Do you run your own business? Or are you considering launching a brand? If so, you'll need to find and use a top-notch payment platform.

Cue, Dwolla.

This solution helps to simplify automated clearing house payments (ACH) and white label bank transfers for businesses. It’s especially handy for companies who want to use bank transfers as a cheaper, easier way to make payments.

Does that interest you? If so, you're in the best place possible. We're taking an in-depth look at Dwolla. So, without further ado, let's dive on in!

Who's Dwolla?

Founded back in 2008, Dwolla‘s now been up and running for over a decade. Initially made by creators who were tired of expensive credit card fees and charges, they decided to take matters into their own hands. So, they developed a solution to empower entrepreneurs to move money fast and affordably.

“Dwolla now facilitates the movement of millions of dollars every day with low transaction costs, easy automation, and near-perfect reliability. The goal is to make an incredibly complex process feel simple, easy and seamless to the people who use it—our customers and their end-user.”

Based in Des Moines, Iowa, Dwolla's creators describe themselves as “inventors, creators and believers,” whose mission it is to work towards “a more secure, more reliable digital means of moving money.

Their CEO Ben Milne confirms: “Our vision is to support the value layer of the internet. We can only achieve that vision if we are unapologetically intentional about embracing people and minds who are as diverse as the internet is.”

Dwolla boasts an intuitive and dynamic dashboard as well as flexible features for API integration. With Dwolla, businesses can move money around by paying from their Dwolla account.

It’s not a third-party processor, and it’s not a merchant account provider, like Stripe, PayPal, or Square. Instead, Dwolla's an agent of both the banks and credit unions it's partnered with.

Historically, Dwolla used to be more of a personal bank transfer platform that businesses could also use.

We're not saying Dwolla doesn’t still offer bank transfers because it certainly does. But, instead of providing a platform like other companies using ACH rather than credit or debit cards (like PayPal). Dwolla, today, is now more of a developer-friendly software. As such, it's better suited to high-tech enterprises. Specifically, those with a need to integrate white-label bank transfers with a system they already have up and running.

Let's take a closer look at how Dwolla works…

Dwolla Review: How Does Dwolla Work?

Well, as we've already said, the whole point of Dwolla is to offer users a secure method for businesses to move money. That at the same time, can be easily scaled.

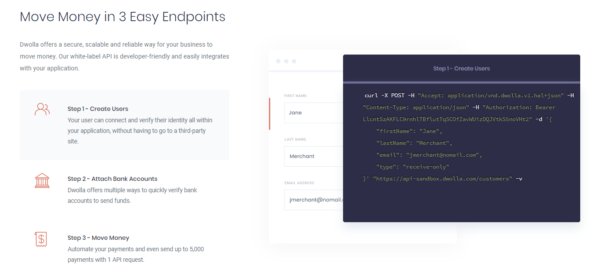

1. Create Users

First things first, you'll need to create ‘users.' Once you've done that, your users can then connect and verify their identity within Dwolla's app.

2. Link Bank Accounts

Now it's time to link Dwolla to your bank account(s). There are numerous ways to confirm a bank account and start sending funds. So, in theory, you should be up and running in no time!

3. Move Money

Now you're ready to automate your payments. You can send as many 5,000 payments with just one API request!

Easy, right?

Dwolla Review: Features

The general concept of Dwolla is easy to understand. Dwolla facilitates ACH payments. There’s no need for PalPal, cards, or crypto-currency, or (any other payment alternatives). But we thought you'd benefit from us delving into the nitty-gritty of its developer-friendly features.

👉 With Dwolla, you can:

- Send payments

- Facilitate payments

- Receive payments

- Manage funds

- Get access to instant bank verification

- Handle on-demand transfers

- Better control your cashflow

Dwolla allows you to create an app where users can send funds to each other without merchants even touching the money.

There's also an option for you to take a percentage or set a facilitator fee for the payment being transferred — which means higher profit margins! These fees exist as a separate entity. As such, they don’t affect the original payment amount.

You should be aware: Fees can only be applied to a transaction between two parties. They can be debited from either the person receiving the payment or the person sending it. However, it can’t exceed more than half of the original transfer amount.

In terms of other features, as we've already said, you can create both recurring and on-demand payments.

What's a recurring payment?

In short, it's just like it sounds. Dwolla's recurring payment feature is very similar to a subscription management tool. This allows customers to pay the same amount to you each month automatically.

What's an on-demand payment?

With an on-demand payment, you work with metered billing. So, you can charge a variable amount each month, depending on the nature of the usage-based product you're selling. A great example of companies who charge variable monthly payments are those in the utilities industry.

Typically, ACH transaction solutions don’t have built-in processes to check whether customers have sufficient funds to make a payment. As such, you might suffer from transactions involving NSF (Not Sufficient Funds). So, not only do you not get your cash but you may also incur costly fees!

This is where Dwolla comes into its own.

Dwolla has a nifty feature called ‘bank account balance checks.' This allows you to ask permission to check your customer's account balance before debiting funds.

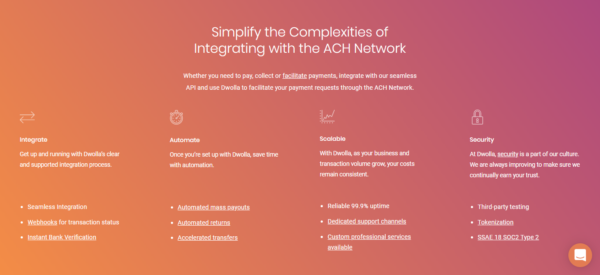

Integration

There are clear developer guidelines over on Dwolla‘s website. These take you through the integration process for the necessary webhooks to monitor the status of a transaction or bank account verification.

Once you’ve gone through Dwolla's integration process, you can then set things up, so that everything's automated. By ‘everything' we mean mass payments, automatic returns, and accelerated transfers.

Yes, it really is that simple.

Dwolla’s ACH payment API integrates with whichever native platform or app you're using to facilitate mass payouts and bank transfers.

For instance, a ‘mass payment' might be when you have to pay batch payments, multiple bills or transactions, and you group them into one payment. The Dwolla dashboard permits a business to monitor these transactions in real-time.

Other ‘mass payment' features include branded transfers, on-demand support from both Dwolla's developers and account managers, a dashboard that charts payments, and the ability to set a limit for each transaction your business makes.

Best of all, Dwolla seamlessly integrates with other services you're already using (or planning to use) alongside your banking system.

Unfortunately, we can’t see a ready-made list of integrations on their website, so you might have to make these integrations yourself. But, what we can see is that Dwolla offers two pre-made plug-ins: Sift and Plaid (more on these later).

You'll be pleased to hear, Dwolla doesn’t have any kind of exclusivity clause in its contract. As such, you can offer customers a vast array of payment methods that work alongside Dwolla. This comes in handy for taking credit and debit cards in addition to ACH payments.

Dwolla's Dashboard

Dwolla‘s dashboard allows you to monitor your payment activity in real-time, so you can better control the flow of your payments.

This is also where you're able to send funds and initiate transfers through the ACH network.

If you have a team, never fear, because you can give multiple users access to your Dashboard. You can even assign permissions specific to the role of each team member or department.

If you struggle getting to grips with new software, you can rest easy. Dwolla's dashboard boasts a simple and easy-to-navigate interface. So, you should grasp how to use this program in next to no time.

We also love that Dwolla's dashboard automatically generates charts and graphs to give you an in-depth insight into any notable trends and metrics.

You should note: If you want to see your user payment info, you can also do this via the dashboard. If you're going to make modifications to these details, it’s a simple process. For instance, you can activate or deactivate users on the go. You can also add multiple bank accounts and view all the transactions you've sent and received. This makes it easy for you to accept payments and confirm the status of your purchases at any given time.

Dwolla Review: Customer Support

Dwolla‘s customer support comes in the form of a dedicated integration and account manager. These amazing people are also known as “developer advocates.”

As you may have already guessed, these support agents will be your dedicated points of contact. So, reach out to them with any questions or if you run into problems. Who knows? Maybe you'll just want to tell them all about the success you're having using their platform.

You can reach out directly to your ‘advocate' via Slack, where users report receiving near-on immediate responses. Apparently, the team at Dwolla will move heaven and earth to ensure you get a helpful and actionable answer.

There’s also a customer service team available. If for whatever reason you can't get a hold of your designated points of contact, they'll handle any problems you have. But if they're techy related issues, they probably won't be able to help!

You can contact customer support either via email or through Dwolla's online chatbox.

That's in addition to having access to a vibrant community forum. It doesn't matter which payment plan you opt for; all Dwolla customers get access to the community forum. Just post your questions here and wait for a helpful answer to come your way.

It's also worth mentioning, if you’re on a cheaper plan, the customer support provided is much more limited — namely, email communication and the community forum. Basically, if you pay more, you get access to an integration engineer and a customer account manager.

The downside is that we can’t see what hours any of this is available. But as the company is still pretty small, we're guessing it’s just standard business hours.

As we've already alluded to, there are also developer guides on Dwolla's website. So, if you have a bit of coding knowledge, you might be able to resolve any issues you have yourself. From what I can tell, the literature on Dwolla's website is relatively thorough. Plus, you can use numerous programming languages to code Dwolla's platform.

Security

Dwolla is passionate about online safety. Period.

They're compliant with the SOC 2 framework that offers independent third-party assurance that sensitive data is protected.

Dwolla approaches security through Dwolla.js, a client-side JavaScript that transmits bank account numbers and routing numbers without this info ever being relayed to your server.

Consequently, you, as the user, aren't lumbered with building these kinds of security features yourself.

Dwolla also uses tokenization. This is where data is encrypted and replaced with different numbers to add extra security before it’s sent across. Such “tokens” can’t be used again, so even if they were to be intercepted, they’d be useless to the hacker.

Dwolla also collaborates with Plaid to allow businesses to verify their bank account ownership quickly and safely.

Users go through the ‘Plaid Link' to authenticate their accounts by inputting their banking credentials. A customer can then verify their info through Plaid and choose which account they want to use to start making bank transfers. In the “back office,” you get a unique token from Plaid that's used to create a funding source via Dwolla's API. Plaid has a mobile-friendly option too.

The long and short of Plaid is that it’s a secure way for Dwolla customers to authenticate that they own the account they’re using. When coupled with access tokens that remove sensitive data appearing, you can be sure the info of your customers is kept safe and secure.

Dwolla also integrates with Sift to prevent fraud. Sift is a software platform that monitors fraud, looks at past transactions, and evaluates the likelihood of the activity being suspicious or fraudulent. Sift also allows you to make decisions in real-time as you look out for potential fraud and fraud risks. You sign up for a Sift account, get an API key, go to your Dwolla Dashboard integrations page, and toggle Sift on. Then enter your API key and hey presto you're good to go!

More about account verification

Unlike other credit card processors, with Dwolla, the end-user HAS to verify their bank account. There are two ways of doing this. Firstly, you can do it via their instant account verification and micro-deposits option.

Instant account verification means logging into your Dwolla account via a secure window. Micro-deposits send a small amount of cash to your bank to verify the info. The thing about micro-deposits, however, is that they take longer to set up and clear.

Dwolla has separated its user accounts into Receive-only, Verified, and Unverified. So, a Receive-only user can basically do just that — receive payouts. Namely, because they’ve only provided a small amount of information about themselves, so they're not deemed as secure.

Whereas, if you're an Unverified customer, you can still receive and send funds, but you can’t hold them in an account. There’s also a $5,000 per week transaction limit. This sort of customer only has to give their name and email address to verify themselves.

What about fully Verified accounts?

These can be either business or personal accounts. If it’s a personal account, then you'll have a $5,000 per send limit, whereas a business account is limited to $10,000 per transaction. It’s true, to have a Verified account you have to provide more information. But, this gives you the option of holding a balance, sending and receiving money, and access to other functionalities not offered to those with just an Unverified or Receive-only account.

More About Dwolla's Security

Dwolla’s InfoSec team understands that ‘security is never done.' Which is why both Dwolla's Engineering and InfoSec teams are continually training and educating themselves in numerous areas of online security (including cryptography and OWASP Top Ten).

Dwolla takes things one step further by ensuring they're ‘Community Conscious.' By this, they mean that they make it their business to share their approach to web security both locally and nationally. This helps to ensure Dwolla remains an authority figure within the online security community.

We also love that Dwolla subjects itself to third-party testing. They don't just want security solutions to work ‘in theory.' Instead, they want to be confident their security controls work in real life.

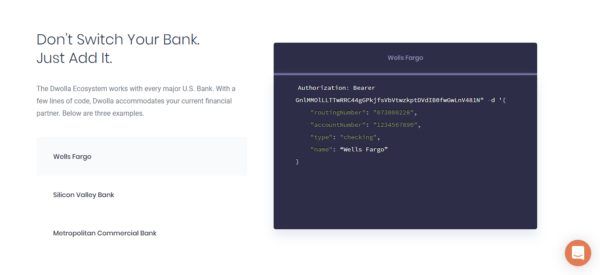

Dwolla's Ecosystem

👉 Dwolla works with every major US bank, including:

- JP MorganChase

- Bank of America

- Citibank

- Wells Fargo

- Silicon Valley Bank

- Capital One

So, there's a good chance you, your customers, and vendors are already banking with a service Dwolla's compatible with.

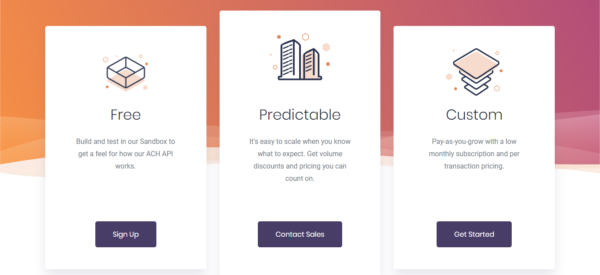

Dwolla Review: Pricing

1. The Free plan

2. The Predictable package

This does exactly what it says on the tin. With this option, you'll know precisely what you'll pay Dwolla month and month, which makes it easier for you to scale and budget your expenses.

You'll even be able to enjoy volume discounts the more you sell! However, from their website, you can't see how much this package will set you back, so you'll need to contact them directly to get a quote.

3. The Custom plan

This is a ‘pay-as-you-grow' style plan. You'll be charged a low monthly subscription in addition to per-transaction pricing. As this is a customized plan, you'll need to contact Dwolla directly to get a personalized quote.

👉 You should note, all plans come with:

- Enhanced security: More specifically, SOC 2 compliance.

- 99.9% uptime

- Bank account verification: You can use Dwolla.js or Plaid to verify your users' bank accounts

- Dwolla's dashboard: This is where you can manage customer payments, view transactions, and spot business trends.

How Long Before I Can Get Up and Running?

Dwolla says they’ve had customers go live in as little as a week. However, a typical timeline for integration, review, and approval is anything between 45-60 days.

Want to know a bit more? You can always wade through the Dwolla Terms of Service.

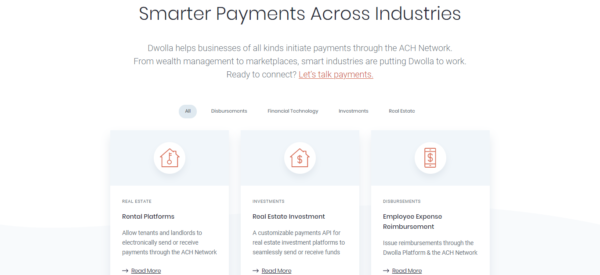

Who Uses Dwolla?

👉 Clients use Dwolla across a wide array of industries. It doesn't matter whether you're running an online marketplace or a wealth management company, Dwolla can help you manage your ACH payments. To give you a feel for the niches Dwolla's used in, we've compiled a quick list:

- Financial tech

- Investments (more specifically, there's a customizable payments API for real estate investment platforms)

- Real estate (rental platforms where tenants and landlords can either send or receive electronic payments through ACH).

- Employee expense reimbursement

- Affiliate marketing programs

- Micro-Investments

- Wealth management platforms

- Marketplace payouts (this allows you to make cost-effective, secure, and automated payouts to your vendors).

- Personal finance and savings applications (you can use Dwolla to simplify fund contribution between your bank accounts).

Just to name a few!

On the whole, Dwolla's best for businesses working in the B2B industries. In addition to the above, Dwolla’s existing clients have also used their platform to fuel gig economy apps.

Contract Lengths and Cancellation

If you're on any other the plan other than Dwolla's ‘Free Plan' you'll be locked into either a 12 or a 24-month contract. Yes, for the majority of business owners, a month-to-month arrangement would be preferable. But, given the time and expense, they spend on their customer service, it's somewhat reasonable for them to want you to stick around for a while.

Sales and Advertising Transparency

Dwolla looks as though it communicates with its consumers reasonably well. There aren't many online reports or comments about hidden fees.

However, we can't not mention the fact that Dwolla has previously got into trouble with the Consumer Financial Protection Bureau. This was back in early March of 2016. The issue? They misrepresented their practices surrounding data security.

Consequently, Dwolla received a fine of $100,000 in addition to having its reputation somewhat knocked.

Negative User Reviews

There isn’t a ton of negative reviews online — which is a plus!

But, from what I can see, the most common user complaint pertains to account termination. This seemed to have been rife while Dwolla was making the transition to becoming a more developer-friendly platform.

Some also claim that the monthly payment plans work out to be more expensive than Dwolla's competitors. As such, if you're on a budget, Dwolla might not be the most sensible option for you.

Last but not least, I can also see from user reviews that Dwolla's help center isn't the best knowledge base out there. It's best described as a ‘work in progress,' so be sure to watch this space! In the interim, you're better off posting in the forum or contacting their customer support team directly.

Positive User Reviews

If you want to see what some of Dwolla's happy customers have to say, head over to their website. Over there you'll see plenty of glowing testimonials.

A Brief Overview of Dwolla's Pros and Cons

👍 Pros

- You can handle white-label payments

- There are plenty of developer tools available

- They offer top-notch customer support

- It's an incredibly convenient service. You don't need us to tell you that bank numbers change less frequently than credit or debit card numbers. Consequently, businesses don’t have to handle as many failed transactions due to invalid card numbers.

- You can send, receive, and hold your business funds in a ‘virtual' wallet. So, this goes further than just accepting customers payments.

- You can offer merchants next-day and sometimes same-day payments. That's super speedy processing!

👎 Cons

- Potentially expensive in comparison to Dwolla's competitors

- Dwolla's features, in contrast to other similar solutions, are somewhat limited.

5 Dwolla Alternatives

Throughout this review, we've referred to Dwolla's competitors, so we thought it would be useful to list a few of the more prevalent alternatives below.

Dwolla Alternative #1: Payline Data

👉 Payline Data offers users a ‘Virtual Terminal' where they can access all manner of features, including:

- The option to key in credit cards

- Store customer data for future use

- In-depth monthly reports

- Invoicing

- A hosted payments page

- You can offer customers billing plans and scheduled payments

- Shopping cart integrations

- A Quickbooks integration

- You can work with ACH Payments

- A mobile app to use Payline on the run

- You can sleep easy knowing your customer data is securely stored

- Emails receipts

- Void and/or refund capabilities

- You can register an infinite number of users

Just to name a few!

This is how much Payline will set you back:

For the purposes of this review, we're only going to touch on their fees for ‘credit cards not present,' i.e., online payments. For more info on all their paid-for plans, head over to Payline's website.

For online transactions, you'll be charged 0.3% and $0.20 per purchase (this needs to equate to a minimum of $20 per month). As you've probably already guessed, you only pay for what you need.

What're Paylines most notable benefits?

As you can see, Payline's pricing is pretty fair and easy-to-understand. Not to mention, users also report not being stung by hidden fees.

It's also come to our attention that Payline offers excellent customer service (both telephone and email support). Their hotline is open between 8:00 AM until 5:00 PM (CST), Monday until Friday. Apparently, the quality of Payline's telephone support is second to none; as such, it's become one of Payline's USP's.

We also love that Payline integrates with Apple Pay several other mobile wallet services.

Users can access month-to-month contracts and don't have to shell out for early termination fees. Put simply, if you decide Payline isn't for you anymore, you can choose to close your account at any time. You don't have to provide a long list of justifications or jump through a ton of hoops to kickstart the closing down process. Just tell them you want to leave — simple right?

You should note, if you're on a Payline plan where you've been given free equipment, you'll have return these devices back to Payline. Needless to say, this seems like a fair deal!

Also, if you’re a business considered to be a ‘high-risk' category, there's a higher chance you won't be on Payline's standard contract. As such, you might not be offered terms as flexible as their traditional monthly contracts. So, before you sign the dotted line, be sure to read your agreement thoroughly.

Who's Payline best for?

Payline is a fabulous card processor for almost any traditional retail business. Their pricing plans are competitive for both small businesses and larger enterprises.

However, if you're running an e-commerce site, you may want to consider other solutions like Stripe. Namely because for online sellers, companies like Stripe offer more straightforward pricing models.

Also, at the time of writing, Payline is only available to entrepreneurs in the U.S, so if you're operating in Europe or elsewhere, Payline isn't the solution for you.

Payline Alternative #2: PayPal

PayPal is probably the most well-known brand on this list. It's famous for providing users with a fast and safe way to send money, make online payments, receive money, and/or create a merchant account.

As such, it's a fabulous solution for both business and personal use. You can use PayPal to do business with companies of all sizes, across over 200 countries across the globe.

👉 PayPal boasts all the following features:

- Secure payment processing

- Access to purchase and/or seller protection

- You can use your favorite banks, credit and debit cards, and still, earn the card and cashback rewards associated with them.

- Benefit from flexible payment options like PayPal Credit.

- PayPal Express Checkout: This is a straightforward add-on business can use to accept regular credit card payments.

- PayPal Payments Standard: If you're running a company that doesn't accept credit card payments, you can use PayPal Payments Standard instead.

- PayPal Payments Pro: This allows you to host a checkout on your own website.

- PayPal Here: This is a handy mobile app for managing customer payments while you're on the go.

- Virtual Terminal: You can access a virtual terminal for $30 per month. This allows you to collect mail and phone orders.

- Digital Goods: This permits you to set up recurring payments.

- Bill Me Later: As you may have guessed, this feature allows you to offer no-interest financing to your shoppers.

- Online invoicing: If you're a freelancer or a contractor, you can send out quick and professional-looking invoices for your services.

This is how much PayPal will cost:

You'll be pleased to hear; you aren't charged any fees for paying money. However, there are fees for receiving payment.

PayPal has tons of costs associated with it. For a full list, head over to their website. But, for your ease, we've noted some of the more important ones below:

- Web transactions: 2.9% and $0.30 per transaction

- Virtual terminal transactions: 3.1% and $0.30 per purchase

- Chargebacks: You have to pay a $20 fee

- PayPal Pro: This is $30 a month and entitles you to additional services and features. The most attractive hallmark is that it allows customers to stay on your website while they pay for your goods and services.

Dwolla Alternative #3: Stripe

Stripe makes it incredibly easy for web developers to accept online card payments. They offer plenty of unified APIs and features so businesses can automatically receive and manage online transactions. With so many tools at your disposal, you should be able to customize its platform to fit the exact needs of your business.

The benefits of Stripe certainly outweigh its drawbacks. We love that Stripe's subscription features are both seamless and robust. It also supports marketplace and international selling, which works wonders for delving into omnichannel marketing across the globe.

As we've said time and again, it's vital entrepreneurs know their numbers. So you'll be pleased to hear that Stripe's reports are both easy to understand and comprehensive. Best of all, Stripe's pricing structure is incredibly transparent, which comes in handy for budgeting expenses. Unfortunately, the same can't be said for a lot of its competitors.

However, like any other payment platform, Stripe isn't without its drawbacks. Namely, if you're operating a business within a higher-risk industry or you're located in what's deemed a ‘higher-risk' country, Stripe isn't the solution for you. Unfortunately, Stripe doesn't support brands that fall under these two categories.

You also can't access Stripe's customer support agents over the phone. However, their online support (especially, their live chat option) provides incredibly quick, friendly, and helpful responses to questions.

For a little while, Stripe permitted merchants to process and accept Bitcoin payments. However, as of April 23, 2018, Stripe dropped this feature. So, if accepting BitCoin is imperative to your business model, look elsewhere.

Most concerningly, Stripe prioritizes its own infrastructure over pretty much everything. So, if you accidentally violate their terms of service you could end up having your account's suspended with little (if any!) warning.

👉 How much will Stripe cost?

Stripe offers a flat rate, per transaction, which is 2.9% and $0.30.

However, Stripe doesn't refund these transaction fees. By this we mean, if you refund a customer, you'll have lost that transaction charge to Stripe. So, unfortunately, you'll have to swallow these costs!

What's the difference between standard Stripe and Stripe Elements?

If you've done some research on Stripe, you'll know that in addition to Stripe's regular platform, they also offer another solution called Stripe Elements. This integrates with Stripe's regular payment processor.

The critical difference between the two is that standard Stripe's core functionality is to collect customer payments when they make a transaction via your online store. Whereas, the Stripe Elements tool provides you with several pre-built modules to help you create a customized checkout area.

This is an easy way to modify your checkout solution to reflect the aesthetic of your brand. You'll also be pleased to hear, ‘Elements' work with way less code than usual and it's PCI-compliant — what's not to love about that?

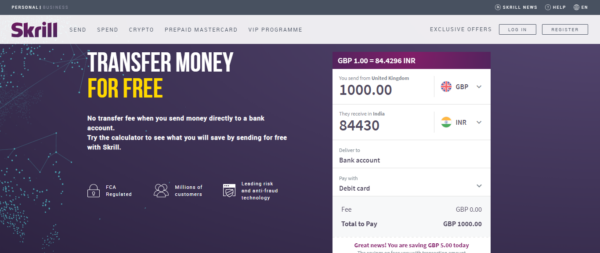

Dwolla Alternative #4: Skrill

Skrill takes on the risk of supporting merchants that aren't traditionally endorsed by PayPal and other more popular processors. As such, it's had to take on extraordinary high-security measures to counteract this risk.

Skrill's most commonly used by those who need somewhere to store and transfer their online gambling winnings.

Skrill also provides users with a money wallet and ecommerce merchant services (also known as payment processing). Plus, if you reside in a country that's part of the EEA, you can use a debit card to store and access your funds.

But, as we've said, its main benefit is that Skrill makes it incredibly easy to send, accept, and store payments across a vast array of countries.

In our opinion, Skills' account setup is one of the simplest we've seen. You just need an email address to start accepting payments. Then once you're up and running, you can use your Skrill account virtually anywhere across the globe.

However, you should be aware that Skrill uses incredibly strict fraud prevention techniques. In light of this, you may experience seemingly random blocks on your account. Plus, some of Skrill's users also report that their customer service could be improved. So, if that's imperative to you, be sure to factor that into your decision.

👉 How much will Skrill set me back?

The short answer is not much. If you're in the U.S and you're uploading funds using local payment methods like:

- Bank Account via ACH Bank

- Account via ACH

- Wire Transfer Bank Account via Wire Transfer

You won't be charged any transaction fees.

You also won't be charged any fees when uploading money via global payment methods like MasterCard and Visa. The same is true when you withdraw funds. You'll also be pleased to hear; it's also free to send and receive money!

But, when it comes to Skrill's currency conversions, Skrill adds a 3.99% exchange rate fee.

Is opening a Skrill account free?

Well, yes and no is the answer to that.

Skrill's free to use as long as you log in (or make a transaction) once a year (minimum). Fail to do this, and you'll have to pay $3.00 a month, which to be fair is still pretty reasonable.

Skrill also doesn't charge for fraud protection, account maintenance, or account configuration.

Dwolla Alternative #5: Braintree

Braintree is more than just a payments platform. It has some pretty impressive backing supporting it. For those of you who don't know, PayPal purchased Braintree Payments in 2013 for a whopping $800 billion! Founded in 2007, this solution soon became a popular choice among tech startups. Some of their more notable clients include Airbnb, Fab, LivingSocial, Uber, Twilio, and GitHub. But, although PayPal owns Braintree, it still runs as though its a reasonably independent company.

Interestingly, as much as $12 billion was made in payments using Braintree back in 2013, of which $4 billion's worth of transactions came from mobile devices. Clearly, this is a testament to how well Braintree supports mobile payments.

Braintree's costs are somewhat similar to Stripe (2.9% and $0.30 per transaction), not to mention; they're also incredibly transparent. You won't experience any nasty shocks in the form of set up and monthly maintenance fees. But you will have to pay $15 for each chargeback you make.

Braintree provides users with somewhere to store all your credit cards, which works quite similarly to GooglePay. You can collect recurring bills from customers, which makes managing subscriptions a breeze. You'll also be happy to hear Braintree accepts all sorts of payment methods, including PayPal, credit and debit cards, and Venmo. Unlike some of the other solutions listed in this article, their customer support is known for being robust and helpful.

Braintree also offers users a unique marketplace payments system — which is just another selling point!

👉 For your convenience, we've listed some of Braintree's other key features:

- You can create a merchant account to access Braintree's payment gateway

- Basic and advanced fraud tools

- Data encryption via the Braintree Vault Phone

- Customer support via e-mail

- Assistance with data migration

- Reporting tools

- Recurring billing tools

- A selection of third-party integrations

However, before diving straight in, be aware that to implement Braintree's payment gateway onto your website, you may need a degree of web development know-how.

Ready to Use Dwolla?

Dwolla is undoubtedly worth more than just a passing glance because it's certainly different from other types of ACH payment platforms.

It’s also worth checking out their case studies, which includes testimonials from the likes of Aeropay, Routable, and bento.

It does, however, have competitors, for example, Braintree, Stripe, and PayPal. So they’re not the only show in town. However, it's safe to say they’re certainly going places.

Have you ever used Dwollefore? If so we'd love to hear all about how you got on with them in the comments box below? Let's kickstart some lively discussion. Speak soon!

Comments 0 Responses