It's more like a ritual for most merchants to look out for the most productive payment processor.No room for expensive mistakes. After all, I don't want my business to hit rock bottom. The expedition begins with an all-inclusive background check.

But hey, relax. I got you on this.

As a business entity, the ultimate approach to optimize the entire checkout revolves around a secure transaction platform. Meanwhile, I must look forward to one which comes with low fees. That's not to say that cheap equals to expensive as they make it seem.

You will agree with me on this.

There's a new breed of highly rated equivalents on the radar. The market is quite stiff. Right guys? However, that really doesn't matter. But here's the burning question. How credible is this payment processor? I need to know how compatible it is with my retail online store. That's why we're here to untangle the puzzle.

This review unravels the good, bad, and ugly side of SumUp. In particular, it covers a whole assessment of its credit card readers. Also, we look at its pricing, how it operates, compatibility, retail integration, and pros as well as the constraints. We leave nothing behind.

As fast as greased lightning, let's go into details.

What is SumUp?

It's more of a multi-tasker. So here is what it does. It lets me handle all major credit and debit card payments via its card readers. I must say, it comes with low transaction fees. More importantly, the rates are fixed. Interesting enough, it comes with zero hidden fees.

SumUp enhances its service delivery by far. The kind of hardware it uses is quite durable and the technology itself is so futuristic. As a matter of fact, the wireless card reader has Bluetooth compatibility which easily connects to my mobile device.

We can't overlook this amazing feature. Perhaps you might think that I'm making some sort of an overemphasis. Please let me persuade you a little further. To elevate secure payment, I get to use internet connectivity to process transactions and save all the data on the cloud.

What's more captivating is the ease to accept contactless NFC payments from cards using the following brands;

- American Express

- Maestro

- Mastercard

- Diners Club

- Union Pay

- V Pay

- Visa

- Discover

Furthermore, making payments from Google Pay or even Apple Pay is a trouble-free experience here. This explains its dominance in Europe. There are thousands of merchants who count on this payment system.

Here's a list of all the 31 countries where SumUp operates in;

- Austria

- Belgium

- Brazil

- Bulgaria

- Chile

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

Seems like everything has been progressing well ever since they made a bold move to merge with Payleven; which was once their close rival. As if that's not enough, reliable news from techcrunch.com indicates that SumUp recently acquired ‘Shoplo', a multichannel e-commerce platform.

This proves it's global outreach, financial muscle, and dependability. It explains why there are over 100,000 daily transactions by SumUp.

SumUp Review: How do I get started?

So here's how to accept payments in a speedy manner.

First thing, I need to sign up. This takes less than 10 minutes. The moment I get on board, SumUp welcomes me with a beautifully designed user interface. At this point, I'm able to purchase a card reader online. It's quite portable; it can easily fit in my pockets. Fortunately, SumUp is generous enough to offer an absolutely free delivery service.

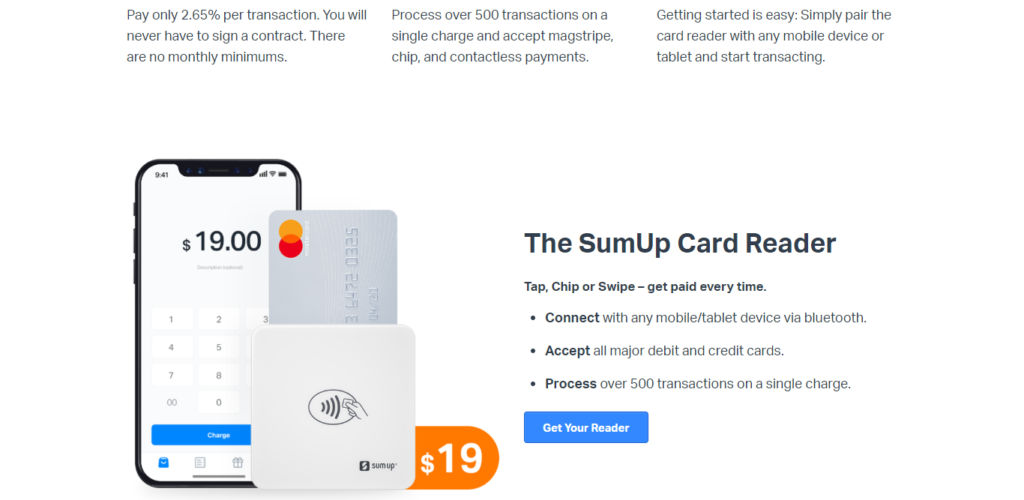

Should I feel the need to buy the Air card reader, I'll only part with $19. This is all inclusive of VAT and it will only take anything between 4-5days to get at my doorstep. What's more of eye-catching is the fact that it comes with no monthly charges nor contracts.

Its EMV (EuroPay, Mastercard and Visa) reader is built to automate card processing. On the app's main screen, I'm able to begin the payment process. The product menu with all my inventory shows up. Alternatively, I have an option to manually enter the product description and amount.

What plays out well for me is the leeway to enter more than one amount if I sell different variants of the same product. On the checkout page, ill tap “charge” or enter the amount if I've included cash payments in my account. The card payment requires me to use the reader to swipe or tap a customer's credit card or mobile device.

As simple as that.

So what acts as proof of payment?

Good question.

There are a couple of actions to leverage. A customer receives an automatic email or text receipt. On the other hand, SumUp's wireless printer lets me print a receipt so long as it's in sync with the device which has the app installed in it.

Perhaps you're muddled by amount limit issues.

Here's the breakdown. Fortunately, no restrictions set if I make payments from either Google Pay or Apple Pay.

SumUp allows transactions from contactless cards which are below £30 without the need to use my PIN. However, any amount above that requires a higher threshold of validation. All payments reflect in my bank account within 2-3 business days.

SumUp Review: How about the Reader's Specifications?

To have a painless breakthrough, I need some sort of certainty. The SumUp app runs smoothly only when my device has 4.0 Bluetooth and operates on Apple 8.0 or Android 4.4 and above. Seems like it wants to upstage Paypal Here.

Furthermore, it doesn't matter whether I'm using an iPhone 4 or an iPad 3. Take note, it easily integrates with my Point of Sale(POS) system and connects to an external printer. This helps me print a client's receipt.

The reader has impressive battery life. Inside the box, it comes with a micro USB cable. Once I charge it, the device can successfully last long enough to handle over 500 transactions. At the forefront of enhancing its longevity, I need to be careful with its magnetic fields. Remember, once I tamper with this area, it's no longer useful.

The sleek and modish device tends to overshadow the Miura M010 Reader which has been the dearest pet for most of Square users. And the steps to connect the reader are so simple. As soon as the power button flashes, the NFC contact lights up, and I'm good to go.

At this point, I need to open SumUp's app and log in. This is where the option to either select a pre-entered item or manually enter an amount comes into play. It directs me to select “charge” and choose “Reader” as my payment option.

What follows, is an automatic search which connects the app to the closest device(my reader). So this is how the Bluetooth feature proves to be handy. Not forgetting the receipt printer connectivity. Lastly, it notifies me that the device is now ready to swipe a customer's card.

As you can see for yourself, the process is actually idiot-proof.

Is this the only reader SumUp has?

As luck would have it, the answer is no. Let's presume, I don't feel like using SumUp Air since having to log in the mobile app to accept payments sucks for me. The SumUp 3G takes away all the hurdles. It's more of a stand-alone and works independently but achieves the same results.

The price for this device is £69 which is all inclusive of VAT and free shipping too. It's ideal for small businesses that don't need to deal with complex POS systems.

And the Printer?

Keep in mind, I still have a choice to issue printed receipts to my customers. Ultimately, I need to purchase a printer which is compatible with the app. Many thanks to the cutting-edge automation which makes it easier to use AirPrint(iOS) and the Google cloud print(Android) technology.

The following, are all the compatible printers;

- Star Micronics SM-L200

- Bixolon SPP-R200lliK/BEGE

- Bixolon SPP-R210iK/BEGE

- Star Micronics TSP100/TSP143

The beauty of it all is, I get to connect to the above printers via SumUp's Android app. Well, it seems like the Bixolon SPP-R210iK/BEGE printer dominates all others. The rationale is so simple. Its portability is one of a kind. This printer only weighs 260 grams.

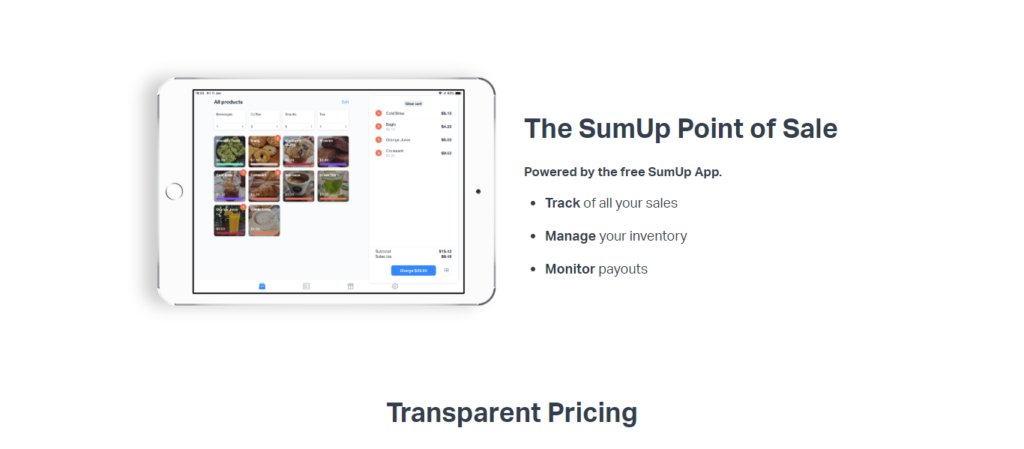

SumUp Review: App and Dashboard Overview

We can't fail to have some scrutiny at the features here.

If truth be told, this is like the backbone of the entire payment process. The app itself, can't be overlooked. Reason being that, it connects to my POS and not only accepts card transactions but cash too.

Let's start off with the Item Category.

It acts as an inventory point where I upload my products. It lets me sort my merchandise by price, product description and I'm at liberty to add a couple of photos. As a retailer, I need to look no further. This is the right tool for my business management.

Remember the variants stuff we talked about earlier on? I get to add things like color and size. So how systematic is the analytics feature? SumUp has the capacity to come up with detailed sale reports.

The information is quite useful and it allows me to import it to my preferred accounting tools. It easily filters what I need. Let's say want a daily or monthly reports, it's only one click away. All payouts are well- organized and the system sends them to my email for reference purposes.

Just like major 3rd party e-commerce platforms, I'm able to create multiple staff accounts. It's the best means to delegate work. What's more fascinating, is the option to set restrictions. It gives me a chance to be an advanced administrator. It lets me choose whether I want a staff to view all transactions or not. Also, I get to decide if it's okay for them to issue a refund.

Talking of refunds

SumUp makes it letter-perfect. I get to use the initial payment method for the transaction. It permits me to issue a partial or a full refund. I like how SumUp helps me scale my business.

It's so stunning how effortless the tax rates are calculated. I can include a tax rate with the item price. Besides, it allows me to work with several tax rates since I might have to sell my items across different regions.

On the contrary, I must point out that it's a bit maddening how SumUp failed to include features such as Bulk product import, Inventory count, and invoicing on their dashboard.

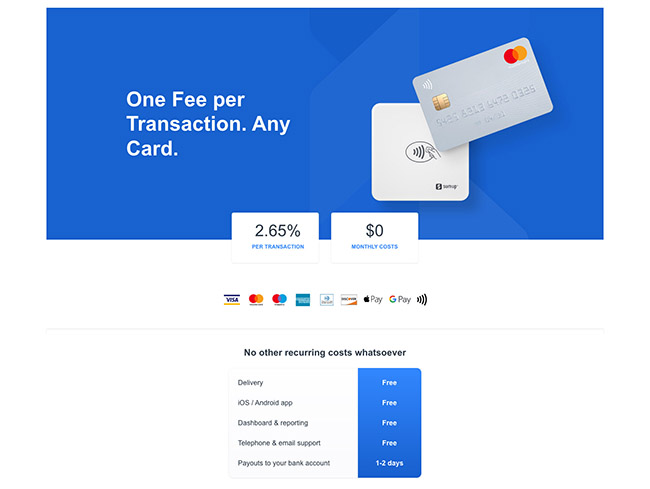

SumUp Review: Pricing

The rates are uncomplicated and pocket-friendly. Let's go into specifics. SumUp charges its US clients a 2.65% card transaction fee. Slightly lower than Paypal Here(2.75%). There are absolutely no monthly costs. So I'm free from setup or cancellation fees.

To be precise, I get to enjoy its dashboard and reporting for free. This includes the app and email support. The price for the card reader is a one-off payment and there are no contracts attached to it.

It's significant to be conversant with SumUp's rate in the UK which is actually the lowest. They only charge a standard rate of 1.69% per transaction. All phone payments are charged at a rate of 2.95% plus 25p.

These rates are so affordable for many small businesses.

Who is SumUp suitable for?

For all registered medium enterprises and sole proprietors, SumUp is the ultimate payment processor to utilize. It's so accurate and brings into the open its affluent capacity. I'm quite sure that this is the only card reader I need if my business isn't sophisticated.

What do I mean? If my business runs without a POS, I should look towards using SumUp.Besides, I get to pay very low fees if we are to make a comparison with some of its competitors. It's suitable for constant travelers since it operates in so many countries across Europe and in the US.

The above-mentioned feature is effective once I make prior consultations with the customer service.

SumUp Review: Customer Support

Just satisfying customers isn't good enough anymore.

SumUp ought to ease my pain. In case of any questions, I can contact the team using the phone number or email listed on their website. You can make a call between 8 am -7 pm on weekdays.

However, there are numerous complaints about its sluggish response. Also, they don't do 24/7 live support and not available on Sundays. Despite the high ratings, this has been their biggest drawback.

Alternatively, I can gain access to their support through my mPOS app. SumUp takes note of the frequently asked questions(FAQ) criteria.

It attempts to answer so many queries which are common in the niche. This section is pretty much informative and covers a wide range of issues that relate to the entire payment experience. On the contrary, I think SumUp should step up to the game and include nearly everything just like it's close rival Square.

SumUp Pros

- SumUp has low transaction fees. The rates are a bargain-basement both in the US and in the UK. They are lower than all of its close competitors. Also, it's impressive how they deal with fixed transaction rates.

- No hidden costs or monthly charges

- Ease of use- the dashboard comes with a couple of features that are so helpful to a merchant. Nothing appears too intricate here. It comes with an analytics section which allows me to have detailed reports on all transactions

- The SumUp Air card reader is affordable and durable. Its portability makes it efficient for use.

- There's an option to purchase the popular SumUp 3G which needs no WiFi or smartphone for it to operate.

- SumUp is available in so many countries across Europe.

- The card reader accepts all major card brands.

SumUp Cons

- Negative comments about customer support. It seems like I can't reach out to the team on a 24-hour clock. Sometimes, it takes longer than expected to get a response. This frustrates quite a number of potential customers. It makes the merchants shy away from putting SumUp into the actual test. I hope that the team resolves this as soon as possible.

- Hardware related issues. Nearly all the complaints relate to SumUp's card reader. Several merchants have cried out loud saying that the reader flunks sometimes. SumUp should come up with newer versions and eliminate such hitches.

- The app's features are so limited. You would expect the dashboard to look as elaborate as that of Square or Paypal Here, but that's not the case. For instance, it denies me the opportunity to edit my products on the dashboard.

SumUp Review: Final Words

This is the moment of truth.

It's so evident that SumUp is the most suitable package for small-sized businesses. All merchants who sell to customers that pay using cards should consider this payment processor.

Besides, it's clear that the benefits of using SumUp tend to outweigh its setbacks. The app does so much to make my work easier. It syncs with a printer anytime I want to issue receipts and receive mobile payments from customers.

The company is fast growing so there's much more to expect as it works to surpass the likes of Paypal Here. Moreover, I get to hold on to its low transaction fees which you can't find in other entities.

Technically, this is simplicity at its level best. No contracts on board guys. Generally, SumUp takes the bull by its horns. I would highly recommend it as a checkout alternative. In case of anything new on SumUp in the near future, I'll be quick to update this post.

Terrible customer service in Cyprus, loosing payments on a daily basis, after three days and dozens of emails problem still not resolved.

Arogant and incompetent personel in customer service! Stay away!

OK the handheld device from SumUp is really good tool.

I would like to leave feedback on SumUp payment Gateway you may need to have implemented in your website to process smooth payment for your good .

STAY AWAY FROM THE COMPANY !!

THE worst customer support EVER ! It takes over a MONTH to just respond – not to fix a problem! They do have massive support from AmExpres and Groupon so they currently do NOT care for its customers . It may change in the future but at this time they have THE worst customer service on Earth in regards of gateway payments fro online businesses .