Few entrepreneurs will tell you they have too much time on their hands as far as their business is concerned. While most entrepreneurs want to focus their energies on boosting their profits, many are bogged down with administrative tasks, including tax filing and other office work.

A recent study by Starling Bank found that the average small business spends 15 hours or 19% a week on finance-related admin. In contrast, a report by accounting solution Sage found that SMEs spent 71 days a year on administrative tasks such as accounting, paperwork, and recruiting.

One quick and straightforward solution is to outsource those tasks. So, we’re looking at one such online outsourcing platform that can help relieve the pressure: Osome.

There's lots to cover, so let's dive straight into this Osome review.

Osome Review: Who's Osome?

Osome’s 7,500+ clients are located all over the world. The company aims to take “the routine off your chest” so that “you grow your business, we do the rest.” Osome believes that “entrepreneurs are society’s problem solvers,” and it’s Osome’s job to handle routine and mundane tasks.

How?

By offering an app and web product that combines AI software and human know-how to provide automated accounting, payroll, tax, and administrative services to entrepreneurs. That said, the company’s core offer is its accounting-related services for eCommerce business owners.

Osome is available to download via the Apple App Store and Google Play.

To date, Osome has helped create more than 4,200 companies and freed up to 40 hours spent on admin per month for its clients. The startup launched in 2019 and quickly attracted Series A investor funding worth $16m to expand globally. Fast forward to today, and it now employs 200+ staff across offices in London, Kuala Lumpur, Moscow, Hong Kong, and its Head Office in Singapore.

There are three versions of the Osome website for either UK, Singapore, or Hong Kong-based companies. Osome users simply click on the drop-down tab to choose from the UK, Singapore, or Hong Kong flag, and they're directed to the relevant website.

In each case, the offer is slightly different depending on the country or region’s legal requirements. For the purposes of this review, we’re focussing on Osome's UK-based services.

Osome Review: What Osome Can Do For Your Business

Currently, there are six core services on offer:

- Accounting for eCommerce businesses

- UK-EU Trade for eCommerce businesses

- Accounting

- Company formation

- Bookkeeping

- Bookkeeping for accountants

Let’s look at each in turn:

Accounting for eCommerce Businesses

Specifically aimed at online sellers, business owners essentially hand over their paperwork to Osome's accountants. From there, Osome takes care of your tax filings, profit and loss reports, processes refunds in multiple currencies, and so on. Then, just connect whichever online platform you're selling from (e.g., Amazon, Shopify, eBay), and Osome handles the rest.

Osome also converts financial statements into easy-to-read reports. For example, you can quickly view shipping and delivery costs, warehouse fees, etc., all of which are helpfully organized into the correct tax categories.

Osome even migrates all your paperwork from your former accountant and automatically uploads your data by connecting your bank and sales platforms to the Osome network. Of course, they’ll also check to ensure your company's compliance with relevant tax authorities, so in the UK, that's the HMRC.

How Much Is Osome's Accounting for eCommerce Businesses?

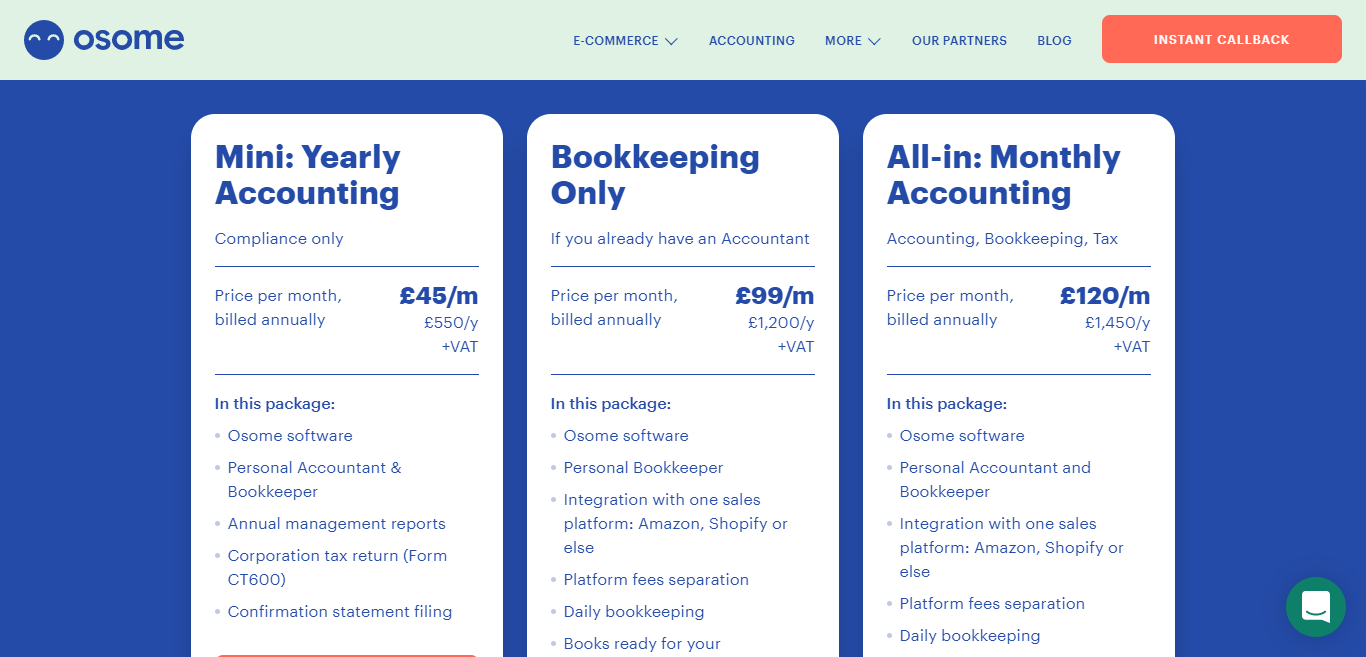

There are three pricing plans, all of which provide access to Osome's core software:

Mini: Yearly Accounting Plan:

This will set you back £45 a month or £550 a year +VAT and includes:

- A personal accountant and bookkeeper

- Annual management reports

- Сorporation tax return (Form CT600)

- Сonfirmation statement filing

Bookkeeping the Only Plan:

This package is worth considering if you already have an accountant. This costs £99 a month or £1,200 a year + VAT and includes:

- A personal bookkeeper

- Integration with one sales platform: Amazon, Shopify, etc.

- Platform fees separation

- Daily bookkeeping

- Books ready for your accountant to review ahead of deadlines

All in: Monthly Accounting Plan:

This package is best suited to those looking for a full accounting, tax, and bookkeeping service. This costs £120 a month or £1,450 a year+ VAT. You get everything in the Bookkeeping Only Plan, and:

- A personal accountant

- Monthly management reports

- Confirmation statement filing, VAT, and Corporation Tax

There are also add-on costs for extra services. For example, suppose you trade in multiple currencies. In that case, you might want to pay an additional £30 a month to facilitate that. On top of that, foreign VAT filings cost £85 a month – so it’s easy to see how costs can pile up.

UK-EU Trade for eCommerce Businesses

Since the UK left the EU in 2020, there are multiple reports of SMEs encountering bumpy starts concerning various regulations coming into force. Most notably, the different VAT rates, rising shipping costs, and so on.

Osome works with UK-based entrepreneurs keen to sell in the EU post-Brexit.

Services offered include:

- Registering your business for VAT in each EU country you sell to

- Tax reports and filings

- Access to a fiscal representative in the EU…should your business require one.

If you sign up with Osome and sell to the EU, the company offers a free consultation on UK-EU trade rules to help get you started. No prices are quoted for this service. Instead, you need to fill out your details, and an Osome representative will walk you through specifics.

Accounting

If you opt for this service, you’re assigned a chartered personal accountant who prepares your:

- Tax reports

- Reminds you when taxes are due

- Suggests where you might be exempt from tax and save money

…and so on.

You’ll have access to your daily balance (online), you can view unpaid invoices, and you're assigned a direct point of contact when you have questions.

Just take a screenshot of your invoices and drag and drop them into your Osome account. Or send them in an email to Osome, and they'll then upload them to your account. You'll then have complete visibility over what’s been paid and what needs chasing.

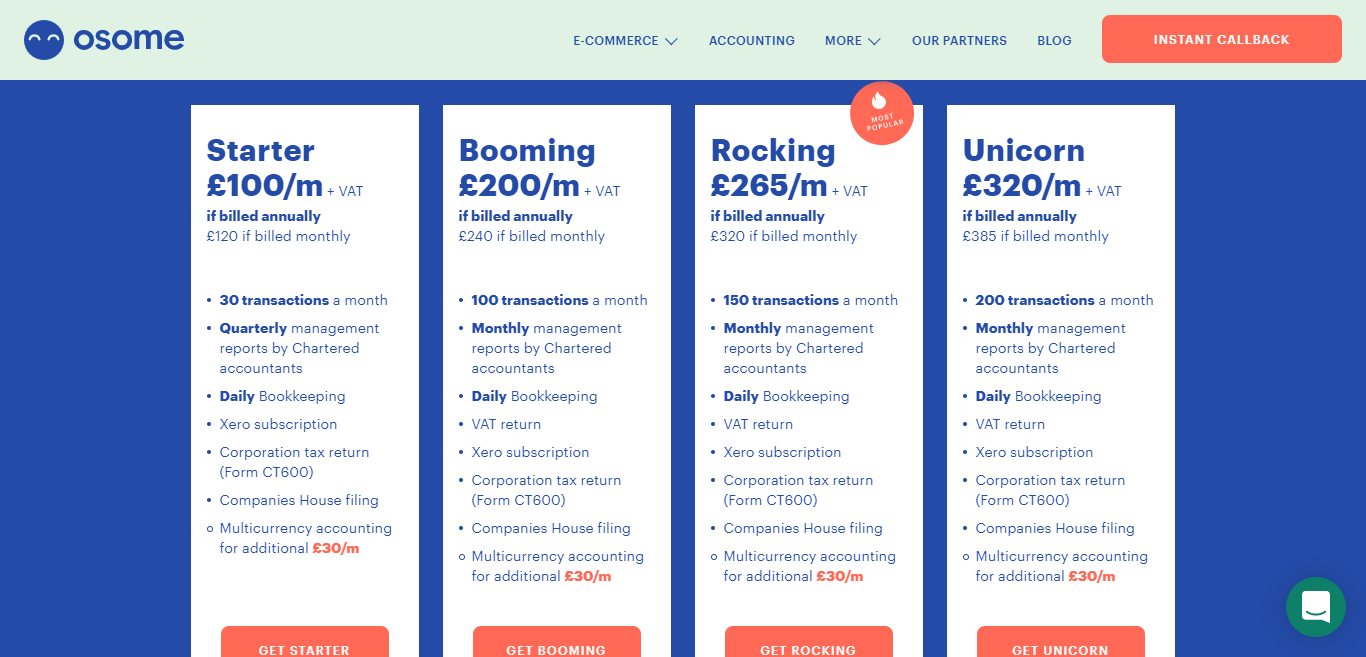

How Much Does Osome's Accounting Services Cost?

- Starter Plan: £100 a month + VAT if billed annually or £120 monthly, for 30 monthly transactions

- Booming Plan: £200 a month + VAT if billed annually or £240 monthly for 100 monthly transactions

- Rocking Plan: £265 a month + VAT if billed annually or £320 monthly for 150 monthly transactions

- Unicorn Plan: £320 a month + VAT if billed annually or £385 monthly for 200 monthly transactions

All plans offer the following services:

- Daily bookkeeping

- A Xero subscription

- Corporation tax return (Form CT600)

- Companies House filing

- Multi-currency accounting for an additional £30 a month

The Starter Plan offers a Quarterly Management Report conducted by chartered accountants, whereas the other three packages provide these monthly.

Company Formation

Suppose you're forming your company in the UK. In that case, Osome can handle the admin side of things – for instance:

- Company registration

- Ensuring your company has the correct paperwork in order

- Advising on whether your business will qualify for tax reliefs like:

-

- SEIS Tax Relief

- EIS Tax Relief

- VCT Tax Relief

- SITR Tax Relief

- The EMI Shares Option Scheme

- Entrepreneurs’ Relief

- Capital Investment Allowances

- R&D Tax Credit

…And how to apply for each.

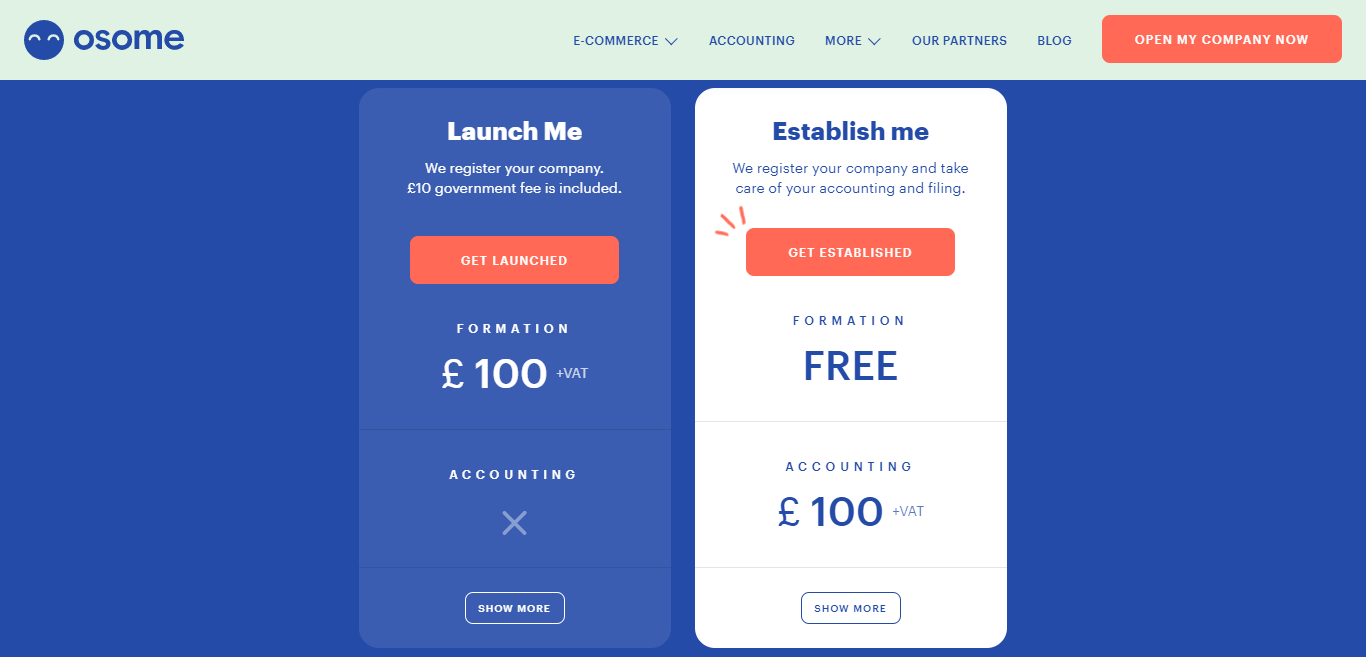

How Much Do Osome's Company Formation Services Cost?

You can choose from two options here:

- Launch Me: £100 + VAT for simple company formation – with no accountancy services

- Establish Me: £100+ VAT per month. This charge includes the free company formation plus all the features included with the Starter Plan (see above).

Bookkeeping

Osome uses Xero for its bookkeeping and keeps all your accounts up to date so that you're ready for your accountant. You also get access to:

- A dedicated and qualified bookkeeper

- Account reconciliation every 24 hours

- Real-time balances

- The ability to drag and drop any documents into your books

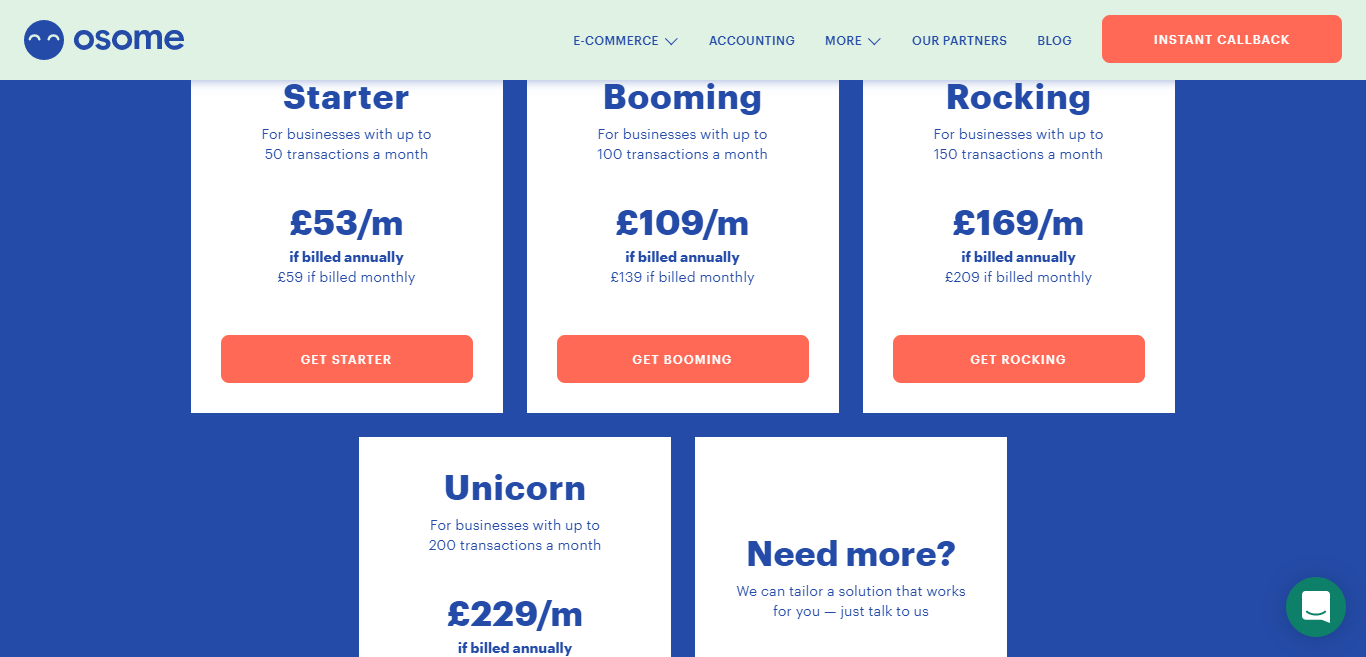

How Much Does Osome's Bookkeeping Services Cost?

- Starter Plan: £53 a month if billed annually or £59 a month for up to 50 monthly transactions

- Booming Plan: £109 a month if billed annually or £139 a month for up to 100 monthly transactions

- Rocking Plan: £169 a month if billed annually or £209 a month for up to 150 monthly transactions

- Unicorn Plan: £229 a month if billed annually or £279 a month for up to 200 monthly transactions

Businesses with 200+ transactions can access a tailored package, but you'll need to contact Osome directly for more info.

Bookkeeping for Accountants

UK-based accounting companies can also outsource their bookkeeping to Osome to reconcile daily online transactions. Osome also chases clients for outstanding documents. Its algorithms process routine tasks such as tagging documents and matching them to transactions.

Prices for this service weren't available at the time of writing. However, Osome states it has various packages that can be tailored according to how many clients the accountancy firm has.

Osome Review: Osome Partners

We’ve already mentioned that Osome integrates with Xero, the cloud-based accounting software. However, they've also negotiated with other online platforms and apps that can potentially save your business money as well as time.

We won’t refer to all of them here, but here are a few examples of Osome partners that offer Osome clients discounts:

- Osome clients can save up to 90% off Hubspot’s rates for its sales, marketing, and customer service platforms.

- Osome clients get $10,000 worth of processing credits when they use Stripe’s payment processing platform.

- Osome clients enjoy $3,000 worth of credits from Amazon Web Services.

Osome Review: Customer Support

How does Osome offer its clients support? Customers have access to a relatively comprehensive range of FAQs that cover each aspect of its services.

There's also a helpful blog on growing your business, preparing for EU VAT changes, insurance for online companies, and so on. The website also offers free online tools, including a Brexit Guide, an A to Z Business Vocabulary, and an FAQ on Xero.

Osome also has an email/helpdesk, phone support, and chat support with a live rep. Trustpilot reviews are primarily positive, with reviewers saying that Osome's support is “helpful” and that the information and advice given is “clear.” Where there are complaints, they tend to be about slow response times, and in one instance, late filings that resulted in fines.

Osome Review: Osome's Pros and Cons

Last but not least, let's round off this Osome review with a quick overview of the platform's advantages and disadvantages:

The Pros 👍

- There's a free demo

- There's a broad range of services that suit businesses of different sizes, so you can scale your plans as you grow

- Signing up is easy

- Osome is supported on iOS, Android, mobile, and desktop

- You get access to helpful online tools, including a blog and FAQs

- There's a good choice of payment plans

The Cons 👎

- There’s no free plan, and pricing is a little confusing.

- You only get a more personalized service if you pay higher fees.

- Costs can mount up, especially if you’re trading overseas in multiple currencies

Osome Review: Our Verdict

Running a business is challenging. So, if you find yourself spending too much time on admin and finance-related tasks, opting for a web-based AI-powered solution like Osome is attractive.

What makes them interesting is that they're a clearly well-financed startup that's growing at a pace. They successfully marry AI with real people to provide a more rounded package for entrepreneurs and businesses wanting to scale their operations.

Ultimately, it’s your decision whether or not to try them. However, we’d always advise that you do your research, read the reviews, and the Osome terms and conditions to fully understand what you’re spending your money on.

Good luck, and let us know how you get on in the comments box below!

Wow, Osome seems like a great idea!! Would be awesome if they start specializing on german and austrian companies as well.

Also their website is amazing :O