In today’s Shopify review, I’ll be covering everything store owners need to know about one of the most popular ecommerce store building platforms on the market.

Quick verdict

In my opinion, Shopify definitely is one best ecommerce builders on the market. It’s endlessly flexible, giving businesses all the freedom, they need to sell a variety of digital and physical products. It even supports dropshipping and print-on-demand selling, with dozens of useful apps.

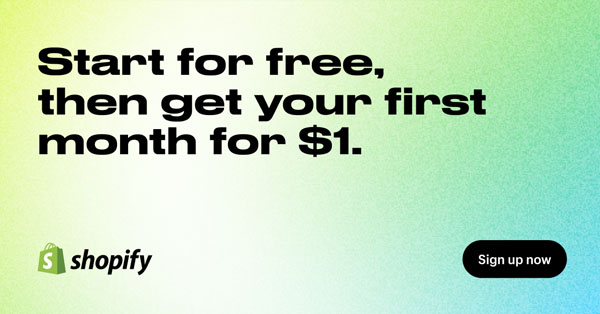

- Full solution from $29/month

- Limited time offer: first 3 months for $1/month

- SEO Friendly

- Offline Store

- App Store

- 24/7 Support

- Beautiful Templates

When to Use Shopify

We consider Shopify to be one of the best ecommerce site builders on the market. However, there are times when this platform may be better suited to your company than others. We recommend using Shopify if you’re looking for a hosted platform, capable of adapting to a range of business needs.

Shopify is one of the best tools on the market for companies investing in dropshipping or print-on-demand selling, thanks to the wide range of applications and add-ons available for this purpose. It’s also a great choice if you’re looking for an easy-to-use platform.

Even if you can’t handle certain functions yourself, there are plenty of experts out there in the Shopify community to help you.

Shopify also has a great range of tools available for multi-channel selling, including it’s own POS solution if you want to combine your in-person store with an online presence.

When Not to Use Shopify

Of course, just as there are some businesses who will be perfectly suited to the functionality Shopify offers, there will also be companies out there who could benefit from a different store builder.

For instance, we wouldn’t recommend using Shopify if you’re looking for extensive customization, unless you’re willing to pay for Shopify Plus, or work with designers and developers on your website.

It’s also not the best option out there if you’re looking for extensive functionality out of the box. You may need to be prepared to install a number of apps and add-ons.

Shopify can be a little problematic for multi-national companies, as the multi-currency features don’t work in all countries, and may not be suited to different payment processing methods.

Plus, if you’re not planning on using Shopify Payments, there are some extra transaction fees to be aware of with Shopify too. Other website builders may be better suited to low-budget companies.

Pros and Cons of Using Shopify

Need a quick insight into the benefits and disadvantages of Shopify?

In my experience, I’ve uncovered a handful of pros and cons within the Shopify platform, although I’d say the pros generally do outweigh the cons.

Shopify Pros 👍

✔️ Straightforward easy to use

✔️ Fully responsive templates

✔️ Great for avoiding lost sales

✔️ Dozens of apps available

✔️ Email marketing capabilities

✔️ Built in SEO

✔️ Multi-currency selling

✔️ Shipping discounts are available

✔️ Point of sale tools are available for unifying online and offline selling

✔️ Numerous payment gateways available

Shopify Cons 👎

❌ Limited number of free themes available

❌ The ability to create “product options” is quite limited

❌ You need apps to enhance the functionality

❌ Reporting and analytics capabilities are limited on cheaper plans

❌ The integrated payment processor only supports some countries

❌ Transaction fees on cheaper plans can be high

Shopify Pros and Cons – Video

Instead of reading, you can watch this video where we explore in more detail the advantages and potential challenges that come with using Shopify as your platform.

You can check our full article where we explore all the Shopify pros and cons.

Still, objectively, Shopify is a feature-rich, comprehensive, and powerful tool for today’s store owners, and today, I’m going to cover why I think it’s among the top solutions out there.

In this article:

Shopify Unique Features

| Use Case | Tool | What It Does |

|---|---|---|

| Design and features | Shopify Liquid | Easy language to create custom designs, and add basic features. |

| Headless ecommerce | Shopify Hydrogen | Build custom headless ecommerce experiences. |

| API access | Shopify API | Centralized access to all your store data. |

| High converting checkout | Shopify Checkout | Secure, fimilar, and seamless checkout experience for customers. |

| Learning | Shopify Academy | Free online courses and resources to learn about Shopify and ecommerce. |

| Generative AI | Shopify Magic | Free AI-powered tools withinn the Shopify interface to help you write product descriptions, blog posts, etc. |

| AI support | Shopify AI support | 24/7 support from Shopify AI chatbot to get instantaneous answers. |

| Automations | Shopify Automations | Automate tasks like order fulfillment and email marketing within Shopify. |

| Emails | Shopify Emails | Built-in email marketing tool. Free for first 10,000 emails every month. |

| International sales | Shopify Markets | Centralised international selling tools to help you manage and expand your global sales. |

| Infuencer collaborations | Shopify Collabs | Partner with influencers directly and easily. |

| Loans | Shopify Capital | Loans without credit checks – based on the sales history of your Shopify store. |

| Discounts | Shopify Shipping Discounts | Special shipping discount rates for all Shopify based stores. |

What is Shopify? Is Shopify Worth It?

Let’s start with the basics. What is Shopify?

Shopify is an ecommerce platform, or website building tool which empowers business leaders with all the tools they need to create an online store. It provides users with a variety of themes they can customize to suit their specific selling and branding needs, and comes with all the payment processing solutions you need to sell both physical and digital goods.

Shopify is designed specifically for beginners in the ecommerce space, with an easy-to-use backend environment and plenty of guidance baked in. However, it also gives you the freedom to expand and customize your store with code as your company grows. Shopify even has its own templating language (Liquid), as well as supporting CSS and HTML.

Shopify currently powers around 4.4 million websites in 175 countries around the world, making it a major player in the ecommerce space.

However, it’s far from the only ecommerce tool out there. Today’s business leaders have a huge variety of platforms to choose from when building their online presence. Finding the right solution for your needs means exploring the features and capabilities of each platform with care.

Shopify Facts

| Launched | 2006 |

| Employees | 10,000+ |

| Shopify Experts | 800+ |

| Apps | 8,000+ |

| Themes | 150+ |

| Most popular store category | Fashion |

| Average order value | $85 |

| Total sales generated | $750+ billion |

| Currently active stores | 4.5+ million |

| Currently active Shopify Plus stores | 30,000+ |

| Countries served | 175+ |

How Does Shopify Work?

The first thing you should know is that Shopify is a hosted ecommerce platform. In other words, this means the solution is hosted on its own servers, so you don’t need to buy any separate hosting packages or install software to use it. You’ll create and manage your Shopify store using your web browser, and there are even mobile apps available for management on the go.

Shopify basically bundles all of the core tools required for an ecommerce store into one convenient package, from templates for your store, to payment processors, email marketing tools, blog and SEO capabilities, and even inventory management. You can also expand the functionality of your store by adding on apps and plugins from the Shopify marketplace.

How We Tested Shopify for This Review

To provide you with a comprehensive insight into the core features and benefits of Shopify, I dove into the functionality of the app myself, leveraging the free demo version of the tool. I’ve been working in the ecommerce and software landscape for quite some time, so I’ve had a lot of opportunities to work with platforms like Shopify before too.

The Ecommerce Platforms team has also conducted several surveys, and looked at more than 3000 stores from across the globe to pinpoint the most popular store builders, and examine their features. We even calculated scores for the most commonly used website building solutions with our comparison chart here.

We’ll also be updating this Shopify review frequently based on any major changes to the Shopify platform, to ensure we can keep you as up-to-date as possible.

Try Shopify for only $1 for the first month!

Shopify has begun offering a special deal for sellers who sign up for a new Shopify plan. That deal? Start a 3-day free trial and enjoy your first month of Shopify for $1. Learn more about the free trial here.

This offer is is now available on all standard plans: Starter, Basic, Shopify, and Advanced.

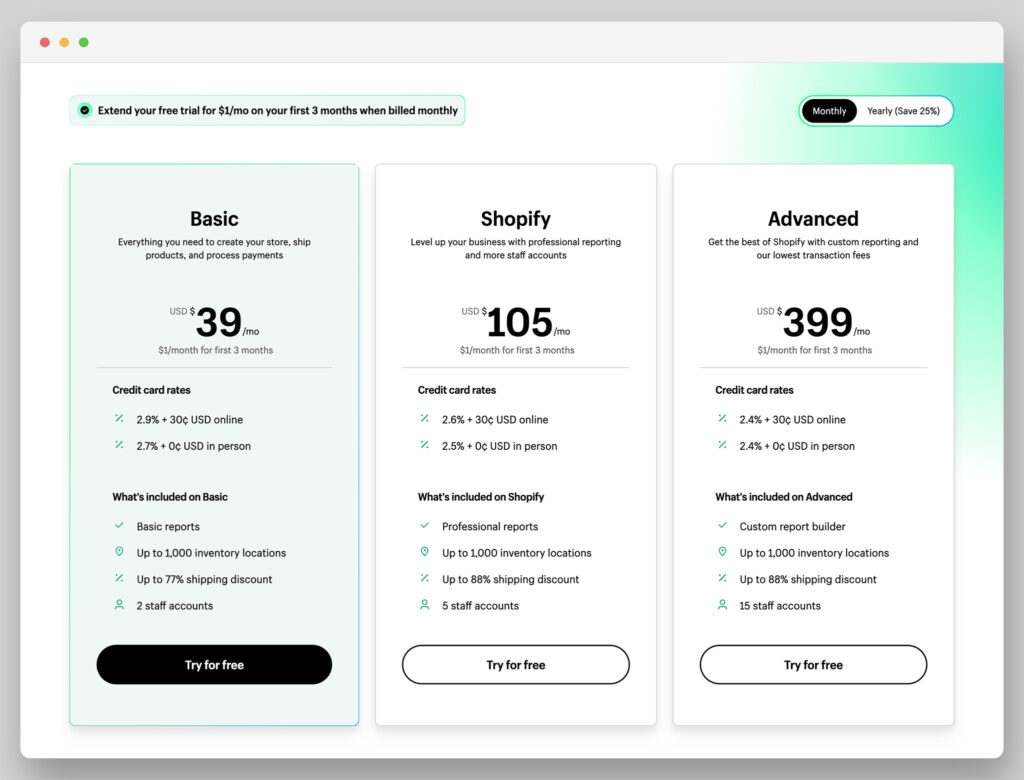

Shopify Pricing Plans – Which Plan is Right for You?

Shopify Review – Pricing Summary

Reviewing Annual vs Monthly Plans

Here's a breakdown of the pricing for each Shopify plan:

- Shopify Starter Plan – costs $5 per month

- Basic Shopify Plan – costs $39 per month + 2.9% and 30¢ per transaction

- Shopify Plan – costs $105 per month + 2.6% and 30¢ per transaction

- Advanced Shopify Plan – costs $399 per month + 2.4% and 30¢ per transaction

- Shopify Plus – starts at around $2000 per month + 2.15% per transaction.

Detailed Comparison – Shopify Plans

| Starter | Basic Shopify | Shopify | Advanced Shopify | Shopify Plus | ||

|---|---|---|---|---|---|---|

| COSTS | Monthly cost | $5 | $39 | $105 | $399 | Starting at $2,000 |

| Yearly cost | $5 | $29 | $79 | $299 | Starting at $2,000 | |

| Yearly Savings | $0 | $120 | $312 | $1,200 | $0 | |

| Online credit card rate (with Shopify Payments) | 5% + 30¢ | 2.9% + 30¢ | 2.6% + 30¢ | 2.4% + 30¢ | 2.15% + 30¢ | |

| In-person credit card rate (with Shopify Payments) | 2.7% + 0¢ | 2.5% + 0¢ | 2.4% + 0¢ | |||

| 3rd-party transaction fee | 5% | 2% | 1% | 0.50% | 0.15% – 0.30% | |

| Shopify Shipping discount | Up to 77% | Up to 88% | Up to 88% | |||

| BASIC FEATURES | Digital products | Yes | Yes | Yes | Yes | Yes |

| Themes | 1 | All | All | All | All | |

| Gift cards | No | Yes | Yes | Yes | Yes | |

| Website and blog | No | Yes | Yes | Yes | Yes | |

| Free SSL certificate | Yes | Yes | Yes | Yes | Yes | |

| No. of products | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | |

| Fraud analysis | Yes | Yes | Yes | Yes | Yes | |

| Discount codes | Yes | Yes | Yes | Yes | Yes | |

| File storage | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | |

| Staff Accounts | 1 | 2 | 5 | 15 | Unlimited | |

| Domain | No | No | No | No | No | |

| Email accounts | No | No | No | No | No | |

| ADVANCED FEATURES | 24/7 support | Yes | Yes | Yes | Yes | Yes |

| Customer accounts | No | Yes | Yes | Yes | Yes | |

| Sales channels | Not all | All | All | All | All | |

| Inventory locations | Up to 4 | Up to 1,000 | Up to 1,000 | Up to 1,000 | Up to 1,000 | |

| Shopify marketplace connect | No | Yes | Yes | Yes | Yes | |

| Automations | No | Yes | Yes | Yes | Yes | |

| Abandoned cart recovery | No | Yes | Yes | Yes | Yes | |

| Customer segmentation | Only via Shopify admin | Yes | Yes | Yes | Yes | |

| SHIPPING FEATURES | Print shipping labels | Yes | Yes | Yes | Yes | Yes |

| Third-party calculated shipping rates | No | No | No | Yes | Yes | |

| Included shipping insurance | No | No | Yes | Yes | Yes | |

| INTERNATIONAL COMMERCE | Language translation | No | Yes | Yes | Yes | Yes |

| Currency conversion | Limited to billing in your local currency | Yes | Yes | Yes | Yes | |

| Local payment methods | Not directly | Yes | Yes | Yes | Yes | |

| Product pricing by market | No | Yes | Yes | Yes | Yes | |

| Duties and import taxes | No | No | No | Yes | Yes | |

| ANALYTICS & REPORTING | Live view | No | Yes | Yes | Yes | Yes |

| Reports | Only financial and product reports | Basic reports | Standard reports | Advanced reports | Advanced reports | |

| Advanced custom report builder | No | No | No | Yes | Yes | |

| ENTERPRISE FEATURES | Advanced checkout customization | No | No | No | No | Yes |

| Sandbox stores | No | No | No | No | Yes | |

| Dedicated customer support | No | No | No | No | Yes | |

| Multiple online stores | No | No | No | No | Yes | |

| Exclusive apps | No | No | No | No | Yes |

While there’s a lot more to choosing the right ecommerce platform than simply finding the right pricing package, every business owner has a budget to consider.

One thing I find particularly attractive about Shopify, is that it offers a host of different pricing packages to suit specific company needs. You can start with a simple solution that allows you to add ecommerce functionality to an existing website or tool, and build all the way up to an enterprise plan.

Here are the plans available from Shopify right now:

‘Shopify Starter': $5 per month:

This plan allows you to add ecommerce functionality to an existing website or social media page using a button. The functionality allows you to add a checkout function to almost any existing app, without building a store from scratch. However, there is a hefty transaction fee included of 5% which can reduce your profits.

‘Basic Shopify': $39 per month:

The cheapest complete store builder plan, the Basic Shopify plan comes with support for unlimited products, 2 staff accounts, multiple sales channels (including online marketplaces like Amazon and eBay, and social media), 1 public storefront, up to 1000 inventory locations, discount codes, manual order creation, abandoned cart recovery, gift cards, basic reports, and customer segmentation.

You’ll also be able to leverage unlimited contacts for email marketing, marketing automation, fraud analysis for payments and manage stores across international markets. You can leverage language transaction, market domains, product pricing by market, and more.

For the Basic plan, transaction fees start at 2.9% plus 30 cents for online credit cards, and 2.7% plus 0 cents in person.

‘Shopify': $105 per month:

The Shopify plan features all of the capabilities of the Basic plan, with lower transaction rates starting at 2.6% plus 30 cents for online transactions, and 2.5% for in-person payments.

You’ll get 5 staff accounts on this plan, as well as access to standard reports and advanced shipping discounts of up to 88%.

‘Advanced Shopify': $399 per month:

The Advanced Shopify plan cuts the transaction fees again to 2.4% plus 30 cents for online transactions, and 2.4% for in-person payments. This plan includes advanced reports, and the opportunity to leverage third-party calculated shipping rates. You’ll be able to create up to 15 staff accounts on this package, and leverage all the features of the Shopify plan.

‘Shopify Plus': Custom pricing starting at $2000 per month

Intended for high-volume sellers, the Shopify Plus plan is the enterprise-level package from Shopify. It opens the door to a more advanced sales platform which allows you to sell across multiple channels, and even create your own headless ecommerce experience.

Shopify Plus supports loyalty programs, innovative access to new tools and advanced automation capabilities. You’ll also get access to more personalized support and assistance from the Shopify team. You can host and manage up to 10 stores on one account, take advantage of API access and a guaranteed server uptime agreement. Plus, there are more sophisticated options for selling in multiple currencies. Shopify Plus even has dedicated apps and integrations for improving store functionality.

Tips To Save Money With Shopify

| Use Case | Average Cost |

|---|---|

| Domain | $15/year |

| Professional email | $5/month/user |

| Email marketing | $0 – $500/month |

| SMS marketing | $10 – $500/month |

| Premium theme | $100 – $400 |

| Shopify apps | $0 – $500/month |

| Shopify POS | $0 – $89/month |

Shopify vs Different Platforms – Savings

| Tool | Price If You're Using Shopify | Price If You're Using A Different Platform (Average) |

|---|---|---|

| Email marketing | $0 (upto 10,000 emails/month) | $0 – $500/month |

| Automations | $0 | $10 – $500/month |

| Multi-currency support | $0 | $0 – $100/month |

| Multi-language support | $0 | $0 – $500/month |

| Customer accounts | $0 | $0 – $150/month |

| AI tools | $0 | $0 – $250/month |

| Premium theme | $100 – $400 | $0 – $500 |

| Reporting | $0 | $0 – $100/month |

| Shipping integration | $0 | $0 – $100/month |

| Tax integration | $0 | $0 – $250/month |

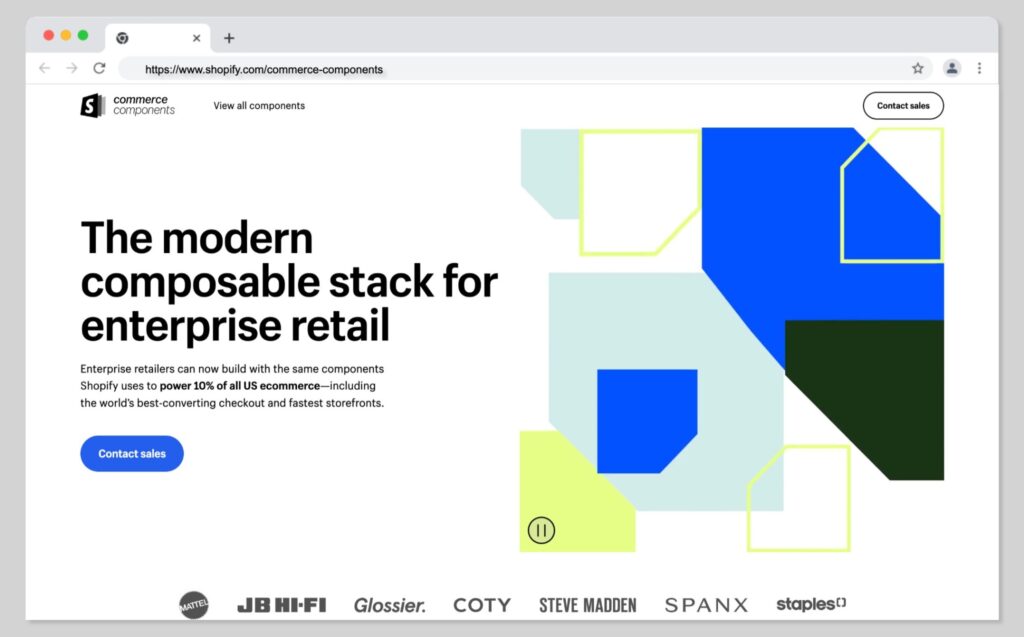

Shopify Commerce Components

Shopify also recently introduced the “Commerce components” package for business leaders in the United States, which essentially allows you to mix and match the features of Shopify you’d like to use, to create a custom plan. You’ll need to contact Shopify directly to get a quote for this.

Annual vs Monthly Shopify Plans

One thing I should note here is that you will be able to save a significant amount of money on your Shopify plans if you opt to pay annually for your services, rather than paying monthly.

An annual package will give you a discount of 25%, which means you can get a more advanced plan for almost the same price as the previous package.

Shopify Fees

Notably, the monthly subscription packages for Shopify are only one of the costs you’ll need to plan for when creating your online store.

There are additional fees to pay for transactions and payments, which can vary from one country and plan to the next. You can reduce your payment processing fees in some cases by using the included Shopify Payments option, instead of another processor.

The transaction fees are highest on the Shopify Starter plan (at around 5%), and are gradually reduced the more you choose to pay for your package. Credit card fees can also be quite high, ranging between 2.9% and 2.4% of every sale you make with your online store for US customers.

On top of transaction and payment fees, there are also additional costs to consider for apps and themes. While some apps and themes are available for free, many are offered on a premium basis, which means you’ll have yet another monthly subscription cost to account for.

What’s more, you need to pay extra if you want to leverage Shopify’s POS (Point of Sale) capabilities. While basic POS functionality is included in all of the pricing plans, you’ll still need to pay for hardware and advanced capabilities as your store grows.

Additional Costs

| Use Case | Average Cost |

|---|---|

| Domain | $15/year |

| Professional email | $5/month/user |

| Email marketing | $0 – $500/month |

| SMS marketing | $10 – $500/month |

| Premium theme | $100 – $400 |

| Shopify apps | $0 – $500/month |

| Shopify POS | $0 – $89/month |

Further reading 📚

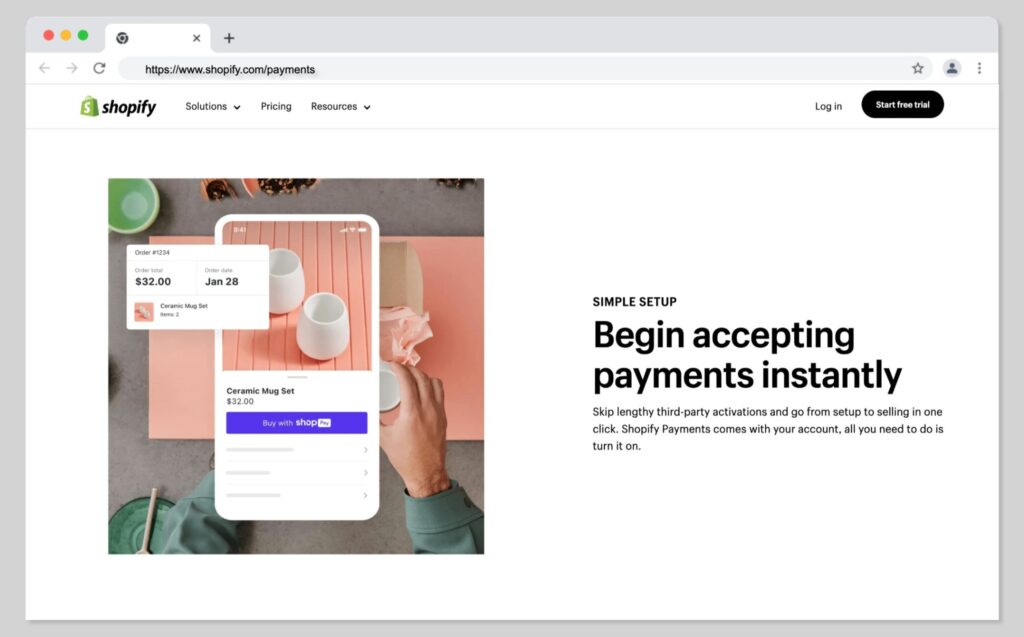

Shopify Payments

If you want to keep the extra fees on your Shopify store as low as possible, it’s best to use the Shopify Payments processing tool. This convenient solution eliminates the need to set up a third-party payment provider with your store. It also allows you to accept all kinds of major payments, from credit card payments to Apple and Google Pay.

Shopify Payments eliminates a lot of costs, because you’re not charged any third-party transaction fees for the orders you process through the platform. You don’t have to pay extra for Shop Pay, Shopify Payments, Shop Pay Instalments, or PayPal Express.

However, it’s worth noting Shopify Payments is only available to stores in certain regions and locations. Additionally, in order to access this service, you’ll need to first secure your account with two-factor authentication. This isn’t really a problem, as using two-factor authentication can be a good way to reduce your risk of data breaches and security issues.

Shopify Payments is very straightforward as a payment processing tool, and can be accessed in a range of countries, making it a great choice for a lot of business owners. However, you may find that you want to consider using other payment processors in the future too, so it’s worth checking out what the transaction fees will be from each provider when you’re building your store.

Other Impressive Features

One of the things that makes Shopify such a compelling tool for ecommerce store owners, is that it’s constantly evolving.

The Shopify ecosystem regularly updates with new tools and capabilities which match the specific needs of today’s online shoppers.

Additionally, Shopify provides all of the essential built-in features you need to run and manage an online store, so you shouldn’t have to worry about adding extra functionality with apps and integrations straight away. Here are some of the most impressive features included with Shopify:

- Comprehensive store design: Shopify provides business owners with all the tools they need to design and run an online store. You’ll have a range of mobile-responsive website themes to choose from, including both free and paid options. There’s also a relatively straightforward online store editor which allows you to make customizations to your website using a visual platform. You can even experiment with CSS and HTML code if you like.

- Selling a range of products: With Shopify, you can choose between selling physical and digital products, to locations across the world. The company supports global and international selling, as well as wholesale and direct transactions, and the option to sell in person through point of sale integrations. You can connect your store with marketplaces and social media channels, and customize the checkout for your customers. There’s even the option to sell subscriptions and memberships for long-term revenue.

- Abandoned cart recovery: As mentioned above, abandoned cart recovery is included on virtually every plan, so you can boost your chances of converting customers. Built-in email solutions allow you to reach out directly to your customers whenever they leave items in their baskets. You can even offer discount codes and vouchers to customers to improve your chances of a sale.

- SEO: To ensure you can attract customers to your online store, Shopify includes built-in search engine optimization capabilities, such as the option to adjust titles, meta descriptions, alt text and headings. You can take complete control over your sitemap URLs, and redirects. Plus, there’s the option to create your own blog where you can develop your inbound marketing strategy and showcase your thought leadership.

- Marketing tools: Shopify has its own built-in email marketing capabilities, which allow you to nurture customers over time, and send transaction and order tracking messages. You can leverage behind-the-scenes insights of your target audience to segment your messages for each customer. Plus, there are integrations available with social media, so you can expand your reach across the channels your customers area already using. Shopify even has its own in-built chat functionality, for connecting with customers when they’re visiting your store.

- Payment processing: As mentioned above, Shopify has its built-in Shopify Payments solution for payment processing which can accept a range of credit card payments, and purchase orders. It also includes its own fraud protection capabilities. If you need to expand your store’s potential, you can connect your payment processing capabilities to other online and offline channels. Plus, Shopify offers “Shopify Capital” for companies in search of funding for scaling purposes.

- Mobile apps: If you need to manage your Shopify store and customers on the go, Shopify has an app available for Android and iOS. With this app, you can edit or view products, check reports, fulfil orders, and even message team members. There’s also a mobile app available for Point of Sale processing if you’re selling items in-person. You’ll just need a compatible mobile app to process credit and cash payments instantly.

- Inventory management: Shopify supports multichannel selling on all of its plans, and makes it easy to manage stock and orders across a range of channels. You can track and transfer inventory across various locations, and sync everything within your Shopify store. However, there are some limitations on what you can do with your inventory management technology if you’re not also accessing additional apps. For instance, you can’t manage dropshipping orders unless you download an add-on plugin for Shopify.

- Reporting and analytics: The reporting options you’ll get from Shopify will vary depending on the plan you choose. The more you spend, the more insights you’ll be able to tap into. Reports cover everything from sales to customer behavior, marketing insights, search data, and abandoned cart statistics. If you’re using one of the basic plans, you may only be able to leverage top-level overviews of your analytics.

- Shipping options: The built-in features for Shopify shipping allow store owners to offer multiple delivery options to customers. Shopify partners with shipping companies around the world to offer discounts on your shipping costs. Plus, you can leverage international shipping, overnight delivery, package pickups, and shipping insurance. There’s even the option to track shipments so you can provide customers with up-to-date insights into the progress of their order.

- Apps and automation: Users can expand the functionality of their Shopify store by adding apps and plugins-from the Shopify marketplace to their existing website. You can leverage a range of free and premium apps, all with their own distinctive features. Plus, Shopify also offers the “Flow” service to automate aspects of your company’s operation through triggers and workflows. This can help you to create a more unified online store.

Shopify Reviews from Real Users

Reviews from real Shopify Users

Common Shopify User Complaints

To gain an understanding of how Shopify has helped individuals build and expand their online businesses, we contacted several users of the ecommerce platform for their insights and feedback.

Here are their reviews:

Dawn LaFontaine from Cat in the Box – Shopify User Review Q&A

Shopify removes the technological obstacles to starting an ecommerce business for everyday entrepreneurs.

1. What do you like best about Shopify?

There are two specific things that I like best about Shopify:

- It's an easy, out-of-the-box solution that can get you up and running in a matter of hours, and your site will look good even if you don't have a graphic-design or technical background.

- The other thing that I love about Shopify is the customer service. There are many ways to get answers, from the robust forums, to the quick-and-easy chat, and to the email channel which is answered by Shopify community experts. But the best way is through old-fashioned telephone support. If you're an English speaker like me, you get someone on the other end of the line who speaks English as a first language, is articulate, and is well trained in the art of a superb customer experience. Your rep will also send a follow-up email detailing the contents of your call, just in case you took insufficient notes.

2. What are the downsides of using Shopify?

What I dislike about Shopify is the nickel-and-diming. Some of the most basic ecommerce capabilities, which come in the box with other platforms, require an app on Shopify. I'd mind less if I could purchase an app once and be done, but nearly all apps are subscription-based.

3. Did you consider other options before settling on Shopify?

I looked at all the other options before I committed to Shopify: WooCommerce, BigCommerce, Wix, and even open-source solutions. But Shopify had the lowest barrier to entry at the time from a technical point of view.

4. Can you please briefly describe your business?

Cat in the Box is a woman-owned business that designs and sells whimsical cardboard box playhouses for cats who think inside the box.

Sven Klas from Svenklas – Shopify User Review Q&A

Shopify's intuitive interface, customizable themes, extensive app ecosystem, and seamless payment processing make ecommerce accessible and efficient for businesses of all sizes.

1. Please describe your experience with Shopify

The experience with Shopify is nothing short of great. The themes are fully customizable as per your design needs and preferences.

2. What do you like best about Shopify and what are the upsides of using this platform?

The Shopify App ecosystem.

3. What are the downsides of using Shopify?

Not able to customize the checkout page as per our needs.

5. Did you consider alternatives when choosing Shopify?

No

6. Can you please briefly describe your business?

Svenklas is a design-driven sustainable luxury lifestyle accessory D2C brand creating technical products of the future using sustainable materials for life's everyday journeys.

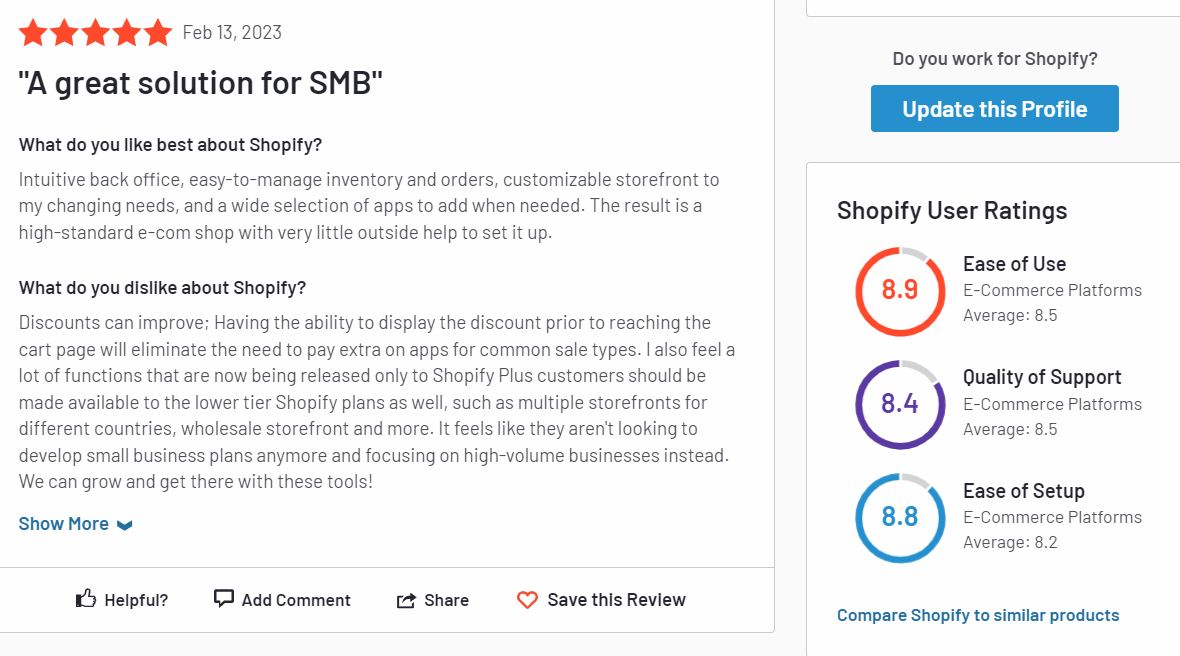

While conducting this review, I took some time to check out the other Shopify reviews and testimonials available on the web today. After all, while I can share my insights into Shopify and it’s functionality, it’s often helpful to get different perspectives on how the platform works.

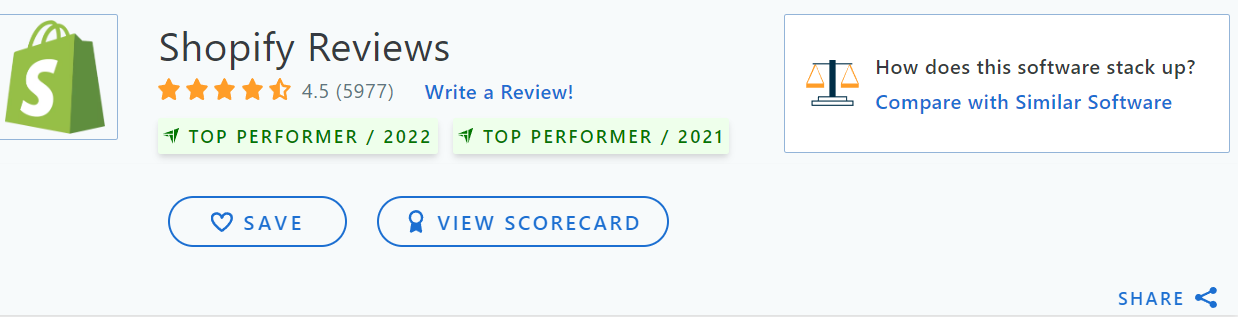

If we take a look at G2, one of the most popular review platforms, we can see the Shopify reviews are generally positive. The company has a 4.5 out of 5 star rating, and more than 4245 reviews from customers. Clients rate the solution as a 8.9/10 for Ease of Use, 8.4 out of 10 for Quality of Support, and 8.8 out of 10 for Ease of Setup:

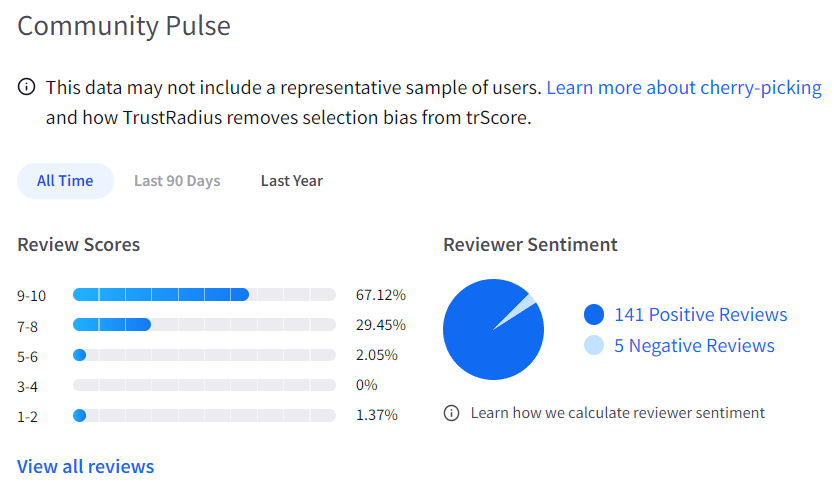

On Trust Radius, Shopify also has a pretty positive reputation. It has an overall score of around 8.8 out of 10, cultivated from more than 540 ratings and reviews. Shopify was also chosen as the top rated platform by Trust Radius during 2022.

Once again, customers say Shopify delivers good value for money, exceptional ease of use, and a relatively comprehensive feature set. The most popular features listed on Trust Radius include Product management, product catalogs and listings, visual customization, and branding capabilities.

Finally, on Capterra, Shopify is rated as a 4.5 out of 5 star product, with almost 6000 reviews from customers. It was ranked as a top performer among ecommerce platforms for both 2021 and 2022.

Overall, customers give the platform a 4.5 out of 5 stars for ease of use, 4.4 for customer service, 4.4 for features and 4.3 for value for money.

Common Shopify User Complaints

Many businesses love the versatility and affordability of Shopify. However, there are some companies out there who have complained about the platform over the years. Some of the most common complaints issued about Shopify cover problems such as:

- Limited functionality out of the box: You may need to install apps which can weigh down your website and lead to added complexity to access crucial features.

- Restricted theme options: There are only 11 free themes available for Shopify, which means you’re restricted in what you can do without paying a premium.

- Poor customization: Creating product options for variations of an item is complicated, and adding custom fields to your site can be a time-consuming process.

Additionally, Shopify adds transaction fees onto its costs, which isn’t an issue with many other builders. This pushes more companies to rely on Shopify Payments.

The Shopify Website Builder

It’s worth noting that although Shopify is best-known as an ecommerce platform, you don’t necessarily need to design a store with Shopify. The flexible website building solution also means you can design virtually any kind of site you can think of, including an online portfolio or blog.

The Shopify website builder comes with a host of professional and free templates to choose from, just like the ecommerce platform, and features the same drag-and-drop simplicity.

You can also leverage a range of add-ons and tools to help expand your site, improve your marketing strategy, or simply boost the presence of your website on the search engines.

Shopify has built-in SEO capabilities and its own blog, to assist with content creation, and it makes it simple to set up all kinds of different pages, from landing pages, to contact forms.

Shopify Ease of Use

Even if, like me, you have a decent amount of experience using ecommerce website builders, it’s worth looking for a tool that’s relatively simple and straightforward to use. Fortunately, Shopify keeps things pretty easy for its users.

When you log into the Shopify admin interface, you’ll find a modern, intuitive environment, built specifically for beginners.

There’s a menu on the left-hand side of the page which allows you to choose what you want to do, such as checking out your sales channels, or editing your themes. It’s also relatively easy to set up an omnichannel sales environment, with buy buttons you can add to social media, integrations with Facebook and Instagram, and the Shopify “Shop” channel or accelerated payments.

Linking your store to other environments, such as Amazon, Etsy, eBay, and Pinterest does require you to use third-party apps, but the process is relatively straightforward. Adding a function from the Shopify app market is as simple as clicking a few buttons.

Designing your Online Store

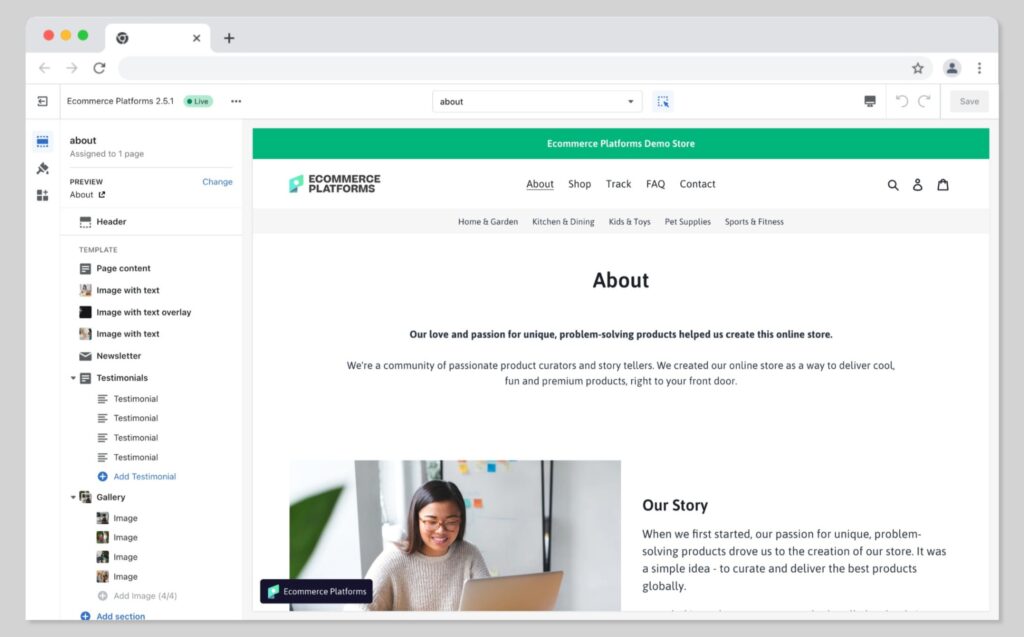

In recent years, Shopify has updated it’s interface with a focus on user-friendliness. The Online Store 2.0 solution gives you access to a convenient drag-and-drop builder which will allow you to add and move blocks and sections around your website in seconds. Notably, however, you’ll only use the drag-and-drop editor to change the templates of your pages. You’ll still need to edit the content yourself using a “WYSIWYG” editor.

One potential downside of the Shopify experience is the drag-and-drop editor only allows you to add basic form functionality to your store. Alternatively, competing solutions like Squarespace and Wix give you access to a fully-fledged form editor and creation tool.

Despite some slight issues, Shopify makes it extremely easy to design and customize your online store. You don’t need to dive into any code if you don’t have programming experience. Plus, the layout for the store builder is clean and intuitive, making it simple to find all the sections you need.

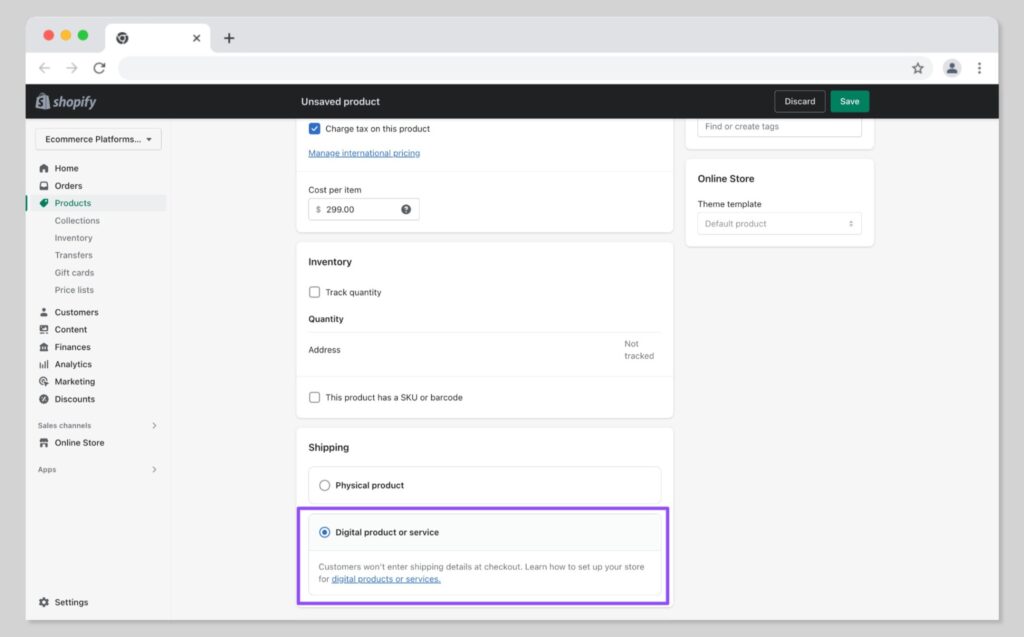

Managing Products

Alongside a simple process for designing your online store, Shopify also offers a straightforward environment for managing and uploading products. As mentioned above, you can sell both physical and digital goods with Shopify. You can add products one at a time, or use a CSV file to upload information in bulk. Just make sure you use the right CSV template if you’re taking this approach.

Shopify allows you to add photos and other media to your product pages too. You can upload up to 250 images, 3D models (depending on your theme), video links and more. Plus, you’ll be able to add alt-text to your images to assist with your SEO ranking.

There is a limit to the number of pieces of media you can include on your store, however, and Shopify doesn’t automatically crop images on your behalf, so you’ll need to make sure you’re uploading content in the right uniform size. On the plus side, there is a photo editor on the platform you can use to adjust images after you upload them, but this could mean you’re wasting more space on your store.

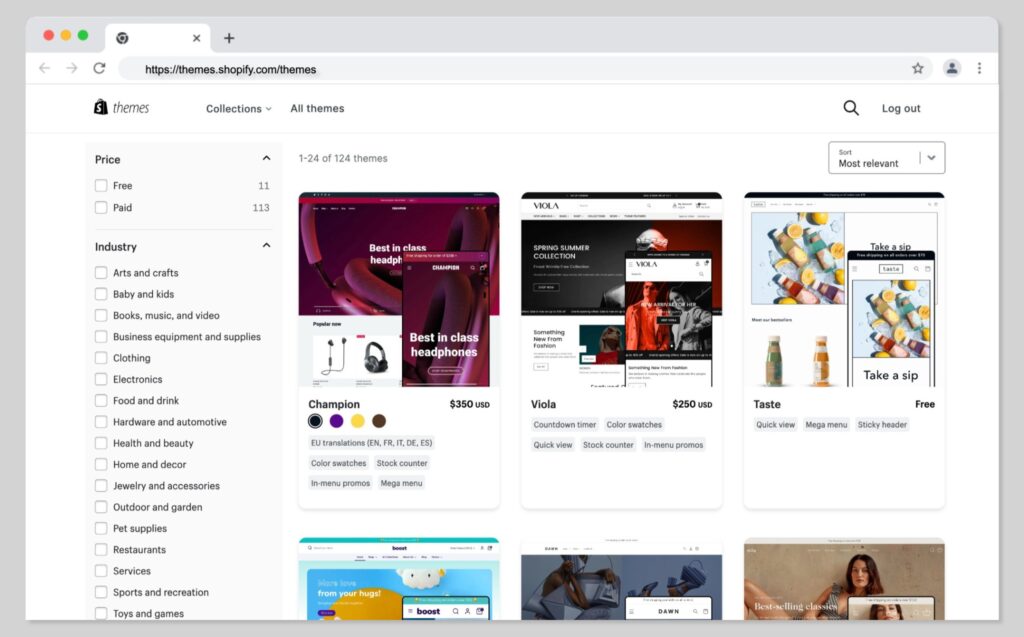

What is the Quality of Shopify's Themes?

What to look for in a Shopify Theme

Shopify Themes

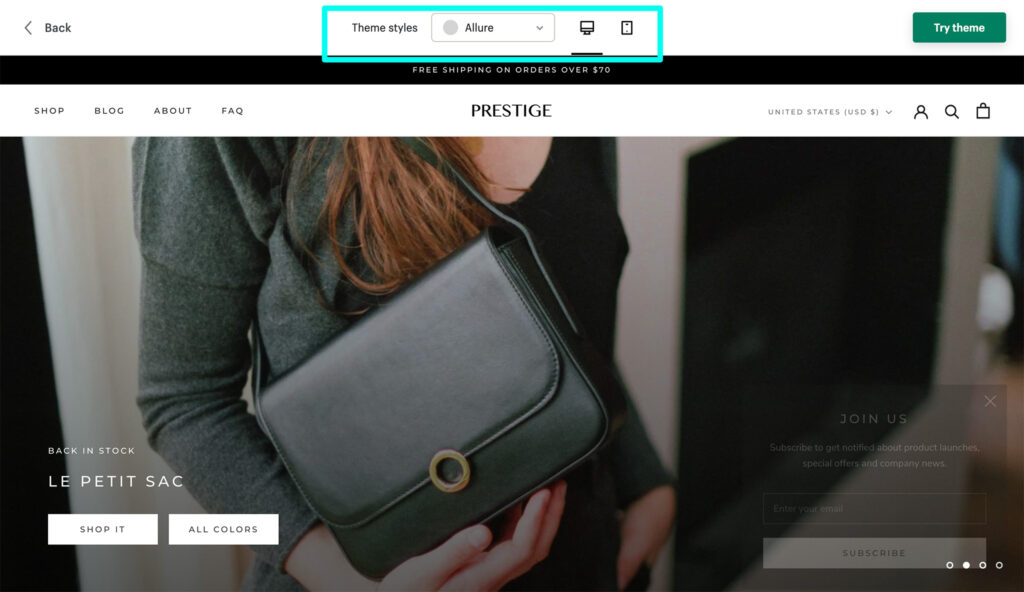

One of the few areas where Shopify struggles to compete with other ecommerce store building tools is in themes and templates. That’s not to say the themes offered by Shopify aren’t professional and attractive. In general, they do look highly sophisticated, and they’re all mobile responsive, to ensure you can interact with customers on any device.

However, Shopify only offers a handful of ecommerce templates to customers for free.

There are around 11 free themes in total provided by Shopify. That’s a lot less than you’d get from other leading platform providers like Squarespace, or Wix.

The alternative option to using a free theme is accessing one of the paid or premium themes from the Shopify marketplace. There are a handful of great options to choose from, and they’re categorized into different sections for various industries and requirements. The premium themes vary in price, but they’re all fully responsive, and they’re relatively easy to use.

What to look for in a Shopify Theme

It’s worth paying close attention to the features included in each theme when you’re making your choice. You may find some themes don’t support things like product carousels or multiple languages. The more expensive the theme, the more features its likely to have. On the plus side, the premium themes might seem expensive, but they’re a lot more affordable than paying for a designer to build your website from scratch.

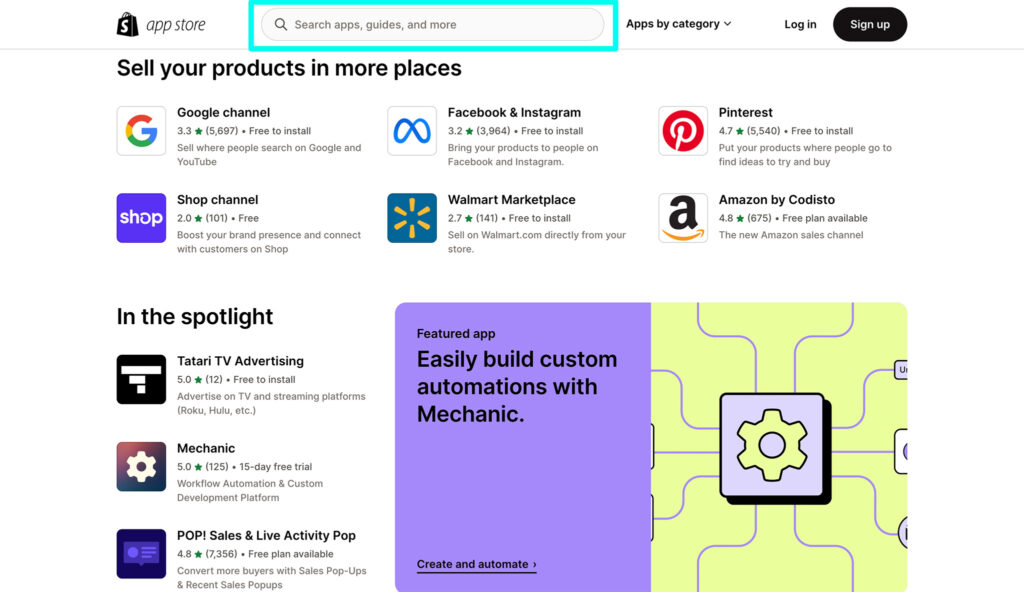

The Shopify App Store

One of my favorite things about Shopify is its amazing app marketplace. These days, ecommerce trends are constantly changing, and consumers are always looking for more personalized, convenient and engaging experiences when shopping online. Adding apps to your store is a great way to expand its functionality, and unlock new opportunities.

The comprehensive app store includes both free and premium apps, covering a range of different requirements. You can find apps for CRM (Customer Relationship Management) tools, comprehensive email marketing and automation, search engine optimization and more. In fact, there are over 8,000 different apps to choose from, with categories such as:

- Accounting and financial data apps

- Marketing and search engine optimization apps

- Loyalty and referral campaign apps

- Advanced reporting apps

- Chat and customer communication apps

- Social media marketing apps

- Pre-order and shipping apps

Shopify offers more integrations and add-ons than virtually any other ecommerce builder. This means you can transform your store however you choose, provided you have enough money to pay for any premium plugins, and you’re willing to take the time to learn how to use each tool effectively.

One point worth noting is that while the apps are excellent for enhancing your online store experience, they can add up to an expensive, and bulky addition to your store. The more apps you add to your website, the more likely it is your shop’s loading times will slow down. The slower your store performs, the more you’re going to suffer in terms of search engine optimization and user experience.

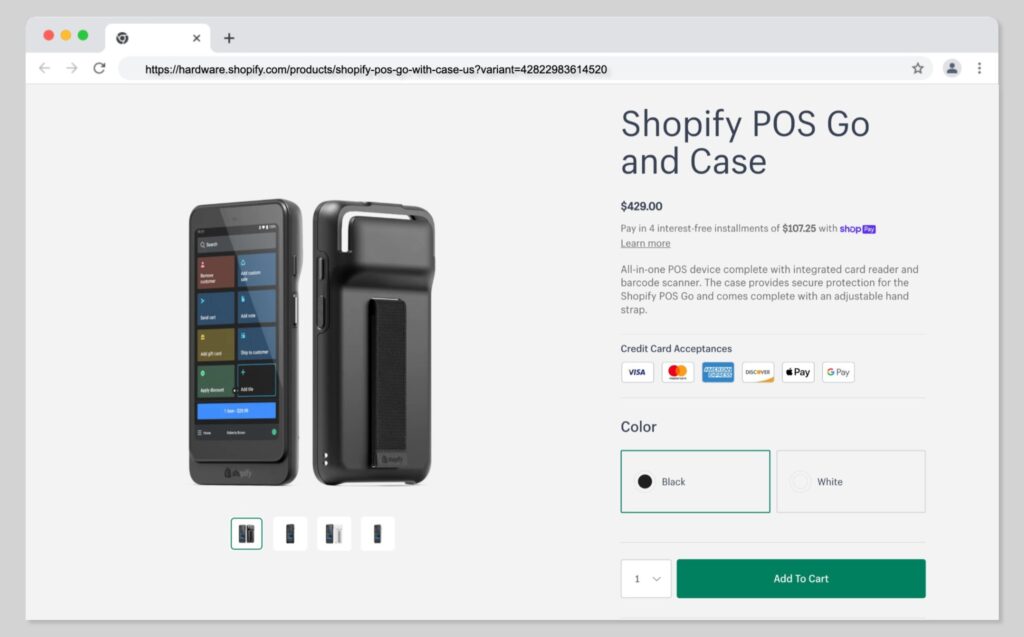

Shopify Retail Solutions (Point of Sale Capabilities)

As mentioned above, Shopify makes it relatively simple for business owners to sell across a wide range of channels, including in the offline landscape.

Shopify has a comprehensive range of point of sale software and hardware solutions, specially designed for offline sellers. This means you can use the exact same platform to sell both online, and in-person.

There’s a wide range of hardware options available to choose from, including card readers, tills, barcode scanners, receipt printers, and stands. Plus, Shopify even has its own dedicated all-in-one device known as “Shopify POS Go”. This solution, which looks similar to a standard smartphone, comes with a card reader, barcode scanner, and more built-in. It can connect your Shopify account over Wi-Fi and allow you to start selling instantly.

Currently, the tool retails for around $399, and it’s only available for merchants in the United States. However, Shopify is planning on rolling the tool out to more locations going forward.

Alongside hardware options, Shopify offers a range of software solutions for in-person sellers too. There are two options available for POS sellers.

The Shopify POS Lite service comes packaged into all Shopify plans except the Starter plan, so you don’t have to pay anything extra for it.

It allows you to access advanced inventory management, customer profiles, and unified reporting capabilities. If you need to upgrade to a more advanced service, you can purchase the Shopify POS Pro add-on for $89 per month. This service is also included as standard in the Shopify Plus package, for larger enterprise stores.

The Pro plan includes smart inventory management, omnichannel selling features, unlimited store staff, and the ability to implement unlimited registers. You’ll also be able to take advantage of more advanced in-store analytics, and staff roles and permissions.

The Pro plan also supports low stock warnings, and the ability to attribute sales to specific staff members for commissions.

Further reading 📚

Selling Digital Products with Shopify

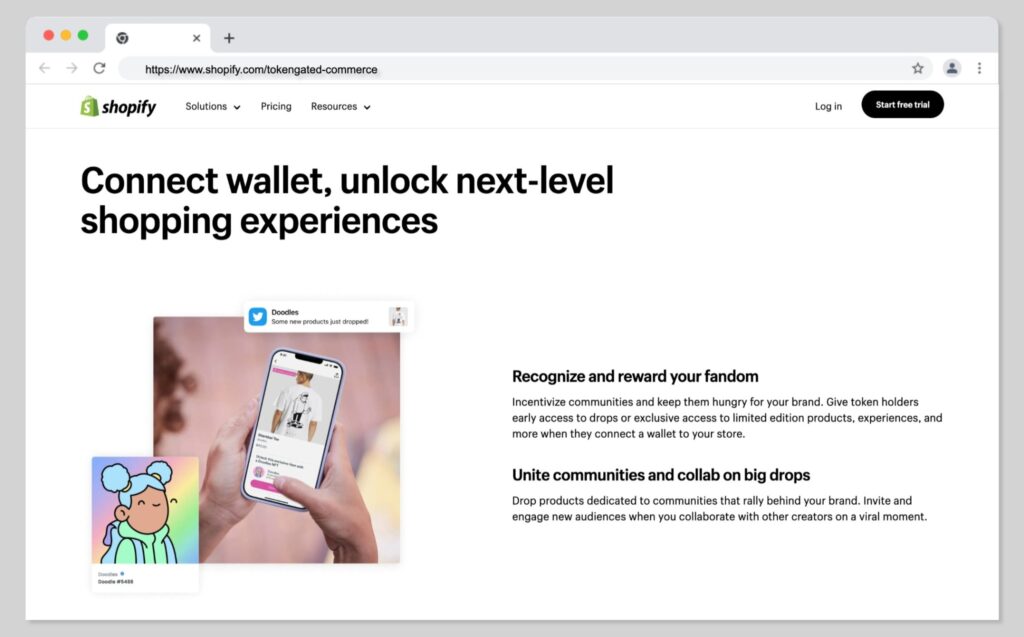

While Shopify is fantastic for selling physical products both online and offline, it’s also a wonderful tool for selling digital products. You’ll be able to sell everything from digital art, video, and audio clips to non-fungible tokens (NFTs). There’s a dedicated “Digital Downloads” app on Shopify which allows you to upload all kinds of digital files to your store.

When a customer purchase one of your products, they’ll receive a link to their email address which allows them to download the file. Like with physical products, Shopify will allow you to track orders containing digital products, personalize email templates and customize checkout options.

The NFT selling functionality of Shopify is particularly interesting for today’s digital retailers. It allows you to sell tokens directly through your store, and even distribute NFTs through Shopify Payments, or the Storefront API. You do need to apply for approval to distribute NFTs, however.

Using the Digital Downloads app on Shopify, you should have no problem delivering a range of virtual goods to your customers, from images, to music and videos. However, there’s a limit on the file size for the products you can sell of 5GB. This is actually quite a generous cap, compared to other online platforms like BigCommerce (512MB) and Squarespace (300MB).

Of course, if you need to sell bigger products, you can always consider adding a third-party app to your store for hosting larger files. Alternatively, you can use an online file sharing service like Dropbox to deliver items to customers. Although this may require a little more work on your behalf, as you’ll need to ensure you’re keeping track of your digital orders.

Notably, you can also leverage bookings and appointments on Shopify if you’re selling online services. However, you’ll need to leverage a third-party app to unlock this functionality.

Selling Globally with Shopify

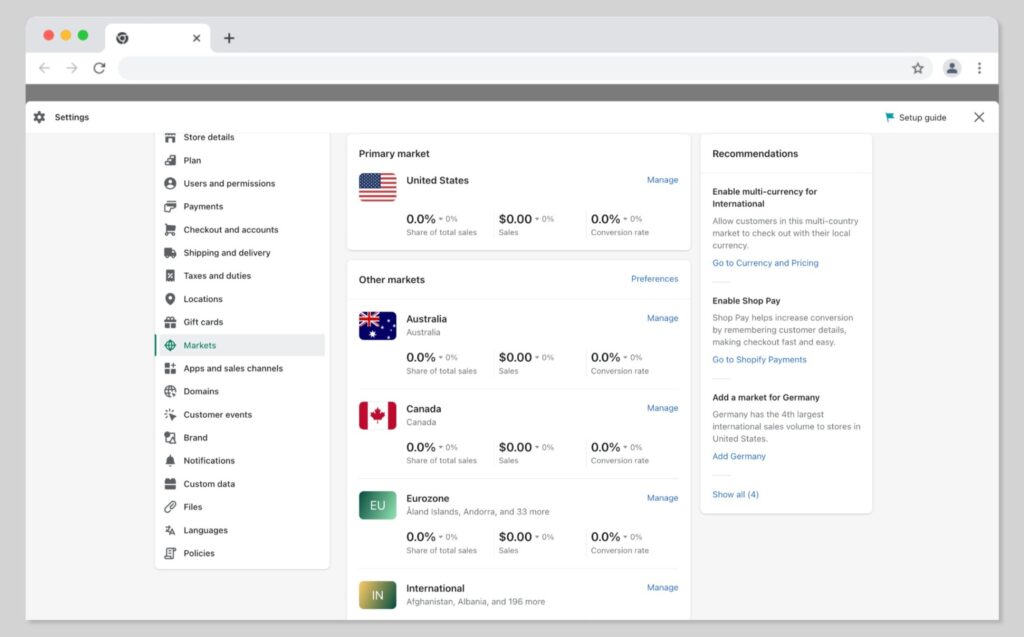

Shopify has enabled companies to sell internationally and globally for some time. The company accepts numerous currencies for sellers, and offers a range of multi-linguistic options for your store. However, recently, Shopify has begun upgrading its global selling features with the introduction of “Shopify Markets”. This convenient tool allows you to define selling areas for your store.

Within the platform, you can choose your markets, manage currencies, languages, and local domains, and even choose the right payment processor for each market you want to sell in. The all-in-one solution will automatically localize your storefront for you, ensure you’re complying with regulations, and handle cross-border requirements like duties and taxes.

You can use Shopify Markets to expand rapidly into a range of countries from one location, without having to set up separate stores. You can also leverage localized marketing and promotional tools with your stores, to boost your chances of return customers.

There are two versions of Shopify Markets available. The regular solution is available to access on virtually all plans, except for the Start plan. However, you will be required to use Shopify Payments for local currencies and payment options.

The Shopify Markets Pro service, provides access to extra features, such as an expanded suite of payment methods, and advanced tax management. You’ll also get access to label printing, documentation management, express shipping with cheaper rates, and zero liability for chargebacks and card fraud. The biggest downside for Shopify Markets Pro is the pricing, which forces business leaders to deal with a 6.5% transaction fee on each payment.

Available Shipping Carriers

| Fulfilment Location | Available Shipping Carriers |

|---|---|

| United States | USPS, FedEx, UPS (not available in Porto Rico), DHL Express (continental US only) |

| Canada | Canada Post, UPS |

| Australia | Sendle |

| United Kingdom | Evri, DPD |

| France | Colissimo, Mondial Relay, Chronopost |

| Italy | Poste Italiane |

| Spain | Correos |

Shopify Customer Support

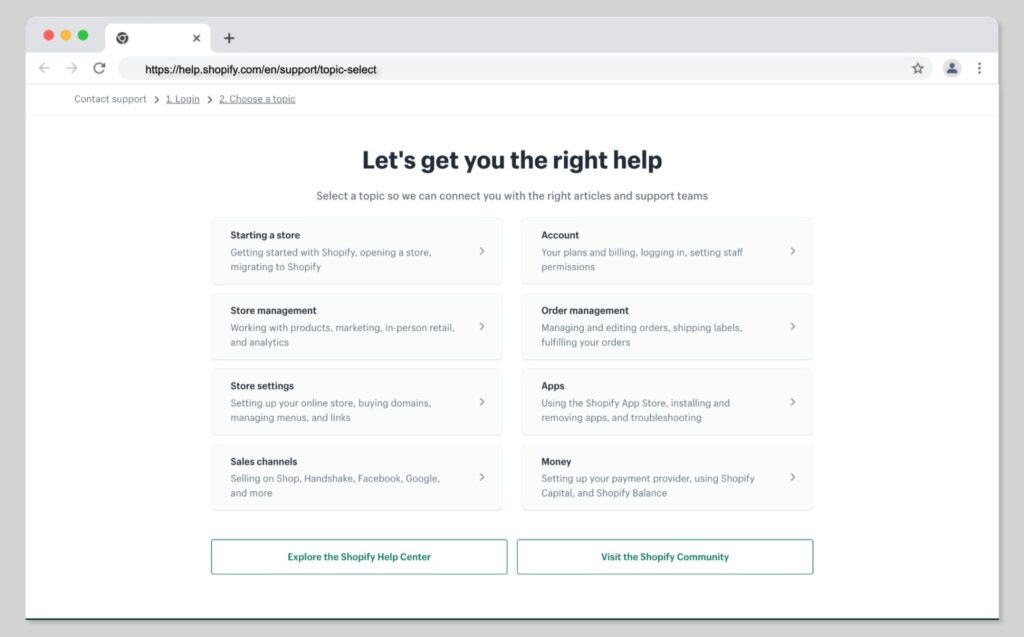

Shopify’s approach to customer support is quite comprehensive. If you’re looking for a DIY solution to solve any problems you might be facing, you can access help materials in more than 21 languages. Plus, the Shopify team is available to answer any questions you might have 24/7 through email, live, chat, and phone calls. The availability of support in your chosen language will vary depending on your location, so keep this in mind.

The knowledgebase, FAQs and resource articles are easy-to-follow and very clear. However, they don’t really include a lot of visual insights into how to use your Shopify admin interface. Most articles are entirely text-based, although you can access Shopify courses and other resources to help you.

Outside of articles and direct access to the Shopify customer service team, you’ll also be able to leverage a huge community of Shopify experts whenever you’re encountering problems. Shopify has community forums you can access with lots of developer support for technical queries. You can even use the Shopify “Hire an Expert” page to find a specialist to assist you with building your site.

Shopify also has a strong social media presence, a range of courses and learning tools available for developers, and a host of events you can attend if you want to learn more about the platform. Overall, you shouldn’t have too much trouble finding assistance when you need it.

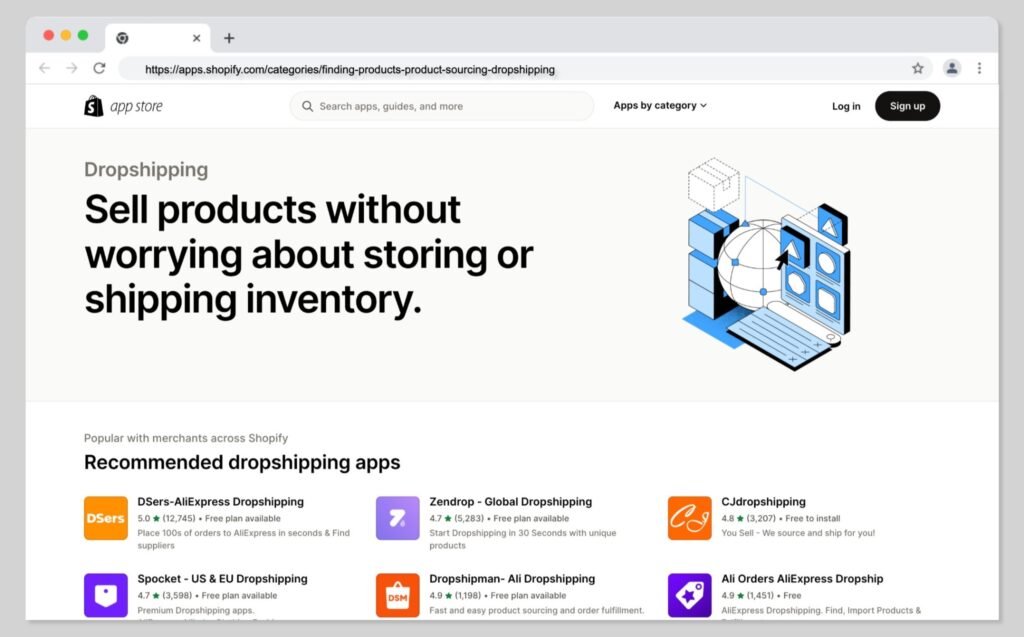

Shopify Dropshipping Reviews

One particularly positive thing about Shopify is that it allows business owners to explore a range of different models for online selling. In particular, the platform is extremely valuable for dropshipping companies, and brands leveraging print-on-demand selling.

With dropshipping, business owners can minimize the amount of work involved in running their online store. Working with third-party manufacturers and fulfillment companies, you can list and sell a wide range of different items, without having to create or store anything yourself. Dropshipping providers can even handle shipping and packaging items for you.

Shopify offers a huge range of dropshipping apps you can use to source and sell products from suppliers around the world. Here’s an insight into some of our favorite dropshipping apps that work with Shopify. If you want some guidance on getting your dropshipping business up-and-running on Shopify, here’s a comprehensive guide to help you.

Overall, Shopify is one of the most popular ecommerce platforms available for vendors investing in dropshipping. It makes it easy to add multiple users to your store, and upload images from suppliers directly. There’s also a host of great dropshipping apps on the Shopify app store, such as:

- AutoDS: An all-in-one dropshipping app which makes it easy to find products, import items and product descriptions to your store and automate fulfillment in seconds. There are more than 25 US, EU, and global dropshipping suppliers to choose from, including AliExpress, Amazon, Walmart, and Alibaba.

- Spocket: One of the highest-rated apps on the Shopify marketplace, Spocket is a convenient dropshipping platform that connects retailers with thousands of suppliers across the US, Europe, Canada, Asia, and other regions. There’s even a free plan available, and automation tools to help minimize repetitive work for your teams.

- DSers: The official AliExpress dropshipping app for Shopify, DSers makes it easy to find cheaper suppliers from regions all around the world, and rapidly add their products to your store. The platform comes with access to bulk order options, automated tracking number syncing, and you can even run multiple stores from the same account.

Print on Demand Selling on Shopify

If you like the idea of outsourcing your fulfillment process to another company, but you want more options to customize the items you sell, print-on-demand might be the ideal solution for you. Similar to dropshipping, the print on demand business model passes all of the tasks that take place after a sale over to another manufacturer. The partners you work with will handle everything from producing your items, to packaging them and shipping them to customers.

However, unlike dropshipping, print on demand gives you the freedom to add unique designs, patterns, and even logos to the items you sell. This ensures you can build an effective, eye-catching brand, with minimal effort.

Shopify is an excellent platform for print on demand selling, thanks again to it’s fantastic app marketplace. There are plenty of great print-on-demand apps that work with Shopify, such as:

- Printful: Perhaps the most popular print-on-demand platform in the world, Printful makes selling custom products simple. The company offers a huge range of products for sellers to choose from, and comes with convenient design tools you can use to add your own designs to anything. There are even options for custom packaging, pack-ins and branded invoices. Printful products are always high-quality, and produced to incredible standards.

- Printify: Another incredible tool for print-on-demand selling, Printify provides sellers with access to a global network of high-quality providers who print, package, and ship orders to customers around the world. There’s a mock-up generator for creating your own custom items from scratch, and you can find a range of unique products on Printify too, such as home décor items, garments, and accessories.

- SPOD: One of the fastest print on demand solutions available for Shopify, SPOD makes it simple to create custom product lines in minutes. You can upload your own designs, or choose patterns from the company’s free graphic library. What’s more, the majority of SPOD orders are shipped within 48 hours, and around 50% are shipped in 24 hours. This means you can get your products to customers as quickly as possible.

Shopify SEO: Is Shopify Good for Search Optimization?

Even the best ecommerce stores won’t accomplish much if your customers can’t find your products online. That’s why many retailers invest so heavily in SEO (Search Engine Optimization).

With SEO, you can improve your chances of ranking for specific keywords and even boost your credibility in your chosen industry. While mastering SEO can complex, Shopify offers a fantastic selection of tools and resources to help you on your way.

First, Shopify’s highly customizable pages allow users to change page titles, meta descriptions, and tags easily, so you can implement keywords wherever you like. You can also add headings and alt-tags to posts, and improve the functionality of your site with a customizable Robots.txt file, and 301 redirects. Shopify’s theme designs (free and paid) are all responsive, so they’ll display perfectly across all devices, with minimal loading times, improving your technical SEO ranking.

You can also use apps to present all products and pages on your Shopify store in AMP format, so it’s easier to engage those mobile shoppers. Speaking of apps, Shopify’s app store is also brimming with tools to help you boost your rankings too, such as the popular Yoast app for on-page optimization.

Some of the other things that make Shopify great for SEO include:

- Free SSL certificates with every site (for enhanced website security)

- Marketplace apps for optimizing your store based on core web vitals

- Simple blogging tools for content marketing

SEO Capabilities: Summary

| Meta information | Editable |

| Alt text | Editable |

| URL structure | Editable to some extent. (Shopify puts certain URL strings like “/products/”) |

| 301 redirects | Automatically generated, and can be managed easily |

| Sitemap | Automatically generated |

| Speed & uptime | Great |

| Custom schema structured data | Requires custom code or Shopify app |

| Automatic TOC for articles | Requires custom code or Shopify app |

| Keyword research | No |

| Blog score | No |

| Internal linking tools | No |

| Automatic canonical links | Depends on the theme |

| Related blog posts | Depends on the theme |

There are a few gaps in Shopify’s SEO strategy, however. Changing an image file name for SEO purposes isn’t possible unless you do it on your local device. Additionally, there aren’t any tools built into the Shopify platform to help you research keywords.

Managing Taxes and VAT Moss on Shopify

Perhaps one of the biggest challenges companies face when selling in the digital world is keeping track of all their tax and VAT information. If you’re selling products to customers in numerous different states or countries, you may have a number of different tax rates to monitor.

Fortunately, Shopify makes tax management simple. You can apply tax rates automatically to products for most territories. Additionally, registration-based tax options are available for VAT and state-based taxes in Australia, Canada, the EU, New Zealand, Norway, the UK, Switzerland, and the US.

Another major benefit of Shopify is its ability to cater for the EU VAT MOSS ruleset. VAT MOSS calculations are crucial for all sellers of digital products with customers in the EU. Unlike most other platforms, Shopify can actually calculate and apply the appropriate tax and VAT rate for your products automatically, wherever you are.

Blogging on Shopify

| BASIC | WYSIWYG editor | Basic |

| Meta title | Yes | |

| Meta description | Yes | |

| Featured image | Yes | |

| Tags | Yes | |

| Categories | No | |

| Post excerpt | Yes | |

| Author | Yes | |

| Comments | Basic | |

| Schedule a post | Yes | |

| ADVANCED | Multiple blogs | Yes |

| Multiple templates | Yes | |

| Insert products | Requires custom code or Shopify app | |

| CTA elements | Requires custom code or Shopify app | |

| Analytics | Basic | |

| SEO SPECIFIC | Custom schema | Requires custom code or Shopify app |

| Sitemap | Yes | |

| Automatic TOC | Requires custom code or Shopify app | |

| Keyword Research | No | |

| Blog score | No | |

| Internal linking tools | No | |

| Automatic redirects | Yes | |

| Automatic canonical links | Depends on the theme | |

| Related blog posts | Depends on the theme | |

| SPECIAL FEATURES | AI blog post writer | Yes |

| Newsletter | No | |

| Email marketing automation | Yes | |

| Integrations | 8,000+ shopify apps |

One of the things that sets Shopify apart from a lot of the other ecommerce platforms available today, is the number of tools you can access to enhance your online presence.

Alongside SEO tools, social media plugins, and tools for PPC advertising, Shopify also offers a blog feature.

Blogging is one of the most powerful tools for any company investing in content marketing, offering an opportunity to increase SEO rankings, demonstrate thought leadership, and boost online visibility. The built-in blogging tool within Shopify ensures you can start creating content easily. Plus, with tools like Yoast, you can make sure your blogs are SEO optimized too.

⚠️ While Shopify does support blogging, its blogging features aren’t quite as robust as the ones you might find on other platforms, such as WordPress. There aren’t any tools for version history management, and categorizing blog posts is a little tricky, as you’ll only have tags to work with.

That doesn’t mean the blogging functionality isn’t worthwhile, however. For most merchants, the tools you get from Shopify will be more than enough to help you strengthen your online presence and start ranking in the search engines. You can also use the tools in the Shopify app store to take your content strategy further.

For instance, you could use a social media embed tool to show user-generated content on your website, or add a comment section to your blog pages.

There’s even a popular app called “DropInBlog” for Shopify which provides access to a few more WordPress-style features for dedicated bloggers, such as SEO post analysis, categories, and product embeds.

If the standard Shopify blogging capabilities don’t quite live up to your expectations, it’s definitely worth browsing through the app store for tools that might help.

Managing Shopify Stores on Mobile Devices

So, what if you want to manage your Shopify store on the move, from a tablet or mobile device? You’re in luck. Shopify provides a variety of apps you can use for this exact purpose.

The main “Shopify” app, available for iOS and Android devices, doesn’t provide the full functionality of the desktop version of the platform, but it does have a lot of handy tools. You can use the app to customize your store theme, add products to listings or edit listings, and even view or fulfill orders when you’re on the move. The app also provides access to a handful of handy reports, communication tools for team collaboration, and Shopify email capabilities.

Alongside the “Shopify” app, the platform also offers the following tools:

- The Shopify POS app: The Shopify POS or Point of Sale app provides access to Shopify’s Point of Sale system, so you can take card payments wherever you are, text product receipts to customers, and monitor inventory in real-time.

- Shopify Inbox: The Shopify Inbox app is a handy tool which allows business owners to add a live chat service to their store, and answer queries or capture leads wherever you are. You can even chat with customers through Facebook Messenger and Instagram.

- The “Shop” app: As well as providing apps for merchants, Shopify also provides a customer centric app in the form of “Shop”. This gives users an accelerated and easy checkout experience on any Shopify store. It supports interest-free instalment payments, merchant tipping, and even personalized product recommendations.

Is Shopify GDPR Compliant?

If you’re operating somewhere in the EU or UK, or you sell to customers throughout these regions, you might be wondering whether Shopify can keep your company compliant with GDPR. Essentially, these regulations govern how companies can use and collect customer data in the digital world.

Ultimately, it’s up to you as a retailer to ensure you’re taking steps to keep your data secure, provide access to privacy documents, and prevent non-essential cookies from running on your website without customer consent. However, some platforms do make it easier to preserve compliance than others.

For the most part, Shopify is designed to be GDPR compliant. It allows you to create privacy pages for your store, and create privacy settings for customer accounts. However, staying compliant with cookie consent requirements can be a little tricky on Shopify.

You’ll need to display a cookie banner to your visitors as soon as they arrive on your store to be compliant. This banner needs to allow customers to choose which cookies they want to allow access to their browser. It also needs to log customer consent, and allow buyers to revoke their consent at a later stage. Shopify doesn’t offer an out-of-the-box way to produce one of these banners.

However, that doesn’t mean you can’t make your Shopify store GDPR compliant. There are plenty of apps in the Shopify marketplace which deal with cookie consent on your behalf. The GDPR and CCPA app here even allows you to tackle both sets of regulatory guidelines at the same time.

Just remember, using one of these apps only solves a portion of your GDPR problems. You’ll still need to create a privacy policy, and audit how you process and manage customer data regularly. It’s also worth ensuring you provide customers with information about how they can request access to their data, or ask you to remove their data from your database.

Shopify Top Alternatives

Overall, Shopify is an excellent tool for online selling and ecommerce. However, it’s also far from the only option on the market. Depending on your specific needs, you might find some platforms are a little better-suited to your requirements. Examining the alternatives is an essential part of any comprehensive Shopify review.

Here are some of the top Shopify alternatives you can consider right now:

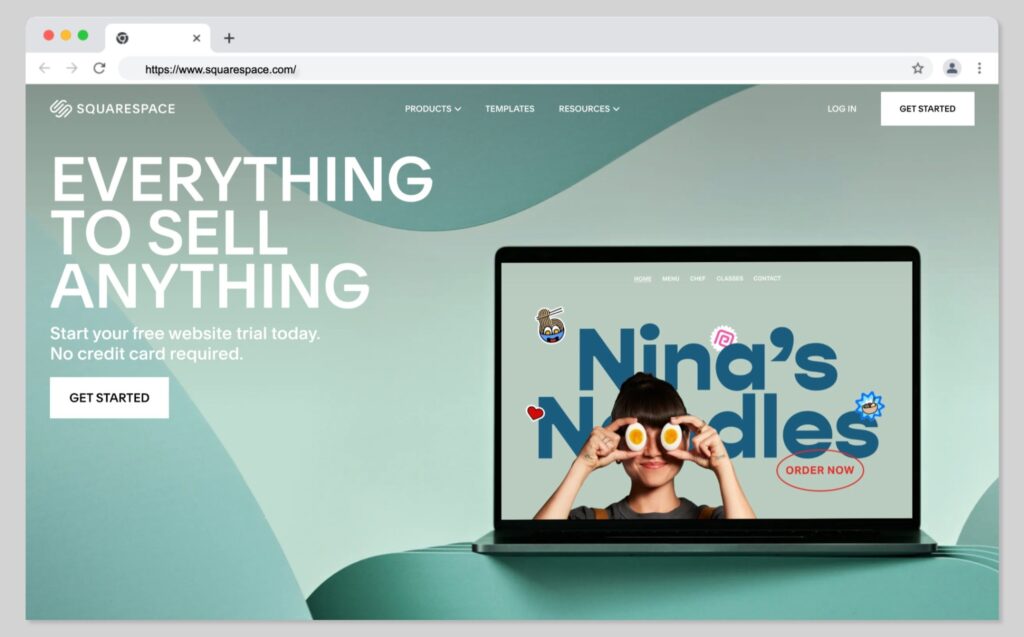

1. Squarespace

Squarespace is a fantastic tool for people who want to build a highly attractive, engaging online store or blog. The powerful platform is specially suited to members of the creator economy, with built-in tools for booking appointments, selling virtual assets, and more. Squarespace is great for small businesses, thanks to it’s easy-to-use backend environment.

There’s a fantastic drag-and-drop editor included with the platform, which many people consider to be more streamlined and convenient than the one offered by Shopify. Plus, the blogging tool offered by Squarespace is a little better than Shopify’s too. However, it’s worth keeping in mind that the ecommerce functionality is a little limited in comparison. For instance, you may have trouble with Squarespace if you want to invest in multi-currency selling and POS integrations.

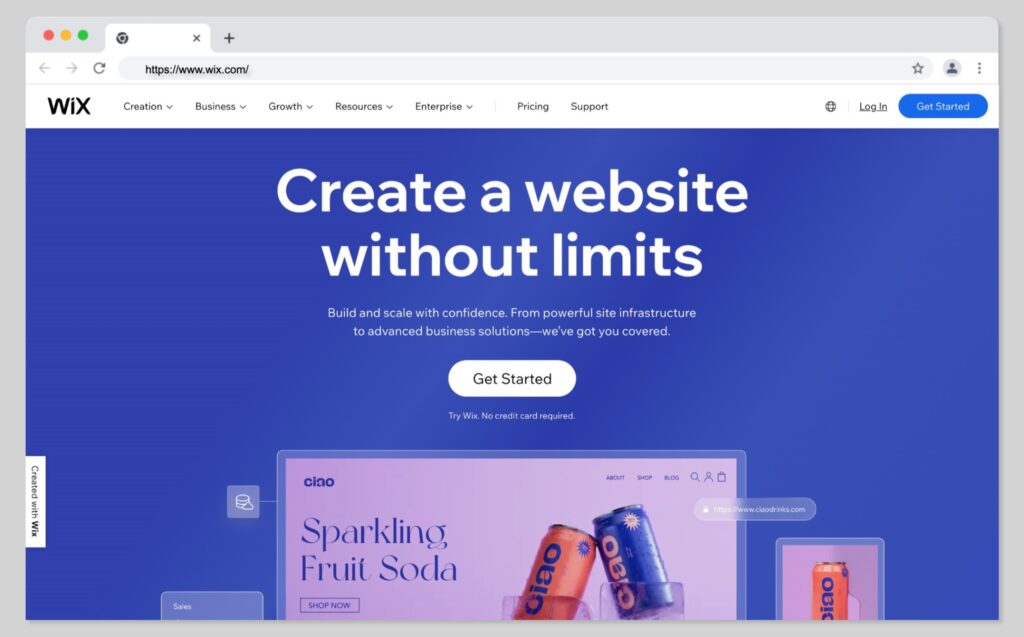

2. Wix

Wix is one of the most straightforward and convenient online store builders on the market. Provided as a hosted service, similar to Shopify, the Wix platform gives business leaders everything they need to start selling through a highly responsive, engaging online site. There are many more template and customization options available on Wix than you’ll get on Shopify, and you’ll be able to leverage a free SSL certificate when you start your site too.

Wix provides access to a number of secure payment options for customers, as well as a variety of marketing and sales tools to help you increase your revenue. You can even get help building your online store with the built-in Wix AI tools.

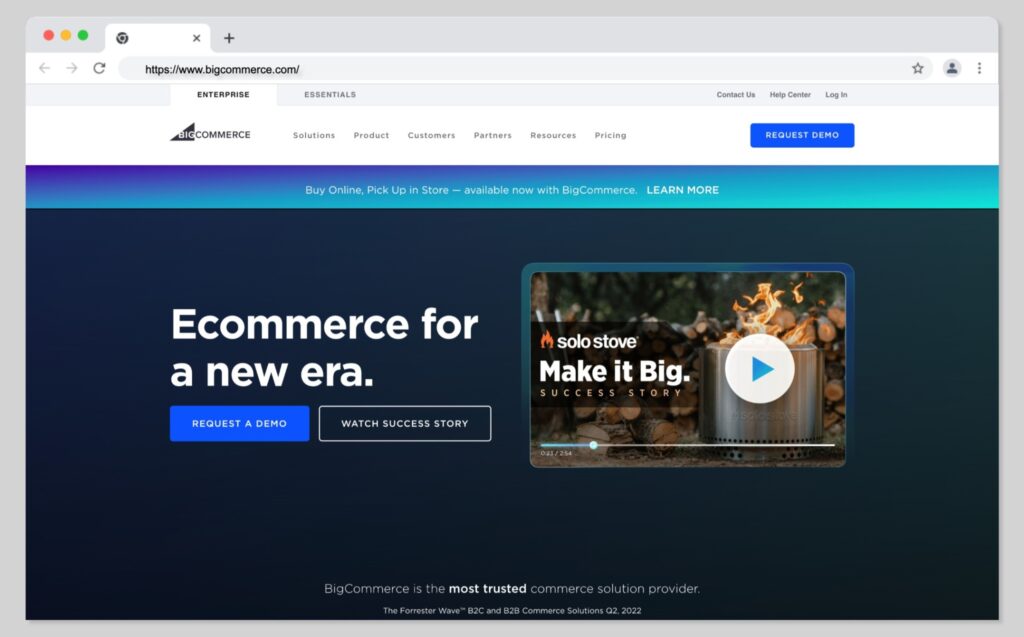

3. BigCommerce

Probably one of the most popular alternatives to Shopify on the market, BigCommerce is a flexible and convenient platform, with a host of crucial tools already packaged into the service. You’ll have access to everything you need to build a phenomenal store with BigCommerce, including a fantastic website building platform, solutions for collecting product reviews and ratings, and unlimited storage, bandwidth, and product options on every plan.

BigCommerce also doesn’t charge any transaction fees, unlike Shopify, so it can be a good option if you want to cut down on extra costs. The platform is easy to use, includes integrated SEO solutions, and even allows for extensive store customization. However, the product can be a little more complicated to set up than Shopify for beginners.

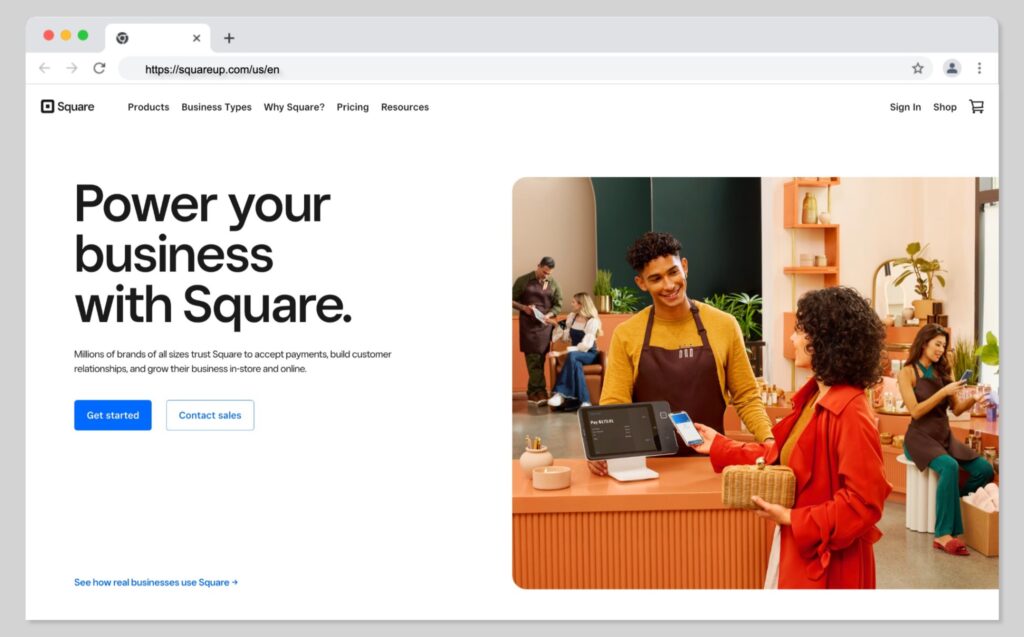

4. Square Online

If you’re looking for a way to combine online and offline selling, Square Online could be the perfect solution. This simple ecommerce building platform allows anyone using the Square payment processing technology to build a comprehensive store from scratch, without paying anything. Square Online makes it easy to monitor all of your transactions and payments across a range of channels, so you can stay one step ahead of the competition.

Plus, Square’s platform comes with specialist tools available for people in specific industries, like the retail and restaurant landscape. The Point of Sale features are excellent, and the transaction fees are relatively low, so you can minimize your expenses when you’re just getting started.

5. Ecwid

If you’re looking for a budget-friendly option to help you start selling online, Ecwid could be an excellent solution. This platform gives companies two options for building an online store. You can either use the plugin solution to build ecommerce functionality into an existing website or app, or you can build a simple store within Ecwid itself.

The platform is easy-to-use and convenient, with various options for omnichannel selling. Plus, it integrates with a huge range of apps and add-ons. As an added bonus, Ecwid, is extremely affordable. You can even get started for free if you already have your own blog or website.

6. Adobe Commerce (formerly Magento)

Adobe Commerce (Formerly Magento) is a flexible and versatile alternative to Shopify, ideal for all kinds of sellers. Not only does the platform offer a range of multichannel sales options to choose from, and access to unlimited product sales, but it’s packed with unique features. You can integrate Adobe Commerce with other tools in the Adobe ecosystem, so it’s easy to upload stunning visuals to every store and product page. There’s even built-in AI tools, to help you optimize your store, and track more in-depth analytics from each customer.

Though it has a slightly higher learning curve than Shopify, Adobe Commerce does benefit from a drag-and-drop builder, and a range of straightforward features. You can access inventory management tools, intelligent report building tools, and even a dedicated staging platform. If you want to expand your store onto mobile platforms, you can also access the Adobe Developer App Builder, right alongside Adobe Commerce.

Steps to Migrate to Shopify

| Step | Action |

|---|---|

| 1 | Configure your basic administrative settings |

| 2 | Import your store's content and data to Shopify |

| 3 | Organize your products after migration |

| 4 | Make your website look great |

| 5 | Set up your domain |

| 6 | Set up your shipping |

| 7 | Configure your taxes |

| 8 | Set up a payment provider |

| 9 | Place some test orders |

| 10 | Invite your customers to create accounts on your new site |

| 11 | Set up URL redirects |

Further reading 📚

Popular Stores Using Shopify

| Store | URL |

|---|---|

| Reb Bull | https://www.redbullshopus.com/ |

| Decathlon | https://www.decathlon.com/ |

| Allbirds | https://www.allbirds.com/ |

| Fashion Nova | https://www.fashionnova.com/ |

| ColourPop Cosmetics | https://colourpop.com/ |

| Steve Madden | https://www.stevemadden.com/ |

| Manscaped | https://www.manscaped.com/ |

| Kylie Cosmetics | https://kyliecosmetics.com/ |

| Victoria Beckham | https://www.victoriabeckham.com/ |

| Blakely | https://blakelyclothing.com/ |

Shopify Review: FAQ

Yes, Shopify is an entirely legitimate business and ecommerce solution for any online business. It’s secured, safe, and highly rated among consumers. There are even advanced Shopify features available that can help to make your store more secure and compliant. However, you will need to ensure you’re looking after your data, and leveraging the right security strategies.

Shopify is definitely not as affordable as some of the other ecommerce builders on the market today, but we’d say it’s worthwhile.

The highly customizable and flexible platform gives you virtually everything you need to grow your company in one place, from marketing tools, to customizable checkout pages.

You can even track crucial metrics with reports, and use add-ons to implement marketing pop-ups, and other sales strategies.

While building your own ecommerce site can have a learning curve on any platform, we’d say Shopify is a relatively user-friendly solution. There are plenty of FAQs, tutorials, and resources available on the website to help guide you through the process of using every feature.

Selling on Shopify is extremely straightforward. All you need to do is upload your products (and photos), choose a price for your items, and select your payment processing method. You can even customize your shopping cart to increase your chances of higher sales. Shopify will help you with tracking sales, and managing tax requirements too.

Shopify is relatively secure and safe for both business owners and customers. The platform is Level 1 PCI DSS compliance, and it comes with a few extra helpful tools to help keep you safe, such as two-factor authentication. However, it’s worth remembering any ecommerce platform can experience security issues and data breaches from time to time.

Shopify offers any ecommerce business a range of ways to make money. Whether you’re selling digital items, or physical products, you’ll be able to make a profit with Shopify. You can even keep your operating costs low and your revenue high with dropshipping apps.

Shopify features some basic SEO-friendly features, such as the option to customize URLs, meta tags, alt tags, and descriptions for your pages. You can also access add-ons and plugins from the Shopify app store that can help you to boost your SEO ranking.

Yes, web hosting is included as standard with most Shopify packages, not including the Starter package, which allows you to simply add a button to an existing hosted platform.

Shopify has around 2.1 million daily active users as of 2023. However, this number can go up and down at any time.

Email hosting is not provided on Shopify. If you have Shopify managed domain and domain name, you’ll need to use a third-party email host for your inbox.

You’re not required to have a business license to sell on Shopify in all cases. However, you may need to acquire a license if the country, city, or state you live in, or the type of your business requires you to have one to sell.

Yes, you can use PayPal as a payment method for customers on Shopify within your checkout. You’ll also be able to create a PayPal Express checkout on Shopify, as PayPal is one of the default payment providers on the Shopify platform.

Shopify is an extremely straightforward and convenient tool for beginners in the ecommerce landscape. The user-friendly platform can help any organization get their own business up and running, for a relatively affordable monthly fee.

Shopify can give you step by step guidance on how to migrate to the platform from another ecommerce solution such as Weebly or WordPress and WooCommerce. You can ask for advice from the Shopify team or checkout the tutorials on Shopify’s website.

While Shopify is great for a wide range of businesses, it’s may not be the best solution for the smallest businesses, due to its transaction fees. However, it is a good choice if you’re looking for something relatively easy to use and highly scalable. The product is generally good for most small businesses, but there are cheaper options out there too.

While Shopify is great for a wide range of businesses, it’s may not be the best solution for the smallest businesses, due to its transaction fees.

However, it is a good choice if you’re looking for something relatively easy to use and highly scalable. The product is generally good for most small businesses, but there are cheaper options out there too.

How to Use Printful with Shopify – Video

In this exciting video, we dive deep into the world of ecommerce, specifically focusing on how to use Printful with Shopify to achieve unparalleled success.

Whether you're a seasoned entrepreneur or just starting your online business journey, this comprehensive guide will equip you with the knowledge and strategies you need to skyrocket your profits.

How to Use Printify with Shopify – Video

In this exciting video, we dive into the world of Printify and Shopify to help you unlock the full potential of your online store. Discover how to use Printify with Shopify and witness a significant boost in your earnings.

Whether you're a beginner or a seasoned entrepreneur, this step-by-step guide will equip you with the knowledge and strategies you need to succeed.

Shopify Launch Checklist

The following tips will ensure you don’t miss any crucial steps, help you to streamline your workflow, and boost your chances of making quick sales.

The Complete Shopify Store Launch Checklist:

- Step 1: Choose and Purchase your Plan

- Step 2: Set up a Custom Domain

- Step 3: Choose Your Sales Channels

- Step 4: Optimize the Checkout Experience

- Step 5: Update your Tax and Shipping Settings

- Step 6: Verify Email Notification Settings

- Step 7: Build Your Core Website Pages

- Step 8: Conduct a Content Audit

- Step 9: Optimize Your Site for Search

- Step 10: Optimize Your Images

- Step 11: Implement an Analytics Tool

- Step 12: Create a Pre-Launch Marketing Plan

- Step 13: Install Useful Apps

- Step 14: Improve your Contact Strategy

- Step 15: Test Everything before Launch

Gift Cards in Shopify: Step-by-Step Tutorial for Beginners

In this video, you'll learn you how to create gift cards in Shopify with a step-by-step breakdown.

Whether you're a beginner or an experienced Shopify user, this tutorial will guide you through the process of setting up and managing gift cards in your Shopify store.

By the end of this video, you'll have the knowledge and tools to leverage the power of gift cards to boost your sales and customer engagement.

How to Start a Blog on Shopify | Ultimate Guide for Beginners

In this comprehensive video, we will walk you through the step-by-step process of creating a successful blog using the powerful Shopify platform.

Whether you're a beginner or an experienced blogger looking to monetize your content, this video is packed with valuable insights and practical tips to help you get started on the right foot.

How to Transfer Your Domain to Shopify

In this video, we dive deep into the process of transferring your domain to Shopify. We'll guide you step-by-step, ensuring a smooth transition. Say goodbye to technical jargon and confusion – we're making it simple.

6 Best Shopify Landing Page Builders for 2024

In this video, we reveal the 6 Best Shopify Landing Page Builders that can help you take your e-commerce game to the next level.

These powerful tools are designed to enhance user experience, increase conversions, and skyrocket your sales! Don't miss out on the chance to improve your Shopify store's performance and success.

Shopify Review: Verdict

Ultimately, Shopify is an excellent ecommerce platform for a wide range of business owners. Not only is it one of the easiest platforms to use on the market today, but it’s also one of the most feature rich and comprehensive solutions available.

With Shopify, you can easily start just about any kind of business, regardless of whether you want to sell both online and in-store, or work with dropshipping providers. The wide range of apps and add-ons offered by the Shopify marketplace also ensures you’ll have no problem expanding the functionality of your store over time.

While there are some downsides to Shopify, such as its expensive transaction fees, the pros far outweigh the cons in our opinion. If you’re looking for a secure, versatile way to start selling online, it’s hard to go wrong with Shopify.

After going through our Shopify review, do you have any questions regarding the platform or whether it suits your needs? If you do, please leave a comment below.

I cannot find a way to contact Shopify to permanently deactivate the soscription .

Hello,

You can contact Shopify Support via the Help Center Assistant chat. Click I still need help to start a live chat. For app support, go to Settings > Apps and sales channels > Get support next to the app.

I hope this helps!

This post has opened up so much information to me. Thank you for this very informative blog post. Thanks for sharing the huge information.

You’re welcome!

thanks for sharing this amazing post i like it

You’re welcome! 👍

Shopify is the best platform for one’s business .Thanks for sharing this useful post I read and get a lot information from it so keep it up, You’re amazing! nice to see.

Thanks!

I read your post thoroughly and the post is very amazing. I liked it very much as it conveys great information. You are doing great work by sharing such information with us. Keep posting such information as it is very useful for us. I have also a website based on bemanningssjuksköterska.

Thanks! 🙂

Great article. Shopify is one of the best ecommerce platforms these days but price is a little high. Startups or Small Businesses need affordable ecommerce solutions in start. I hope they will also offer some free professional solutions just like wordPress in future. Secondly, they also need to add a Live support 24/7.

it is wonderful to be here with everyone, I have a lot of knowledge from what you share, to say thank you, the information and knowledge here helps me a lot

Happy to hear that Aunjeet!

Hi, we run a few offline stores and also a Magento online shop but are looking for a more modern solution. Is it possible to connect our ERP system with Shopify and Shopify POS to get all the information from the ERP system and connect everything with eachother?

Hello Marina, what ERP software are you using?

I use BigCommerce and just started another store on Shopify. So far, I’m liking the latter much better. I’m amazed at how much care Shopify has placed on organization and usability in the admin to get it right.