There are a huge range of payment processing brands out there, all offering tools to help make your organization a money-making entity.

The trouble is, choosing the right technology can be a challenging concept. After all, how do you know you’re selecting a payment processor that can simultaneously keep your costs low, and ensure you’re offering a great service?

Today, we’re going to cover some of the most popular payment processing companies, and what makes them so compelling for business owners.

What are The Best Payment Processing Systems in 2023?

- Square

- Stripe

- Adyen

- Payline Data

- Bit Pay

- Checkout.com

- PayPal

- Apple Pay

- Google Pay

1. Square

One of the best-known payment processing solutions in the world, Square offers a host of online and offline payment options. Wherever you are in the world, you can connect with customers and process their payments using Square. The technology can manage everything from contactless payments in-person to online transactions.

Square even offers a range of payment processing hardware solutions, like terminals, stripe readers, and POS stands, making it perfect for offline retail and pop-up stores. The Square Payments solution is the central payment processing service from Square, allowing users to accept payments quickly, easily, and safely, at any moment, anywhere.

Square supports tap payments, chip-and-pin, Square online payments, key-in payments, and invoices. There’s also the option to build your own ecommerce store with Square. On top of that, Square offers an API to build payment management into your website.

Pricing:

The amount you spend on Square will depend on the kind of payments you’re processing. The in-person transaction fee is 1.75%, while online, you’ll pay either 1.9% for EU cards, or 2.9% for non-EU cars. Manually-keyed in payments cost 2.5%

Pros 👍

- Great for both online and offline selling

- Hardware available for your store

- Secure and reliable payment tools

- Software to build your own website

- Predictable flat-rate pricing

Cons 👎

- More advanced for offline selling

- Can have some issues with account stability

Further reading 📚

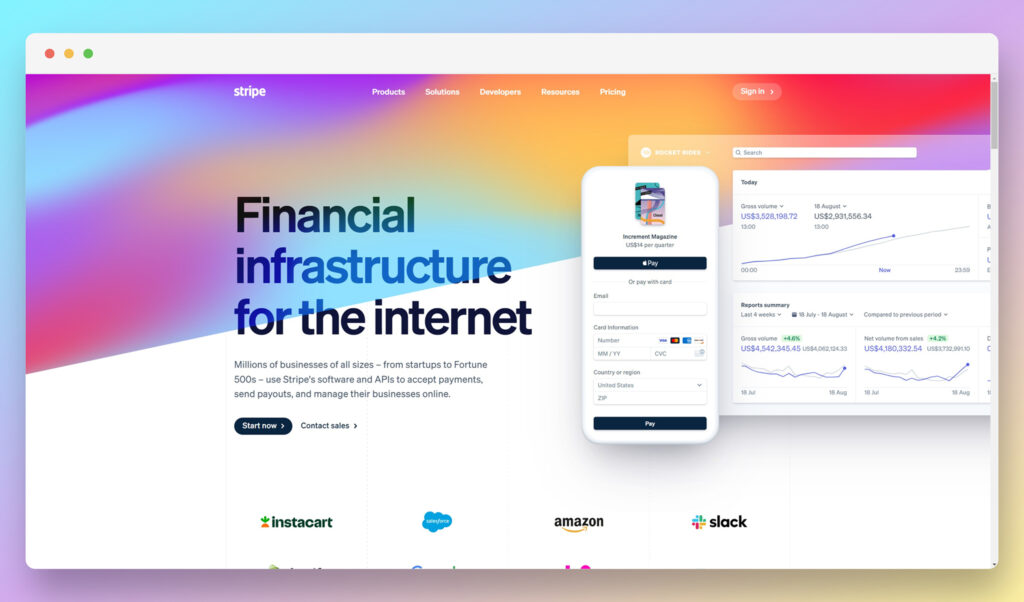

2. Stripe

Standing among the top payment processing solutions on the market, Stripe supports millions of companies around the world. The Stripe technology offers both software, and APIs, so you can build payment processing into your existing apps and tools.

Signing up with Stripe means accessing a comprehensive suite of payment products. You can power online and offline payments, set up subscription businesses, and even design your own marketplace. There’s also a host of features in place to help protect against things like fraud and chargebacks. Plus, you can issue virtual and physical cards to your customers.

Stripe is particularly impressive thanks to its API access. The API doesn’t require a lot of technical knowledge to access, but it means you can include Stripe payment processing in all of your apps and existing technology. The technology-first approach from Stripe is very appealing in today’s digital world.

Pricing

Stripe fees start at 1.4% plus 20p for European cards, and 2.9% plus 20p for non-European cards. This includes everything you need to manage your payments. There’s also the option to create a custom package for your business if you’re selling at high volumes.

Pros 👍

- Fantastic range of API and technology tools

- Secure payments and fraud protection

- Payment options including bitcoin and crypto

- Ecommerce support for a range of global companies

- Access to a huge range of analytics and insights

Cons 👎

- Can sometimes have issues with frozen accounts

- Limited options for in-person payments

Further reading 📚

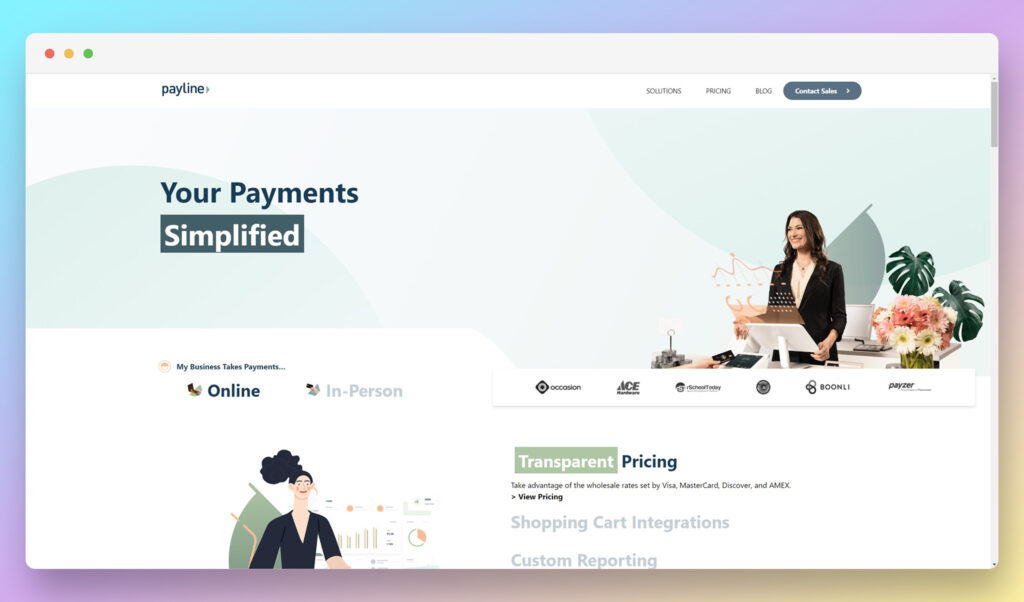

3. Payline Data

Payline data promises a simple way to start selling online and offline. This technology comes with access to a host of functions, from flexible APIs to build payment processing into an existing app, to shopping cart integrations. Payline promises next-day funding to companies who need help getting their business off the ground too.

Simple and secure, Payline data is one of the many payment processing solutions available today giving users more freedom with how they use their data. The simple and secure solution supports a variety of tools for security too, including fraud protection services. You can even use the Payline calculator to track how much you’re likely to pay in terms of charges.

Payline Data can offer customized packages, for companies who want to build a comprehensive payment ecosystem including everything from invoicing and recurring billing to cart integration. There’s also no cancellation fee if you decide to go elsewhere.

Pricing:

Payline is extremely straightforward with its pricing structure, which makes it much easier for you to calculate how much you can expect to spend. For instance, swiping cards in payment costs 0.2% and 20c per transaction, or $20 per month.

Credit cards not present costs 0.4% and $0.20 per transaction, or $20 per month, too. You can also calculate your exact costs with Payline’s calculator.

Pros 👍

- Helpful budget tracking

- Excellent range of easy-to-use features

- Great for security and privacy

- Access to various integrations and API support

- No cancellation fees

Cons 👎

- Not as advanced for things like reporting

- Pricing can be a little expensive

Further reading 📚

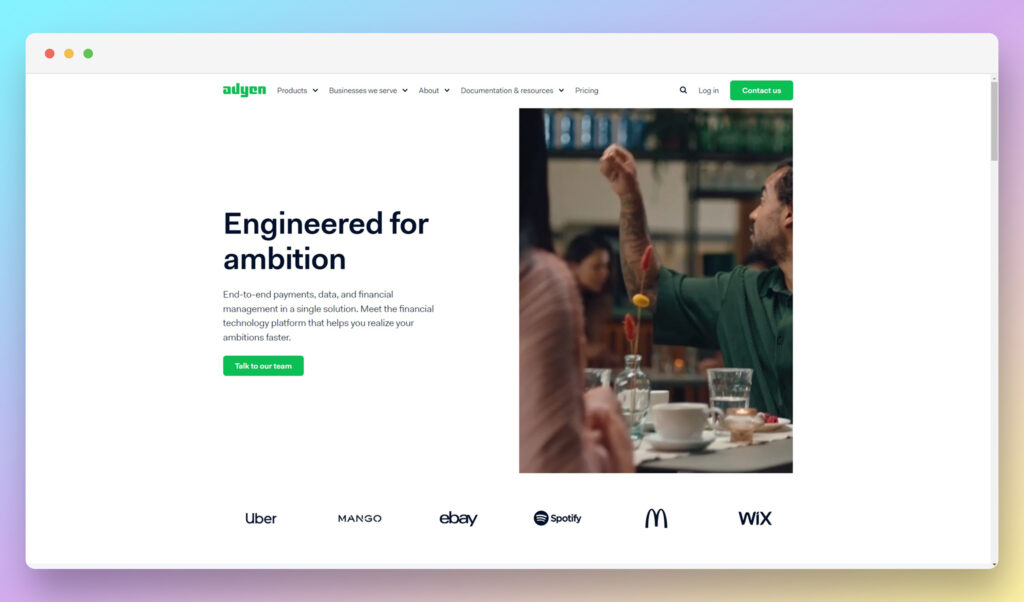

4. Ayden

Ayden is a payments platform designed specifically to enable business growth. You can use the technology to handle transactions anywhere, whether you’re online or offline. There’s already a huge range of big names using Ayden too, like Mango, Shopify, and Uber.

The Ayden ecosystem supports everything from card payments to mobile wallets and more, with fully optimized checkout experiences to encourage more conversions. There’s also available POS setups and payment terminals for your in-store transactions. With lightning-fast transaction optimization and excellent security, it’s easy to see how Ayden can help brands grow.

With Ayden, you’ll also have access to a host of reporting and analytics tools, so it’s easier to understand what your customers want most. As an extra bonus, there’s 24/7 support if anything goes wrong, the option to link multiple bank accounts, and no setup fee.

Pricing:

With no setup fee required, you’re free to start accessing your payment processing tools as quickly as possible. The cost of your transactions will vary depending on the payment type you’re accepting, and where you are, however – which can make things a little confusing. For instance, in Europe, transactions cost 3% for an Alipay wallet.

Pros 👍

- Suitable for taking a range of payment options

- Excellent for online and offline payments

- Lightning-fast transaction optimization

- Excellent security management

- 24/7 customer support

Cons 👎

- Complicated pricing structure

- Not available completely worldwide

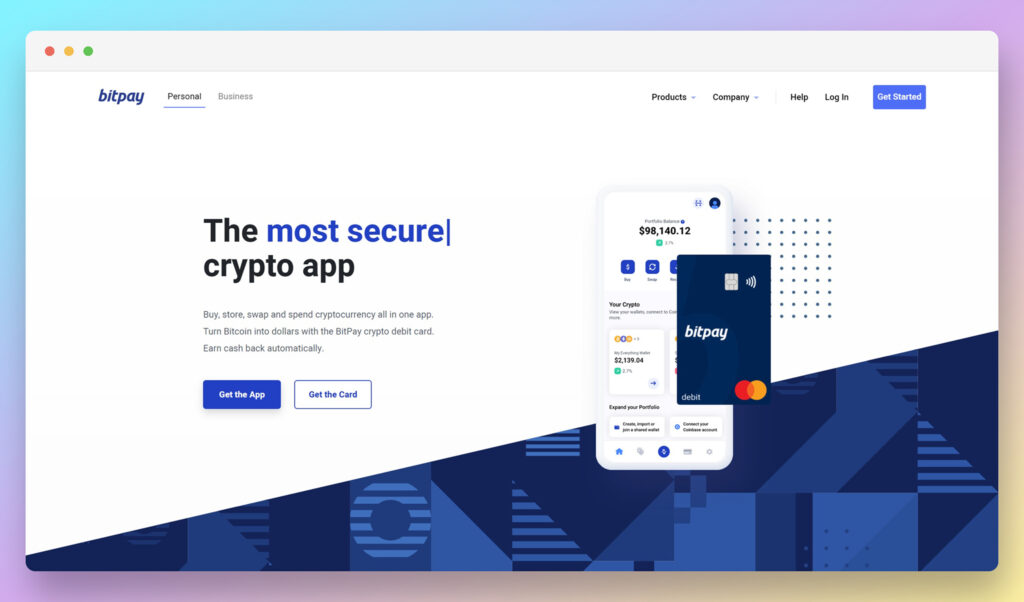

5. BitPay

Originally founded in 2011, BitPay is one of the larger bitcoin payment providers in the current market. Responsible for more than $1 million in transactions, BitPay gives companies an exciting way to accept payments through more than just credit and debit cards. You can convert bitcoin payments into a choice of nine different currencies too, if you want to minimize volatility.

Known for commonly partnering with all kinds of other payment solutions, like PayPal, and Global Payments, BitPay is a wonderfully flexible solution. There’s also a merchant directory where customers can find companies capable of taking crypto payments. This could be a great way to get more attention to your brand.

BitPay also ensures a range of protections are in place for business owners, including no fraud chargebacks to worry about. There’s also access to around 229 countries, so you shouldn’t have any problem scaling your company to a global level.

Pricing:

There are no monthly minimums or set-up fees required for BitPay, which is great if you’re just getting started with your new company. Even better, the transaction fee is a simple 1%, with daily settlements available, and absolutely no hidden fees. This might be a much cheaper way to take payments than many of the leading payment processors on the market.

Pros 👍

- Great for taking cryptocurrency payments

- Available for transactions all around the world

- Only a 1% transaction fee to worry about

- No hidden fees and unlimited monthly transactions

- Wide range of integration options available

Cons 👎

- Limited number of fiat currency options

- May not be ideal for companies not interested in cryptocurrency

6. Checkout.com

Checkout.com doesn’t have the same market presence as some of the other payment processing solutions we’ve covered so far, but that doesn’t make the solution any less compelling. The technology empowers global brands with a host of digital payments built for scale and speed, including well-known companies like Samsung and Pizza Hut.

Checkout.com offers companies access to simple, modular payment solutions which adapt according to their individual needs. You can access a single integration for multiple tools and unlock over 150 processing currencies with tons of actionable data to help you make better business decisions.

The powerful platform comes with a unified API which can transform and evolve according to the needs off market leaders. There’s also the option to send seamless pay-outs quickly, whenever you need to. Overall Checkout.com takes a very simple and straightforward approach to giving you the scalability you need to grow a global business.

Pricing:

Lack of transparent pricing is probably the biggest issue with Checkout.com. You need to reach out to the customer service team to get information on how much your service is likely to cost. On the one hand, this means you get a fantastic, customized pricing package specific to your individual needs. On the other hand, it’s hard to predict whether you can really afford this payment processor.

Pros 👍

- Lots of global payment options for growth

- Unified API access for multiple needs

- Customized pricing packages

- Quick and convenient pay-outs

- 150+ processing currencies

Cons 👎

- Not the most transparent pricing

- Can be a little complex for beginners

7. PayPal

There are few companies in the payment processing landscape with the same market impact as PayPal. Perhaps the best-known shopping solution around, PayPal acts as the ultimate digital wallet for customers and businesses around the world. There are hundreds of millions of people already using this payment processing service, so it’s sure to appeal to plenty of customers.

PayPal keeps things simple and effective, with a straightforward interface any business owner can understand. You can take payments in currencies from all around the world. Plus, integrating your PayPal checkout system with your business website or store couldn’t be easier.

PayPal requires no contracts to get started, so you can jump in without having to worry about long-term commitments. Pricing is transparent – though it can sometimes be expensive, and integration options are boundless. PayPal also offers multiple ways for users to get in touch if you have any issues with the service.

Pricing:

PayPal merchant fees are usually dependent on your location, and the kind of payments you’re taking. A card-funded payment usually has a 1.20% transaction fee, plus a fixed fee. On the other hand, commercial transactions without a card can be around 2.90% plus a fee. The pricing structure is relatively straightforward, but it can also be quite complex with so many different fees to think about.

Pros 👍

- Well-known and trusted around the globe

- Excellent range of currencies and payment options

- Integrates with a huge range of tools

- Easy to use backend for companies

- Extra features available – like credit

Cons 👎

- Pricing structure can be difficult to understand

- Customer service isn’t always the best

Further reading 📚

8. Google Pay

For a business leader, choosing the right credit card processing tool or merchant services isn’t just about finding the solution with he smallest fees. You also need to ensure making credit card payments is as convenient as possible for your audience. Solutions like Google Pay ensure you can take quick and convenient payments from a point of sale or credit card processor with the Google system.

Designed mainly for in-person payments, Google Pay allows customers to place their smartphone on a card reader to make purchases quickly and conveniently. This can be an excellent way to ensure your consumers don’t have to waste time looking for a Vis, Mastercard or Discover card. The mobile credit card has become increasingly popular in recent years.

Like other payment gateways, Google Pay allows users to link their cards quickly and easily to their devices for mobile payments. It’s basically like giving customers a mobile credit card.

Pricing

Google doesn’t charge merchants any fees for accepting Google Pay. However, Google Pay payments are “card present transactions” when they’re in a physical shop, which could mean you have to pay credit fees up to 4%.

Pros 👍

- No monthly fee to worry about

- Works with a range of POS systems

- Excellent PCI compliance

- Good for in-person start-ups with Android customers

- Takes a range of cards and payment options

Cons 👎

- Can be some expensive transaction fees

- Mobile device payments won’t be suitable for everyone

9. Apple Pay

After you’ve started to pull your first data back from your flagship merchant services provider and you determine if a mobile device transaction system is right for you, you can also look at Apple Pay. Popular among Apple users, Apple Pay enables businesses to create a kind of virtual terminal where they can accept card payments from mobile phones.

Apple Pay works like other credit card processing services for mobile providers. You’ll get access to tracking for your credit card transactions, so online businesses can record valuable financial information properly. You’ll also be able to offer an easy point of sale system for all kinds of customers. The Apple Pay system allows you to process payments in no time. You can even process credit cards loaded onto an Apple Watch.

Apple Pay is a secure solution for both offline and online shopping, capable of accepting most major credit cards, with no complex termination fees.

Pricing:

Similar to most mobile payment options, Apple Pay doesn’t charge a monthly pricing model for you to access the service for your online store. Instead, you’ll need to look at the transaction fees and interchange rates associated with your bank and credit card companies.

Pros 👍

- Can be more convenient than magstripe or echeck payments

- Suitable for offline credit card terminal

- Review payments in minimal business days

- No markup costs to worry about

- Gives you more payment methods to offer customers

Cons 👎

- Can be expensive for credit card rates

- May not be suitable for all retailers

Further reading 📚

Choosing the Top Payment Processing Companies

For a small business, choosing a payment processing company can seem like a complex process. There’s more to just looking at processing fees, or which solutions accept Visa or American Express payments. You’ll need to learn all about the ins and outs of business payments, from ACH and EMV payments, to what it means to have a merchant account, or access interchange-plus pricing.

Retailers need to ensure they’re accessing the right service provider to unlock an all-in-one payment processing experience. There are all kinds of credit card processing companies out there, accepting a wide variety of payment methods, but it’s not always easy to know which is right for you.

Hopefully, this guide has given small business owners and start up entrepreneurs a quick insight into some of the options available for their online store or offline retail location. Don’t forget, the best credit card processing solution for you will offer a combination of competitive rates, low interchange fees, and even integrations with your accounting tools (like Quickbooks). Take your time to research all of your options before you jump in.

Comments 0 Responses