PayPal is synonymous with payments. So, anyone running either an online shop or in-person store should know what it is and what it does. But did you know that you can start taking PayPal payments while you're on the go? PayPal has introduced a new card reader and its PayPal Here app. PayPal markets the PayPal Here card reader as the card reader that will “make it easier to accept secure payments in your store or on-the-go.”

Interested? Well, it doesn't stop there. PayPal has more than one card reader that works with the PayPal Here app.

Let's delve a bit deeper into this!

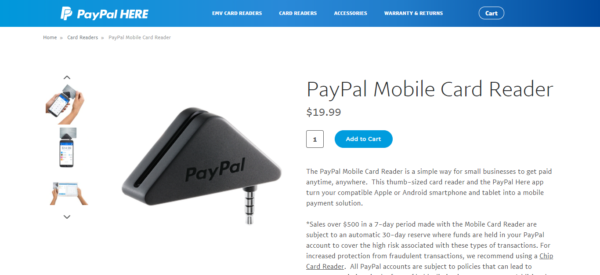

PayPal Here Review: Mobile Card Reader

The mobile card reader is aimed at start-up businesses. More specifically, it’s designed for companies with low volume transactions that need processing just every now and again. Your monthly sales need to be less than $500 over a seven-day period. So, it’s not for busy stores, selling high ticket items.

It's great for entrepreneurs on the go; PayPal describes this reader as ‘thumb-sized,' making it easy to transport. All you need is either an Apple, Android, or Windows mobile device to run the PayPal Here app, and you have yourself an effective mobile payment solution. Just connect the two devices using the audio jack, and voila, you're good to go!

Ideal if you're selling at markets and pop-up fairs.

It’s the simplest of all their card readers, but it’s also the cheapest.

💡 You should note: If you want customers to have more freedom to choose how they pay, you’ll need to upgrade to one of PayPal's more expensive readers. At the time of writing, this card reader can only accept payments from credit and debit magnetic stripe cards.

Plus, you’ll still have to fork out for transaction fees, but more on that later. Also, your funds are automatically subjected to a 30-day hold inside of your PayPal account. This is to counteract the higher risk associated with these.

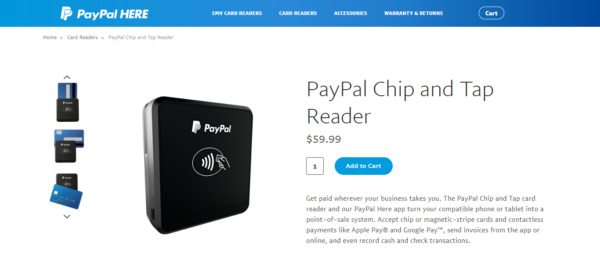

PayPal Here Review: The Chip and Tap Reader

This guy accepts all major credit cards and debit magstripe cards, Samsung Pay, and contactless pay methods, such as Apple Pay® and chip cards. It also connects via Bluetooth to the PayPal Here app on your smartphone (provided they're compatible of course).

It’s effortless to connect. Basically, you charge it up first, then turn it on, duh!

Charge it up by connecting the micro-USB cable that comes with it to a powerpoint. If it’s ready to go, you’ll see a blue light blinking away. Then, turn on the Bluetooth on your device, pair it with the Paypal Here app, and you’ll be guided on what to do next.

PayPal should send you a message via the app when there’s new software you need to update onto your device.

Customers can insert their chip card, swipe it, or use it contactless-ly. As the Chip and Tap reader is a tad more expensive than the Mobile Card Reader, you get a broader choice of payment options. Make sense?

It doesn't matter whether you're running a fast-food restaurant or a real estate agency; you can use this reader alongside the PayPal Here app to help you manage your business.

You'll also be pleased to hear, PayPal's PCI-DSS compliant. It also supports EMV-certified devices. Both of which, help keep your transactions and your customer's sensitive info protected.

This specific package includes the PayPal Chip and Tap reader, device clip, point-of-sale sticker, and micro USB cable for charging.

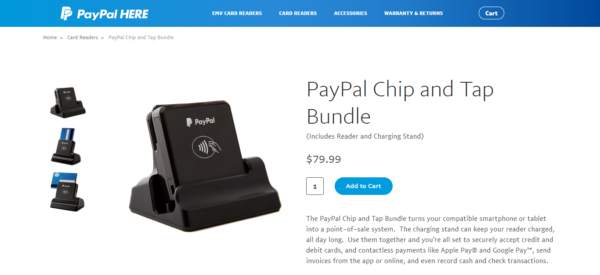

PayPal Here Review: Chip & Tap & Charging Stand

This reader is aimed at bigger operations, such as larger restaurants and retailers with a higher customer volume. There are more options for accepting payments with this device. It’ll take contactless payments such as Google PayTM and Apple Pay® as well as magstripe cards and chip cards.

You set it up exactly as we’ve already described with the Chip & Tap Reader.

This fabulous bundle transforms your smartphone or tablet into a fully functioning point of sale system. You can keep your reader inside of the charging stand so that it's ready for action, all day, every day.

If you want to give your charging stand a boost in stability and security, attach the stand to your counter using the installation template. This comes included with PayPal's ‘quick start guide' and consists of a locking screw. Use this to securely attach your Chip and Tap reader to the charging stand. That way you'll know where it is at all times, and the likelihood of it being stolen is massively reduced.

💡 You should note: in addition to the cable that comes as standard with this package; you can use any other USB to micro USB cable to charge this reader. It's also compatible with other third-party USB wall adapters.

👉 The PayPal Chip and Tap Bundle include:

- The PayPal Chip and Tap reader

- Device clip

- Point-of-sale sticker

- A micro USB cable for charging

- Charging Stand

Want to return your chip and tap reader and stand?

Yes, you can return this package and get a refund. However, you'll have to give PayPal both their reader and stand back to get a full refund…which to be fair, sounds pretty reasonable.

PayPal Here Review: Quick Overview

As we've already alluded to, The PayPal Here mobile app powers the card reader. Its first card reader was in fact introduced in 2012, but as you can see, it’s advanced somewhat since then.

👉 So here’s a quick overview of what Paypal Here does:

- Apple Pay processing

- Android Pay processing

- EMV chip card reading

- Magstripe Swiping

- Contactless payment processing

- Helps you calculate tips and taxes

- Helps you add discounts

- Invoicing

- Manages inventory

- Customizes sales reports

- Allows multiple passwords and users

- Enables business owners to set passwords and access controls

PayPal Here Review: What Else Does the App do?

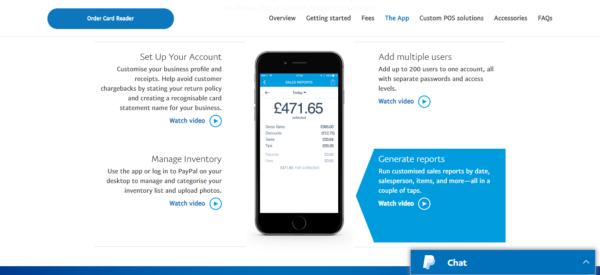

You can manage your store’s inventory and categorize it. You can also upload photos of your stock and add up to 1,000 users to one account. You can even give each user a separate password for extra security and anti-fraud measures.

You can assign users different access levels, depending on their seniority. That, in turn, helps you control which employees see what.

You can also run customized sales reports which you can categorize by date, salesperson, and much, much more.

Last but not least, you can record cash, check payments, and customize and create invoices to send to customers.

Signing Up

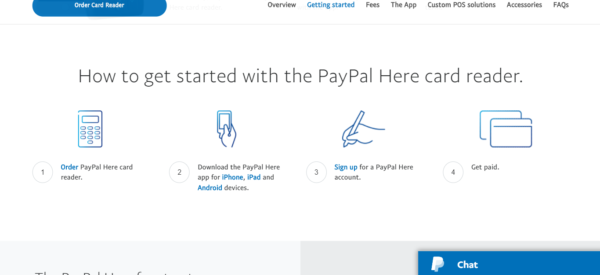

It may be easy to use, but you still have to go through an application process before you can get going.

First off, you'll have to sign up for PayPal Here via their website, or just download the PayPal Here app and order the card reader at the same time. PayPal says that the approval process for a PayPal Here account takes place straight away. The site emphasizes that you have to be accurate when entering your details (like your home address), mistakes may delay the process.

Sometimes PayPal reviews applications and asks potential customers to upload additional documents such as proof ID and/or proof of address. That’s why it’s probably a good idea not to buy a reader until your application has been approved; otherwise, you face having to return it and get a refund if your request is declined. But if you haven’t done this and gone ahead and bought the reader and are refused, keep the packaging so you can return it and get a refund!

We cannot guarantee that all PayPal Here Card Reader features will work with all phone models, so do your due diligence first!

PayPal Review: Pricing

The Mobile Card Reader comes in at $14.99. It’s the cheapest of the bunch, but, at the time of writing, it was offered for free until 31 December 2019.

Typically, the Chip & Swipe comes in at $24.99, but at the time of writing, for anyone signing up for PayPal, you get their Chip and Swipe Reader for free through December 31, 2019. However, this only applies to new PayPal accounts.

The Chip & Swipe & Charging Stand comes in at $79.99, and there’s no special offer or even a freebie when you sign up a deal on this one.

Last but not least, the PayPal Here Chip Card Reader will cost $99.99.

So, which one to go for?

Cost should, of course, be a factor. Why bother spending $99.99 when you have a smaller start-up? There’s no need, right?

Next up, you just have to check your device’s compatibility before starting out. Are you ok with connecting via a headphone jack with the cheaper version or are you absolutely sure you need the Bluetooth option? If you need Bluetooth, ensure you’ve got the version required. Decide upon compatibility before pressing that “buy” button.

Just as important, you’ve got to think about your customers before going ahead. What kind of payment experience do you want them to have? If you’re a tiny start-up and convinced your customers wouldn't mind not using contactless payments, then that’s great.

If you know your customers are cool with swiping their cards to buy your products, then the cheapest option is just excellent, as long as you’re not about high volume transactions. But if you're a firm believer in the chip and pin or contactless way to pay, then you’re going to have to layout a bit more.

And last but not least, you'll have to be sure that your device, whether it’s an iPhone, iPad or Android has the following: for Apple devices, they must be running iOS version 9.3.5 upwards. Androids must run 4.1 or later, Bluetooth 2.0 or more. In other words, check before you buy!

PayPal Here Pros 👍

The upside is that you don’t need a degree in rocket science to use any of these card readers. You can also manage inventory on the app for faster check out, manage sales staff, and send receipts and invoices when you aren’t with your customers.

The other good news is that there’s no contact involved. You can leave at any time. And, if after less than 30 days you decide it’s just not for you and your business, you can return it and get a refund. But only if you bought it from PayPal or via the PayPal Here app.

The readers come with a 12-month warranty, meaning you’re covered during that period if it packs up. But that doesn’t include someone spilling their coffee all over it or other liquids, which is presumably why they encourage you to buy a stand to go with it. This offers another layer of protection against clumsy employees and customers!

Also useful is that PayPal Here integrates with your regular PayPal account. So, store owners and other businesses can access additional features that aren’t always found with PayPal’s card reader competitors. If your business accepts payments that aren’t risky, then these are available immediately in a merchant’s PayPal account, with the exception listed below where we cover downsides.

Once the money’s in your PayPal account, you can transfer it across to your own checking account or use a debit card to make ATM withdrawals and debit card purchases.

👉 It’s a worldwide option too, with language support in:

- English

- German

- Chinese

- Japanese

- Swedish

- Russian

- French

- Polish

- Turkish

- Hindi

- Dutch

- Portuguese

- Spanish and,

- Italian

Overall, it’s easy to use, and the instructions on the PayPal Here website are easy to follow. The add ons are useful, like invoicing, and PayPal also suggests other software you can purchase to help extend its functionality.

PayPal Here Cons 👎

The downside is pretty obvious. Sales made with this card reader are automatically subject to PayPal’s reserve policies. What’s this? Basically, it means that any key-in transactions and purchases over $500 in 7 days made with the mobile reader are subject to an automatic 30-day reserve.

This means PayPal will hold onto your funds inside of your PayPal account for 30 days and won’t release them until after that time. Why? Because PayPal says that there is a “high risk associated with these types of transactions.” They believe it's a way of protecting themselves and their customers against fraud. It really is worth reading the fine print in their User Agreement, however boring that may be.

The other downside, predictably, is the fees. They charge you 2.7% per transaction for every swipe and check-in payment and 3.5% for keyed or scanned, plus 15 cents per transaction. That’s quite a bit. And international transactions also cost. PayPal Here does accept international, non-US cards, and the fee is 2.7% per swipe and another 1.5% cross-border fee, and/or a 2.5% currency conversion fee.

You may be excited that it allows you to invoice, but be wary. It charges 9% + $0.30 each time!

A quick and straightforward look via Google will tell you that the above downsides upset a lot of people!

If you’ve got an Android device, be sure it has Bluetooth 2.0 upwards. Windows phones aren’t compatible, and it doesn’t work with some Samsung Galaxy models such as Ace, Ace Advance, and Pocket.

To use PayPal Here, you absolutely have to have a verified bank account from another baking institution. This can be difficult for some people.

Lastly, there’s no free trial option on offer at the moment.

PayPal Here Review: Typical problems

If you have questions connecting your phone, PayPal recommends the old favorite of disconnecting and reconnecting the phone and reader again. Sometimes the phone recognizes the reader, but the card won’t read the credit or debit card. It’s worth checking the magnetic card strip is in good shape. Sometimes it won’t work if you haven’t swiped the card in one smooth motion.

👉 To be sure you’ve tested your reader works, and you avoid embarrassing long waits with customers, you can do the following:

- Tap your Menu icon and select the Card Readers option

- Then tap “tutorials.”

- Go to “practice swiping.”

- Plug your card reader into the audio jack on your smartphone; you’ll see an icon that says you’re connected.

- Test the reader by scanning a card. You’ll know if it works if an image shows you it’s worked.

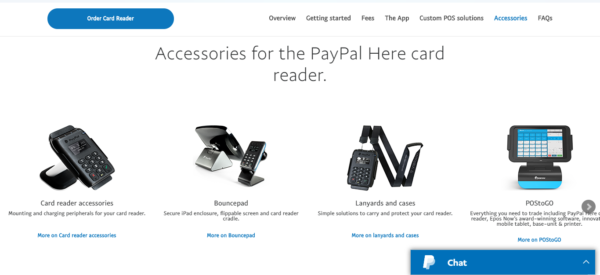

PayPal Here Review: Accessories

There’s also a wide range of accessories to go with the readers such as a point-of-sale stand. These are for your tablet or card reader. They're lockable and helps protect your tablet and reader. You can also buy a receipt printer for transactions and cash drawers to keep cash and receipts in too.

PayPal Here Review: Customer Service

There’s plenty of help to hand, whether you prefer the virtual or the human kind.

PayPal offers a phone number to call for live help from their customer service agents. Alternatively, turn to the PalPal Here app for troubleshooting help, and there’s also the option of checking out their Help Center.

The Help Center is basically a load of FAQs and a lively PalPal online community; the downside is you won’t always find specific answers to questions you may have, and it can take time to get answers if folks aren’t online at the time you need them to be.

What Are the Alternatives to PayPal Here?

We looked at Square POS, SumUP and ShopKeep, these are some of the best PayPal Here alternatives on the market.

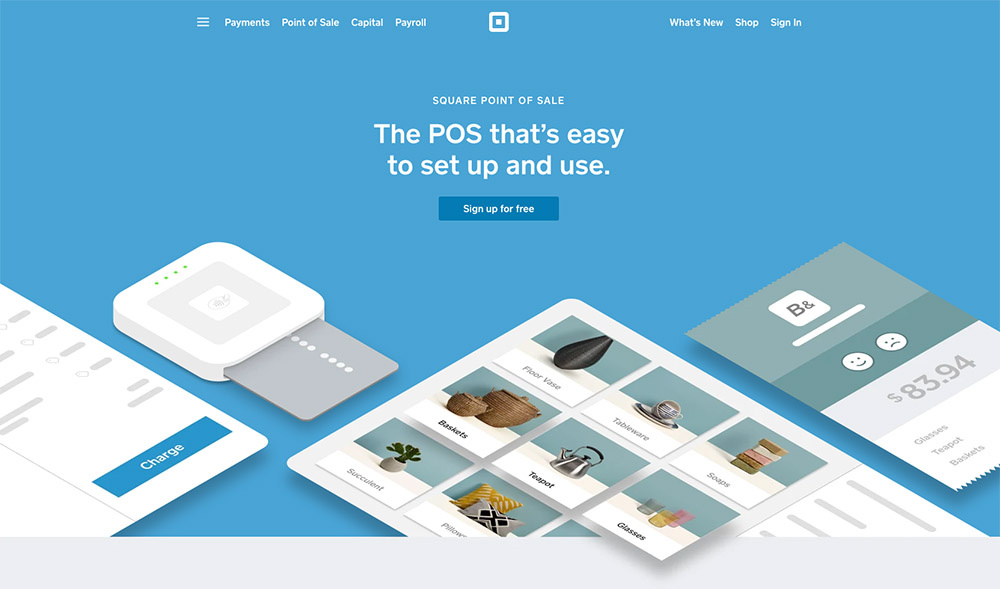

PayPal Here Alternative: Square POS

Square is a free app and has a clear pricing model, charging 2.75% for swiped or tapped payments for Visa, Mastercard, Discover, and Amex. However, there are add ons you have to pay for, like appointment scheduling, marketing tools, and payroll. Their websites states “swipe $100, see $97.25 in your bank account in one to two business days.”

It’s compatible with Android, iOS, and laptops too. There are two versions of Square Reader for magstripe. One needs a headset jack and the other a Lightning connector. You can take in-person card payments by adding a Square Reader to your Apple computer or Chromebook.

Credit card info is encrypted and Square doesn’t store this kind of data. There’s also an option to print receipts and send e-receipts if customers prefer that option.

Cost? As we've already said, it's free to sign up and there are no monthly fees. But, each additional reader costs $10 thereafter.

👉 Check out our Square POS review for more information.

It's ideal for smaller businesses with lower transaction rates. The chip card readers are inexpensive and there are free tools for selling online.

Unlike other POS apps, Square offers four different solutions for POS depending on what your business is. There’s Square for Restaurants, Square Appointments for retail and booking appointments, Square for Retail and the generic Square Point of Sale.

PayPal Here Alternative: SumUp

SumUp also has no monthly fees and charges the same as Square for transactions. It works fine with Androids and iOS and can email receipts. There are no termination fees with SumUp and there’s plenty of free add-ons to boot.

Fees for transactions are slightly lower with SumUp, at around 2.65% in the US and as low as 1.69% in the UK. It boasts more than one million active users in Europe and has expanded into 31 countries. SumUp takes all major credit cards.

It feels like the best option for anyone wanting something simple and cheap. It’s a bigger contender than it used to be since it merged with Payleven.

👉 Check out our SumUp review for more information on what you get from each pricing option.

However, their customer service phone line isn't open on Sundays. The wireless card reader connects with Bluetooth. The card reader accepts chip transactions, either PIN or sign, and contactless with Visa, V Pay, Mastercard, Amex, and Diners Club. It also takes Apple Pay and Google Pay too.

PayPal Here Alternative: ShopKeep

No monthly fees or contract here either but there's a sign-up fee of $69. This tool supports all devices but it doesn’t send SMS receipts, only email receipts. It’s aimed at the smaller business and especially targets food and drinks sellers. That doesn’t mean it’s just for this industry though.

👉 Check out our ShopKeep review for more information on what you get from each pricing option.

ShopKeep is simple to use and is perfect for any start-up or small retailer. It used to have flat-rate pricing. Now costs are done on a by-quote basis. You can either fill in questions online or call them up. The process is quick. ShopKeep offers analytics in real-time, inventory management, unlimited users, and unlimited inventory items, and free support if you encounter any problems.

Have You Used PayPal Here Before?

Have you ever used PayPal Here before? If so, we would love to hear about how you got on with the app.

Which card reader did you use? Let us know in the comments box below. Speak soon!

Comments 0 Responses