您是否厌倦了依靠多个平台来处理金钱的不同方面? 如果是这样, Revolut 可能是答案。

Revolut 提供所有财务方面的一站式服务,为您提供储蓄、汇款、投资和合理花钱所需的一切。

您还可以享受在国外消费和汇款的自由,无需大惊小怪,也无需支付高额费用。

听起来不错? 然后在我们深入研究时坚持我们 Revolut. 此移动应用程序承诺为个人和企业帐户提供全面支持。

Revolut 可能是众多国际支付平台之一。 尽管如此,它还是提供了一些突出的功能,使其成为市场上增长最快的金融应用程序之一。

这是足够的序言; 让我们深入了解这篇评论的精髓...

什么是 Revolut?

正如我们刚刚暗示的那样, Revolut 是增长最快的数字银行,并提供大量的内置功能和可选的附加功能,但是这一切从何而来?

由 Vlad Yatsenko 和前交易员 Nikolay Storonsky 于 2015 年创立,Storonsky 成长为 Revolut 由于他对国外转账和收款所带来的不公平兑换率感到沮丧。

最初只是一个预付卡和应用程序,但很快就扩展到包含广泛的功能。目前,全球有超过 5 万用户使用该平台来管理日常财务。

为了将资金管理重新交到帐户持有人的手中,多币种借记卡及其免费应用旨在帮助您更好地了解自己的财务状况,并确保最大程度地利用自己的资金。

这意味着没有不道德的货币兑换费用。 和 Revolut,您只使用真实汇率。

所以,虽然在其核心 Revolut 是一种数字支付服务,其庞大的服务量使其远不止于此。

因此,无论您是希望更好地了解自己的资金的人,还是希望以安全的方式发送和接收商业交易的企业主或自由职业者, Revolut 派上用场了。

Revolut 利与弊

优点👍

- 设置速度非常快:您可以在几分钟之内创建一个帐户,从设置到批准,您几乎不必等待几天。

- 无需信用检查即可设置帐户。

- 您可以访问免费的多币种经常账户,并可以灵活地持有多达30种不同的货币。

- 在国外使用您的卡不会产生任何费用。

- 该应用程序非常用户友好。

- 您将对财务的各个方面享有无与伦比的控制权。

- 没有透支,所以没有意外变红的风险。

- 您可以使用24小时客户服务。

- 很容易为您省钱 Revolut'金库'功能。

- 出色的防欺诈工具

- 预算功能不仅可以很好地跟踪您的支出,而且可以跟踪您在哪里支出,以确定可以拉紧皮带的区域。

缺点👎

- 不同于一些 Revolut的竞争对手如 Monzo,它目前不是一家完全许可的银行。 因此,如果出现问题,您将不受高达 85,000 英镑的金融服务补偿计划 (FSCS) 的保障。 也就是说,你确实得到了一定程度的保护,因为 Revolut受金融行为监管局 (FCA) 监管。

- 周末外汇汇率波动。

- 免费提款数量有限。

- 没有面对面咨询的选项,因为在撰写本文时, Revolut 没有任何现有的分支。

- 没有创建联名帐户的选项。

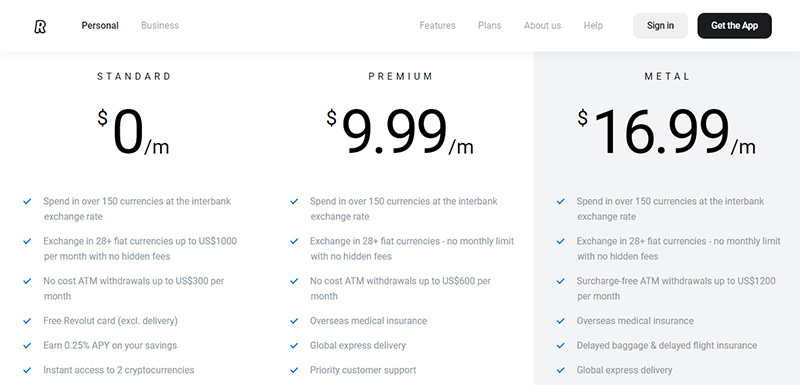

Revolut的定价

入门 Revolut 不必昂贵。 事实上,根据您正在寻找的特定功能,您可以创建个人或企业 Revolut 今天根本算不了什么!

第一步是为您选择正确的计划,因此让我们看一下提供的计划,这些计划将使您退缩多少以及可以期望得到的回报:

标准帐户:(免费)

- 您可以使用银行间汇率在150多种主要货币(欧元,美元,英镑等)中消费。

- 您可以28种法定货币兑换货币,每月最高$ 1,000(无隐藏费用)

- 免费ATM提款,每月最高$ 300

- 一个自由 Revolut 卡(有运费)

- 节省0.25%的APY

- 你得到一个 Revolut 一个孩子的初级帐户。

这个 Revolut 高级计划:(每月 9.99 美元)

您可以在免费软件包中获得所有内容,此外:

- 免费ATM取款,每月最高$ 600

- 海外医疗保险

- 全球快递

- 优先级客户支持

- 您的储蓄将产生0.50%的APY。

- 您将获得独家设计的高级卡。

- 您将获得一次性虚拟卡。

- 使用LoungeKey通行证

- 如果您的航班延误了不到一个小时,您将获得免费的休息室通行证。

- Revolut Junior 最多可容纳两个孩子。

金属计划:(每月16.99美元)

您将获得上面列出的所有内容,此外:

- 无附加费的ATM取款,每月高达$ 1,200

- 行李延误和航班保险

- 独家 Revolut 金属卡

- 如果您的航班延误了不到一个小时,您将获得免费的休息室通行证(最多三个朋友)。

- 你会得到 Revolut Junior 最多可容纳五个孩子。

- 每月一次免费的SWIFT转移。

上述计划涉及个人账户。假设您正在寻找一个企业帐户。在这种情况下,定价又会有所不同,并且结构会变得更加深入,因为它们可以根据您的业务增长而扩大或缩小。

对于自由职业者来说,还有一组单独的选项。

不用担心; 即使有 Revolut 企业帐户,您仍然可以免费启动和运行。

也就是说,共有三种付费选项:Grow、Scale 和 Enterprise 计划,它们的价格分别会上涨。

要了解更多信息并了解哪一个最适合您当前的业务需求,请查看 Revolut's 定价页面 ,了解更多详情。

Revolut 评论:转会费

其中一个 Revolut其突出特点是价格实惠,在您的外汇限额内提供免费现金转账。

如果获得负担得起的汇率不是您使用的主要原因,那么这非常有用 Revolut. 就像您严重依赖跨币种银行转账一样,当您超出限额时,您可能会面临兑换金额 0.5% 的费用。

出于这个原因(当然还有其他原因),不同的价格计划很有帮助。 如果您可能会定期转账,请选择以下之一 Revolut的高级帐户使您能够这样做而不会产生高额费用。

通常,您可以期待 Revolut的汇率比货币兑换处和大多数其他卡供应商更具竞争力。

不过,值得注意的是, Revolut的费率在周末有所不同。 在此期间,您可以预期涨幅在 0.5% 到 2.5% 之间。

支付记录

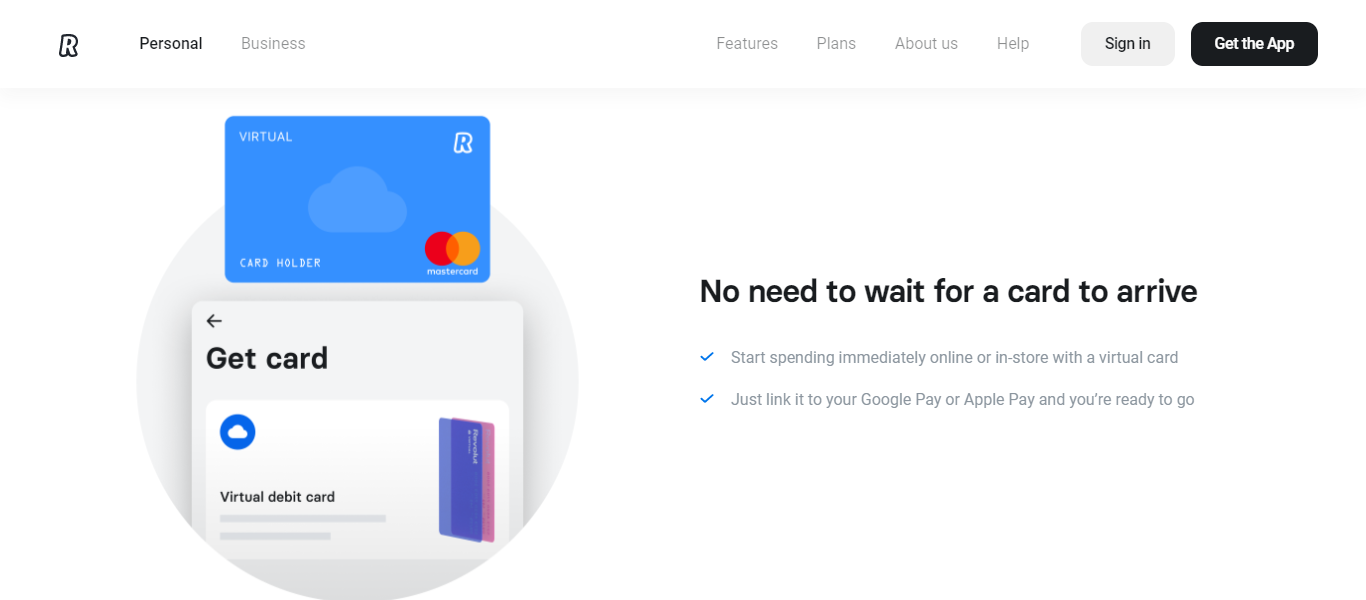

无论是在国内还是国外 Revolut 允许您通过虚拟或虚拟支付 实体卡.

两者都是免费的(无交易费),但如果您选择实体卡,则必须支付邮费(具体取决于您选择的送货方式)。

实体卡

您将获得一张具有非接触式功能的预付万事达卡或维萨卡(分配给您哪一张取决于您所在的位置)。

您可以在 ATM 机以及国内外大多数零售商处使用此卡。您可以用您的本国货币为卡充值或兑换成其他货币。

如果您选择后者,您将锁定当前汇率,这意味着如果汇率下降,您仍然可以毫无问题地使用它!

或者,您可以按原样在国外使用您的卡。 Revolut 将自动应用正确的货币和当时适合的汇率。

无论哪种方式,您都需要为实体卡设置 PIN 码,以启用芯片密码支付和磁卡支付stripe 卡支付。

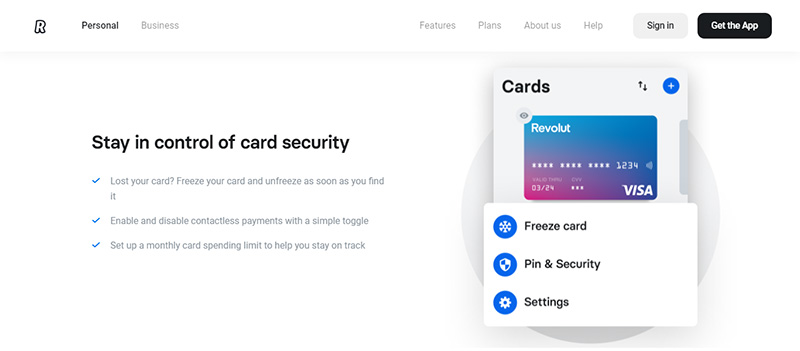

Revolut卓越的安全设置使您只需通过应用程序按一下按钮即可冻结您的卡。

如果您怀疑您的卡被欺诈使用,您还可以禁用现金提取和电子商务交易。

虚拟卡

就像实体卡一样,虚拟对应方连接到您的帐户 Revolut 应用程序。 同样,您可以轻松控制您的虚拟卡。

虚拟卡可以免费订购,几乎不需要花费任何时间进行设置,但是,当然,由于没有物理卡,没有密码,因此不能用于在ATM上提取现金。

此外,虚拟卡缺少物理卡随附的其他一些安全功能,包括:

- 五月stripe 付款禁用

- 基于位置的安全性

- 禁止非接触式付款

- 禁止ATM取款

- 电子商务交易停用

但是,选择虚拟卡有一些好处,尤其是如果您大部分在线消费时,尤其如此。 由于虚拟卡每隔几个月就会被删除并替换为新的虚拟卡,因此可以保护您免受在线卡欺诈的侵害。

假设您选择金属计划。在这种情况下,您可以使用无限量的一次性虚拟卡,这意味着每次交易后卡的详细信息都会发生变化。

这使得黑客很难追踪您的在线账单信息并窃取您的付款详情。更不用说,即使不可信的网站泄露了您的信用卡信息,您仍可免受欺诈,因为信用卡信息不再正确。

Revolut的主要特点

说到功能, Revolut 真正在竞争中脱颖而出。

它为用户提供了广泛的好处,将其功能分为几个类别,这些类别根据您使用的是个人帐户还是企业帐户而有所不同。但是,某些功能跨越两种类型的帐户。

也就是说,让我们从查看个人帐户用户可用的功能开始:

帐户:

- 关联账户: 由于 Revolut的开放式银行设施,您将享受无与伦比的支出控制。 只需将您的所有外部银行账户与 Revolut 应用程序从一个地方方便地了解您的财务状况。

- 预算和分析: 您可以根据实时分析设置每月预算。 在这里,您将全面了解您的帐户状态,这对于本月保持正常运转非常有用。 不仅如此,该应用程序还使用智能技术根据过去的使用情况预测您的消费习惯。 有了这些信息, Revolut 提供有关如何更好地进行预算的定制化、有用的提示。

- 牌: 从设置消费限额到冻结丢失或被盗的卡,以及屡获殊荣的反欺诈系统,您可以完全控制您的卡设置。 Revolut 还为您在网上购物或新的或不熟悉的地方提供独特的一次性卡。 顾名思义,这些卡只能使用一次。 然后,一旦付款,卡的详细信息就会发生变化,因此您的帐户永远不会受到损害。 而且 – 您可以在 150 多个国家/地区以极具竞争力的低汇率使用这些一次性卡。

- 初级帐户: 以可控的方式向孩子介绍资金管理 Revolut的初级账户。 这些是为孩子设计的,但不要害怕,它们完全由你,父母控制。 您可以跟踪他们的消费、冻结和解冻他们的卡,它带有一个旨在帮助孩子们更好地了解资金管理的初级应用程序。

- 口袋:不要通过预先创建钱袋来考虑账单或支出。 付款后,这些费用的正确金额会自动从您的帐户中转出并入您的口袋。 您不得不担心意外丢失付款的日子已经一去不复返了。

财富:

- 商品: 从黄金和白银到其他贵金属——您可以快速轻松地从内部交换这些商品 Revolut的应用程序。

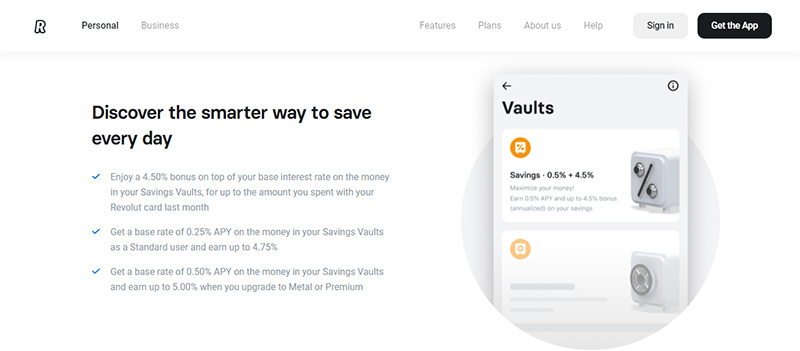

- 保管箱: 有什么你关注的吗? 如果您在阅读本文时正在点头,请考虑将您的钱投入到 Revolut 保险库并为你想要的东西存钱。 您可以用 30 多种货币(包括商品)存钱。 此外,如果您要为与朋友或家人的活动存钱,您可以打开一个群组保险库,将您的积蓄集中在一起。

- 备用变更汇总: Revolut 会将您的卡购买四舍五入到最接近的整数。 然后将此差异存储在您的保险柜中,以备不时之需。 该应用程序还允许您将备用零钱乘以原始金额的十倍,然后再进入您的储蓄 - 如果您需要推动储蓄更多,这会产生奇迹!

- 汇款:无论您身在何处,都可以付款,而无需支付任何隐藏费用。 有30多种货币可供选择,并使用银行间汇率,汇款从未如此简单。

- 团体账单: 永远不要再用团体账单来支付你的账单份额。 立即从一个地方轻松跟踪、结算和拆分账单。 无论您是支付月租的一部分还是一次性支付,只需输入您的份额,然后 Revolut 会算出你欠多少钱。 而且,如果你欠了钱,该应用程序会发送礼貌的提醒,让你免于任何不舒服的谈话。

- 订阅: 此功能为您提供所有订阅,直接付款和定期付款的简单概述。 如果有任何过时的订阅服务,您可以轻按一下以快速阻止它们,从而帮助您缩减支出。

附加功能:

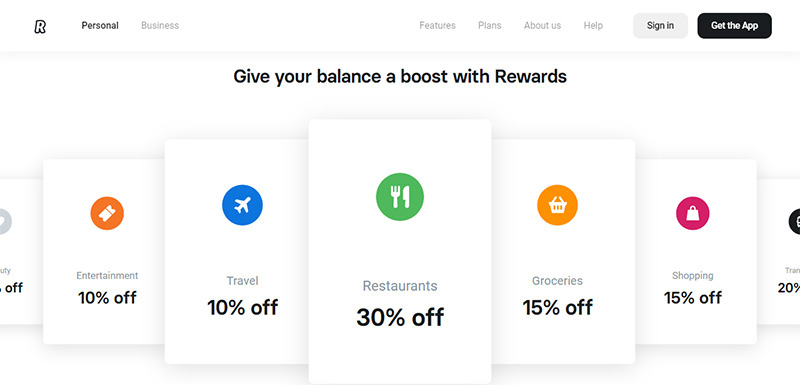

- 奖励: 您将享受一系列知名品牌的独家现金返还优惠。 这种奖励计划不仅可以为您赚取现金,还可以根据您的购物习惯创建个性化的优惠。

- 捐款: 向您最喜欢的慈善机构捐款变得简单,而且没有隐藏费用,他们将收到您礼物的 100%。 Revolut 与一系列知名的全球慈善机构合作,您可以通过各种方式进行捐赠,包括断断续续的礼物和定期付款。

- 海外保险: 只为您在国外的日子支付保险,感谢 Revolut独特的地理定位技术。 该保险涵盖紧急牙科和医疗旅行保险,并迅速向您支付报销 Revolut 帐户。

- 设备保险: 每周仅需£1英镑,就可以在全球任何地方获得手机保险,以应对所有意外损坏。 这包括在保修范围之外造成的损坏,并且可以在多个移动设备上携带。

还有一系列旨在支持企业主的附加功能,使您能够以优惠的价格接受来自世界任何地方的付款。

而且,通过次日付款结算,您无需等待数天或数周的资金即可清算。

作为企业 Revolut 帐户持有人,您可以从上述功能中受益。 此外,您还可以开设多币种账户。 这些使您能够跨 28 种不同的货币进行国际转账。

所有业务转账均以实际银行间汇率进行。 你也可以使用 Revolut的分析来跟踪您的所有进出并掌握公司支出。

简而言之,一个企业 Revolut 账户让您可以随时随地以最优惠的价格安全地监控、发送、请求和接收资金。

Revolut 安防性能

Revolut 几乎涵盖了所有基础,在安全方面为您提供安全和专业的服务。 他们的一些最显着的安全措施包括:

- 指纹识别:您可以选择使用唯一的指纹安全地登录帐户

- 可定制的功能: 例如,您可以在怀疑有欺诈行为的情况下禁用诸如电子商务付款和取款之类的功能。 您还可以通过单击按钮快速冻结您的卡。

- 一次性虚拟卡: 每次在线支付后,您都可以更改卡的详细信息,这对于保护您免受在线骗子的侵害很长。 即使有人窃取了卡的凭据,这些类型的卡也只能使用一次,因此,如果将其卡入不正确的手中,它们几乎是无用的。

- Sherlock反欺诈系统:这将提供有关欺诈活动的实时警报。

技术支持

尽管 24/7 客户支持曾经是一项高级功能, Revolut 现在已向所有客户开放。

因此,无论您身在世界何处,都可以启动 Revolut的应用程序并与支持代理讨论您遇到的任何问题。

为了即时响应,应用内聊天功能可以位于屏幕底部。 或者,对于不太紧迫的问题,您可以发送电子邮件 Revolut的客服团队随时待命。 用户还可以完全访问 Revolut 社区。

在这里你可以与其他人交谈 Revolut 用户和专家。

这是交换技巧和建议的完美场所!或者,您可以咨询在线帮助中心。在这里您可以找到常见问题的答案以及大量有用的用户提示。

这个 Revolut 应用

我们 Revolut正如您可能已经猜到的那样,该应用程序是您所做的一切的中心。您可以在这里管理财务的各个方面。

该应用程序本身可以免费下载,并提供简单易用的界面。

Revolut 客户可以使用 Apple Pay, Google Pay、非接触式或使用实体卡进行芯片和密码支付。

您执行的所有操作都会向您的手机(如果您下载了 Apple Watch 应用,则发送至 Apple Watch)发送通知,让您可以轻松掌握最新情况。

在应用程序的主屏幕上,您可以导航到以下四个区域之一:

- 您的账户

- 贺卡

- 关联账户

- 初级帐户

或者您可以选择导航到应用程序的其他区域。

例如,检查您的投资、发送付款、设置共享账单、访问附加功能,甚至赚取奖励。

导航您的方式 Revolut 应用程序非常直观。只需很少的时间,您就可以熟悉一切的位置。

只需点击几下即可执行操作或查看帐户,非常简单,因此所有类型的用户都可以轻松访问。

报名参加 Revolut

如果您追求简单, Revolut 拥有您入门所需的一切。他们说您可以在不到一分钟的时间内开设一个银行账户。

由于没有繁琐的文书工作需要筛选,这个过程比在传统银行注册要简单得多。

整个注册过程可以通过应用程序完成。您只需验证您的电话号码即可。

填写完您的详细信息后,您将被邀请从现有帐户进行存款,这实际上是作为初始安全检查。

然后,您将被要求通过上传的护照或驾照图像来发送身份证明。

您通常会在几分钟内收到短信确认您的身份。

设置完成后,您可以选择首选的订阅计划,订购卡并开始消费。

您准备好开始使用了吗 Revolut?

现在我们已经走到了尽头 Revolut 回顾,不可否认 Revolut 为客户提供真正独特的东西。

显然,它不仅仅是一个向国外汇款的平台。事实上,它的服务种类繁多,而且经过精心设计,如果有人愿意,它可以作为某人的唯一账户。

对于仍在学习储蓄技巧的年轻人来说,这是一个绝佳的选择。

其广泛的控制功能提供了安全的入门体验。

此外,它提供了一些市场上最具竞争力的汇率,如果您进行大量跨货币转账,它是一个理想的选择。

您是否正在考虑开设一个 Revolut 帐户? 或者,你认为你会选择其中之一 Revolut的竞争对手,比如 Wise? 无论哪种方式,请在下面的评论框中告诉我们所有相关信息。 我们迫不及待想收到您的来信!

如何存入支票

你好,菲利普,

您是否尝试过联系 Revolut 通过应用程序?