In this Tide vs Revolut Business review, we’re zoning in on two of the most popular business banking services on the market.

However, if you don't have time to trawl through my entire Tide vs Revolut Business review, here are some of the headlines:

- Both platforms are FCA registered, so your money is protected up to £85,000.

- Both offer free accounts. Although they have limited features, they’re great starting points for small startups and solopreneurs.

- In both cases, you must keep an eye on extra charges, such as ATM withdrawals, money transfers, and transaction fees; otherwise, your costs might mount up.

- Both are easy to set up and use.

- In the case of Revolut, if you run an international business, it’s ideal. Tide, however, probably isn’t for you since it doesn’t support multi-currency accounts.

- In contrast, Tide is best for UK-based businesses looking to trade domestically

With all that said, let's dive into the meat and potatoes of this Tide vs Revolut Business review:

What is Tide?

Founded in 2015, over 5000,000 companies now use Tide. Although based in the UK, Tide also has offices in Bulgaria, India, and Germany. It’s regulated by the Financial Conduct Authority (FCA), and the Tide app is available for download on Google Play and the Apple App Store.

Please note: In the literal sense, Tide isn’t a bank. Instead, it’s a business financial platform.

To use Tide, You must have a UK residential address or be a director of a business registered with the UK’s Companies House.

Each account holder receives a:

- UK sort-code and account number

- A business Mastercard

- Invoice creation and payment features

- Up to £150,000 credit

- Automatic transaction categorization to simplify your accounting.

What is Revolut Business?

Revolut was founded in 2015 by Nik Storonsky and Vlad Yatsenko. Then Revolut Business followed in 2017 after a further round of funding to offer one centralized place for managing all your company's finances.

According to its website, over 10,000 businesses sign up to Revolut Business a month, equalling 130,000 cards issued monthly.

Revolut is registered with the Financial Conduct Authority. Companies can pay and be paid in 25+ currencies across 100+ countries.

When you open a Revolut Business account, you receive the following:

- Currency accounts in GBP, EUR, and USD

- Account number

- Sort code

- Access to Revolut features (more on this below)

- Revolut virtual card

- Revolut plastic company card

Tide vs Revolut Business: Features and Services

The features you receive depend on which account you go for. I cover prices lower down in this review. But, in the meantime, let’s explore Tide and Revolut Business's key features:

Tide

- In-app invoices: Generate, send, and track invoices within the Tide app. You can also match payments to invoices, so you know exactly who’s paid you.

- Expense cards: You and your team can purchase directly from your account. You can set individual spending ceilings and monitor itemized spending by person and category.

- In-built accounting software: This automates tasks such as real-time tax bill estimates. You can also complete and submit VAT returns and check transactions. Until May 2023, this was a free feature, but Tide now charges a monthly fee of £6.99 + VAT.

- Cashflow forecasts: A 30-day forecast with actionable tips for a strong credit rating. You can also track your credit score with Experian and view incoming and outgoing payment statuses.

- Business loans: Tide looks at your business account usage to assess your borrowing options from one of its partner lenders. It runs pre-eligibility checks that don’t impact your credit rating to provide a quick decision. However, partner lenders may take longer to check your eligibility.

- Accounting integrations: Tide integrates with Xero, Sage, QuickBooks, and ClearBooks. You can automatically push payments to your software every 24 hours.

- Direct debits with GoCardless: You can collect payments by direct debit, which is ideal if you run a business that relies on regularly scheduled payments, such as a gym or a subscription service.

- Open banking: Connect your Tide account with apps that help you do business.

Revolut Business

Revolut has five categories of features, each of which contains several sub-features@

Essentials

This includes:

- Cards: Choose from metal, plastic, and virtual cards (Depending on your pricing plan).

- Multi-currency account: Send, exchange, and receive money in 25+ currencies

- Teams: Oversee your team’s spending in real-time and set spending limits and user permissions

- Transfers: Approve and track all money transfers in real time.

Tools

This includes

- Analytics: Plan, manage and track your spending by tracking spending by time period, account, and team member.

- Invoices: Create, send, and monitor invoices

- Team expenses: You can authorize team members to use expense cards while setting spending limits and monitoring expenses in real-time

- On-demand pay: For a small fee, employees can withdraw a portion of their accrued earnings and track what they’ve earned per shift/week/.

- Payroll: Customize employee pay by automating tax calculations and tailoring pay schedules to suit employee needs.

Accept Payments

This includes:

- Accept payments: Accept and track online and in-person payment processing with next-day settlement. You can accept payments in 25+ currencies with no currency conversions (unless you ask Revolut to do that).

- Payment gateway: Customize your website’s checkout process with Revolut’s widgets and integrations, including Xero, Shopify, OpenCart, WooCommerce, and BigCommerce.

- Payment links: Create payment links you can share with customers by email, SMS, or invoice.

- QR code: Create a QR code to accept in-person contactless payments via your smartphone.

- Revolut Pay: Set up a single-click checkout button on your website with Revolut Pay for faster payment.

- Revolt Reader: The Revolut card reader is compatible with Apple Pay, Google Pay, and credit and debit cards. It’s ideal for fast in-person payments.

Connect

There are several categories within this feature, including:

- APIs: For paid plan subscribers, you can build custom integrations to suit your business needs.

- API payouts: Automatically disburse payments in real-time, for example, to pay insurance claims, loans, and contractor payments.

- Integrations: A range of integrations, including Xero, Sage, Zoho Books, Slack, WooCommerce, and Shopify, are available.

Treasury

This feature has several subcategories, including:

- Currency exchange: Exchange 25+ currencies 24/7 via Revolut’s app or website. Exchange is at the real rate with no hidden fees.

- Forward currency contracts: Set your currency exchange rate yearly to protect your business against volatility – available in GBP, EUR, and USD. You can also set up foreign contracts to the maximum value of £500,000 and manage them online 24/7.

- Crypto: If you have surplus cash, you can buy Bitcoin and Ether instantly with no hidden fees. You need a Revolut Bitcoin account to do this. But please note this is unregulated and unprotected.

Tide Pricing

Tide offers four accounts:

Free

For this, you get:

- A Tide Business Mastercard

- An expenses card for your team (for £5/month per card)

- Transfer money in and out for £0.20 per transaction.

- ATM withdrawals for a £1 per withdrawal free

- Read access for team members.

- Schedule payments

- Up to five business accounts

- Accounting integrations

- Create and send invoices.

- Free card payments

- Free replacement cards

- Free transfer between Tide accounts

- Cash deposits at the Post Office for a 0.5% fee of the total amount over £500 or £2.50 per deposit for deposits under £500. You can also deposit cash via PayPoint for a 3% fee of the total deposit.

Plus £9.99/mo + VAT

You get all the above and:

- One free expense card

- Up to 20 free money in and out transfers a month

- Priority in-app customer support

- Phone support

- Access to a 24/7 legal helpline

- Exclusive member perks include discounted RAC membership, discounted storage space with Big Yellow, and a one-year free business membership with Zipcar.

- Support with trademark filings and disputes on a case-by-case basis

Pro £18.99/mo + VAT

You get everything above, plus two expense cards and unlimited in and out money transfers (for free).

Cashback £49.99 + VAT

You get everything above and three expense cards, 150 money transfers a month for free, access to a dedicated team of account managers, and 0.5% cashback with your Tide card.

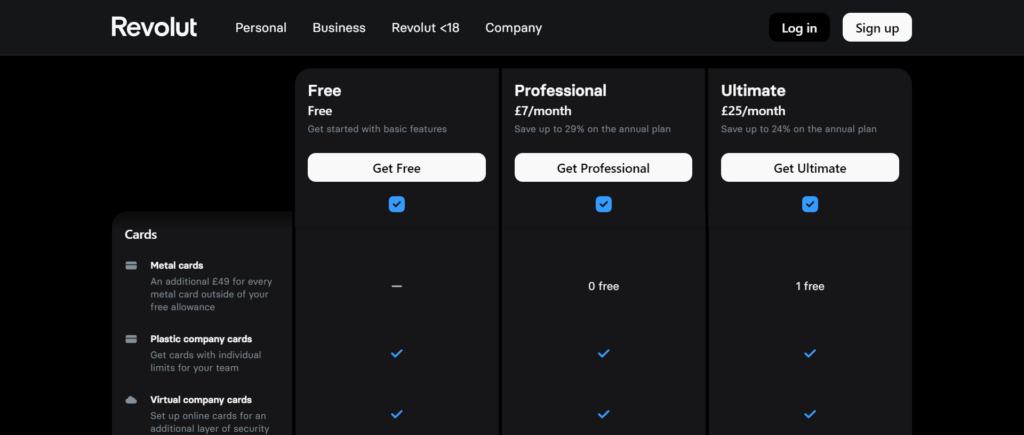

Revolut Business Pricing

Revolut Business offers two categories of accounts:

- Business

- Freelance

For Business, there are four accounts:

Free

For this, you get:

- Plastic company cards – up to three per person (fees may apply, but these aren’t listed)

- Virtual company cards – up to 200 per person

- Five free local payments/mo (£0.20 per transaction after that)

- 1.99% crypto exchange fee

- Spend in 150+ currencies.

- Hold and exchange 25+ currencies.

- Free transfers to other Revolut accounts

- IBANs for global transfers

- Manage recurring transfers

- Local accounts in GBP and EUR

- Accept payments online for a 1% + £0.20 fee.

- International and commercial cards for a 2.8% + £0.20 fee

- Revolut Pay for a 1% + £0.20 fee

- Bank transfers for £1 or less

- Create and track invoices.

- Accept payments on your website.

- Accept in-person payments with a 0.8% and £0.02 fee for UK consumer cards and 2.6% and £0.02 for international and commercial cards.

- Register unlimited team members.

- Team member permissions (set whether team members can view-only, perform financial operations, restrict spending, or grant full access to all features).

- Manage team member expenses for £5/mo per team member.

- Access 24/7 support

- Manage payroll for £3/mo per team member on the payroll.

- App integrations, including those mentioned in the Revolut Business, features section. Other examples include Magento2 and PrestaShop.

- Web and mobile access to your Revolut Business account

- Payment link creation

Grow

This will set you back £25/mo (or benefit from up to 24% off on an annual plan)

You get everything in the Free account and:

- One free metal card

- Ten free international payments

- 100 free local payments per month

- Foreign exchange up to £10,000 per month with a 0.4% markup for each exchange after that

- 0.99% crypto exchange fee

- Bulk payments, for example, when running payroll.

- Analytics

- Rewards include a six-month Shopify trial and a two-month free trial of Sage

- Business API integrations

- Forward currency contracts

Scale

This will set you back £100/mo (or up to 21% off on an annual plan).

You get everything above, and:

- Two metal cards

- 50 free international payments per month

- 1,000 free local payments per month

- Foreign exchange up to £50,000 per month with a 0.4% markup after that

Enterprise – Custom Pricing

You get everything above customized to your needs, plus a dedicated account manager.

For Freelancers, there are three accounts:

Free

For this, you get:

- A plastic company card

- A virtual card

- Five free local payments a month (£0.20 per payment after that)

- A £3 fee per international payment (weekend and rare currency markups apply)

- Spend in 150+ countries and 150+ currencies

- Hold and exchange 25+ currencies

- Free transfers to Revolut accounts

- IBANs for global transfers

- Manage recurring transfers

- Local accounts in GBP and EUR

- Accept payments online and in person with fees the same as those quoted above

- Create and track invoices

- Accept payments on your website

- Create and share payment links

- Invite unlimited team members

- Team member permissions

- 24/7 support

- Manage payroll (£3/mo per team member on the payroll)

Professional

This will set you back £7/mo (or up to 29% off if you pay annually)

For this, you get everything in the free freelancer plan, plus:

- Five free international payments per month (with the fees mentioned above applied after that)

- 20 free local payments per month (with the fees mentioned above after that)

- Foreign exchange to a £5,000 limit per month with a 0.4% markup for each exchange after that

- Bulk payments

Ultimate

This account costs £25/mo (or up to 24% off if you pay annually).

For this, you get everything in Free and Professional plans, and:

- One metal card

- Ten free international payments per month (fees mentioned above apply after that)

- 100 free local payments per month (with the fees discussed above after that)

- Foreign exchange to a £10,000 limit per month with a 0.4% markup for each exchange after that

Tide vs Revolut Business: Pros and Cons

Tide Pros

- There’s a free account available.

- Access to a decent range of price plans to choose from

- You can access Tide via an intuitive mobile app.

- Access priority in-app and phone support on the paid plans

- FCA registered

- Access to in-app invoicing with free invoice templates you can use to generate and send invoices and match payments to invoices

- Access to automated 30-day cashflow forecasts

Tide Cons

- It’s strictly only for business use, so if you want a personal account, too, you’ll have to go elsewhere

- There’s a £1 ATM withdrawal fee on all plans

- No multi-currency options; it only supports GBP

- You can only use it if you have a UK address or are a director of a UK-registered business

Revolut Business Pros

- Revolut Business is FCA-registered

- It supports 25+ currencies

- It’s reportedly easy to setup

- There’s a good range of accounts to choose from, including a free one

- You can access Revolut Business via an intuitive Mobile app

- 24/7 support on all plans

- You can create a payment QR code for contactless in-person payments

Revolut Business Cons

- ATM transactions are charged at 2% of each withdrawal regardless of which plan you are on

- You can’t make cash deposits.

Tide vs Revolut Business: My Final Verdict

Hopefully, you now have a better idea of what both Tide and Revolut Business offer. As you can see, Tide and Revolut Business are distinct options that will appeal to different customers depending on their needs.

Overall, I think Tide is aimed at smaller and medium-sized UK companies that solely operate within the UK. In contrast, I think Revolut is a better fit for businesses that operate all or part of the time internationally, with its 25+ currency support and a more comprehensive selection of accounts.

However, in both cases, it’s worth keeping an eye out for transaction fees so there aren’t any nasty surprises!

That's enough from me; over to you! What do you think of Tide and Revolut? Or are you considering other business bank account providers like Starling Bank, Monzo, or HSBC? Tell me your thoughts in the comments box below!

Comments 0 Responses