Square is probably one of the most popular and well-respected companies on the market when it comes to payment processing systems and tools.

Designed to help merchants from all backgrounds build their businesses in today's digital and mobile world, Square offers everything from online selling accounts to in-person point of sale machines. You can even use your Square solution with an iPad to keep your costs as low as possible.

Announced back in Autumn 2018, the Square Terminal is the first countertop credit card machine available from the brand. This modern tool accepts EMV chip cards, magnetic stripe cards, NFC contactless payment, and more. What's more, the all-in-one machine provides the same sleek experience that merchants expect from Square in restaurants, salons, retail locations and more.

As a portable option for credit card payments, the Square Terminal is a card reader, receipt printer, POS system, and more, all contained in a small and simple device that you can use wherever you go. Although it's not a full replacement for the Square stand, the Square Terminal fills the middle ground between the Square Register and the Square Stand in the hardware portfolio.

If you're looking for something that bridges the gap between bring-your-own-device transaction tools, mobile card readers, countertop point of sale systems, and more, then this is the tool for you.

Square Terminal Pros and Cons

Pros 👍

- No expensive monthly fee

- Simple and transparent transaction rate and cost

- Excellent set-up and usability

- Accept a range of payment types

- Commitment-free account

Cons 👎

- Difficult to enter detailed tax information

- Receipts aren't suitable for tax purposes

- Refunds can take a while

What is Square Terminal?

You might be wondering why Square introduced the “Terminal” tool when it's already got so much hardware and software available for modern merchants. The simple answer is that the company wanted to give today's businesses a wider range of options. Square's primary goal with Terminal is to help companies to replace their old fashioned payment strategies with new-and-improved POS software.

Business owners using Square Terminal can charge their customers by manually entering the right payment amount, or by selecting from a wide selection of inventory options. Because the Square Terminal naturally integrates with the back-end software available from Square, it's easy to browse through all your products and services, as well as adjusting your business information.

Sellers using Square Terminal can track items and sales through the built-in Square Point of Sale software. You can set this tech up on your desktop or phone depending on your preference. What's more, Square has designed the device to work wireless with a battery life that lasts all day. This means that busy hairdressers and restaurant workers can bring their Terminal straight to the customer. The Terminal is one of the most flexible credit card processing tools and inventory management systems on the market.

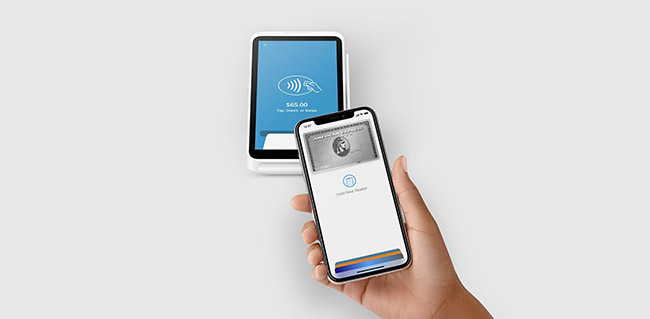

With a portable payment option available, end-user buyers can use the digital payment apps that aren't typically accepted on the smaller Square Reader attachments too. Some of the basic beneficial features of Square Terminal include:

- Sophisticated design: As usual, the Square Terminal is another product from Square that looks highly professional. It's a lot more modern and elegant than older POS systems.

- Reliability: Because battery life is designed to last all day, you can use your Square Terminal, however you see fit. Additionally, Ethernet and Wi-Fi internet connections combined with offline mode mean you don't have to worry about missing a sale.

- Portability: Bring the Square Terminal reader straight to your customer, so that they can make purchases in a way that's suitable for them.

- Transparent pricing: Square only charges a single transparent transaction rate for every tap, dip, swipe, or payment, regardless of the card type you're accepting on Square Terminal.

- Quick and easy set-up: The intuitive and compelling design makes setting up your system easier than ever.

- Security: Data security, fraud prevention, and dispute management are all included as part of the Square Terminal experience.

- Integration with back-end Square software: You can run your entire business through a single and compact device, without having to log into a separate tool. The full inventory management and eCommerce system is available through the Terminal for small business owners.

Square Terminal Pricing & Processing Fees

Square Terminal aims to give today's merchants a more flexible and transparent way to manage their day-to-day money-making activities. From day one, Square has always been committed to supporting the numerous smaller businesses that are popping up around the world. That means that you can expect simple and straightforward pricing, whatever you buy.

The first fee you'll need to deal with for the Square Terminal is the cost of the actual hardware. You'll be paying around $399 for the Square Terminal – which is a lot less than you'd pay for the much larger Square Register. Additionally, if you switch to Square as a new merchant, there's the option to sign up for Square Processing credit of $300, which brings your entire cost down to around $99.

If you're not a new merchant, it's worth noting that Square does have an option for companies on a limited budget. For instance, with Terminal, you can access financing for purchases of $49 or more. That means that you can spread the cost of your new hardware out over twelve months for a relatively reasonable price of $37 per month. Obviously, that means you're paying $45 more in total, but it's worth it for some merchants who can't afford a big purchase all at once.

There's also a selection of Square Accessories that you might want to consider when you're planning the total cost of your new POS. For instance, the belt clip and the countertop mount make it easier for companies to create a more professional experience with customers. With the belt-clip, you can more easily carry your POS around with you. On the other hand, the countertop mount gives you a consistent space to store your machine in when you're not actively using it.

Alongside the cost of the hardware, you do have a price to pay for the Point of Sale functionality that you get from Square. While the software app is free, you do pay 2.5% per keyed-in or online transaction, and 1.75% per chip and pin payment or contactless payment. The good news is that you’re paying processing fees, rather than paying separately for your checkout software. The credit card processing fees required from Square are pretty reasonable, even when compared with other service providers like PayPal.

When it comes to pricing, Square Terminal isn't a huge expense for beginner retailers and smaller businesses. While it's not the cheapest option on the market, it is one of the solutions with the best value if you're looking for a combination of professional design and functionality.

Square Terminal Design and Specs

Now that you know what you can expect to pay for Square Terminal, let's take a closer look at the functionality that you can access for your money.

As mentioned above, Square Terminal is intended to be an all-in-one payment processing machine – which means that you get everything you need to handle the transactions in your store. Unlike some other tools from Square, this feature-rich functionality doesn't come in the form of a chunky piece of plastic. The machine itself is only 5.6 inches long and 3.4 inches wide, so you can easily carry it around with you if you need to.

The Square Terminal comes with:

- Payment reader support for EMV, Apple Pay, Google Pay, Samsung Pay, Magnetic Stripe cards, and NFC cards. You can take everything from gift cards to American Express or Mastercard as a form of payment.

- Accessories Hub, and power adapter

- Wi-Fi, USB, and Ethernet connectivity options

- Option to plug into a power source or use cordlessly with an all-day battery

- Extensibility through available accessories

You can also choose to add Square Terminal Printer paper to your order for a price of $20 for 20 rolls.

The Square Terminal can support a range of connections, including Ethernet and Wi-Fi, so it's easy to use your system however, you see fit. Additionally, we particularly like the fact that you can keep the machine plugged in for stationary use if you prefer, or leave it unplugged when you want to take it straight to your customers.

One downside is that although Square claims the battery will last “all day” on its Terminal, it's not very specific about the duration, or what “all day” actually means. I wouldn't necessarily expect the machine to work 24 hours right off the bat, so be careful how much you rely on it at first.

Square Terminal supports chip card, magstripe, and contactless payments too. This means that you have more options than ever available to take the payments that keep your business up and running. The chip card reader is at the base of the device, and the magstripe is on the size – just as you would expect from most modern card terminals. Although the design should be relatively familiar to your customer, however, it's worth noting that the screen portion of the device really does make Square Terminal stand out. The fact that your customer can see an itemized list of what they're paying for rather than just a single sum really makes a big difference to their experience.

What's more, thanks to the Square POS software, you can easily collect signatures for transactions digitally, as well as on paper. That makes it much easier to keep track of everything.

Basically, whatever way your customer wants to checkout with you, the credit card processing solutions from Square will make your life and theirs a little easier.

Square Terminal Review: Setting up & Usability

The Square Terminal is affordable, attractive and feature-rich. However, as any business owner will know, it takes more than just an aesthetically pleasing device to keep a business running smoothly. Fortunately, this amazing little device is also incredibly easy to use. All it takes to start setting up your terminal is to sign-up to the Square POS account system and get your bank verified.

From that point onwards, you'll be able to accept a host of different types of payments wherever you like, and instantly access your crucial Square dashboard features from any browser too. Crucially, it’s in that back-end system that you can go beyond things like credit card processing on your smartphone, iPad, and other devices. As well as allowing you to process payments, the software from Square also gives you everything you need to manage long-term contracts with customers, and take advantage of other merchant services too. For small business owners, the credit card reader offers an all-in-one solution for card transactions with exceptional ease of use.

Notably, some businesses using the Square Terminal have said that it can take a few days before your bank account gets verified. That's probably because Square is dealing with so many different merchants at once. The good news is that even if you're still waiting for verification, you don't have to hold off on taking payments. Square Terminal allows you to begin processing payments immediately.

While you wait for your account to set up, your money stays in your Square account system. Usually, settlement for each payment will take about one or two days after each transaction.

Square Terminal Review: Square Virtual Terminal

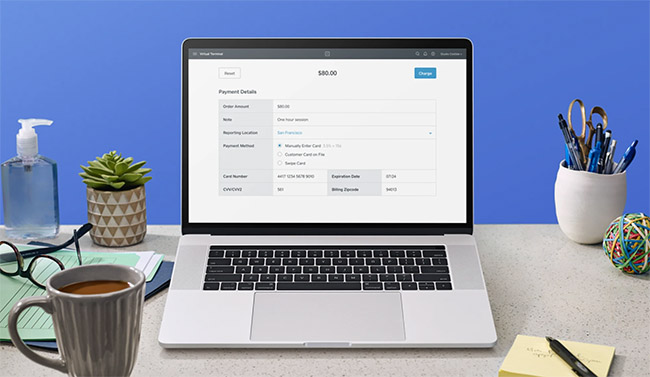

Another point worth noting when it comes to Square Terminal usability is that processing your mobile payments is very simple thanks to Square Virtual Terminal.

All you need to do to get started is log into your Square Dashboard through a browser connection. You'll be able to use any device with an internet browser, provided that you have a network connection available. Once you've gotten into your back office account, just click on the Virtual Terminal option and the “Take a Payment” button. Here, you can enter card details like:

- Reporting location

- Order/transaction amount

- Date of expiry for the card

- Card number

- CVV or CVV2

There's also an option to add a description or note when you're processing the payment, so you know exactly what it was for. After you put your sale through, you can also send a digital receipt to your customer via email or text, or you can print your receipt directly through the connected printer that comes with the Square Terminal.

If for compliance purposes, you're going to need to record important customer details, you can do that using the Customer Options tab in the confirmation page once your payment has been processed. There's also the option to add card details for your customers to a profile for future payments if you expect recurring payments. Your customer does need to give you permission to keep their information on file, however, so keep that in mind.

Remember to keep Square Virtual Terminal Pricing in mind when choosing your Square solution too. There's no monthly fee here, but you will pay 3.5% plus 15 cents for every typed-in transaction, and 2.6% plus 10 cents for every swiped card.

Although these fees might seem expensive at first glance, they’re actually one of the cheaper options available on the market, particularly for a company that also offers the option to buy your barcode scanner, physical chip reader, magstripe reader and more in the same place.

Square Terminal Review: Software & Additional Features

Square Terminal comes with access to the standard free Square Point of Sale app that comes connected to all Square solutions. Just keep in mind that you're only going to get limited compatibility with Square for Restaurants – so if you're running a food company, you might need an alternative. Not all of the Square for Restaurants features will carry over with Terminal, but you can use the system for table-side ordering if you're running a busy café or restaurant location. Unfortunately, Terminal doesn't come with access to things like seat tracking, coursing, or conversational modifiers.

When it comes to limitations in the Square Terminal software, it's also worth noting that this solution might not be the best option for businesses that need to record more details during each transaction. You need to go into the Square customer profile separately after each sale, which can make it harder to jump from one client to the next. Additionally, if you need to track or study stock levels, then you'll need to do that manually or separately.

Another major downside is that you can't add taxes to your order – the receipts that you print out aren't a tax invoice, so it's not ideal to use Square Terminal if you're a VAT-registered company. However, that doesn't mean that there aren't benefits to using Square Terminal for your company too. You can't track sales by employee, mark items for sale, or keep a history for your cash drawer. However, you can keep track of things like item creation, receipt management, and custom tipping. What's more, Square Terminal also comes with a built-in thermal receipt printer, or you can use a third-party tool if you'd prefer.

Another point worth noting with the Square Terminal is that you can connect multiple terminals to a cash drawer. This means that you're not going to build up extra software subscription costs. The most important thing to keep in mind is that Square Terminal is excellent for quick and affordable functionality – but it can't do everything.

The machine doesn't work with Bluetooth peripherals, so you'll need to connect USB-based devices instead. Additionally, there's no support for cellular data connections – although you can choose to connect with Wi-Fi or Ethernet.

Square Terminal Review: Security

Perhaps one of the most important final features that we need to look at in this Square Terminal review, is the security that comes built into your payment processing system. Square Terminal isn't just designed for easy use and accessibility; it's also intended for state-of-the-art security. To avoid common payment issues, Square recommends taking various precautions during your customer-not-present transactions, to minimize your risk.

If you need to keep your customer's card details on file, for instance, you'll need to ask your customer to sign an authorization form so you can defend yourself against chargeback liability. Fortunately, Square offers this form for you to download through the Customer Options pop-up after you've made a sale. Additionally, there's the option to download your form in the Add-Card popup when you go to the Customer's profile. It might be a bit of a pain downloading and printing the form – but it's worth it in the long term if you need to be secure and compliant.

Additionally, Square comes with built-in fraud protection, which is both a blessing and a curse. On the one hand, you get a system that's designed to keep you and your business safe regardless of where or what you're selling. On the other hand, various merchants over the years have claimed that their accounts have been frozen or canceled with Square because they've been perceived to be fraudulent incorrectly. Unfortunately, if you do get banned from using Square because the company sees your behavior to be fraudulent, it's also very difficult to get in touch with the company.

Who Should be Using the Square Terminal?

The Square Terminal is an incredibly piece of tech – but it's not the right solution for everyone. If you're running a restaurant, then you might find some of the more advanced features for Square for Restaurants are missing with this particular tool. Square Terminal isn't intended to be just a cheap replacement to the Square Register – instead, it's a portable solution that you can take with you to customers in a busy retail environment.

If you're looking for an all-in-one machine that's lightweight, portable, and comes with all the Square software functionality that you know and love, then you're going to really appreciate the Square Terminal. For small business types, Square Terminal offers a cheap and easy-to-use system that's perfect for selling online, in-person or remotely. Additionally, the customer-not-present or card reader payment options means that you have more versatility for your transactions.

However, businesses that plan on selling a lot of products very regularly should keep in mind that your Square system can only be used in the country that you register your account in. Additionally, if you're selling in the UK, then you can only use GBP, and you won't be able to switch to other currencies. The Square Terminal is another excellent way for businesses in the offline environment to combine things like offline card transactions and debit card processing with their online environment. If you want more control over the payments you take during your business day, then Square will give you plenty of features. Square’s POS is even available on Android too now, so you can access your software in even more environments.

Square Terminal Review: Verdict

Ultimately, Square Terminal is an efficient and compelling tool for companies that want to accept and manage their payments in the easiest way possible. However, if you need to track detailed specific information, or record various numbers, then this might not be the best choice for you.

Additionally, while Square offers a fantastic range of payment methods for today's vendors, it doesn't come with an option to upgrade to an advanced software solution. If you want more features from the Square POS, then you'll need to buy a different piece of hardware. Despite this, Square Terminal is a much more affordable option for some businesses that don't have a lot of budget to work with.

We'd recommend using the Square Terminal in your business if you want to jump into taking payments as quickly as possible. This simple and affordable solution for payment processing doesn't require any monthly fee or annoying contracts, and it's very easy to use too. Whatever you need from your payment processing device, Square has you covered.

This was an interesting article, but what I have been looking for is how to get started guide. I am not a techy and need a step by step guide and there was not one with the terminal. Turning on the terminal was even a challenge. Luckily, I got this for the local farmers market so I will only use it once a week for 4 hours. How do I get the products I sell onto the terminal? When I originally used my cell phone many years ago with the original Square, every thing was entered as it was on my computer. I have not been able to figure out how to get the old products off, or organized, and how to enter my new products with the terminal.

I am forever being told it is “intuitively obvious”.

Not for me. Flour, sugar and butter are my intuitively obvious arenas.

From what I understand, if you update the desired changes on your computer (Square dashboard), they will update on the terminal automatically.

On occasion, I need to give someone a receipt for cash. Can I just print out a receipt for that?

Hey Alan, you can find more info about this here.