Not sure how to choose between Stripe vs Square?

You're not alone.

At first glance, both Stripe and Square seem pretty similar.

Both of these tools are market leaders in the payment industry, along with other popular solutions for card payments like PayPal.

These credit card payment processing tools are crucial for business owners, offering features that transformed the way that we pay for the things that we need. What's more, both Stripe and Square are on the cutting edge of payment technology, giving businesses access to more efficient and reliable ways of accepting and managing their transactions.

However, while Stripe and Square do have a lot in common – they're not the same tools – and they shouldn't be treated as such. All payment processing solutions, from Braintree and PayPal, to Stripe and Square, have their unique pros and cons to offer.

To put it plainly, Square is a far more diverse all-in-one payment processor that can handle everything from ecommerce payments online, to in-person transactions with immersive register hardware. On the other hand, Stripe is a digital-only company, with a focus on mobile and eCommerce, and plenty of powerful tools for subscription-based brands and marketplaces.

Stripe vs. Square: Pricing

Let's start with the basics.

When you're making the choice between Stripe and Square, the first thing you'll need to think about is how much it costs to keep your business up and running.

One good thing to note is that both Stripe and Square are relatively straightforward with their pricing plans.

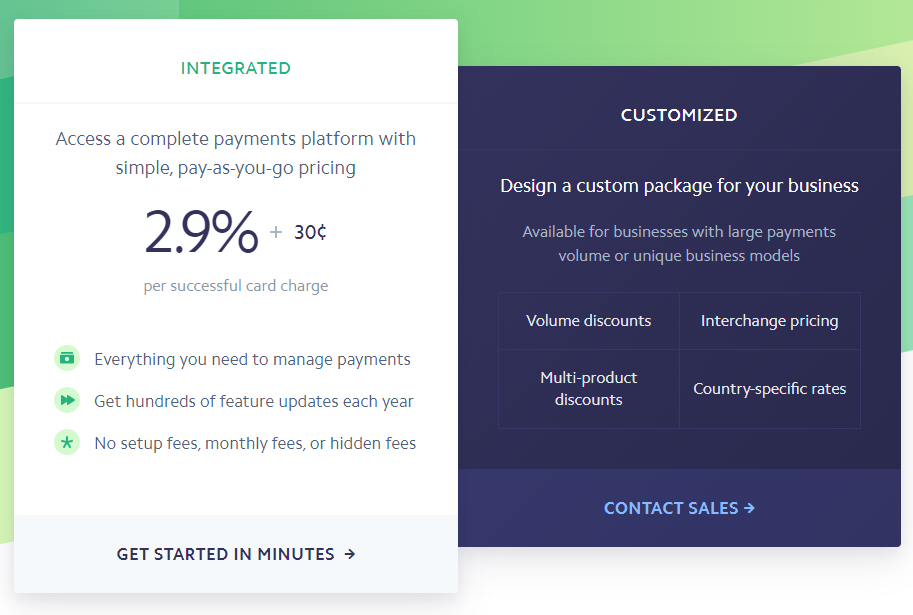

Stripe's prices are ⤵️

- 2.9% plus 30 cents online

- 2.7% plus $0.05 using Square terminal

- 0.8% for ACH transactions ($5 max)

On Stripe, you'll need to pay a processing fee of 2.9% and 30 cents for every transaction to add Stripe payments to your website. There are no extra monthly fees to worry about, which is a massive bonus for any modern merchant.

Additionally, Stripe provides a great variety of payment processing options to choose from, including ACH payment processing, to help you save some extra cash.

With Stripe, you get access to things like embeddable checkouts, custom toolkits, fast and predictable payouts to your business account and more. What's more, there are things like recurring billing and subscriptions available for free up to your first $1 million in recurring charges.

To use Stripe as an online payment processor, you're going to need to connect it to a separate eCommerce platform, which could mean that you need to pay additional fees again. On the plus side, you can potentially negotiate for micro-transaction rates too. However, because this isn't something offered as part of the standard package, it may not be available to everyone.

Overall, Stripe delivers credit card processing and simple payment management for your online store. The fees that Stripe charge are incredibly low compared to most payment services, including PayPal and Braintree. What’s more, Stripe combines an affordable flat rate payment system with a user-friendly design.

👉 You can read more about Square pricing here.

On the other hand, Square also provides a relatively straightforward pricing strategy.

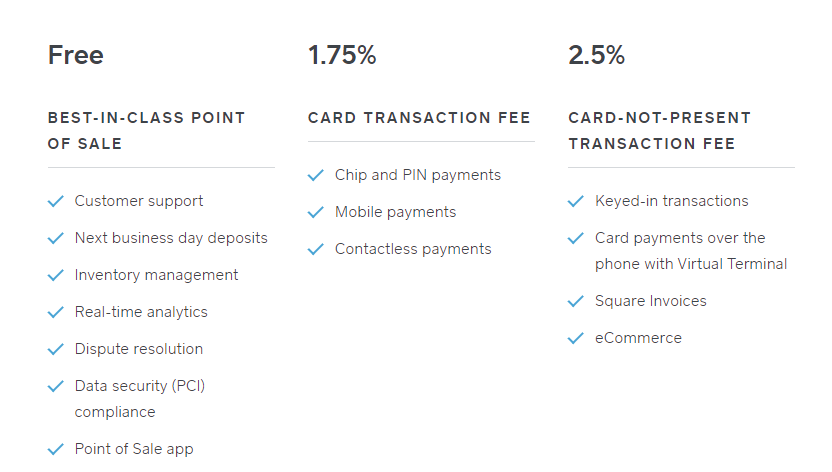

Square Prices are ⤵️

- 2.9% plus 30 cents online

- 1.75% for card transactions

- 2.5% for keyed entry

Your card transaction fee for chip and Pin payments is 1.75%, or you'll pay 2.9% to take payments online, plus 30 cents for each transaction. Offline, you can also access keyed-in purchases for 2.5% when you want to take payments when someone doesn't have their card present.

The most important thing to note about Square's pricing is that it comes with access to a free credit card reader when you open an account, so you can start taking payments almost instantly. Additionally, you'll have access to Square's all-important free POS system – which is what really makes this vendor stand out in today's market.

Devices like the Square Terminal and Square Register are why so many business owners opt for Square as a solution for credit card processing. There are few other payment services on the market that can offer the same high-value solutions for taking in person payments.

👉 Read our Square Terminal review and Square Register review.

Square also has absolutely no chargeback fees to worry about – which is unusual for today's payment processing brands. The company has even delivered its own chargeback protection solution, which covers the chargeback costs on disputes up to $250 a month. Although actually dealing with customer support if something goes wrong can be a bit of a hassle with Square, your chances of having an issue with chargebacks is very small.

If you process a lot of payments each year (more than $250k) and you have a ticket size that exceeds $15 then you can get some volume discounts on your transactions too. However, there are no discounts available for non-profits at this time, which is a bit of a downside. Another point to note is that there are additional fees that you might end up paying for Square if you want to access advanced tools like Square Payroll ($34 per month), or customer loyalty features.

Add-ons include ⤵️

- Square for Retail $60 per month

- Square for Restaurants $60 per month

- Employee management $5 per employee per month

- Payroll $34 per month

- Loyalty $25 per month

- Marketing $15 per month

Like Stripe, Square offers a fantastic experience, and one of the best payment methods available on the market. If you’re looking for an easy alternative to Braintree and PayPal that’s custom-made for small business owners, then you can’t go wrong with Square. At the same time, this company ensures that you’ll have access to all the hardware tools to make in-person payments too, whether you want a chip card reader, a magstripe system or a complete register.

Stripe vs. Square: Setup and Ease of Use

Whatever payment processing system you choose, it's important to make sure that you feel comfortable using it. Fortunately for today's merchants, Square has built its entire business on the concept that simplicity should always come first. A user-friendly option for small business owners ensures that you don’t have to worry about constantly contacting customer support about how to use your credit card processing system. It’s simplicity that have made solutions like PayPal, Stripe and Square so popular among growing companies and online stores today.

All of the software in the Square portfolio is designed to work seamlessly together, with a free POS that works across all devices, centralized reporting, and interfaces specifically intended to help you get a great response whether you're on a tablet, smartphone or desktop. The free mobile POS application is easy to use and intuitive, and Square's eCommerce options are great too.

From the moment you set up your Square account, you'll have access to all the varied tools you need to take and manage payments. Just keep in mind that you might find that the complexity of your experience goes up online depending on the kind of shopping cart service you choose. Another thing that contributes to the user-friendly nature of Square, is the fact that there are so many ways to take in person payments too. If you have the Square register, for instance, you’ll be able to use your chip reader and magstripe reader to offer in-person payment services on the go. People will be able to use their chip card, contactless systems, and debit cards wherever you choose to sell your wares. What’s more, you’ll be able to check and track all of those payments on the back-end of your Square system.

On the other hand, you could argue that Stripe is a slightly more complicated payment processing system – but that's to be expected from a tool that's so rich in features and designed primarily for developers. Depending on what you want from your payment platform, your Stripe experience can be either simple or difficult.

For instance, if you don't have access to a tech professional or developer, then you'll be able to copy and paste JavaScript code onto your business website and install an embeddable checkout from there. On the other hand, if you do have a developer to assist you, then you can access your custom toolkit and create your own platform from scratch.

Although Stripe may be more challenging to use than Square overall, it still provides the right level of user-friendliness because you can choose how complex your setup is going to be.

Stripe vs Square: Payments Accepted

Now that we know how expensive Square and Stripe are, and how simple the solutions are to use, we can take a look at some of the features that each of the options has to offer – including which payments they're available to choose.

The good news with Square is that it processes all major credit cards, including eWallet payments, Android Pay, and Apple Pay across any sales channel. In other words, you're not going to have any problems taking a payment through Square. Additionally, Square also comes with a free card reader and access to hardware registers if you want to create an offline business. Whether you’re looking for contactless or credit card payments that go straight to your merchant account, you’ll have no problem with Square.

Although Square is highly flexible, it's worth noting that there are more kinds of online payments available to process with Stripe, while Square is more suitable to in person payments.

If you're running an online business, Stripe accepts more than 135 different currencies, and an affordable ACH payment processing option for payments of up to $5.

Like Square, Stripe also processes all major credit cards, as well as digital options like Android Pay, Apple Pay, Google Pay, and more. For global payments, there's also access to other options like AliPay too. If you're looking to develop a highly global business online, then Stripe would definitely be a better choice overall.

Stripe vs. Square: Mobile and eCommerce

So how do Square and Stripe stack up when it comes to mobile and eCommerce payments?

Well, Square has recently acquired Weebly to help you access a more affordable and engaging eCommerce strategy for your online transactions. Also, it's worth noting that Square has a pretty immersive list of integrations available already, including a wide selection of shopping cart options to choose from.

Even if your preferred shopping cart isn't available on the list of integrations, you can always use Square APIs to build your own solution through Square's extensive range of developer tools. Square's developer tools mean that you can build virtually any custom integration you need for transactions and checkouts. What's more, using the Square Checkout will mean that you're eligible to take advantage of perks like next-day deposits, chargeback protection, and more. The transaction API is also highly customizable to suit your business needs.

What's more, for mobile payments, it's impossible to ignore the impact that Square has had on the market. The Square POS is one of the most powerful mobile apps available today, and it does perfectly as an iPad POS if you want to start selling as quickly as possible. When you sign up for your Square account, you'll get a free magstripe reader, and you can access a host of additional pieces of compatible hardware too. What's more, Square's POS and Reader APIs means that you can use the Square Checkout experience in custom apps too.

The only major downside of Square for ecommerce and mobile payments is that the subscription tools available are very limited. Although there's access to things like recurring invoices and installment payments, your options are restricted. That means that digital merchants might not ha4ve the broadest range of options available from Square.

Stripe, on the other hand, is one of the most incredible online payment platforms there is, along with options like PayPal. Like Square, Stripe has earned a reputation as an option that's great for developers who want to integrate their payment tools with a range of third-party apps for better processing.

Stripe's eCommerce payment processing options extend way beyond what Square can offer in terms of the number of shopping cart integrations that the brand has to offer. As well as integrating with a wide variety of eCommerce vendors, Stripe also offers integrations and plugins for businesses using tools like Magneto and WordPress too.

Stripe is one of the most-loved tools on the market for developers, thanks to its incredible levels of flexibility, extensive documentation, and support for multiple different programming languages, both in mobile apps and on the web. Stripe allows you to build a completely custom solution with pre-built components taken from Stripe Elements. Additionally, there's also access to Stripe Checkout to generate a pre-built form for you which you can just drop into your site.

For mobile payments, you'll need to check out Stripe Terminal. Although this isn't a standalone mobile PSO like Square's solution, it will allow you to build Stripe Payments into your own POS if you have the developer skills.

While Stripe is a compelling option for online payments and eCommerce, it's not perfect for everyone. If you're looking for a ready-made tool that can handle a wide variety of sales channels at once, then Stripe might not be the right choice. Instead, Stripe seems to be a better solution for those who have tech and coding knowledge.

It's also worth noting that Stripe doesn't have a comprehensive virtual terminal like Square. That means that it can only support minimal keyed-in payment options from the Stripe dashboard. Although you can enter phoned-in orders, it's a little bit complicated. Square is more streamlined when it comes to providing you with a comprehensive way to take payments when your customer doesn't have a card available.

Stripe vs. Square: Additional Features

Lots of payment processing tools like PayPal come with extra features like invoicing and back-end management to make your life easier.

Ultimately, the choice between Stripe vs. Square will come down to what you're looking for to support your business. If you're searching for something ready to go and equipped to handle a range of payment channels, then Square is a great option. Square's free POS is one of the leading solutions on the market for small business transaction management. With Square, today's companies can process a wide variety of sales, record transactions, manage their inventory, schedule employees, and collect crucial contact information from customers.

Additionally, with Square, you can choose to add advanced features to your campaign like marketing, loyalty programs, and appointment scheduling. On the other hand, Stripe is far less comprehensive. Stripe is one of those tools that you really need to build from scratch, using a range of developer tools and APIs. Although you can do a lot with Stripe, you're going to need a lot more resources and work to get your campaigns up and running.

For instance, unlike Square, Stripe doesn't give you access to POS features. Although the company has been testing out its own programmable POS solution, there's still a long way to go before the business can access the kind of functionality that Square has to offer.

One interesting place where Stripe does come out ahead of Square is in subscriptions, memberships, and recurring payments. Stripe is even better than other tools like PayPal at these things.

Square might be the go-to selling solution for companies that want to run in-person companies with registers, point of sale systems, and various online eCommerce tools, but Stripe is much better for recurring payments. While Square does offer recurring payment features for monthly fees, the experience isn't nearly as sleek and streamlined as the one that you can get from Stripe.

Compared to Square, Stripe is a much better solution, specifically for businesses with a high-volume selling strategy. Stripe Subscriptions means that you can design and manage your recurring payments to suit any kind of subscription-based business, including subscription box retailers, memberships, free trials, and educational sites.

Here are some of the unique features that make Square stand out as the go-to payment processing solution for omnichannel merchants that want to sell anywhere ⤵️

- Invoicing

- Advanced inventory management

- Employee management

- Apis for inventory, item catalogs, and customer management

- Free virtual terminal

- Free mobile POS

- Dashboard reporting

- Customer database

Here are some of the unique features that help Stripe to stand out as a fantastic option for high-volume online sellers and membership companies ⤵️

- Custom SQL reporting

- Multiple currency displays

- Currency conversion

- Digital and physical cards

- Marketplace and platform building tools

- Plenty of developer customization

It’s also worth looking at the integrations that business owners can access when they set up credit card processing and payment systems through Square and Stripe. Many online payment services, including those offered by Braintree and PayPal, integrate with leading tools for backend systems with your online store. This means that you can link to things like Shopify for customer relationship management, or integrate with your accounting software.

Before you choose between Square or Stripe for your online store, make sure that the best payment solution for you comes with all the extra features and integrations you need. Remember, there’s more to choosing the best payment solution than finding the widest range of payment methods or a flat rate pricing package.

Stripe vs. Square: Contracts and Chargeback Protection

One valuable thing worth noting when you're choosing between Stripe and Square is that they both come with pay-as-you-go payment processing solutions, similar to PayPal. That means that you're not stuck dealing with any pesky contracts for longer than you'd like. If you want to get out of your payments with Stripe or Square, you can just terminate your account. Stripe can even help you out with transferring customer data to another company if you want.

Additionally, if you're using Square's additional “add-on” features in addition to your payment processing tools, you can get 30-day free trials for most, and you'll be able to cancel those features at any time too. There's no annual fee to think about, and you don't get any discounts for choosing to pay annually, so you're once again not stuck with anything.

One particularly interesting thing to look at when you're comparing these two vendors is their approach to chargeback protection. Chargebacks are a common concern for many vendors today. The kind of payment processor you choose will help to ensure that you're defended if anything goes wrong with the transactions that you accept.

Square is a market leader in Chargeback protection, offering up to $250 in coverage each month. This means that if one of your customers disputes a charge that you make to their card or bank account, you can protect yourself against the loss. However, you do need to respond to any payment disputes within seven days to be eligible. This simply shows Square that you're adhering to their fraud best practices.

On the other hand, Stripe has the industry-standard procedures in place when it comes to dealing with disputes and chargebacks for your business. There's a $15 chargeback fee if your customer files a dispute – although that fee will be refunded if someone decides to rule in your favor. Unlike with Square, there's no protection coverage if you lose out on a dispute.

Another great plus with Square when it comes to chargebacks is that there's no chargeback fee whatsoever. You won't have to worry about losing out on any money if your customers decide to dispute your claim to their money, which is a massive relief for today's vendors. While Stripe doesn't give you the same freedom or peace of mind, it does give you access to a top-rated tool for fraud protection called “Radar.” This tool uses machine learning technology to identify the most common high-risk sales so that you're flagged about potentially dangerous transactions.

Stripe vs. Square: Customer Service

Last, but not least, it's always important to feel comfortable with the customer service that you can get from your payment processing company. After all, you never know when you're going to end up needing some help.

Whatever payment methods you’re interested in taking, it’s always helpful to have access to plenty of support in case something goes wrong with your chip reader, online system, or even an integration with a third-party tool like Shopify.

Many leading tools like PayPal and Braintree stand out because of their approach to customer service. However, not every payment company offers the same level of customer support for small business owners. For instance, while Square offers a user friendly interface, in person payments, chip card support and PCI compliance, it’s customer support isn’t ideal.

Don’t get us wrong, there is support from Square available, but it has its issues.

Square promises its customers email and phone support, along with access to a fantastic knowledgebase where you can track down the answers to most of your questions with an easy-to-use search function.

Another thing about Square is that there's also access to a great community of merchants, so you can get support from other people online if a Square representative isn't available. Square's customer service group even monitors Stack Overflow too.

If you're active on social media, you'll find that Square has a dedicated Twitter account where you can connect with members of the team.

The biggest issue with Square when it comes to customer service is that if your account gets terminated, you're going to have a tough time finding anyone to talk to about the issue. That's because Square automatically cuts off all access to phone support if your account is shut down. This is an unfortunate issue for Square users because sometimes accounts can be terminated for no good reason, just because Square thinks that your transactions for a certain month might be unusual.

On the other hand, Stripe seemed to lag behind other payment processing providers for quite a while in terms of customer service – but that's all started to change. Stripe now maintains a fantastic self-service knowledgebase – although it's not quite as detailed as Square's yet. You can also find questions to help you with Stripe development on Stack Overflow too. After years of complaints about Stripe not giving customers access to real-time support, the company implemented 24/7 support for all merchants in 2018 – that's a vast improvement.

Stripe's round-the-clock live support makes it a fantastic choice for companies that might need regular guidance or answers to their questions. What's more, fi you need a more premium level of support, Stripe can also give you a unique package that starts at a price of around $1,000 per month. While this might seem like a very expensive price tag, it's intended for bigger companies that need constant technical support.

After years of complaints, Stripe has gone above and beyond to give their customers the kind of support that they need most. Additionally, because Stripe focuses significantly on the developer cloud in payment processing, the documentation available for developers is second-to-none too. You should find that you can answer most of your own questions without the need for any specialist guidance or support.

Stripe vs. Square: Verdict

When you’re choosing the ultimate payment processing system, there are a lot of options to consider, from Braintree and Paypal, to Square, Stripe, and more.

At first glance, it's safe to say that Square and Stripe have a lot of similar capabilities and features to offer. Both of these tools are compelling third-party payment processors with a mostly good reputation in the digital market. Stripe and Square both give merchants the tools that they need to sell online, and neither is particularly relevant for companies in high-risk industries.

However, there are a lot of differences between Square and Stripe too.

Square appears to be best suited for companies in search of an all-in-one payment processing system, with a ready-made strategy for accepting payments in a wide selection of different environments. You can sell your items and services online, on-the-go, and in-store, without having to switch between different dashboards.

What's more, everything you need is located on the same intuitive dashboard. What's more Square is continually rolling out new hardware, software, and tools to make its service more impressive for today's merchants. If your tech knowledge is limited and you want everything to be ready-to-use and designed for you, then Square is the best choice.

On the other hand, Stripe is a payment processing solution that focuses heavily on online payment strategies. The wide range of tools available from this company makes it easier for businesses to cater to sales around the world, and even set up immersive membership and subscription platforms too. If you're looking for an international payment provider that makes digital transactions easier – Stripe is a great choice.

Stripe is also particularly suitable for those with developer and coding knowledge, as it comes with plenty of ways to customize your payment processing experience if you know how to use the tech to your advantage. If you're looking for something that you can tailor to your specific needs, then Stripe is the right option for you.

Ultimately, it's hard to classify these two tools by saying that one is better than the other because they're both designed for very different purposes. Both Stripe and Square are excellent, the choice of which one to pick will come down to what your business needs. Don’t forget to look at other options like Paypal, Braintree, and more too.

Featured image credits: Shutterstock

Comments 0 Responses