Do you offer some kind of online membership? Or, do you package your products and/or services as a subscription or SaaS?

Either way, you'll need a recurring billing solution to take customer payments for you.

…And Recurly is one such option.

So, in this review, we'll explore Recurly pricing packages, it's core features, pros, cons, and, eventually, our thoughts on the automated recurring billing platform.

There's lots of ground to cover, so let's dive straight in!

Who's Recurly?

As we've just hinted at, Recurly.com is a recurring billing platform that enables you to manage ongoing subscription-based online card payments with ease.

It's its own payment gateway (for US vendors) that connects your business with your preferred payment processors. But, on top of that, Recurly also comes with its own built-in virtual terminal, which empowers you to take your subscriber's credit card info over the phone.

Founded back in 2009 and launched in 2010, the Recurly team quickly spot the popularity of online subscription products and services. They soon realized that merchants would need user-friendly recurring billing software to facilitate this style of business.

Recurly's client roster is somewhat impressive. Here you'll see flourishing subscription businesses like Sling TV, BarkBox, Asana, DISH Digital, Hubspot, LinkedIn, FabFitFun, Cinemark, and Fubo.tv. To date, Recurly has assisted thousands of companies with their subscription billing across a whopping 42 countries.

Recurly Pricing

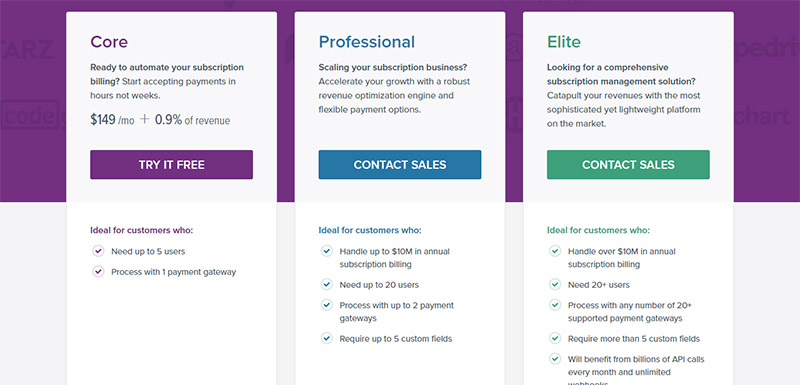

Recurly describes its paid-for packages as ‘Flexible Plans to Scale Any Business.' The platform offers three plans to choose from:

- Core

- Professional

- Elite

At this stage, it's worth noting; you can try each of these plans for free before committing your hard-earned cash.

Let's explore each of the Recurly pricing packages in greater detail…

The Core Package

The first of the Recurly pricing plans is the Core package. This is best for online merchants who are ready to get started with automation. With this plan, you can start accepting payments within hours!

The Core package will set you back $149 a month, plus 0.9% of your revenue, and this is what you'll get for your money:

- You can register five users on your Recurly account.

- You can process customer transactions with one payment gateway.

- You can create and launch hosted payment pages.

- You get access to automated customer communication and invoicing tools.

- You'll enjoy credit card payment support.

- You get access to out-of-the-box reports with key business insights.

- You can use Recurly's coupon and discounting tools.

- You get access to 24/7 online chat-based support.

The Professional Package

This plan is a step up. It's best for those scaling their subscription business and generating up to $10M in annual subscription billing. With its more flexible payment options, you'll soon be able to accelerate your revenue growth.

Recurly recommends contacting their sales team for a customized quote.

With this, you'll get everything in the Core package, plus:

- You can register up to 20 users.

- You can process customer transactions with up to two payment gateways.

- You can create five custom fields.

- You get access to Recurly JS.

- You can integrate with popular business software like QuickBooks online and

- You can create manual payments, invoices, and calendar billing.

- You'll enjoy proactive credit card updates.

- You get access to Recurly's revenue optimization engine and smart dunning management.

- You can accept alternative payment methods.

- You get access to both 24/7 phone and online chat support.

The Elite Package

Last but not least, there's the Elite plan, Recurly's most comprehensive package. It's the ideal solution for merchants generating over $10M in annual subscription billing and those that want full control and flexibility over their billing strategy.

Again, just with the Pro package, you'll need to contact Recurly's sales team to receive a quote.

You'll get everything in the previous two programs, plus the following:

- You can register more than 20 users.

- You can process customer transactions with any number of Recurly's 20+ supported payment gateways.

- You can create more than five custom fields.

- You'll benefit from billions of API calls every month and unlimited webhooks.

- You get access to an automated gateway failover and dynamic gateway routing.

- You'll benefit from revenue recognition and pricing and billing models for near-on every imaginable scenario.

- With Recurly's advanced analytics, you'll understand your business and customers in incredible detail.

- You'll benefit from multilingual customer communication features and local payment methods, and multi-currency support.

- You'll get access to tons of flexible integrations across CRM, accounting software, support, tax, fraud management, etc.

- You're assigned a dedicated customer success manager.

Recurly Pros and Cons

Let's start with the perks:

Recurly Pros 👍

- In terms of ease of use and set up, Recurly's incredibly intuitive

- You get access to an impressive suite of highly customizable and seamless integrations.

- Recurly is PCI Level 1 compliant (which is what enables Recurly to store credit cards on your behalf)

- You get access to multiple payment gateways (without being locked into any of them).

- Recurly's customer support is reportedly excellent.

- One of its unique selling points is that you'll see a reduction in credit card declines because Recurly boasts a sophisticated credit card retry logic technology. Apparently, this empowers Recurly to correct over 60 common errors in credit card transactions, consequently reducing credit card declines by 27%.

Recurly Cons 👎

Now, for the drawbacks:

- Recurly customers say they'd like to see a feature that enables them to generate a single payment invoice detailing all the client's past invoices that are overdue.

- One customer complained that Recutly's page load times were slow and that sessions time-out quickly after short periods of inactivity.

- Recurly's permissions system (regarding user registration) could be more granular.

Recurly's Compatible Processors

Recurly integrates with the majority of leading credit card processors and gateways.

For instance:

- Amazon Payments

- Authorize.Net

- Beanstream

- Braintree

- Chase Paymentech

- CyberSource

- First Data

- Merchant Solutions

- PayPal

- Stripe

- Vantiv

- WorldPay

🗒️ Please note: You’ll need to create a merchant account with your chosen provider before you can integrate it and use it alongside Recurly. You'll also need to budget for whatever payment processing rates your provider sets.

Recurly Features

We've mentioned some of these in the Recurly pricing section; however, we thought it would be useful to explore some of Recurly's features in more detail.

💡 Top Tip: Be sure to keep an eye on Recurly's website to stay updated with any new features they release.

Hosted Payment Pages

You can create, manage, and launch hosted payment pages. These are PCI-compliant checkout pages that facilitate online transactions. You can customize these pages with your logo and the payment fields you require. You'll also be pleased to hear that these pages are mobile-optimized so that shoppers using their smartphones or tablets also enjoy a seamless payment process.

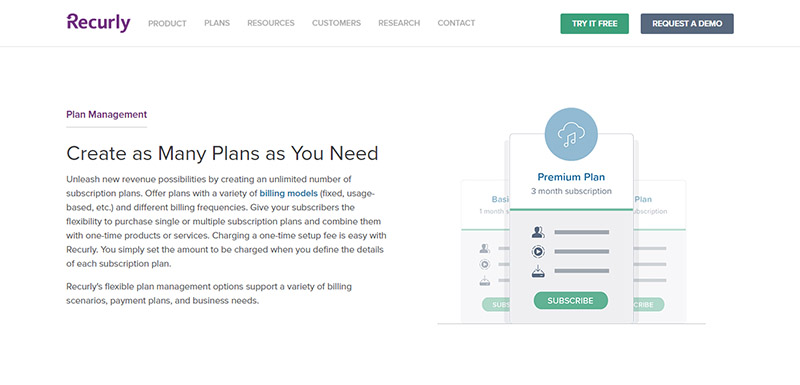

Subscription Management

With Recurly‘s subscription plan management tools, you can offer customer's a greater degree of flexibility. Namely, you can create tailored subscription plans to meet their needs. It doesn't matter whether you want to accommodate various billing cycles or pricing tiers; you can manage it with Recurly.

Also, if your customers decide to upgrade or downgrade their subscription, never fear. Recurly automatically prorates their payments so that you don't have to!

Offer Customers a Trial Period and Set One-Time Fees

If your subscriptions come with a free trial period, you can configure this with Recurly. You just tell them how long you want the trial to last, and voila, you're good to go.

On a similar note, if there's a one-time fee associated with your product or service (customer service, a setup fee, insurance, etc.), you can set that expense while customizing your subscription plan inside Recurly.

Sales Tax Collection

Recurly can calculate and collect your sales tax for you. This platform keeps up to date with all the latest tax rules and rates and uses this to guide its sales tax collection. Best of all, it even handles European VAT.

Invoicing and Metered Billing

You can even create and send traditional invoices, and keep track of whether the customer's paid partially or in full. The same goes for metered billing; Recurly also supports this kind of customer payment.

Automatic Billing Updates

It's not uncommon for people to get a new card or change their contact details without telling their subscription providers. Traditionally, this would result in delayed, if not declined, payments.

However, Recurly compares your customer's credit card details with Visa and Master Card to ensure they process customer payments using their up-to-the-minute billing information.

Data Portability

You have access to your transaction information and stored card data. So, if you choose to switch providers, you can transfer all your data to whichever platform you're planning to use.

Security

Recurly is incredibly secure. In fact, it's PCI-DSS Level 1 compliant (the highest level of PCI compliance). On top of that, it also encrypts data, follows industry guidelines on secure coding to the letter, and hosts your data in centers boasting first-rate physical and network security.

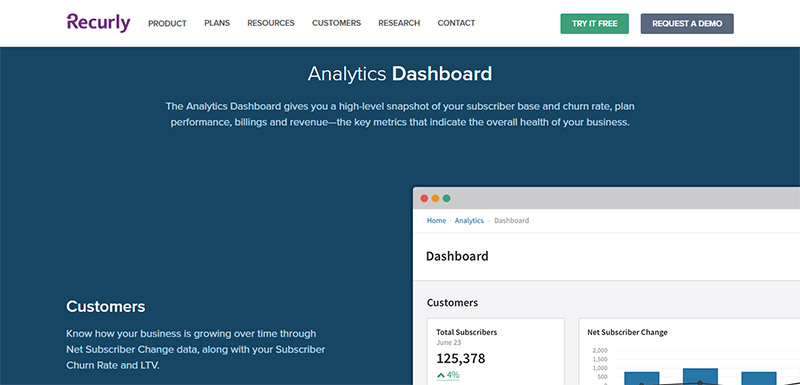

Reporting

Recurly’s reporting functionality provides an incredibly intuitive analytics dashboard. From here, you can keep an eye on your most essential metrics with just a glance—for instance, your subscription churn rate, plan performance, sales revenue, retention rate, etc.

You can also generate reports spanning different business areas and filter the results by date range, currency, etc.

Best of all, you can transform these reports into easy-to-read graphs and charts. These are fabulous visuals for displaying data and work wonders for helping you and your team make quick comparisons and spot trends.

Who's Recurly Best For?

In short, Recurly is best for United States merchants looking for enterprise-class recurring billing management. Whether you're selling a couple of subscription-based products or thousands, this platform has the infrastructure to handle your needs.

However, please note that at the time of writing, Recurly doesn't offer a Salesforce integration. So, if this is your CRM of choice, you'll either have to get some custom code to integrate the two platforms, or look elsewhere.

Are You Happy with The Recurly Pricing Plans? Are You Ready to Start Using Recurly?

We hope having read this Recurly review, you now have a better idea of whether this automated subscription billing system is the right choice for your business needs. Do the Recurly pricing packages fall in line with your budget?

Let us know in the comments box below whether you go with this provider, and if you do, how you get on with them. Or, will you go for one of their competitors like Chargebee? Either way, we'd love to hear your thoughts. Speak soon!

Comments 0 Responses