When launching an online business, you need to consider where your funds will go once you start making sales. To keep compliant with taxes and receive a clear overview of your cash flow, creating a separate business account is advisable.

While you can simply create a business account with your existing bank, there are plenty of providers out there with account types explicitly designed for online business owners.

One such example is Statrys.

Based in Hong Kong, the platform primarily serves Hong Kong-based companies frustrated with the difficulty of getting a business bank account to respond to their needs.

This is where Statrys comes into its own. This service offers all-human support, with ease of use being its biggest selling point. But beyond that, they also provide a suite of international business features that shouldn't be overlooked. Statrys presents an attractive option to global eCommerce sellers based in Hong Kong, Singapore and the BVI with multi-currency accounts, multi-language support, and eCommerce integrations.

With that in mind, this Statrys review covers everything you need to know about their business accounts to help you decide whether this financial institution is the right option for your company.

Let's dive in!

What is Statrys?

Statrys, launched in 2018, is a young company with the singular aim of making digital payments more manageable for small businesses.

While prevalent in Hong Kong, this doesn’t exclude Statrys from having an impact worldwide. Many of their services are geared towards international business; they even have a base in Bangkok, Thailand and in London,in the UK.

Statrys’ Business Accounts: Features and Services

The Business account is Statrys’ bread and butter and is also where its features shine the most. To open an account, you have to apply online, which takes about ten minutes of filling out information. Then, the team will review your application, and in most cases, your account will be opened within a week.

There are no minimum deposits or maximum transaction amounts – so you can use Startrys' no matter the size or business.

That said, here are some of Statrys’ most notable business account features:

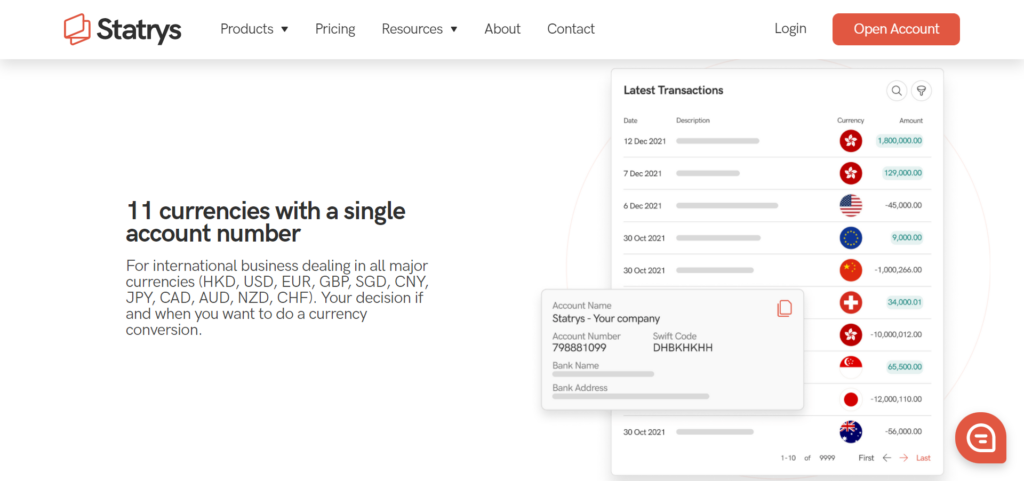

Multi-Currency Accounts

Statrys’ business accounts allow you to manage 11 currencies with just one account number. These currencies include:

- HKD

- USD

- EUR

- GBP

- SGD

- CNY (or RMB)

- JPY

- CAD

- AUD

- NZD

- CHF

You can decide if and when you want to convert a currency. However, all payments will be brought into your account in their original currency.

If your eCommerce business is dealing a lot with China, Statrys can reduce the costs and time associated with making payments to China from your eCommerce business.

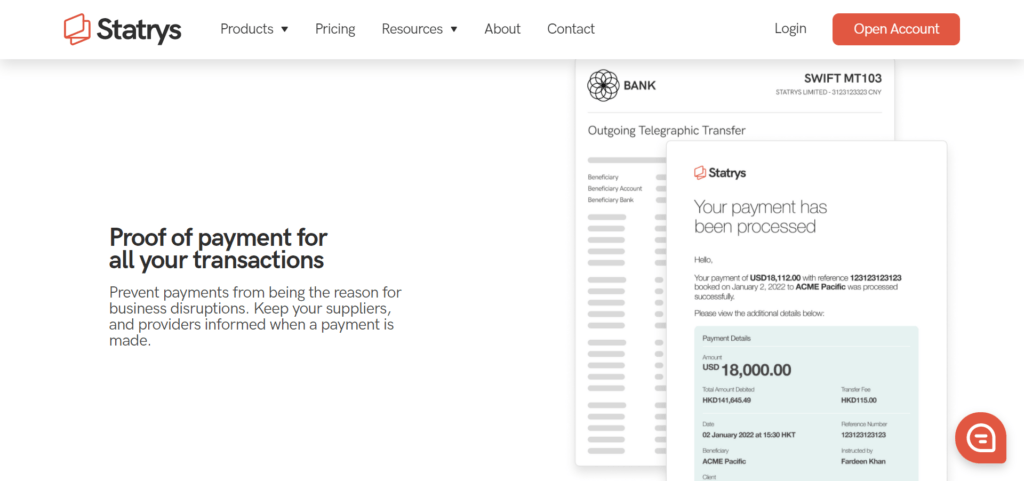

Proof of Payment

Statrys allows you to make and receive payments from over 100 countries globally and provides proof of payment for each transaction. This allows you to keep your suppliers and vendors informed, and should you need to, you can quickly attest your payment.

The proof of payment is totally free of charge compared to some other banking solution that charge.

Link Your Accounts

You can integrate your Statrys account with payment services and eCommerce platforms connected to your business for collecting funds. For example, online marketplaces like Amazon and eCommerce platforms like Shopify can redirect payments straight into your account. Similarly, you can also connect Statrys with Stripe and PayPal.

Payment Cards

To bring your digital payments into the real world, you can order prepaid Mastercards.

Having a prepaid Statrys card allow you to, for example, give employees a card for their business expenses. It also allows you to make point-of-sale purchases when you’re out and about. This comes in handy for noting business-related expenses purchased from brick and mortar stores.

You can manage your cards from the app. From here, you benefit from an overview of live transactions and spending types. You can also generate monthly statements that outline your spending. You’re better positioned to get a clearer idea of your business expenses with this info to hand.

Note that the card’s currency is HKD by default, so if you make payments or withdraw money in another currency, this will incur a 1.5% FX fee.

Forex Services

If you frequently manage cash in multiple currencies, exchange rates can quickly cut into your profits. Unfortunately, with simple bank transfers, these rates are often the highest.

In contrast, Statrys offers a Forex service that allows you to benefit from real-time exchange rates. You can spot and forward orders through their Trade Desk, which enables you to book preferable exchange rates to convert your money into your chosen currency when it’s the most cost-effective.

This add-on service comes with 24/7 access to the Trade Desk and Hedging services to help you avoid forex pitfalls (more on pricing below).

Statrys Pricing

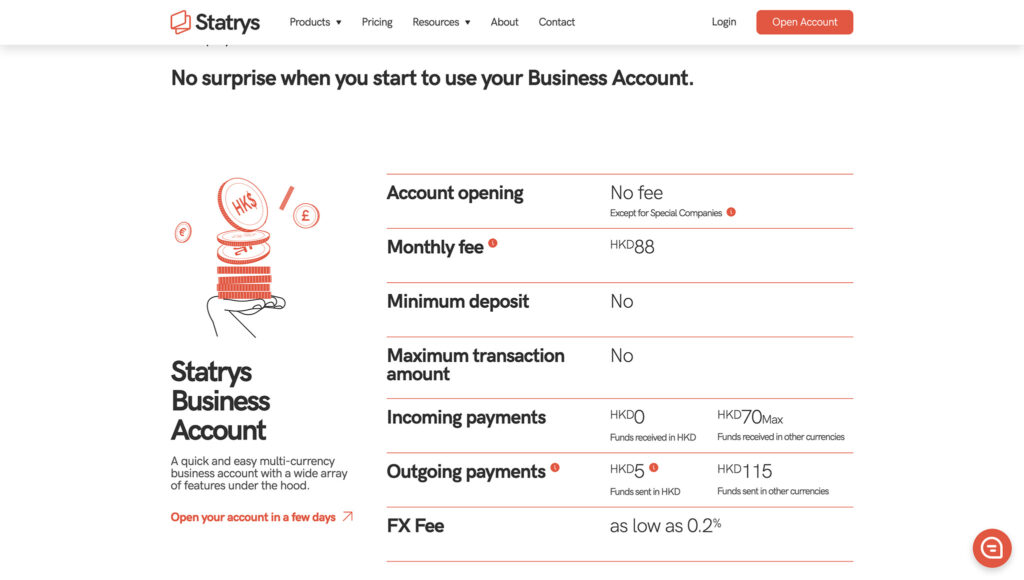

Statrys charges a monthly account fee of HKD 88. This is roughly the equivalent of £8.50, or $11 (USD). This fee covers the all-human customer support and helps the provider fight off “ghost clients” that never end up using their accounts. This enables the team to ensure they only invest their time to active users.

There’s no fee associated with opening an account for Hong Kong or Singapore-based businesses. However, companies incorporated elsewhere or those with a complex structure and business profile may face a fee.

There is no charge for receiving funds in HKD. However, those received in other currencies incur a maximum fee of HKD 55.

Where outgoing funds are concerned, you’re charged HKD 5 for funds sent in HKD, for payments below HKD 500K. If you send more than HKD 500K then the rate will be at HKD 25.

There may be an additional fee for payments over 50,000 USD per month.

Statrys has recently expanded its payment options, issuing local payment solutions. The available options for transactions include AUD, USD, THB, VND, IND, EUR, and GBP, providing you with greater flexibility in managing your payments. This helps ensure that the recipient receives the full payment without any deductions from intermediary banks.

Additional monthly fee of HKD 148 is applied for the EUR IBAN Account, on top of the business account. The incoming and outgoing payments in the SEPA zones are completely free while in the international or SWIFT zones will cost EUR 35. If you want to transfer EUR between your EUR IBAN account and the virtual business account, this will cost HKD 35.

If you wish to engage their FX services as discussed above, this starts from 0.1% on the transactions in question.

Finally, it’s worth noting that one physical payment card is included with your account. Additional cards cost 48 HKD a month, and there’s a withdrawal fee at ATMs of 1.99%, or a minimum of 31 HKD.

Statrys Review: Customer Support

Statrys prides itself on its high-quality customer support. Its business hours are between 8 am to 8 pm Hong Kong Standard time, and you can reach the team via phone, email, WeChat, and Whatsapp.

For global businesses, multi-language support is also available, including English, Cantonese, Mandarin, French, Spanish, Tagalog, Hindi, and Thai.

Response times depend on your timezone, but you’ll always receive an answer within 24 hours. However, Statrys tends to get back to you within 15 minutes (on average) during business hours.

Statrys Pros and Cons

As we draw this review to a close, let’s consolidate everything we’ve learned into a quick pro-cons list:

Pros 👍

- The application process is easy – everything is handled 100% online.

- You benefit from quick, all-human support- you’ll never speak to a bot, and support is also available in eight languages.

- A single Statrys account can hold up to 11 different currencies.

- You can easily connect your business’s payment services and online marketplaces to route your business finances to your account.

- You can create a remote IBAN account to better handle European payments.

- You can get physical payment cards to conduct POS purchases and give these to employees to track expenses. You can manage all your cards via the app.

- You can get better exchange rates by booking ahead at an affordable fee.

- There are no minimum or maximum transactions and no minimum deposit required.

Cons 👎

- The mobile app only allows you to manage physical payment cards, not your online account’s transactions and expenditures. However, Statrys plans to expand the app’s capabilities in the future, so watch this space!

- There’s no free plan – business accounts come with a monthly fee of 88 HKD.Although there is a fee, unlike some other solutions, the fee for their services is clearly posted on their website.

- If you don’t operate in HKD currency much, you’ll incur fees paying and receiving money.

- You can’t open a business account unless your business is incorporated in Hong Kong, Singapore, or the BVI.

- While the Trade Desk for Forex Customers is available 24/7, general support comes with limited business hours.

- Additional cards incur a monthly fee, which can quickly increase costs.

FAQ:

Last but not least, let’s answer some of the most frequently asked questions about Statrys:

Do I need to be based in Hong Kong to create an account with Statrys?

Companies registered in Hong Kong, Singapore, and the BVI (British Virgin Islands) can apply for a business account. However, if you’re incorporated outside these areas, you may still be able to use their services, but the sign-up process requires more attention. As such, Statrys may charge a setup fee. In the future, Statrys plans to expand its services to new jurisdictions.

What information is needed to apply for a business account?

You’ll need the following documents for your application:

- The passports of all directors and shareholders of your business

- The business registration certificate of your Hong Kong company, or the equivalent for Singaporean or BVI companies.

Is Statrys a real bank?

Statrys is not a bank; rather, it’s a financial institution. Statrys is a fully licensed Money Service Operator supervised by the Customs and Excise Authority in Hong Kong and the Financial Conduct Authority in the UK, where it’s classified as a small payment institution.

Why do I need an IBAN account?

If your business frequently operates with European buyers or suppliers, you might benefit from a remote EURO IBAN account. This ensures no transfer fees on EUR payments in and out of your account. In addition, instead of making SWIFT payments, your IBAN account is set to making SEPA payments, which bypasses additional banking fees.

Statrys Review: Our Final Verdict

So that brings us to the end of our Statrys review. All in all, Statrys is a convenient business account for eCommerce store owners and other online sellers looking to streamline their payments. Thanks to their multi-currency accounts, you can easily manage your payments worldwide and benefit from better exchange rates.

As a primarily Hong Kong financial institution, it’s easy to see how it benefits customers in that corner of the world. The human support is excellent and rated highly online, surpassing many Hong Kong banks for its ease of use.

Creating remote IBAN accounts ensures that businesses in Hong Kong, Singapore, and the BVI can easily trade with European countries without suffering major financial losses or difficulties. Everything is quick and easy to set up online, with no in-person presence required.

We can recommend Statrys for Hong Kong businesses with a global reach, especially if you’re still growing and scaling. The affordable monthly fee may be well worth it for the fast support, especially if you need a lot of help. Primarily, Statrys makes sense if you convert currencies frequently and want to benefit from better exchange rates and lower transfer fees.

While some features are still a little underdeveloped, like the app and the fact that Statrys doesn’t currently operate in many locations, it’s a financial service worth keeping an eye on for the future!

Comments 0 Responses