Business banking accounts have a tendency to charge monthly or signup fees, require tedious application processes, and upsell you on outdated business tools. So, what can you do to ensure you find a simple, no fee account to manage your business expenses, revenues, and overall cashflow? One solution is to look at the Novo business banking account, which is known for its beautiful mobile interface and fee-less structure. In this Novo review, we figure out how Novo works as a business banking account, as well as how it differs from all the other business banking accounts on the market.

At a Glance: Novo Business Banking

Novo offers an online business banking account with a focus on the United States. The company strives to eliminate the usual fees that come with business banking accounts, while also making it easy to set up an account and complete tasks like mailing checks and accepting wire transfers.

As an “all-online” business banking account, you’re left without the option to visit a banking branch (which are extremely helpful to have). However, Novo makes up for the lack of branches by providing a sleek online interface, with a mobile app that would make Chase and Bank of America envious. It’s intuitive, offers the necessary insights at the top of the app, and there’s no need to go digging around to locate essentials like buttons to move money or check recent activity.

Novo supports small business owners, ecommerce merchants, freelancers, and entrepreneurs all around the US. This means you can either be a US citizen or international founder to start an account. There may be plans in the future to expand to other markets, but that hasn’t happened yet.

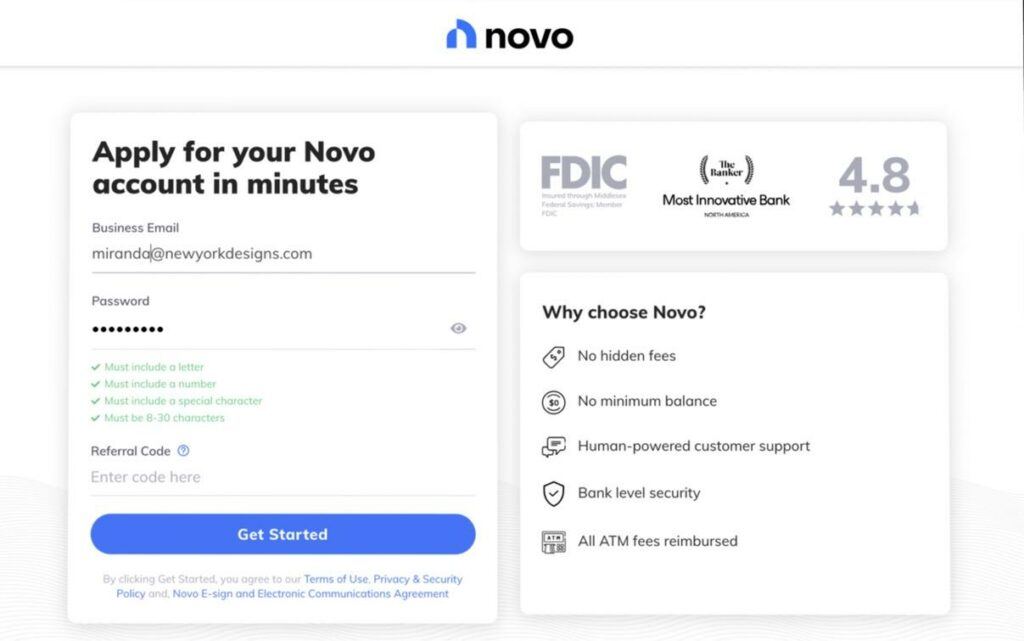

You should remember, however, that Novo is not actually a bank, but a Fintech company, essentially providing all the technological resources you get with your account. Novo states that it operates a completely digital workforce, with its business locations in Miami, New York City, and India. It is partnered with Middlesex Federal Savings, F.A., which is in Somerville, Massachusetts. These types of partnerships ensure you receive stronger technological tools for banking while remaining secure with FDIC insurance and protection from an actual bank.

Pros

- Novo offers a 10-minute business account application.

- There are no hidden fees while signing up, holding an account, or closing an account. Novo provides a complete list of fees (most of which are $0) to maintain full transparency throughout your time as a customer.

- There are no monthly fees.

- Make quick transfers without any obstacles. Mail checks, complete ACH transfers, and accept incoming wires, all free.

- You get the benefits of a beautiful online interface from a tech company while still receiving an FCIC-insured bank account.

- Their customer service is solid for a Fintech company.

- You get refunds for all ATM fees you encounter.

- All customers receive a virtual and physical debit card for business spending.

- You can send invoices and integrate with multiple payment tools like Wise, Stripe, and PayPal.

- Integrate directly with your tax software.

- They have a product called Novo Boost for receiving payments within hours instead of days. This works through the Stripe integration for speeding up transfers to your bank and providing more immediate cash flow to your business.

Cons

- There are downsides to the Fintech/bank combination

- You don’t have access to physical banking branches.

What Makes Novo Business Banking Stand Out?

Here’s the trendy new setup: a fancy Fintech company teams up with a small bank. And that’s precisely what Novo has done. This solves countless problems. For one, business account users don’t have to suffer through the often abysmal online and mobile interfaces slapped together by banks. In addition, you’re not giving your money to a Fintech company that mostly cares about a growing user base. Instead, your money gets stored and ensured by the partner bank, in this case, Middlesex Federal Savings, F.A.

So, this allows Novo to stand out in many ways with the benefits of a stunning online interface and the support from a banking institution. Users can mobile deposit checks, complete bank transfers, and check their balances, all from one simple interface.

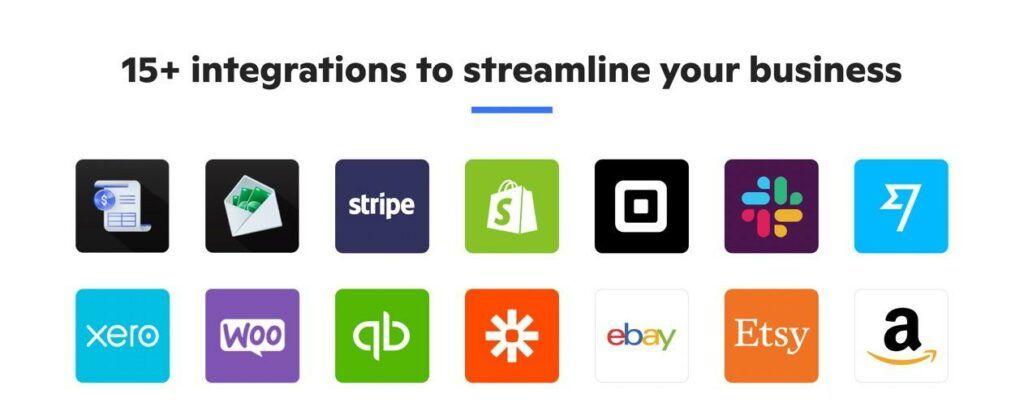

Novo stands out from other Fintech companies by integrating with dozens of apps like Etsy, Shopify, Stripe, and Wise. Fees are also virtually nothing, and transparent. There are no hidden fees, no monthly payments, and no initial payments to sign up. Finally, you don’t have to go through the lengthy process that usually happens when you apply for a business bank account. Novo keeps it to about 10 minutes. That’s it.

Novo Review: Business Banking Offerings

We've already seen in our Novo review that it has a wonderful interface. We know it’s partnered with an FDIC-insured bank. And we know it's meant for small businesses, ecommerce merchants, and freelancers. But what about the offerings? The features you can expect to receive after signing up for an account.

To begin, Novo provides one type of account: Business Banking.

The business banking account opens up a nice list of features for you to manage the workflows of your business financials.

Here’s what we like the most:

A 10-Minute Application

As many business owners know, business banking accounts and credit cards typically have special application processes, often requiring a long waiting period, higher than average requirements for credit, or a long application to fill out.

Unfortunately, that’s still the standard experience you’ll encounter whenever applying for a business banking account. Luckily, Novo gets rid of that entire process with its 10-minute application process.

Create an account on whatever device you want, without having to speak directly to a bank teller, and without running through a credit check or long application or waiting line.

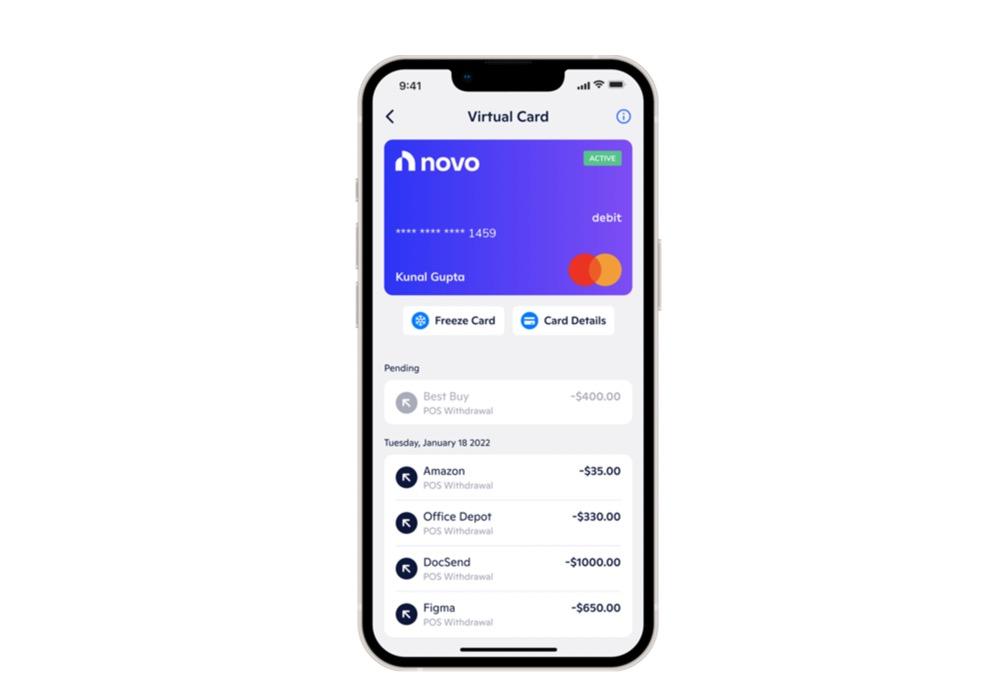

The Novo Virtual Card

Novo sends all users a physical Mastercard debit card for business expenses. Outside of that, you’re given a virtual debit card for spending without the plastic card. This way, you can link the card to your Apple Pay or Google Pay apps, keep your account secure on your phone, and check on recent transactions.

Another advantage of the virtual card is that you mustn’t wait around to receive your physical card to spend from your business account. And as a bonus, Novo offers a button to freeze the card if you notice any suspicious activity or lose the physical card.

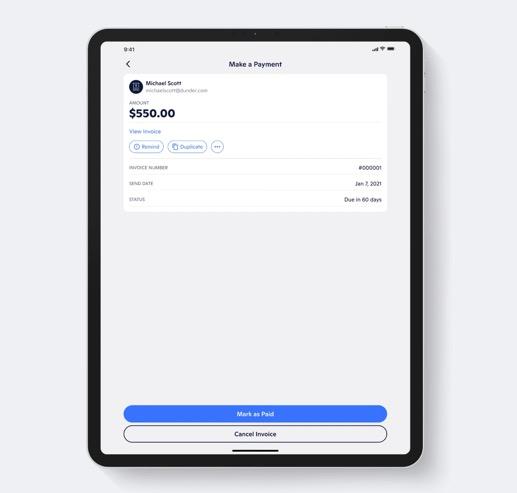

Invoices and Payment Integrations

Instead of paying for a completely separate invoicing software, Novo provides invoicing for free. With branded, personalized invoices, freelancers and small business owners have the opportunity to send invoices in a matter of seconds. There’s no limit on the number of clients or invoices you create.

As for payment methods, Novo allows you to accept ACH transfers and physical check payments, which are the easiest options for getting rid of transaction fees. Having said that, it’s possible to accept credit cards—and other payment methods like Apple Pay—with the PayPal, Square, and Stripe integrations. Simply choose which options you want to include in your invoices.

Novo Reserves: Set Aside Money For Taxes and Payroll

The Novo Reserve feature ensures all business owners set aside the right amount of money for things like:

- Estimated taxes

- Sales tax

- Profit

- Payroll

- Future business expenses

The online interface shows 5 reserves for you to manage budgets. Move money to and from those accounts, while also storing incoming money in those reserves for automated savings.

Free Transfers and Payments

Whether sending an ACH transfer or check, you need not worry about extra fees. International transfers get processed through Wise, and there are unlimited transaction inside the US, all for free.

Furthermore, it’s free to deposit a check on your phone, and you can accept or transfer money from another person or business without extra fees. Transferring money from a third-party account to your Novo account also takes just the click of a button, and it doesn’t cost a thing.

Novo Boost: Faster Payments

Speaking of payments, Novo provides a product called Novo Boost, which allows small business owners the chance to receive their revenues in their business banking accounts in a matter of hours instead of days. It only works through the Stripe integration, but it functions similar to some of the expedited payment transfer tools you may find in platforms like PayPal and Venmo, where you have the option to either accept the standard payout (which takes a few days), or to speed up the money transfer for a small fee.

Novo Boost works great for freelancers, ecommerce stores, and other small business owners who want faster access to their revenues for using elsewhere in their business. It essentially sends more immediate cash flow into your business to pay your team, reinvest in growth, or use for your vendors. And it's all done through Stripe, so that money goes directly to the business banking account you have linked to Stripe.

It appears they may have plans to add Novo Boost for some other payment integrations, besides Stripe, so hopefully we see that available for options like Square, PayPal, and Wise. Regardless, it looks like a promising feature that any business owner can try out, or use on occasion when they're in need of more liquidity.

Novo Boost gets configured inside the Novo Stripe app, where it asks you to opt into Instant Payouts. That allows you to get paid up to 2 days earlier than usual, and it doesn't matter where those payments are coming from; they could be from invoices or your online store, as long as it's through the Stripe app.

So, to sum things up, here's what you get with Novo Boost:

- A faster payout method through the Stripe payment integration.

- Access to these funds regardless of whether they come through an online store or invoice.

- Improved cash flow for spending on the rest of your business.

- Payments that take hours instead of days. Most Novo Boost users get their money up to 2 days faster than those who use the standard Stripe method.

- A simple integration that only requires you to click one button to turn on the rapid payments.

- Automatic payouts whenever there's an active balance in Stripe. This means you never have to go into the Stripe app to start a transfer. It's all done for you.

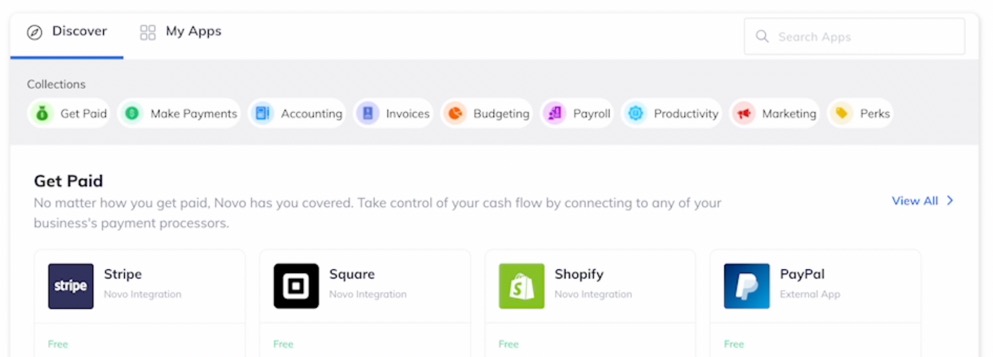

Numerous Financial Integrations

Very few business banking apps integrate with a wide range of apps like Novo does.

To begin, Novo offers deep integrations with payment processing tools like Stripe, Square, and PayPal. Collect invoices with ease, and even opt to charge your clients for the credit card fees.

Ecommerce platforms and marketplaces have integrations with Novo as well. The list includes Shopify, WooCommerce, Amazon, Etsy, and eBay. Finally, international payments become easier, and cheaper, with the Wise integration.

International Spending Freedom

The Novo debit card gets accepted anywhere you travel in the world, as it contains an EMV chip that’s both secure and transferable, regardless of where you go. Cross-border travels aren’t limited with a US-only debit card. Novo only supports US-businesses, but you’re still able to spend your money elsewhere.

You also get immediate notifications whenever spending, just in case you need to freeze your account.

Finally, Novo’s ATM fee reimbursements apply while traveling. So, take a trip to Italy, use an ATM (with a fee), and get that fee refunded by Novo.

Novo Review: Fees and Pricing

As mentioned earlier in this Novo review, there are no hidden fees when you sign up. Novo is transparent with its fees, even listing a Checking Fee Schedule right on its website. Keep in mind that this is a fairly old document, but everything is accurate.

Here are the highlights:

- Monthly service charge: $0

- Sign up fees: $0

- International transfers: $0

- International ATM fees: $0

- Annual percentage yield: 0%

- Fee to close your account: $0

- Incoming and outgoing ACH transfers: $0

- Incoming domestic and foreign wires: $0

- Stop payments: $0

- Debit card replacement fee: $0

- Physical check payments: $0

- Bank check: $0

- Paper statement fee: $0

We particularly like the paper statement fee at $0, since it’s often easy to forget that some banks still charge if you’re not onboard with digital banking.

Anyway, that doesn’t mean there’s a complete lack of fees from Novo. In fact, the one part that’s a little misleading is the $50 minimum amount to open an account. Having said that, it’s still fine to hold a minimum balance of $0, just not right at the beginning.

Here are the main fees:

- Insufficient funds charge: $27

- Uncollected funds returned fee: $27

And that’s all! The only reason you’d see extra charges on your business account is because you tried to charge your debit card without having enough funds. Or when you have the funds, but they’re not available to use for a charge (the uncollected funds returned fee). Both of those are $27.

Overall, there’s no need to think about a recurring monthly fee, or having to keep your balance above a certain minimum. This is the type of business banking accounts we should all want, considering there’s no reason to pay extra money just to have a separate banking account for your business spending and money management.

Note: You will most likely incur fees when accepting invoice payments through third-party apps like Stripe, PayPal, and Square. These are for credit card processing, taken by the card companies and not Novo.

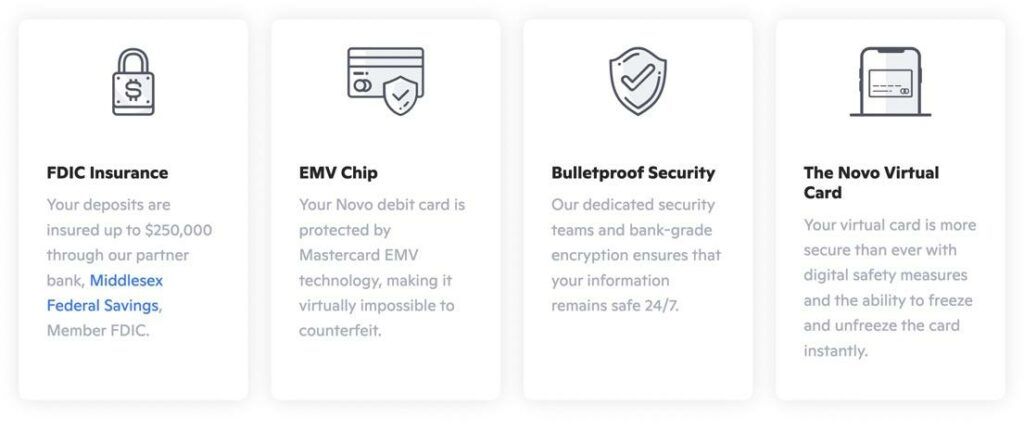

Novo Review: Security

A significant concern with Fintech is security. After all, Fintech companies mainly focus on user base growth and not protecting customers as much as traditional banks.

The good news is that Novo isn’t alone. They’ve partnered with Middlesex Federal Savings, F.A. which is FDIC insured for up to $250K per depositor. This means all fraudulent debit card transactions get reimbursed after a review process, and although rare, any money stolen from your account, is insured.

As another safeguard, all Novo debit cards have chip technology powered by Mastercard. The EMV chips are known for their anti-counterfeit security, so you should feel confident when using your card.

Other security measures from our Novo review include:

- A “Freeze Account” button in the online dashboard and mobile app.

- Strong security and encryption for all information and payment data that passes through the account.

- A virtual card that remains on your phone and online dashboard, making it impossible to access without the right login credentials. In short, it’s much harder to steal and use.

- A list of recent transactions to monitor transactions and identify questionable activity.

Novo Review: Customer Support

Customer support is always a concern with Fintech companies, seeing as how tech companies often shoot for rapid growth at the expense of user base concerns. As of right now, it appears Novo has decent customer support.

They claim you’ll speak to a “real person” (that should be a given with banking), but there’s no information about whether that human workforce is outsourced or not. As far as we’re concerned, a strictly outsourced workforce is usually no more helpful than a chatbot.

But during our testing, the customer support email address (listed right on the Novo website) got us in contact with a support representative within 24 hours. They replied with, what seemed like, a knowledgeable email about integrating a Wise account. It sounded a little scripted, but at least we received some answers.

Having said that, our Novo review showed no phone number to be found, and no chat box. And, of course, Novo offers nothing in terms of physical branches, so you can’t find that unique insight that often arises while speaking with a person at a bank.

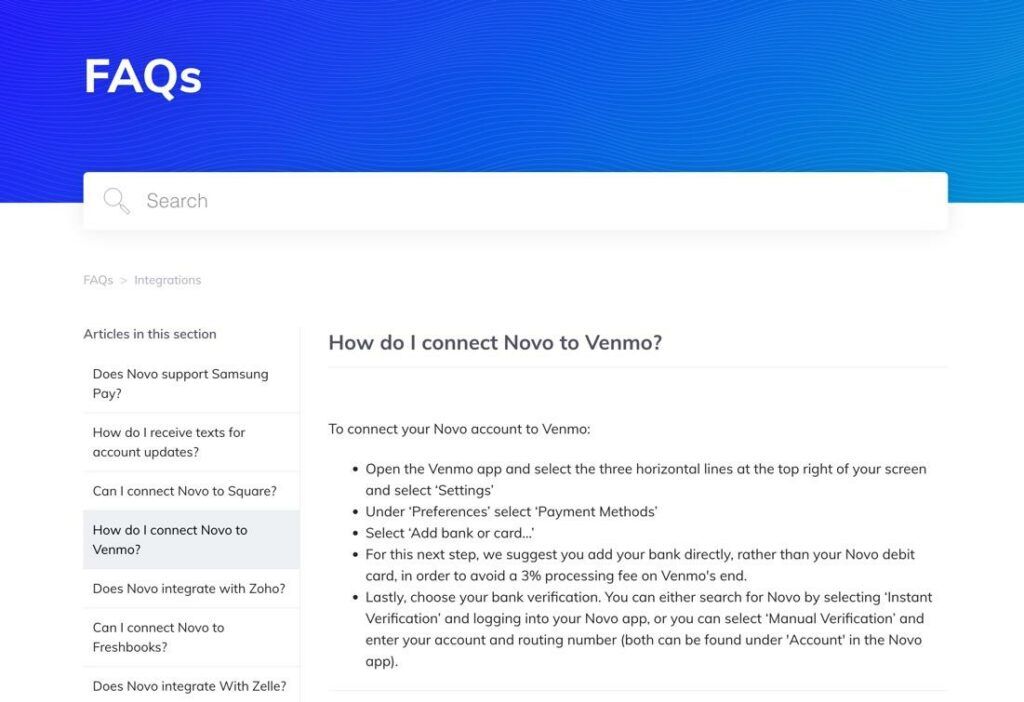

As for online resources, Novo links to FAQ and Help pages, but they both go to the same place. It’s a respectable knowledge base with search bar to locate articles that may answer questions. You can also search by category.

They have hundreds of knowledgebase “articles,” but they’re more like FAQ answers, with extremely short answers and no visuals to guide you with things like integrations or the interface. We’d like to see this improved in the future.

You can connect with Novo on just about every social media site, ranging from Facebook to Youtube. That’s all somewhat pointless for a bank, but considering this is also a Fintech company, we can obviously see that their social media pages are for marketing and not customer support.

Finally, Novo offers a blog with small business stories, company news, business building, and more. Again, blogs are more for marketing, but it’s very possible you answer some of your questions after reading the Novo articles.

Is Novo Business Business Banking Right for You?

If you’re okay with using a Fintech company for your business banking, Novo looks like a wonderful option with virtually no fees, a beautiful mobile interface, and both physical and digital debit card options.

We like it best for freelancers and ecommerce businesses that work with invoices. You can send and receive money with ease, forget about most fees, and move around the world with no international restrictions. Pair that with the multiple integrations and Novo seems like a winner.

Please let us know in the comments if you have any questions about our Novo review!

Comments 0 Responses