The best subscription billing software can make life running your own business a lot easier. With the right technology, it’s easy to collect cash on monthly subscriptions, without having to chase after your target audience with endless manual invoices and reminders.

Subscriptions are one of the most effective tools for ensuring ongoing income in the software landscape. In fact, the arrival of “subscription” solutions even allowed for the introduction of a new avenue of growth for software companies, in the form of “SaaS” (Software as a Service).

Unfortunately, managing subscriptions, customer cycles, and pricing structures can be a real headache. That’s where the power of subscription billing software comes in. These tools allow you to set up recurring invoices, so you can minimize the amount of manual work your team does.

Here’s your guide to subscription billing software.

What is the Best Subscription Billing Software?

Recurly

Best Overall Subscription Billing Software

Designed to accelerate your business growth and delight subscribers, Recurly is one of the most popular subscription billing platforms around. The solution allows business leaders from major companies like Lucidchart and Twitch to automate subscriptions at scale.

Businesses can create as many billing platforms as they like, which makes it easier to attract a wider range of potential customers. You can build catalogues of items and list their pricing, and other key details. Plus, there’s access to one-time or recurring purchases with Recurly too.

Standout features of the technology include everything from automatic pro-rating of billing variations to automatic upgrades, downgrades, and refunds. You can also allow your customers to pause a subscription or set an unlimited period of time to reduce the risk of cancellations. You’ll also be able to automatically notify your customers when any changes happen to your subscriptions.

Pricing

Pricing starts with the “Core” plan at $199 per month when you pay annually. Thee solution supports businesses with subscription revenue of up to $1 million annually. There are also the “Professional” and “Elite” pricing packages for people with more annual income, but you’ll need to request a quote to start with these.

Pros 👍

- Machine learning tools to minimize churn

- Integrates with a range of payment gateways

- Easy to calculate a host of crucial metrics, like LTV

- One-time or recurring purchasing options

- Automated solutions for upgrading and downgrading

Cons 👎

- Can be quite expensive for smaller businesses

- Something of a learning curve for some companies

Further reading 📚

Chargebee

Best Subscription Billing Software for Small Business

One of the leading subscription billing platforms in the digital market, Chargebee is extremely popular among B2B SaaS platforms. Ideal for automation, companies can make use of more than 480 leading recurring billing scenarios, with endless different billing options.

There’s the option to create a no-code checkout experience and catalog page in Chargebee without having to worry about accessing developer expertise. With Billing LogIQ, customers can also bill customers on a specific date or custom billing dates for every customer. Auto calculations are included for pro-rations for upgrades and downgrades, as well as cancellation, so you can quickly manage the entire billing cycle.

Chargebee offers a comprehensive view of your customer, by reporting numerous metrics like customer lifetime value, average revenue per subscription, and customer lifetime value. There’s also MRR, and over 100 local currencies and payment methods to meet with international customer needs.

Pricing

Pricing for Chargebee starts with the “Rise” plan for agile companies who want to grow revenue quickly with data-driven decision making and subscriptions for $249 per month.

There’s also “Scale” for fast-growth scaleups that want to grow by maximizing efficiencies in revenue operations. “Enterprise” is suitable for large businesses in search of enterprise-class compliance, available via quote.

A free package is available, but it offers just the very basics to a maximum of 3 users.

Pros 👍

- Integrations with a range of payment gateways

- Wide range of payment options

- Trial management and product catalogs

- Billing LogIQ for intelligent insights

- Range of recurring billing scenarios

Cons 👎

- Can be very expensive for beginners

- Free plan is very basic

Further reading 📚

Chargify

An event-based solution for subscription management, Chargify is a tool which supports companies in setting up a range of billing scenarios, including one-time billing, recurring subscriptions, prepaid, and quantity-based subscriptions. There’s also access to PCI compliant signup pages with mobile responsivity already built-in.

Chargify is packed full of amazing features, including billing built for B2B SaaS strategies, subscription management tools, and accounting functionality. There’s also state-of-the-art data and analytics for monitoring revenue, customer trends, and product purchasing behaviors.

Chargify also allows you to send trial design emails, welcome emails, receipts after transactions, and more. You can get full behind-the-scenes insights into growth metrics, and real-time insights into things like most-used products and daily email snapshots.

Pricing

Costs for Chargify start at $599 per month with event-based billing for up to 250k events, analytics, customer hierarchies, managed sales tax, business intelligence, and a range of integrations with leading tools. There’s also the “Standard” package for $1,499 per month, with advanced analytics and SFDC integration.

The Specialized package starts at $3499 per month, with access to bespoke integrations, billing health checks, and a dedicated technical architect. You’ll also have the option to create a custom pricing package if you’re in need of enterprise support.

Pros 👍

- In-app revenue alerts and notifications

- Integrations with a range of tools, including accounting software

- Revenue retention analysis

- Powerful range of billing scenarios

- Insights into growth metrics

Cons 👎

- Quite expensive for the basic package

- Requires a little learning to discover the full benefits.

Further reading 📚

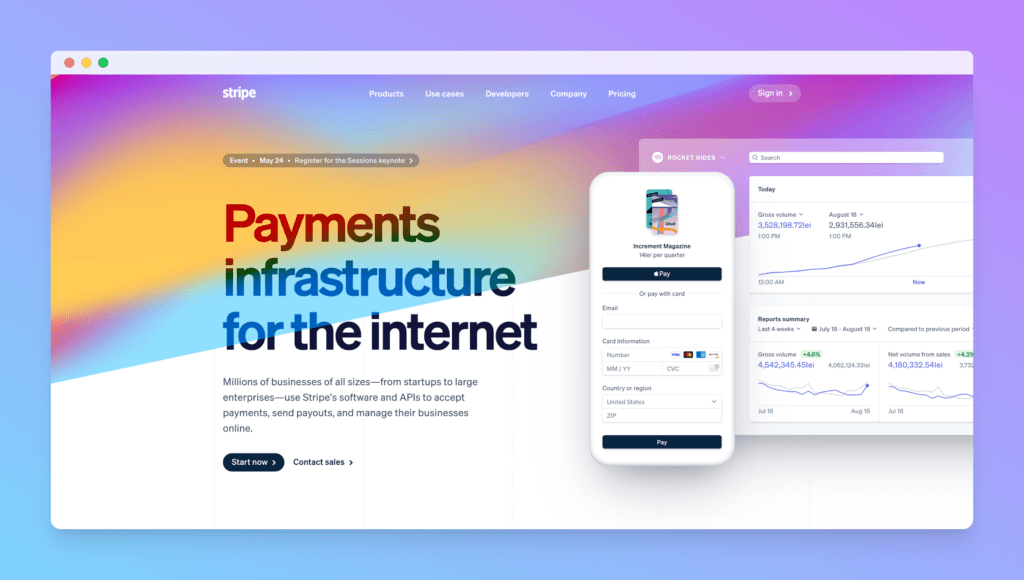

Stripe

Stripe is one of the better-known billing solutions on the market for ecommerce stores. The solution allows companies to accept payments in a range of different scenarios, including for SaaS subscriptions. Stripe is an excellent global tool, with 135 currencies and payment methods supported for business users around the world.

Stripe’s subscription management platform is a great software for managing customer invoices, and it’s great for collecting one-time and recurring payments through all kinds of bank transactions, cards, and other popular methods of payment. You can access everything from per seat pricing to metered billing functionality, and there’s even support for free trials, coupons, and add-ons.

With automated failed payment emails, automatic card updates, and payment emails, Stripe makes it quick and simple to reduce churn and improve revenue. There’s even the option or business users to combine their subscription payment service with regular Stripe Payments and invoicing.

Pricing

Pricing for Stripe is a little different than most of the subscription solutions mentioned here. Rather than paying a monthly fee for your subscription, you’ll pay transaction fees. Paid plans start with 0.5% on recurring charges and go up to 0.8% on recurring charges.

The more expensive plan includes quotes, Stripe Connector for NetSuite and a range of additional bonuses.

Pros 👍

- Excellent billing integrations with API access

- One-time, recurring and usage-based billing models

- No code for setup

- Convenient range of currencies

- Excellent automatic card updates

Cons 👎

- Transaction fees can quickly add up

Further reading 📚

Authorize.Net

Authorize.net is a popular solution for ecommerce business owners looking for easy-to-use payment processing options. You can take all kinds of credit card payments and manage online transactions for both one-off and regular purchases with Authorize.net.

The automated recurring billing service ensures users can accept and submit monthly recurring or instalment payments with minimal stress. Users can pay via credit card, or direct from a bank account. You can set billing schedules that suit you, and accept multiple payment methods, including credit cards, eChecks, and more. There’s even support for trials which allow customers to try products before you start billing them.

The Authorize.net environment comes with an easy-to-use interface where you can review the status of all of your subscriptions in a matter of minutes. API access also means you can integrate the subscription option into your website and optimize payments for customers.

Pricing

If you want to run your subscription business with Authorize.net, you’ll need to spend at least $25 for access to the monthly gateway, and there are transaction fees to pay on every purchase, starting at 10 cents per transaction if you already have a merchant account.

Pros 👍

- Easy to configure environment with customizable elements

- Works with a wide range of payment methods

- Easy to streamline subscription invoices

- Keep track of all your subscriptions and renewals in one place

- Custom workflows to save you time on invoicing

Cons 👎

- Transaction fees can be quite expensive

Further reading 📚

Braintree

Another relatively well-known tool for billing and transaction management in the ecommerce world, Braintree supports companies in easily accepting all kinds of repeat online payments for subscription-based businesses. You can tailor the solution o match your company’s needs, implementing flexible or even custom pricing plans for each customer.

There’s support for pro-rated subscriptions, so customers can change their package whenever they choose. There’s even the option to securely store billing information in the “Braintree Vault” to make repeat billing as simple as possible.

With fully customizable experiences for every brand, Braintree makes it easy to ensure more conversions by enhancing the customer experience. You can even get reports on your customer subscriptions, so you can check the profitability of your business model.

Pricing

Pricing for Braintree starts at a standard transaction fee of 1.9% plus 20 cents. There’s no monthly cost for your subscription service, so you can keep the costs for your billing needs relatively low.

Pros 👍

- Excellent backend for all your billing needs

- Easy to use recurring billing software

- Store information for online payments securely

- Implement all kinds of custom solutions

- Access useful insights with reporting

Cons 👎

- May have a slight learning curve for beginners

Further reading 📚

Paddle

Specifically designed to enable flexible payments for your subscription customers, Paddle is a state-of-the-art tool for online selling. With Paddle, you can create the SaaS billing model that makes the most sense for you, and grow your revenue across the full customer lifecycle. The unified payments infrastructure even sures payments are tax compliant.

All payments managed and accepted through Paddle are protected against fraud and optimized for global payments, so you can focus on growing your company. There’s access to automatic proration, so your clients can easily upgrade or downgrade their services whenever they choose. You can even pause or reactivate customers to minimize churn.

With a host of easy management tools built in, and customization options to suit every business, Paddle is one of the best services out there for subscription based pricing. However, the highly flexible ecosystem could mean you need to take a while to learn all the features.

Pricing

Paddle is one of the more expensive options for SaaS businesses and companies looking to join the subscription economy. Although the service is ideal for minimizing your issues with taxes and other concerns, it costs around 5% and 50 cents for every transaction.

Pros 👍

- Excellent range of ecommerce features

- Fraud protection and tax compliance

- Data management with reporting

- Seller support and migration services

- Lots of customization options

Cons 👎

- Some of the most expensive transaction fees

PayPal

PayPal stands out as perhaps the best-known payment solution for virtually any business. If you want a convenient way to track payment information and invoices without the spreadsheets, PayPal has you covered. The service even has its own mobile app, and a recurring billing system.

For SaaS companies and subscription brands, PayPal offers a very easy-to-use and convenient solution for subscription payments. There are no fixed monthly fees to worry about, and you get the added benefit of a recognizable name for customers to add to your checkout.

PayPal also supports a range of international currencies, so you can deliver your services to customers all around the world, without having to worry about extra expenses. However, there are some significant issues with PayPal, such as the risk of getting your account locked if something goes wrong with your customer payments.

Pricing

There’s a standard transaction fee of $2.9% plus a fixed fee for every kind of transaction you manage through PayPal. The exact cost of your service will depend on a number of factors, including where you’re accepting the payment from.

Pros 👍

- Well-known name in payment processing

- Easy-to-use environment with minimal learning required

- Excellent range of security features

- Multiple currencies for selling worldwide

- Fantastic mobile app

Cons 👎

- Not the best customer service

- Hidden fees can quickly add up

Cheddar Getter

Otherwise known as simply “Cheddar”, Cheddar Getter is a usage-based subscription billing software intended specifically for those in the SaaS landscape. Designed with simplicity in mind to reduce the time it takes to monetize your product, Cheddar getter is all about getting your company up and running fast, with built-in tracking to help you ensure you’re sending the right bills.

Cheddar’s platform will automatically track customer activity for you, then apply your billing rules, so you can spend more time actually working on growing your brand. There’s access to various different billing models, including one-time payments, subscriptions, metered payments, and a combination of different options.

Cheddar Getter is also designed by and for software developers, so you can customize your backend ecosystem however you choose, providing you know what to do with the codebase. This does mean the service is a little more complicated if you don’t have a lot of experience with coding, however.

Pricing

All Cheddar packages come with SaaS reporting, invoice generation, robust subscription billing features, revenue optimization and usage tracking. The cheapest plan starts at $99 per month plus 30 cents per transaction, while the Growth plan is $599 per month with a 0.5% transaction fee.

Pros 👍

- Excellent range of customization options

- Multi-currency support

- Self-service environment for building your subscription model

- Integrations with leading tools

- Fantastic reporting functionality

Cons 👎

- Quite complex for subscription management software

- Can be very expensive for some packages

Paywhirl

Designed to be the most flexible subscription payment software around, Paywhirl is all about giving you more control over the experiences you give to your target audience. The solution comes with a host of tools and widgets to help you manage your recurring billing in the way that makes the most sense to you. You can even sell pre-orders and set up payment plans.

Paywhirl is a secure and user-friendly solution which allows companies to accept payments from anywhere, even if you’re talking to a customer over the phone. You can embed customer portals into your website, so customers can login and manage their subscriptions on their own. There’s also access to a range of customizable invoices.

The Paywhirl system makes it easy for small businesses and larger companies to keep track of accounts receivable and profit. You can also link your subscription management software to other tools you use every day for revenue recognition. Link your CRM or ERP for more insights into your target audience and get stronger reports.

Pricing

The packages for Paywhirl start at 3% per transaction with no monthly fee. The next package up is $49 per month with a 2% transaction fee, and then you can move to $149 per month with a 1% transaction fee. The most expensive package is $249 per month, but the transaction fee is only 0.5%.

Pros 👍

- Excellent range of integrations

- Lots of payment and subscription options

- Insights into reports for your pricing models

- Convenient customer portal with protected customer data

- Multi-currency support for different countries

Cons 👎

- Can take a while to figure out all the features

Finishing Thoughts

Finding the right software to make your subscription business a reality can be difficult. There are so many different tools out there, and each has their own benefits to offer, from integrations with Salesforce, Quickbooks and Xero, to custom reporting. You can check out our subscription billing calculator here.

When it comes to running a successful business, few things are more important than getting the billing process right. Make sure you take your time to find the service that makes the most sense for you, so you can deliver the kind of streamlined experiences your customers need.

Comments 0 Responses