Consumer preference for pay-over-time services like Affirm for financing their purchases quadrupled between 2018 and 2019. Affirm’s 2020 survey predicts that 54% of US consumers will pay over time for their purchases in 2021.

After all, why pay upfront for a big-ticket purchase when you could repurpose that cash for more essential expenses? Even if you had to pay a small interest for the chance to split up your bill into easier-to-make monthly payments.

The question then is, is Affirm the right choice for you? Or would a credit card do just fine?

How do you finance your purchases through Affirm for an easier shopping experience?

Find out in this review.

POS Loans vs Credit Card

Some credit card lenders let you pay over time as an extended repayment arrangement. It’s limited to a few hundred dollars at a time. And still subject to credit card services’ high rates, hidden fees, and penalties.

So, it can hardly achieve the cash-use efficiency you hope to get with POS loans.

Moreover, these credit card features could quickly turn into disadvantages:

- Revolving line of credit based on your credit report

- Atm cash withdrawals.

- Variable repayment plan where borrowers may pay the minimum loan amount if they choose.

You experience this every time you make unplanned purchases of unnecessary wants or withdraw cash you don’t need. These are major contributors to the 2019 average credit card debt of $6,194 in the US.

On the other hand, POS loans are useful for many reasons, including financing big planned purchases. I emphasized planning because impulse shopping on POS loans without a repayment plan leads back to a debt pileup.

You won’t pay extra service fees or penalties for POS loans besides the considerably lower annual percentage rates (APRs).

What is Affirm?

Affirm offers low-interest rates on consumer loans at the point of sale, enabling you to buy what you want now and pay later. Affirm lets you repay your loans in several monthly installments.

Consumers who finance their purchases using Affirm enjoy credit with zero extra fees and no application fees or down payments.

There’s no penalty APRs for delinquency on the personal loans you get from Affirm. A loan is delinquent when you don’t make a payment on time.

How it Works

You can shop up to $17,500, depending on your eligibility, using Affirm, and pay over time at your own pace.

Buying with Affirm will take a few more steps than paying with a Visa card at checkout. However, here are the three main steps:

Step #1: Add product to cart

Pick out that product you’ve been planning to buy and add it to the bag. The goal here is to locate the product page on the vendor’s store and complete an order.

Step #2: Choose Affirm as your payment method

On the vendor’s checkout page, select Affirm as your preferred method of payment. Affirm pays the vendor for your purchases and buys your debt. A few retailers offer 0% APRs when you pay with this loan provider, but Affirm's rates generally range from 10% to 30% APR.

The other end of this step is to prove your eligibility to pay for the loan Affirm is about to give you. If you already had an Affirm account and prequalified, you can go ahead to pay for your purchase with Affirm.

Some purchases may require you to make a down payment of some part of the product cost before loan approval.

Step #3: Pay off your Affirm balance over time

Once you buy successfully with Affirm, you’ll get the first reminder to make payments in about a month.

Affirm’s loans are generally short term, extending over a year at most. You can pay off your loans in

- three monthly payments,

- six monthly payments, or

- twelve monthly payments.

You can also choose to pay off your loan early or in one full payment; Affirm will not charge you extra.

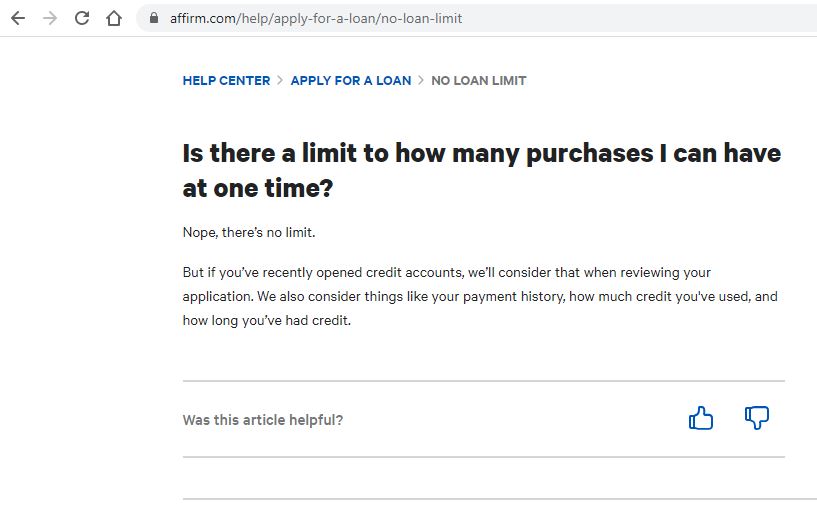

Affirm loans are non-revolving; you would need to apply separately to finance each purchase.

Balances overlap, and it’s not a problem. There’s no limit to how many loans you can get with an Affirm account at one time.

Creating an Affirm Account

Any citizen or permanent resident of the US or a US territory can create and use an Affirm account. However, due to Iowa and West Virginia state laws, you can’t prequalify or get a loan there.

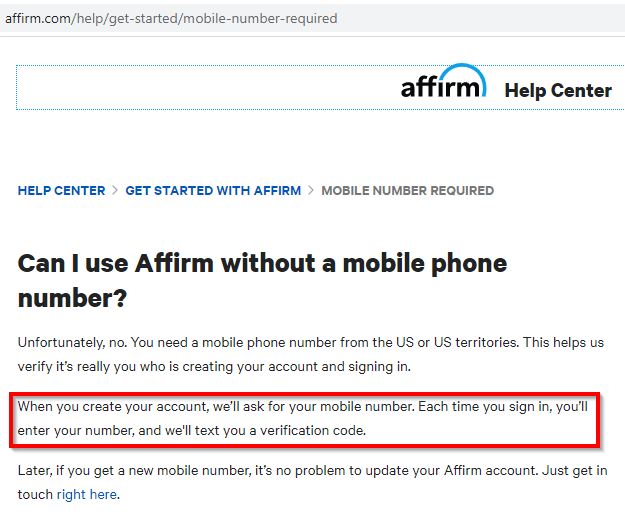

Creating an Affirm account requires your phone number for verifications at subsequent logins.

Affirm conducts soft credit checks for loan requests, which does not affect your credit score.

They also claim that your credit score and credit report doesn’t affect your chances of approval. But, Affirm often considers other factors like your payment history and how long you’ve had an Affirm account.

Over 6,500 merchants partner with Affirm in the US to offer consumer lending to their shoppers. Top Affirm partner vendors include Adidas, Walmart, Peloton E-commerce, West Elm, and Purple.

With the Virtual card feature, there’s no limit to where you can use your Affirm account online.

Financing a Purchase with Affirm

To show you what to expect when you use Affirm to finance your purchase, I created an Affirm account. Then I purchased two Adidas products, which I paid for with Affirm.

Let me walk you through what I did.

From my account on Affirm.com, I clicked on the featured Adidas page on the home page.

Selecting any of the three “Shop now” buttons on the featured page will send you to the Adidas.com store. You can still get to the store via web search.

I selected my order, confirmed my details on the Adidas.com checkout page, and clicked on “Review and Pay” to get to the payment.

Depending on the order and vendor, you’d get the option of three, six, or twelve monthly payments.

I selected the “3 Interest-Free Payments by Affirm” option available for my order, which brought up the Affirm login screen.

The goal here is to enter your number, confirm it’s you by entering the verification code sent to your phone. Once you enter that, you go through an easy application to get financed.

Prequalify for an Affirm loan to make this process faster.

How can You Pay Your Affirm Balance?

Repaying your Affirm loan is easy to do. For each purchase you finance with Affirm, you can pay over time by:

- Debit card,

- Checking account with any US banks, or

- Sending a check via mail to their Pittsburgh address.

Who is Affirm Best Suited For?

Affirm runs a flexible loan application process, which they claim does not consider your credit score or credit history. Any shopper who meets the requirement to create an Affirm account could be eligible for a loan at the vendor’s point of sale.

However, according to a report by CNBC Make It, POS loan options can harm your credit if not planned cautiously.

So, Affirm is the right financing option for you if you answer yes to any of the following:

- Do you have a low credit score?

- Are you new to credit?

- Can you set a suitable repayment plan? Or

- Do you need to make large purchases but can’t pay your balance?

Then this solution might just be right for you.

Affirm’s Features

Affirm users enjoy more features than you expect from a regular online loan service. Let’s explore them.

Pay on the Go

Affirm launched a mobile app downloadable on the App Store and Google Play store. You can manage your Affirm account, shop on the go, and make payments at your convenience using the app.

Mobile Savings Account

The mobile savings account is a way to keep small savings on the Affirm app.

The Affirm savings account is connected to your bank savings account and operates in much the same way. It can be handy for small purchases, budgeting for a big spend, or repaying loans on the Affirm app or online.

OTU Virtual Card

It’s a lot like buying with a prepaid or debit card.

When buying from a store that’s not an Affirm partner store, log into your Affirm account, get prequalified and pay with a virtual card number.

The one-time-use virtual card allows you to buy from any online vendor.

Prequalification

Prequalifying for an Affirm loan doesn’t require any special processing. Just a check to find out how much you’re eligible to spend with your Affirm account.

On-site Vendor Accessibility

Affirm lets you access a list of partner vendors that can link you directly to each vendor’s site.

You can browse featured stores and special offers on the home page or select any product category on the “Shop” navigation.

Multiple Loans

Depending on how you use it, the ability to take out various POS loans from Affirm at a time might be good or bad.

Affirm allows you to select which purchase you want to repay when you need to make payments. So, you can pay off more than one loan without default.

Benefits that Make Affirm Standout

Besides shifts in consumer and merchant awareness, shoppers might prefer Affirm over other POS lenders due to these features:

Fixed Repayment Amounts

Affirm only allows payment of the same amount made monthly. This way, you won’t accumulate debts from paying minimum amounts, as with credit cards.

Flexible Repayment Schedule

This feature allows you to complete your payment in three, six, or 12 monthly installments. You also have the option to pay early or in one full amount.

No Extra Charges After Purchase

Affirm calculates the value of your loan at checkout. The value of your monthly installments never changes, even if you default on payment.

Secure Payment Option

Buying with Affirm provides you with a way to make secure payments online. And Affirm confirms it’s you every time you log into your account via phone verification.

Affirm's Weaknesses

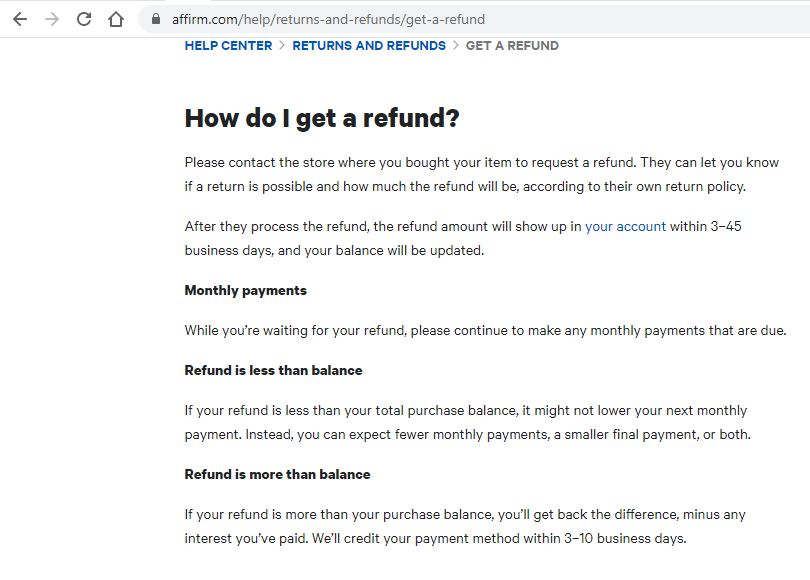

When you plan to make a large purchase but don’t have enough cash to pay your balance, a POS loan can be useful over a credit card. But, refund rules for returned goods and canceled orders affect your payments differently.

These areas are points of concern:

- Depending on merchants refund policy, and sometimes your negotiation skill, refunds for goods bought with Affirm fall short.

- Even when you get full refunds for returned damaged goods, Affirm doesn’t refund any paid interests.

- There is no penalty for late payments, but it affects your creditworthiness if you cannot repay your loan.

- At the point of sale, the company’s no-loan-limit feature might seem like a ticket to unlimited shopping on credit. But, it becomes more challenging to repay over time, given that their loans are short term.

When it comes to these, affirm’s system is not infallible. I advise you to look through your vendor’s return policy and Affirm’s terms to know what applies to you.

Affirm Rankings

Your Affirm account is only worth as much as how good the deal it can get you. Here’s how Affirm makes it worth your while to pay with its service at checkout:

For each of these service features, we’ve rated Affirm’s performance over a 5-star system.

Ease of Use

Each of the “three easy steps” to buying with Affirm has a few steps to it.

From a merchant’s checkout page, it would take you longer. Most of that time is for Affirm to verify your details, check your eligibility for a loan, or set up your account if you’re a new user.

Otherwise, prequalifying for a loan makes it easier to use on any vendor site.

Our rating: 4.5/5

Customer Service and Support

Affirm encourages the use of their help page for getting support than their elusive customer care. Without a Live chat option, you can only get customer care by emailing [email protected] or calling 855-423-3729.

To their credit, calls to this number are toll-free, the help page is exhaustive, and they claim to have a team on standby all days of the week. But, their response time needs optimizing.

Our rating: 3/5

Affirm vs Alternative Personal Loans Solutions

Two of Affirms top personal loan competitors are AfterPay and Klarna.

AfterPay finances interest-free consumer loans through a compounding penalty fee basis.

Like AfterPay, Klarna lets you pay over a short time ( 14 to 30 days), but at 0% APRs and zero fees. However, you incur prepayment fees for early repayment and late fees for late repayments.

Let’s not go into details of how they both work. Just know that Affirm tops their competitors by charging zero late fees and penalty APRs and allowing flexible loan terms.

Our rating: 4.8/5

Features and Functionality

Given the competition in the financial tech industry, Affirm would need to be on its toes to maintain customer interest. This nervousness has resulted in a continually improving brand, optimized service offerings, user-friendly features, and greater ease of use.

A user growth four times more than their top competitor proves that users find these features useful.

However, buyers don’t want to go through additional steps at checkout. Affirm would be a lot more functional by qualifying buyers for a loan on the vendor’s site pre-purchase.

The prequalification feature Affirm offers on their site comes close to achieving this functionality.

Our rating: 4.4/5

Pricing

Some of Affirm’s personal loans are interest-free. Up to 159 of Affirm’s partner vendors finance the split payment options you get from them. For up to a certain amount, anyway.

It’s a great way to get shoppers to come back.

But, on average, you could pay 10% to 30% of the value of your purchase, split over time, as interest for the installment loan.

It could be better but, a 30% maximum APR loan is considered a better deal than most credit card services.

Our rating: 4/5

Overall rating

Affirm delivers on its promise to help consumers say yes more often. That’s, as long as you’re comfortable with paying a few percentages in interest.

Their system delivers outstanding loan service packed with extra features to make shopping easier, smoother, and possible.

Some of their features could use a few tweaks, like the customer service response time. Affirm could also improve functionality by offering loan approvals on vendor sites before checkout.

Overall, Affirm provides an efficient pay-over-time POS lending service.

Our overall rating: 4.1/5

Summary

Consumers are demanding quicker access to what they need. Sometimes, not having ready cash limits that access. Affirm provides a useful, faster, and cheaper way to buy and pay over a term of up to one year.

Many vendors are already onboard with Affirm’s offerings. So there’s no shortage of where to buy with the platform. Paying with Affirm on checkout is safer than bank cards too.

Affirm offers the perfect payment plan for financing large purchases, like a new mattress or a luxury bike. More so, if you have a credit limit, you’re new to credit, or your personal finance needs fixing.

Their main weaknesses are not unique and are common to most POS lending services.

However, with a healthy credit history and high credit score, you should consider other ways to finance your big-ticket or larger purchases. Or pay cash upfront, if you can afford it.

Comments 0 Responses