If you come from a place like Pakistan, Peru or Belarus you know that running a business is a little limited when it comes to how you accept credit cards and payments through PayPal and other processors. This is troubling considering it limits options for your business, whether it be a service or product-based business. This means you must resort to an old-fashioned money transfer, which is tedious, time-consuming and expensive.

You may be surprised to know that hundreds of countries still remain unsupported by PayPal. Here's a look at the list of countries where PayPal is not supported, or where it's only somewhat supported:

| Africa | Americas | Asia Pacific | Europe |

|---|---|---|---|

| Angola | Anguilla | Afghanistan | Andorra |

| Benin | Argentina | Armenia | Azerbaijan |

| Burkina Faso | Aruba | Bangladesh | Belarus |

| Burundi | Bermuda | Bhutan | Faroe Islands |

| Cameroon | Bolivia | Brunei | Macedonia |

| Cape Verde | British Virgin Islands | Cambodia | Monaco |

| Chad | Cayman Islands | Cook Islands | Montenegro |

| Comoros | Costa Rica | Kiribati | Russia |

| Congo | Dominican Republic | Kuwait | Svalbard and Jan Mayen |

| Cote d'Ivoire | Ecuador | Kyrgyzstan | Ukraine |

| Djibouti | El Salvador | Laos | Vatican City |

| Egypt | Falkland Islands | Lebanon | |

| Eritrea | Greenland | Macau | |

| Ethiopia | Guatemala | Maldives | |

| Gabon | Guyana | Marshall Islands | |

| Gambia | Jamaica | Micronesia | |

| Guinea | Montserrat | Mongolia | |

| Guinea-Bissau | Netherlands Antilles | Nauru | |

| Kenya | Nicaragua | Nepal | |

| Liberia | Panama | Niue | |

| Madagascar | Paraguay | Norfolk Island | |

| Malawi | Peru | Pakistan | |

| Mali | Saint Pierre and Miquelon | Papua New Guinea | |

| Mauritania | Saint Vincent and the Grenadines | Pitcairn Islands | |

| Mayotte | Suriname | Qatar | |

| Namibia | Venezuela | Samoa | |

| Niger | Solomon Islands | ||

| Nigeria | Sri Lanka | ||

| Rwanda | Tajikistan | ||

| Saint Helena | Tonga | ||

| Sao Tome and Principe | Turkmenistan | ||

| Sierra Leone | Tuvalu | ||

| Somalia | Vanuatu | ||

| Swaziland | Wallis and Futuna | ||

| Tanzania | Yemen | ||

| Togo | |||

| Tunisia | |||

| Uganda | |||

| Zambia | |||

| Zimbabwe |

This seems unacceptable to me, and the idea presents severe cost problems for small businesses. The unfortunate part is that great people and ideas come from the countries on this list, so there should be no reason why they should be hindered in their ability to do their business.

To find a solution for this issue we worked through the kinks and figured out the most efficient way to accept credit cards online from any country by using some key ecommerce solutions.

Accept Credit Cards: what are we trying to achieve here?

Let's say you're working in Panama as a freelancer or contractor. You're trying to bill your client for the work you completed, but PayPal doesn't give you the opportunity to do so. Therefore, you need to figure out a way to present an invoice and a way for the client to pay you.

You need two things in order to make this happen:

- A billing interface

- A payment provider

The billing interface comes in the form of an invoice, where you set up an online document of all the services you performed, along with the pricing that correlates with those services. A Pay button needs to be listed on that invoice so that the client can submit the money.

The payment provider then takes that money and puts it in the account of your choice.

What Specific Tools Will You Need?

- A 2Checkout Account to use as a payment processor. This will not only process your payments, but it will also collect them.

- An InvoiceNinja account for managing your billing and sending out invoices to your clients.

- A Payoneer account for receiving the money.

Each of the services listed above integrates in some way. Therefore, we'll cover how to do that in the tutorial below.

The Scoop on 2Checkout

| Afghan Afghani (AFN) Albanian Lek (ALL) Algerian Dinar (DZD) Argentine Peso (ARS) Australian Dollar (AUD) Azerbaijani Manat (AZN) Bahamian Dollar (BSD) Bangladeshi Taka (BDT) Barbadian Dollar (BBD) Belize Dollar (BZD) Bermudan Dollar (BMD) Bolivian Boliviano (BOB) Botswana Pula (BWP) Brazilian Real (BRL) British Pound (GBP) Brunei Dollar (BND) Bulgarian Lev (BGN) Canadian Dollar (CAD) Chilean Peso (CLP) Chinese Yuan (CNY) Colombian Peso (COP) Costa Rican Colon (CRC) Croatian Kuna (HRK) Czeh Koruna (CZK) Danish Krone (DKK) Dominican Peso (DOP) East Caribbean Dollar (XCD) Egyptian Pound (EGP) Euro (EUR) Fijian Dollar (FJD) |

Guatemalan Quetzal (GTQ) Hong Kong Dollar (HKD) Honduran Lempira (HNL) Hungarian Forint (HUF) Indian Rupee (INR) Indonesian Rupiah (IDR) Israeli New Shekel (ILS) Jamaican Dollar (JMD) Japanese Yen (JPY) Kazakhstani Tenge (KZT) Kenyan Shilling (KES) Lao Kip, Democratic Rep (LAK) Kyat, Myanmar (MMK) Lebanese Pound (LBP) Liberian Dollar (LRD) Macanese Pataca (MOP) Malaysian Ringgit (MYR) Maldivian Rufiyaa (MVR) Mauritanian Ouguiya (MRO) Mauritian Rupee (MUR) Mexican Peso (MXN) Moroccan Dirham (MAD) Nepalese Rupee (NPR) New Taiwan Dollar (TWD) New Zealand Dollar (NZD) Nicaraguan Cordoba Oro (NIO) Norwegian Krone (NOK) Pakistani Rupee (PKR) Papua New Guinean Kina (PGK) |

Peruvian Nuevo Sol (PEN) Philippine Peso (PHP) Polish Zloty (PLN) Qatari Riyal (QAR) Romanian Leu (RON) Russian Ruble (RUB) Samoan Tala (WST) Saudi Riyal (SAR) Seychellois Rupee (SCR) Singaporean Dollar (SGD) Solomon Islands Dollar (SBD) South African Rand (ZAR) South Korean Won (KRW) Sri Lankan Rupee (LKR) Swedish Krona (SEK) Swiss Franc (CHF) Syrian Pound (SYP) Thai Baht (THB) Tongan Pa’anga (TOP) Trinidad and Tobago Dollar (TTD) Turkish Lira (TRY) Ukrainian Hryvnia (UAH) United Arab Emirates Dirham (AED) United States Dollar (USD) Vanuatu Vatu (VUV) Vietnamese Dong (VND) West African CFA Franc (XOF) Yemeni Ria (YER) |

Step 1: Make a 2Checkout Account

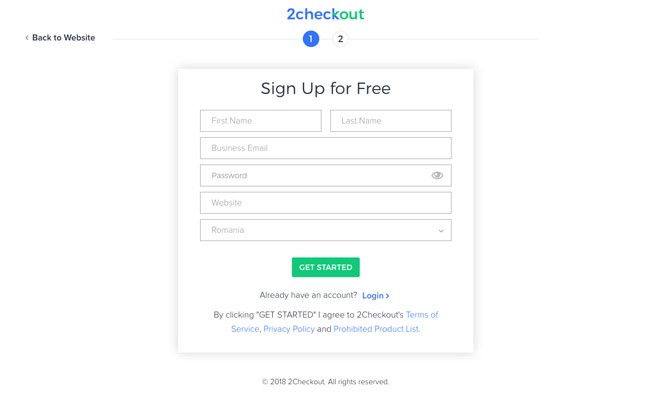

The first step in this whole process to accept credit cards is to go to the 2Checkout website. Click on the Get Started button to start walking through the steps required to launch your account.

The next screen reveals three steps that you must complete in order to finish the process.

The first one asks for you to enter a username, email, website, password, and country. Agreeing to the terms of use and privacy policy is also part of the setup. Click on the Create Account button once that's all done.

Bare in mind your password needs to be at least 10 characters and contains a special character.

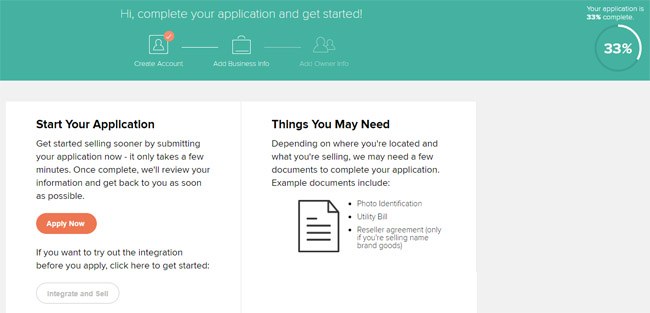

The next part asks that you complete an application for approval.

This really isn't that difficult of an application, but you'll need to fill out the country you're working in, along with some other personal details. For example, they'll ask for information about the business, industry, address, legal registration, company owners and some information in regards to your businesses refund and privacy policies.

What's handy about 2checkout is that it highlights how far along you are in the process of your application in the top right-hand corner.

Ensure you have at least one of the following things on hand before completing your application:

- Photo ID

- Utility Bill

- Reseller agreement

You will only need a reseller agreement if you are selling on branded products.

After you fill out the application you can hit the Apply button.

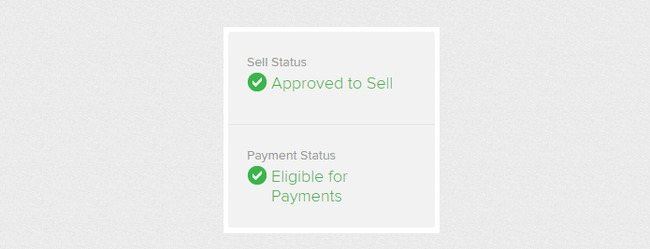

It generally takes around 24 hours to hear back from 2checkout. They should send you an email regarding the status of your application, and you can also go to your dashboard to see if you're approved to sell and collect payments. If you are successful then you will see this information below on your dashboard.

Step 2: Make a Free InvoiceNinja Account

A few paid plans are offered through InvoiceNinja, but all you need right now is the free version. Go to the InvoiceNinja website and click on the Test Drive button.

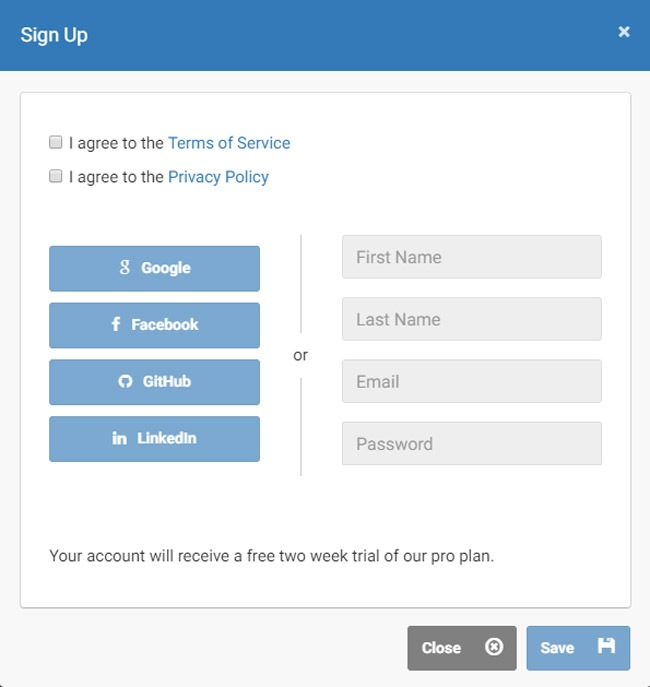

Sign up using a social account or by entering your personal details and desired password. Hit the Save button when you're done. Firstly ensure that you have agreed to both the terms of service and privacy policy.

They will tell you that you're signed up for a Pro account for about two weeks, but then this account expires. This is because they want to show you the cool features you'll be missing out on with a free account. Don't worry about this, because your payment information is not required. Simply click out of the window to view your invoice creation page.

Step 3: Connect InvoiceNinja with 2Checkout

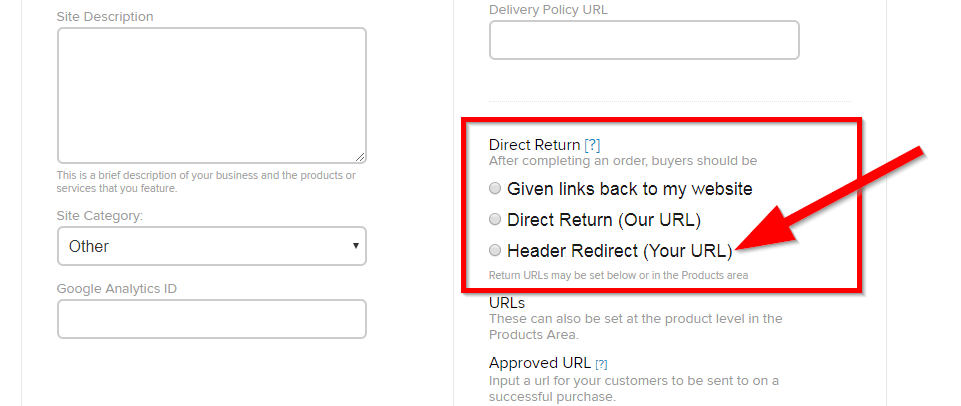

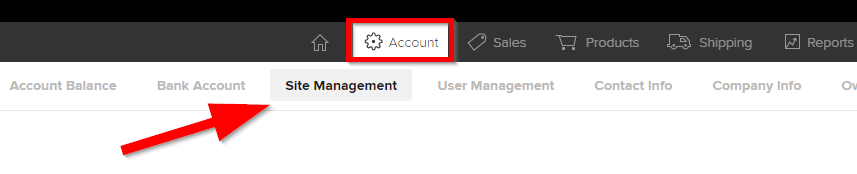

What to do in your 2Checkout account:

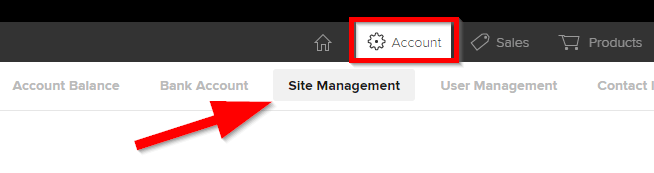

- Login to your 2Checkout account

- Go to the Account tab, and select the Site Management sub-category

- Find Direct Return, then select the Header Redirect (Your URL)

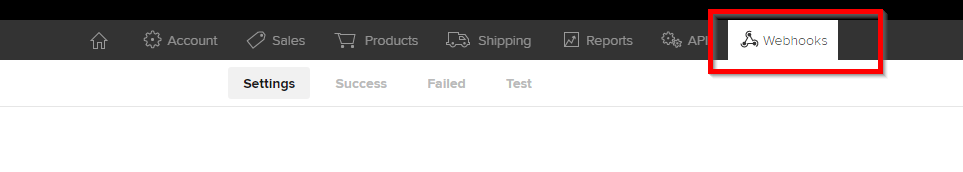

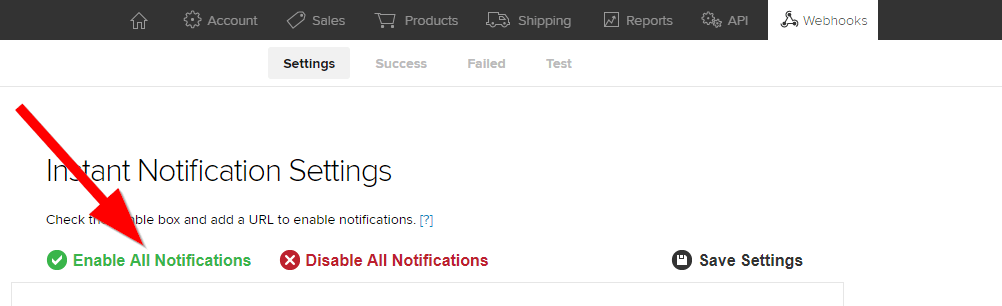

- Click on the Webhooks button towards the upper right-hand corner of the page

- Select the Enable All Notifications option

- Save these settings

Most of the API information is not needed in your 2Checkout account, so you will be good simply setting up the following InvoiceNinja information.

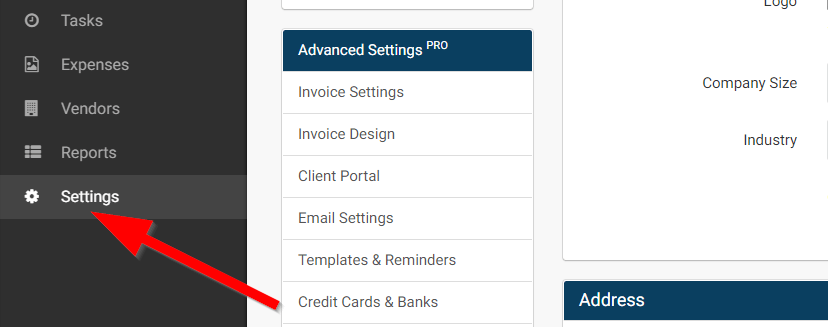

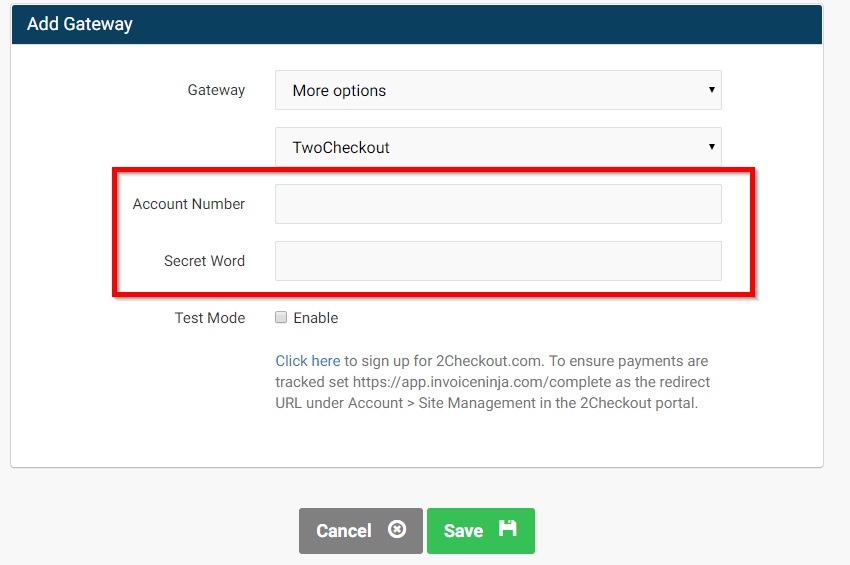

What to do in your InvoiceNinja account:

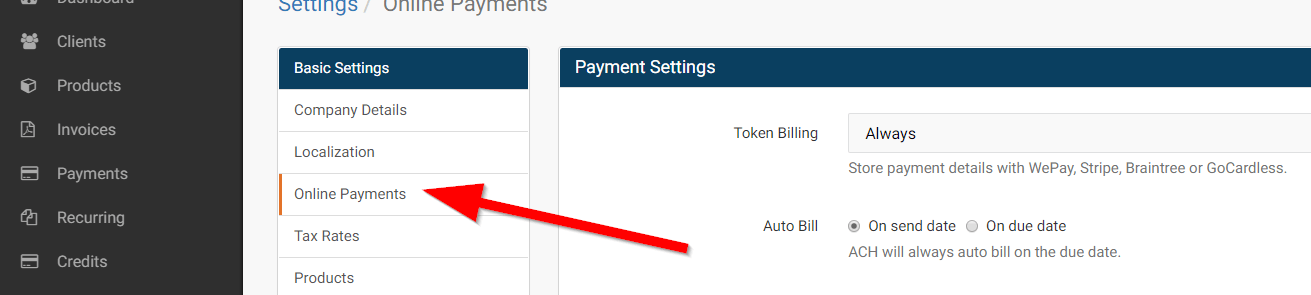

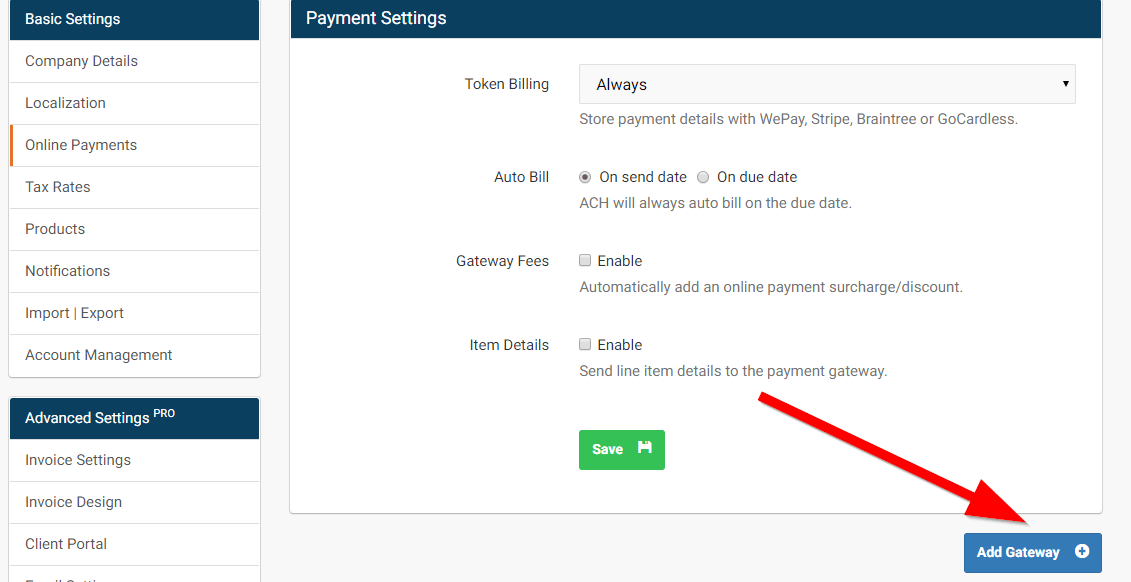

- Go to Settings

- Select Online Payments

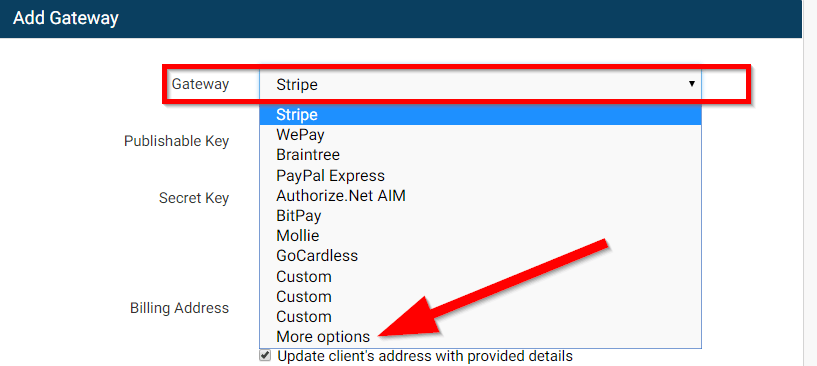

- Choose Add Gateway

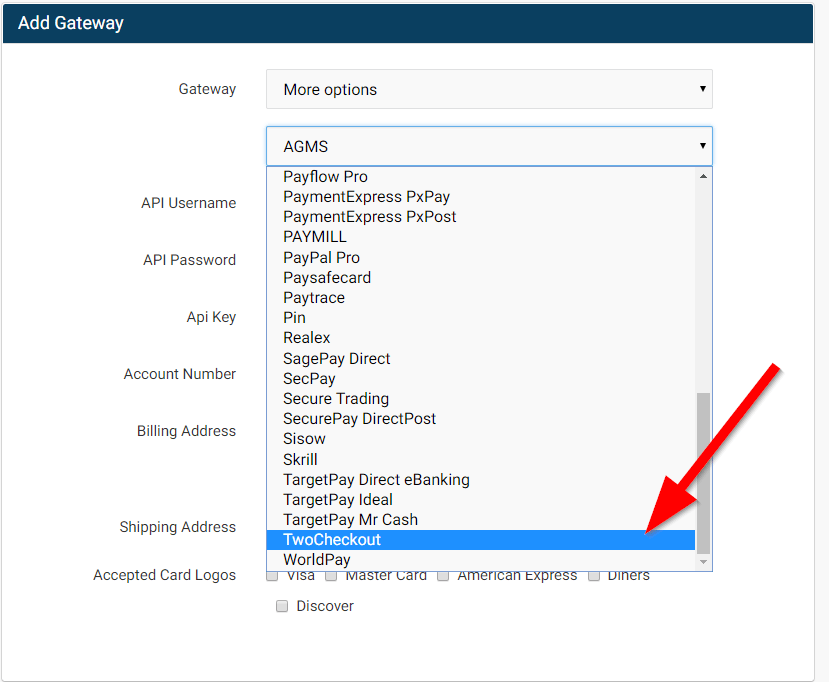

- Select More options from the Gateway options

- Select TwoCheckout as the Gateway (They spell out the “2”)

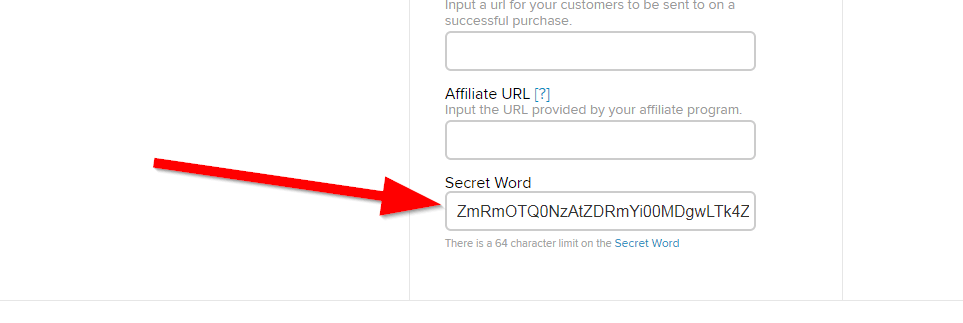

- Find the Secret Word from your 2Checkout account. In your 2Checkout account head to Account > Site Management

- Under Checkout Options look for Secret Word

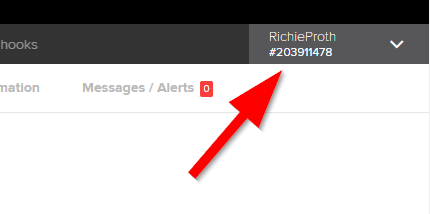

- Find the Account Number as well which can be found in the top right-hand corner

- Head back to InvoiceNinja and paste them in the boxes below

- Hit the Save button

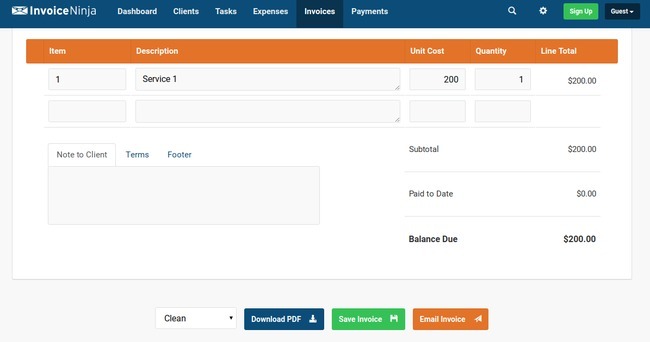

Step 4: Make Sure the Integration Worked

Before you can accept credit cards you need to see if the integration between InvoiceNinja and 2Checkout worked.

Go to your InvoiceNinja dashboard and start making your own invoice to test out. Fill in a fake service description, and feel free to type in things like the following:

- Unit cost

- Quantity

- Subject line

- Client

- Due date

- Invoice number

- The invoice template you want to use

Keep in mind that none of the information you fill in really matters. It's just a test.

You may need to create a new client in order to send out the invoice. In this case, make sure the client email is your own. This way you can see if the invoice goes through by checking your own email inbox. After this is all done find the Email Invoice button (above) and click it. This sends the invoice to your inbox.

After that, we recommend checking to see if the whole payment integration worked out okay. You can open the invoice in your email and click through on the Payment button.

It's recommended you actually make a small payment to yourself to see how this works. For example, you can send yourself $5 to ensure that the whole integration is running right.

After completing the test payment to yourself, go to the backend of 2Checkout. The dashboard has an area for looking at your recent sales. If that sale comes up as completed, you know that the integration between InvoiceNinja and 2Checkout is complete.

We recommend that you submit a refund so that you get your money back. Technically the money should be going into your own account, but there's no reason to have to wait around a few days to get your own money back. You're better off issuing a refund.

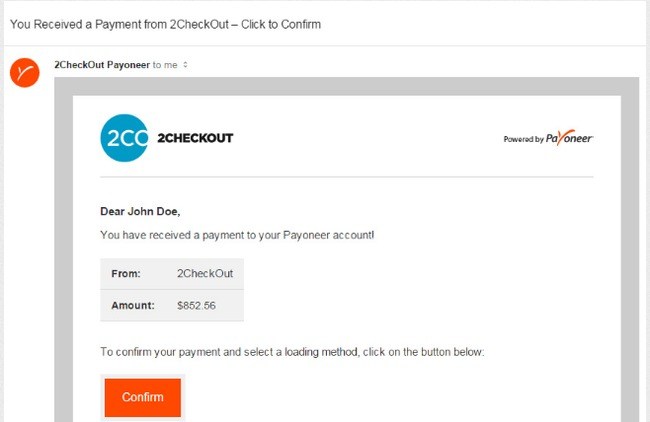

We'll talk about integrating with Payoneer below, but if you plan on using Payoneer for receiving money, you'll get an email that looks like this:

All you have to do is click through on the email in order to see the new payment.

The best part about the integration we're going to talk about below is that 2Checkout automatically sends the money from your 2Checkout account to your Payoneer account. It happens every week so you'll constantly have funds in your account.

So, technically you don't have to do anything to get the money in your account. However, the email below is an indicator that it occurred, and a way to click through and view the information.

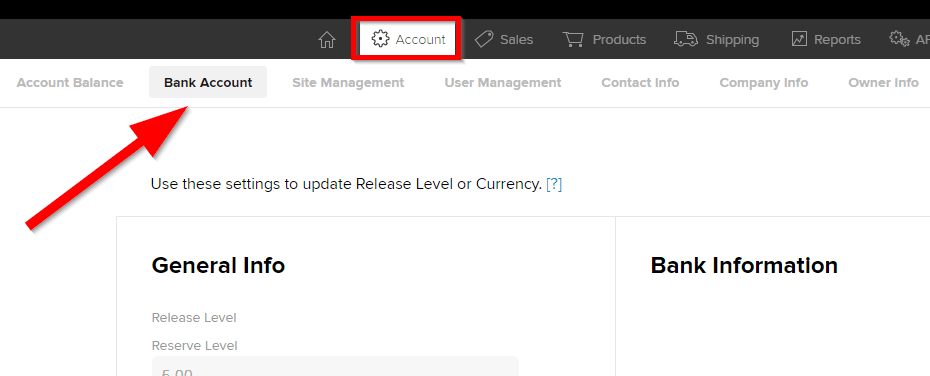

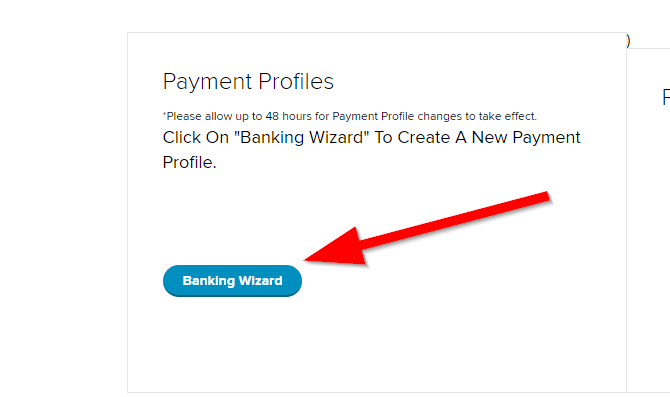

Step 5: Connect 2Checkout to Payoneer

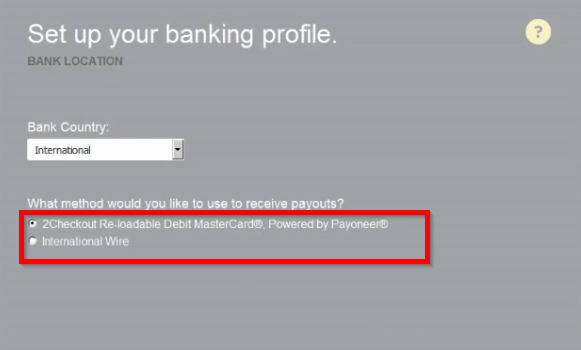

Although this is a pretty simple process, we wanted to give you a step by step look at what you'll need to do to connect 2Checkout with Payoneer. Remember that this step is optional.

- Login to your 2Checkout account

- Click on Account > Bank Account

- Find the Payment Profiles tab and click on Banking Wizard

- Select 2Checkout Re-loadable Debit Mastercard. Powered by Payoneer

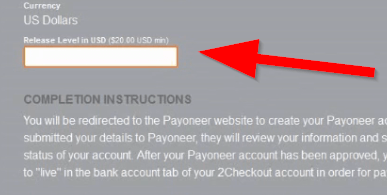

- Select your minimum Release Level in USD

- You are then prompted to log in to your Payoneer account, and choose the account that you'd like to link to

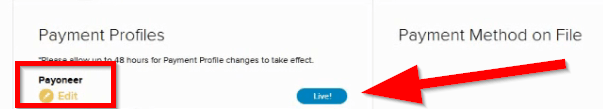

- When you have done this you will see this on your Payment Profiles

Congratulations! You have now linked your Payoneer account to your 2Checkout account. Please be aware that it can take up to 48 hours for this to take effect.

What Fees Can You Expect from Each of These Services?

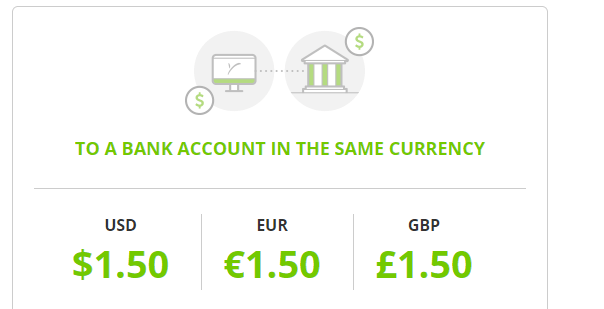

2checkout Pricing

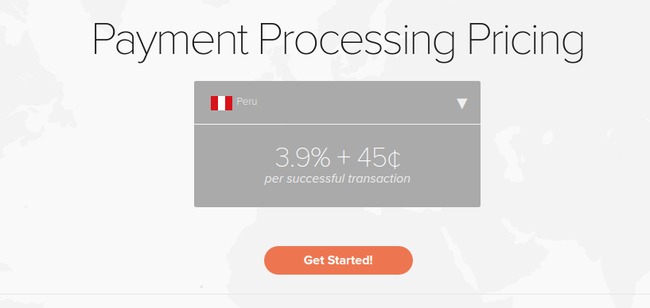

It completely depends on the country you're doing business in when figuring out how much your rates are going to be with the 2Checkout payment processor. Luckily they have a rates page that allows you to flip through a wide range of countries to see the rates they offer.

For example, if you're running a business in Peru you'll see that the rates are currently at 3.9% + 45 cents per successful transaction. Processing more than $50k per month requires you to contact 2Checkout and figure out a more custom plan.

It's also worth noting that you should look out for the 1% cross-border fee if you're trying to accept payments from customers outside of the US. There are no monthly fees or setups fees, but chargebacks cost you $20, and conversions to your home currency incur an average fee of 2-5% above the daily bank exchange rate.

With 2checkout setup you can let your customers pay how they want, which allows you to accept credit cards, debit cards and PayPal without have any nasty additional fees on top.

InvoiceNinja Pricing

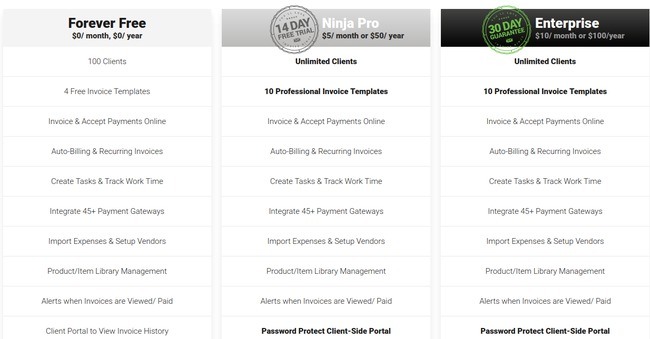

The main reason we chose InvoiceNinja to use as your invoicing platform is because it integrates with 2Checkout. However, a close second is the fact that InvoiceNinja has a free account. You can work with up to 100 clients, and you get a bunch of other cool features like invoicing, accepting payments online, four free invoice templates, over 40 payment gateways and work time tracking.

Ninja Pro upgrades you to more advanced features, but you'll have to pay $8 per month. They also have an Enterprise version for $12 per month. Your best bet is to start out with the free version then move up from there.

With the Enterprise package, you have the option to pay annually and they will give you 2 months for free. Enterprise gives you the options to add custom backgrounds to invoices so is suited to companies who are very focused on their branding.

Payoneer Pricing

Creating an account and accepting payments through Payoneer is free!

Research has shown as well that Payoneer can save you up to 71% of the fees that you would pay through other payment options.

When you want to withdraw to your bank account in the same currency there is a fee and if it's in a different currency then there's a fee of 2%.

Over to You…

Now that you've had a chance to see how to accept credit cards online from any country, feel free to play around with the tools to see what else you can do with them. NinjaInvoice has some interesting options for things like importing expenses, setting up recurring billing and setting up alerts when you get paid.

Overall, the whole point is to replicate what you might find with the PayPal invoicing system. However, now just about every company in every country can get the same tools.

If you have any questions about how to accept credit cards from any country, drop a line in the comments section below.

header image courtesy of Matthew Lew

Bonjour !

Je n’arrive pas à faire la vérification d’identité de mon compte 2checkout, je suis en République démocratique du Congo, chez nous la déclaration légale des entreprises e-commerce ( dropshipping) n’existe pas.

Que faire ?

Aidez moi s’il vous plaît, ça me freine beaucoup pour le lancement de mon business

Merci

Unfortunately Sam, e are not able to help. Plase contact their customer support team!

bonjour ces articles sont disponibles pour plateforme Godaddy ?

Hello, yes they do!

Bahamas is not supported. We used to be and our country is still on their support list. I don’t whats changed to make it unavailable here.

Thank you very much for your really helpful information on this very sensitive and vital subject ! You did great work !

You’re welcome Zeo!

Hello,

In lack of a merchant’s id, looking for alternatives to get started, payoneer seems like a good choice for my transactions.. Would invoiceninja do the trick or would I still have to declare taxes and or vat through it?

Hello

Nice post! Thanks !

I’m in Congo. My country is listes.

Wonder if I could go through this method to sell my music on web site (on creation).

And what about tips? Somebody wanna gift you some money, does 2checkout go with that ?

Thank you !

Hello Richard! your article was really helpful! but I have some doubts. I’m re-designing my web in WordPress and my plan is to use 2chekout as a payment option.

1. Should I buy a security certificate before starting? I mean, is a requirement?

2. should I have everything set up before sending the request to 2chekout? (I read in other sites that this process can be a little bit difficult sometimes

3. the payment process is on the same page? or they have to go into a separate page (similar to the process with PayPal)

4. is the customer paypal via Paypal, then I can transfer those founds into my payoneer account via 2chekout or that money goes to a Paypal account?

Thanks in advance!

Hello Silvina,

Here are some quick answers to your questions:

1. Yes, this is strongly advised

2. Yes

3. It depends on the platform you’re using

4. Yes, but with a fee.

Bonjour. Une petite simulation s’il vous plaît. Moi je suis au Cameroun et nous utilisons le FCFA. SI un client fait un achat de 100 $

Pour savoir, Que fait 2chekout ?

– elle prélève 3,5% + 0,45 $ soit 3,95$

– il reste 96,05$

– Ensuite elle prélève 1% soit 0,96$ pour les frais transfrontaliers et il reste un peu plus de 95$

Ensuite je veux transférer dans mon compte personnel et il m’applique par exemple 5% ?

C’est bien cela le calcul ?

Yes, that should be correct.

Hi

I live in Uganda and sad to say it doesn’t support many of the online payment gateways any advice for someone who wants to startup an ecommerce store.

Thanks

Does this method work for online stores?

Hey Alex,

Yes, of course.

Hello,

Thanks a lot for the great article. I still have one BIG (newbie) question however: How do I connect all this to my WordPress site?

With Stripe for example, I can download the plugin directly from the plugins research page and activate it. How does it with 2checkout & co please?

Thanks in advance

Hey Manal, you will need the help of a web developer for that.

Hi I tried 2Checkout and they no longer accepts services to Jamaica. I am out of options, I have done so much research and I cannot find one platform that offers these service for ecommerce business. Do you know of any other platform

Hello Diondra,

PayPal might be an alternative in Jamaica. Check out our full PayPal review for more info.

Bonjour et merci pour cet article.

Ces systèmes de paiement sont-ils compatibles avec WooCommerce ?

Merci de votre réponse.

Bien cordialement. Pierre

Oui, ils sont.

Bonjour,

2checkout n’est pas disponible en Tunisie, avez-vous d’autres options svp?

Bonjour,

Je suis au mali et 2checkout et paypal ne sont pas acceptés dans mon pays.

Que me proposez vous ? J’ai entendu parlé de Bluesnap, ça peut m’aider ?

Cordialement

Hello, have you considered using PayPal?

This is quite a great article but my country Cameroon still is not supported…so sad…non of my online businesses will go anywhere

I’m from Suriname and I can’t work with 2checkout or Payoneer due to the fact that my business/ line of work isn’t supported. Any alternatives?

Hello Morino,

Maybe you should find a local payment gateway. If your business model isn’t supported by 2Checkout and Payoneer, I think none of the other major payment gateways will support it.

–

Bogdan – Editor at ecommerce-platforms.com

Hi,

My country(Qatar) isn’t supported by 2checkout. Any suggestions? Appreciate your help

Hello Basem,

As far as I know PayPal is available in Qatar. Here is our full PayPal review.

–

Bogdan – Editor at ecommerce-platforms.com

Hi,

Thank you for all these informations 🙂

Please tell me, Can my customers pay in my website with 2checkout without living the website to 2checkout ?

Thank you.

Hello Saney,

Yes, that’s possible, but it really depends on the platform you use.

–

Bogdan – Editor at ecommerce-platforms.com

You’ll need to go with the 2checkout pro version

A really informative post for the non-USA people who don’t have paypal, thank you.

On shopify store what is your suggestion to accept both credit card and paypal?

Thanks

Abu

Hello Abu,

We’re really glad you found this useful!

Please check out this post for more info.

Great article. I work with agencies that directly pay to Payoneer. I want to expand my services to individuals that may not use Payoneer as payment methods. The only problem is that Payoneer is becoming something else. They suck!

Anything better than Payoneer?

Thanks for the info.

Hello Fadi,

What exactly do you mean by that? Maybe applying for a PayPal prepaid card would be another option?

Hi

Quick question. Do I really need to prepare an invoice with Ninja Invoice since I can do same with 2checkout?

I have a business registered in the British Virgin Islands (No corporate tax!) and I was wondering if you could tell me, if I use 2checkout and payoneer integrated, would I be liable for tax in the US or is it dependent on where the business is registered?

Thank you!

Salut Bogdan!

Sunt din Republica Moldova.

La moment creez un magazin online (dropship website).

Pentru a primi bani pe credit/debit card care ar fi cea mai avantajoasă opțiune?

Thank you!

Hello Johnny,

For Moldova you could try 2Checkout, you can check pricing here. For more info you can read our full review.

Best,

–

Bogdan – Editor at ecommerce-platforms.com

hello. im currently living in Bolivia? what should i use as a payment gateway..

Hi,

Great article i must say. I’m looking to start a shopify store and would like to sell to mostly the US market in USD. I have a US Bank account but I’m based in Nigeria most of the time. Is this possible?

Hello Dele,

Your business should be based in the US, I don’t think it matters where you actually live. See this link for more info.

HI

we are based in Kenya

we are looking to take payments in KSH for our online store is this possible?

Hi David,

It seems like 2Checkout is supported in Kenya: https://www.2checkout.com/global-payments/

Check out our full 2Checkout review below for more info:

https://ecommerce-platforms.com/ecommerce-reviews/2checkout-review-payment-gateway

Best,

–

Bogdan – Editor at ecommerce-platforms.com

What about oman…paypal etc not much in action, matercard/visa,fine…

Hi Prajeesh,

As far as we know PayPal is available in Oman but you can only link your Credit/Debit cards or a US bank account for withdrawal.

Best of luck,

Thank you!!!!!!!!!!!! I’m planning on launching an admin service website in a few weeks and I was desperately hunting for an alternative to PayPal, the prospect of waiting up to two months to receive a check and waiting another six weeks for it to clear was really daunting. Now I don’t have to. Appreciate it.

Hi Catalin,

I live in Jamaica and I was really excited when I read your article and saw that my country was on the list. Unfortunately, a few days ago I tried setting up an account and I was told that they no longer supported Jamaica. I’ve almost finished building my site and I’m really disappointed.

I can use Paypal but I would have to request a check to get my funds and that’s going to take a few months plus it’s probably going to take another two months to clear in my bank account.

At this point I’m pretty much desparate, do you have any suggestions?

Hi Mark,

It seems that PayPal + check is your only option at the moment.

Bogdan – Editor at ecommerce-platforms.com

Hi,

I read on a blog online, where a Jamaican with a PayPal account acquired a Payoneer card, but had to call PayPal customer service to be able to transfer money from their PayPal account to their Payoneer card. I haven’t done this myself (as yet), but I found that information helpful (the thought that using them both is possible).

I do wish to check it out, because I could use that kind of possibility.

Hello Gregory,

Here’s a quote from a Payoneer employee:

“Payoneer offers the possibility to collect funds from Paypal by adding the collection bank account details provided on the account. The details can be added to the banking section of your Paypal account. But first, you will have to connect a Credit/debit card with available funds on it because Paypal needs first to verify a payment method. Once the card is linked to the website, you may proceed with adding the Global Payment Service details in order to withdraw your funds.

The Global Payment Service Details can be found by going to the “receive” menu and selecting the “Global Payment Service” tab. In case you cannot see this option on your account, please contact the support center to get further assistance.”

Hope this helps.

–

Bogdan – Editor at ecommerce-platforms.com

Interesting blog am hoping it may help me to setting up a payment platforms.

By the way, great post. Very valuable and very much appreciated.

Hi Caitlin,

I’ve been following your site now (and receiving your emails), hoping to hear of an ecommerce platform that integrates ie. gets clients to pay locally.

I reside in Nigeria, and thus looking for a ‘no-hassle’ means to get customers to pay for products or services, ensuring payment is received, sometimes within minutes!

Keep up the nice job. Hopefully, you’d let us know of something soon.

Regards,

Hi Tony,

In your case 2Checkout might e a good option.

Best of luck!

Hi,

I live in Nigeria, but we are not among the countries listed that is covered by 2Checkout. So what do I do or what can I do?

Thanks

Hi Charles,

Nigeria is amongst the supported markets listed on the 2Checkout website.

Cheers!