Mobile banking is the new and improved alternative to challenger banks. Period.

Gone are the days of manually tracking your incomings and outgoings and making tedious journies to physical branches. With everything digitalized, online banking services provide intuitive money management features from the convenience of your smartphone.

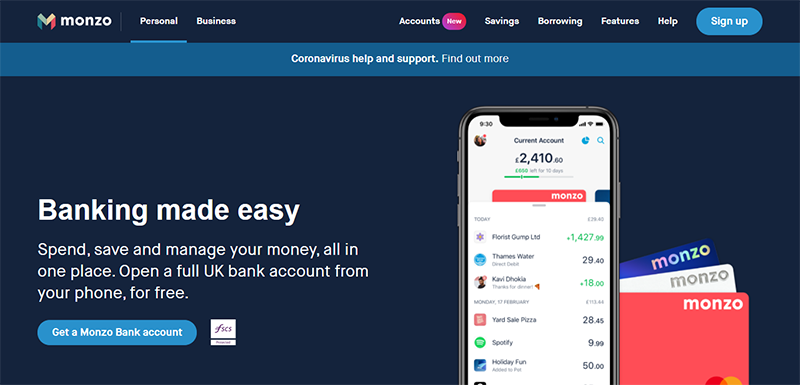

We’ve already covered other banks like Revolut. So, in this review, we’re rounding up our online banking series by divulging everything you need to know about Monzo. Primarily a UK bank, Monzo aims to provide you with full control over your money no matter where you go.

Sound good? Let’s dive into what Monzo has to offer.

What is Monzo?

Founded and based in the UK, Monzo was one of the first app-based mobile banks on the market. Launched back in 2015, they're now the bank of choice for nearly five million people.

While Monzo offers some of its services to US citizens, most of its features and functionalities are only available to British customers.

Monzo lets you quickly make payments, create joint accounts and shared tabs, open an account as a teenager and spend money abroad with a full travel report when you return. They also offer business accounts with some nifty features. If you're a budding entrepreneur, these are undoubtedly worth checking out.

In short, Monzo offers a full suite of mobile banking features that make it easy to see where you're spending and/or saving money. You can create budgets, keep a close eye on your saving goals, and take advantage of Monzo's cheaper international transfers and cash withdrawals (compared to traditional high street banks).

Monzo Pros and Cons

Let's start with the perks:

Monzo's Pros 👍

- Monzo provides a convenient and easy-to-use app that comes with plenty of tools for saving, managing, and spending your money.

- Monzo is registered with the financial conduct authority (FCA) to provide full deposit protection alongside other security features.

- You can earn interest on your savings to grow them slowly!

- Monzo allows you to set up joint accounts, which is great if you’re starting a family or want to share expenses with your partner.

Monzo's Cons 👎

- Monzo's saving rates aren't very high. You could find better offers with some of Monzo's competitors, so if saving is your priority, look elsewhere.

- Monzo uses Mastercard’s exchange rates. Many other mobile banks use the interbank rate instead, which is often cheaper. As such, Monzo isn't the most affordable option for international withdrawals and exchanges.

- Monzo charges a £1 fee every time you deposit cash into your Monzo account.

- There's a monthly limit on how much you can withdraw for free when abroad. If you go beyond this limit, you'll be charged 3% on all your withdrawals.

- Monzo doesn’t have a desktop app.

- Monzo doesn't offer a credit card.

Monzo’s Pricing

Like many banks, Monzo offers a mixture of free and paid-for accounts. How much you pay for Monzo depends on the card and account type you choose. As to be expected, the more you pay, the more features you unlock.

Let's take a look at these in more detail…

Monzo Current and Monzo Lite

These are Monzo's free personal and business accounts. However, you should be aware of the following fees:

- You can withdraw up to £200 a month for free when abroad. After that, you face a 3% fee.

- You’re subject to a £1 charge when depositing money into your account via one of 28,000 PayPoint’s across the UK.

Monzo Plus

This is a personal account costing £5 a month and comes with:

- A holographic card

- Virtual cards

- Advanced roundups

- A credit tracker

- Up to £400 fee-free withdrawals abroad

- You can overview multiple Monzo accounts from your app.

- You can split your payments into multiple categories to make it easier to see what you’re spending where.

On top of that, you can make one free deposit. You also earn a 1% interest rate on your balance and saving pots up to £2,000.

Please note: There's a three-month minimum term.

The Premium Plan

This personal plan costs £15 a month. Your monthly withdrawal limit abroad is lifted to £600, and you can make up to five free cash deposits. As well as everything above, the Premium plan also comes with worldwide travel insurance, phone insurance, 1.5% interest, discounted airport lounge access, and a high-quality metal card.

Please note: There's a six-month minimum term.

The Pro Account

This business account costs £5 a month and provides you with:

- Integrations with third-party accountancy software

- Ltd company's benefit from multi-user access

- You can create, send and track invoices.

- You can also open tax pots to save for your tax returns.

- Enjoy six months of Xero access for free!

This plan also comes with all the Monzo essentials, like a full UK current bank account, Apple and Google Pay, fee-free spending abroad, and budgeting tools. Plus, you’ll get a business debit card and digital receipts to make managing your business expenses easier.

Card Shipping:

Your Monzo card is shipped for free (if you reside within the UK). In contrast, an international delivery costs £30.

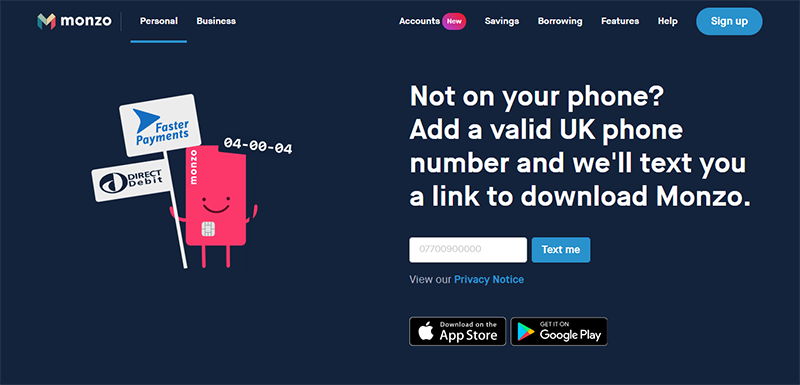

Signing Up with Monzo

To sign up for a Monzo bank account, you'll need to:

- Be a UK resident

- Be older than 16

- Own a smartphone – Monzo doesn't have any physical branches, so you’ll need to download the Monzo app to your Android or iOS device to sign up.

- Have your identification and proof of address at the ready

- Provide your email address, phone number, and date of birth.

The app will also prompt you to submit a five-second selfie-video delivering a message. This will check your voice's sound and identify your face. These are anti-fraud protection measures to help keep your account safe from hackers.

The Monzo App

As we've already hinted at, you can access all of Monzo's banking services via its mobile app, so you can bank while you're on the go via your smartphone or tablet. However, unlike some of its competitors, Monzo doesn’t provide a desktop version of its app. This means you have to have a smartphone or tablet.

The Monzo app is easy to install, use, and keep secure. In fact, at the time of writing, the app boasts an impressive 4.8-star rating on the Google Play store and a 4.9 rating in the App Store on iOS. This speaks volumes as to its quality of service and user-friendliness!

Making Payments with Monzo

You can use your Monzo app and card to make payments and send transfers easily.

Via the app, just set up a secure, personalized link and send it to the intended recipient by text or email. The recipient can simply open this link, enter their details, and get paid in next-to-no time.

Monzo also works with Google and Apple Pay, and you can easily set up direct debits and standing orders to stay on top of your bills. Monzo even informs you when next month's bills are predicted to be higher than usual so that you don't suffer any unpleasant financial surprises!

Monzo Physical Cards

Monzo current accounts all come with a debit card, of which you can pick the color – hot coral, blue, and white. On Monzo's Plus plans, the card's holographic – fun, right?!

In contrast, Premium Monzo users receive a snazzy metal card, which at 16g weighs 3x more than Monzo's plastic debit card. The metal card's made out of a single sheet of stainless steel for extra rigidity and makes an immensely satisfying ‘clink.’ Logos and card details are precision engraved. Like its plastic counterpart, the metal card is also contactless.

You can use your physical cards to withdraw and spend money all around the world. Best of all, using your card abroad is free; you're only charges the MasterCard exchange rate.

Monzo Virtual Cards

Monzo's virtual cards are exclusively available to Plus and Premium account-holders. Each virtual card has a unique ID, so you can buy online without reusing the same card details, making it much safer to shop online. In the unfortunate event that a website you've shopped with is breached, your bank accounts aren't compromised.

With the Plus account, you can use up to five virtual cards at any time. Best of all, you can hit the ground running within minutes – Plus and Premium account-holders can create virtual cards from within the Monzo app.

Security

In 2017, Monzo became a fully regulated UK bank. This means your money is protected up to £85,000 by the financial services compensation scheme (FSCS).

This is an independent fund set up by the government to protect the capital of the people. If Monzo, or any other bank under the scheme, goes bankrupt, you won’t be left with empty pockets.

On top of that, you benefit from the following security measures:

- Instant notifications whenever a payment is made.

- You have to approve online payments and protect your account with either Touch ID, Face ID, fingerprint, or a PIN.

- Monzo doesn’t use passwords to avoid phishing and poor password practices. Instead, it creates magic links that are sent to your email. From here, you can log into your app with just a click.

- You can block and unblock your card whenever you want

Best of all, Monzo is four times better at preventing card fraud compared to other UK banks and three times better at stopping identity theft.

Monzo Customer Support

When it comes to evaluating Monzo's customer service, the voice of their brand is worth noting. Monzo aims to speak its customers' language, so you can expect them to be transparent about technical information, keeping things as simple and jargon-free as possible.

Monzo provides an online help center. Here, you'll find various resources, including guides on what to do in an emergency, how to manage your account, making mobile payments, creating pots and budgeting, getting an overdraft, and much more.

There's also a busy online forum where Monzo encourages users to raise concerns and ask questions. Reading the forums is also an excellent way to get an impression of the product too, so if you’re curious about signing up for a Monzo account, make sure to visit it!

If you have further questions, you can contact Monzo’s support team via the in-app live-chat or on the phone. For urgent issues, the chat is available 24/7. For other inquiries, the Monzo team is available to chat from 7 am to 8 pm.

Monzo Top Features

Below we've highlighted some of Monzo's key features:

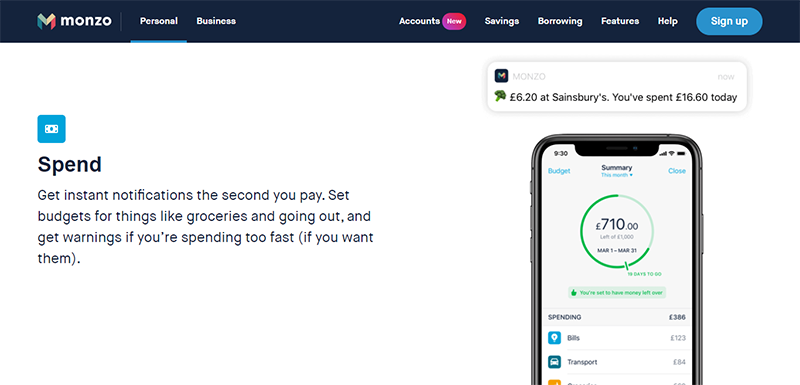

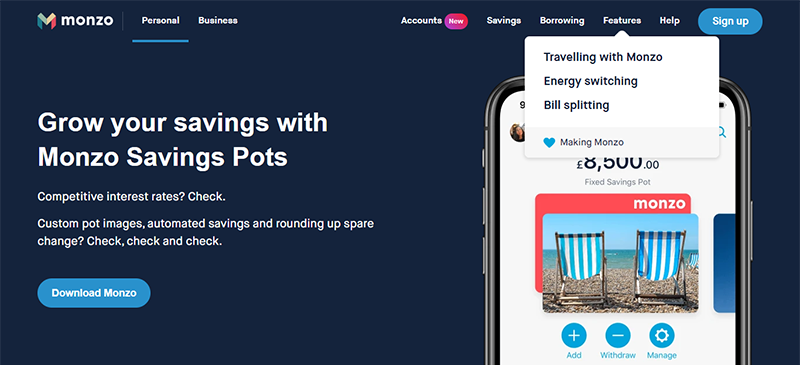

Pots and Budgets

Monzo empowers you to organize your money. The ‘Salary Sorter' separates your income into different categories, for example, spending, savings, bills, etc. That way, you can see exactly where you're money's going and how much disposable income you have that month.

On top of that, you can set up separate ‘savings pots' where you siphon off money towards your savings goals or bills. When you launch Monzo's 12-month fixed pot with a minimum £500 deposit, you can earn up to 0.27% (AER, fixed) worth of interest on your money. Alternatively, if you would prefer easy access to your savings, Monzo's got you covered. With their easy access savings account, you can get your money the next working day!

To help kickstart your savings, you can even opt to automatically round up your spare change to the nearest pound and have the difference sent to one of your saving pots. Handy, right?

Joint Accounts

If you and your partner share expenses and want to manage your money together, Monzo’s joint account is well worth considering. This allows both of you full control and visibility over your savings accounts and spending.

Note: Joint accounts come with all the money-management features granted to personal account users.

Business Features

If you opt for Monzo’s Business Pro account, you unlock a range of nifty business features. For example, you can create and send invoices from within the app and register multiple users if you’re an Ltd company. This is an excellent feature for businesses that either share or delegate banking-related tasks.

This same account also integrates with accounting software like Xero, FreeAgent, or QuickBooks. Plus, you can use Monzo’s ‘pot' system to set money aside for taxes.

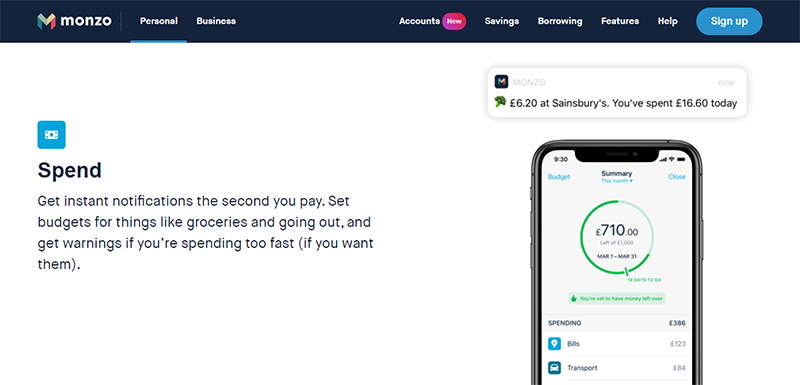

Instant Notifications

When you spend money, Monzo immediately notifies you the second the transaction's complete. You can set budgets for whatever you like, whether it’s going out, getting groceries, or going on a shopping trip with your friends. Then, you’ll get warnings the moment you start spending too fast to meet those budgets. However, if you don't want to receive these notifications, you can disable them – the choice is yours.

16-17 Accounts

If you’re not yet eighteen, you’re still able to open a full UK current account complete with an account number and sort code. You'll also receive a contactless card to make payments with. This account comes with all of Monzo's saving and budgeting features, but it doesn't enable you to make purchases on things illegal to under 18s. For instance, gambling. You also can't create an overdraft.

Overdrafts and Loans

For short-term borrowing, you can set up a Monzo overdraft. Monzo sets a £1,000 limit on overdrafts, charged at a rate of 19%, 29%, or 39% EAR. The rate depends on your credit score, which you can review in the Monzo app. Beyond this, Monzo doesn’t charge extra overdraft fees.

You can also explore several loan offerings with flexible repayments and same-day monies. There are no fees if you repay these loans early! Monzo offers loans up to £3000 with a representative APR of 26.6%.

Extras

Besides the above features, Monzo users can look forward to the following extras (depending on the account they’ve chosen):

Bill splitting: Easily split bills with shared tabs. Whether you're eating out, going on a day trip, or dividing household expenses, this functionality keeps track of who owes what. You can split the tab however you like and settle bills as they come in or at the end of the night – the choice is yours.

Traveling: Spend money abroad in any currency without incurring any fees. You’ll only pay the MasterCard exchange rate. Monzo also comes with travel reports that let you know how much you spent abroad. On premium accounts, you’ll also get worldwide family travel insurance up to £5,000 to cover cancellations.

Are You Ready to Get Started with Monzo?

Now that we’ve covered everything you need to know about Monzo, it’s time for you to decide.

Is Monzo the right mobile banking app for you? Let’s recap some of the essential points to remember:

If you’re not a UK resident, Monzo isn’t the right choice for you at this very moment. While we can look forward to seeing Monzo operate internationally at some point in the future, that day hasn’t yet arrived.

Also, Monzo might not be your best bet if travel money is your primary motive. While Monzo has a range of superb features for traveling, like travel reports, extra travel insurance, and free card uses abroad, the Mastercard exchange rate (usually) isn't the most favorable for travelers.

You also have a withdrawal limit abroad, after which you’re charged a 3% fee each time you make an ATM withdrawal.

Monzo provides some flexibility on its loans, overdrafts, and savings pots, although the interest you earn isn’t impressive.

But, overall, the Monzo app is incredibly useful for saving, budgeting, and managing your finances – especially if you’re under 18 or need a joint account with your partner. Monzo’s various saving features are intuitive and very useful for managing cash flow and meeting your saving goals for both personal and business use.

In short, we think Monzo meets the mark with its other handy features like bill sharing, deposit predictions, and automatic spare change rounding, and as such, we would recommend this digital bank!

If you choose to sign up for a Monzo account, let us know what you think! Or, are you considering one of their competitors, like Starling Bank? Either way, we’d love to hear your thoughts in the comments below and how your online banking experience compares to that of traditional banks. Speak soon!

I need a loan urgently but I am in Buro what can I do to get it thank you.

Hello Sergio, I’m not sure if Monzo can help with this in Buro. The best thing is to contact a finance expert in your area to get the best advice about this.