing for their native languages, currencies and even local support.

- The merchant doesn't have to pay any hidden fees.

- Identity theft and fraud decreases, since credit cards are eliminated for many transactions.

- Merchants sell to more international customers, considering more than 200 payment methods are consistently used around the world.

- Transaction acceptance is more common, regardless of the currency.

- Merchants gain access to recurring billing and subscription tools.

- Merchants get to work with chargeback-free payment options.

- You can actually recover declined transactions.

- The local payment methods fees are pretty low.

Alternative Payment Review: Standout Features

Alternative Payments has a wide range of appetizing features, but I would argue the following are the most intriguing:

It's a Payment Gateway Built In-house

Not all payment gateways are built in-house, and this leads to standardization, where you're left with numerous payment processing options, yet not many differences in your choices.

However, Alternative Payments seems to have listened to its customer over the years to establish a system that makes cross-border transactions easier.

This lets you tap into the largest markets where credit cards aren't used that much. The best part is that the platform helps your customers, in turn bringing in more sales for you.

The customers don't have to go out and get a credit card, and they don't even have to open up bank accounts for completing transactions with you. Finally, currency exchanges and legal entities are removed from the mix.

Security You Can't Find Anywhere Else

Whenever I review a payment processor or gateway, it seems like all of the security measures are the same across the industry.

However, Alternative Payments has a completely different approach, further protecting you and your customers.

Not only do they have black and whitelisting features, but you gain access to SEPA processing with SMS verification. It's considered a more secure form of processing, especially when complemented by the blacklists and whitelists.

Voice and fraud protection is also included, along with tools for decreasing chargebacks and refunds. It's obviously not a perfect system (and some people would rather checkout with a credit card,) but it opens up opportunities for merchants (safer and cheaper processing) and customers (local payment options that don't include credit cards).

Click here if you'd like to learn more about SEPA.

What else can you expect from Alternative Payments?

- Voice and SMS fraud protection tools

- Payment tokenization so that no personal information is stored on your system.

- Logging with plenty of details

- Coding libraries with examples

- Support for both recurring billing and subscriptions.

- Extended of webhooks

- Widget based payment options

- Manage multiple businesses under a single account

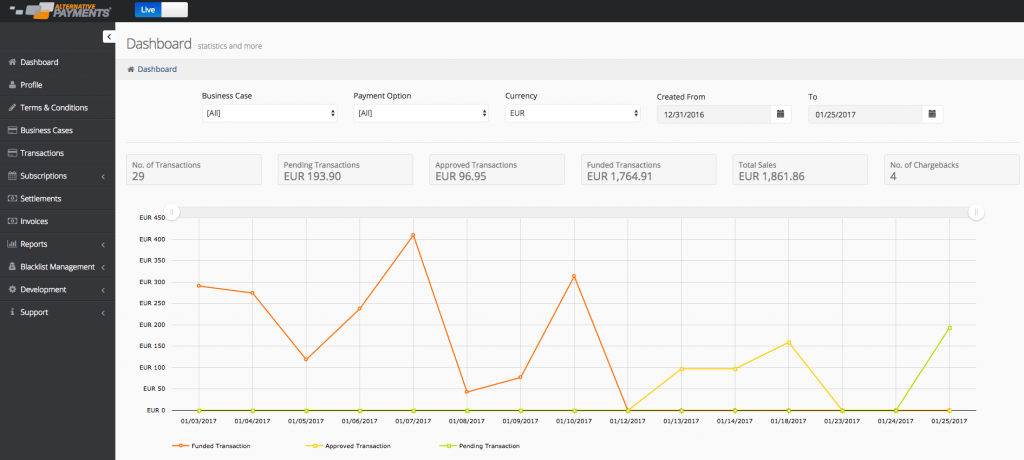

- Extensive sales reporting

- Reporting for chargebacks and refunds

- Money is deposited directly into your account

- RESTful API

- It's a licensed payment institution.

A Pricing Model That Works For Everyone

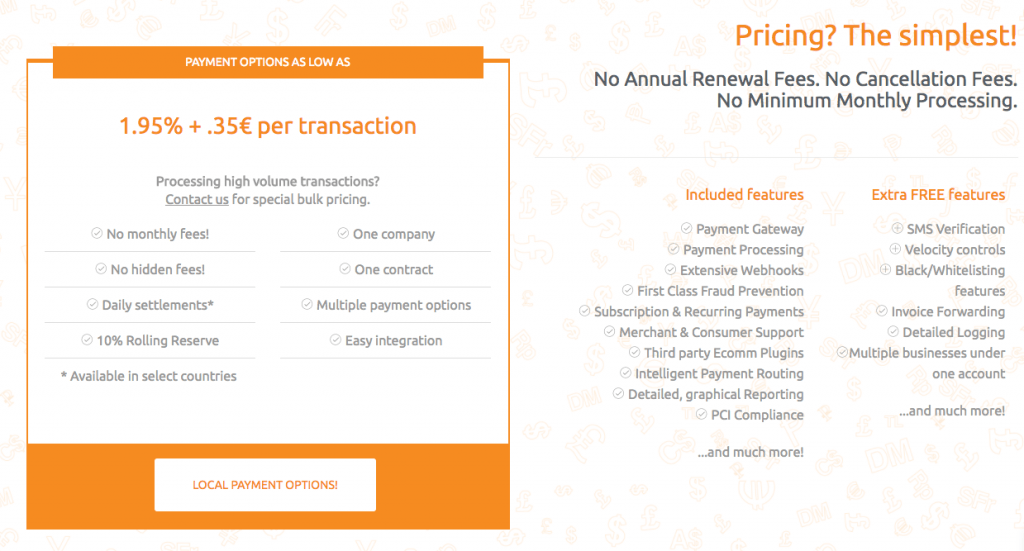

You don't pay a dime with Alternative Payments unless you make a sale. The hidden, monthly and setup fees have been completely removed from the equation.

That said, you must pay 1.95% + .35€ per transaction.

That's not a bad rate, especially considering your customers are opened up to various other payment methods, and you're given a chance to expand your business without taking the risk of more fraud.

I also like that Alternative Payments has these built into its pricing model:

- No monthly fees.

- No hidden fees.

- No cancellation fees.

- No fees for minimum monthly processing.

- No annual renewal fees.

- No launch or setup fees.

Overall, the pricing looks solid with Alternative Payments. It's hard to recommend against the company, because you're not locked into any contracts or forced to pay a certain amount of money if cancelling your account.

Not to mention, I would assume you end up making more money with the decrease in chargebacks and fraud fees.

Who Should Consider Alternative Payments?

As a conclusion we like to talk about what makes the payment processor different. Also, it's nice to evaluate which ecommerce companies might be interested in such as service.

As for Alternative Payments, I would argue that it doesn't matter how big your online store currently is.

Large ecommerce shops need this functionality to support the millions of dollars they bring in from other countries. Whereas small and mid-sized companies are most likely trying to expand to other regions.

I also like it for ecommerce companies that have had problems with fraud and chargebacks in the past. Alternative Payments finds the best possible payment method for the markets you're trying to target.

They have the global expertise to help you expand into local payment methods, which is bound to decrease, or eliminate, fraud and chargebacks.

Overall, Alternative Payments has a solid case. After all, what business wouldn't want to give customers more payment options? It's only going to make you more money.

If you have any questions about Alternative Payments, feel free to check out the processing company here. Also, let us know if you have any experience with Alternative Payments in the comments section below.

Comments 0 Responses