该 Wise vs Revolut 回顾一下,我们正在研究两种最流行的在国外汇款和收款的解决方案。

我们的第一个供应商, Wise, 专注于尽可能便宜地以其他货币汇款。 Revolut另一方面,它是一种提供更多功能的移动银行解决方案。 但是,哪个适合您的目的? 继续阅读以了解...

什么是 Wise?

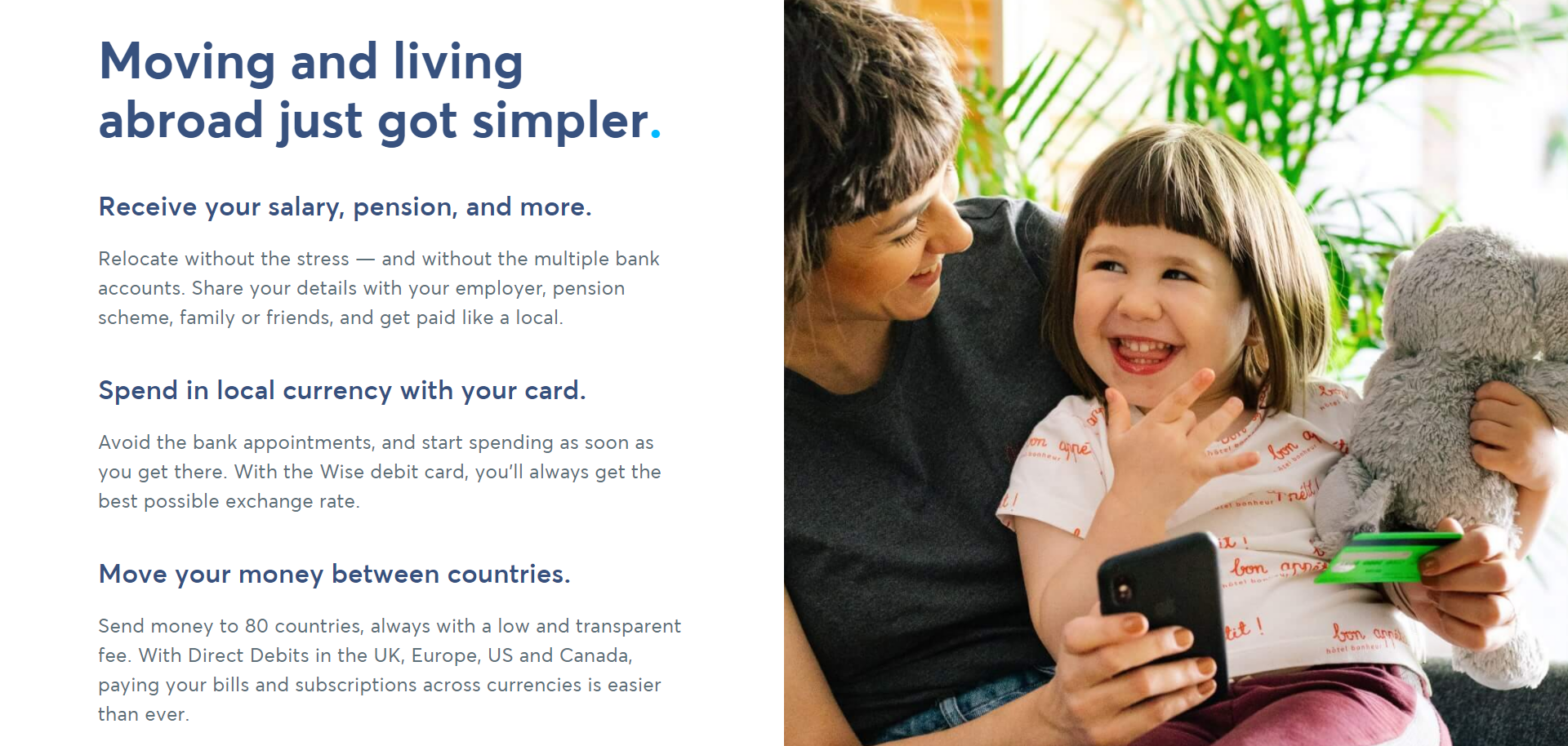

尽管 Wise 提供自己的账户和财务管理服务, Wise的核心价值主张提供了一种快速简便的向国外汇款的方式。

如果你还没听说过 Wise,你可能会认出它 旧名称:Transferwise. 居住在另一个国家的任何外国人都可能听说过这项服务如何帮助他们将钱汇回家或转换外国储蓄。

名称转换发生在 2021 年 XNUMX 月,使其成为一个相对较新的发展。 但尽管进行了品牌重塑,但并没有太大变化。 该公司仍然是最值得信赖的以经济实惠的方式向国外汇款的服务机构之一。

Transferwise 是由几位想要实现跨境汇款的企业家于 2011 年创立的。

当时,没有一种简单的方法可以做到这一点。每一条向海外汇款的途径都依赖于银行机构网络,而每家银行机构都会在此过程中收取费用。不用说,这很昂贵!因此,Wait 通过使用中间市场汇率进行货币转移,对这一流程进行了创新。

怎么样做?

Wise 使你能够向 Transferwise 无边界账户进行银行转账。一旦资金进入该账户, Wise 使用中间市场汇率转移货币。 换汇后, Wise 然后向您想要汇款的人进行本地银行转账。

因此,任何银行都不能在此过程中增加任何隐藏的转账费用,这通常高达转账的 5%。

Wise,相反,收取一小部分交易费,您就会知道您的预付费用。 在某些情况下,您可能会发现 Wise 进行国外转账便宜 8 倍。

👉阅读我们的 Wise 检讨.

什么是 Revolut?

Revolut'一款声称可以处理'所有金钱'的移动银行应用程序。 它是当今数字和移动银行业务的主要竞争者之一。 实际上, Revolut 是英国增长最快的金融应用程序。

他们于 2015 年在英国成立,最初专注于汇款和兑换。它专注于欧洲市场,但其大部分服务也在美国提供。

所以可以肯定地说 Revolut 正在成为真正的全球金融应用程序。

快进到2021, Revolut 目前在超过 500 个国家/地区拥有超过 35 万个人客户和 XNUMX 万企业客户。

那些日子已经一去不复返了 Revolut 只提供汇款和兑换服务。 相反,客户的整体财务状况现在是他们最关心的问题。

Revolut 凭借其直观的应用程序和财务管理功能,您可以充分控制您的财务状况。

但是,正如你将会看到的,这设置 Revolut 除了 Wise. 无论您是想管理您的财务、帮助您的孩子制定预算,还是从灵活的移动银行账户中受益,都没有关系—— Revolut 拥有一切。

👉阅读我们的 Revolut 检讨.

Wise vs Revolut: 货币

如果您的目标是从国外汇款或收款,您需要确保 Wise 或 Revolut 可以轻松处理您最常用的货币。

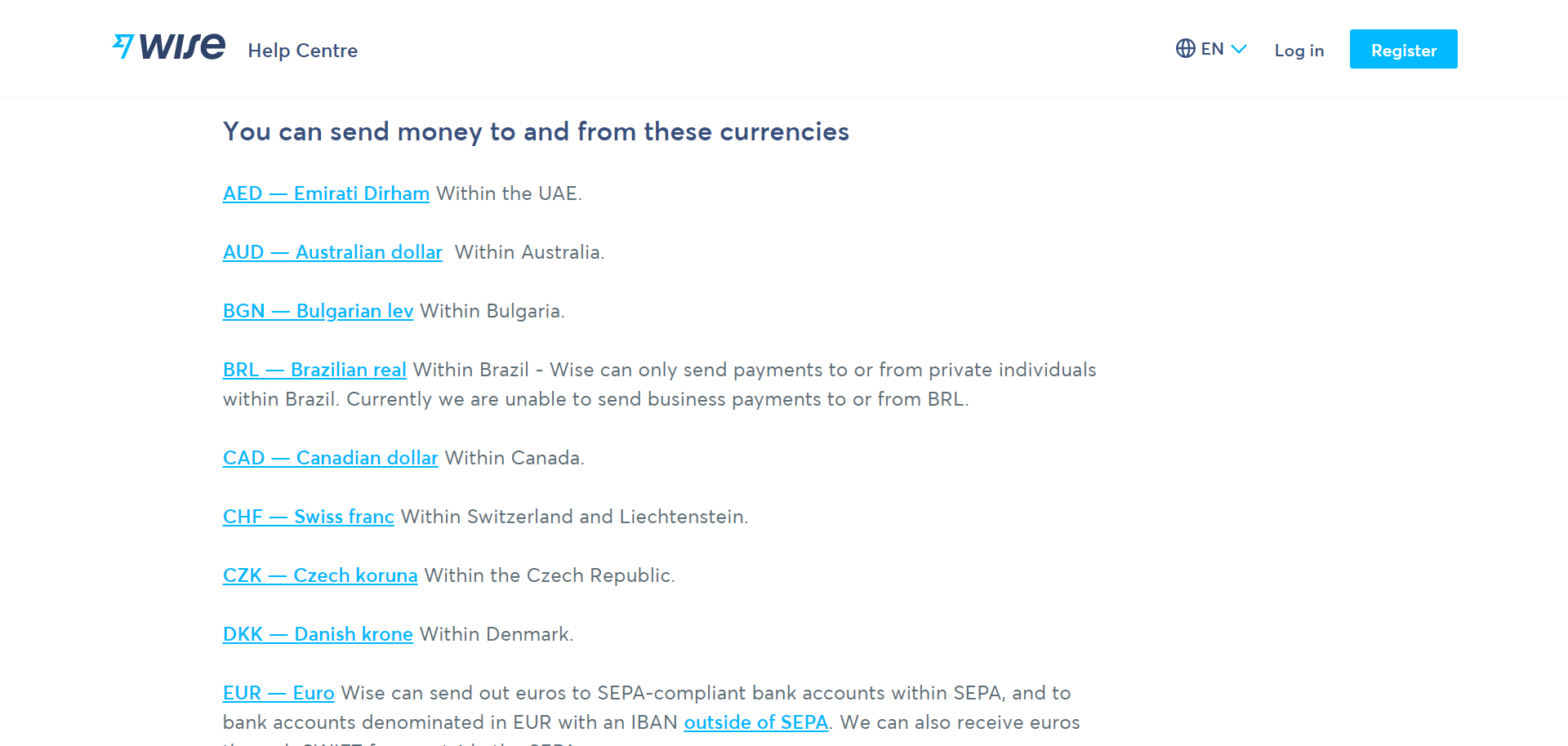

Wise的货币

通过 Wise,您可以使用以下 24 种货币进行汇款和收款:

- AED

- 澳元

- BGN

- BRL

- CAD

- CHF

- 捷克克朗

- DKK

- 欧元

- 英镑

- 港币

- HUF

- IDR

- INR

- JPY

- MYR

- NOK

- NZD

- PLN

- RON

- TRY

- 瑞典克朗

- SGD

- 美元

没有看到您要找的外币?除了上述货币之外,您还可以使用另外 29 种货币进行汇款。但是,您无法将这些货币接收到您的帐户中。

欲了解更多信息,您可以查看 可用货币的完整列表在这里。

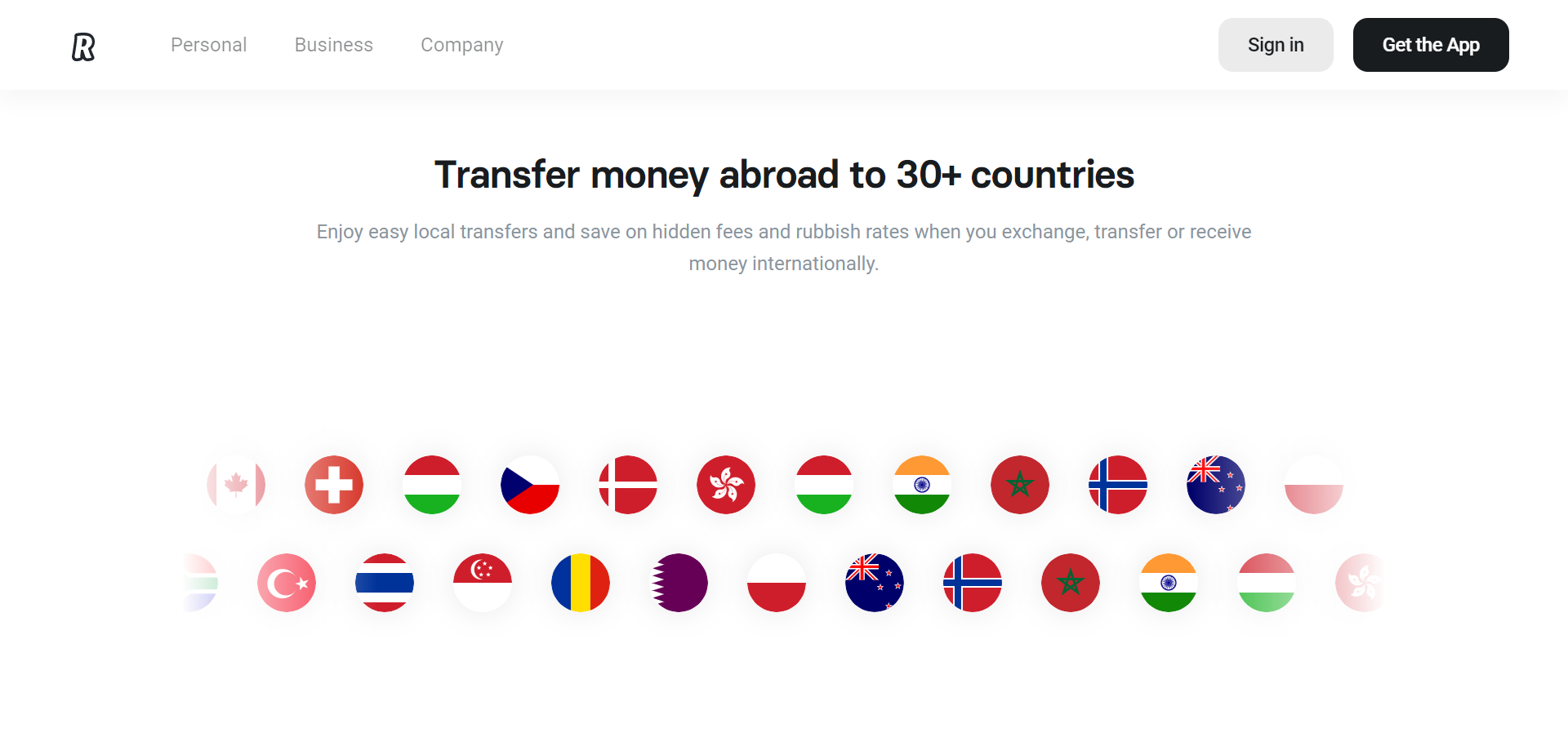

Revolut的货币

Revolut的货币组织方式略有不同—— Revolut的活期账户支持28种货币。

它们是:

- AED

- 澳元

- BGN

- CAD

- CHF

- 捷克克朗

- 英镑

- 港币

- HRK

- ILS

- ISK

- JPY

- 疯狂

- MXN

- NOK

- NZD

- PLN

- QAR

- RON

- RSD

- 擦

- 结构-活性关系

- 瑞典克朗

- SGD

- 泰铢

- TRY

- 美元

- ZAR

然后,您可以在里面兑换 35 种货币 Revolut 应用程序。 除了我们上面已经提到的货币之外,这些货币还包括:

- DKK

- 欧元

- HUF

- IDR

- INR

- MYR

- PHP

您还可以充值 Revolut 也可以使用以下 15 种货币开户:

- 澳元

- CAD

- CHF

- 捷克克朗

- DKK

- 欧元

- 英镑

- 港币

- JPY

- NOK

- PLN

- RON

- 瑞典克朗

- 美元

- ZAR

Wise vs Revolut: 功能和服务

正如我们已经暗示的那样,由 Wise 与 Revolut 这是他们的服务最不同的地方。

那么让我们来看看:

Wise的服务

Wise 保持简单,专注于做最擅长的事情:国际汇款。 正如这所暗示的,它的主要功能围绕着发送和接收资金。

它的功能最好分为个人和企业。

个人用户

个人用户可按实际汇率一次性支付 Wise的小而透明的费用。 您可以使用上述货币发送大额或小额款项。

Wise 还可以让您在资金转移过程中跟踪资金,以便您随时了解收款人的进度。

个人账户持有人还可以设置经常性付款,如账单、租金等的直接借记。您还可以持有多种货币,随时随地轻松管理国际资金。

商业用户

商业用户享受一些额外的功能。 例如,他们可以使用 Wise 在本地或国外支付发票,并同时为最多 1,000 个国际收款人设置批量付款。

然后,只需上传包含必要发票和货币信息的电子表格,然后 Wise 剩下的就做。

您可以将团队成员注册到您的 Wise 帐户,以便他们可以直接从您的企业帐户中扣除费用。 您还可以通过以下方式更好地管理现金流:

- 按团队成员过滤交易

- 下载报表

- 设置支出限额

企业帐户还提供 API 访问权限,因此您的开发团队可以深入研究代码并设置自动化工作流。

而已!

没有花里胡哨,只有简单的多币种账户,可以更轻松、更便宜地向国外汇款。

Revolut的服务

Revolut 如果您正在寻找传统银行业务的功能丰富的替代方案,则可以提供更多服务。 首先,我们来谈谈最接近匹配的特征 WiseS.

发送和接收资金

Revolut 只需轻按一下按钮,即可轻松免费发送和请求资金。 这使得与朋友和家人分摊账单变得轻而易举。 如果您尚未收到付款,您还可以发送提醒。 与任何银行服务一样,您当然也可以向指定的银行账户汇款。

Revolut 还提供免费转账,以便您可以使用 30 多种货币向国外汇款。 这个过程在欧洲、美国、新加坡、日本、澳大利亚等地之间是即时的。

国际和本地业务转移也可以通过 Revolut的企业账户。

而且喜欢 Wise,您可以添加团队成员、查看他们的付款和转账、设置支出限额以及创建审批规则和工作流程。

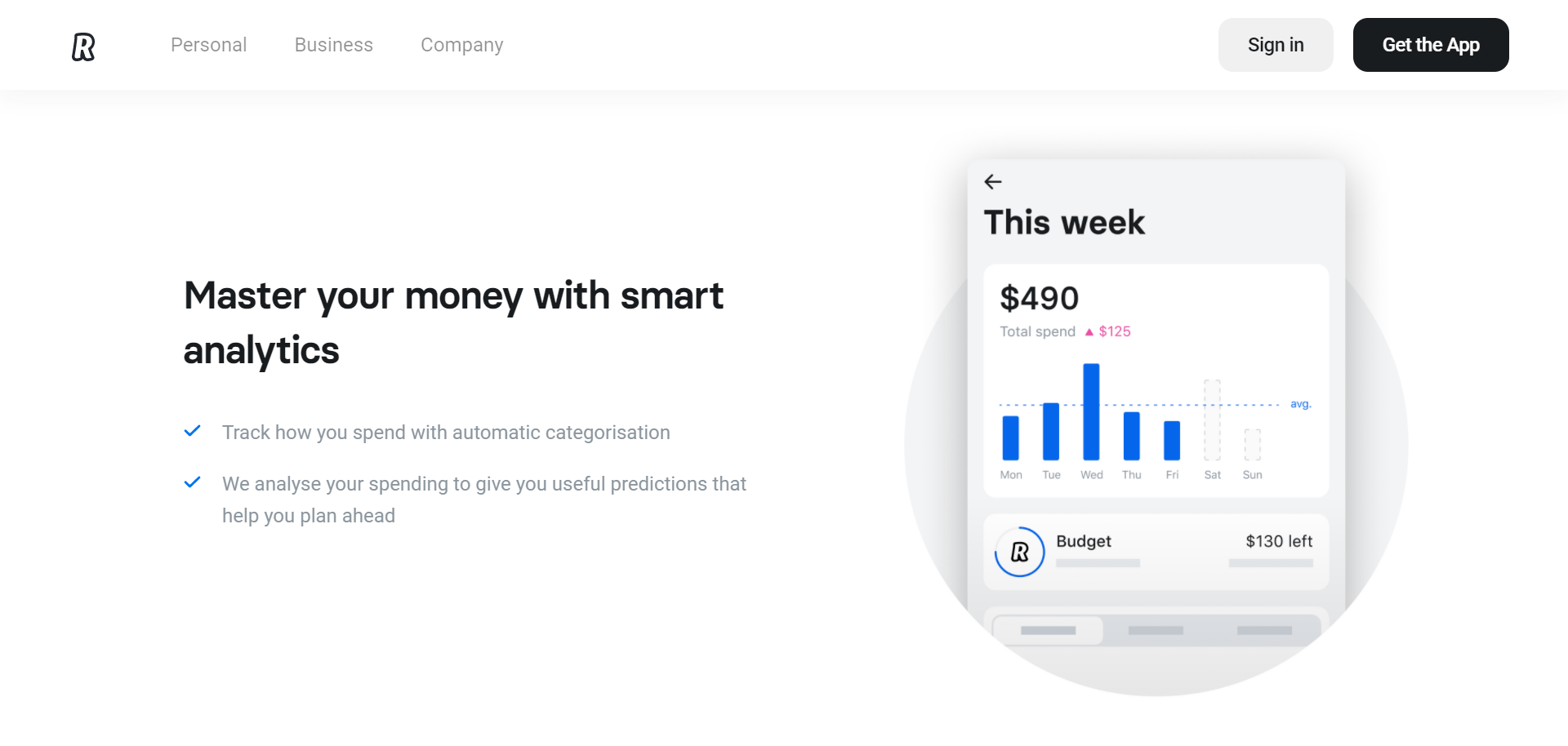

预算和分析

其中 Revolut 远远超过 Wise 与它的实际应用程序一起管理资金。账户持有人可以针对特定类别(例如餐厅和杂货)设置每月预算。

这需要几秒钟的时间,如果您接近超支,您将会收到通知。

Revolut 自动对您的交易进行分类,以便您可以快速分析哪些地方花费最多,哪些地方可以省钱。

您甚至可以创建自定义类别并将过去的交易添加到这些组中。

您还可以建立每个月的储蓄目标。 Revolut 甚至会计算每日支出限额以帮助您实现目标。 Revolut非常适合预算,不仅适合您,也适合您的家人。

所有帐户都可以访问至少一个 Revolut Junior 帐户为 12 至 17 岁的儿童开设,因此您可以帮助他们学习如何负责任地消费和储蓄。

初级计划带有上述所有预算和财务跟踪功能,甚至还有一张供他们使用的实体卡。 此外,当您的孩子付款时,您会收到即时支出警报,并且可以为他们的支出设置自定义控件,包括硬性支出限制。

少年卡也不能用于有年龄限制的商家。

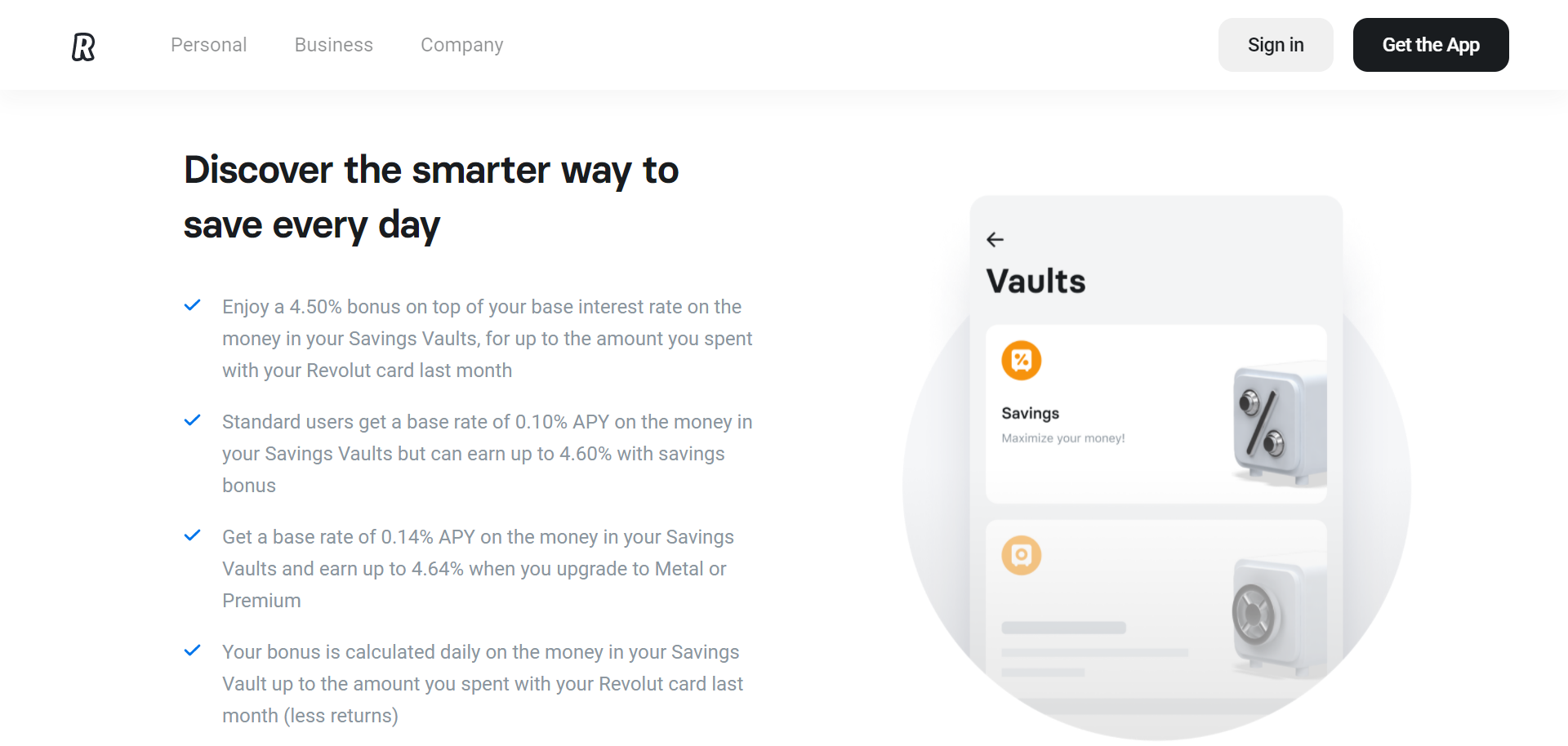

保存保管库

不比 Wise, Revolut 让您从储蓄中赚取利息。 每个定价计划都带有量身定制的利率。 您所要做的就是将您的积蓄存入“保险库”,您将获得高达 0.14% 的年收益率。

您还可以在基本利息的基础上获得 4.5% 的奖金(不超过您在 Revolut 卡片)。 此外,储蓄账户没有提款限制。 您可以随时立即退出。

您可以轻松地为不同货币的特定储蓄目标创建储蓄金库。

这使您的资金与主账户分开,以帮助您清楚地了解哪些资金可供您使用,而无需动用您的储蓄。

为了帮助你填满你的金库, Revolut 使您能够将卡付款中的多余零钱存入您的储蓄中。您甚至可以创建团体保险库,为共同目标(例如假期或梦想家园)进行储蓄。

当然,金库还配备了一些标准账户功能,例如设定储蓄目标和截止日期的能力。

商务功能

最后, Revolut 商业用户可以获得一些帮助他们管理资金的附加功能。

例如,您可以轻松跟踪订阅并查看您经常在哪里消费。

此外,您还可以在一个视图中查看商业软件和在线广告等在线服务的所有订阅和常规支出。

您可以直接通过应用程序暂停或取消多余的订阅,并对定期付款设置限制。如果提供商试图向您收取超过您的限额的费用,这将通知您。

如果您的帐户中没有足够的资金来支付预定付款,您也会收到通知。

企业帐户还可以帮助您跟踪费用。您可以使用公司卡跟踪支出,并将所有分类交易以数字方式保存为收据。

账户持有人可以为每张卡定制其团队成员的访问和支出限额,并将这些费用和其他交易与 Xero. 或者,您可以导出电子表格以与您喜欢的会计工具一起使用。

Wise vs Revolut: 计划和定价

在账户和定价方面, Wise 与 Revolut 采取两种截然不同的方法。

那是因为 Revolut 在银行和财务管理功能方面提供更多。 相比之下, Wise 使开户变得便宜和容易,并从持有多种货币的卡中受益。

让我们来看看:

Wise的计划和定价

虽然账户和计划并不是固有的 Wise的设置为 Revolut, Wise 提供多币种账户。

这允许您以不同的货币存储资金并简化通过您的帐户的转账。个人和企业帐户均可用。

这个 Wise 卡在 200 多个国家/地区可用,并解锁多项福利。

但是至于 实际定价, Wise的个人账户是免费的。 仅当您的余额超过 15,000 欧元时,您才需要为该帐户付费。 如果您超过此限制,则需支付 0.40% 的年费。

如果你想要一个 Wise 借记卡,您可以以 9 美元的价格订购一张或以 5 美元的价格订购一张替换卡。 使用该卡,每月超过 100 美元的所有 ATM 取款费用为 2%。 在当月第二次 ATM 取款后,您每次取款还需支付 1.50 美元。

所有主要货币均可免费将资金存入您的账户。然而,美元电汇需支付 7.50 美元的费用。

但是,您可以通过直接借记以英镑、欧元、澳元和美元免费汇款。对于任何其他货币或付款方式,均需付费。这因货币而异,可以根据以下公式计算 Wise的网站。

如果你想使用 Wise 对于企业,您可以设置一个企业帐户,一次性费用为 31 美元。这将解锁您开展国际业务所需的所有银行详细信息。例如,您将收到 IBAN、路由号码、排序代码等。

您还可以将海外付款接收到您的帐户中,而无需支付高额收款人费用或货币兑换费用。此外,您将能够在 70 多个国家/地区轻松地进行大规模汇款和收款。

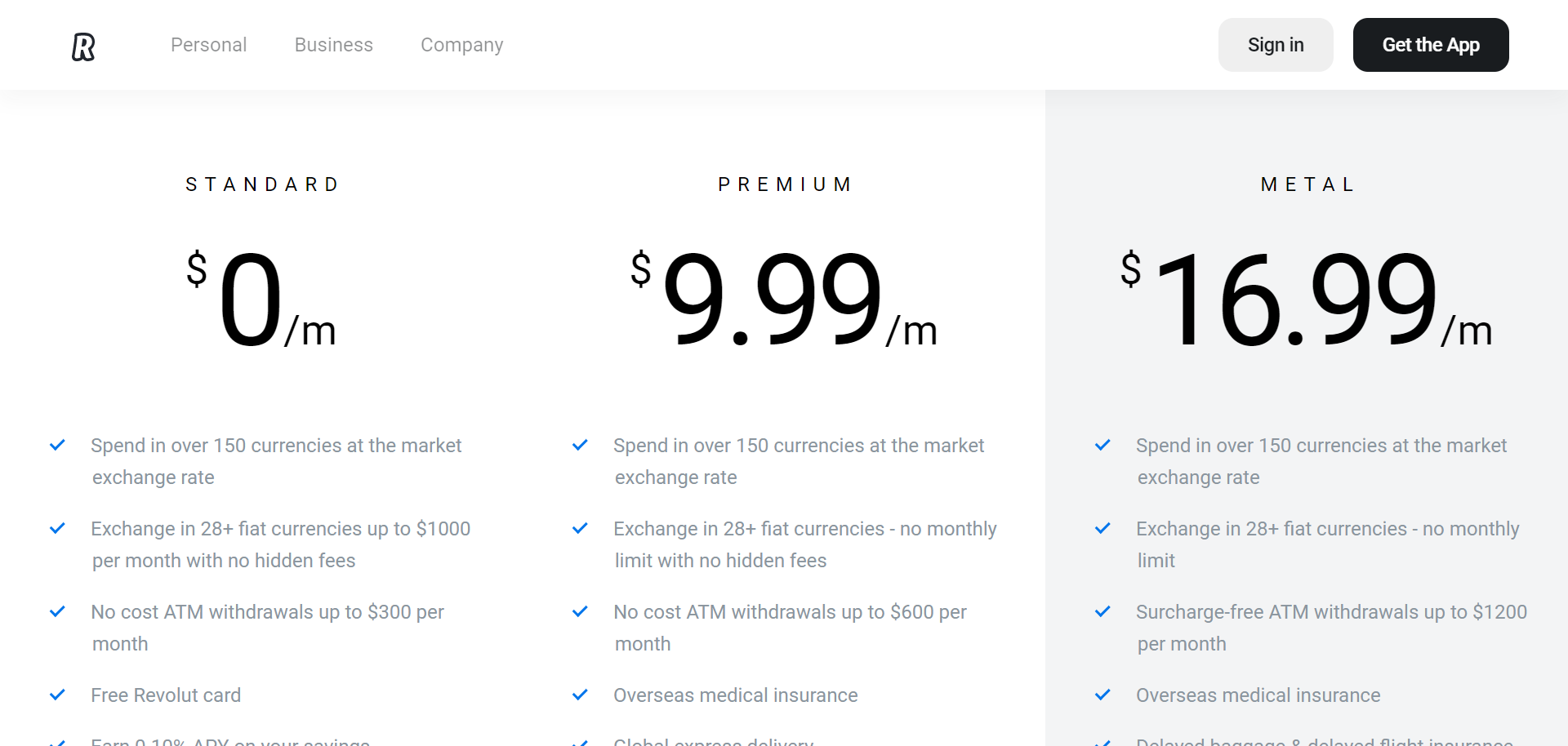

Revolut的计划和定价

与之相反 Wise, Revolut 有几个可供个人和企业使用的计划(免费和按月收费):

个人计划

我们先从 Revolut的免费标准计划。

没有与此帐户相关的每月费用。 您可以按照市场汇率以 150 多种货币进行消费。 您还可以每月兑换超过 29 种货币,最高可达 1000 美元,且无任何隐藏费用。 此外,您无需支付高达每月 300 美元的 ATM 取款费用!

此外,您将获得免费的 Revolut 卡,您可以从储蓄中赚取高达 0.10% 的 APY。 在标准计划中,您还可以享受 Revolut 一个孩子的初级帐户。

标准计划附带所有 Revolut的核心功能,用于在国外进行预算和储蓄。 例如,您将收到即时付款通知; 您可以汇总卡付款以实现储蓄目标等。

创建帐户只需几分钟,一旦您启动并运行,您就可以立即开始管理您的财务。

接下来,是高级帐户。 这将使您每月花费 9.99 美元。 在这里,您的每月 ATM 限额增加到每月 600 美元,您将受益于以下额外功能:

- 海外医疗保险

- 为您的卡提供全球快递

- 优先级客户支持

- 具有独家设计的高级卡

- 一次性虚拟卡可提高在线安全性

- Revolut 初级帐户最多两个孩子

在 Premium 计划中,您将获得 0.14% 的 APY 储蓄,并且您将每月享受一次免费的国际转账!

最后,金属计划每月收费 16.99 美元。 它进一步将 ATM 提款限额提高到每月 1,200 美元。 此外,您将获得额外奖励 Revolut 金属卡。

其他福利包括行李延误和航班延误保险。如果您的航班延误超过一个小时,您还可以为您和最多三位朋友获得免费休息室通行证。

此外,您最多可以获得五个 Revolut 初级账户和每月 XNUMX 次免费的 SWIFT 转账。

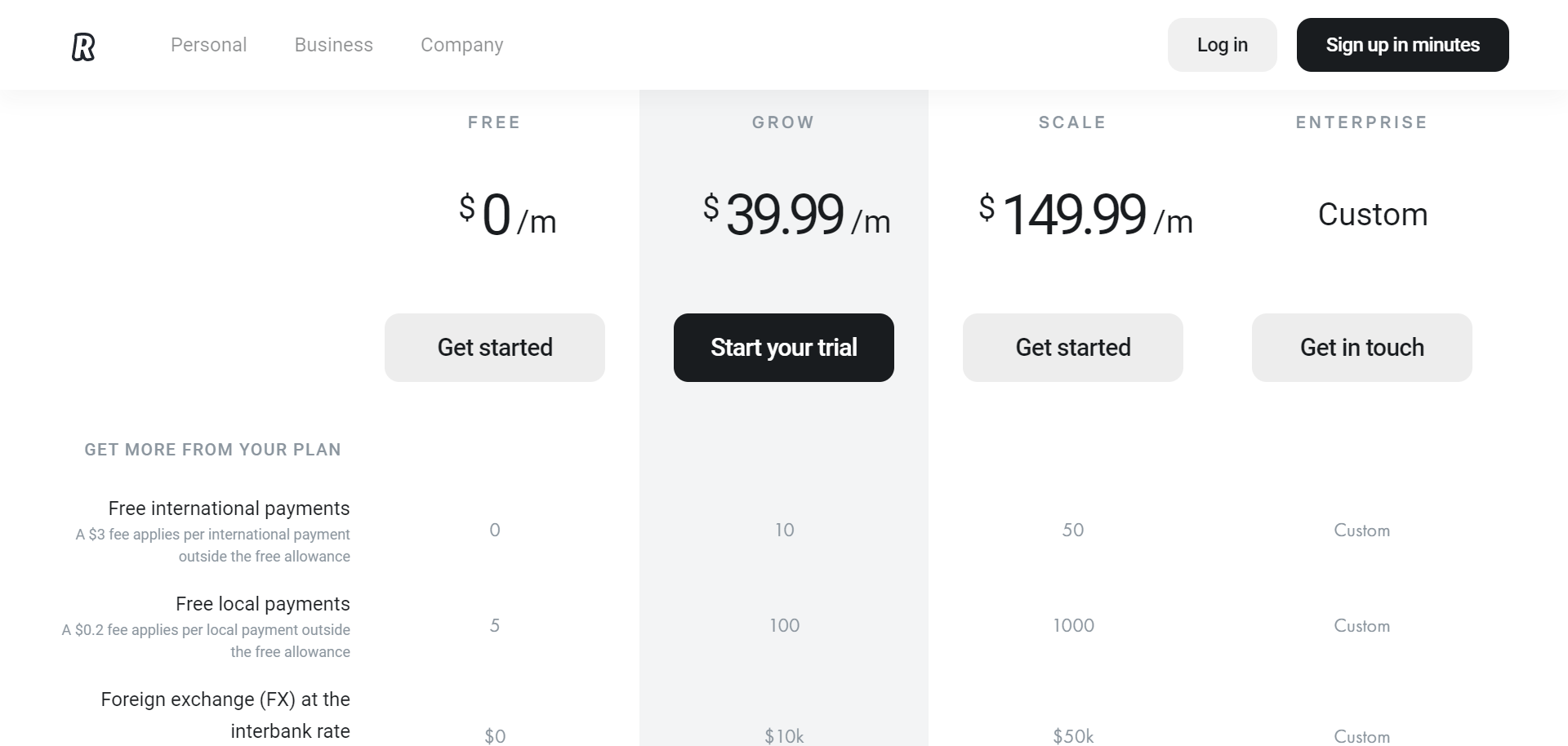

商业计划书

Revolut 还提供四种不同的商业计划,让您可以更好地控制您的团队成员。 您还将受益于免费的本地和国际付款和功能,以帮助管理您的开支 - 仅举几例!

再次,我们先从免费计划开始。此套餐有限制 - 它不附带任何免费国际付款,并且您只能进行五次免费本地付款。(否则,每笔本地付款将收取 0.20 英镑的费用。)您也无法按银行间汇率兑换外汇 - 每次兑换均需加价 0.4%。

您可以在免费计划中注册十名团队成员,但您无法管理他们的帐户权限或费用。 您可以免费向其他人付款 Revolut 帐户,持有超过 28 种货币,在帐户中存入英镑和美元,并创建虚拟公司卡。

您还可以管理帐户中的订阅和定期付款,并连接您的日常应用程序和会计软件。

Grow Plan 每月只需 39.99 美元,即可解锁更多功能和好处。 例如,您现在将获得 10 次免费国际付款、100 万美元的外汇津贴和 24 次免费本地付款。 您还将通过实时聊天获得 7/XNUMX 全天候优先支持。

Grow 计划使您能够管理团队的费用和帐户权限。 您可以注册 30 个成员并通过设置审批工作流来保护自己免受管理错误的影响。 此外,您可以设置批量付款。

Revolut 不断增长,未来,该账户还将解锁更多货币和工资单功能的本地账户。 所以,注意这个空间!

Scale 计划的费用为每月 149.99 美元。

这进一步增加了您的津贴 - 更具体地说,您可以进行 50 次免费国际付款,1,000 次免费本地付款,并且您将受益于 50 万美元的外汇津贴。您还可以注册 100 名团队成员。

如果这些计划都不适合您的企业规模,您可以选择定制的企业帐户,为满足您独特需求的计划提供定制定价。

请注意:注册额外的团队成员(在任何计划中)将花费您每月 5 美元。

Wise vs Revolut: 客户服务

金钱是一个敏感的问题,如果转账或您的帐户出现任何问题,您需要依靠优秀的客户服务团队来寻求帮助。

那么让我们看看如何 Wise 与 Revolut 如果您遇到问题可以提供帮助:

Wise的客户服务

Wise 提供在线帮助中心。 在这里,您可以找到常见问题的答案以及有关汇款、编辑和取消转账、管理您的账户、 Wise 卡等等。

如果您想联系 Wise的客户支持团队,您需要登录您的帐户。 您可以通过以下方式联系支持代表:

- 电子邮箱

- 电话

- Facebook Messenger

他们的支持中心在周一至周五上午 8 点至晚上 8 点(UTC)运营。

Revolut的客户服务

Revolut 还在其网站上提供了广泛的自助文档。 在这里,您可以查看有关其所有可用功能的信息并找到常见问题的答案。

如果您想获得个性化支持,可以通过应用内实时聊天进行联系。

您收到回复的速度取决于您选择的计划。不幸的是,电话支持不可用。

Wise vs Revolut:优点和缺点

没有什么比快速直接的利弊比较更能突出这些服务真正闪耀的地方了。

那么让我们来看看:

Wise的优点:

- 您将通过实时在线计算获得低成本、透明的费用和汇率。 您可以快速查看转账将花费您多少以及您将节省多少,然后决定是否继续进行交易。

- Wise 汇款比 PayPal 便宜 19 倍,通常比传统银行便宜 8 倍。 因此,它是目前市场上最实惠的汇款选择之一。

- Wise 带有一个开放的 API,使您能够创建自定义集成。

- 它直观且易于使用。

- Wise 适合每月想要汇出少量金额的个人和个体经营者。

Wise的缺点:

- Wise 不提供大量的本机集成。 例如,它只与会计软件集成 Xero、QuickBooks 和 FreeAgent。

- 您无法访问大量附加服务。 它的主要功能是向国外汇款和快速收款。 这意味着它在许多功能上都表现平平 Revolut 提供,如预算工具、账单拆分、设定财务目标等。

- 对于很多国家来说, Wise 不是最快的汇款方式。 (尽管它也不比任何银行慢。)

Revolut的优点:

- 您可以使用主要计划创建初级帐户。 这对帮助您的孩子建立健康的理财习惯有奇效。

- Revolut 在您账户的提款限额内提供免费的境外提款。 之后,所有国外取款均收取 2% 的费用。

- Revolut 拥有不错的 Trustpilot 分数:4.3 星中的 5 星(在撰写本文时)

- 您可以申请信用卡,灵活的信用额度最高可达您月薪的两倍(最高 6,000 欧元)

- 您可以从储蓄中赚取利息。

- Revolut 带有用于银行业务的网络和移动应用程序,为您提供了很大的灵活性。

- 国际转账不会产生额外费用。

- Revolut 带有一系列有用的预算功能,可帮助您从资金中获得更多收益。

Revolut的缺点:

- 除非您订阅了 Premium 或 Metal 帐户,否则您需要支付运费才能收到您的卡。

- 而 Revolut 拥有 2018 年颁发的欧盟银行执照,但它们提供的财务安全性与具有 FSCS 存款担保的服务不同。 出于同样的原因,他们不能处理现金或支票。

- 没有任何电话支持 Revolut的计划。

- 虽然您可以免费发送国际付款,但每月可以发送的金额有限制。 这使得 Revolut 灵活性不如 Wise 如果您想发送更大的金额。

Wise vs Revolut: 他们的服务何时适合您?

现在我们已经深入研究了两者 Wise 与 Revolut。不可否认,两者都有其优点和缺点,但最终都是可靠且有用的银行解决方案。

这两种金融服务中哪一种(如果有)适合您取决于您的情况。

但是,在本节中,我们将阐明何时更好地使用 Wise or Revolut:

何时使用 Wise

而 Wise 为您提供一张持有多种货币的卡和一个易于管理的在线账户,它不提供任何高级银行功能 Revolut 一样。

因此,最好使用 Wise 因为它的设计目的——在国外汇款和收款。

A Wise 帐户是免费的,即使申请一张卡也不会让您失望。

总之, Wise 如果您预计经常向国外发送付款,这是一项非常宝贵的服务,并且在以下情况下可能适合您:

- 您已移居国外并在那里获得报酬,但希望将您的收入转换回您的原始货币。

- 您想向国外的朋友、家人和服务提供商汇款

- 在另一个国家/地区花费大量资金时,例如购买房产、支付租金等,您希望以另一种货币充分利用您的储蓄。

- 您想使用不同的应用程序进行大部分银行业务,并且只使用 Wise 为其汇款服务。

- 您可以很好地控制自己的财务状况,并且不需要很多预算功能。

- 您只是偶尔向国外汇款,包括超过 1,000 美元的大笔款项

何时使用 Revolut

Revolut 是满足您所有财务需求的解决方案,并提供深入的银行功能。它的工具可能会帮助您和您的家人养成更好的财务习惯。

凭借众多预算、账单分割和储蓄功能,您可以轻松管理您的资金。除此之外, Revolut 为旅行目的提供了一个出色的帐户。

您可以在国外免费提取现金,进行比大多数传统银行更便宜的国际支付,并且根据您选择的计划,享受额外的旅行功能。

选择 Revolut 如果:

- 您需要一个手机银行账户来预算您的资金、增加您的储蓄并控制您的消费习惯。

- 您是一家企业,想要安排批量付款并管理团队成员。

- 您经常旅行,需要一张卡和帐户,以便您可以享受额外的旅行津贴。 例如,海外医疗保险和机场休息室通行证。

- 您正在寻找一个适合家庭使用的账户,它也可以帮助您支持您孩子的财务未来。

- 您住在国外或在国外有亲人,并希望向那里汇款比普通银行便宜十倍。

Wise vs Revolut:我们的最终裁决

所以,那里有,我们 Wise vs Revolut 审查! 虽然两者 Wise 与 Revolut 可能最初是作为汇款服务开始的,但后来他们找到了自己的利基市场。

仅用于向国外汇款, Wise 仍然是最受欢迎的选择。 它仍然提供最优惠的在线费率,特别是如果您想在适合您的情况下发送大笔款项而没有支出限制。

相反, Revolut 作为一般旅行账户,它能够持有多种货币,因此非常出色。它的帐户还具有各种功能,可以更轻松地制定预算、保存和跟踪您的支出。

总之, Revolut 是一项功能丰富的手机银行服务。 它甚至可以让您从储蓄中赚取一些利息。

我们希望如此 Wise vs Revolut 审查已帮助您确定哪些服务可能适合您。 或者您是否正在考虑像 Sepa 这样的不同平台? 无论哪种方式,如果您有任何使用任何一种解决方案汇款的经验,请在下面的评论中告诉我们。 我们很乐意听取您的意见!

嗨,我想知道哪家银行更适合接收大约 6000 美元的每月付款。 如果你住在英国,你能建议哪家银行更优惠吗?

感谢您的深入比较。我正在使用 wise,但最近在完成之前取消了一笔交易。我的银行收取了两次费用,16 天后我只收到了一笔退款。

除此之外,我很享受 Wise…没有双关语。

👍