If we are to hunt for the most elite ecommerce payment solution in the market, we ought to scrutinize a couple of attributes.

Admittedly, any customer is always on the run for a secure checkout payment tool.

The entire experience needs to be one which is not only swift but nearly perfect.

And my point is?

We all need tangible results. Right guys? A high degree of optimism unfolds if my business gains quite a substantial amount of confidence from my customers. But here's the million dollar question.

How safe are the transactions? This definitely forms part of the whole equation.

Besides, consumer credit trends surprisingly indicate a visual depiction to consider. I need to work with a payment software which connects my clients to diverse facilities. How about one that allows them to pay later?

Klarna seems to heighten its game by doing the same. But that's just a snippet of what it's capable of. On the contrary, it's always a tough decision to make.

Actually, if we put all the payment alternatives on the table, it's hard to confirm which one, in particular, scores the greatest victory.

This review, however, saves you the distress. It allows you to assess Klarna's financing options, its ease of use and rates.

On board, is an elaborate guide which lets you have an in-depth comprehension of how to use Klarna. Also, it covers its support system, and shop directory.

So let's jump right in.

What is Klarna?

It's a software built to enhance a shopper's experience. What do I mean? The immense pressure to keep up-to-date with technology makes Klarna mark its territory among other payment methods. It lets me pay later whenever I shop an item.

The point of sale financing applies to goods like electronics, clothes, furniture and many other items sold online.

Think of it as a means which lets me have flexible payment options. I don't need to worry about insufficient funds.

But how does it work?

First, I need to pick all orders. There's Klarna button at checkout which I choose as my payment option. From here, I get to fill in some requisite information. This helps to determine whether my purchase is approved or not.

It's quite impressive how efficient the process gets. It sends me a confirmation email immediately after I submit all details.

The email includes the purchase description and the date when repayment is due. How cool is that?

In case I'm faced with difficulties, customer support is more than willing to resolve all sorts of issues.

Klarna Pros and Cons

Pros 👍

- Painless checkout experience

- Customers can choose to pay for items in installments

- Klarna instantly pays the merchant at checkout

- Customers can pay later after delivery

- Easily integrates with major third-party carts

- Low transaction fees

Cons 👎

- Sluggish customer support

- Several refund-related complaints from customers

Klarna for End Users

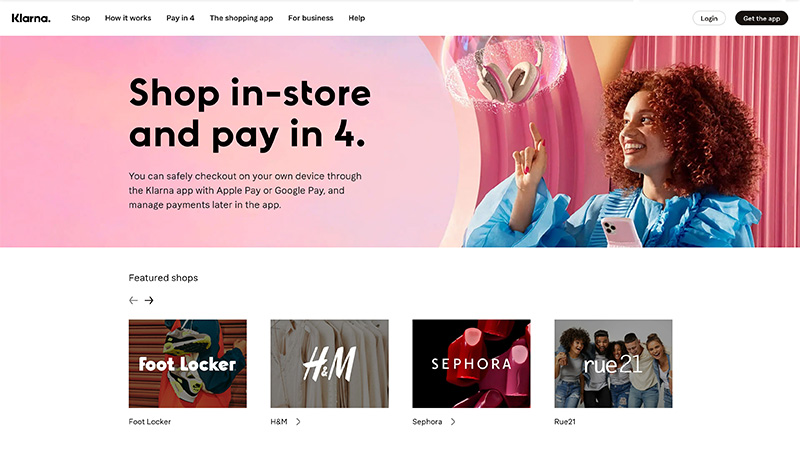

Shopping from a notable and high-end retailer has never been easier. Key among the retail categories listed on Klarna include;

- Automotive

- Beauty

- Home and Garden

- Apparel and Accessories

- Electronics

- Personal Care

- Sports and Outdoor

There are thousands of stores in each section. The list is endless. The integration part of it is a smooth sail.No wonder there are over 100,000 merchants on board.

We can't ignore the platforms and plugin support. Klarna has partnered with big multi-channel e-commerce solutions. I get to integrate the payment processor with stores built on profound platforms like;

I can't agree more.

This whole integration idea might seem confusing at the first instance. Worry not. There's an elaborate Developer's integration guide to utilize.

There are Software Development Kits (SDKs) for languages like Java, Net, PHP, Javascript, and Mobile apps.

Let's suppose, I'm not a developer nor privy to the complex coding jargons. All I need to do is connect Klarna to my online store to manage payments.

The above-mentioned platforms are easily compatible. I don't need prior skills to do this.

Here's a brief setup guide.

Once I successfully integrate Klarna to my store, it lets me pick the most appropriate checkout package. To go live, I must sign up for the merchant account.

I need to fill in my business details. From this end, I'm able to download the live credentials.

So where do I need this information? I paste the credentials on my platform's plugin. And the magic happens. Klarna updates its products at the checkout.

My customers can now purchase items and pay later by using their preferred payment plan.

What are Klarna's Key Features?

At this point, I know you're so eager to know and get to judge if it's actually an asset to consider for your online store. On the other hand, a customer still wants to make comparisons with other major competitors.

So let's start off.

Klarna has a mobile app both on the Apple store and Google Play. It lets me download their latest version which I use to pay for my orders.

What's more astounding is its login page. A distinction is drawn between customers and merchants.

Let's keep our eyes on what the app can do for me? It allows easy access to customer service. Also, I get accurate notifications regarding payments.

It helps me avoid late payments. It's so obvious that I need to build a good credit score as early as possible.

Klarna gives a run for my money. Actually, there's a merchant portal to utilize for business purposes. It's so amazing how easy it's to manage my payout reports, daily orders, and get detailed store statistics.

Moreover, it lets me customize general settings which ultimately reflect on my dashboard.

On the customer's page, there's an overlay which shows all upcoming payments. All this, at the click of one button.

Putting more focus on payments.

Klarna pledges to boost my experience through its flexible repayment plans. It gives me an allowance of up to 30 days.

Take note, it's a zero interest transaction. No extra costs to be incurred. What's more exquisite is the fact that I can spread the payments to 4 interest-free installments.

Tell me, where else can I find such an enticing offer? Also, I get to make most of its monthly payments plan. Quite breathtaking how instant the financing works.

Buyer Protection

It's undisputed how sensitive this part is. To be precise, my customers need a safe checkout which fends off all possible risks.

So how feasible does it get with Klarna? What delights me most, is the Klarna buyer protection policy.

It endeavors to instill an assurance to all potential customers. Consequently, all Klarna merchants need to be verified.

As a result of that, a buyer gets their money back in case they don't receive their purchased goods.

However, to make it a fair level ground, there's a certain threshold which is set and ought to be met.

It's the ultimate way to support my claim and get a refund. The grounds could either be;

- I've purchased goods but I didn't receive them

- I've received the wrong products

- The merchant sends me products which don't match the initial description, they're defective, or not complete at the time they get delivered.

Furthermore, it's so easy to file a claim. I only need to contact customer care via the official phone number or email.

Klarna steps in the right direction through its zero fraud liability protection program. It proves to be convenient in the occasion where a purchase or a charge is made using my details but without my consent.

But there's more to count on.

Actually, the policy covers all procedures which guide me on how to file a claim against a merchant. It includes any dispute where an unauthorized payment is made using my credit card information.

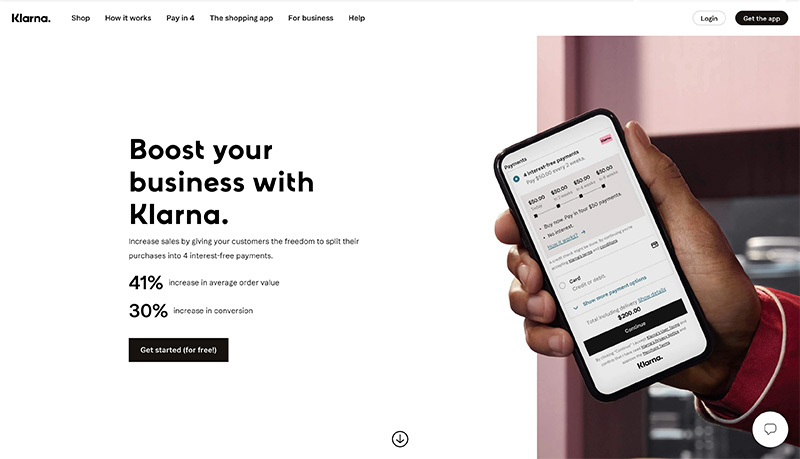

Klarna's Merchant Solution

Here, Klarna brings into play quite a comprehensive service for me as a merchant. One which I can't exhaust. It lets me get paid even when a customer chooses to pay at a later date.

And that's just a tip of the iceberg.

Why is it so imperative to work with Klarna? It serves as a technique to boost my sales. As a matter of fact, it reduces the number of cart abandonment.

I've had quite a diverse experience and I'm confident to attest to this.

If I work with a facility such a Klarna, where funds are easily accessible, there is a high likelihood that the number of impulsive buyers will increase by a huge margin. There's a low risk involved here.

How's that attainable?

I'm always paid upfront. It doesn't matter whether a customer delays to make their payments. My business is not frustrated at any single point.

Here's what any retailer wants to hear.

The credit risk is nearly zero. I get to fully take control of my enterprise. Nothing hold's me back! Looking at the numbers on Klarna's site, the customers' satisfaction rate is impressive.

What exactly comes to mind, is an end-to-end payment solution which gives more for less.

As a merchant, I can't overlook its buyer protection policy and pre-authorization procedure.

To say the least, this is the ultimate strategy to build a customer's trust. Klarna's dashboard is built with proficiency which makes me work with a high degree of precision.

It lets me have detailed reports and analytics which are quite relevant and help to scale my business.

I can't overlook its integration point which links the various payment methods with my store. To optimize the experience and performance, I get automatic updates for the latest checkout.

Order processing is well structured and businesslike. I get a wholesome experience by using Klarna to activate all orders. It helps me send invoices either by mail, or email.

So how authentic is the Checkout?

Klarna‘s team promises to let my customers have a seamless experience while making payments.

This is how its functionality swings into action.

It identifies a customer's details and the preferred shipping method.

Fortunately, Klarna pays for both costs. It removes all stumbling blocks through its one integration point. It helps me turn a mere guest to an esteemed customer.

All a customer needs is to make an order in just a click of a button. No more no less. To build a good reputation and market my business better, Klarna comes with easy customization tools. In fact, it lets me edit and make all sorts of changes to the checkout.

For instance, I'm able to brand the checkout in a bid to suit my needs and expectations.

Here's another one.

All PCI merchant compliance process is well taken care of. It's a hassle-free affair. I get to jump right in its global support. It's worth mentioning that Klarna operates in so many countries across Europe and in the US.

Also, let's give credit to the In-store checkout solution.

This package turns my point of sale to a money minting machine. But wait. How viable is this? I get to include an array of payment options.

Keep in mind, a customer gets to access the credit in real-time. In other words, a walk-in client could be a potential customer.

In fact, they don't need to do any signup. Interesting enough is the fact that a customer gets up to 14 days to make a payment.

Things get better even when products are out of stock. Klarna has a delivery segment which is accessible to customers.

They get to choose how and when they want their goods delivered once I restock them. Many thanks to POS financing. How ingenious is that?

With the popular payment option dubbed ‘Slice it', I get to reach out to most clients who visit my store.

Klarna fulfills this by sending a prompt notification to a customer's mobile device with all the pertinent details.

Customer Support

To begin with, Klarna has a 24/7 live chat support. Besides, there are a couple of resourceful articles on the site. I get to understand how Klarna works, Its refund policies, payment plans among other amazing features.

It has language support for all the regions it operates in. Klarna is active on the mainstream social media platforms like Facebook, Instagram, Twitter, and LinkedIn.

The most interesting bit is the signup process. It's quite fast and straightforward.

Also, it lets me do all tests using the demo account. From this point, I can get acquainted on the checkout process and all available payment plans.

Is Klarna Legit?

If you’re wondering whether the Klarna app is a good option for you, there are a few things to consider. For instance, are you exploring Klarna from a merchant perspective, or a consumer point of view?

If you’re a consumer, than Klarna can be a handy way to spread out the cost of big purchases. If you don’t have much money in your bank account and you want to buy something now, Klarna can help you do that.

Paying for products using Klarna is likely to be cheaper than getting finance in the form of a personal loan. Just remember that Klarna will conduct a credit check, so you’ll still need decent credit.

However, some people feel that Klarna is easier to be approved for than a typical loan or credit card. If you’re low on cash due to Covid, or have issues making payments, Klarna has you covered.

Just don’t put yourself in a difficult position with your ghost card from Klarna.

Different people can access different interest rates and benefits from Klarna.com. A zero or deferred interest option may be the best route for you if you can access this, rather than seeking traditional lenders for online shopping.

If you’re checking out Klarna as a merchant, then there are a few positives and negatives to consider. This Swedish company is gaining a lot of popularity among buyers lately.

Having an affiliation with the Stockholm brand could help you to connect with a wider audience of potential customers. Giving your audience the chance to off-set payments for a short while also means that you can potentially benefit from more conversions.

Of course, there’s always the risk that someone with a bad credit history will try to buy an item through the Klarna app then be unable to finish their purchase.

Ultimately, it will be up to you to determine whether you can take the risk of adding Klarna to your payment options alongside credit and debit card payments.

If you do have problems with getting a payment by the due date, you can seek help from Klarna at www.klarna.com, but there’s no guarantee that you’ll get support straight away.

The customer service from Klarna is lacking in some areas, which may make it tougher to get a response to your query the first time when you’re trying to track down your cash.

Should You Use Klarna?

For customers that need a little time before they make the first payment on a big purchase, a Klarna account can be a good way to avoid typical loan and lending options.

Just make sure that you know what the situation is if you can’t pay over time on schedule for your online purchase. You might need to deal with a late fee and various other issues.

If you’re shopping on a company’s website, the buy-now and pay-later option can be an appealing way to reduce the stress of buying things online.

All you need to do is make sure that you understand the rules and regulations associated with the service you’re using.

For merchants, Klarna offers an interesting and attractive alternative to things like PayPal and credit card payments. When your customers need a larger time frame to handle paying for big expenses, Klarna is a handy choice.

There are always risks to consider when you start offering different financing and purchasing options to your customers. However, if Klarna means that you can convince more customers to convert, then the risk might well pay off.

On the plus side, there’s no contract or early termination fee to tie you into using the service. If you decide that you don’t want to offer this feature anymore, you can just remove it from your website.

Just make sure that your customers know the terms and conditions that they’re agreeing to when they buy from you using Klarna.

It’s also worth having a plan of action in place for how you’ll reach out to the company if anything goes wrong with a sale.

Klarna Review: Conclusion

Taking everything into account, there's much to tap on Klarna. Both merchants and customers need to highly consider this checkout service.

Where else will I find a solution which lets me pay an item in installments?

If we look at the numbers(60 million consumers) it's certain that Klarna has garnered its reputation via its global outreach and smooth purchase experience.

It gives me retail business an edge. I get to minimize the number of cart abandonment by far.

On the other hand, I believe the flaws detected are issues which Klarna can easily resolve. After all, nothing is ever flawless.

Let's not forget its APIs integration capacity. To say the least, it serves as a useful payment alternative. Is Klarna worthwhile? Definitely yes. Trust me; expect almost zero regrets.

Furthermore, it has one of the lowest transaction fees in the market. Besides, it comes with a demo account which I get to joy ride. I don't need to spend a dime to do a run through.

Hi, I bought from Temu and checked if I can pay with Klarna. I have received the package, but I don’t know how to pay. I have no invoice, no account to transfer money to. Please help me. Thank you very much. Yours sincerely, Mirela Velea.

Hello Adriana,

You should be able to pay via the Klarna mobile app, but be sure to reach out to them in case you need extra instructions. They have very good support.