These days, the digital world, combined with mobile point of sale systems, easy eCommerce management options and a range of other tools means that it's easier than ever to launch your own business online. Unfortunately, that doesn't necessarily mean that merchants don't have challenges to face. If you want to get the payments you need each month from your consumers, then you're going to need the right payment processing system.

WePay is one of the better-known options on the market today. Launched as an alternative to the standard options like Stripe and PayPal in 2008, WePay was designed to give merchants something different. The primary focus of the company is providing today's online eCommerce sellers with a way to collect payments from donors and customers alike.

WePay supports virtually any website by delivering a way to integrate accounts for the collection of payments from participating users via ACH transfers (bank transfers) and credit card payments. There are no set-up fees to get you started, which is always a plus, and there's no service length requirement.

So, what's the problem?

Well, there are positives and negatives to using WePay as your processing provider, as you're about to find out in this comprehensive WePay review.

What is WePay?

When WePay arrived on the market more than 10 years ago, it was designed to compete against various existing solutions like Stripe and PayPal.

The service emerged because two friends (the co-founders of WePay) were unable to find a solution that they felt comfortable using to split the costs of their ski house rental. A problem like that doesn't sound very realistic today – but this was before most of the peer-to-peer payment options you know today existed.

Unhappy with what was already on the market, the two partners designed and built their own secure online payment processing website. The solution was designed to sit on top of traditional financial rails at first, but eventually, the couple moved onto creating apps. WePay's flexible API is now available for all manner of B2B, B2C, and P2P funding options.

WePay aimed to offer a unique experience in the payment processing market by putting its customers first. However, as you'll see later in this WePay review, consumers don't always feel as though they're getting the best level of service from this provider. Despite this, WePay has a wide variety of unique solutions and capabilities to offer, including:

- Apple pay compatibility

- Integrated payments

- Android pay features

- Direct bank transfers

- Account provisioning

- Transaction-level reporting

- Mobile point of sale and flexible POS

- High-level PCI compliance

- Account provisioning

- Risk API

- Funds settlement

- Instant onboarding

- Custom UX

- Tokenization

WePay Fees and Pricing

If on your search for the right payment processing solution, you've explored WePay before, then you'll notice that its website isn't very forthcoming. You'll struggle to get a lot of information about the solution on the site – which seems quite odd considering WePay is probably trying to sell itself, just like any other software.

WePay doesn't list any direct pricing information on the website, which means that you'll need to contact the company in person to make sure that you're getting a trustworthy quote. Although it's unusual for no pricing to be available from a software company, it's not as surprising as it may seem. WePay approaches business as a white-label payment provider, which means that they need to work individually with every partnered platform to construct a unique quote.

Only once a partnered platform is set up, can the platform begin conveying separate pricing plans to merchants. It all seems pretty complicated, but you'll get used to it as you go. The white-labeled structure of WePay means that platforms are free to charge virtually whatever they want on top of the rates provided by WePay.

Although we can't give you much in the way of accurate pricing figures here, due to the lack of information available from WePay, we can tell you what we've learned from WePay's TOS. The Terms of Service share a few basic rates for the software if you don't decide to negotiate a specific price for your company.

👉 For instance:

- Chargeback fees are $15

- Per transaction fees are $15 plus $0.30

- ACH return fees are $15

- Research fees are $25

Extra Costs to Consider

Before we move on entirely from discussing the costs of WePay, it's worth noting that there may be some additional costs to consider too. For instance, WePay comments that they might delivery “pass-through” fees for payment network liabilities to merchants. This means that you could have extra to pay. You'll also need to think about any advanced features you need that could expand or enhance your costs.

If you're a merchant and not a platform provider and you want to process payments through one of the partnered platforms with WePay, then you'll need to go to their websites to find out their pricing. Remember that platforms can add extra fees to the costs that they charge for their services.

Another point to mention is that WePay introduced a new rate of 1% plus an additional $0.30 for ACH payments that are processed through partner platforms a few years ago. The price appears to have remained the same over the last few years, but there's not a lot of valid information available about this out there. You'll need to make sure that you know what you need to pay by contacting the team.

WePay Contracts and Termination Fees

One of the most significant problems that most merchants have when signing up with payment processors is that they often have to agree to use that processor for a specific period. This means that you're stuck in an environment that might not be right for you if you make the wrong decision. WePay, on the other hand, is a little bit less likely to hold you to a contract. The company claims that there are no specific requirements when it comes to signing up for services.

The fact that there aren't any lengthy or difficult to escape contracts involved with WePay is a massive point in the platform's favor. In most cases, when merchants or platforms want to cancel or get out of a contract early, they end up paying huge fees. However, according to the WePay terms of service, you can cancel your service with WePay at any time without paying any additional termination fees.

Keep in mind that there are some complicated terms involved with WePay when it comes to things like payout thresholds and reserves, however. These are common points of misunderstanding when it comes to a lot of processors on the market today.

Features for Payment Processing

Crucially, as we come into our overview of WePay features and solutions for payment processing, it's worth noting that this particular company is targeting the owners of payment platforms, rather than the merchants that use those platforms. With that in mind, you can begin to see the value of what WePay has to offer.

As we noted above, the WePay website is incredibly sparse when it comes to providing descriptions of the various features and products that the company has to offer. The company hasn't approached their marketing strategy very well, as they seem to be more focused on explaining what their value proposition is than introducing you to the benefits of the software.

When it comes to payment processing, remember that WePay is a third-party solution like Square or Stripe, rather than a traditional provider for modern merchants. According to the FAQ section of the website, the company will only accept and manage payments within the US, as well as a handful of Canadian merchants. That's something that really should be mentioned in the home pages of the website. Ultimately, it's annoying to have to search through the content to find out if you can accept the right payments with WePay.

Despite this FAQ section, however, there's also a merchant agreement available for UK-based merchants on their Terms of Service section, which doesn't make a lot of sense. Additionally, you can find developer documentation for UK merchants, which means that either the company now does offer solutions for UK companies and the rest of its website is out of date, or something else has gone wrong.

Despite a very confusing website, WePay offers everything that companies need to manage quick and easy payment solution through an API-based integrated processing strategy. Your refunds and secure payments are covered from start to finish, with a customizable checkout to give you a better level of control over user experience. You can also support multiple methods of payment processing, like credit and debit cards, bank transfers, and mobile payments.

Platform vendors also have the option to give their merchants more control with options for weekly, daily, or monthly payments, and there's a solution to increase conversions with automatic updates for replaced cards.

As a platform, you may also appreciate the knowledge that you'll be given your own completely self-branded payment solution from WePay. This means that you can create a personalized environment with your unique colors and logos, without having to build the software backend. You will still have the “Powered by WePay” option as part of your set-up, however.

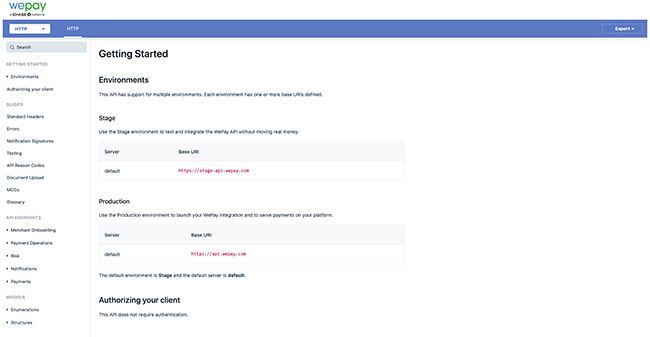

APIs and Integrations

One of the things that WePay is most proud about for its software offering is the fact that platform providers have so many options to customize and enhance their solution. The entire WePay structure is built on application programming interfaces, or APIs, which means that you should be able to create an environment that suits you from scratch.

According to WePay, the team behind the brand works with every partner to explore the options for customization and development, so that everyone can accomplish the perfect merchant experience. However, we'll come back to whether you can get the right level of support a little later.

The good news is that the developer section of the WePay website is one of the best and most informative areas of documentation for the entire WePay brand. If you're looking for a solution that can be customized according to your preferences, then WePay does seem to have that level of flexibility.

WePay Merchant Onboarding

Now, remember that WePay is all about supporting the platform providers that help today's merchants to process payments. That means that it needs to be designed to give merchants a quick and secure merchant onboarding experience. The WePay environment allows users to start accepting payments immediately with just an email address and some basic information. It's then possible to customize the experience further using Know your Customer information.

Platforms will have the option to set up their onboarding process to include all of the WePay added features for simplicity and convenience. The Merchant Onboarding overview section of the website explains that the partner platform will be able to set up all-new merchants on your behalf. This means that there are only a handful of additional verification steps required to get your merchants up and running.

WePay allows today's platform providers to choose from a range of onboarding options, intended to offer the most frictionless experience for modern merchants. Pre-built iframes are available to add into your onboarding flow, and for more integrated experiences, there are APIs to help you embed payment onboarding into your existing sales plan.

👉 Other features include:

- Accept payments instantly: Accept payments rapidly for your merchants and reap the benefits of enhanced customer satisfaction and better engagement for your platform. Your merchants will be able to start accepting payments instantly from the moment they provide their email address and name to open an account with you.

- Revenue over risk: WePay aims to offer speedier onboarding with their risk platform that has been tailored to the needs of companies who need to manage multiple payers and merchants at once. There's instant payment acceptance available, and transaction authorization rates are over 98.5%. This means that merchants get paid faster without security issues.

- Progressive underwriting: WePay also offers the ability to increase customer satisfaction and drive engagement on your platform with continuous underwriting.

WePay Point of Sale Solutions

One of the most common features of any payment processing tool or transactional software is a point of sale system. WePay approaches the POS strategy from a unique angle, using SDKs that allow payment processing platforms to connect their software with mobile card readers and other tools. This flexible and granular approach means that no matter what kind of businesses your platform serves, you'll be able to offer them a POS they can rely on.

WePay's POS strategy is highly mobile-oriented. Their white-label solution allows merchants to use a platform's app and mobile hardware to collect payments from customers at pop-up shops, stores, and more. WePay claims that with their POS solution, your merchants will never have to miss out on an earning opportunity because they can accept payments whenever and wherever they do business. This includes taking transactions at trade shows, delivery site sand storefronts alike.

WePay also supports a range of card readers as-standard, or it provides the opportunity to integrate its software into your existing point of sale solution. Because the whole experience is white labeled, you can feature your colors and logo on a customizable card reader for your audience.

👉 Other benefits include:

- Access online and in-person transaction data with ease

- Get your merchants up and running quickly with in-person and online payments

- Have WePay handle all of your payment-related risk and compliance on your behalf

- Access POS solutions with more than 100 different Android and iOS products

- Accept all credit cards with ease using EMV and magnetic stripe transactions

- Enjoy the peace of mind of knowing that all transactions are processed using industry-leading standards.

Fraud Protection and Risk Management

Having a feature-rich solution for building your own payment processing solution is great. However, you also need to make sure that the tool you're using is secure, compliant, and reliable if you want to get the most out of it. WePay strives to provide a highly secure solution for payment processing, with 100% coverage of all payment-related risk.

What does that mean?

Well, WePay can offer complete insurance if you're exposed to things like chargebacks and fraud losses. Additionally, the platform also offers compliance with KYC, PCI, and OFAC to help keep customer data safe too.

WePay claims that protecting customer privacy and security is essential to them. You can contact the team if you have any security related issues and they'll strive to help you out as quickly as possible. What's more, because WePay is PCI DSS compliant, platform providers can give their merchants some additional peace of mind too. Merchants will know that all of their sensitive data is protected because WePay is regularly audited by an independent party to ensure that no-one can unscrupulously gain access to essential information.

👉 Other security benefits to note with WePay include:

- The software uses cryptographic algorithms during the transmission of data, and in the management of their databases to keep information secure. All servers are both PCI and SSAE16 certified.

- WePay's team regularly undergoes background checks and immersive security training. The development team follows strict guidelines for OWASP and SDLC.

- Any money processed through WePay's software is held in a protected according to with a CDIC-insured, or FDIC-insured provider, to keep funds safe.

- As security standards continue to transform and change, WePay's systems evolve with them. This PCI compliant provider continually works to keep its services and systems secure from front to back.

- WePay investigates all reported vulnerabilities in their software and invites users to get in touch if they notice anything suspicious.

Customer Service and Support

So, if WePay has so many great features to offer, why doesn't it have the best reputation in payment management? The simple answer is that the company's customer service just isn't up to scratch. Although WePay claims that it offers “Premier Partner Support”, the experience that businesses actually get is often sub-standard.

On the WePay website, you'll find claims that the company works alongside all partnered platforms to offer constant support to merchants. WePay has access to crucial data and support records, which means that it should be able to help out with ease. However, the actual quality of the service that you get all depends on how lucky you are.

Whether you're a customer or merchant, there are no established guidelines in place for how to make the most of WePay's service. There's an email ticketing system, although there seems to be no guarantee on when you'll get a response. Additionally, there are links to support pages for various platforms on the WePay support page, but again, the kind of response you get will all depend on the platform you choose.

The WePay Customer Delight support team is available through from 6 am to 6 pm PST each day, Monday to Friday. However, there's only email ticket support available. Although live chat was offered at one point, it's no longer there today. Additionally, WePay has removed it supports phone number, which is a little worrying for most companies.

If you are interested in solving your own problems with the WePay knowledge center, then you can access a handful of white papers and guides that offer basic information on using payment processing systems in general. However, there aren't a lot of direct insights into how you can successfully use WePay daily.

The Customer Service from WePay is so basic and limited that we were surprised to learn that it had once won a Stevie Award in 2017. Honestly, there's barely enough information on the WePay website to tell you what you need to know to make an informed investment into the software. When it comes to customer support, you seem to be left mostly on your own to figure things out for yourself.

The only major plus side to the customer service and support from WePay is the fact that if you decide that you've had enough of the software, you can easily cancel your service whenever you like with absolutely no early termination fees at all.

WePay Pros and Cons

WePay Pros

Importantly, while WePay does have some issues to overcome if it wants to become one of the best payment solutions around, it also has benefits to deliver too. On the WePay website, you can even find video testimonials from partners and customers who have found success using the WePay platform.

👉 These reviews discuss things like:

- Easy onboarding processes for merchants

- Increased merchant stickiness for long-term platform success

- General business booms with white-label payments

- Control and customization of the user experience

- Niche understanding of platform needs

- Benefits of incredible security and fraud management

There's plenty of positive feedback to consider from merchants and payment providers who appreciate the WePay platform. For instance, many reviews suggest that the integration features of WePay are very impressive. These tools make it easier to integrate WePay with established platforms for a simpler end-to-end experience.

Additionally, Merchants on some platforms have said that they were able to access lower rates of processing with WePay than with other payment providers. On top of that, WePay offers the benefit of a simple and intuitive checkout process, which is excellent for the end-user in need of a quick way to manage and accept payments.

WePay Cons

Despite a somewhat sub-standard approach to customer service and support, WePay maintains a relatively impressive A+ rating with the Better Business Bureau. Of course, there have been a handful of complaints from customers using this service. When it comes to dealing with complaints, WePay has a 25% rate for addressing issues in a way that satisfies their customers.

Of course, this rate only applies to the Better Business Bureau complaints. If you look online through Google, you'll find plenty of other issues that WePay has failed to resolve on other parts of the internet.

👉 Here are some of the most common problems that customers have when they're using WePay:

- Frozen accounts or terminations: Although it's easy to get approved transactions flowing through WePay, customers regularly complain that accounts are subsequently terminated or frozen. Merchants often have trouble with the complex restrictions that WePay has around the business types that are supported by the platform. There can also be issues with refunding payments to donors and customers.

- Withheld funds: Alongside account terminations, some WePay users also complain that holds related to high-risk transactions can sometimes result in account cancellation. Disputes over reserve accounts on WePay can also crop up from time to time. Various merchants have reported inadequate and delayed explanations for unnecessary holds and terminations.

- Long processing times: Some users say that it can take between 2 and 5 days to receive funds. This means that it takes a very long time for people to get the money they need.

While it's fair to say that all payment processors can struggle with stability issues from time to time, WePay does have a few more complaints than some platform providers will feel comfortable with. On the plus side, you can always learn more about how to avoid holds, terminations, and freezes going forward, to boost your chances of success.

WePay Alternatives

If WePay doesn't seem like the right solution for your company, don't panic.

There are plenty of alternative options available for payment processing, including:

Square Payments

Square is a direct payment processing option for merchants. If you have a brick and mortar company, or you want to process payments regularly in person, then Square is the must-have way to upgrade your chances of success. Square comes with plenty of point-of-sale hardware options to get you started, as well as software that allows you to accept cash, checks, gift cards, and more.

Square even processes payments in real-time when you don't have an internet connection. That's great for when you're dealing with transactions at festivals or market stalls.

👉 Read our Square reviews.

👍 Pros

- Plenty of POS options

- Excellent hardware and software

- Build the POS experience that suits you

👎 Cons

- Some issues with customer service and transaction hold

- Not ideal for online businesses

Skrill

Skrill is another merchant-focused software that allows users to send and receive money, link bank accounts, store cards, and more. All you need to get started with this service is a free account using your email address and a password. Skrill wallet holders also have access to low fees of only 1.45%, which means you get to keep more of the money that you earn.

Available for both business and personal use, Skrill is excellent for managing payments in a range of different environments. You'll even be able to access global support across more than 30 countries.

👉 Read our Skrill review.

👍 Pros

- Excellent fees and pricing

- Fantastic for personal and business use

- Easy to use

👎 Cons

- Not as advanced as some other tools

- Not as many API and integration options

Stripe

Stripe is one of WePay's biggest competitors in the current marketplace, alongside PayPal. If you're running an internet-focused business, then Stripe is an excellent solution, particularly for those in search of a way to enhance their payment platform. Stripe is a developer-first community that believes that payments can always be more easily managed when you have the right code.

Stripe offers a unique API solution that ensures that you can have your payment systems up and running within a matter of minutes. What's more, the transaction prices of Stripe are very reasonable, at about 2.9% plus 30 cents for every transaction.

👉 Read our Stripe review.

👍 Pros

- Great for internet businesses

- Developer-first approach with advanced API

- Range of integrations with POS hardware

👎 Cons

- Not for beginners or those without coding knowledge

WePay Review: Verdict

As a third-party solution for payment processing, WePay has always worked hard to establish its own niche among names like Stripe and PayPal. Despite plenty of intense competition for market share in the current market, WePay has managed to stand out from the crowd by targeting platforms, rather than merchants directly.

WePay has a lot of benefits to offer when it comes to things like customized form building and security. However, it has its downsides too, which include things like issues with transaction holds and account freezing. Additionally, it's fair to say that customers will have a hard time learning much at all about WePay from its website alone.

If you're not sure whether WePay is right for you, the only real way to get an answer is to test it for yourself. While some people love this payment processing solution, others aren't so sure.

Comments 0 Responses