When running your own ecommerce business, having a firm handle on your finances is imperative.

But, with so much for online store owners to keep track of, this is sometimes easier said than done! From their expenses and investments to payment processing fees, sales taxes, shipping costs, and income. It's safe to say there's lots to consider.

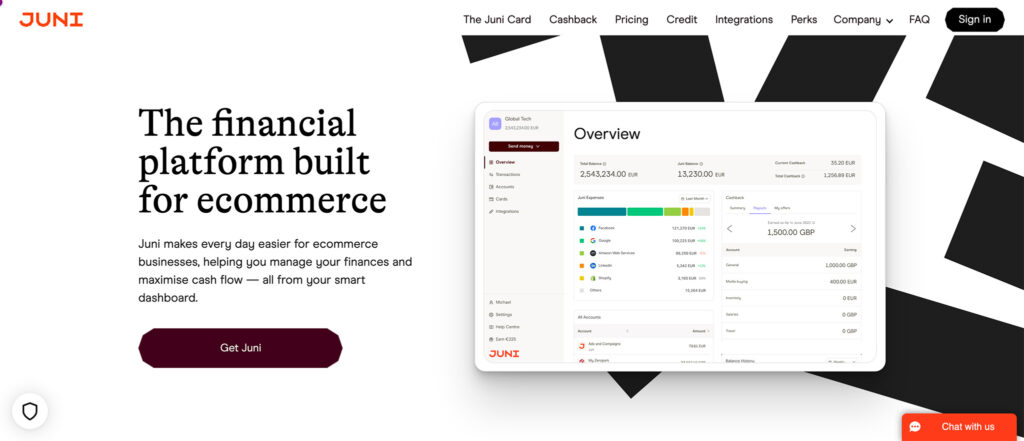

This is where using the right mobile banking solution or financial platform becomes vital.So, today, we're looking at Juni, a FinTech solution that prides itself on providing financial services specifically for ecommerce merchants. Juni offers plenty of handy features that online merchants might need from a financial platform. For instance, cashback, multi-currency accounts, virtual cards, and insights – to name a few!

With that said, below, we'll explore everything Juni has to offer, including more of an in-depth look at its features, pricing, and integrations, to help you determine whether this is the right financial solution for you.

There's lots of ground to cover, so let’s get cracking!

About Juni

Juni was founded in Sweden in 2020 by creators disappointed with the current banking solutions available for ecommerce merchants. Juni is an all-in-one financial platform explicitly designed to support ecommerce businesses and help them scale. The Financial Conduct Authority and the Bank of Lithuania regulate the platform.

Juni is now accepting applications from companies based in the UK and EEA. However, only Limited Liability Companies can apply, including LTD, PLC, LLP, BV, AB, and EEOD.

As with any financial institution, getting started with Juni takes a little paperwork and patience. The process, however, comprises just three simple steps:

- Fill out a form that provides Juni with your details, and they'll get back to you as soon as possible.

- Upload your identification documents to complete the application process. After that, Juni can onboard you within five business days.

- Start scaling your business with virtual cards, multiple currency accounts, and cashback.

For a successful application, you'll need to provide Juni with the following:

- A recent bank statement (within the last three months) to verify the source of your funds

- Information about who owns your business, where it's located, and what your business operations entail

- A current (non-expired) government-issued form of identification

- Your company's registration information

Juni Review – Key Features

Now that we've covered the basics, let's take a closer look at Juni's core features:

The Juni Card

Physical VISA cards are currently only available for UK companies in GBP. Virtual Juni Mastercard® Corporate Cards and Visa Platinum Cards are both available. You can order up to 10 physical cards; the first three are free. Although Juni doesn’t offer physical cards for USD and EUR at the time of writing, Juni plans to provide this in the near future.

You can also create virtual cards instantly and for free. Just like the physical cards, virtual cards are eligible for the platform’s cashback scheme. In addition, you can assign virtual cards with specific user roles and permissions to other employees in your business.

You’ll also be notified of every card transaction, whether physical or virtual. This is especially handy if you want to stay on top of your spending.

If you're a UK-based business, with your UK Juni card, you can apply for flexible credit limits ranging from £10k to £2M*. This zero-interest credit can be repaid within 37-60 day payment terms upon eligibility. However, this is for UK companies only, so penalties and interest will arise if you default on payments. You can check the terms and conditions here.

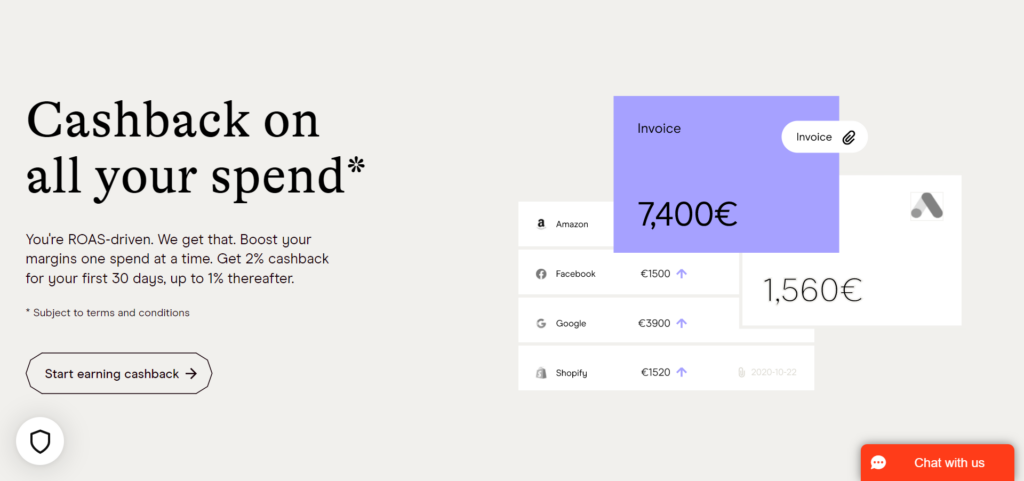

Cashback

As we’ve already hinted, Juni runs a cashback benefit program that applies to all your eligible transactions! Here you can get up to 2% cashback with your Juni card for the first 30 days. After that, you’ll only earn up to 1% cashback. There’s no cap on cashback, so as you keep using your card, you’ll keep making small savings. The money you make is credited to your account 30 days after each month-end.

Multiple Currencies

You can create current GBP, USD, EUR, and SEK IBAN accounts. As such, Juni doesn't currently offer IBAN accounts in other currencies but does allow you to pay and get paid in multiple currencies with low FX fees capped at 0.25% For each currency, you can create up to 10 separate accounts. This is helpful if you want to create different accounts for specific employees to better track their expenses. It also comes in useful if you're going to dedicate an account to a particular project or store location.

By default, upon registration, every account starts with one GBP and one EUR account.

Mobile App

Juni is primarily available via your internet browser. At the time of writing, Juni has a mobile app in the works. So keep your eyes peeled for that! In the meantime, you can log into Juni through your mobile browser and add a shortcut to Juni’s login page on your phone’s home screen.

Insights

You can overview all your Juni transactions from a simple, intuitive dashboard. More specifically, from here, you can review profits received via different channels and what percentage of your monthly revenue each channel makes up. In addition, you can compare incoming and outgoing transactions and visualize your closing balance per week, month, or year. You can also review your next cashback payout due at the month’s end. On top of that, you can download statements for your records anytime.

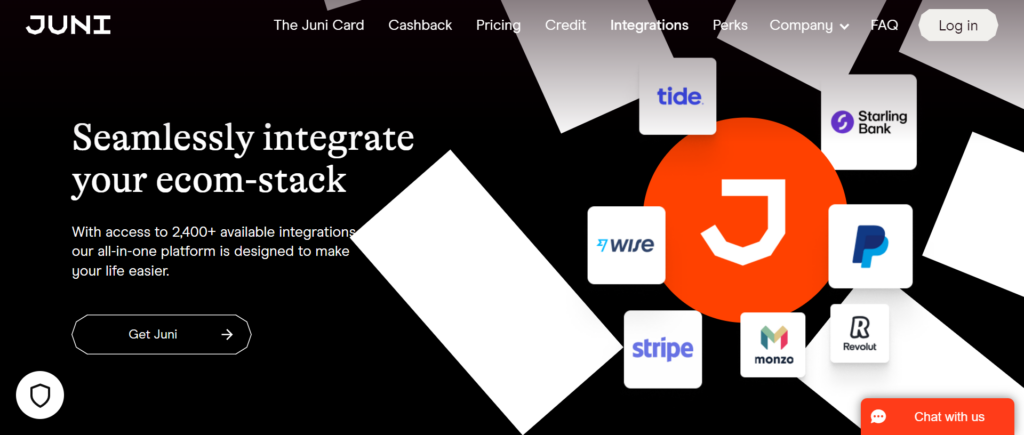

Juni Review – Integrations

Juni works with your existing financial tech stack. With over 2,400 integrative solutions, there’s plenty of flexibility to better manage your financial workflows and increase visibility into how your money moves.

Some of Juni’s more notable integrations include:

- Shopify App

- Google Ads

- Facebook Ads

- Xero

- PayPal, Stripe, Wise, and more

- Banking providers like Monzo, Revolut, and the Starling Bank

Juni Review – Special Perks

Cashback is one of the biggest perks Juni offers, but it’s far from the only one. Juni also unlocks access to discounts on a range of SaaS tools to help your eCommerce business expand. This includes services like automated payment solutions, marketing campaign managers, affiliate programs, landing page designers, and more. Discounts are either a percentage (up to 50%) or a fixed price reduction. In some cases, Juni can get you extended trials with these software.

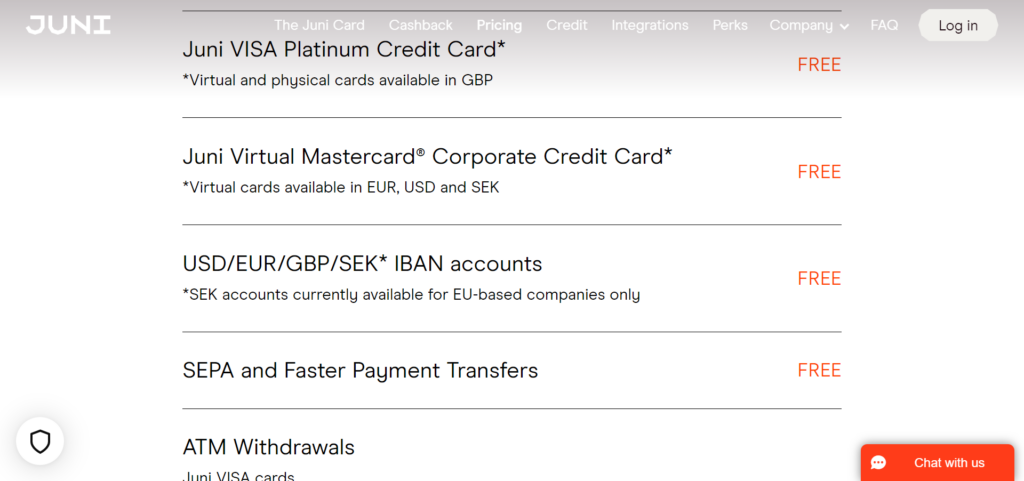

Juni Review – Pricing

Signing up to Juni is free, and the platform does its best to keep fees to a minimum. Setting up virtual cards also comes at no extra cost.

With that said, here’s what you can get for free:

- Create your Juni account for free

- Create Juni virtual Mastercard Cards in EUR, USD and SEK

- Create Juni virtual VISA Cards in GBP

- Get the physical Juni VISA Platinum Credit Card in GBP

- SEPA and Faster Payment Transfers

- Free ATM withdrawals with Juni VISA cards

There are also no FX fees on your Visa and Mastercard cards (but partners, like the FX brokers do charge a fee), and as we’ve already mentioned, there’s no cap on how much cashback you can receive.

However, here are the fees you should be aware of:

- While Juni itself charges no FX fees, their partners do, like the FX brokers. This means you’ll be charged a 0.25% transaction fee if you receive money in a currency different from your own. For example, when you transfer money from your GBP to your EUR account.

- There’s a card replacement fee of 5.00 EUR

- There’s a dormancy fee of 5.00 EUR (This occurs after 12 months without spending on your account or card. The dormancy fee recurs every 30 days until the account is closed or returns to activity.)

- Juni itself does not charge any ATM withdrawal fees for Juni VISA cards, but the ATM you are using may take a fee that is outside Juni's control.

- Juni does not apply any FX fees for VISA or Mastercard cards. When making transactions in a currency that doesn’t match your Juni GBP account, Juni uses the VISA rate as seen here. For Juni EUR, USD and SEK accounts, Juni uses the Mastercard rate as seen here. Again, Juni does not apply any fees on top of this.

Juni Review – Customer Support

Juni offers support via email and 24/7 live chat on its website, while people can submit support tickets via email and chat 24/7, the working hours during which these tickets will be processed are 9am – 7pm CET, Mon-Fri. Additionally, there’s an online help center where you’ll find answers to frequently asked questions and articles outlining the platform’s features.

Juni Review – Pros and Cons

That’s a lot of information to digest! So, let’s condense some of what we’ve learned into a quick pro-cons list:

Pros 👍

- Juni integrates with Shopify so you can get centralised overview of your stores

- Google Ads and Facebooks Ads Integrations

- You get discounts with partnering software solutions. However, these perks won't affect you much unless you’re actively interested in these specific tools.

- Juni accounts are entirely free to create. There is also no charge for setting up virtual cards and ordering your first three physical Juni Visa cards or Juni Mastercard Cards.

- The transaction dashboard provides a detailed and valuable overview of your Juni transactions, allowing you to quickly spot where money is coming in and out.

- You can open a free IBAN account, which is great if you’re doing business in Europe or in the US.

- You can integrate with other financial tools like Xero, Monzo, and Revolut.

Cons 👎

- Juni is only available in the UK and EEA areas.

- Only Limited Liability Companies benefit from Juni.

- There’s no phone support.

- Pricing isn’t hugely transparent. The pricing page will refer you to terms and conditions for further information, which isn’t easy to skim through and understand.

- There’s currently no mobile app.

- Physical Cards and credit are only available for UK businesses right now.

- The online help center doesn’t provide great insight into pricing, platform capabilities, etc. At the moment, many features seem to still be a work in progress, and articles are often only a few lines, providing a basic description of the feature in question.

Juni Review – FAQ

Last but not least, before we say goodbye, let’s answer some of the most frequently asked questions we hear about Juni:

How does Juni keep my money secure?

Juni is regulated by the Financial Conduct Authority to assure its compliance and security in the UK. It also complies with Payment Card Industry Data Security Standards (PCI DSS). It runs its online infrastructure on Amazon Web Services (AWS), a cloud services and data security leader. Additionally, they have an active FinCrime team that operates advanced transaction monitoring 24 hours daily. Finally, Juni is compliant with GDPR standards.

However, it’s worth noting that Juni doesn’t protect your funds through the EU deposit guarantee scheme. There’s also no protection through the Financial Services compensation scheme (FSCS) or the Federal Deposit Insurance Corporation (FDIC).

That said, Juni keeps its operational funds separate from the money in your account, so your funds are returned to you in the event of closure. Nonetheless, your cash isn’t insured.

Does Juni have an Affiliate program?

Yes! If you want to promote Juni to make extra money, you can sign up for its affiliate program. You can promote Juni on your blog, YouTube channel, or elsewhere on the web and earn weekly revenue. Juni offers a commission of 225 EUR when someone you refer to them creates their first Juni card.

Juni Review – Our Final Verdict

Ecommerce merchants undoubtedly need a financial solution that clearly breaks down their cash flow and offers additional benefits. At first glance, Juni seems like an attractive option with cashback and multi-currency accounts.

However, the company is still young and lacks features where other providers excel.

Most notably, there are very few digital cash-management features that make Juni stand out. For instance, there’s no way to track saving goals and revenue targets, categorize spending with custom tags, or create custom reports. In addition, although Juni promises thousands of integrations, the website barely mentions eight, and currently, there’s no mobile app available.

The fact that Juni is free to use and comes with up to 1% cashback after the initial 2% boost is its most significant benefit. But physical cards are only available in GBP. So right now, Juni caters to a niche audience. On top of this, while the provider assures security, it lacks some of the same deposit insurance that traditional banks and larger fintech providers offer.

Unless cashback is vital to you, we recommend shopping around a little more for alternatives. Of course, Juni might develop into an excellent solution for ecommerce merchants a few years later. But right now, its features don’t significantly set it apart from other solutions. So we’d recommend patience and caution if you want to check out Juni for yourself.

Comments 0 Responses