The Tl;dr Version

Which one is better? Shop Pay or PayPal. The truth is, that since they both have their advantages and limitations, it’s difficult to say which one is better for your eCommerce store.

While PayPal has been around for ages, Shop Pay is rather new and has already become the favorite of many merchants.

However, PayPal still has a much larger user base.

Let’s look at some key features firts:

PayPal

- It has been here for longer and has gained the trust of millions

- It is more versatile than Shop Pay

- Since it has been here for years, most merchants are already using it

Shop Pay

- Shop Pay has overall lower transaction fees

- It’s easy to install

- It offers faster dispute resolution

Alternatives

If you want to chuck both Shop Pay and PayPal, you can go with Stripe, Apple Pay, or credit cards.

Overall rating

Shop Pay: ⭐ 4.7/5

PayPal: ⭐ 4.5/5

So you’re a merchant and want to know which payment gateway you should use for your eCommerce business – Shop Pay or PayPal. You know that both of them have their advantages and limitations.

While Shop Pay is relatively new, it’s giving strong competition to PayPal.

According to Wappalyzer, Shop Pay is primarily popular in the United States and Canada. It has largely grown in popularity since 2020 and several merchants use it as their ecommerce payment platform. Does that mean PayPal is becoming obsolete?

Should merchants migrate to Shop Pay?

To understand that, I’ll go on and explore the key differences between Shop Pay and PayPal. But before that, let’s have the lazy version.

Table of contents:

Research Methodology

I already have a PayPal merchant account and I’ve been using it for years. I’m rather new to Shop Pay. I use it with one of my eCommerce websites that runs on Shopify. Since I have used both services, I could easily compare them for this review.

While I have always loved PayPal, Shop Pay is easier to set up on Shopify websites, which is why I used the latter for my new store. That’s definitely one up for Shop Pay but I haven’t stopped using PayPal.

In this review, I’ll try to cover as many points as I can, based on my experience with both platforms.

What Are These Platforms Anyway?

When you have an eCommerce store, you need a payment gateway to accept payments from your customers. There are many options available out there and Shop Pay and PayPal are among the most popular ones.

Let me introduce both of them to you.

Shop Pay

Shop Pay is a payment gateway by Shopify. If you have a Shopify store, Shop Pay can be a great choice for you as it easily integrates with the platform. It is easy to set up and use, and customers can quickly make the payment and check out.

This enhances the customer experience of your store.

PayPal

PayPal also allows customers to make payments to your store. Setting up PayPal isn’t overly complicated but if you have a Shopify store, Shop Pay will be a better choice.

However, since PayPal has been around for years, there are chances that you already have a PayPal merchant account, making it easy to link.

Let’s Compare Shop Pay and PayPal

Now that we understand what both these platforms are, let’s begin comparing.

| Shop Pay | PayPal | |

|---|---|---|

| Trust factor | Rather new, so hasn’t built as much trust | Been around for years, so trusted by merchants |

| Transaction Charges | 2.4%+$0.30 – 2.9%+$0.30 depending on the plan | 2.9%+ $0.30 in the US. 4.4%+fixed fees outside of the US. The fixed fees depend on the currency. |

| Ease of Use | Easy to install, particularly for Shopify users | Takes more time to install than Shop Pay |

| Dispute resolution | Within 60 days | 14-30 days |

| Payout schedule | 1-3 business days | 5-7 business days |

| Number of users | 60 million | 431 million |

| Global availability | Available in 23 countries | Available in more than 200 countries |

| Option to pay in installments | Yes, through Shop Pay Installments | Yes, through the Buy Now Pay Later service |

| Usage | For online shopping only | More versatile and can accept payments from multiple streams. |

Both have their advantages and limitations. For most merchants, payment charges are a big deciding factor when selecting a payment gateway. PayPal charges a higher fee when international payments are involved. This could be a deal breaker for many, but PayPal also has a set of other advantages.

Let’s discuss all these factors (and more) in detail.

Trust Factor

When money is involved, trust plays a huge role. Merchants who earn their living through online stores have traditionally depended on PayPal. They know they can trust this platform. PayPal has been around since 1998, which makes it a very secure and reliable platform.

Shop Pay, on the other hand, was launched in 2017. It has been around for over six years now and many merchants from all over the world rely on it.

Winner:

As far as trust goes, PayPal takes the cake here.

Transaction Charges

You don’t have to pay anything to enable Shop Pay. But it does have transaction charges. So when your customer pays something, Shop Pay will take a percentage of it. This percentage depends on the plan you choose.

- If you have the Basic plan, the charges will be 2.9% + $0.30

- For Shopify plan, the charges will be 2.6% +$0.30

- And for Advanced Plan, the charges will be 2.4% + $0.30

If you use PayPal, the transaction fee is 2.9% +$0.30 within the United States. For foreign countries, the charges are 4.4% + fixed charges. These fixed charges depend on the currency being used.

These are just the basic costs. It gets a little more complicated when you give your customer the freedom to pay in installments. I’ll discuss that later in detail.

Winner:

Shop Pay wins this point.

Ease of Use

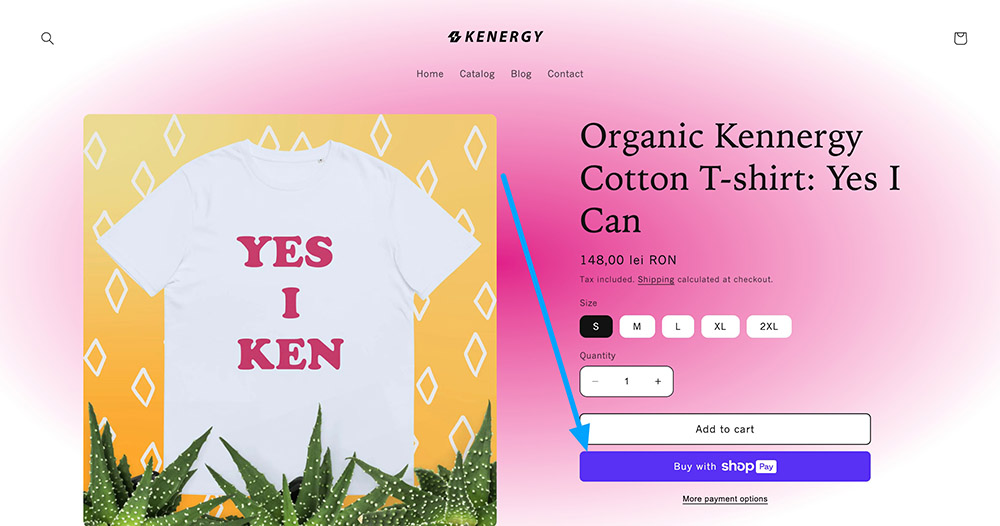

Shop Pay integrates seamlessly with your Shopify store. From your Shopify admin dashboard, you’ll see an option for payments.

From there, you can select Shop Pay and you’re done. It’s set up in just a few clicks, and this is another reason why Shop Pay has become very popular in a short duration.

With PayPal, you will need to install the gateway on your website, which can be time-consuming. Also, when the customer wants to buy something, they will be redirected to PayPal to complete the payment. This can be a major turn off and may decrease the conversion rate.

Winner:

Shop Pay wins again.

Dispute Resolution

I went through several reviews for this one. I’ve had one dispute with PayPal and they resolved it in 40 days, but I’ve had no disputes with Shop Pay so far.

From what I’ve heard, Shop Pay is good with dispute resolution and will conduct a detailed investigation to check claims from both sides and arrive at a conclusion.

If Shop Pay rules in favor of your customer, a refund will be initiated and you will have to pay $15 as a dispute fee. Keep in mind that these dispute costs can quickly add up.

PayPal dispute fees are a bit more complicated. There are standard and high volume dispute fees. If you don’t have many disputes and you’re eligible for the Seller Protection program, you will not have to pay the dispute fee.

If Shop Pay solves a dispute within a maximum of 30 days, that’s an amazing service because while PayPal claims to solve disputes in 14-30 days, it generally takes more than 30, to be honest.

Payout Schedule

How long does it take for the money to be settled in your account? In my experience, Shop Pay settled payments much faster than PayPal. With Shop Pay, my payments arrived in about 2 business days or fewer.

With PayPal, it takes about 5-7 days. In some cases, my payment was settled in just 3 days. But it mostly takes at least 5 days, and sometimes longer.

While it doesn’t take too long with either of these platforms, Shop Pay is faster and wins this round again.

Number of Users

According to Shopify, Shop Pay has 60 million users all over the world, mainly from the United States and Canada. Most Shop Pay users offer a 4-installment payment schedule to their buyers, thanks to Shop Pay Installments.

PayPal has 431 million users as of 2023. This is about 40.52% of the global market segment of payment services. With such a huge user base, PayPal is larger than Shop Pay, Stripe, Amazon Pay, AfterPay, and others.

Winner:

So when it comes to the number of users, PayPal beats Shop Pay by a large margin.

Option to Pay in Installments

As a merchant, you can allow your customers to buy your products now and pay in installments.

Shop Pay Installments

Shop Pay allows part payments with Shop Pay Installments. There are two ways in which this can be done.

The first option allows the customers to divide the payment into four interest-free parts. This helps customers convert easily as they don’t have to pay a large sum in one go.

The second option allows your customers to make monthly payments for up to a year.

However, keep in mind that the transaction fees go up to 5-6% for each transaction when you offer the installment option.

PayPal Buy Now Pay Later

When it comes to PayPal Buy Now Pay Later, you can choose between paying in 4 installments or monthly payments.

In the first case, the customer needs to make 4 payments over 6 weeks. In the second case, the customer can set monthly payments over two years.

And the best part is that there are no extra merchant charges associated with PayPal Buy Now Pay Later.

Winner:

So as far as the installment payments go, PayPal wins.

Usage

If you’re an eCommerce merchant, you can choose either Shop Pay or PayPal. If you’re a Shopify merchant, it’s better to use Shop Pay because it integrates easily with the platform and the transaction charges are lower.

However, Shop Pay is only for online shopping. If you’re also accepting other online payments apart from the payments through your online store,

Winner:

PayPal will be a better option since it’s more versatile. You can use PayPal for personal reasons as well. For example, if you want to send money to your friends or family, you can do that via PayPal.

Let’s Discuss Their Safety Features

When an agency handles your money, you need to make sure it’s trustworthy and keeps your money safe. If you’re aware of the technical details of cyber security, you might want to read this. If not, you can skip this part.

Tl;dr: they’re both safe.

Shop Pay is from Shopify that’s Payment Card Industry Data Security Standard (PCI DSS) compliant. It’s a security standard that defines how customers’ credit and debit card details should be handled. The credit or debit card information of your customers is stored in encrypted form on PCI-compliant servers.

Apart from that, there’s also an SMS verification system that acts as another factor for authentication to ensure that the transaction is done by the actual owner of the account.

PayPal is also PCI DSS compliant, which means all customer card data is stored in encrypted form on secure servers. When you use PayPal on your eCommerce store, PayPal handles PCI compliance for you.

Final Verdict

Since both Shop Pay and PayPal have their pros and cons, it wouldn’t be right to say that one service is simply better than the other. But we can break it down on a case-by-case basis.

If you have a Shopify store, Shop Pay will hands down be better for you as it will integrate easily with your store and customers will be able to make a purchase easily.

If you have a non-Shopify store, PayPal might be a better option. You can use Shop Pay but you’ll lose the advantage that Shop Pay offers to Shopify merchants.

If you run an online store and also offer other services for which you receive online payments, PayPal will be a better option as it is more versatile.

So which one would you want to use? Do you already use a payment gateway service? Comment and let me know.

Comments 0 Responses