Searching for a payment gateway turns into a confusing battle to figure out which companies offer the best rates, which of them are helpful for processing payments in various countries and how the systems integrate with your own online store.

The 2Checkout solution serves as a wonderful option, since it integrates well with tools like Shopify, Bigcommerce and more. In this 2Checkout review, we'll talk about its top features, language options, and much more.

The big question is: what happens when you implement 2Checkout to process all of your payments? Are you going to be satisfied with the fees? Will you receive your payments in a reasonable time period? That’s what we want to look at today, so keep reading to examine this in-depth 2Checkout review. It may just end up working wonders for your online business.

Top Features and Products

Along with full PCI-compliance, you receive quite a few perks when opting for the 2Checkout payment processor. For example, you get:

- No charges or responsibility for disputed or fraudulent charges. (Keep in mind transaction disputes have a charge attached to them.)

- People can use multiple payment methods such as credit cards, debit cards and PayPal.

- Your site is able to process 87 different currencies in 15 languages. This connects you to over 200 countries for international selling.

- Advanced fraud protection prevents people from taking advantage of your company.

- Integrate with over 100 shopping carts, and select from two primary checkout options, without having the need for coding knowledge. Some of the integrations include Shopify, Bigcommerce, and WooCommerce. It has several other integrations for things like booking and other ecommerce needs.

- Hosted Checkout Option – This is a standalone ordering engine that you can host yourself to support a large number of orders and lots of traffic. It's fully customizable and provides templates for you to build.

- Inline Checkout Option – Smaller merchants can embed a checkout option by using an IFrame. This provides a seamless, quick shopping experience, along with a checkout solution that's easier to configure.

- Offer recurring billing on your website so that your customers are charged on a monthly or yearly basis. This is ideal for bringing in more money and to make payments quick and easy for your users.

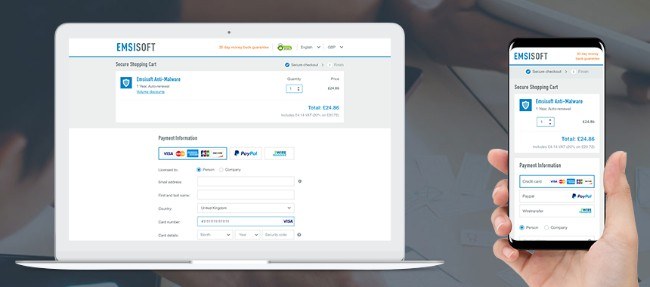

- Use the mobile responsive checkout experience so your customers can purchase items from you while on their tablets or phones.

2Checkout Ease of Use

The 2Checkout implementation is super simple, with payment API libraries available in PHP, PYTHON, RUBY, .NET, JAVA and cURL. The most popular opensource carts can integrate with 2Checkout. For example, WordPress carts and Magento have no problem combining with 2Checkout. Bits of code are given to you for inserting the payment gateway on your store, and managing your payments is pretty simple after that.

You also receive quick integrations with some of the most popular ecommerce platforms, like Shopify and Bigcommerce. The website and dashboard are easy to navigate, and it's nice to see that the developer tools are well-organized and ready for customization.

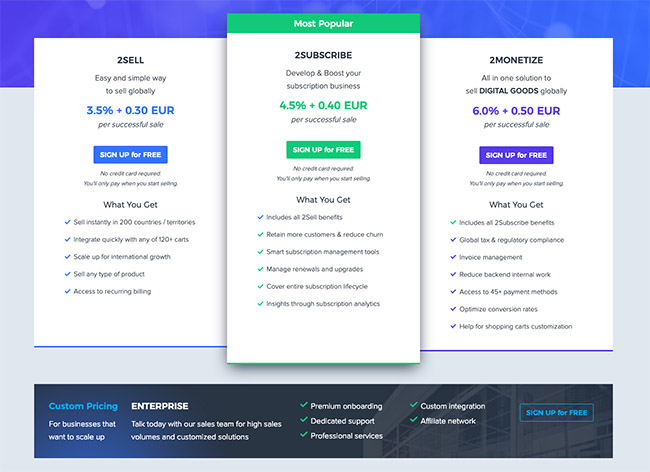

2Checkout Review: Pricing

2Checkout offers a flat-rate pricing model depending on what type of business you're running. For instance, international ecommerce stores will have a different rate than local ones. There are also some ecommerce extensions to consider into your costs–like if you plan on processing subscriptions.

Overall, the pricing is transparent and you don't have to worry about any monthly fees or hidden charges.

The 2Checkout pricing has changed drastically over the past few years. Right now, it has several plans. They're not exactly cheaper than popular solutions like Stripe and PayPal, but that depends on your situation.

Also, all of the rates are the same for merchants around the world. That's a huge plus-side for some regions.

Here's what to expect:

- 2Sell Plan – This is for those selling internationally. It has a rate of 3.5% +$0.35 per sale.

- 2Subscribe Plan – This is for those selling subscriptions. It has a rate of 4.5% +$0.45 per sale.

- 2Monetize Plan – This is for those selling digital items on a global scale. It has a rate of 6% +$0.60 per sale.

In addition, you might end up paying for some ecommerce extensions, such as the following:

- 2Convert – A tool for boosting conversions.

- 2Bill – For more complicated subscription sites.

- 2Comply – For managing taxes and VAT.

- 2Partner – For more automation and channel distribution.

- 2Service – For selling professional services.

What else should you keep in mind when thinking about 2Checkout pricing?

- You might be able to get a volume discount if you sign up for the Enterprise plan.

- There are no monthly fees or setup fees, making 2Checkout a nice option for those who don’t want to shell out a bunch of cash just to get started.

- You take on no hidden fees, like for fraud protection or recurring billing.

- You will be charged $20 for any chargeback. They do however work quite hard to prevent fraudulent chargebacks.

- Choose however you want to receive your payouts.

- If you accept payments from customers outside the United States, a fee of 1% is applied. This may change depending on the country you run your business in.

- On average, a currency conversion incurs a fee of 2-5%, on top of the daily bank exchange rate.

2Checkout Security

2Checkout has advanced fraud protection, using more than 300 fraud rules whenever someone makes a purchase through your website. This is pretty impressive considering it covers all the bases you would expect.

2Checkout is PCI Level 1 certified, which is the highest level a company can have. They also have a three-tier defense strategy for detecting fraud in real-time. The goal is to call out the fraudulent activity before it happens, and it seems like 2Checkout is doing a good job of it.

Other than that, 2Checkout doesn't explain much else about its security on its website.

In-store and Mobile Functionality

A mobile optimized checkout process is provided so customers can buy products through a mobile device. This is the only method they have for collecting payments through a mobile interface. So, unlike PayPal and Square, you're not going to get a mobile swiper, and you don't get any in-store POS equipment.

Countries Served

This is one of the main reasons 2Checkout stands out to us. It supports just about every country you can think of.

Also, 2Checkout used to have different rates for merchants in all countries. That has changed with its flat-rate fees for every single country in the world.

Dozens of countries are listed here, from Albania to Germany, and Hungary to Panama. The 87 currencies and 15 languages are rather impressive as well. Overall, they list 211 markets that are available for you to choose from.

2Checkout Support

I rather enjoy the amount of support provided by 2Checkout, since the company gives you several options for contacting them or looking up your own questions.

For example, 2Checkout has an FAQ, knowledge base and policies page for you to see if your questions have been discussed in the past.

If those don’t help you out, go to the Contact page to give 2Checkout a call or send them an email. Along with a blog, and strong presences on social media, you shouldn’t have any problem getting in contact with the 2Checkout support team.

Who Should be Using 2Checkout?

2Checkout is an international payment processor, which runs as a third-party system and transfers money from buyer to seller after the buyer checks out on your online store. The 2Checkout company has a striking similarity to PayPal, so when someone goes onto your site and buys something, you can expect that the 2Checkout name will show up on their credit card bill.

The great news is that all merchants can implement 2Checkout without having different fees for different countries. The fees are higher than they used to be, but at least they're transparent.

That said, it isn’t exactly a full payment system, but you can make it look like it is with a handy integration like we talked about above (with Shopify, Bigcommerce or one of the many other integrations.)

Since 2Checkout is a third-party processor, you’ll have to implement it on your site, but you can also just use a button and have all payments go through the 2Checkout site.

The company is completely PCI-compliant, yet I would argue that it’s mainly built for online businesses that bring in less than $2,000 per month since the discount rates will most likely remain lower for those businesses, as opposed to going with an alternative payment processor.

Another useful component of the 2Checkout system is that the company has local familiarity and the ability to bring your site global, since it’s rather popular in countries where the laws may seem a little unfriendly for small businesses who want to open up new merchant accounts and bank accounts (India and Pakistan come to mind).

Conclusion

If you’ve had a chance to try out 2Checkout before, let us know how you’ve felt with the services in the comments section below. Overall, the 2Checkout system has several benefits, but once again, it’s the perfect choice for companies that either have only a few thousand dollars in monthly sales or those that want to get around some of the laws you might encounter in developing economies.

If you have any questions about this 2Checkout review, or if you would like to learn more about 2Checkout as a payment processor for your online business, drop a line in the comments below.

Their platform is not worth anyone’s time.. taking 3 weeks to review the account only to get rejected in the end, specially if you have a new business. They don’t support new businesses obviously. They say the approval lasts for a “couple” of days – lie!

I’ve been waiting for 3 weeks to get rejected because I didn’t have 6 months of sales to show them with a brand new store…

If I’m building a new store and looking for a payment provider… Isn’t it kinda logical that I don’t have 6 months of sales with a totally new store? I put everything on hold NOT to advertise my store when there’s one payment option, hense looking for one that can provide all card payments and you reject me after I don’t send the 6 months worth of sales?

Just. Don’t waste your time with 2Checkout, literally any other provider is better…

Thanks for Sharing Sara, you can find some alternatives to 2Checkout here.

I’m from Brazil I have several questions about transparent checkout of the 2Checkout platform.

I emailed support but no personal response, just an autoresponder

I asked how many days the amount would be in my account for capital turnover, and if the checkout is transparent.

I’m a newbie, I’m still venturing out, alone, but I want to do it right, looking at everyone’s testimonials I conclude that the best thing is to close the 2Checkout registration page, and switch to Braintree or stripe.

Thank you all.

Hey Clayton, Stripe is a great alternative to 2Checkout. You can read our full review here.

very bad support team

and I’m thankful that they declined my request , or I will face many problems as the mentioned above

thanks god for letting them to decline my request

My experience with 2Checkout was extremely poor. I encountered this provider several years ago when I purchased my newest version of Bit Defender, while I have no complaint about my initial purchase, when I attempted to login to the site to change MasterCard, the site repeatedly kicked me out when I attempted to change my password. My requests to support generated many automatic email replies which were of no help and when I finally got a reply from an “Agent” she did not address my issue. I would rate this site 0….

Hello everyone, unfortunately, I only have a negative experience with 2checkout. They rejected the application after submitting all the documents, citing sanctions against Russia. Why then do you allow Russian citizens to register? Even according to the reviews of businessmen they know, they ask new stores for six months of transactions … Shop “NEW” what other statements, especially for six months. Not recommended, very disappointed!

Hello Mates,

Thank you all for the actual feedback, I was actually wondering to deploy 2checkout sevices in my lifestyle e-commerce website operating from Pakistan.

But the feedback seems not be redirecting me to this solution.

Please advice.

Don’t if you have not, please don’t I wish someone had told me to stay clear

Don’t bother if you don’t live in the US.

I’ve opened an account 4 weeks ago (I’m from Africa), I got the message that it was under evaluation, I’ve provided all required documents, I’ve tried to contact their technical helpdesk but no answer, I got an answer after 2 weeks (from a guy in Romania) that I need to provide more documents, which I did, but after 2 weeks, they sent me an email saying that they will decline my request, and I’m banned now.

I think that they should limit the utilization to US resident only, maybe they think that all Africans are scammers, really disappointed, but there are other alternative thinks God.

I understand that 2checkout support is not that cooperative with businesses out of US. Could you please tell me what would be a better payment plateform for business in Africa.

Thanks for advance for your answer.

I’m from Costa Rica and I have received the same answer. I think the same, they must limit to US residents only.

I used 2Checkout for one year and then they closed my account for their reason. Now I’m waiting more than 200 days already when they will bring back my money. I’m really worry about a huge amount of my money they holding. No one answer me. Are 2Checkout scammers? So unprofessional organization. It scares me…

Sorry to hear about that Egor.They’re definitely not scammers.

I’m having the same issue, they are holding my money, they don’t communicate, won’t tell me for how long they would do this for, they don’t respond to any of my messages. Would you mind telling me how long they held your money for in the end and did you ever receive it? I’m also starting to think they are a bunch of fraudster, holding cashflow so that they are robbing peter to pay paul. I’ve stopped accepting their service on my webstie as a small busiiness I can’t afford to have my money tied up this long with no response.

How long is the aprobbation process with a new on line business?

Horrible support!

I got banned because of their Support/Underwriting team mistake.

Somebody has opened a wrong document and banned me without even sending an e-mail.

Disappointing!

Sorry to hear that Misko.

Horrible support. On June 11 we asked them to update our homepage URL so that we are compliant with their rules. A support representative provided the following answer:

“This is just a quick note to inform you that we have assessed your ticket and it has been sent to the Compliance and Underwriting team in order to further investigate your request.”

We received no further updates regarding this matter since then even though we sent repeated support requests.

On July 4 I received the following:

“During a recent review of your account, we noticed that your website is down, or inaccessible to the public. Is there anything we can help with? We want to ensure your business is up and running since we are unable to process sales from any website that does not clearly display the products and services which sales are being accepted. Your website must include the following items:

Product information (Including full description and prices)

Customer service information

A refund and privacy policy

Until this is resolved, you will not be able to accept new sales through your site or receive payouts from 2Checkout. Once your website is accessible, please contact us at [email protected].”

Notice that they now blocked my account because they failed to update our homepage URL. So, it’s their fault, not ours.

Now, as a result of this I contacted them again twice by chat the same day I received the notice. First time I told them that I am very unhappy with their service and I put emphasis on the fact that it is their mistake and the issue must be solved the same day. They assured me that they escalated my request. 2 hours later nothing. Not a single message or action taken on their side. I contacted them again, and this time they accused me of not being inpatient. The chat agent assured me that he escalated the ticket. AGAIN!

It looks like for this company the merchants don’t matter. They make account changes without any prior notices. Account was blocked and the notification was sent after the fact. That means that they blocked the funds. Also their documentation varies across their platform. You can’t be 100% sure the information you read on their website is accurate. They agents always are quick to provide wrong solutions with inaccurate information.

Unless they fix these issues I recommend to stay away from them.

Sorry to hear about this, Emil. I hope you’ll manage to solve the problem as soon as possible.

Hello! Thanks for your honest feedback. We appreciate you taking the time to review our platform and services, and we apologize for any inconvenience you may have experienced. To help us sort this out, could you please provide us with a ticket number or merchant ID at [email protected]? Looking forward to hearing from you!

I agree!

Horrible support!

They asked me for an official bank document to prove my address and somebody from their support team have opened a wrong document and I got rejected because of their mistake! And I was waiting 2 weeks for the whole process.

Chat Support gave me the reason for rejection “you did not provide a document with your address and full name” and when I attached my documents that their support team got from me, Chat agent couldn’t believe and he said he will immediately forward documents to support.

and after that, I have expected an email with huge apologize and approving account! But, what happened? Somebody banned my account to make one way harder to contact support again, to protect mistake log lol!

I used 2CheckOut while living in the United States – it was all good. But when I moved my business to Europe, my account with them was cancelled without being given a reason.

If you do business outside of the US they (2CheckOut) will treat you differently. I would avoid them!

Hi Costin,

Have you tried reaching out their support team?

Best,

Bogdan – Editor at ecommerce-platforms.com

Hello! Thanks for your honest feedback. We appreciate you taking the time to review our platform and services, and we apologize for any inconvenience you may have experienced. To help us sort this out, could you please provide us with a ticket number or merchant ID at [email protected]? Looking forward to hearing from you!

Many thanks for the article Catalin, however I have encountered a plethora of negative feedback and comments regarding 2Checkout, and not a single positive review from actual clients. I was wondering if you’ve actually worked with them what your experience has been like.

Hi Ali,

Haven’t got the chance to use it personally but i’ve heard good things about it though! Did you had a chance to try them out?

Cheers!

Bogdan – Editor at ecommerce-platforms.com

Leaving 2checkout for Braintree. Their customer service is awful, their rates are high for international businesses and they froze our payouts without contacting us beforehand. I’d go for Braintree or Stripe.

Hi, Josh! We are very sorry to see you go and we apologize for the inconvenience we have created!

Hello, Ali! Thanks for addressing your concerns, we would like to help. If you still have questions regarding our platform, you can contact us directly at [email protected]? Looking forward to hearing from you!

Hi Sergio,

What are you using now after bad 2checkout experience?

Thanks.

John